Whether you are a novice or an experienced entrepreneur, starting a business can be a challenge. You need to work hard on it to ensure its success. However, the work doesn’t end even when your business actually becomes operational. You still have to do so much more to ensure that it will keep on track.

Obviously, it is going to be difficult, especially if you are a beginner. It seems that you have to keep an eye on so many things and focus on so many urgent tasks every day that there isn’t any time left for business planning and budgeting. However, it is very important to find that time, because business planning and budgeting are actually one of the most crucial things to ensure success of a business.

But have you ever thought, why so? This is because a business plan allows you to get a better understanding of your business, and how you can take it further.

Basically, planning and budgeting helps in the growth of a business. However, this happens only when it is done in the right manner. Read on to know more about it.

What is a Business Budget?

A business budget is a plan or a strategy to manage the assets, income, and expenses. It represents an overview of the spending and helps you predict the revenue of your business.

It acts as a yardstick for achieving your financial goals. Without having a proper budget, you can be at the risk of overspending. Thus, having a good budget is imperative for a business to succeed.

What makes a Good Budget?

If you want to frame a good budget, you need to have a clear idea of what has to be included in it. The budget should be well-planned, flexible, realistic, and efficiently communicated to make it successful.

To make a good budget, consider the following points:

- Accurate & Enough Spending Categories

- Accurate Income Projections

- Categories for irregular expenses

- Treat Savings as an Expense

- Efficient tracking for cash purchases

- Realistic written Goals

- Regular reviews

Creating a budget

A key to the success of a business is to create, monitor, and manage a budget. This will help you allocate the resources in a better way, making your business more profitable.

You can begin by asking yourself these questions:

What are the projected sales for the budget period? Remember to be realistic, if you overestimate, you will have problems in the future.

What are the direct costs of sales, i.e., cost of materials or cost of goods sold, components, or subcontractors to make the product or supply the services?

What are the fixed costs or overheads?

You can break down the fixed costs or overheads into:

- Cost of premises including rent, taxes, and service charges

- Staff costs including wages, benefits,

- Utilities including heating, lighting, telephone

- Printing, postage, and stationery

- Vehicle expenses

- Equipment costs

- Advertising and promotion

- Travel and subsistence expenses

- Legal and professional costs, including insurance

Every company has different business expenses. That is why it is important to classify the budget by department. Remember to include how much you need to pay yourself. Don’t forget to include a tax allowance.

Whenever you are preparing a business plan, make sure that it should help in establishing projected sales, cost of sales, fixed costs, and overheads. That is why it is important to prepare it first.

Once you are clear with the figures for income and expenditure, you can easily evaluate how much money you are making. You can keep an eye on the costs and figure out ways to reduce them. Also, check if you have problems related to cash flow, give yourself ample time to do something about it.

Whenever you make a budget, always try to stick to it, but make sure you review and revise it constantly whenever required.

What are the Key Steps in Drawing Up a Budget?

Let’s take a look at some of the key steps in drawing up a budget:

Take Time for Budgeting

Don’t rush. Take your time for framing a comprehensive and realistic budget. This way it will be easier to manage and ultimately turn out to be more effective.

Use Previous Year’s Figures

Collect the past information on sales and costs, if possible. This way you’ll get an indication of probable sales and costs. However, you should consider your sales psychology, how your sales resources will be used and any changes it would bring in the competitive environment.

Go for Realistic Budgets

It is quite essential to form a relationship between variable costs and sales. Once this is done, you can use your sales forecast to project variable costs. For example, if your unit cost reduces by 10 percent for an additional 20 percent of sales, then how much will be the decrease in unit costs for 33 percent rise in sales?

Your budget should have enough information so that you can monitor the key components of sales including sales, costs, and working capital. You can also take the help of accounting software for a streamlined process.

Include the Right People

You can consult professionals who already have experience in the finance industry, to chalk out your budget. These people can help you estimate the figures of your budget including sales targets, production costs, etc so that you can achieve a realistic budget.

Visualization can Help

These days a lot of tools are available which can help you in visualizing your budget. With the help of charts and diagrams, you will be able to track your income and expenses easily. For example, you can create one chart based on your plan and another one based on your budget, then you can compare these two and check whether your budget plan works as expected or not.

What Your Budget Should Cover?

Your budget depends on what kind of business you have. Small businesses can have one overall budget which includes how much money is required to run a business over the coming period; usually a year.

When your business grows, you will find out that the total operating budget consists of several individual budgets such as marketing or sales budget.

What your budget will need to include?

Projected Cash flows

Having a cash budget will provide you a clear idea of your future cash position on a monthly basis. In this way, you will be able to overcome any difficulties that you might face. Remember to review it timely.

