In today's trying times, every business is struggling for its survival.

To boost the SMEs, the Government of India has implemented several measures. The list of such schemes and initiatives is quite extensive. It showcases the importance of the sector and why the Government is keen on helping them grow.

According to CII, India is home to 63.4 million small and medium businesses that account for 30% of India's GDP. The SME sector employs about 460 million people. Thus, it plays a significant role in the country's socio-economic development.

Today, India is the third-largest startup ecosystem in the world.

The SME and startup sector is vibrant and evolving. They play a critical role in entrepreneurship development. And the Government of India understands its importance very well.

Additionally, small businesses and startups are witnessing the adverse effects of the pandemic. Thus, the Government is helping SMEs overcome these challenges.

The idea is to create an environment so that they remain sustainable and competitive.

So, What is Government Aid?

It is the aid given to an eligible person/group/business to help them overcome their challenges.

Several schemes and initiatives support small businesses and startups, such as loans with low-interest rates, subsidies, relief funds, income-based tax credits, etc.

In this article, we will be discussing the various types of aids provided by the Government that small businesses and startups can make the most use of:

- Schemes for Financial Assistance

- Scheme for Development of Khadi, Village, and Coir Industries

- Technology Upgradation and Quality Certification

- Marketing Promotion Schemes

- Entrepreneurship and Skill Development Programme

Here's a list of Government schemes for small businesses and startups in India:

Schemes for Financial Assistance

Pradhan Mantri Mudra Yojana (PMMY)

Headed by

Government of India

Industry

Any

About the Scheme

Launched in 2015, Pradhan Mantri Mudra Yojana is meant to empower Indian entrepreneurs. Micro Units Development and Refinance Agency Bank (MUDRA) Banks provide loans up to 10 lakhs at low-interest rates to non-corporate, non-farm startups and small businesses. You can get these loans from any commercial bank, small finance banks, RRBs, MFIs, and NBFCs. As of August 6, 2021, the number of loans sanctioned for the F.Y. 2021-22 was 10955714, with INR 63444.00 crores.

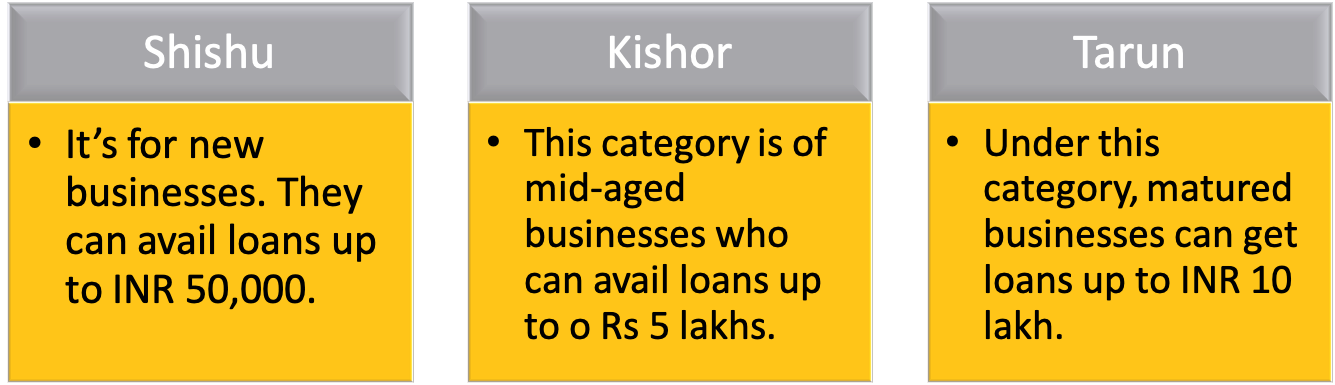

The three categories of businesses that can avail of this loan are Shishu, Kishor, and Tarun. They signify the growth and funding needs of the beneficiary and provide a reference point for the next phase of growth.

Shishu

The term in Hindi means baby. Therefore as the name suggests, new businesses can avail loans up to INR 50,000.

Kishor

The term in Hindi means teenage. Hence, this category is of mid-aged businesses who can avail loans up to o Rs 5 lakhs.

Tarun

It means a young man. Under this category, matured businesses can get loans up to INR 10 lakh.

How to apply?

You can approach any lending institutions or apply directly through this portal www.udyamimitra.in.

Documents required:

- Business Plan

- Duly filled application form

- Recent passport-sized photographs

- KYC documents of Applicant and Co-applicants- Passport, Voter's I.D. card, Aadhar Card, Driving License, PAN card, Utility Bills (Water/Electricity Bills).

- Special category (SC/ST, OBC, minority) certificate

- Bank statement of last six months

- Business address and tenure proof, if applicable

Benefits of the MUDRA Loan

- Small businesses and startups from the manufacturing, trading, and service sectors can easily avail of this loan for their business growth.

- No need for any security or collateral.

- No processing charges.

- These loans are covered under the Credit Guarantee Scheme.

- The credit from these loans can be used for term loans, overdraft facilities, etc.

A Scheme for the Promotion of Innovation, Rural Industries, and Entrepreneurship (ASPIRE)

Headed by

Govt. Of India, Ministry of MSME

Industry

Agro industries

About the Scheme

ASPIRE is A Scheme for the Promotion of Innovation, Rural Industries, and Entrepreneurship. This program aims to set up technology centers and incubation centers to encourage more and more small businesses and startups in the agro-industry.

To boost the entrepreneurship culture and promote innovative ideas in this sector, the Government launched this program under the Ministry of MSME.

These incubation centers are set up by National Small Industries Corporation (NSIC)/Coir Board/Khadi and Village Industries Commission (KVIC) or any other government institution or agency (Central/ State) on its own or by any agency.

To fulfill its objectives, the Government provides a one-time grant of 100% of the cost of Plant & Machinery, land, and infrastructure or an amount up to INR 100 lakhs, whichever is less. In the case of Public-private partnership (PPP), the Government provides a one-time grant of 50% of the cost of plant & machinery, land, and infrastructure or Rs.50.00 lakhs, whichever is less.

The Small Industries Development Bank of India (SIDBI) plays a crucial role in the ASPIRE program, discussed below.

