Have you ever wondered why your business profits don’t align with your sales growth? The answer might lie hidden in your overhead costs. These indirect expenses, often overlooked, play a significant role in determining your profitability. Mismanaging or misunderstanding them can lead to inaccurate pricing, inefficient operations, and reduced profits.

Overhead costs are the silent drivers of your business operations. They encompass expenses like rent, utilities, and administrative costs that support your daily functions but are not directly tied to producing goods or services. Understanding these costs is essential for accurate budgeting, pricing, and financial planning, as they ensure your business remains financially sound in the long run.

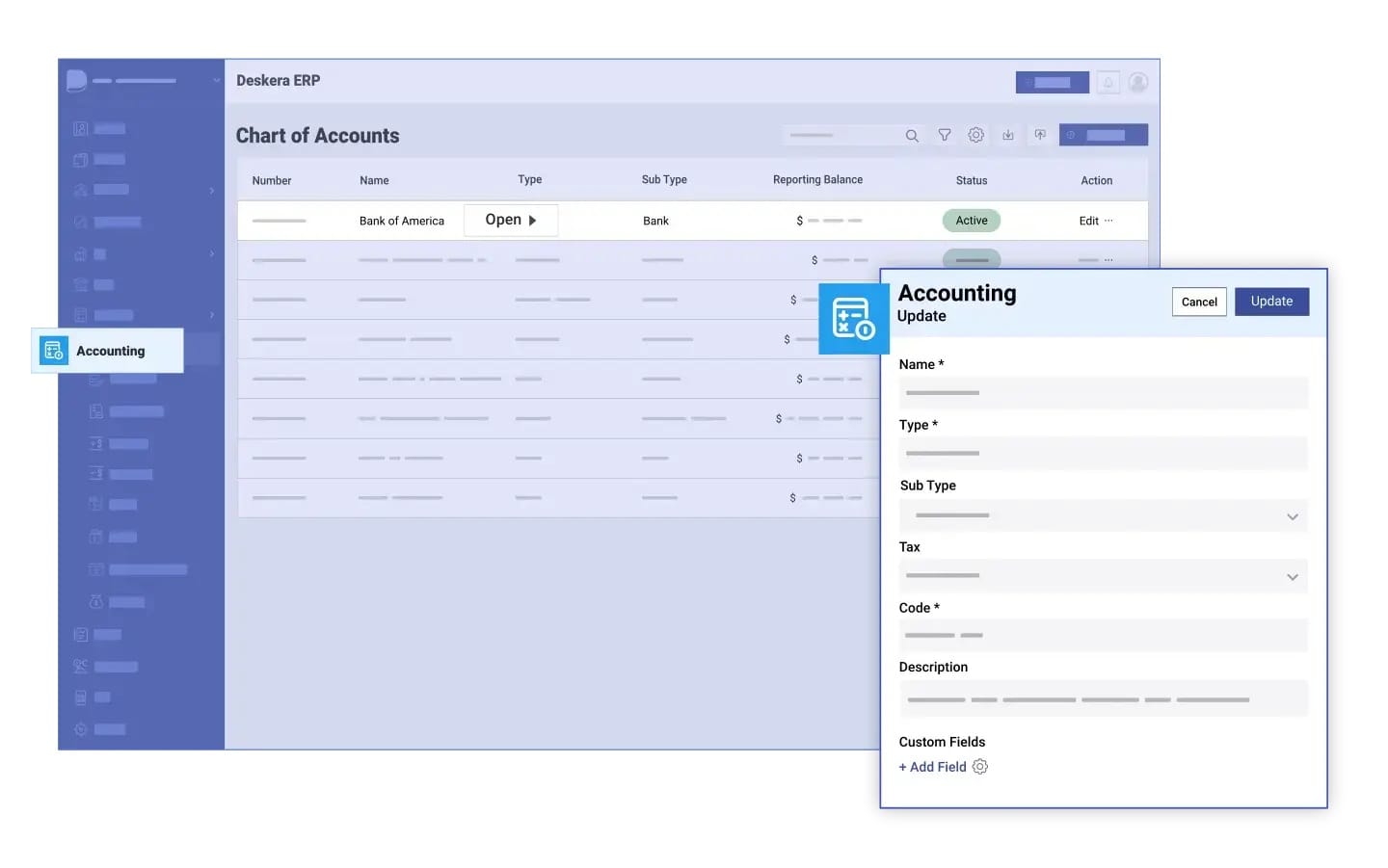

Managing overhead costs doesn’t have to be overwhelming. With tools like Deskera ERP, businesses can automate the tracking and categorization of expenses. Deskera's intuitive platform provides real-time insights into financial data, simplifies cost allocation, and helps you maintain tight control over your indirect expenses. By leveraging such software, businesses can streamline their operations and optimize costs effectively.

