Whether you are a freelancer or a small business owner, if you want to create great looking and professional invoices, or had any questions on invoicing, this guide is for you!

Invoicing is the first step to getting paid! In this guide, we introduce invoices, clear up common misconceptions and share what are the top nine elements of an outstanding invoice. We also share FREE invoice templates that you can use for your small business!

- What is an Invoice?

- Nine Traits of an Outstanding Invoice

- How Do I Start Preparing Invoices?

- Examples of How Invoices Are Used in 5 Diffferent Industries

- Invoicing and Payment Terms - Cash vs. Credit

- What Happens After I've Received Payment?

- How does Invoicing Impact Acounting?

- Invoices and Accounts Receivable

- Journal Entries and Invoices

- How Does Invoices Impact Financial Statements?

- Frequently Asked Questions About Invoices

- Are Quotations and Invoices The Same?

- What Is the Difference Between an Invoice and a Receipt?

- Are There Different Types of Invoices?

- Invoice Templates for Your Download

- Why is Having a Good Invoice Software Necessary?

- What Invoicing Software Should I Use As a Small Business Owner?

What Is an Invoice?

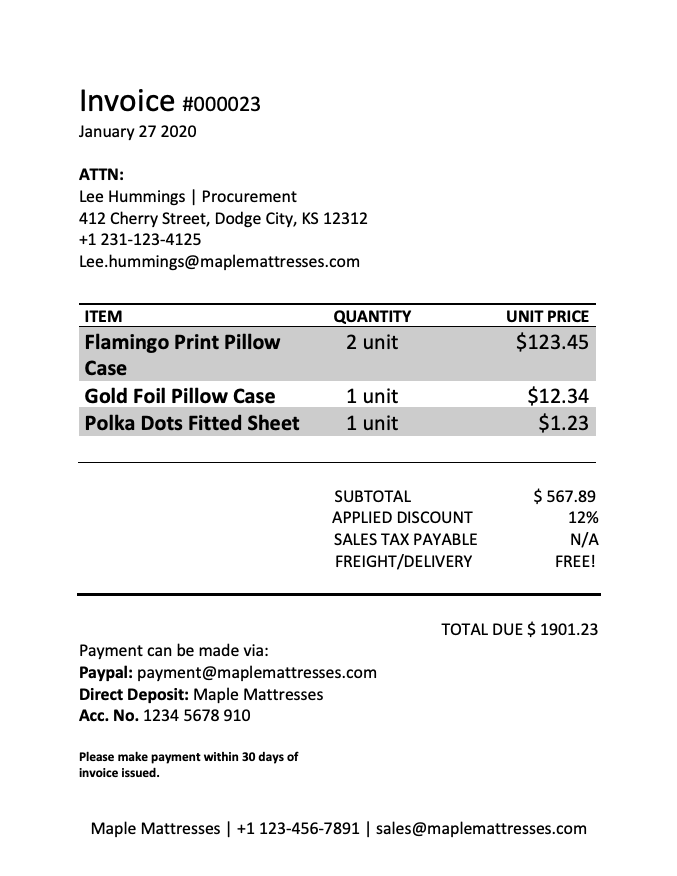

An invoice is a sales document that lists the products and services provided and their respective prices. Invoices are binding documents that are issued after a sale is confirmed.