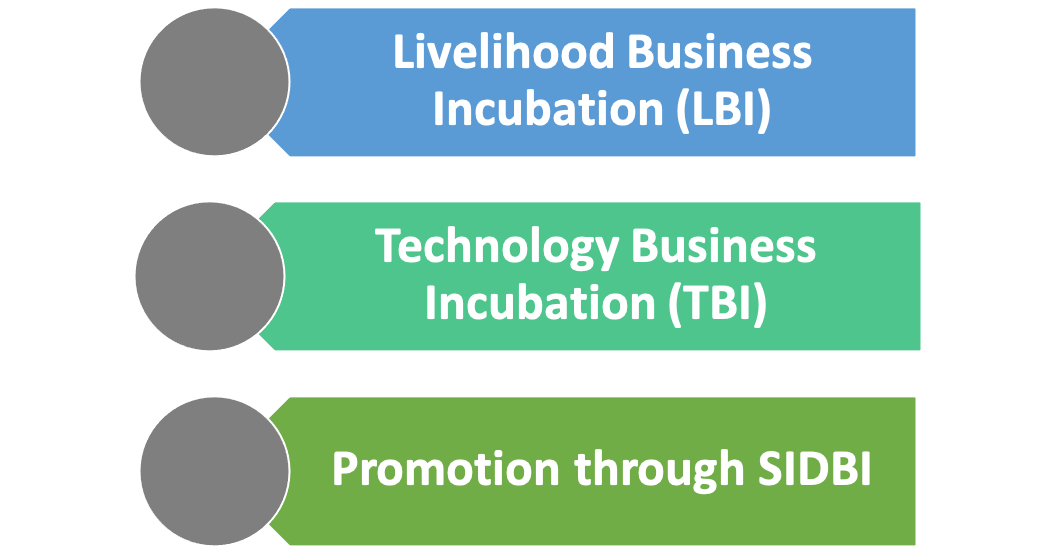

Components of ASPIRE scheme:

Livelihood Business Incubation (LBI)

Livelihood Business Incubation includes:

- Setting up business incubators.

- Providing skill development training.

- Giving financial assistance to entrepreneurs to set up their businesses.

The idea behind these incubators is to create a favorable environment to fuel entrepreneurship among the youth. It further helps in creating more jobs at the district level.

Technology Business Incubation (TBI)

The sole purpose of Technology Business Incubators is to help businesses make the most use of technology and innovation for their growth. The various programs under TBI provide support and set up incubation centers, incubate ideas, create business enterprises out of those innovative ideas, and provide accelerator programs for incubators. The TBI's help commercializes many technologies.

Promotion through SIDBI

Through this component, ASPIRE brings many innovative knowledge initiatives. SIDBI encourages entrepreneurs to convert their ideas/innovations with creativity and scalability to come ahead and convert these into commercially viable enterprises within a specified period with specific outcomes through innovative means of finance. The innovative means of finance of SIDBI include equity, quasi-equity, venture capital fund, angel fund, challenge fund, impact fund, etc.

This component targets knowledge initiatives which require support and nurture to succeed in the development of technology. It also targets the business enterprises in innovation, accelerator support in Agro-based Industry vertices, entrepreneurship, and forward-backward linkage with multiple value chains of manufacturing and service delivery.

As part of the ASPIRE program, the entrepreneurs and startups from the sector get livelihood incubation facilities for their business, funds for plants, machinery, land, and infrastructure, and Technology Incubators for providing technology networks. Livelihood Business Incubators create employment at the district level while the Technology Business Incubators work on increasing technology networks centers.

The funds are managed by SIDBI, NSIC, KVIC, or Coir Board.

How to apply?

You can send your application to the Aspire Scheme Steering Committee of the Ministry of MSME. The Scheme Steering Committee coordinates, manages, and takes care of the entire program.

Benefits

- The scheme provides training and knowledge to entrepreneurs for starting up their businesses.

- It assists small businesses during the initial period so that they can become self-sustainable with time.

- ASPIRE exposes businesses to the external market and helps them establish themselves there.

- With ASPIRE, businesses learn how to use new technologies to automate agricultural practices and other activities.

The Venture Capital Assistance Scheme

Headed by

Ministry of Agriculture and Farmers Welfare

Industry

Agriculture

About the Scheme

Under the venture capital assistance scheme, an interest-free loan is given by the Small Farmers Agribusiness Consortium (SFAC) to eligible persons or groups. The idea is to provide financial assistance to all the qualifying projects to not fail due to a shortfall in the capital requirement.

Eligibility

Individuals, farmers, producer groups, partnership/proprietary firms, self-help groups, companies, Agri-preneurs, and agriculture graduates individually or in groups for setting up agri-business projects.

Benefits:

- Assists Agripreneurs in setting up agribusiness projects by providing financial assistance

- Provides financial support for the preparing bankable Detailed Project Reports (DPRs) through Project Development Facility (PDF)

How to apply

You need to apply online through this site here. No offline applications are accepted.

Documents to be submitted

- Application Form

- Letter addressed to the Managing Director SFAC, New Delhi on the letterhead of the company.

- Sanction letter addressed to recommending branch.

- A process note from the bank bearing the signature of sanctioning authority

- Latest statement of account of term loan and cash credit

- Equity Certificate

- Farmer's list/backward linkage supported by an agreement

- A certificate providing information on any unsecured loans raised by the promoters

- Copy of the latest inspection report from the bank

- A confirmation letter from the bank assuring that they will not release primary & collateral security without SFAC consent

Credit Guarantee Trust Fund for Micro & Small Enterprises (CGT SME)

Headed by

Ministry of Micro and Small Enterprises

Industry

Any

About the Scheme

Today, aspiring entrepreneurs face a significant challenge in availing institutional credit due to a lack of collateral / third-party guarantees. The Government of India understands this very well. Therefore, the Ministry of Micro, Small & Medium Enterprises (MSME), Government of India, and SIDBI jointly set up the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) to catalyze the flow of institutional credit for small businesses and startups.

The objective of this scheme is to strengthen the credit delivery system and facilitate the flow of credit to the MSE sector. Banks and financial institutions are provided credit guarantees by CGTMSE (Trust) under this scheme to lend collateral-free credit to MSEs. The Credit Guarantee reassures the lender that in case an MSE unit, which has availed collateral-free credit from it, by any chance fails to discharge its liabilities to the lender, the CGTMSE would make up that loss incurred by the lender.

CGTMSE extends them a helping hand by providing guarantees to enable these businesses to access credit to set up viable micro and small enterprises.

As per the latest statistics, a total of 8.36 lakh guarantees have been approved for an amount of Rs. 36,954 crore during the financial year 2020-21.

Cumulatively, as of March 31, 2021, a total of over 51.4 lakh accounts have been given guarantee approval for Rs.2.59 lakh crore.

With a dedicated focus on MSE lending, CGTMSE has expanded the scope of its schemes to uncovered segments like Partial collateralized loans, Retail Trade, and amongst uncovered lenders like NBFCs and Small Finance Banks and Scheduled Co-Operative Banks.

Eligibility

Micro and Small Enterprises from the manufacturing or service sector. Not applicable for retail trade, educational institutions, agriculture, self-help groups (SHGs), training institutions, etc.

