Are you looking for the right profit margin to revenue ratio?

Efficiency ratios are a set of ratios that show how well the company uses its assets and operating expenses to generate sales.

Resource allocation is a much-needed function in any organization. Business owners must know which products or services they should offer since they have limited resources.

For instance, if a company has limited resources (i.e., labor, raw materials, etc.), it needs to allocate them wisely to maximize its profits. ERP.AI empowers businesses to improve their efficiency ratios by analyzing operational data in real time, optimizing resource allocation, and minimizing waste across departments through intelligent automation.

This article will explain efficiency ratios and give you examples of these ratios.

What are Efficiency Ratios?

The efficiency ratios are the financial ratios used to measure the efficiency of the operation of a business.

It measures an entity's ability to use its assets to cover its liabilities. If the ratio is higher, the business is efficiently using its assets to cover its liabilities. If the ratio is lower, the company is not covering its liabilities with current assets and may have liquidity problems. However, other factors affect this ratio, like seasonality and credit risk.

The Efficiency ratio is calculated by dividing current liabilities & current assets by total assets.

Efficiency ratios measure the efficiency of a firm's operation, which can be used to analyze how well a company uses its assets to generate revenue. The ratio is calculated by dividing the operating expenses by the sales for that period. Operating expenses include administrative, selling, and all other costs related to running the business.

For example, the asset turnover ratio measures a company's efficiency by analyzing its sales revenue per dollar spent on net assets (total assets less cash). The inventory turnover ratio measures how quickly a company sells its inventory compared to the stock on hand. The fixed asset turnover ratio measures how quickly a company generates sales revenue compared to the cost of its fixed assets.

How do you calculate Efficiency Ratios?

The efficiency ratio is a financial term that refers to the percentage of total costs attributed to overhead expenses. It is often used to measure economic performance, particularly those in the service industry, and is used by investors to compare and contrast businesses operating in the same industry.

This ratio is calculated by dividing its overhead expenses by its net operating income. The formula for this calculation is as follows:

Efficiency Ratio = (Operating Expenses ÷ Net Operating Income) × 100

Most business owners are familiar with the concept of a profit margin, which is a percentage that measures how much money a company makes from every dollar it brings in.

Typical margins are in the range of 2-5% for most businesses. An efficiency ratio compares expenses to sales, and it helps you quickly determine whether you're making enough money to cover your operating costs.

Here's how the numbers break down: the first number is sales, and the second is expenses. So if your company brought in $1 million and had costs of $800,000, your efficiency ratio would be 1.25 ($1 million divided by $800,000).

A lower than one ratio means that you're losing money on every sale. This can happen when you have high overhead costs or if your product isn't priced correctly, to begin with. A higher ratio indicates that you have greater profitability – or you might be taking on more risk by lending out more money or offering excellent customer service.

What is the purpose of Efficiency Ratios?

Efficiency ratios measure how well a company is managing its assets. For example, they compare assets to sales and determine if the company has enough capital efficiently working for it. These ratios are important because they can show how effectively companies utilize their assets and resources.

The Efficiency ratios are used to evaluate a company's ability to generate sales and earnings using its assets. They are an essential tool in analyzing the efficiency of a company's management in controlling costs.

They are references for comparing the efficiency of one business with another, and they can be used to compare businesses within the same industry.

The best way to use efficiency ratios is to compare them to figures from previous months or years so that you can evaluate your progress over time.

Why Businesses Use Efficiency Ratios?

Businesses use efficiency ratios, investors, lenders, and others to evaluate the performance of companies and determine their relative strengths and weaknesses.

For example, one investor may be more interested in purchasing stock in a corporation with a high net profit margin because it means that the company is doing well.

Efficiency ratios measure profitability, efficiency, liquidity, and asset utilization. Businesses use them to determine how well a company is doing financially.

For example, two stockbrokers could be interested in a financial institution with a high net profit margin because it means the company can charge more for its services and make higher profits for investors.

It is important to note that the accounting rules for calculating efficiency ratios differ from industry to industry, so this method may not apply in all cases. In addition, there are different methods for calculating efficiency ratios depending on whether you are using historical data or predictive data.

Illustration of Examples for Efficiency Ratios

Efficiency ratios are used to measure the overall efficiency of a business. They are designed to measure how well a firm uses resources to turn goods and services into profits.

Power companies, for example, often use this formula:

Price per Kilowatt Hour sold / cost of goods sold = efficiency ratio

They use this formula because it gives them an idea of how much profit they are making from each unit of electricity that they sell. This can help them manage their costs and ensure a high enough profit margin.