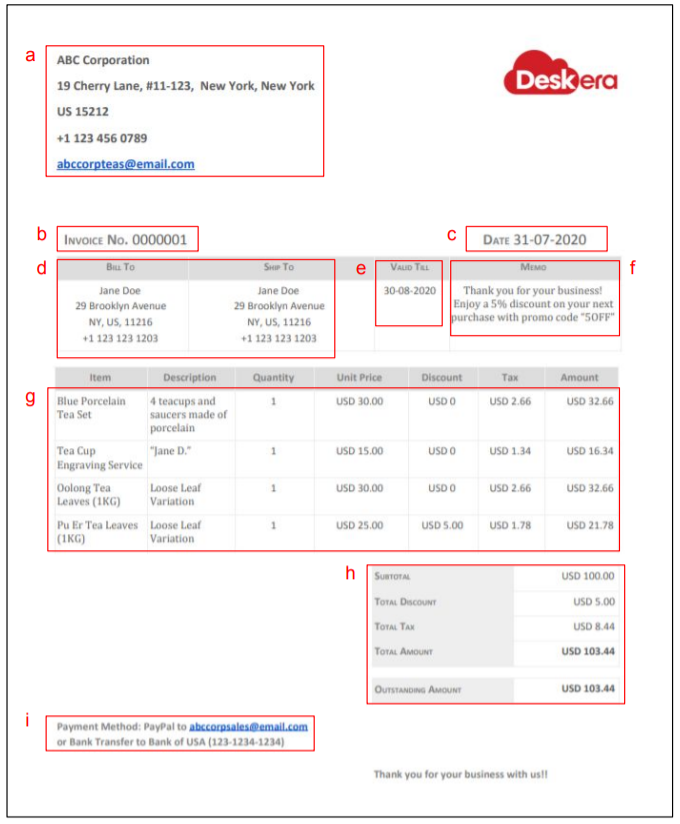

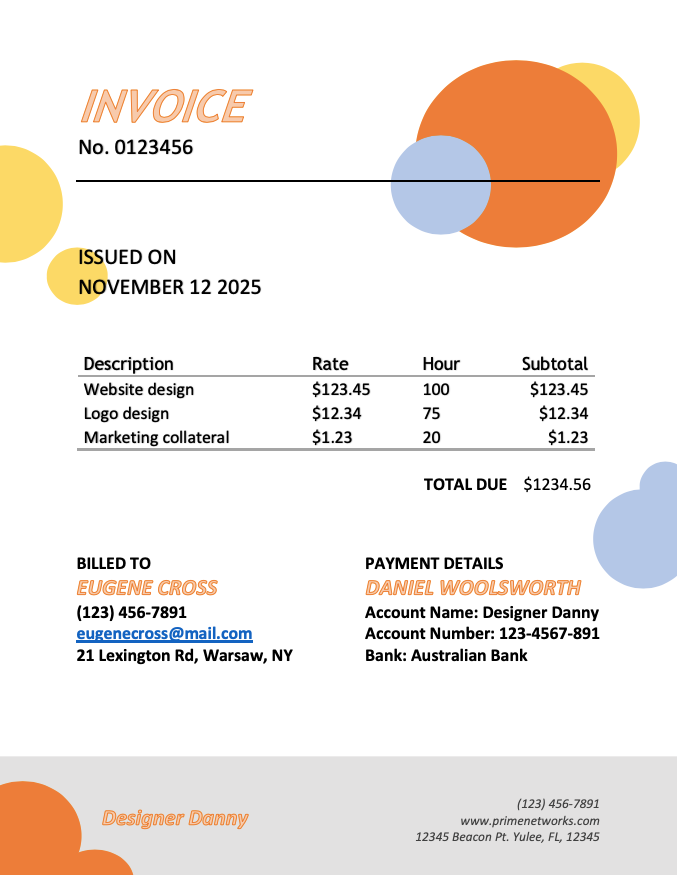

The standard invoice typically looks like this:

You can expect invoices to contain the following information:

a) Contact information of the seller (you!)

Your contact information, such as billing address and email or number, should be accurate. This allows your customer to contact you quickly if there are any discrepancies with the invoice.

b) Documentation Number

Your invoice documentation should be unique as it allows for a neater organization of your transactions and a reference point if you need to look for a particular sale later on.

c) Issued Date of Invoice

The issued date is vital as it protects your business from disputes with the seller regarding payment terms, which are commonly based on when the invoice was issued.

d) Contact information and shipping address of the buyer (your customer)

Sharing the contact information and shipping address helps your customer to identify the location that the products are delivered quickly. Having the contact information and shipping address displayed in the invoice also allows any other staff in your company to promptly locate or contact the customer if there are discrepancies with the invoice.

e) Due Date For Invoice / Validity Date

Other than the Issued Date of Invoice, the Due Date or Validity Date is also important in an invoice: it clearly states when payment is due for the order shown and leaves little space for disputes over late payment.

f) Memo section

The memo section is where sellers can put thank you messages or promo/discount codes to encourage recurring orders.

g) Description of the goods and services provided, and their prices

At one glance, your customer must be able to identify the individual costs of each product or service. Goods sold and services provided should be clearly defined and separated. Standard columns that can be found in an itemized grid includes description, quantity, per-unit price, and other miscellaneous factors such as tax and discounts.

h) Individual subtotals and total amount payable

Calculating and displaying the total amount payable in the invoice saves both you and your customer from a headache adding up the total due for the invoice.

i) Payment details

Your invoice should clearly show the payment methods accepted and any necessary information to support them. These details can range from your PayPal email to your bank account number.

Every business requires an invoice - even small businesses! They are used to communicate money owed to the seller for the goods and services provided to the customer.

9 Traits of an Outstanding Invoice

Follow these 9 pointers while creating your invoice and you would not go wrong!

- Display unique invoice document number

- Show invoice issue date and invoice due date

- Include customer contact and address

- Specify sender (your) contact and address

- Provide itemized list of products and services

- Clarify any miscellaneous costs

- Mention the payment details and options

- Add your company branding (logo)

- Leave a personal note or message

Once you have prepared it, make sure you send your invoice to your customer and do not forget to follow up.

How Do I Start Preparing Invoices?

Invoices are generated by a business (the seller) and sent to their customers. These documents can be sent in various formats and are created either physically on paper or electronically via an invoicing software or word processing applications.

Depending on your company’s operations, you can provide this vital sales document before, during, or after the goods and services are fulfilled.

