Profit is the money or revenue a business pulls in after accounting for all expenses. From a lemonade stand to a publicly-traded multinational company, the primary goal of any business is to earn money, therefore a business performance is based on profitability, in various forms.

What Is Profit Margin?

Profit margins is perhaps one of the simplest and widely used financial ratios in corporate business finance. Profit margin is one of the most commonly used profitability ratios to measure how a company or a business activity makes money. Profit margins represent what percentage of sales has been turned into profits. Simply put, the profit percentage figure indicates how many cents of profit the business has generated for each dollar of sale.

If a company reports that it has achieved a 25% profit margin during the last quarter, it means that it has a net income of $0.25 for each dollar of sale generated.

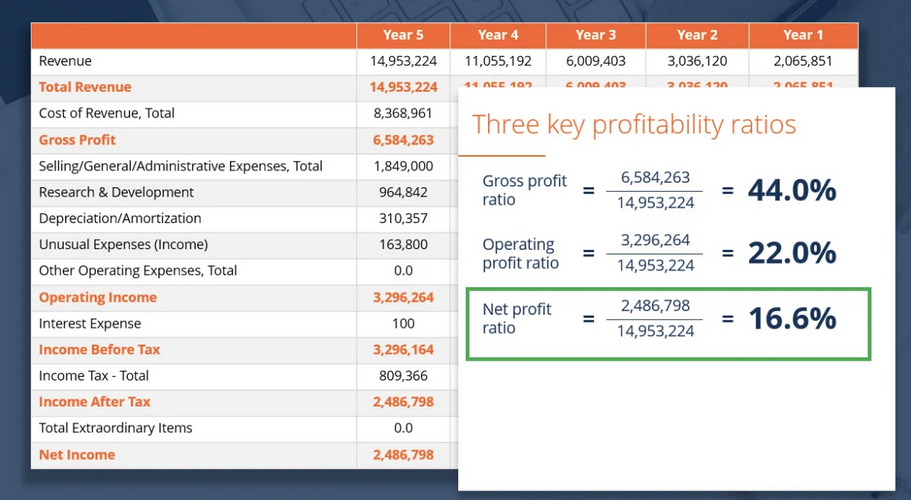

There are several types of profit margin. A company's profit or loss is calculated as three levels on its income statement. Starting with the most basic gross profit and building up to the most comprehensive, net profit. And in-between these two lies the operating profit. All the three corresponding profit margins calculated by dividing the profit figure by revenue and multiplying by 100.

However, in everyday use, the profit margin usually refers to the net profit margin. A company's bottom line is after all other expenses, including taxes, have been taken out of revenue.

What are the Different Types of Profit Margins?

The three major types of profit are gross profit margin, operating profit margin, and net profit margin. All of which can be found on the income statement. Each profit type gives analysts more information about a company's performance, especially when it is compared to other competitors and time periods.

Gross Profit Margin

The first level of profitability is gross profit, which is sales minus the cost of goods sold. The calculation of Gross Profit margin is from gross profit. The formula to calculate gross profit margin as a percentage is Gross Margin. It is as per the formula mentioned below:

Gross Profit = Total Revenue − Cost of Goods Sold (COGS)

Gross Margin = (Total Revenue – Cost of Goods Sold)/Total Revenue x 100

For example, if Company X has $100,000 in sales and a COGS of $70,000, it means the gross profit is $30,000, or $100,000 minus $70,000. Divide gross profit by sales for the gross profit margin, which is 30%, or $30,000 divided by $100,000.

Operating Profit Margin

The second level of profitability is operating profit, which is calculated by deducting operating expenses from gross profit. These are things like selling, general, and administrative costs (SG&A). Operating margin is an important measure of a company's overall profitability from operations. It is the ratio of operating profits to revenues for a company or business segment.Higher ratios are generally better, illustrating the company is efficient in its operations and is good at turning sales into profits.

Operating Profit = Gross Profit − Operating Expenses

Operating Profit = Operating Revenue - Cost of Goods Sold ( COGS) - Operating Expenses - Depreciation - Amortization

Operating Profit Margin = Total Revenue / Operating Profit

Gross profit looks at profitability after direct expenses, and operating profit looks at profitability after operating expenses. If Company X has $10,000 in operating expenses, the operating profit is $30,000 minus $10,000, equaling $20,000. Divide operating profit by sales for the operating profit margin, which is 20%.