Costs

Most businesses have three kinds of costs:

Fixed Costs - This includes rent, salaries, and financing costs

Variable Costs - This includes the cost of the raw materials, and overtime.

One-off capital costs - The costs related to the construction or enhancement of assets are known as one-off capital costs. For example-Costs associated with the computer equipment or premises.

Revenue - It refers to the income returned by the investment.

Planning for Business Success

Running a business is not easy. You can often get trapped in day-to-day problems and forget the big picture. However, to succeed to need to plan well ahead of time, create and manage budgets. You need to prepare business plans, monitor finance, and regularly review the performance.

Structured planning can take your business to the next level. It will help you improve profit margins, reduce costs, and increase return on investment.

What is a Typical Business Planning Cycle?

Let’s know about how the typical business planning cycle should be:

- Review your current performance against last year

- Look for opportunities and work upon threats

- Analyse your highs and lows during the last year

- Focus on your key objectives in the coming year and change your long-term planning accordingly.

- Identify and refine the resource implications of your review and create a budget.

- Once this is done, you can define the new financial year’s profit and loss and balance sheet targets.

- Summarize the plan

- Review it regularly by monitoring performance, reviewing progress, and achieving objectives. You can review it on a monthly basis.

- Go back to step 1

Small business owners may not see the need to chalk out a budget. However, if you are planning for the future of your business, you will need to put wings to your plans by funding them. Budgeting is the best way to monitor your cash flow, enabling you to explore new opportunities at the right time.

If you have a growing business, you may have to split your budget into various sections such as sales, production, marketing, etc. This will help to control the expenditure in a better way.

Benefits of a Business Budget

Having a budget is quite imperative for the success of a business. It has a plethora of benefits: Let’s take a look at some of them:

- Having a budget helps in the efficient management of money

- It helps in the allocation of appropriate resources to projects

- It is used to monitor performance

- With the help of a budget, you can meet business objectives

- It improves decision-making

- When you have a proper budget, you can easily identify financial problems beforehand such as the need to raise finances or cash flow difficulties.

- It enhances staff motivation.

Use your Budget to Measure Performance

Your budget can act as an indicator of the costs and revenues associated with your business. It is the best way to monitor and control your business, especially if you evaluate the difference between your actual and budgeted income. It can help to measure the performance of your business. Let’s take a look, how?

Benchmarking Performance

Comparing your budget every year can be the best way to benchmark your business performance. You can compare your projected figures with previous years to measure your performance.

You can even conduct a comparative analysis with some other companies in the same sector.

Key Performance Indicators

If you want to enhance the performance of your business, you need to have an understanding of the key drivers of your business. A driver is something that plays a huge impact on your business. Let’s take a look at the key drivers for most businesses:

- Sales

- Costs

- Working Capital

Understanding the key drivers will help you identify the cash flow problems or any kind of other difficulties.

Review your Budget Regularly

If you want to use your budget effectively, it is imperative for you to review and revise them regularly. You should use up-to-date budgets so that you can manage your cash flow and identify what can be achieved in the next budgeting period.

Actual income

- You should compare your actual income with your sales budget by analyzing the reasons for any shortfall; for example, under-performing products, flat markets, and lower sales volume.

- You should consider the reasons for a high turnover; for example, setting very low targets.

Once you analyze these points, you will be able to set future budgets accurately, allowing you to take the action whenever required.

Actual expenditure

Make sure you review your actual expenditure against your budget. In this way, you will be able to predict future costs with better reliability. You need to analyse how your fixed costs differed from your budget; check whether the variable costs were in line with your budget, and identify the reasons for changes in the relationship between costs and turnover.

Staffing for Budgeting

Whether you have a large business or a small one, you need to make sure that it is staffed properly for writing and maintaining a budget. For example, you own and operate a small cafe, you might have a unique menu and a reputation for quality customer service, but that doesn't mean you're a financial professional.

If you don’t want to hire a full-time person to handle your budget and other financial affairs, you can even consider part-time help or seek help from an outside consulting firm, in order to write a new budget for the next fiscal year. This can be quite beneficial for you in budgeting and managing other financial problems.

What are the Benefits of Business Budget Planning?

- Monitor financial health

- Strategic planning

- Obtain debt financing

- Attract investors

- Tax preparation

- Decision making

What are the Different Types of Budgets?

- Cash flow budget: It determines when and how the cash will flow in and out of your business. It is usually defined for a specific time, for example, a year. A cash flow budget helps to determine whether a company has sufficient cash to continue its operations and also determines major financial decisions of the company. It helps to improve cash flow of the company. For example, if you have a pharmaceutical company, you can use your cash flow budget to determine whether you can invest in new products or not.