In this section, we will cover the following:

- Examples of How Invoices Are Used in 5 Different Industries

- Invoicing and Payment Methods - Cash vs Credit

- What Happens After I've Received Payment?

Examples of How Invoices Are Used in 5 Diffferent Industries

You might find it difficult to visualize how invoicing is done in an actual business. In this section, we share how invoicing is done in five different areas (with fictional examples!)

1. Invoicing for Dropshipping

Technology has become so advanced that budding entrepreneurs can start their business from the comfort of their home. Dropshipping is a popular business that has low startup cost and lean operations. One crucial aspect for dropshipping businesses is the creation and sending of invoices to their customers.

As dropshipping involves coordinating orders between suppliers and customers, no physical stock passes the seller's hands. Once the order is received and the shipping details are confirmed, the dropshipper should send an invoice to the customer.

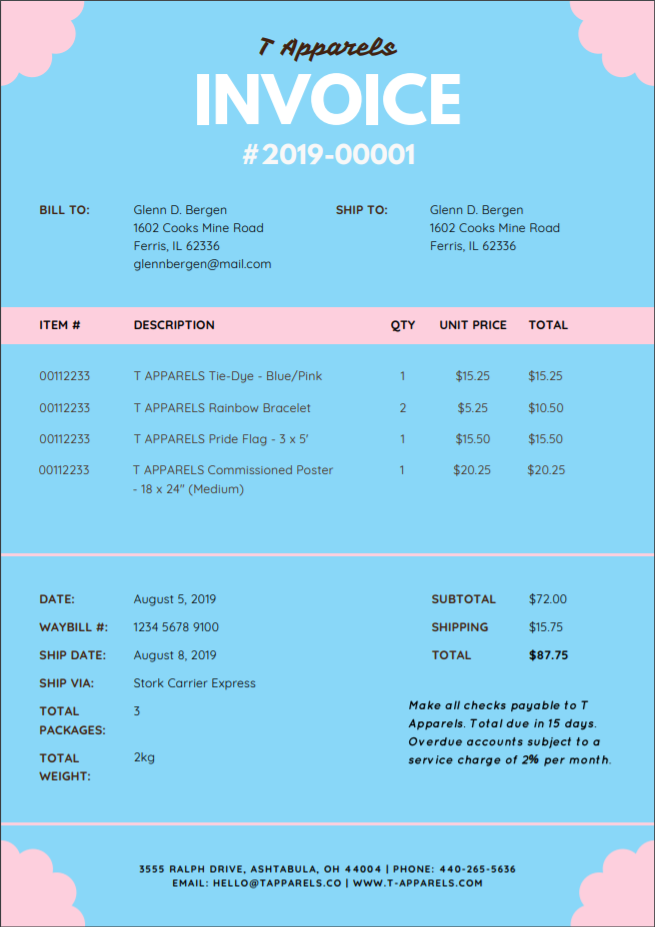

After finalizing the shipping details with the supplier, T Apparels has generated an invoice for their customer that includes crucial information such as:

- A description of the products sold

- Per unit price and subtotals

- Shipping fees

- Payment terms and details

On top of that, they have also provided details that will come in handy during customs clearance:

- Waybill number

- Ship Date

- Shipping courier

- Number of packages

- Total weight of packages

Managing a dropshipping business involves lots of time and effort spent on securing reliable suppliers and building the brand. This leaves little time for dropshippers to process multiple orders and send out invoices quickly to get paid on time. With an intuitive cloud-based Enterprise Resource Planning (ERP) software like Deskera Books, dropshippers can ease the process of invoice creation and order management, leaving them with more time and resources to grow their business.

2. Invoicing for Online Tutoring

With video-calling software such as Zoom and Skype being readily available, many people have turned to conducting online classes to earn their keep. Regardless of whether they charge per-hour, per-lesson, or offer a package for x number of classes, sending a professional invoice to their students is essential to getting paid on time.

Marianne Black has signed up for two classes with Gareth's Online Courses. The invoice she received clearly indicates:

- The classes she has enrolled in

- The number of hours required for each class

- The hourly rate

- Taxes applicable

- Payment details

- Both her and the tutoring company's contact details

- A note containing details of the online tutoring business's social media

Invoicing for an online tutoring business can become unnecessarily tedious as a huge chunk of their time is spent on conducting lessons. Investing in an e-invoicing software such as Deskera Books allows them to generate invoices with little hassle!