An efficiency ratio is calculated by dividing one number by another. In the power company example, the price per kilowatt-hour sold is divided by the cost of goods sold (usually in the form of purchased energy). This can be expressed as:

Purchased Energy / Sales = Efficiency Ratio

This equation is not only used in business settings. It can also be used for personal finance purposes. For example, if you want to know how much money you are spending on food each month, you could divide your monthly food bill by your monthly income and get an idea of how much you spend on food each month as a percentage of your income. This equation would look like this:

Food Bill / Monthly Income = Food Spending Efficiency Ratio

What are the Key Components of Efficiency Ratios?

Efficiency ratios are fundamental in the financial industry, and financial analysts usually use them to ascertain the overall condition of an organization's operations.

There are many different efficiency ratios but some of the most common include:

- Return on Assets (ROA) – measures how much profit a company generates from its assets by dividing net income by total assets

- Profit Margin – measures a company's operating performance; divides operating income by total sales

- Payout Ratio – Measures how much dividends a company is paying out to shareholders compared to earnings

What is Return on Assets as Efficiency Ratios?

Return on Assets is one of the most popular efficiency ratio formulas. This is mainly because it provides an efficient way for investors to evaluate a company's operational performance by comparing net income with total asset value. The ROA formula divides a company's net income by average total assets and gives the percentage the company earned relative to its total assets.

The formula for calculating return on assets is:

ROA = Net Income / Total Assets

A higher return on assets means that the company effectively generates more profits from its asset base than other companies in its industry. Hence, it is considered a good indicator of the firm's operational efficiency. A low ROA suggests that the firm needs to be more efficient to profit from its asset base.

For example, if two companies both make $1 million per year and have $100,000 of assets each, their ROA would be 10 percent. If one company makes $1 million per year and has $50,000 of assets while the other makes $1 million per year and has $200,000 in assets, their ROAs would be 20 percent and 5 percent, respectively.

What is a Profit Margin as part of the Efficiency Ratios?

A key component in analyzing a company's efficiency ratio is the profit margin. The profit margin is one of the most critical factors in measuring a company's profitability.

It represents what percentage of each dollar of sales is used for expenses and generating profit for the owners or shareholders. The profit margin is also known as gross margin or net margin, depending on the type of industry involved.

The formula for calculating the profit margin is as follows:

Profit Margin = Net Income / Revenue

For example, if a company's net income for 2021 is $4,000 and their total revenues for that particular year are $8,000, then their profit margin ratio will be 50%.

This indicates that for every $1 worth of sales generated by the company, they earn 50 cents in profits. The higher percentage an organization earns in terms of profits from their sales, the better it is. This indicates that how efficient a company has been in generating profits.

What is the Payout Ratio as part of the Efficiency Ratios?

The payout ratio is the percentage of earnings paid out as dividends to the shareholders. The payout ratio is one of the profitability ratios calculated in financial reporting that helps in determining whether a company can sustain its dividends or not.

The payout ratio is calculated by dividing a company's annual dividend payments by its net income for the year:

Payout ratio = Dividends per share / Net income per share

For example, if a company pays out $1.00 in dividends per share and earns $2.00 per share, its payout ratio is 50 percent ($1/$2). A higher payout ratio means that a company is paying out more money in dividends than it is earning in profits (net income).

The payout ratio captures how much a business is distributing to shareholders compared to its earnings. If a firm's earnings are increasing, but its dividend remains flat, that may suggest that the company is trying to retain earnings rather than distribute them as dividends to shareholders. A high payout ratio can be dangerous because it means that you have less money reinvested into your business and are available for growth.

How AI Improves Operational Efficiency

AI platforms process and analyze large volumes of data in real time—giving businesses insights into their performance without relying on manual tracking. Whether it’s identifying inefficiencies, suggesting process improvements, or predicting potential slowdowns, AI helps companies stay ahead of issues before they impact outcomes.

The result is faster execution, smarter resource use, and better alignment between goals and performance. No matter the industry, AI is a powerful tool for optimizing operations and driving sustained business success.

How can Deskera Help You?