How to apply?

You can directly reach out to any lending institutions - Public banks, private banks, regional banks, etc.

Documents required

- Business Plan

- Duly filled application form

- Recent passport-sized photographs

- KYC documents of Applicant and Co-applicants- Passport, Voter's I.D. card, Aadhar Card, Driving License, PAN card, Utility Bills (Water/Electricity Bills).

- Special category (SC/ST, OBC, minority) certificate

- Bank statement of last six months

- Business address and tenure proof, if applicable

Stand-Up India for Financing SC/ST and Women Entrepreneurs

Headed by

Ministry of small and medium enterprises

Industry

Any

About the Scheme

Stand Up India facilitates bank loans between 10 lakh and 1 crore to scheduled caste (S.C.) or Scheduled Tribe and one women entrepreneur for greenfield projects. These entrepreneurs must be from the following sector - manufacturing, services, or trading, and it should be their first venture. A scheme designed for the upliftment of SC/ST or Woman entrepreneurs clearly states that at least 51% of the stake should be held even in a group enterprise.

Benefits

- Provides financial assistance in terms of loans at low-interest rates

- The idea is to empower SC, ST, and Women Entrepreneurs so that they become job providers.

Eligibility

- Any SC/ST or women entrepreneurs above 18 years of age

- Any loan under the scheme is sanctioned only for greenfield projects.

- For group enterprises, 51% of the stakes should be held by either SC/ST or Women Entrepreneur.

- The borrower should not be a part of the default to any bank or financial institution.

How to apply?

You can apply online through this site, or at your nearest bank, or through the Lead District Manager.

Documents required:

- Duly filled application form

- Recent passport-sized photographs

- KYC documents of Applicant- Passport, Voter's I.D. card, Aadhar Card, Driving License, PAN card, Utility Bills (Water/Electricity Bills).

- Special category (SC/ST, OBC, minority) certificate

Technology Upgradation and Quality Certification

Support for International Patent Protection in Electronics & Information Technology (SIP-EIT)

Headed by

Ministry Of Electronics & Information Technology

Industry

I.T. Services, analytics, enterprise software, technology hardware, Internet of Things, A.I.

About the Scheme

Under the SIP-EIT Scheme, MSMEs and Technology Startup units get financial support for international patent filing. This scheme aims to encourage innovation among MSMEs and Technology Startup Units in the ICT sector. It boosts the morale of small businesses and starts ups by helping in recognizing the values and capabilities of a global international patent. Additionally, it helps in capturing growth opportunities in the Information Communication Technology & Electronics sector.

Eligibility

- The applicant should be a registered MSME as per the Government of India's rules.

- The applicant should be a registered STP unit and fulfill the investment limits in plant and machinery or equipment.

- The applicant can either be a startup or technology incubation enterprise located in an incubation center and should be a registered company.

- It should fulfill the investment limits in plant and machinery or equipment.

How to apply?

You can apply online on this website.

Documents required

- Proof of registrations as per eligibility criteria.

- Scanned copy of Last Audited Balance Sheet.

- If applying for a waiver under Section 39 for international filing, then a scanned copy of the Official filing with the Indian Patent office.

- If an international application has already been filed, then Proof of PCT/Paris convention or direct international filing. A documented proof showcasing the applicant is an employee or Member of the Board of Directors.

- Technical write-up of Present Invention has to be given in *.pdf format filled as per the format—download format of technical write-up.

- Patent Search Report

- A scanned copy of Details for Transfer of e-Payments must be duly filled up as per the format.

- Scanned copy of Declaration Forms duly signed and sealed.

Software Technology Park Scheme

Comes under

Ministry of Electronics and Information Technology

Industry

I.T. services, fintech, enterprise software, analytics, A.I.

About the scheme

The objective of this scheme is to encourage and promote software exports from India. And therefore, it is focused on the export of software as well as professional services. What is so special about this scheme is it focuses on one sector, i.e., computer software. It integrates two critical concepts of the Government - 100% Export Oriented Units (EOU) and Export Processing Zones (EPZ), and Science Parks/Technology Parks, operating elsewhere across the globe. It provides a single-point contact service for member units to ease out the export operations of businesses.

Benefits

- Single window clearance

- A business can set up an STP unit in the country anywhere

- 100% foreign equity is permitted.

- Imports of Hardware & Software are duty-free.

- Import of second-hand capital goods, as well as re-export of capital goods, permitted

- Minimum Export Performance norms Simplified

- Use of computer systems for commercial training purposes is allowed

- The capital goods purchased from the DTA are entitled to a refund of GST.

Eligibility

- Any Indian company

- A subsidiary of a foreign company

- A branch office of a foreign company

How to apply?

You can apply online through this link here

Documents required

- Application

- Project report

- Board resolution

- Memorandum or Articles of association

- Export order/contract or MOU

- List of Directors

- Importer - Exporter Code number

- Proof of STP location premises ( e.g., Leave and license)

- Valid data communication proof (e.g., Receipt of payment, service acceptance letter)

Scheme To Support IPR Awareness Workshops/Seminars in E&IT Sector

Headed by

Ministry Of Electronics & Information Technology

Industry

I.T. Services, analytics, enterprise software, technology hardware, Internet of Things, A.I

About the scheme

This scheme promotes Intellectual Property Rights Awareness Workshops and Seminars. This scheme aims to sensitize and spread awareness about Intellectual Property Rights among various stakeholders, especially in the Electronics & Information Technology sector.

The financial aid will be provided to the following bodies

- Educational Institutes - They will get grants-in-aid of up to 2 lakhs

- Industry bodies like CII, NASSCOM, FICCI, ASSOCHAM, etc.- They will get grants-in-aid of up to 5 lakhs

- Meity Societieses) or Meity Autonomous Bodies - They will get grants-in-aid of up to 5 lakhs

Eligibility

Educational Institutes; Industry bodies like CII, NASSCOM, FICCI, ASSOCHAM; Meity Societieses) or Meity Autonomous Bodies.

How to apply?

You can apply online through this site here.

Documents required

- Scanned copy of Terms & Conditions with Undertaking duly signed and sealed by the Head Of the Institution.

- Scanned copy of Undertaking duly signed and sealed.

- Detailed program

- Scanned copy showcasing detailed transfer of e-Payments

Marketing Support/Assistance to MSMEs (Bar Code)

Headed by

Ministry of Micro, Small and Medium Enterprises

Industry

Any

About the scheme

The purpose of this scheme is to encourage Micro and small enterprises (MSEs) to use barcodes to enhance their market competitiveness. Therefore, the MSME ministry organizes several seminars and reimburses registration fees for barcoding. Through this scheme, the MSME ministry provides financial assistance to reimburse 75% of the one-time registration fee and 75% of the annual recurring fee for the first three years paid by MSEs to GS1 India.