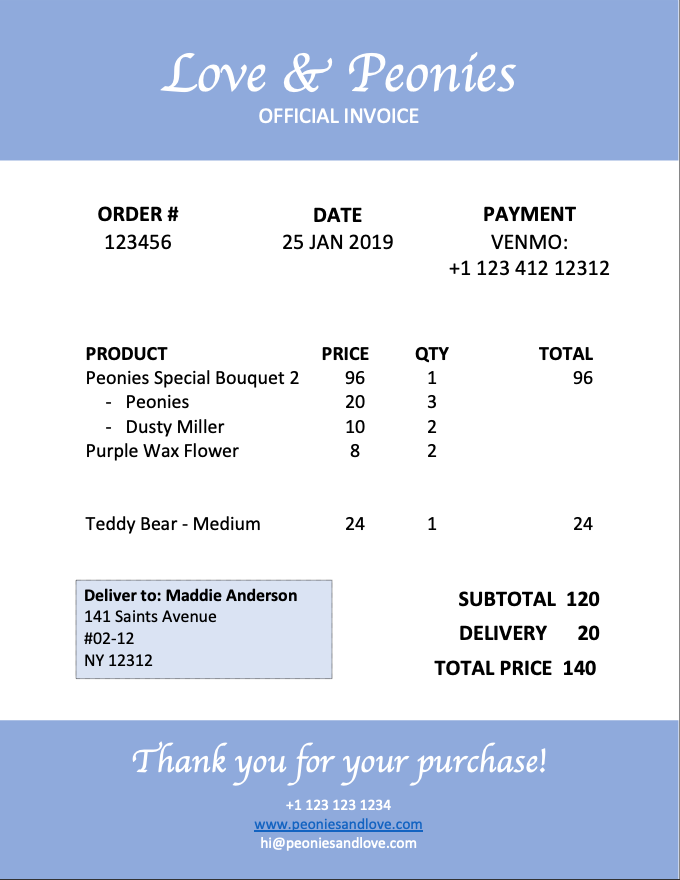

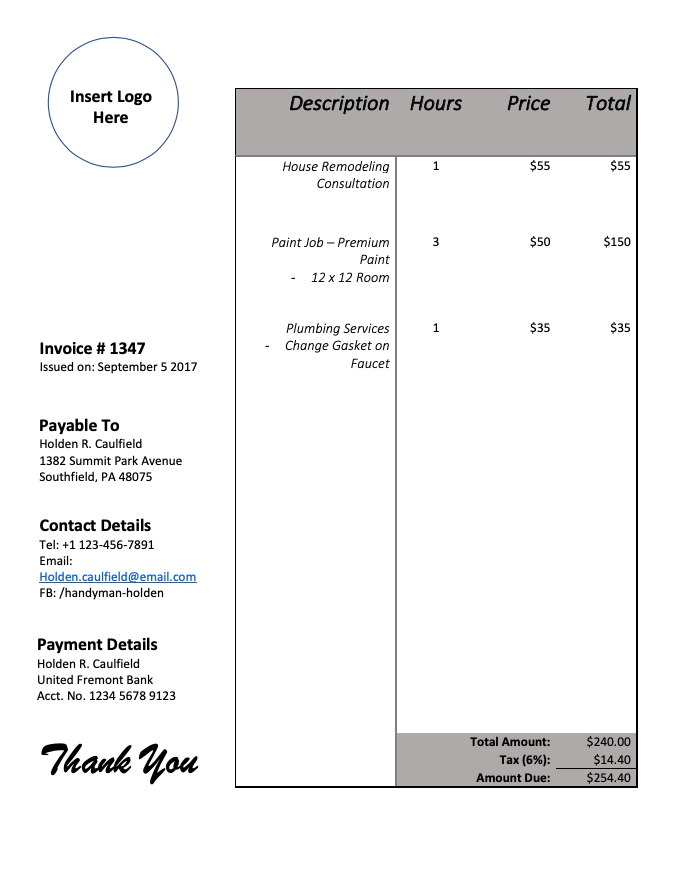

3. Invoicing for Handymen

Handymen refer to individuals who provide a variety of repair services that typically revolve around households. In this line of work, quotations/estimates are often sent before the invoice to finalize the price of the services provided. Invoices can be set up as a combination of interim and final invoices for big renovation projects that span over a couple of weeks, or in a single invoice for ad-hoc home improvement and repairs.

As the nature of their work is very labor-intensive, creating concise invoices are key to getting paid on time and making sure that all that hard work does not go to waste!

For a simple one-day job, Mr. Caulfield has provided the following details in his invoice:

- Description of the work done

- Additional details of each service completed

- The hourly rate and number of hours spent for each type of service rendered

- Applicable tax

- Contact and payment details

- Social media handles to learn more about the full range of services he can provide

Creating and sending professional invoices ASAP is an integral part in getting paid on time. After a long and tiring day of work, handymen can rely on e-invoicing software such as Deskera Books to simplify the usually-tedious process of generating and sending invoices.

4. Invoicing for Freelance Musicians

Freelance musicians can be hired for performances at event venues such as restaurants or malls, and are typically paid by the hour. Some musicians also provide ad-hoc music production services, or record jingles that can be used in advertisements.

Regardless of the range of services provided, musicians must be able to create professional invoices to leave a good impression on their clients and more importantly, get paid on time.

