Out of the total nine states of the United States which do not levy income taxes, New Hampshire is one of them. New Hampshire does, however, tax interests and dividends, though it has passed legislation to phase out that taxation from 2024 and end it completely by 2027. New Hampshire payroll taxation does not even require any state income deduction form. This makes payroll in New Hampshire a much less complex affair.

Yet, there are certain specifications and details that you must take care of in regards to New Hampshire payroll taxes. In fact, processing of payroll in New Hampshire becomes quite straightforward once you are aware of all the applicable federal and state rules and regulations.

These will be discussed in this article by covering the following topics:

- New Hampshire Taxes

- New Hampshire Payroll Taxes, Laws, and Regulations

- New Hampshire HR Laws that Affect Payroll

- New Hampshire Payroll Forms

- New Hampshire Payroll Tax Resources

- How Can Deskera Help with New Hampshire Payroll Taxes?

- Key Takeaways

- Related Articles

New Hampshire Taxes

New Hampshire is one of those nine states of the United States which does not impose any income tax on the wages and salaries of the employees. Additionally, it also does not have any state sales tax. In fact, no cities in New Hampshire levy local income taxes. However, New Hampshire does impose a 5% tax on the interests and dividends earned by an individual.

New Hampshire generates the bulk of its tax revenue by levying select sales taxes known as excise taxes and corporate income taxes. On top of it, homeowners in New Hampshire pay some of the highest average effective property tax rates in the country.

However, except for a few exceptions, most of the employers in the United States are required to pay Federal Insurance Contributions Act (FICA) taxes. The current FICA tax rate for Medicare is 1.45%, and for Social Security, it is 6.2%. These will have to be paid by both- the employer as well as the employee, with each paying 7.65% for the combined Medicare and Social Security taxes.

New Hampshire Payroll Taxes, Laws, and Regulations

While New Hampshire does not levy any local taxes or state income tax on the employees, there are certain taxes that the companies of New Hampshire are obliged to pay. These are:

Employer Unemployment Taxes

All the businesses in New Hampshire must pay State Unemployment Tax Act (SUTA) taxes whose current wage base is $14,000, with its tax rates ranging from 0.1% to 7.0%. In case you are a new employer, then you would have to pay a SUTA at the rate of 2.7%.

Note: Businesses that pay SUTA in full and on time can claim a tax credit of up to 5.4% on the Federal Unemployment Tax Act (FUTA) taxes. Generally, FUTA is 6% of the first $7,000 of each employee’s paycheck.

Workers’ Compensation

Every employer in New Hampshire with one or more employees is required to carry workers’ compensation insurance. A workers’ compensation insurance is aimed at providing benefits to the employees who suffer on-the-job injuries. Workers’ compensation insurance is a type of employee benefits program aimed at assisting employees, and in this case, it does so by covering the cost of their medical treatment and lost wages.

This is different from the long-term disability insurance policy with pre-tax or post-tax premiums as that is something which is largely paid by the employees with only a part (if you wish to) paid by you as an employer. An employer is usually engaged in the long-term disability insurance policy premiums when they want to retain top talent as well as want deductions in their tax liability.

In the case of workers’ compensation insurance, you would be protecting yourself from potential lawsuits and other monetary damages. Remember, as an employer, you would have to apply for and obtain coverage for the workers prior to hiring them. In fact, one can even opt for workers’ compensation self-insurance upon getting the commissioner’s approval for the same.

Minimum Wage

Considering that New Hampshire does not have a minimum wage, the federal minimum wage of $7.25 will be applicable by default to the employers here. This also means that the businesses will be required to pay at least $3.26 per hour to the tipped employees, as long as it helps them reach the federal minimum wage. If they are falling short there, then the employers will have to make up for the difference.

Calculating Overtime

The Fair Labor Standards Act requirements are followed by New Hampshire in their overtime rules. According to this, all employers will be required to pay their employees 1.5 times their regular hourly wage for hours worked over 40 in a workweek.