GS1 India is an autonomous body under the Ministry of Commerce & Industry that provides solutions for registration for the use of barcoding.

Benefits

- Bar Coding plays a significant role in the success of an organization.

- With barcoding, businesses get accurate and factual information about products.

- Barcoding also helps in a smooth transfer of information electronically across the Supply Chain.

- It also lowers inventory costs

- Barcoding helps in accurate demand forecasting and real-time product tracking.

Eligibility

The scheme applies only to MSEs who have registration with GS1 India for the use of barcodes.

How to apply?

You can apply to the Director, Micro, Small & Medium Enterprises - Development Institute of the region for claiming reimbursement on the Barcode. The application form and the information for supporting documents can be collected directly from the Director's office. You can also download the form and other relevant information through this website.

Lean Manufacturing Competitiveness for MSMEs

Comes under

Ministry of Micro, Small, and Medium Enterprises

Industry

Manufacturing

About the scheme

As the name suggests, the scheme is focused on improving and making MSMEs from the manufacturing sector more competitive by using lean manufacturing techniques. These techniques help small businesses and startups reduce their manufacturing costs by improving personnel management, better space utilization, enhanced inventory management and procurement, organized process flows, and so on. LMCS also helps in improving product quality.

For the implementation of lean manufacturing techniques, the Government provides financial assistance. This aid primarily bears the costs of lean manufacturing consultants. GoI takes care of 80 % of the expenditure, whereas beneficiaries bear 20% of the cost.

Eligibility

The scheme is open to all manufacturing MSEs. They must form mini clusters and work closely with the assigned Lean Manufacturing Consultants to implement specific L.M. techniques. Mini clusters can be ten or so units by signing a Memorandum of Understanding (MoU) to participate in the scheme.

Benefits

- Reduced manufacturing costs

- Improved product quality

- Better utilization of space

- Improved inventory management

- Organized process flows

How to apply?

Since this is a group scheme, SMEs can apply in groups. Either a recognized SPV can apply on its own, or a mini-cluster can be formed. The application can be submitted to the National Monitoring and Implementing Unit (National Productivity Council for the Scheme. You can also go through this document here for further information.

Design Clinic for Design Expertise to MSMEs

Comes under:

Ministry of Micro, Small and Medium Enterprises

Industry

Manufacturing

About the scheme

To encourage small businesses to adopt new product designs, the MSME Ministry has created a Design Clinic for inducing design-related expertise for startups and MSMEs. The objective of this scheme is to increase the competitiveness of MSMEs' products through new and contemporary designs. The scheme also aims to spread awareness of the value of design and establish design learning in the MSME.

The Government provides financial assistance up to INR 60,000 for attending design seminars and up to Rs 3.75 lakh or 75% of the cost of a workshop. 'Design Clinic for Design Expertise to MSMEs' exposes small businesses and startups with the latest trends and practices related to designs and gives a platform to interact and network with other designers and entrepreneurs and learn in-depth about design mentality and theories.

Eligibility

MSMEs, new businesses, startups, agencies, Academic Institutes/ design companies/ design consultants, etc., applying as co-applicants along with a designated MSME.

How to apply?

Agencies can apply to design clinic centers expressing intent to conduct workshops and seminars.

MSMEs can apply alone or with a design company or a design consultant/academic institute for design projects by submitting a proposal to the Design Clinic Centre. They can also apply online through this site here.

Entrepreneurial and Managerial Development of SMEs through Incubators

Headed by

Ministry of Micro, Small and Medium Enterprises

Industry

Any

About the scheme

The scheme aims to promote tech startups and knowledge-based ventures with financial assistance to nurture innovative business ideas. The funding is used to set up business incubators. It promotes the untapped creativity of individual innovators so that they can become technopreneurs. It also provides a platform for networking so that these business ideas can be commercialized within a year.

Total funding of INR 66.5 lakhs may be given for setting up a business incubator. The cost ranges from INR 4 to 8 lakh per idea. Other expenses include upgradation of infrastructure Rs 2.50 lakh, orientation/training Rs 1.28 lakh, administrative expenses Rs 0.22 lakh

Eligibility

Any individual or MSME unit with innovative ideas that is ready for commercialization of its idea.

Any technical institution such as IITs, NIITs, research institutes that wants to become a host institution.

How to apply?

Any individual or MSME can apply directly to the nearest host institution.

Technical institutions can apply once an RFP or EOI is released.

You can go through this website here for further details

Sustainable Finance Scheme

Headed by

Small Industries Development Bank of India (SIDBI)

Industry

Any

About the scheme

The Sustainable Finance Scheme aims to fund sustainable development projects that contribute towards energy efficiency and cleaner production. However, these projects are independent of the international or bilateral lines of credit. Projects such as renewable energy, Bureau of Energy Efficiency (BEE) star rating, green microfinance, green buildings, and eco-friendly labeling can use the benefits of this scheme.

The scheme covers all the aspects of energy efficiency (EE)/ cleaner production (CP) and sustainable development projects that are currently not covered under the viable financing lines of credit. The rate of interest is applied as per the standard lending rate based on MSMEs' credit ratings.

The scheme provides financial assistance such as term loans or working capital. This scheme is exclusively for MSMEs and those companies which provide its services to MSMEs.

Here’s the criteria for applying for this scheme:

- New and existing MSMEs are eligible for the Sustainable Finance scheme.

- Small businesses must have a satisfactory track record and should not be part of the default list of institutions/ banks.

- According to the internal credit rating model, the units should have a minimum credit rating of investment grade or its equivalent.

- Renewable energy projects such as solar power plants, wind energy generators, mini hydel power projects, biomass gasifier power plants, etc., for captive/ non-captive use.

- Any potential CP investments that include waste management

- Timely assistance to OEMs that manufacture energy-efficient/ cleaner production/ green machinery/ equipment. Further, the OEM has to be an MSME or supply its products to a substantial number of MSMEs.

Eligibility

- Renewable energy projects - solar power plants, wind energy generators, mini hydel power projects, biomass gasifier power plants, etc. for captive/ non-captive

- CP investments such as waste management

- OEMs that manufacture energy-efficient, cleaner production, or green machinery types of equipment. However, the OEM must be an MSME, or it should be a supplier of such equipment to a significant number of MSMEs.

Development of Khadi, Village and Coir Industries

Interest Subsidy Eligibility Certificate (ISEC)

Comes under

Ministry of Micro, Small and Medium Enterprises

Industry

Khadi and the polyvastra sector

About the Scheme

The ISEC Scheme is designed to give a push to the age-old khadi industry of India. It funds various khadi programs being run by the khadi institutions. The idea is to ease the credit dissemination process from banking institutions to bridge the gap between the actual fund requirements and the availability of funds from budgetary sources. Through the ISEC scheme, small businesses and startups get credit at an interest rate of 4% for working capital. The Central Government pays the difference between the actual lending rate and the concessional rate to the banks.