The band "E Equals MC Squared" has created a stylish and slick invoice that is sure to leave a good impression on their client. For their gig at Za's & Booze, their invoice contains the following details:

- The client's address (which is also the venue)

- A description of their set

- Transportation fees

- Applicable tax

- Their payment details (Venmo and Paypal)

- Their band website and social media handle

Invoices like the one above are vital for bands and musicians relying on gigs to earn a living. Creating and sending out invoices to their customers are essential in getting paid on time!

5. Invoicing for a Pet Care Business

Ranging from pet food and toys to grooming and dog walking services, pet care business owners can soon find their hands full! Invoicing for pet care can include the following line items:

- Pet grooming services

- Pet-sitting or pet-boarding

- Dog walking services

- Pet training services

- Pet food

- Pet toys and accessories

For pet care services, invoices are typically sent after the session has ended. Sending an invoice afterward allows the provider to account for miscellaneous costs for pets that require special attention to be included in the final invoice.

On the other hand, selling pet care products may instead have more immediate payment terms such as cash-on-delivery (COD).

Regardless of what products or services the pet care business offers, creating and sending invoices efficiently is a huge part in maintaining the business.

For Bolt Pet Services, they charge for pet grooming services per session. The customer has also picked up some treats and accessories for her pet.

In the invoice above, they have provided the following information:

- Their company address

- The customer's billing address

- The gross subtotal and prevailing tax

- A prominent display of total amount due ($117.30)

- A breakdown of the products and services rendered

- Payment details (via bank transfer)

Invoicing and Payment Terms - Cash vs. Credit

Payment terms may differ between companies - you should implement the payment term that best suits your business needs. You can choose to accept payment via cash or credit terms (when) and in various methods (how).

This section focuses on the aspect of payment terms that indicate when payment should be made.

Cash terms

For businesses operating on cash terms, payment is made immediately upon placing an order. Cash terms are suited for smaller businesses that rely on a steady supply of cash or firms with a high volume of transactions from non-recurring customers.

- Cash-on-Delivery (COD) is the most common payment term that requires the customer to make payment upon receipt of goods or services. COD is also called Payable on Receipt.

- Cash-with-Order (CWO) requires the customer to make a partial payment to secure an order. This payment term can also be known as Cash in Advance (CIA) or Payment in Advance (PIA) and is a form of downpayment.

- Cash-before-Shipment (CBS) denotes that payment must be made before the seller proceeds to ship the products ordered.

Companies that operate solely on cash terms do not need to maintain an Accounts Receivable for each customer as payment is received immediately.

The benefits of operating on cash-only terms are that your books will always reflect actual cash flow, and a cash-based accounting system is more straightforward. However, most customers prefer the flexibility of not having to pay immediately - a perk that comes with credit terms.

Credit terms

Companies typically extend the option to purchase on credit for regular customers or businesses to generate recurring sales. Offering credit terms facilitates a better customer-seller relationship as you allow your customer to pay their invoice later. Do note that as you trust that the customer will settle the invoice eventually, your business will also be taking on the risk of bad debt.

Commonly used payment terms that are credit-based include:

- NET x (NET 7, NET 15, NET 30, NET 90) is a common credit-based payment term. x represents the number of days from the issued invoice date that the customer is given to pay the invoice in full. NET 30 (payment due within 30 days from invoice issued date) is most commonly used.

- z/y NET x is a variation of the usual NET x, where z is the discount given if payment is made within y days. On top of indicating when payment is due, the business can offer an incentive for the customer to enjoy a discount if they make payment earlier.

- End of Month (EOM) indicates that payment is due at the end of the month (from invoice issued date). This payment term is commonly used for businesses that want to streamline their cash inflow periods for their accounting team.

For your business to operate on credit terms, you must maintain an Accounts Receivable account in your books to capture what is owed to you. Setting clear due dates and late payment penalties are also vital to get paid on time.

What Happens After I've Received Payment?

After you have received full payment for your invoice, you should send your customer a receipt to acknowledge that payment has been made.

In the next section, we cover how invoices can impact your accounting practices, ledger book, and accounting statements.

How does Invoicing Impact Acounting?

Invoices are an integral part of every business. As such, it is natural that invoices impact the accounting system. In this section, we cover how invoices can affect various aspects of a business's accounting records.

Invoices and Accounts Receivable

Accounts Receivable is a general ledger account that records the amount owed by customers to your company for goods and services rendered. It is classified as a current asset and has a debit nature.

When a business operating on an accrual basis accounting system issues an invoice to a customer, that customer's Accounts Receivable is debited (increases). Whenever the customer makes payment for the invoice, the Accounts Receivable is credited (reduced).

Companies using a cash-based accounting system do not have an Accounts Receivable account as sales are recorded only when payment is received.

Journal Entries and Invoices

So how are journal entries generated when invoicing a customer and completing a sale?