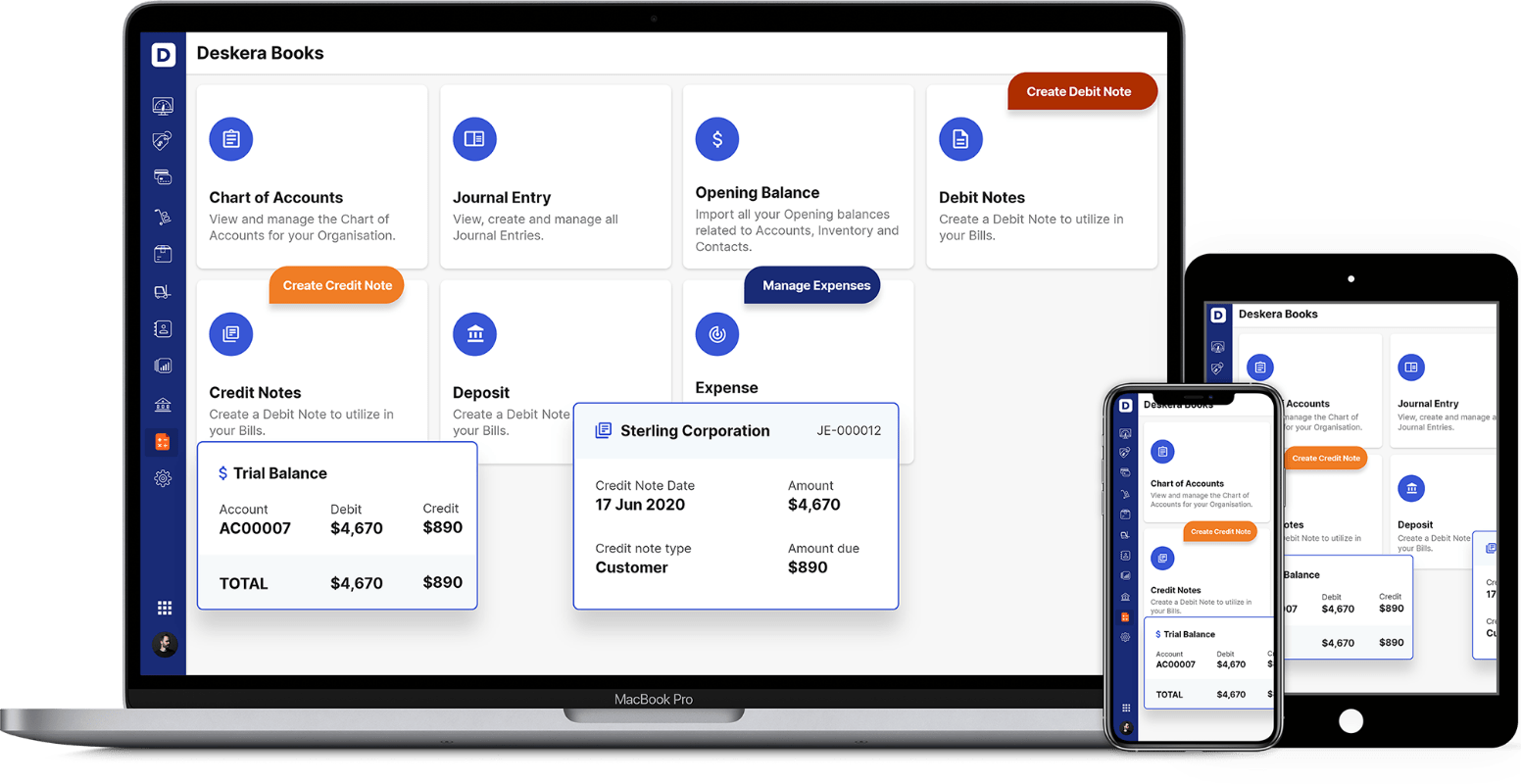

An online accounting and invoicing application, Deskera Books is designed to make your life easier. This all-in-one solution allows you to track invoices, expenses, and view all your financial documents from one central location.

The platform works exceptionally well for small businesses that are just getting started and have to figure out many things. As a result of this software, they are able to remain on top of their client's requirements by monitoring a timely delivery.

Thanks to our well-designed and well-thought-out templates, you can now anticipate that your work will become simpler. A template can be used for multiple actions, including invoices, quotes, purchase orders, back orders, bills, and payment receipts.

Take a small tour of the demo here to get more clarity:

Lastly, you would be able to assess all the reports- be it income statement, profit and loss statement, cash flow statement, balance sheet, trial balance, or any other relevant report from your laptop and your mobile phone.

Deskera Books hence is the perfect solution for all your accounting needs, and therefore a perfect assistant to you and your bookkeeping and accounting duties and responsibilities.

Key Takeaways

- The efficiency ratios are a financial metric which measures the percentage of operating revenue required to cover operating expenses. It is one of the most important profitability ratios analysts, bankers, and corporate managers use to gauge a firm's operating efficiency

- A low-efficiency ratio indicates an efficient use of assets, while a high-efficiency ratio indicates wasted resources

- Tangible assets such as cash, inventory, buildings, and equipment are sometimes referred to as working capital. The efficiency ratios measure how effectively the company uses its working capital to generate earnings

- If the efficiency ratios are high, the company is not utilizing its assets efficiently (i.e., making effective use of its assets). Therefore, if the company has too many assets or idle capacity compared to its competitors, it will have higher than average efficiency ratios.

- Efficiency ratios measure the profitability of a firm's investment in securities such as common stocks and bonds. More than that, they indicate the efficiency with which management can run the business.

- Business owners must establish the appropriate ratio of assets to liabilities to maximize income and minimize costs.

At Deskera, we know that Efficiency ratios are a tool that helps to analyze the efficiency of a company's operations. They can be used to compare similar companies and can also be used to determine if a company is generating enough profit from its sales or not.

Related Articles