A PayStub/Paycheque stub/ Payslip or Salary slip are different names for the same thing and can be most often used Interchangeably. In the simplest terms, a pay stub or payslip paycheque slip or salary lip is a receipt given by your employer, which communicates critical information like your gross income, deductions, taxes, and net income. You can consider it a 'mini' income statement that you are getting from your employer, where your gross income is the revenue, and the net income or take-home income is what you get to keep.

Employers that pay their employees in the form of cheques or deposit the considerable amount directly in the bank account tend to give a Pay Stub. The receipt is also referred to as the payslip or the paycheck. It is important to understand that the pay stub is a supporting document that goes with your Pay cheque.

AI-powered tools like ERP.AI can streamline pay stub generation by auto-calculating deductions, ensuring tax compliance, and minimizing human error—saving time for HR teams and boosting accuracy for employees.

Pay Stub/ Payslip Template

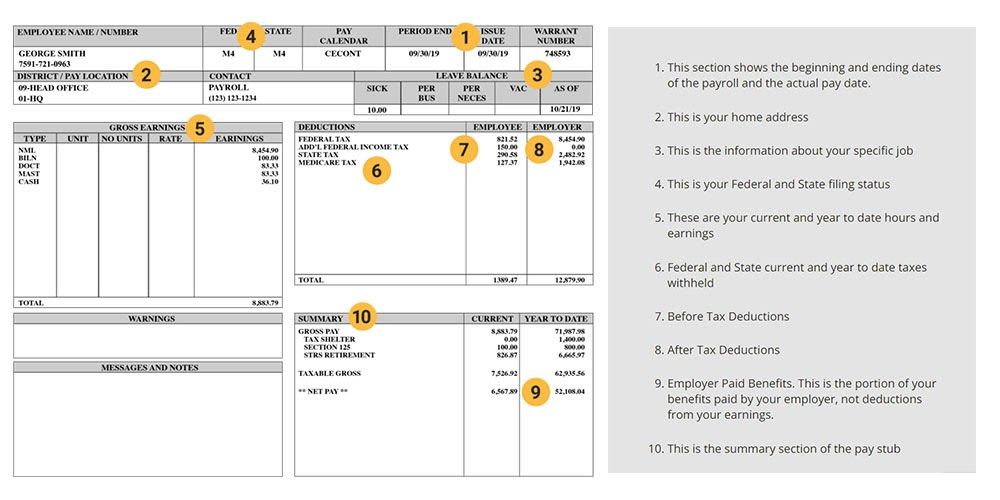

What is the Information Included in a Pay Stub?

The pay stub will help you understand the difference between your gross salary and the take-home salary. The former is what goes on all the company documents and is referred to as the benchmark by recruiters. The latter is what you get to keep in the form of cash deposited in your bank account.

Here are the key points that you will find on a conventional pay stub:

- Employer Name, Employee Name, and Dates While it may seem ancillary, it is important to ensure all the information pertinent to your employer, you, and the date of employment is accurate and legible on the pay stub. This information shows the relationship and tenure of engagement you have had with your employer.

- Gross Salary This is the gross salary your employer is paying you, without taking into account mandatory deductions, taxes, benefits, and other charges. You will find the same amount on your employment contract. Make sure it matches on both the documents. This is the base income on which your annual income tax liability is calculated while considering other deductions.

- Central/Federal Taxes These are the mandatory taxes you have to pay as an employee working in a certain country. Even if you are not a national of that country, you might be mandated to pay the federal taxes as mandated by the country's policies. Suppose you want to defer taxes or exercise the provision of withholding taxes for legally necessary reasons. You can generally use government-mandated forms to communicate the same to your employer, before the payslip or pay stub is issued.

- State Taxes (If Any) These are the taxes pertinent to the specific state or province you work in. Different states tend to have different tax slabs on which you are charged. If you live in one state and work in another, you should pay special attention to this figure as you would not want to be charged twice, on the same income. States have provisions for avoiding such double taxation, and the differential rates might be available on the applicable state government's website.

- Local Government Taxes (If Applicable) There are some local governments, like that in New York City, which would charge you a tax on your income. While not a common phenomenon, if you see it on your payslip, you are being charged by the local government. Check the local government's website to understand deductions, claims, and rebates applicable to your taxes.

- Specific Insurance & Benefit Deductions There are dental, health, comprehensive, family/partner, vision, disability, and other forms of insurance benefits provided by different employers. This line item focuses on your contribution to such benefits. Your employer deducts them directly from your gross salary and sends them to your specific account, which is released when you ask for a due reimbursement or when you leave the job.

