With the onset of the COVID-19 pandemic in 2020 and all the havoc and chaos that it brought in its wake and is still continuing to do so in waves, 54% of the businesses now expect late payment on their invoices. This has led to their cash flow, and thereby their revenue to get affected negatively.

When you have sold a product or offered service, the first step that you would take to get paid is to make an invoice. While earlier the payments used to mostly be based on cash and the bookkeeping and accounting used to be done manually, today with the rise of technology, these trends have changed.

One of the base reasons that supported this change was also the fact that manual bookkeeping and accounting led to erroneous billing, delayed account payables and account receivables, and brunt on the investing activities of your business because of cash flow problems and a higher ratio of outstanding receivables.

Financial technologies like card payments, electronic transfers, and online payments have vastly speeded up the payments while having an invoicing software has made everything not only faster but also more efficient and professional, further assisted by the invoice templates and payment reminder features that are offered by several invoicing software.

By using these invoicing software, you would be able to improve your cash flow, have higher net profits, lesser losses, and save on your time and efforts as well. In fact, an 80% growth rate has been forecasted for the digital e-invoicing market by 2027, therefore surpassing its $24,726 million markets.

If you are here, you are planning to be a client of this huge market as well. But first, let us take you through all the core features and key benefits that invoice software will offer you. Additionally, this article will also be covering one of the leading invoice software examples for your consideration.

What is an Invoicing Software?

Invoicing software is a tool that will automatically generate billing for your rendered services and products. The tool is designed to create a list of services and products along with their corresponding costs and then send it to your customers as an invoice.

Often, these invoices are created using the ready-made templates that come with the invoice software. These invoice templates tend to be professional-looking ones that make the whole process of invoicing easier, faster, and more advantageous for your business.

It is because of these functionalities that every year, more and more businesses are shifting to using e-invoicing software. In fact, in comparison to conventional paper invoices, the processing time and associated costs are streamlined when using invoice software.

This cost and time savings by invoicing software does not only come from saving on postage and printing costs but also from reduced timelines for receiving your payments as well as due to the unification of all processes related to invoicing.

In fact, the benefits of invoicing software are so far and wide that they will also assist your business in managing its working capital as well as in increasing its productivity. Additionally, it will also result in your business having better relationships with its clients and suppliers, therefore even encouraging returning customers and increasing customer loyalty and customer retention.

What Does an Invoicing Software Do?

While the earlier sections of this article have given you a glimpse into what invoicing software does, this section is dedicated to giving you a clearer idea and therefore understanding for the same so that you can make your decision to use invoice software for your business accordingly.

The key processes that you would be able to do with an invoicing software are:

Create and Customize Invoices

In comparison to desktop invoice software, the cloud-based invoicing software is relatively easier to use, hence making them the preferred choice for the majority. One of the main advantages of cloud-based invoicing software over desktop invoicing software is that it lets you easily access your information for creating invoices and also accommodates personalization in accordance with your brand positioning statement.

Additionally, unlike already having a printed invoice in case of the traditional means, by using cloud-based invoicing software, you would be able to make your invoice from scratch and include any or all of these details as relevant:

- Customer’s name

- Quantity of the products or services purchased

- Amount of the purchased products or services

- Discounts (if any)

- Sales tax

And other such details that are relevant to your business and your customer’s purchase.

However, if you do not want to make your invoice from scratch, then this invoice software comes with pre-configured invoice templates for you to use, requiring you to just fill in the fields. In fact, most of the invoice software even lets you customize your invoices by letting you add elements like your company’s logo, corporate symbols, etc.

In case of adding your client’s name to their invoice, you can either create a new client or import the existing client’s name and details from the database and just click on send.

One of the other useful features offered by these invoicing software is that it lets you transform your quotations and estimates as finalized by your client into their invoices. These invoices can then be sent to your clients, or you can direct them to get them from an online portal. This feature is especially useful for automating recurring invoices for your long-term clients.

Facilitates Billing and Payment

In the case of online invoicing software, they do not require additional set-ups and hence provide you with the capability of conveniently processing your payments. By using invoicing software, you would be able to make an online portal through which your customers would be able to make their payments directly to you, and you would be able to immediately process them.