In this guide, we’ll explore what overhead costs are, their classifications, real-world examples, and how to calculate them. Whether you're a small business owner or a financial manager, mastering overhead costs is the first step toward boosting profitability and achieving sustainable growth.

What Are Overhead Costs?

Overhead costs are the indirect expenses required to run a business but are not directly tied to producing goods or delivering services. These costs support the overall operations of the company and are necessary to maintain its infrastructure and functionality. Unlike direct costs, such as raw materials or labor directly involved in production, overhead costs are not linked to specific projects or outputs.

For example, expenses like office rent, utilities, insurance, and administrative salaries are considered overhead costs. They are essential for the business's day-to-day operations but do not fluctuate significantly with production levels or sales volumes. Understanding these costs is crucial for determining pricing strategies, managing budgets, and evaluating overall profitability.

Overhead costs are categorized into three main types: fixed, variable, and semi-variable. Fixed costs remain constant regardless of business activity, such as rent or long-term lease payments. Variable costs fluctuate based on operational levels, like utility bills or shipping charges. Semi-variable costs combine elements of both, like a base salary with overtime pay.

Properly accounting for overhead costs ensures that businesses can set realistic prices, allocate resources effectively, and make informed financial decisions. It also helps in calculating the overhead rate, which shows how much of every dollar earned is spent on indirect expenses, providing valuable insight into operational efficiency.

Difference Between Overhead Costs and Direct Costs

Overhead costs and direct costs are two essential components of a business's financial structure, but they serve different purposes and are categorized differently. Understanding the distinction between these costs is critical for effective budgeting, pricing, and financial analysis.

1. Definition and Nature

- Direct Costs: These are expenses directly attributable to the production of goods or services. Examples include raw materials, direct labor, and manufacturing supplies. They vary with production levels and are specific to particular products or projects.

- Overhead Costs: These are indirect expenses required to run a business but cannot be directly traced to any specific product or service. Examples include rent, utilities, insurance, and administrative salaries.

2. Relationship to Production

- Direct costs have a direct correlation with the volume of production or services offered. As production increases, direct costs typically rise proportionally.

- Overhead costs, on the other hand, remain relatively stable regardless of production volume, especially fixed overhead costs like rent or equipment depreciation.

3. Role in Cost Accounting

- Direct costs are used to calculate the cost of goods sold (COGS), a key metric for understanding the profitability of specific products or services.

- Overhead costs are allocated to products or services using an overhead rate, ensuring the true cost of business operations is accounted for in pricing.

4. Example in Practice

Consider a furniture manufacturing business:

- Direct Costs: Wood, nails, and the wages of workers assembling the furniture.

- Overhead Costs: Factory rent, electricity, and salaries of administrative staff managing the operations.

By distinguishing between direct and overhead costs, businesses can allocate resources effectively, set competitive pricing, and enhance their overall financial efficiency.

Difference Between Overhead Costs and Operating Expenses

Understanding the distinction between overhead costs and operating expenses is essential for accurate financial management and decision-making. While both terms relate to a company's expenditure, they serve different purposes and are categorized differently in financial reporting.

1. Definition and Scope

- Overhead Costs: These are indirect costs that are not directly tied to the production of goods or services but are necessary for running the business. They include expenses like rent, utilities, administrative salaries, and office supplies.

- Operating Expenses: Operating expenses (OPEX) refer to the total costs required to run day-to-day business operations. This category includes both direct and indirect costs related to producing goods or services, such as raw materials, labor costs, and overhead expenses.

2. Direct vs. Indirect Costs

- Overhead Costs: These are typically indirect costs that support business activities without directly contributing to the production process.

- Operating Expenses: Operating expenses can be a mix of direct costs (such as direct labor and raw materials) and indirect costs (like overhead).

3. Examples

- Overhead Costs: Rent, utilities, office supplies, insurance, and equipment depreciation.