- Operating budget: It is formed after the analysis of the expenditure and revenue generated from the daily functions of the businesses. Production, labour cost, are some of the factors that determine the operating budget.

- Financial budget: It consists of a strategy to manage its assets, income, expenses, and other financial aspects. It helps to provide an overview of the overall financial health of any organization.

- Sales budget: It helps to determine the expected sales revenue and expenses for a specific period of time. Sales forecasting is an important aspect of a sales budget. It can be done either in quantity or value depending on the type of your business.

- Production budget: The basis of a production budget is the sales budget. The production budget helps in determining the cost of production which further determines the price of the product. It depends largely on the sales and demand of the product.

- Overhead Budget-It helps to determine the costs and expenses required for the production of a product. Indirect labour, factory expenses, and other expenses are included in the overhead budget.

- Personnel Budget-it is one of the most important budgets that include the manpower budget for a specific period of time. Labour hours, workers’ grade, costs, are some of the factors affecting the personnel budget.

- Marketing Budget: The budget kept for the marketing department refers to the marketing budget. It includes all the marketing and promotional activities related to your business. All the money spent on advertisements, promotions, and events is included in the marketing budget.

- Static Budget: Similar to the fixed costs, a static budget includes the expenses which are static i.e., that remain unchanged over a period of time. This budget is not affected by the sales volume or any other changes taking place in the company.

- Master Budget: It is a combination of all the individual budgets of the company, thus providing a clear picture of the finances of the company. All the budgets including sales, marketing, production, overhead, etc. are combined together to form the master budget.

What are the Components of a Budget?

- Estimated Revenue

- Fixed Costs

- Variable Costs

- One-time expenses

- Cash-flow

- Profit

How do Budgets Work?

No matter the budgeting process for companies is complex, but it is a vital tool that helps in the success of a business. Basically, a budget is a powerful tool that helps to compares a company's revenue with its expenses in a given period.

A budget is not limited to determining how much to spend on various expenses and projecting sales. But there are a lot of other factors including projecting capital expenditures, which are large purchases of fixed assets such as machinery or a new factory, ongoing cash needs, revenue shortfalls, and the economic backdrop. Despite the type of business, a budget has the ability to gauge the performance of a company's overall financial health.

Do I Need a Business Budget?

Whether you own a small business or a large one, having a budget is quite important for its success. Depending on the type of business you have, you need to decide your budget.

Having a budget will help you make important decisions such as cutting down on unwanted expenses, increasing staff, purchasing new equipment, and a lot more. If you end up having inadequate money, your budget will help you in altering your business plan accordingly. Also, you can keep your business out of debt with the help of the right budget plan. Thus, having a budget can help you take your business to the next level.

How Can Deskera Help You?