Paying Employees

It is mandated by the New Hampshire law that employers pay their employees at least every other week. The same law thus provides the following options in pay schedules:

- Employees who are paid weekly must be paid within eight days of the end of the pay period.

- Employees who are paid every other week must be paid within 15 days after the end of the pay period.

Note: Employers can request a different pay schedule for their employees from the New Hampshire Department of Labor, and the same will be reviewed on a case-to-case basis. However, if you want to pay less frequently to your employees, then you would have to provide the following information to the New Hampshire state:

- Method of payment

- Proposed frequency of payments

- Designated payday

- Employee classification

- Salary range of all employees

- FEIN

The methods by which New Hampshire employers can pay their employees are:

- Cash

- Paper check

- Direct deposit

- Payroll card

Pay Stub Laws

New Hampshire has made it mandatory for every business to give their employees access to pay stubs, including an itemized accounting of wage deductions at least once per month. The pay stub information generally includes:

- Employee name and ID

- Pay period

- Pay date

- Gross wages, including regular and overtime pay

- Tips, commissions, or other earnings

- Deductions

- Net pay

New Hampshire Paycheck Deductions

There is an extensive law in New Hampshire that discusses wage deductions. According to this law, the components which a company cannot deduct from his or her employee’s pay are:

- Cash shortages

- Broken, damaged, or stolen company property

- Returned checks

- Required uniforms or tools

The law further states that the employer cannot deduct any amount from their employee’s pay unless:

- It is permitted by law.

- The employee has given consent for the same in writing, and the consent covers any one of the following items:

- Union dues

- Healthcare and retirement contributions

- Charitable contributions

- Payments to a bank account held by someone other than the employee

- Vehicle use

- Child care

- Parking fees

- Loan repayment to the employer

- Accidental wage over-payment

- Educational payments

- Gym or fitness center memberships

- Additional reasons agreed upon by the employer and employee

Note: As stated by the laws of the Department of Labor, a company cannot make deductions to an employee’s pay if those deductions would cause the employee to earn less than the $7.25 per hour federal minimum wage for that pay period.

Employees’ Final Paychecks

New Hampshire law also has set requirements on employers to pay employees’ final pay based on how the employment relationship ended. The state requirements on when you will need to pay your employee’s final wages after separation from employment with your company are:

New Hampshire HR Laws that Affect Payroll

While New Hampshire has only a few state-specific HR laws that must be followed by the employers, there are also federal guidelines that are mostly followed by the New Hampshire Law and which you should abide by too. These are:

New Hampshire New Hire Reporting

It is mandated that every employer in New Hampshire must report their new hires and any rehired employees within 20 days to the New Hampshire Employment Security. This reporting is the basis for enforcing child support orders and must also include the employee’s name, address, and Social Security Number.

Meals and Breaks

If your employees are scheduled to work for more than five consecutive hours, then it is mandatory for you to give them a 30-minute break. However, this break does not have to be paid until and unless the employee’s work profile is such that they cannot completely escape work during this time.

New Hampshire Child Labor Laws

According to the New Hampshire Child Labor Laws, provided that they have a Youth Employment Certificate, children whose minimum age is 12 years, can work. However, the rules to be followed here are that children between the ages of 12 and 15 cannot work more than three hours a school day and a maximum total of 23 hours in a school week. In the case of non-school days, they can work for a maximum of eight hours and a total of 48 hours maximum during non-school weeks.

Children who are aged between 16 and 17 do not require a Youth Employment Certificate to work, but they do require signed parental permission. These children do not have a restricted number of working hours per day but rather have limitations in the workweek hours and school days as follows:

Note: There are no circumstances under which children aged 16 or 17 are allowed to work for more than six consecutive days.

Time Off and Leave Requirements

- New Hampshire Family Leave

The Family and Medical Leave Act (FMLA) is followed by New Hampshire. According to this, all the eligible employers are required to provide up to 12 weeks of unpaid leave for employees who fall under a covered disability, including pregnancy and caring for an ill family member.

The FMLA does not require employers to pay employees for this time off work, but it does require them to keep that employee’s job or a substantially similar one available for them when they return.