- Operating Expenses: Overhead costs, salaries, marketing, research and development, and production costs.

4. Financial Reporting

- Overhead Costs: These are a subset of operating expenses, and they are typically reported separately to give a clear understanding of indirect costs.

- Operating Expenses: Operating expenses encompass all costs associated with running the business, including both direct and indirect expenses, and are reported on the income statement as part of the operating income calculation.

5. Role in Profitability

- Overhead Costs: Overhead costs are crucial for determining the overall efficiency of a business. They are necessary for daily operations but do not directly generate revenue. Monitoring and reducing overhead costs can significantly improve profitability.

- Operating Expenses: Operating expenses impact a company's profitability directly. A business needs to manage its operating expenses efficiently to maintain a healthy bottom line, as high operating costs can erode profits.

In summary, while both overhead costs and operating expenses represent crucial expenditures for a business, overhead costs are specifically indirect costs required to run the business, while operating expenses encompass both direct and indirect costs. Understanding their differences helps businesses allocate resources effectively and optimize financial performance.

The Importance of Overhead Costs in Determining Business Profitability

Overhead costs play a pivotal role in assessing and improving a business's profitability. While they may not directly contribute to producing goods or services, these expenses significantly influence overall financial performance and strategic decision-making.

1. Accurate Pricing Strategies

Understanding overhead costs is essential for setting competitive and profitable prices. By factoring these costs into pricing models, businesses can ensure that every product or service sold contributes fairly to covering indirect expenses. Failing to account for overhead costs can lead to underpricing, which erodes profits, or overpricing, which may drive customers away.

2. Evaluating Operational Efficiency

Monitoring overhead costs provides valuable insights into how efficiently a business is operating. High or escalating overhead expenses may indicate inefficiencies, such as excessive utility usage or unnecessary administrative functions, which can be addressed to improve margins.

3. Budgeting and Financial Planning

Overhead costs form a significant part of a company’s budget. Accurately estimating these expenses enables businesses to allocate resources effectively, avoid cash flow issues, and plan for future growth. Proper management of overhead costs ensures the organization remains financially resilient.

4. Enhancing Profit Margins

Businesses that manage overhead costs effectively are better positioned to maximize profit margins. Reducing unnecessary overhead expenses or optimizing resource usage can directly increase the profitability of products or services without sacrificing quality or value.

5. Strategic Decision-Making

Understanding overhead costs supports informed decision-making, from expanding operations to investing in new technology. For example, businesses can assess whether outsourcing certain functions or adopting cost-saving tools like Deskera ERP could help streamline operations and reduce indirect expenses.

By keeping a close eye on overhead costs and incorporating them into financial strategies, businesses can safeguard profitability and build a foundation for sustainable success.

Classifications of Overhead Costs

Overhead costs can be categorized into three primary types: fixed, variable, and semi-variable. Understanding these classifications helps businesses allocate resources effectively, monitor expenses, and make informed financial decisions.

1. Fixed Overhead Costs

Fixed overhead costs remain constant over time, regardless of the level of business activity. These expenses do not fluctuate with production output or sales volumes, making them predictable and easier to budget.

- Examples:

- Rent or lease payments.

- Insurance premiums.

- Depreciation of equipment or property.

- Key Insight: Fixed costs provide stability but can become burdensome if the business faces a decline in revenue or production.

2. Variable Overhead Costs

Variable overhead costs change in proportion to business activity levels, such as production output or sales. These expenses increase or decrease based on operational demands.

- Examples:

- Utilities like electricity and water used in production.

- Shipping and delivery charges.

- Indirect materials (e.g., lubricants for machinery).

- Key Insight: Monitoring variable costs helps businesses identify areas where efficiency can be improved as demand fluctuates.

3. Semi-Variable Overhead Costs

Semi-variable costs have characteristics of both fixed and variable costs. They include a fixed base cost that remains constant and a variable component that changes with activity levels.

- Examples:

- Salaries with overtime pay.

- Equipment maintenance costs.

- Telephone and internet bills with a base fee and usage-based charges.

- Key Insight: These costs require careful tracking to avoid unexpected spikes during periods of increased activity.

Classifying overhead costs into fixed, variable, and semi-variable categories allows businesses to gain a clearer understanding of their financial structure. By analyzing these classifications, businesses can better manage expenses, optimize budgets, and develop strategies to enhance profitability.