In addition to this, the invoicing software will also let you accept payments in foreign currencies because the billing and invoicing software does have features that lets it handle multiple currencies.

One of the other reasons why managing and processing payments have become easier with invoicing software is because they come integrated with online payment platforms like PayPal, Paytm, Razorpay, etc. In fact, the invoicing software also facilitates the processing of credit card payments.

Mostly, therefore your invoicing software would have the features required for handling multiple languages, multiple currencies, tax adjustments, and even the functionality to be able to track your business’s offline payments.

Generates Reports

By using your invoicing software, you would be able to generate a variety of reports that will assist you in tracking your finances as well as in monitoring your outstanding invoices. Through your invoice software, you automate your report generation, export them as PDF files and share or receive them through your email.

Additionally, you can even get your reports generated and data analyzed in order to get relevant insights from your billing and invoicing operations like number of past due invoices, number of sales invoices, number of outstanding invoices, average time for a payment cycle, the ratio of your clients paying on time to those paying late and other such relevant and insightful business metrics.

Considering that your invoicing software manages all your records, transactions, and database, it is only evident that you would be able to get all your important information, including your financial KPIs, through it. This will assist you in making fast and effective business decisions.

Types of Invoicing Software

Invoicing software has become a boon for businesses across the globe. They help you in efficiently managing your company’s finances by keeping track of your expenses and payments, creating automatic accounting reports, and creating and sending invoices and quotes.

However, each business comes with its own requirements, and this is where understanding the different types of invoicing software becomes important so that you can choose the most suitable one for your business.

Online Invoicing Software

Online invoicing software is the one that takes the paper out of the paperwork and keeps all your invoices and financial documents organized in one easy-to-use platform. To use online invoicing software, you will need a phone or a computer or a tablet, and an internet connection, so that everything is saved on its cloud.

By using an online invoicing software, you would be able to create an invoice on the go from any device with an internet connection. In fact, you would be able to access your data on your invoicing software from anywhere in the world because it saves it on the cloud. Online invoicing software tends to be multi-device invoicing software.

Online invoicing software is also easier to use, especially if you have no prior knowledge or experience in accounting. It will make sure that all the legally required details are imputed correctly.

In fact, most of the online invoicing software will also allow you to connect payment accounts or card readers so that you get paid faster. It is also possible to connect a bank account for automatic bank reconciliation.

Offline Invoicing Software

Offline invoicing software is one that needs to be saved on your device and does not get saved on the cloud. Therefore, an offline invoice software can either connect to the internet or cannot. Some of the most common offline invoicing software includes Excel and Word, where you can create the invoice, download it and then email it to your customers.

However, this is where the disadvantages of offline invoice software come to light. It is a time-consuming process, which involves lots of paperwork and is also prone to human error and potential data loss. While this type of invoicing software does not involve a subscription cost, it does involve costs associated with having someone do this manual process for you.

In fact, by using this type of invoice software, automatic reports will not be generated, requiring your team to make them manually using all the invoices and receipts.

The other variant of offline invoicing software is one where it does connect to the internet, is installed in your system, can create invoices and quotes and then send them to your customers, and includes options to connect accounts and view accounting records. Here, the data is not stored on the cloud but is rather system dedicated, which is how it is different from online invoicing software.

Open Source Invoicing Software

Open source invoicing software is one that can be programmed and modified to suit your business needs. Open-source software provides programmers with source codes that will let them change, study, and distribute the software as and when needed by you. In fact, to facilitate this, most online invoicing software provides API documentation on their website in the form of information and codes for developers.

Benefits of an Invoicing Software

In addition to managing all your invoicing related tasks of your business, a good invoicing software also extends the following benefits:

Minimizes Late Payments

The right invoicing software will help you in streamlining your billing and invoicing process, hence letting you get and receive your payments on time. Your invoicing software will help you keep your data as well as scheduling organized, which will hence enable you to get your receivables on time. This, in turn, would help in increasing the net profit ratio of your business.

Minimizes Missed Payments

By accurately monitoring and tracking your billing commitments through your invoice software, you would be able to ensure that you have not missed out on any payments, which will lead to higher net profits and healthier financial statements like income statements, profit and loss statements, and balance sheet.

