Index

- What is payroll

- Challenges in handling the payroll process

- What are payroll taxes

- Payroll tax vs income tax

- Reporting to the government

- What is payroll software

- Why is a payroll system necessary

What is Payroll?

When one hears the word payroll, the first thing that comes to mind is issuing paychecks. While issuing paycheck is an important part, it does not completely define payroll. Investopedia defines payroll as "The total of all compensation that a business must pay to its employees for a set period or on a given date," this includes wages, salaries, bonuses, deductions, and net pay.

Typically, payroll is the most substantial-deductible of any business that employs individuals; this is due to the expense it takes to compensate each employee in salary while also paying them for overtime and sick days.

In simple terms, payroll is a business's financial record of their employees, an annual record on employee wages, and the distribution of employee paychecks.

Challenges in handling the payroll process

Before a payroll is processed, the concerned person needs to source information from the attendance register, salary revisions, conveyance, and reimbursement, etc. Excel sheets for years have been used as a payroll and payroll tax calculator. While you can run the payroll on excel, the number of formulae and the complexity of removing and adding employees and sourcing the information can make it a lengthy process, prone to errors.

Non-adherence to government timelines for individual taxes can also lead to penalization by authorities. In worst-case scenarios, penalties can even threaten the existence of a business. There are many advanced payroll software in these digital times, which helps to process payroll as per the government law and timelines automatically.

What are payroll taxes?

A payroll tax is a tax that is withheld by the employer from the employee's salary and paid to the government on the employee's behalf. This tax is based on salaries, tips paid to employees, and wages. These taxes are deducted directly from an employee's earnings and paid to the Internal Revenue Service (IRS). In the United States, payroll taxes are divided into three essential categories:

Medicare, Federal Income, and Social Security.

The government uses the revenues from these payroll taxes to fund various programs such as healthcare, Social Security, workers' compensation, and unemployment compensation. An employer is usually responsible for financing unemployment compensation if the former employee needs to access those funds upon termination if qualified.

Special Consideration

Self-employed individuals such as freelancers, contractors, small business owners, and musicians are also required to remit payroll taxes. These are known as self-employment taxes. Due to them being self-employed, they have to cover the amount of taxes as both the employer and the employee.

The tax rate for self-employment, as well as regular employment, is 15.3%. 12.4% of this goes to the survivors, old-age, and social security fund while the remaining 2.9% goes to Medicare.

Social Security Tax

Old-Age and Survivors Insurance Trust Fund (OASI) are the two beneficiaries of the funds dispensed towards social security tax from payroll. OASI and Old-Age pay survivor and retirement benefits while the Disability Insurance Trust Fund pays for disability benefits.

Medicare Tax

As mentioned above, Medicare is also one of the beneficiaries of the payroll tax. These deductions go to The Hospital Insurance Trust Fund pays and the Supplementary Medical Insurance Trust Fund.

Payroll tax vs Income tax

Every individual pays a flat payroll tax, while income tax can be progressive according to an individual's earning. Due to the nature of payroll tax, funding specific programs, they are distinct from income taxes. Individuals are taxed by both the state government as well as the federal government. Income taxes support the general fund of the U.S. Treasury.

Reporting to the government

On a quarterly or a yearly basis, an employer has to report payroll tax withholdings, employee statuses, and payments to the federal government, state government, and the local government. Reporting can sometimes be a tedious job, so many companies use payroll software to help them through the entire ordeal.

What is a Payroll software?

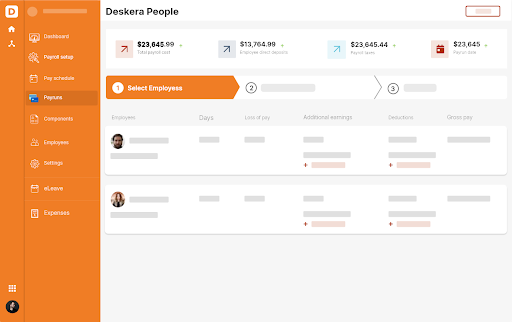

Due to a large amount of work that goes into managing employees' payroll, small and large businesses invest in software. A Payroll software such as Deskera is a solution to manage the entire life cycle of a payroll operation and ease your accounting cycle.

To err is human, and manually processing payroll can leave the door open for some mistakes, proving costly. Payroll software automates tasks to reduce errors and keep your payroll efficient and on time.

Each employee that comes in will have a different compensation than the other, and you need complete visibility of all your payroll expenses on your income statement. A Payroll software for small businesses or otherwise can help you to track your business' payroll easily.

With Deskera, run your payroll process smoothly in just three simple steps:

Calculate wages, weekly, monthly or ad-hoc.

Pay your employees.

Generate payslips.

As mentioned above, reporting payroll taxes is extremely important and can cause the government to penalize businesses in case of non-remittance of taxes. Payroll software will help you adapt to changing payroll tax system laws with ease and without errors.

Why is a payroll system necessary?

Payroll management needs to be error-free and on time, regardless of the size of your business. Whether you choose to run the payroll manually or through payroll software, every business needs a system to track employee hours, understand deductions, and issue payments to your workers. Adopting a manual process can not only be overwhelming, it can lead to errors and is time-consuming. For running a payroll, you also have to be really hands-on with the Tax laws of the countries you are operating in. This is why many small organizations choose to outsource the payroll process to contractors or adopt a payroll software that helps them automate a lot of their processes

It provides online portals for your employees to view important payment information, like tax deductions, 401(k) withdrawals and other breakdowns of benefits.

To eliminate errors and have a smooth process, many industry experts suggest using a payroll software such as Deskera.