Examples of Overhead Costs in Different Industries

Overhead costs vary across industries depending on the nature of their operations. Recognizing these costs helps businesses allocate resources effectively and ensure accurate financial planning.

Below are examples of overhead costs specific to different industries:

1. Manufacturing Industry

In manufacturing, overhead costs are essential for maintaining operations but are not directly tied to production.

- Examples:

- Factory rent or lease.

- Utilities like electricity and water.

- Salaries of supervisors and administrative staff.

- Depreciation of machinery and equipment.

- Maintenance of production facilities.

2. Retail Industry

Retail businesses incur overhead costs to maintain storefronts and manage inventory.

- Examples:

- Store rent or property taxes.

- Utilities like lighting and air conditioning.

- Point-of-sale (POS) system maintenance.

- Salaries of sales staff and cashiers.

- Marketing and advertising expenses.

3. Hospitality Industry

Hotels, restaurants, and other hospitality businesses have unique overhead costs to ensure customer satisfaction.

- Examples:

- Facility upkeep, such as housekeeping and landscaping.

- Utility costs like heating, cooling, and water supply.

- Employee training programs.

- Marketing campaigns and loyalty programs.

- Licensing fees for music or television in guest areas.

4. Technology Industry

Tech companies, including software developers and IT service providers, face overhead costs related to innovation and client support.

- Examples:

- Office space and utilities.

- Software licenses and subscriptions.

- Salaries of support and administrative teams.

- Research and development expenses.

- Server maintenance and cloud storage fees.

5. Healthcare Industry

Hospitals, clinics, and other healthcare providers have significant overhead costs to maintain quality care and compliance.

- Examples:

- Facility rent and maintenance.

- Utility costs for specialized equipment.

- Insurance and legal fees.

- Salaries of administrative staff and non-medical personnel.

- Compliance-related costs for adhering to regulations.

6. Education Industry

Schools, colleges, and training institutions have unique overhead costs associated with maintaining educational facilities and resources.

- Examples:

- Campus maintenance and utilities.

- Salaries of administrative and support staff.

- Technology for online classes or digital libraries.

- Marketing for student admissions.

- Compliance with accreditation requirements.

By understanding overhead costs specific to their industries, businesses can identify opportunities to reduce unnecessary expenses, optimize operations, and enhance profitability. Tailored strategies and tools like Deskera ERP can help track and manage these costs effectively, regardless of the industry.

How to Calculate Overhead Costs

Calculating overhead costs accurately is essential for managing budgets, pricing products or services, and improving business profitability. The process involves identifying all indirect expenses, classifying them, and using the data to compute the overhead rate.

Here’s a step-by-step guide:

1. Identify All Overhead Expenses

List all the indirect costs that are essential to your business operations but not directly tied to production or service delivery.

- Examples: Rent, utilities, administrative salaries, insurance, maintenance, and depreciation.

2. Categorize Overhead Costs

Classify the expenses into fixed, variable, or semi-variable categories for better analysis:

- Fixed Costs: Rent, insurance premiums.

- Variable Costs: Utility bills, indirect materials.

- Semi-Variable Costs: Salaries with overtime pay, maintenance costs.

3. Sum Up the Overhead Costs

Add up all the overhead expenses to get the total overhead cost for a specific period, such as monthly, quarterly, or annually.

4. Determine the Overhead Rate

The overhead rate helps allocate overhead costs to products or services. It is calculated using the formula:

Overhead Rate = ( Total Overhead Costs / Direct Costs or Revenue ) x 100

Example:

- Total Overhead Costs: $50,000.

- Total Direct Costs: $200,000.

Overhead Rate = ( 50,000 / 200,000 ) x 100 = 25%

This means that for every dollar of direct costs, an additional $0.25 is spent on overhead.

5. Allocate Overhead Costs to Products or Services

To determine the cost of a specific product or service, include the overhead allocation alongside direct costs. This ensures accurate pricing and profitability analysis.

Example Allocation:

- Direct Costs for Product A: $10,000.

- Overhead Rate: 25%.

Overhead Allocation = 10,000 x 0.25 = 2,500

The total cost of Product A is $12,500, including $2,500 in overhead costs.

6. Monitor and Adjust Regularly

Overhead costs can fluctuate due to changes in business operations. Regularly revisiting and recalculating these costs ensures accuracy and helps identify opportunities for cost optimization.