Maintains a Professional Image

A good invoicing and billing solution always helps in boosting a company’s reputation, thus leading to positive brand awareness and higher sales referrals. By using a good invoicing software, you would be able to customize your invoices with your company’s logos. You would even be able to redesign some of the elements of your payment documents and invoices such that they are a reflection of your brand.

In addition to this, you would largely be able to avoid any billing errors while simultaneously being prompt and organized in the same, hence exuding a professional image with your clients.

Helps Streamlining Your Accounting and Financial Processes by Automating Important Tasks

One of the ways in which you can cut your business expenses is by reducing your staff in the invoicing and billing departments of your company. One of the other ways is by saving time spent on taking follow-ups from your clients for your payments and by going after the late payers.

Additionally, with faster payment of your invoices and enhanced customer relations due to shorter times in fixing and resolving errors, you would be able to increase your cash flow even more, even while having the ratio of your operating income to operating expenses increased.

Minimizes Fraud and Improves Security

A good invoicing software is one that has levels of bank-grade security features to ensure that the entire billing to payment process is protected from hacks or prying eyes. This is comparatively more secure than making your invoices manually and sharing them as email attachments with your clients. This, too, will lead to the clients trusting your business more, and therefore you would have increased sales, as well as assured positive customer feedback.

Features of an Invoicing Software

While the nitty-gritty of an invoicing software does vary a lot, there are some features that are vital for its functioning and are hence shared by every good invoice software. Based on the availability of these features, you should make your decision about whether to get a particular invoice software or not. These important features are:

New Invoice Creation

Invoicing software will let you create clean and professional invoices that can further be customized to reflect your branding. Additionally, the invoicing software should also let you extract and integrate information from projects, time-sheets, and customer records.

Customer Records Creation

The invoicing software you choose should let you summarize your customers’ personal as well as purchase information by letting you attach relevant files in a single, centralized database equipped with search filters for easy access to customers’ records.

These records would prove to be especially valuable when designing marketing strategies and marketing campaigns for your customers, based on their buyer personas and your marketing attribution. This, in turn, will help increase your company’s return on investment and gross profits.

Credit Card Processing

The invoicing software should be able to save you time and effort by facilitating billing through the prompt processing of your customers’ credit card payments. It should also allow for the setting up of a recurring billing system and secured customer management.

In fact, some of the invoicing software will also let you enable auto-billing of credit cards so that your clients do not miss out on a due payment. All of these will have a huge role in setting up an efficient invoice management system.

Predefined Templates

In addition to the accuracy of your bills and invoices, how they look is equally important. This is why the invoicing software that you choose should come with professional and predefined communication templates. These templates will not only help you save your time but will also allow you to customize your accounting as well as represent your brand through your bills and invoices as well.

Multiple Currency Setting

The importance of having this feature in your invoicing software is that it lets you connect your billing and invoicing system seamlessly with the rest of your software architecture. This is similar to their connection with your basic financial operations.

The multiple currency setting is especially useful for issuing receipts, accepting payments, and managing taxes. In fact, it is crucial for you if yours is a global business. By having a multiple currency setting, you would be able to process your transactions faster and therefore ensure that your billing and invoicing remains on time and accurate.

Receive/Send Information

This function of an invoicing software is one where it will allow you to quickly send quotes to your customers. This is made possible through the centralized database on your invoice software, where all their information is stored and readily made available.

Invoice, Payment, and Tax Report

A good invoicing software is one that will eliminate the need for you to use external systems for tax reporting and allow you to perform it within the same system without losing hours to summarize information.

Such an invoice software will indeed help you in cutting back your expenses, preventing financial reporting errors, ensuring that you are fulfilling all your tax obligations, and even saving you time and effort. In fact, such invoicing software, which is an integrated platform for all your financial operations, would also help you make well-informed decisions through analysis of financial KPIs and key business metrics.

Why Use an Invoicing Software?

In addition to all the features, benefits, and functionalities of invoicing software discussed above, some of the additional reasons why your business should adopt an invoicing software are:

Create Invoices Faster and More Accurately

A proper invoice document is one which has:

- An invoice number with a different number on each invoice you send

- Details of the products or services provided by your business

- Date of when the invoice was sent

- Date of when the products were delivered, or the services were rendered

- Name and contact information of the seller or the service provider

- Name and contact details of the buyer

- A proper breakdown of all the costs

- Total amount due

- Payment details

- Payment due date

Putting all of these details manually is a time-tasking task while also making it prone to errors. Having an invoice software that does it all for you, while you are required to only put in the variable details, will save you lots of time and effort, while also increasing your accuracy and the overall business productivity by letting you and your employees focus that saved time and efforts on other tasks that require detailed attention.