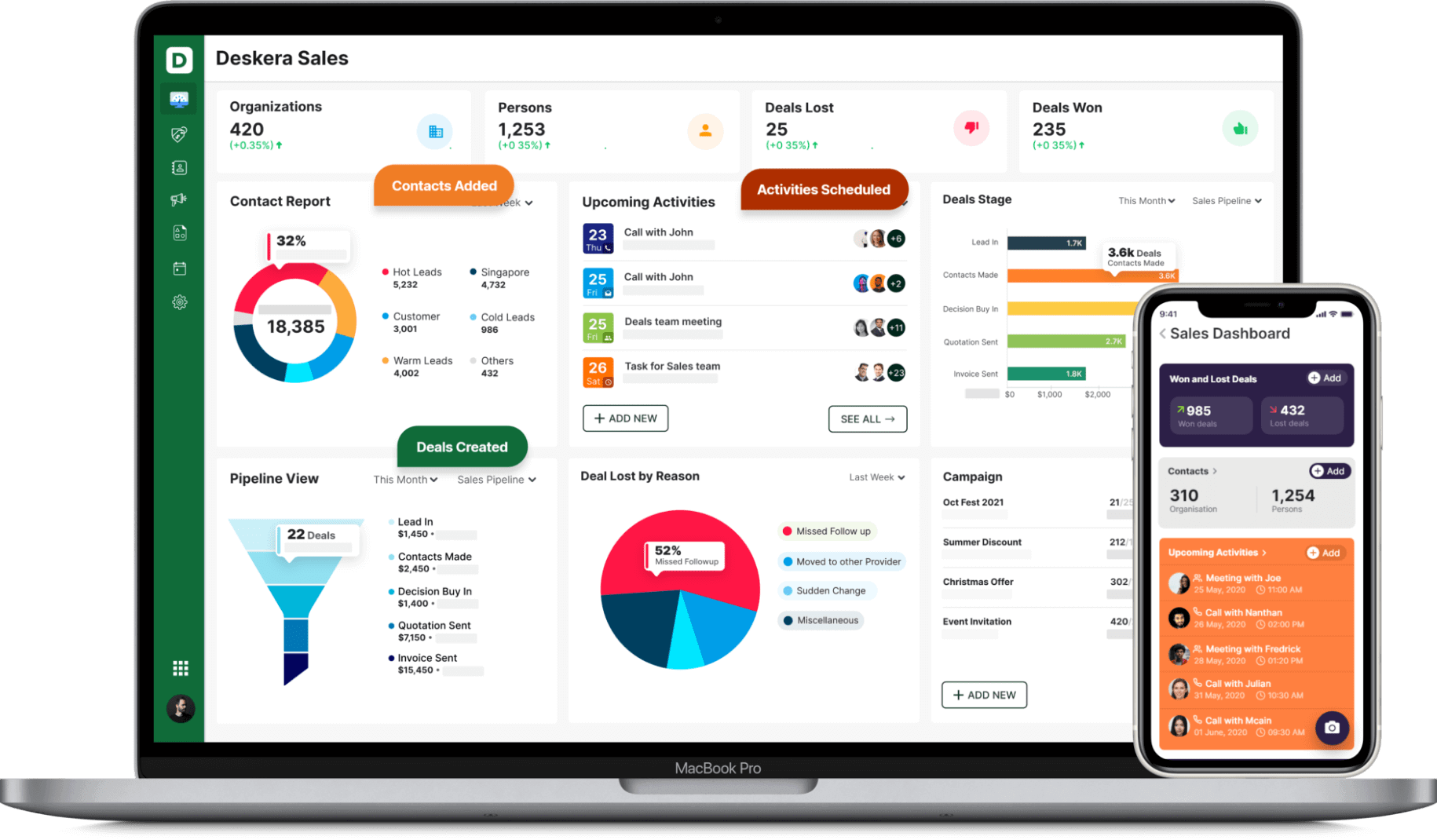

Deskera is the best platform where you can learn the important concepts of business. You can even use the top accounting software applications for startups through this platform. Deskera’s blogs can help you get a better understanding of the business topics such as What Are Operating Expenses? Small Business Guide, Why are income statements important, and the list goes on.

Deskera can assist you with real-time updates about your business like cash flow status, inventory management, sales, purchases, purchase orders, customer tickets, customer satisfaction and revenues.

Deskera books which maintain all your financial statements like balance sheet, profit and loss statement, income statement and cash flow statement will tell you the budget you have for content marketing. It will also keep a track of account receivables and accounts payables for the same.

Deskera can also help you to sync between your orders, payments, taxes, refunds, product variants, sending out invoices and reminders, and even undertaking follow-ups and advertisement campaigns.

Deskera CRM is a cloud platform that stores and manages your leads and contacts. It hence is an ideal platform for managing your proposals too.

Your business proposal can be incorporated in the Deskera sales pipeline stages. This will make it more convenient to track the proposal activities. The stages of the sales pipeline can be customized as per your needs.

It will also facilitate the movement of prospective clients through the different stages of the sales pipeline.

What will further help you would be the real-time insights that the Deskera CRM platform provides. Using these insights, you can know your business's strengths, weaknesses as well as forecast the opportunities and threats. Further business activities could be planned accordingly.

The insights would also show the areas that are faring nicely and badly. Working upon these areas accordingly will ensure larger profits, customer retention and a happier work environment for your business.

Such a consolidated platform will help you to make faster and well-informed decisions. It will help you in strengthening your opportunities and being braced for the threats. Undue expenses and penalties arising out of mistakes in invoicing, taxations, late deliveries, etc will be prevented as well.

With Deskera’s All-in-one-platform, you can take your business to the next level. Whether it is invoicing, accounting, inventory, CRM, or HR & Payroll, Deskera can help you in every aspect. Not only this, Deskera Books, can help you understand online invoicing, accounting & inventory to enhance your business. The concepts of billing, payments, warehouse management, credit and debit notes, and financial reports are very well explained in these books.

Key Takeaways

Take a look at the important points covered in the above article:

- A business budget is a plan made to manage the assets, income, expenses

- The budget should be well-planned, flexible, realistic, and clearly communicated to make it successful

- There are various steps in creating a budget

- Your budget should include projected cash flows, costs, and revenue

- A typical business plan cycle is important for the success of your business

- There are various benefits of having a business budget which have been discussed in the article

- There are various types of budgets including cash flow budget, operating budget, financial budget, overhead budget, static budget, marketing budget, production budget, sales budget, master budget, and personnel budget

- A budget can be used to measure the performance of your business

- Deskera can help you in better budget planning for your business

Related Links