Eligibility

The Khadi institutions, having valid Khadi certificates and sanctioned khadi programs. The Institutions should be registered with the KVIC/State Khadi and Village Industries Boards (KVIBs).

How to apply?

The Khadi institutions can apply to the bank for financial assistance along with the ISEC certificate issued by KVIC. You can go through the detailed process here.

Revamped Scheme of Fund for Regeneration of Traditional Industries (SFURTI)

Comes under

Ministry of MSME

Industry

Khadi sector

About the scheme

The idea behind this scheme is a revival of traditional industries like the khadi industry. As part of this scheme, traditional industries and artisans are organized into clusters and encourage competitiveness among them. Rural entrepreneurs and artisans play a crucial role in nation-building. Therefore, the Government of India wants to support them to become sustainable by providing them facilities, tools, types of equipment, etc.

The scheme also helps these small businesses become market-ready both at the domestic and global levels. Small businesses get support through this scheme for enhanced marketability of their products, with improved designs, better packaging, and a well-organized marketing Infrastructure. This scheme also helps traditional artisans and businesses associated with these clusters in skill development and enhanced capabilities through training.

Thus, SFURTI provides startups and small businesses in the cluster with innovative and traditional skills, improved technologies, advanced processes, market intelligence, and new models of public-private partnerships.

The three types of clusters and their project outlay is as follows

- Heritage cluster is of 1000-2500 artisans with INR 8 cr

- Major cluster is of 500-1000 artisans with INR 3 cr

- Mini cluster is up to 500 artisans with INR 1.5 cr

P.S.: For NER/ J&K and the Hill States, there is a 50% reduction in the number of artisans per cluster

SFURTI covers 3 types of intervention - Soft Interventions, Hard Interventions, and Thematic interventions

Soft Interventions - up to INR 25.00 lakhs with 100% funding

Hard Interventions - Depends on the project requirement with 75% scheme funding

Eligibility

- Non-Government Organizations (NGOs)

- Institutions of the Central and State Governments

- Semi-Government institutions

- Field functionaries of State and Central Govt.

- Panchayati Raj institutions (PRIs)

How to apply?

The proposal needs to be submitted to the State Office, KVIC.

Credit Linked Capital Subsidy for Technology Upgradation (CLCSS)

Comes under

Ministry of Micro, Small & Medium Enterprises

Industry

Any

About the scheme

In today's world of digitization, small businesses must adopt technologies to run and manage their business efficiently. Technology is the catalyst that pushes Indian startups and MSMEs to become globally competitive.

The Credit Linked Capital Subsidy for Technology Upgradation (CLCSS) scheme aims to help MSMEs and startups become digitally advanced by using cutting-edge technology in their business.

Under this scheme, the Government provides a 15% subsidy for investment up to Rs 1 crore for upgrading technology for startups and MSMEs in India. More than 7500 products/services are covered under this Government scheme.

Eligibility

Any MSE business

How to apply?

Businesses can reach out directly to SIDBI, NABARD, SBI, BoB, PNB, BOI, SBBJ, TIIC, Andhra Bank, Corporation Bank, Canara Bank, and Indian Bank. You can also go through this website here.

Marketing Promotion Schemes

International Cooperation Scheme

Headed by

Ministry of Micro, Small & Medium Enterprises (MSME)

Industry

Any

About the scheme

International cooperation scheme promotes the exports of MSMEs through international exhibitions/ trade fairs, conferences/ summits/workshops. The idea is to give MSMEs . a platform so that their products and services can get global recognition and expand their business.

MSME delegations visit other countries to participate in international exhibitions, trade fairs, conferences, etc. The objective is to explore various ways and means to improve the market of MSMEs products through joint ventures, technology infusions, etc.

At the same time, international conferences, summits, workshops, etc., related to the MSME sector are organized in India by various bodies.

International cooperation scheme provides financial assistance by reimbursing airfare, space rent, freight charges, advertisement & publicity charges, and entry/registration fees for participating in international marketing activities.

Eligibility

Any Government institution and industry association that works towards the promotion and development of the MSME sector.

The organization must be engaged in such activities for at least the last three years and have a good track record.

How to apply?

You can apply for financial aid in the prescribed form to the Director (International Cooperation), Ministry of MSME, Udyog Bhawan, New Delhi -110011.

You can also find the details on this site here.

Procurement and Marketing Support Scheme (P&MS)

Headed by

Ministry of Micro, Small, and Medium Enterprises

Industry

Manufacturing and services sector

About the scheme

The Procurement and Marketing support scheme is meant to promote and educate MSMEs by organizing trade fairs/awareness programs about the GeM portal, Online services, and other services. The scheme also encourages Micro and Small Enterprises to develop domestic markets and find new ways of promotion to gain access to new markets.

Through this 'Procurement and marketing support scheme,' MSMEs are made aware of the critical methods such as packaging process in marketing, latest packaging technology, import-export policy and procedure, MSME Conclave, latest developments in international, national trade, etc. Additionally, MSMEs are educated about trade fairs, barcodes, digital advertising, e-marketing, GST, GeM portal, public procurement policy, and many more.

Eligibility:

Individual manufacturing and Service MSEs

How to apply?

Eligible MSEs can apply online or offline. For details, please go through this link here.

Marketing Assistance Scheme

Headed by

Ministry of Micro, Small and Medium Enterprises

Industry

Any

About the scheme

This scheme was launched to enhance the marketing capabilities & competitiveness of the MSMEs and showcase the competencies.

For MSMEs to market their products, the scheme allows them to organize exhibitions and trade fairs abroad and participate in such events. It provides a platform where MSMEs get an opportunity to interact with large institutional buyers. Also, it polishes the marketing skills of MSMEs.

The overall financial assistance for participating in international events is restricted to INR 30 lakh per event.

For domestic events, budgeting depends on several factors such as space rent, printing material, transportation, etc. The budgetary support towards net expenditure for organizing such exhibitions is restricted to a maximum amount of Rs. 45 lakh, whereas the budget for participation in such an event is up to INR 15 lakh.

Eligibility

MSMEs, Industry Associations, and other related organizations can apply.

How to apply?

Applications seeking assistance under the scheme should be submitted to the Branch Manager of the nearest office of the National Small Industries Corporation.

For more details, you can go through this link here.