Generate Invoices Anywhere

Considering that online invoicing software is powered by cloud technology and is web-based, you would be able to create your invoices from any location as long as you have an internet connection. In fact, some of the invoicing software even offer their mobile apps, which would let you create your invoices on the go. This is an added benefit that is not available with on-premise invoicing software. This will not only increase your invoice creation feasibility but also help you cut back on unnecessary delays and improve your cash flow.

Integrate Invoicing with Key Business Systems

An online invoicing software would be able to integrate with your full accounting system for fulfilling all your financial requirements. This means that your invoicing software can be linked to your payroll, inventory, banking, and reporting modules by using one basic source or platform.

In fact, some of the invoice software even connects directly with the eCommerce platforms and their shopping carts, as well as with their external client databases and time-sheets. Such software is preferred over other invoicing software because of ease of business as well as having an integrated platform that is a one-stop solution for all your business needs. This also helps in keeping your data more in sync with other departments, therefore saving you even more time and effort while increasing your efficiency.

How Much Does an Invoicing Software Cost?

Invoicing software can either be acquired as a standalone application or as a part of full-packaged accounting or finance software.

However, what needs to be understood here is that a standalone invoicing software would not be able to perform its function accurately as in order to do so, it will be required to use some accounting processes. It is because of this reason that invoicing tools are bundled along with other features in a complete accounting software solution.

The prices of invoicing software tend to vary widely. Some are free apps for small businesses with a couple of dozen customers or fewer than that. Other invoicing software are apps with double-figure pricing per month depending on the number of their users and business customers. Most of the invoicing software, however, offer flexible pricing plans starting from Basic and Starter to Pro and Enterprise offerings.

Depending on the needs of your business, the pricing plan you opt for in your invoicing software gets determined. While cost is always a major factor to be considered while acquiring any software, a free invoicing software might not have all the features you will need, while an expensive all-in-one accounting software may not be able to meet all your expectations.

Hence, while deciding which invoicing software to purchase, you will need to make a well-informed and considered decision, such that you are getting the best features at the best price.

Factors to be Considered When Choosing Your Invoicing Software

The key factors that you should consider while choosing your invoicing software in order to ensure that you are making the right decision for your business are:

Should Fit into Your Business Context

Before you start choosing your invoice software, you should first identify all the processes involved in the billing and invoicing of your business. This will help you in knowing how the new invoicing software you are choosing will help you and your team in becoming more efficient. Instead of opting for a multi-functional invoicing software and paying for the features that you might never use, it is smarter to choose an invoice software that will fulfill all your specific needs.

Invoices Should Look Professional and Be Easy to Understand

While the details that are to be included in your bills are critical information, your overall bill should not look dull and dreadful. This is because your invoices are a reflection of your business and its brand, in fact, it does your brand marketing in its own way.

This is why your invoices should be clear, polished, and expertly designed. If they are something that you have directly picked up from your spreadsheet app, then your clients are more likely to not hold your business in high regard.

Must be Safe to Use

In addition to the factors considered above, your invoicing software should be secured, having a solid reputation in their system’s security. This is because your invoicing software would be dealing with private details around finances, and if the hackers get in, it can cause losses to you and your clients and hamper your business’s reputation as well. This can directly lead to a decrease in your net sales.

Hence, in order to ensure that you are not compromising the security of your business and customer data, you should make sure that the invoicing software you choose has robust safeguards in place.

Must Offer Solid Customer Support

Considering that your invoicing software would be cloud-based technology, it is unavoidable for it to be susceptible to bugs and issues- both from the software itself as well as from using it. This is why it becomes important to sign up for invoicing software that has reliable, easily accessible, and proactive customer service.

In addition to providing you with useful insights about your financial operations, the vendor of your invoicing software should also be able to offer you further support in the form of knowledge centers, manuals, tutorials, help-desk, and other such resources.

