Revenue is the basis of almost every type of business. Your business needs to generate revenue to justify the fixed and variable expenses you pay to operate. This article discusses what revenue is, how it works, and its types and shows examples to help clarify.

Before we go into the formula for calculating revenue, it is essential to understand the essence of revenue and business.

Understanding your business = Understanding revenue = Growing your business

Revenue is an essential metric for any business and yet it is rarely understood entirely:

- There are different types of revenue

- Calculating revenue gets more complex as business scales

- Once calculated, you should know what to do with it

What is Revenue?

Revenue is also referred to as sales revenue. Revenue is the amount of gross income gained through sales of items, products, or services. An easy way to calculate revenue is by multiplying the number of sales and the sales price or average service price.

Revenue = Sales x Average Price of Service

Revenue is the total earnings that your business generates through its operations, such as the sale of service or products, rent on the property, interest on borrowings, etc.

For example, cookie seller's revenue is generated through the sale of cookies; hairdressers earn their revenue by providing services, and banks generate their revenue in the form of interest on the loans to borrowers. Your company's revenue is reported on the first line of your income statement. It is usually described as sales or service revenues. Hence, revenue is the amount that is earned from clients and customers before subtracting your current expenses.

Net Revenue Vs. Gross Revenue

There are two types of revenues: Net Revenue and Gross Revenue.

Net and gross revenue can affect a company's income tax. The two different revenues can be defined as:

- Gross revenue is all of the income from a sale. Not considering any of the expenditures from any source. Let's say a retailer sells the latest line of sneakers for $100; then the gross revenue would be $100

- Meanwhile, Net revenue subtracts the cost of goods sold from gross revenue. Fees for production, shipping, and storage, plus any discounts, allowances, and returns, can contribute to this cost. For example, net revenue from an item worth $225 that costs $125 to make would be $100

Net revenue is also known as "the bottom line" often since it is listed on an income statement at the bottom.

Recognized Revenue Vs. Deferred Revenue

Recognized revenue is simple. It is the revenue recorded as soon as the business transaction is conducted. Once the sale has taken place, you can record it in your financial statements.

An example of Deferred revenue are companies that are subscription-based. These companies regularly receive payment for goods or services that they will deliver in the future. Since the company has received the money in advance of earning it, this is known as deferred revenue. Hence, this is recorded not as an actual income but as a current liability.

For example, a company like Netflix offers a video subscription service for $8.99 a month. Hence, totaling $107.88 per year. Every month payment is recorded as it is delivered to the company before being reversed and booked as revenue at the end-of-year cycle. On the receipt of a yearly subscription purchase from a new customer, the company cannot simply record the entire year's subscription.

Revenue Types

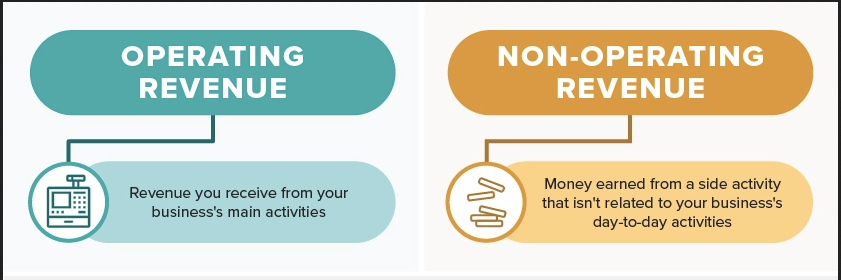

We can also categorize revenue types as - Operating Revenues and Non-Operating Revenues.

Operating Revenues

Operating revenues are generated from your company's main business operations. This means that this is the area of activities that your company that earns most of its income and chooses to operate. Operating revenue is different as per the industry. A few examples of operating revenues are :

- Sales: A sale of merchandise or items. A cloths retailer would record the income from selling shirts to customers as merchandise sales.

- Rents: This income is earned by landlords for allowing tenants to reside in their buildings or land. This revenue the landlords record rental income when it is earned.

- Consulting services: Also known as "professional services", refers to income from providing a service to clients or customers. Law and software firms report their revenues when they provide services to their clients.

Non-Operating Revenues

Non-operating revenues are derived from activities that are not related to your company's core operations. Examples of these non-operating revenues include:

- Interest revenue: Most companies earn small amounts of interest from their checking and savings accounts. Includes bank account interest and interest accrued from accounts receivable or other contracts.

- Dividend revenue: Refers to earnings received as a shareholder based on a percentage of a company's earnings in the form of cash payments.

What is the Sales Revenue Formula?

The sales revenue formula simply calculates revenue by multiplying the number of units or products sold by the average unit price.

In turn, service-based businesses calculate the formula slightly differently. It is calculated by multiplying the number of customers by the average service price seen as below:

- Product-based business formula:

Revenue = Number of Units Sold x Average Price

- Service-based companies formula for revenue:

Revenue = Number of Customers x Average Price of Services

Example of Sales Revenue Calculation:

- We sold 1,000 game consoles for $250 per piece.

- Sales revenue = 1,000 x 250 = $250,000

Examples of Revenue

Here are some general types of revenue you may encounter:

- Government revenue: The government revenue refers to the money received from fees, fines, taxation, grants, governmental transfers, mineral or resources rights, securities sales, etc.

- Non-profit organization revenue: Revenues for a non-profit are from gross receipts. Gross receipts may include donations from companies or foundations, individuals, grants, investments, fundraising activities, and membership fees.

- Revenue from real estate investments: This revenue refers to income that a property generates, like on-site laundry costs, rent, parking fees, etc. When you subtract the property's operating expenses from the property's income, you will get the net operating income.

How Can Your Business Use Revenue Data?

Calculating revenue correctly is the compass by which you can orient your entire business. You can use the numbers to make the right decisions for your company in a number of ways like:

- Plan Operating Expenses

Based on revenue, you can plan both immediate and future expenses for your business like inventory, pay, etc

- Determine Growth Strategies

Historical revenue data can help plans for growth. To know how much you can invest in R&D and how much you spend on equipment

- Analyze Trends

Historical revenue data helps set up sales dashboards to identify customer behavioral patterns and predict future revenue

- Update Pricing Strategy

Revenue can be increased with the correct pricing strategy. A clear picture of your revenue will help you recognize if you are pricing your product right and if your company is being profitable

How do you Prevent Loss of Revenue?

Losing revenue through customer churn is the easiest way to fail. Potential revenue can be lost by failing to convert the right customers. You can keep track of this by keeping an eye on the following:

- Your product isn't engaging your customers: The value proposition of your business needs to be very clear to your customers. If your customers are not engaging, then they are likely to churn.

- You aren't communicating with your customers: Customer complaints can be excellent sources of learning. Failing to listen to your customers means you are missing an opportunity to improve your product. Your unhappy customers will probably churn.

- Your pricing page is confusing or uninformative: This page must explain your plans clearly and make it easy for customers to convert. A confusing page will discourage customers and cause churn.

- You can try to incentivize conversion by offering discounts: Discounts may nudge some buyers to convert sooner.

- Your pricing model is not aligned along with a value metric: A value metric would let you better monetize customers by providing them with the exact version of your service they want to pay for.

- You have not adjusted your prices in a long time: This means your business is out of touch with your market's need and with their willingness to pay.

Key Takeaways

- Revenue is the total earnings that your business generates through its operations or services.

- Different Revenues are Net revenue, Gross revenue, Recognized Revenue, Deferred Revenue

- Net revenue is also known as "the bottom line" often since it is listed on an income statement at the bottom.

- Revenue type as - Operating Revenues and Non-Operating Revenues.