Entrepreneurship and skill Development Programme

Entrepreneurship Skill Development Programme (ESDP)

Headed by

Ministry of Micro, Small and Medium Enterprises

Industry

N/A

About the Scheme

Entrepreneurship Skill Development Programmes are organized regularly to train and make the youth aware of the various requirements and know-how for setting up MSEs. The idea is to bridge the skill divide in the country. These EDPs are generally conducted in ITIs, Polytechnics, and other technical institutions. The idea is to motivate the youth towards becoming job creators rather than job seekers.

20% of the ESDPs are conducted exclusively for SC/ST/women and P.H. members of the society. It is a free-of-cost program.

Eligibility:

MSME-DIs of Ministry conduct these programs

How to apply?

N/A

NewGen Innovation and Entrepreneurship Development Centre

Headed by

Department Of Science & Technology (DST)

Industry

N/A

About the Scheme

The NewGen Innovation and Entrepreneurship Development Centre (NewGen IEDC) is promoted in Science & Technology academic institutions to create entrepreneurial culture in these institutions and encourage techno-entrepreneurship. The idea is to generate more and more employment in the S & T field with knowledge-based and innovation-driven enterprises. The NewGen IEDCs are established in institutions such as science colleges, engineering colleges, universities, management institutes.

Eligibility

- The institution to set up a NewGen IEDC should be a University or Deemed University or a recognized Institute or college offering Engineering, Technology, Science courses at degree level or above for at least 5 years

- Have qualified and dedicated faculty in various disciplines with a good Research & Development base and background in industry-related activities

- Should have at least two faculty trained in Entrepreneurship through DST sponsored Faculty Development Programme

- Have a dedicated space of about 5000 square feet for accommodating the NewGen IEDC and the startups promoted through it. Should have availability of utilities like electricity, water, telephone, and internet connectivity

- Experience in Entrepreneurship Development and Promotion and Industry related activities such as Consultancy, Product Development, Testing, Calibration, etc.

Documents required

To know more about the documents required and how to apply, please go through the links below.

Guidelines & Proforma for Establishment of NewGen IEDC

List of Entrepreneurship Development Cells

List of Innovation and Entrepreneurship Development Centres

How can Deskera Help?

As a small business owner or a startup, you need to take care of thousands of things. In the above sections, we realized that so many essential factors could make a significant change in your business, such as barcoding, well-managed inventory, financial aid to manage your business efficiently, use of new technology, and proper marketing tools and strategy.

Of course, the Government of India has been involved in all the above initiatives so that you as a small business can rise and shine not only in India but on the global platform.

Small businesses are the backbone of every economy, and the irony is you don't hear about them often. But at Deskera, small businesses are the center of everything.

We at Deskera have always been committed to helping SMEs realize their dreams. Since its inception, Deskera has had a singular mission- To transform how SMEs run their business. We want them to grow and exceed expectations by using the best possible technology and tools.