Here's a simple example:

ABC Pte Ltd has sold $400 worth of goods to John. An invoice is created and issued to John. The following journal entry must be recorded to capture this:

| Accounts | Debit (Dr) | Credit (Cr) |

|---|---|---|

| Accounts Receivable | $400 | |

| Sales | $400 |

As mentioned previously, Accounts Receivable is indicative of what is owed by John to the company. This $400 has not been received by the company yet.

ABC Pte Ltd has previously purchased the goods provided to John for $350. Once the order is fulfilled, the cost of goods sold and inventory accounts are updated:

| Accounts | Debit (Dr) | Credit (Cr) |

|---|---|---|

| Cost of Goods Sold | $350 | |

| Inventory | $350 |

When John makes payment for the invoice via bank transfer, his Accounts Receivable must be credited by $400 (as he has already paid for the outstanding amount). The Bank account is also debited to record an increase of $400 in the bank balance.

| Accounts | Debit (Dr) | Credit (Cr) |

|---|---|---|

| Accounts Receivable | $400 | |

| Bank | $400 |

How Does Invoices Impact Financial Statements?

As generating invoices impact the Accounts Receivable account, invoicing also plays a part in affecting prominent figures used when preparing financial statements.

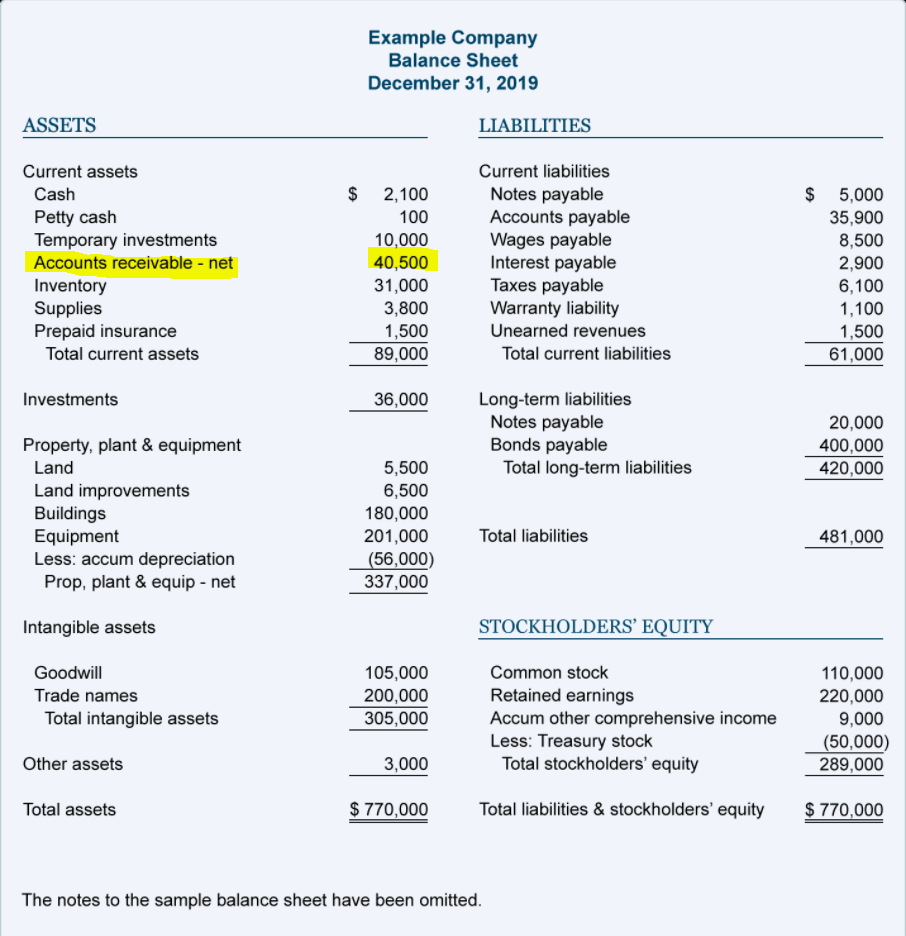

Balance Sheet

The balance sheet summarizes your company's assets, liabilities, and owner's equity. It provides the viewer with a glimpse of the business's financial standing..

The general formula for the Balance sheet is:

Assets - Liabilities + Owner's Equity

As mentioned previously, the Accounts Receivable indicates unpaid invoices (an amount owed to your company). Accounts Receivable is classified as a current asset and can be found under the balance sheet's Assets section.