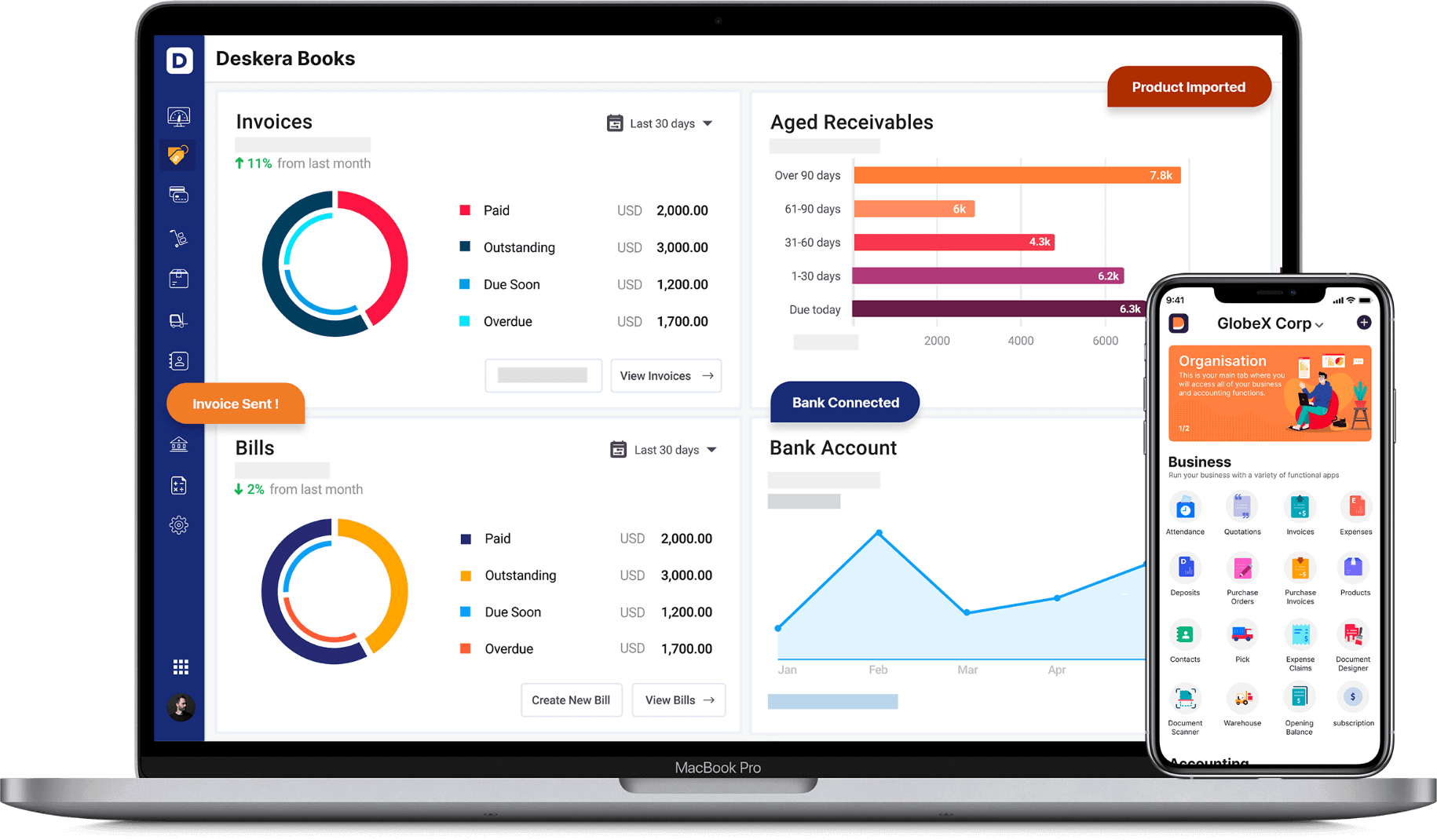

Deskera- An Example of Well-Established and Reputed Invoicing Software

Deskera Books is an easy-to-use online invoicing software that will not only help you with tracking your invoices but also with establishing an efficient cash-flow system for your business. In fact, Deskera Books will also help you create professional-looking invoices in just a few seconds.