By following these steps, businesses can gain a clear understanding of their overhead costs and make informed financial decisions. Tools like Deskera ERP simplify the process by automating cost tracking, categorization, and allocation, ensuring you stay on top of your finances effortlessly.

Why Monitoring Overhead Costs Is Crucial

Monitoring overhead costs is a vital component of effective financial management and long-term business success. While these expenses may not directly generate revenue, their impact on profitability, operational efficiency, and decision-making cannot be underestimated.

1. Ensures Accurate Pricing

Overhead costs significantly influence pricing strategies. Without proper monitoring, businesses risk underestimating these costs, leading to underpriced products or services and reduced profit margins. Conversely, overestimating overhead costs could result in overpriced offerings, potentially driving customers to competitors.

2. Improves Profitability

Regular tracking of overhead costs enables businesses to identify areas of inefficiency or waste. For example, excessive utility usage or redundant administrative expenses can be addressed to optimize costs and improve profitability.

3. Supports Better Budgeting and Forecasting

A clear understanding of overhead expenses is essential for accurate budgeting and financial planning. Monitoring these costs allows businesses to anticipate future expenses, allocate resources effectively, and avoid cash flow issues.

4. Aids in Identifying Cost Reduction Opportunities

Monitoring overhead costs helps identify unnecessary or excessive expenses that can be reduced without compromising operational quality. For instance, automating routine tasks with tools like Deskera ERP can streamline processes, cut administrative costs, and improve overall efficiency.

5. Enhances Financial Decision-Making

Knowing the breakdown and trends of overhead costs empowers businesses to make informed decisions. Whether it's investing in new technology, expanding operations, or launching new products, understanding these costs ensures strategic and financially sound choices.

6. Aligns with Business Goals

Overhead cost monitoring aligns operational expenses with broader business goals. It helps organizations allocate resources to areas that drive growth while maintaining a balance between cost control and quality service delivery.

Monitoring overhead costs is not just about tracking numbers; it’s about gaining insights into the financial health of a business. With a proactive approach and the right tools like Deskera ERP, businesses can effectively manage these costs, enhance profitability, and achieve sustainable growth.

Tips to Optimize and Reduce Overhead Costs

Reducing overhead costs is essential for improving profitability and maintaining efficient business operations. By strategically managing indirect expenses, businesses can free up resources for growth and innovation.

Here are some actionable tips to optimize and reduce overhead costs:

1. Automate Routine Tasks

Automation helps reduce manual labor and minimizes human error. Tasks such as payroll, invoicing, and inventory management can be streamlined using tools like Deskera ERP, which automates these functions. This reduces administrative costs and frees up time for more value-driven activities.

2. Outsource Non-Core Functions

Instead of maintaining in-house teams for every task, consider outsourcing non-core functions such as IT support, marketing, or customer service. Outsourcing allows businesses to access specialized services without bearing the full costs of permanent staff.

3. Negotiate with Suppliers

Review supplier contracts regularly to ensure you’re getting the best prices for your services and materials. Negotiating discounts, exploring bulk purchasing options, or seeking alternative suppliers can help reduce material and service-related overhead costs.

4. Optimize Energy Usage

Energy costs can be a significant component of overhead expenses. Investing in energy-efficient equipment, using LED lighting, and adopting energy-saving practices can help reduce utility bills. Additionally, setting up smart thermostats or monitoring energy usage with software can further optimize costs.

5. Embrace Remote Work

Remote work can significantly reduce overhead costs related to office space, utilities, and office supplies. By shifting to hybrid or fully remote work arrangements, businesses can reduce their real estate expenses and streamline operations.

6. Monitor and Control Inventory

Excessive inventory can lead to unnecessary storage and handling costs. Implementing inventory control strategies, such as Just-in-Time inventory management or using inventory management software like Deskera ERP, can minimize storage costs and ensure that businesses only hold the necessary amount of stock.

7. Reduce Travel and Entertainment Expenses

Travel and entertainment expenses can add up quickly, especially for sales and management teams. By using video conferencing tools and reducing unnecessary business trips, companies can cut down on travel expenses without compromising productivity.

8. Consolidate Software and Tools

Using multiple software tools can lead to redundancies and increased costs. Consolidating software platforms into an all-in-one solution, such as Deskera ERP, allows businesses to streamline operations, reduce licensing fees, and centralize data for better decision-making.