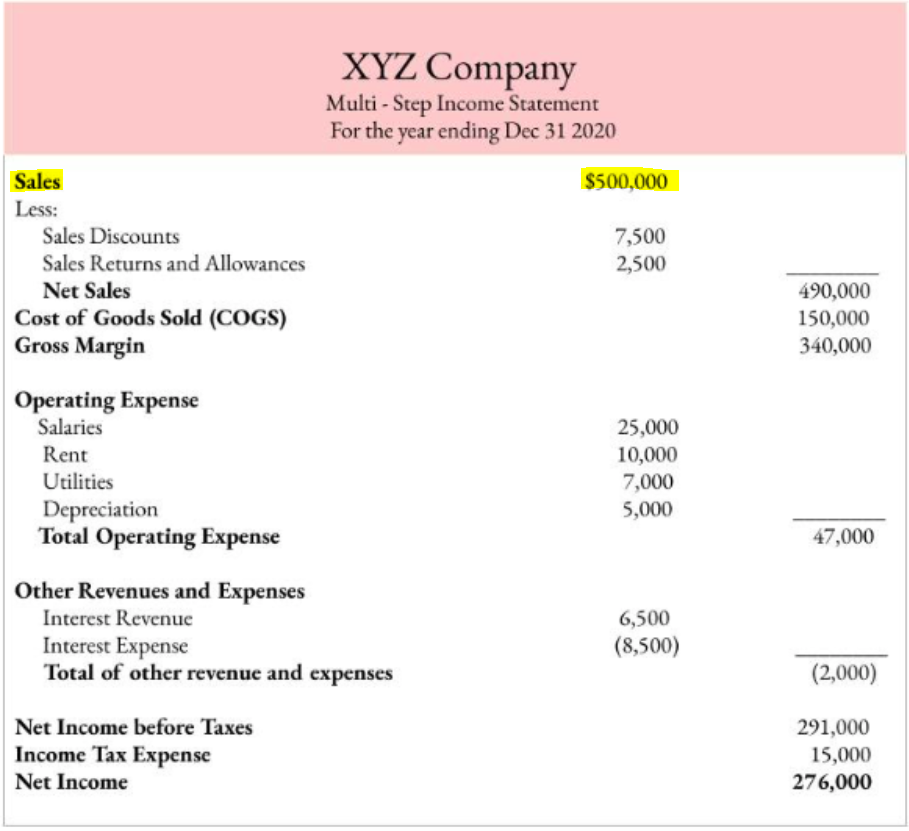

Income Statement

The purpose of an income statement is to display if the business has made a net profit during a specified period.

When invoicing, the Accounts Receivable account is debited, and the Sales account credited. The balance of the Sales account is the starting line item for every income statement. This value is adjusted to determine Net Sales and, subsequently, the gross margin for the period. Therefore, invoicing plays a direct role in the income statement.

Want to learn more about the income statement? Check out our guide on income statements.

Frequently Asked Questions About Invoices

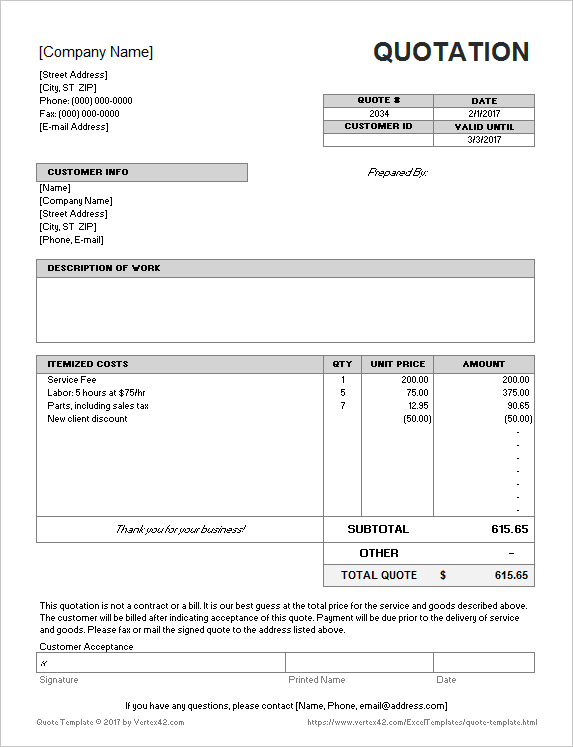

1. Are Quotations/Estimates and Invoices the Same?

No, they are not.

Quotations are a formal document used to capture an estimation of the cost of goods and services provided. These proposed prices are subject to change over time. A quotation does not necessarily indicate a finalized amount and does not represent money receivable by the business.

Invoices, on the other hand, capture the finalized cost that is agreed upon between the business and the customer.

In other words, an invoice is indicative of what the customer owes the business.

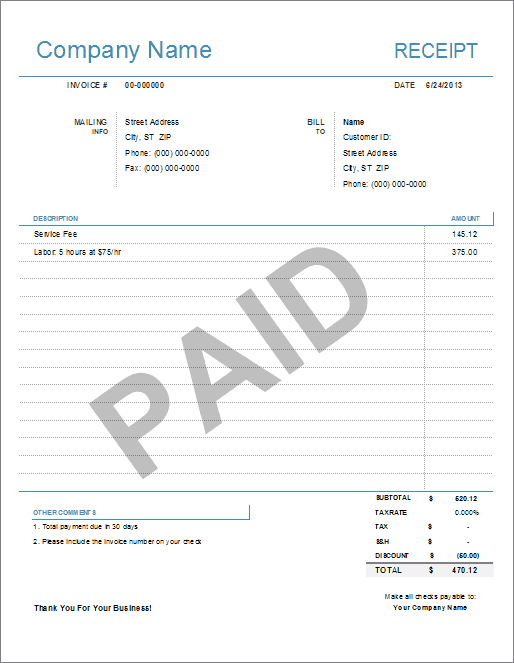

2. What Is the Difference Between an Invoice and a Receipt?

Invoices and receipts both involve a breakdown of costs and an itemized list of products and services provided.