To facilitate that, it comes equipped with pre-configured templates of invoices for all industries that you can customize as per your needs. With Deskera Books, you would hence be able to create invoices that will impress your customers and get you paid faster too.

This is because if you choose Deskera Books as your invoicing software, then one of the very useful features it offers is the acceptance of credit card payments and online transfers by just inserting a payment link using your Deskera account. This will make it considerably easier for your clients to pay you.

Further on, you would be able to save lots of time and effort by using Deskera Books, as through it, you would be able to automate almost all of the repetitive tasks of your business like invoicing, billing, expenses, payments, and accounting.

In fact, you would even get reminders and notifications for due dates and be able to create recurring invoices for your business by using Deskera Books. Deskera Books also offers the facility of requesting advance payment or deposit to improve your cash flow and exceed your clients’ expectations. These would then be offset against that client’s future invoices.

Through Deskera Books, you would even be able to track your cost of goods sold and be assured of the fact that you are billing the right amount to your clients. One of the other benefits of using Deskera Books as your invoicing software is that through it, you would be able to forecast your workload, income, and expenses while also letting you stay on top of your invoices, bills, due payments, and expenses.

Lastly, through Deskera Books, you would even be able to work seamlessly with international clients as you would not have to worry about forex gain/loss and exchange rates. Deskera’s multi-currency comprehensive support covers around 100 countries and currencies. In fact, you would even be able to connect your bank and other applications like Google Apps, Shopify, Trello to easily be able to reconcile your invoices and invoice payments.

Deskera Books is, therefore, that efficient and dependable accounting system with an invoicing software that covers all the features and benefits that are discussed above and you would definitely benefit from.

Some of the Latest Trends in Invoicing Softwares

Some of the key invoicing trends in invoice software are:

Government-led Adoption

As more governments realize the efficiency of invoicing processes through an invoice software and the savings that it also ensures, countries in regional areas like Scandinavia and South America and specific nations like Mexico and Brazil are spearheading the adoption of e-invoicing.

In fact, Northern American and European nations and countries like Canada, Australia, New Zealand, South Africa, and South America are also catching up with this adoption. In these countries, the governments are pushing for compliance with e-invoicing requirements.

For instance, the US Office of Management and Budget had declared that all the government agencies had to shift to e-invoicing by the end of 2018. Similarly, the European Union had mandated that its Public Administrators will have to start accepting e-invoices by November 2018.

The Driver of the Real-Time Economy

Considering that invoicing software allows for faster and more accurate data between the purchaser and the supplier, businesses and governments are being driven towards a “real-time economy.”

A real-time economy is one where the purchaser would be able to quickly validate data, and the supplier would be able to respond immediately by using invoices that can be modified and sent again in a span of 24 hours. Not only will this system drastically reduce late payments and penalties, but it will also fasten up your entire sales process, helping you close deals faster and receive payments for the same.

AI and Expanded Automation of the Invoicing Process

As the invoicing software expands more and more, more of the invoicing tasks will get automated. This automation would be to such an extent that it will remove the need to manually monitor the financial transactions of every customer.

Additionally, automation to this extent will further decrease the possibility of errors, including incidences of late payments. Similarly, AI will enable invoicing to evolve further and elevate this financial process to become a dynamic, strategic element of any business. AI will be able to push this change by automating the reconciliation process, enhancing cash flow, identifying invoice fraud, and so on.

Key Takeaways

Invoicing software is designed for automation and accuracy. If yours is a business that sends out invoices regularly, then adopting an invoicing software will help you save a lot of effort and time while also reducing errors and getting timely payments.

However, invoicing software does more than just this. A good invoicing software will help you monitor sales, keep track of the relevant business metrics, give reminders on due dates, and even help in tax compliance.

With its data being updated in real-time, with low scope for errors, invoicing software has become the chosen technology in adoption by several governments and their agencies as well. The trend of invoicing software has just started, and its need, as well as benefits, are only going to increase more and more with more advancements in AI technology.

In fact, the vendors of invoice software have been actively working towards solving the security issues and lack of global standardization in the invoicing software. While they have made progress in the same, there is still a scope of improvement, which, once covered, will only increase the number of users of invoice software.

With its flexible pricing, varied features, and customization that it offers along with its other features, invoicing software has become an essential asset for each business to ensure its long-term success.

Related Articles