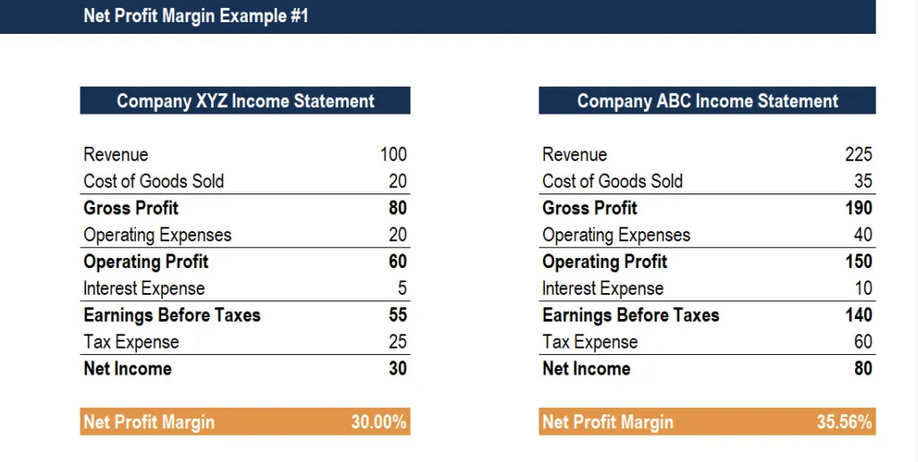

Net Profit Margin

The third level of profitably is net profit, which is the income left over after all expenses, including taxes and interest - have been paid. The net profit margin, or simply net margin, measures how much net income or profit is generated as a percentage of revenue. It is the ratio of net profits to revenues for a company or business segment.

Net Profit or Net Income = Operating Profit − Taxes & Interest

Net Income or Net Profit = Revenue − Cost of Goods Sold − Operating Expenses − Other Expenses − Interest − Taxes

Net Profit Margin = Net Profit/ Revenue

Net profit is calculated by deducting both taxes and interest, of these from operating profit. In the example of Company X, the answer is $20,000 minus $10,000, which equals $10,000. Divide the net profit by sales for the net profit margin, which is 10%.

What is the Difference Between Net Profit and Gross Profit?

Gross profit is the profit a company makes after deducting the costs associated with making and selling its products, or the costs associated with providing its services.

Gross profit appears on a company's income statement and can be calculated by subtracting the cost of goods sold (COGS) from revenue or sales. Gross profit can be found on a company's income statement. Gross profit may also be referred to as sales profit or gross income.

Gross Profit = Revenue − Cost of Goods Sold

Net Profit or Net Income, we need know Net Income, also called net earnings, is calculated as the sales minus cost of goods sold (cogs), selling, administrative and general expenses, depreciation, operating expenses, taxes, interest, and other expenses.

It is the number used by investors to assess how much revenue exceeds the expenses of an organization. This number appears on a company's income statement and is also an indicator of a company's profitability.

Net Profit = Revenue − Cost of Goods Sold − Operating Expenses − Other Expenses − Interest − Taxes

How is Profit Margin Calculated?

In finance and accounting, a profit margin is the measure of a company’s earnings or profits relative to its revenue. Profit margins are used by investors, creditors and businesses themselves as indicators of a company's financial health, management's skill, and growth potential.

Gross profit margin is an metric expressed as a company's net sales minus the cost of goods sold (COGS). Gross profit margin is often shown as the gross profit as a percentage of net sales. The gross profit margin shows the amount of profit made before deducting selling, general, and administrative costs, which is the firm's net profit margin.

Gross Profit Margin = Net Sales − COGS / Net Sales

Gross profit margin is a metric analysts use to assess a company's financial health by calculating the amount of money left over from product sales after subtracting the cost of goods sold (COGS).

Net profit margin measures how much net income is generated as a percentage of revenues received. Net profit margin helps investors assess if a company's management is generating enough profit from its sales and whether operating costs and overhead costs are being contained. Net profit margin is one of the most important indicators of a company's overall financial health.

Net Income = (Revenue − Cost of Goods Sold − Operating Expenses − Other Expenses − Interest − Taxes) X 100 / Revenue

Net Profit Margin = (Net Income) X 100 / Revenue

Which Financial Report Shows the Profit Margins?

An income statement shows the total of a company's revenues and expenses. The Profit margin is found on the income statement. The income statement has revenues from selling goods and services against all expenses – depreciation and taxes, including interest, that is required to operate the company profits over a specific time period. The income statement has:

- Gross profits

- Operating profits, or EBITDA (earnings before interest, tax, depreciation and amortization)

- Net Income or Net Profit

The easiest way to calculate your Profit Margins is by using accounting software for invoicing and sales management.

While the number can be calculated manually, using accounting software's such as Deskera Books helps track revenue and expenses accurately, providing you with the profit margin figure that you can trust.

Key Takeaways

- Profit margin measures the degree to which a company or a business activity makes money, essentially dividing income by revenues

- Expressed as percentage, profit margin indicates how many dollors of profit has been generated for each point of sale

- Profit margins are used by investors, creditors, and businesses themselves as indicators of a company's financial health, management's skill, and growth potential.

- Usually profit margins vary by industry sector, care should be taken when comparing the figures for different businesses.

- Gross profit includes variable costs but does not account for fixed costs

- Gross profit is calculated by subtracting the (COGS) cost of goods sold from the sale or revenue

- Gross profit calculates a business's efficiency at using its labor and supplies in producing goods or services.