The difference between an Invoice and a Receipt is when the document is sent to the customer.

Receipts are sent to the customer from the seller after payment and are used to acknowledge that payment is complete. It serves as proof that the customer has paid the seller for the goods and services rendered.

Invoicing must be done before payment as it informs the customer how much they should pay the seller.

With Deskera Books, creating sales documents online has never been easier! You can generate a Quotation and convert it easily to an Invoice. Once payment is received, a Receipt is automatically generated and can be easily downloaded and sent to your customers.

3. Are There Other Types of Invoices?

The traditional invoice refers to a document sent to request payment for goods and services provided. However, you might have noticed that many particular scenarios call for other documents that also include the word “invoice” in its title.

In this section, we briefly explore these terms used:

- Commercial Invoice

- Interim and Final Invoices

- Retainer Invoice

- Pro Forma Invoice

- Past Due Invoice

Commercial Invoice

The term commercial invoice usually refers to invoices used in cross border transactions.

These invoices contain additional information such as the airway bill number, the gross and net weight of the parcels, country of origin, and declared value of goods.

The commercial invoice is vital in the customs declaration process and a staple to have if you engage in frequent international transactions. You can also use the standard invoice for this purpose if it contains the relevant information required.

Interim and Final Invoices

Interim invoices describe invoices used for staged payments standard in the construction and project-based industries. It provides a steady cash flow while working on the project across several months.

Upon completion of the project, a final invoice is issued. The final invoice should contain the finalized outstanding amount due, minus the payment already made for previously sent interim invoices.

Retainer Invoice

As the name suggests, retainer invoices are used when the business retains a sum provided by the client or buyer before fulfilling an order. Retainers are considered a form of pre-payment and are recorded as a liability until the order is complete.

Upon delivery of goods or services, exceeding the retainer provided results in another invoice being issued to the buyer for the outstanding amount. However, if the order value is less than the retainer, the retained amount can be used to offset another future invoice or is refunded to the buyer.

Interim and retainer invoices are documents used when implementing a deposit or milestone payment system. We describe how deposits and milestone payments can help improve your business cash flow in our short article here.

Pro Forma Invoice

Pro forma invoices contain essential information about the cost of goods or services provided and are typically used for approval processes within a buyer’s organization. Some may say that pro forma invoices are quotations presented in the style of an invoice, as they are also sent before the sale is made.

Despite the similarities it shares with an invoice, a pro forma invoice is not a binding agreement and does not warrant payment. Additionally, the final amount may still be subject to change. However, it usually does not differ significantly from the cost indicated in the proforma invoice.

Recurring Invoice

Recurring invoices are commonly used in businesses that provide rental or subscription-type services where the customer is billed a standard amount at regular intervals.

Past Due Invoice

A past due invoice is issued when your customer fails to pay for the initial invoice on time. In addition to the outstanding amount, it also contains any late fees or interests applicable.

Free Sample Invoice Templates

We have prepared multiple templates that you, as a small business owner, can use to improve your invoicing process! These templates are available for download in PDF.

Why is a Good Invoice Software Necessary?

Don’t undermine the value of investing in an invoicing software!

E-invoicing is being rapidly adopted in various companies (even government bodies) as it is more reliable and accurate than manual paper invoicing, on top of being cost-efficient.

A 2018 EY survey shares some advantages to using e-invoicing:

- The ability to deliver within a shorter time frame at lower costs

- An increase in overall productivity

- Optimized usage of available business resources while managing the stakeholders’ needs

An excellent invoicing software automates invoice generation to capture the crucial details of each transaction accurately. This reduces operating costs and allows scalability as your business grows.

Additionally, a professional invoice is an extension of your business image.

A poorly designed document may frustrate your customers and negatively impact their perception of your business.

On the other hand, a professional document will impress your customers, on top of minimizing any back-and-forth between you and your customer, reducing any delay in getting paid. This is especially crucial for small businesses that have just started and need to grow and retain their customer base.

What Invoicing Software Should I Use as a Business Owner?

With Deskera Books, you can create business invoices online and further customize your business invoice by uploading a custom template. Generating a personalized invoice is made simpler as using a template applies the same format across the system, minimizing any manual editing required.

Get Deskera Books for sending professional invoices today!

Related Articles

Here are some useful articles on Invoicing which you may find useful.