While New Hampshire does not provide for any additional family leave under state law, it does require employers with more than six employees to provide pregnancy disability leave. This means that any employee who cannot work due to childbirth, pregnancy, or a related condition may take unpaid leave for as long as the individual is disabled. The employer is, however, required to keep that employee’s position or a similar one available for them upon their return.

- Paid Time Off

There are no laws in New Hampshire that require employers to provide employees with paid time off (PTO). This means that companies in New Hampshire are free to create their own PTO policies and may include whether they pay out accrued and unused PTO when an employee leaves. Considering that this is not required by the New Hampshire laws, it is recommended that you clearly define it in your company policy, which you will then have to follow, or else you will be held liable.

- Holiday Leave: New Hampshire does not have any law that makes it mandatory for the private companies to pay employees for holidays or even a law that makes it mandatory for them to give an increased rate to employees who work on holidays. A company may choose to do so and must comply with the FLSA.

- Paid Sick Leave: There is no mandatory law in New Hampshire in regards to paid or unpaid sick leaves. Employers are free to create their own sick leave policies.

- Voting Leave: There is no law in New Hampshire that makes it mandatory for employers to give time off to employees for voting.

- Jury Duty Leave: As per the New Hampshire laws, employers are not required to pay employees when they are on jury duty leave. However, they cannot discharge, threaten, or coerce an employee who is summoned to serve on a jury.

- Bereavement Leave: New Hampshire laws have not made it mandatory for businesses to give bereavement leaves to employees. In fact, if they choose so, companies are free to create their own policies, and if they do create one, they will be obliged to abide by it.

New Hampshire Payroll Forms

Considering that New Hampshire has no state income tax, it has no state payroll forms, and instead, the companies based in New Hampshire will have to file federal payroll forms. Thus, the complete list of the federal payroll forms that you would need as an employer in New Hampshire are:

- W-4 Form: The W-4 Form will provide information on the employee withholdings so that you can properly calculate and withhold federal income taxes.

- W-2 Form: The W-2 Form is used to report the total annual wages for each employee.

- W-3 Form: The W-3 Form is used to report total annual wages for all employees and is a summary form of W-2 Form.

- Form 940: Form 940 is used to calculate and report unemployment taxes due to the IRS.

- Form 941: Form 941 is used to file quarterly income tax.

- Form 944: Form 944 is used to file annual income tax.

- Form 1099: Form 1099 provides information for non-employee contract work.

New Hampshire Payroll Tax Resources

The following are the New Hampshire Payroll tax resources:

- New Hampshire Department of Revenue will provide you with many forms as well as information on the latest laws and regulations. Additionally, it will also provide with other employer-specific information.

- New Hampshire Department of State Online Business Services is a New Hampshire payroll tax resource as it has great resources for new as well as existing businesses that will help you in navigating through licensing, taxes, and employer requirements.

- New Hampshire Department of Labor is a payroll tax resource that will give you support and resources to help ensure that you are complying with labor laws, including those related to unemployment and workers’ compensation.

How Can Deskera Help with New Hampshire Payroll Taxes?