9. Regularly Review Overhead Costs

Continuously monitoring and evaluating overhead expenses allows businesses to identify areas of inefficiency. Set regular intervals to review financial statements, analyze trends, and adjust where necessary to optimize costs.

10. Improve Employee Productivity

Investing in employee training and development ensures that staff can work more efficiently, reducing the time and resources needed for training. Enhanced productivity can also result in fewer errors and lower operational costs.

By implementing these strategies, businesses can effectively optimize their overhead costs and improve overall profitability. Tools like Deskera ERP provide the insights and automation needed to reduce inefficiencies, streamline operations, and keep costs under control, allowing businesses to focus on growth and success.

How Can Deskera ERP Help You With Overhead Costs?

Effectively managing overhead costs is essential for optimizing business operations and improving profitability. Fortunately, several tools and software can help businesses monitor, track, and control their overhead expenses.

These tools provide valuable insights into financial performance, enabling companies to make informed decisions. One such tool is Deskera ERP, an all-in-one business management software that simplifies overhead cost management.

1. Tracking and Categorizing Overhead Expenses

With Deskera ERP, businesses can easily track and categorize all overhead expenses, such as rent, utilities, and administrative salaries. The software allows users to input and assign costs to specific categories, helping businesses maintain accurate records and identify areas where savings can be made.

2. Streamlining Financial Reporting

Deskera ERP offers comprehensive financial reporting features that provide real-time visibility into a company’s overhead costs. It helps businesses generate detailed reports on their expenses, enabling them to analyze trends, compare costs over time, and make adjustments as necessary to improve financial performance.

3. Budgeting and Forecasting

By using Deskera ERP’s budgeting and forecasting capabilities, businesses can plan their overhead costs more effectively. The software allows for the creation of detailed budgets, ensuring that overhead expenses remain within set limits. It also provides forecasting tools to predict future costs based on historical data, helping companies prepare for potential changes in their overhead structure.

4. Identifying Cost Reduction Opportunities

Deskera ERP’s analytics and reporting features help businesses identify areas where overhead costs can be reduced. Whether it’s minimizing utility consumption or cutting back on unnecessary administrative functions, the software provides actionable insights that can lead to more efficient cost management.

5. Automation of Routine Tasks

Routine tasks such as invoicing, payment tracking, and payroll can be automated with Deskera ERP. By reducing manual processes, businesses can lower administrative overhead costs and improve efficiency.

Managing overhead costs is crucial for maintaining profitability and operational efficiency. With the right tools, like Deskera ERP, businesses can streamline their cost management processes, monitor expenses in real-time, and make data-driven decisions to optimize their financial performance.

Key Takeaways

- Overhead costs are indirect expenses that are necessary for running a business but do not directly contribute to the production of goods or services. They include costs such as rent, utilities, and office supplies.

- Overhead costs are indirect costs that support overall business operations, while direct costs are directly tied to the production of goods or services, such as raw materials and labor.

- Overhead costs are indirect expenses required to run a business, while operating expenses include both direct and indirect costs necessary for day-to-day operations. Both play a significant role in determining profitability.

- Managing overhead costs is essential for maintaining profitability. By accurately tracking and optimizing these expenses, businesses can improve their financial performance and maintain competitive pricing.

- Overhead costs can be categorized into three main types: fixed, variable, and semi-variable. Each type has distinct characteristics that influence cost management strategies and budgeting.

- Overhead costs vary across industries. In manufacturing, they include utilities and factory rent, while in service-based industries, overhead costs may include office supplies and administrative salaries.

- Overhead costs can be calculated by adding up all indirect expenses and dividing them by the total direct costs. This provides an overhead rate, helping businesses understand the proportion of overhead in relation to their production costs.

- Regular monitoring of overhead costs helps businesses maintain financial control, make informed decisions, and improve profitability by identifying inefficiencies and areas for cost reduction.

- Businesses can optimize overhead costs by automating routine tasks, outsourcing non-core functions, negotiating with suppliers, and improving energy efficiency. Regularly reviewing expenses also helps identify areas for cost reduction.

- Tools like Deskera ERP streamline the management of overhead costs by automating tasks, generating reports, and providing real-time visibility into expenses. This helps businesses track and reduce costs more effectively.

Related Articles