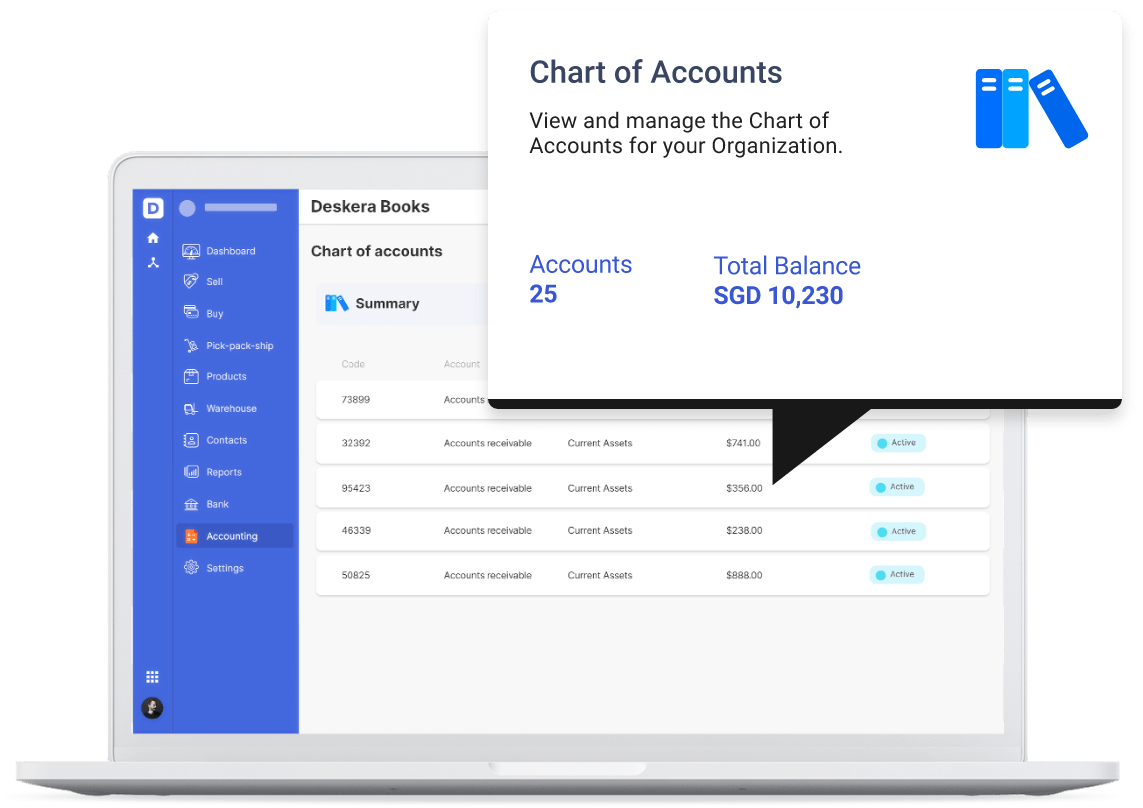

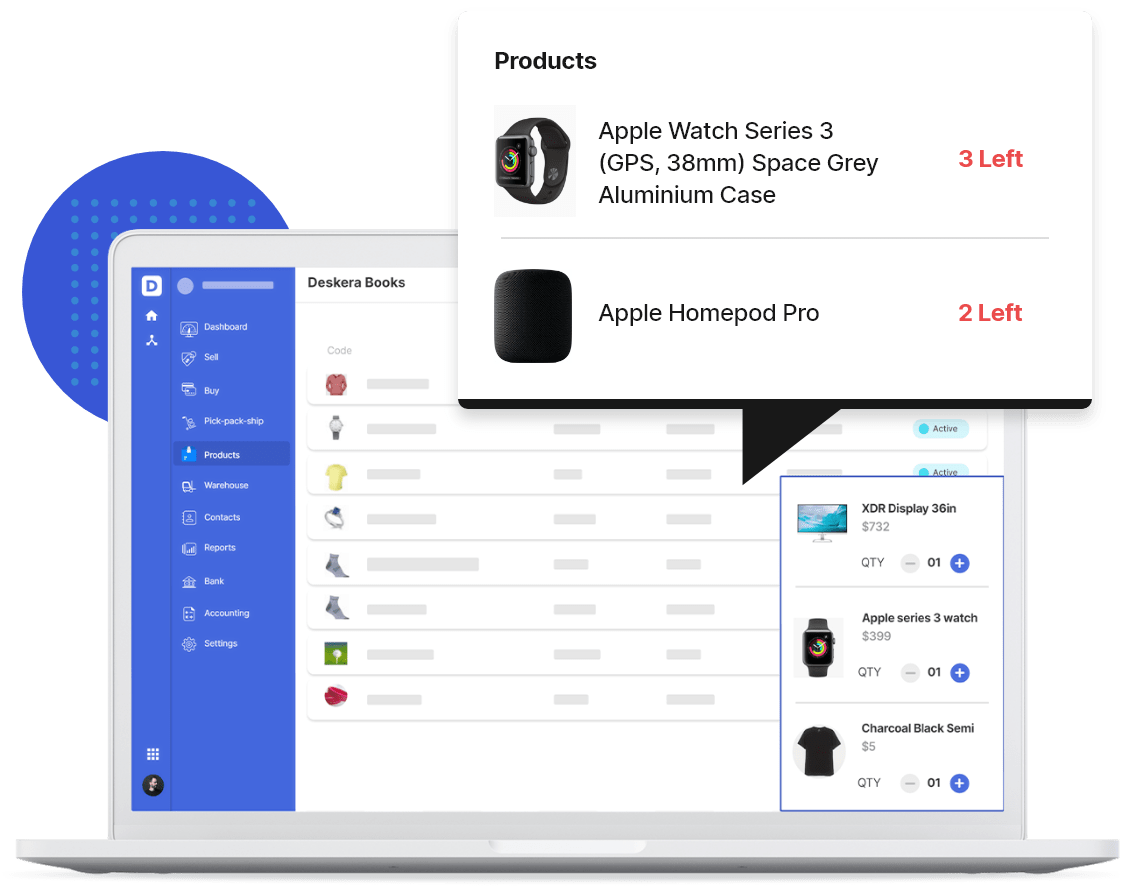

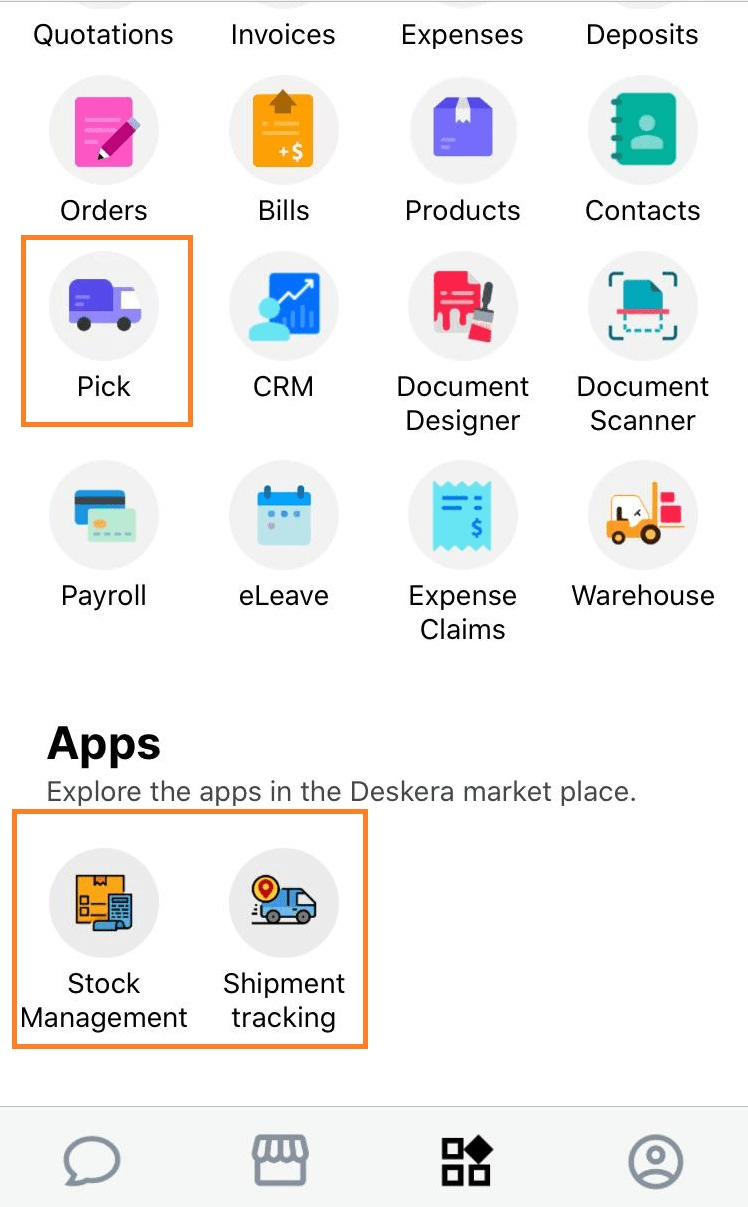

And that is why we have designed Deskera-all-in-one - a cloud-based software suite consisting of Books, CRM, and People modules.

This intuitive and hardworking software takes some load off the back of small businesses and startups by optimizing their accounting, operations and process workflows. Deskera is an all-in-one cloud-based accounting software that helps small businesses run their business efficiently anytime, anywhere, on any device.

Deskera all-in-one does all the below-mentioned tasks and much more for your business.

Smooth management of your finances

Deskera all-in-one helps small businesses in managing their general ledger efficiently. Whether it's Assets, Liabilities, Equity, Revenue, or Expense, keep your worries behind.

It helps you track every business transaction across your organization.