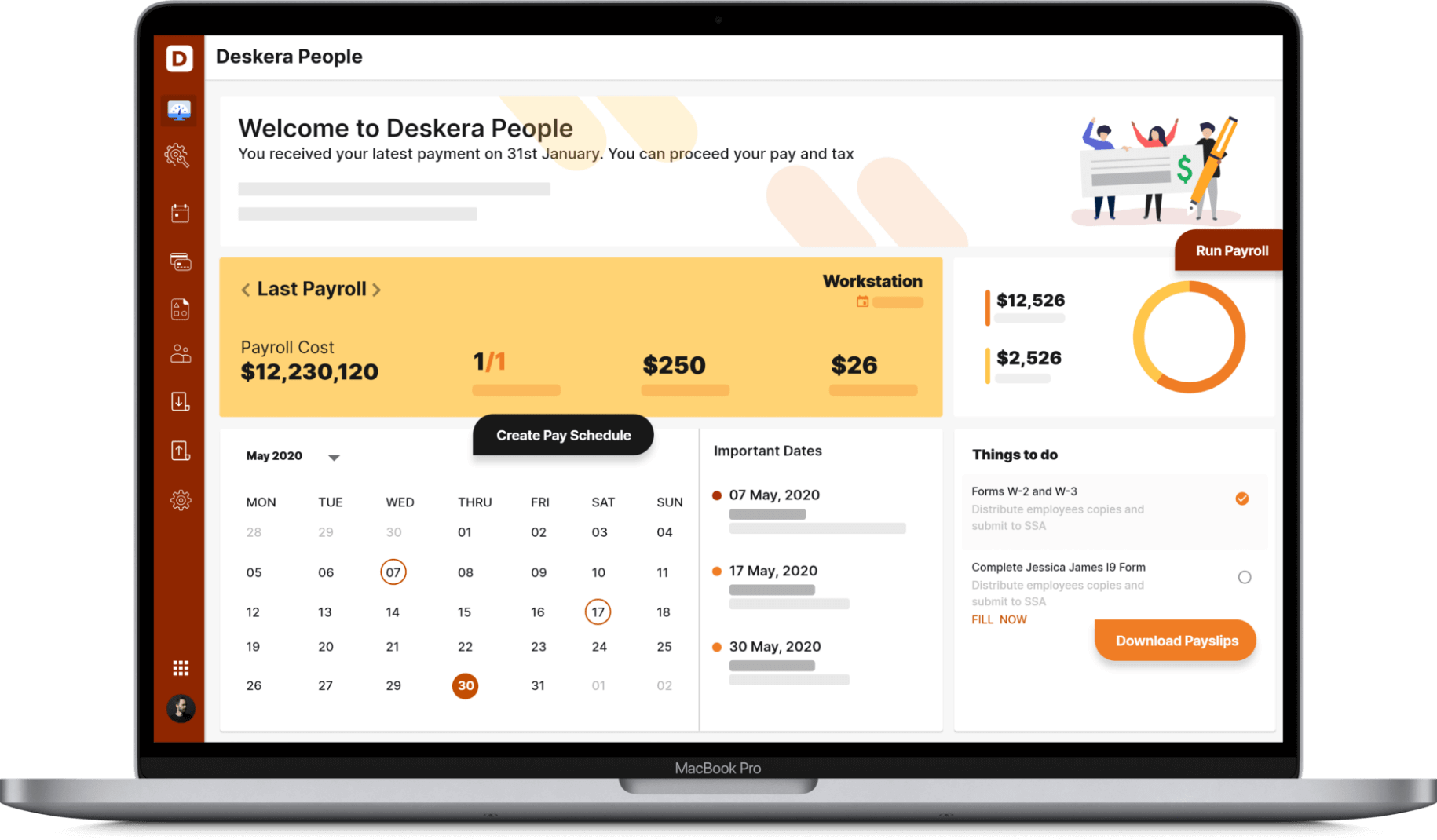

Deskera People is a software that automates and runs your payroll for you through three easy steps: add employees, select the amount, and pay them. It will let you choose your own payroll schedules, thereby letting you pay your different groups of employees according to their payment schedules which can be weekly, semi-monthly, monthly, and more. These pay schedules will also be determined by the New Hampshire payroll rules and the industry that you are a part of.

Deskera People will also facilitate robust employee management as with a simple click on any employee; you would be able to view their personal details, components, and compliance.

In fact, to get better insights into your payroll, you should rely on your payroll reports which will even mention your payroll tax obligations. This is because Deskera People comes with inbuilt statutory and tax compliances for the USA.

Key Takeaways

New Hampshire is one of the simplest and easiest states to process the payroll in the United States as it has no state income tax and state payroll forms. This means that in the majority of the cases, they follow the federal regulations and requirements, which makes the whole job and process a lot easier as well as straightforward.

However, this does not mean that employers in New Hampshire cannot make mistakes, but to avoid them, they can resort to using software like Deskera People, which is equipped with all the features that will ensure your tax compliance, as well as the efficiency of your payroll processing.

Related Articles