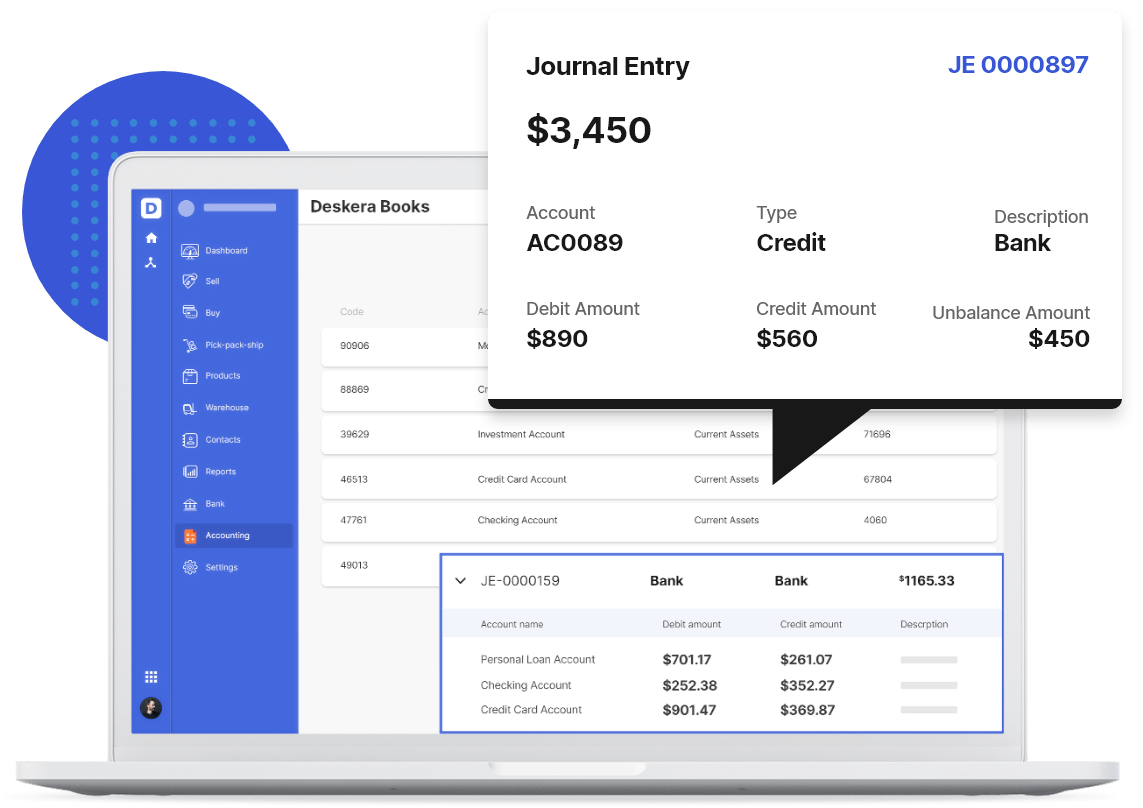

Since Deskera automates most of the processes, all business transactions automatically populate the journal entry record. It also allows you to create recurring journal entries to save more time.

You can easily record different types of expenses and deposits — and generate accurate financial reports.

Reduce your inventory Costs

Deskera's inventory management software enables you to stay on top of your stock levels at all times and fulfill your customer orders with confidence.

The software updates your stocks in real-time and allows you to view the stock availability in each warehouse in seconds. Thus, helping you make informed decisions to optimize your inventory and reduce costs significantly.

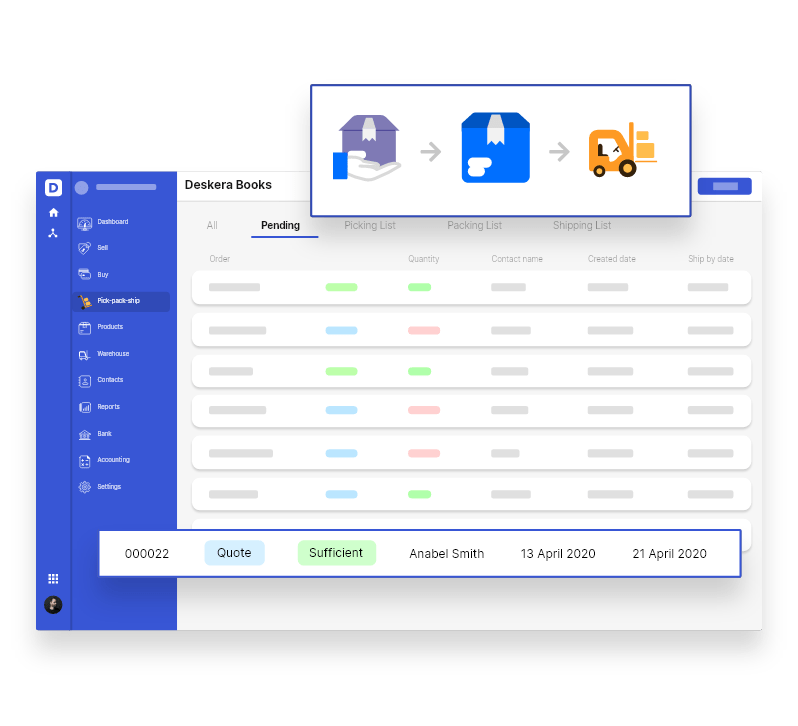

With Pick-Pack-Ship, you can efficiently pick products from the warehouse, pack them in the carton, and promptly ship them out to customers.

You can create stock adjustments and transfers anytime, anywhere, and scan your products' barcodes in seconds.

Barcoding of Stock Items

Deskera allows you to assign Barcodes to all your product masters. Assign Barcodes by scanning the Barcode and then fetch Products instantly while making transactions using the mobile app.

Barcoding helps save time and generate invoices for small businesses quickly. It will help you automate Invoicing and improve efficiency significantly.

Barcoding also helps during the Pick-Pack-Ship process in the Pick Step to reconcile the products being Picked against the quote or invoice.

Key Takeaways

A country cannot prosper without strengthening its MSME and startup sector. They play a decisive role in nation-building. In a country like India, with a youth population of 464 million, it is imperative to realize their strength and create an ecosystem that fosters a culture of entrepreneurship, innovation, and job creation. Through various such schemes and initiatives, the Government of India is working towards helping millions of youth realize their dreams and build a better tomorrow.

Here are the key takeaways from the article:

- PMMY is meant to empower Indian entrepreneurs. MUDRA Banks provide loans up to 10 lakhs at low-interest rates to non-corporate, non-farm startups and small businesses.

- To boost the entrepreneurship culture and promote innovative ideas in this sector, the Government launched ASPIRE under the Ministry of MSME.

- ASPIRE aims to set up technology centers and incubation centers to encourage more and more small businesses and startups in the agro-industry.

- Under the venture capital assistance scheme, an interest-free loan is given by the Small Farmers Agribusiness Consortium (SFAC) to eligible persons or groups.

- The objective of CGT SME scheme is to strengthen the credit delivery system and facilitate the flow of credit to the MSE sector.

- Under the SIP-EIT Scheme, MSMEs and Technology Startup units get financial support for international patent filing.

- To encourage small businesses to adopt new product designs, the MSME Ministry has created a Design Clinic for inducing design-related expertise for startups and MSMEs. The objective of this scheme is to increase the competitiveness of MSMEs' products through new and contemporary designs.

- NewGen IEDC is promoted in Science & Technology academic institutions to create entrepreneurial culture in these institutions and encourage techno-entrepreneurship.

Related Links