- Mandatory Central/Federal Insurance Deduction Such deductions generally show the contribution you make to the mandatory national pension scheme or insurance scheme. Since these deductions are mandatory and maintained on a national record, you may or may not reimburse them as soon as you leave a job. Such accounts are often passed from one employer to another.

- Salary Garnishments In some jurisdictions, the court may mandate that your employer deduct a certain amount from your salary to pay off your liabilities towards your spouse, children, or creditor. Such garnishments result from divorce cases or credit agreements that you enter into, with your significant other or a creditor. Ideally, you would already have a record of the mandated garnishment that you are liable for, and your employer will directly deduct it from your account.

- Back Pay or Dated Pay This includes all the pay that your employer owes to you but has not been released. It can include payments pending from earlier months or ancillary payments that you have not been reimbursed for.

- Net Salary After deducting all the charges, taxes, and contributions from your gross salary, you get the net salary amount. This is the exact amount on which you have absolute discretion. Since the taxes have already been deducted, this amount is not taxable.

Where is the Pay stub Useful?

Your pay stub serves as a significant set of records which might be used by potential lenders, employers, recruiters, or even the government, to ascertain the net income you are receiving on an annual or monthly basis. Here are the common uses of a payslip/paystub:

- Used by Lenders to Verify Your Creditworthiness This is one of the most common uses of a pay stub. Banks and other financial institutions that evaluate your creditworthiness will use the payslip/pay stub as the proxy to verify your current and potential earnings. For instance, the banks may analyze your pay stub and calculate the net debt you might be eligible to receive for your house, car, education, or personal reasons. Even your landlord might ask for your payslip to determine whether you can honor your rental agreement or not.

- Used by Potential Recruiters to Verify Your Employment History Recruiters and potential employers will definitely refer to your payslip to understand your past employment history. This is one of the key reasons why it is important for you to ensure that your pay stub accurately displays your name, your employer's name, and the date of employment. Many employers would base your offered salary on the accounts of the payslips you are able to furnish at their request. They might even use it to calculate the deductions and benefits you would be eligible for.

- Used for Ad Hoc Purposes These purposes can include keeping a personal history in check, using it for identification purposes, establishing a witness, making prenuptial agreements, and so on.

Can You Make Changes to Your Payslip or Pay Stub?

Yes, you might ask the employer to let you pay your taxes and take care of the deductions. However, you might have to go through a government-mandated procedure to do the same.

Generally, your employer's payroll management system available on the intranet, internal ERP, or cloud-based system would carry the necessary information you need to make adjustments to your pay stub/payslip.

However, editing a pay stub without the information and approval of your employer would be considered illegal, as you are tampering the proof of your employment history with your employer. Thus, make sure all the changes you want to have in your pay stub are duly communicated to your employer before you get the pay stub.

How to Get a Payslip/Pay stub?

Since payslip/pay stub is not a mandatory document in all jurisdictions, your employer may not provide you one unless your request for it. However, getting access to your pay stub should not be a difficult or tedious process:

- Get the government-mandated form available on the website of the applicable tax authority of your region. Fill it and submit it to your employer to get the pay stub.

- Access your employer's payroll management system.

- Talk to your Human Resources team: They would have some record of the payslips or similar documents accessible to them.

If you are seeking the pay stub for a specific purpose, make sure you let your employer know about it. For instance, if you are submitting the pay stub for a home loan, your employer might have a readily available set of documents that would show your creditworthiness. Thus, mentioning your purpose for using the payslip will often help you.

How AI Improves Payroll Management

AI systems automatically track work hours, overtime, bonuses, and deductions, reducing the need for manual calculations. They also adapt to changes in tax laws, benefits policies, and employee status in real time, ensuring payroll remains up to date without constant human oversight.

Additionally, AI provides predictive analytics that help forecast payroll expenses, detect anomalies like overpayments or missed entries, and generate reports that aid in strategic decision-making. By streamlining workflows and reducing risk, AI empowers HR teams to focus more on employee engagement and less on administrative tasks.

PaySlips and Payroll software for small Businesses

Giving out a pay stub to your employees can be a time consuming process if done manually or through Excel sheets with a very high chance of Error. Especially if you are a small business with a limited team who is not a specialist at this job.Thankfully cloud based, affordable payroll softwares like Deskera provide you with a simple solution which is easy to access and can be run by almost anyone. The software helps you run your payroll effectively and lets you design and give out the pay stubs to the employees.Click here for a free Trial

In Conclusion

A pay stub is a non-binding document issued by your employer to show your gross salary, set of deductions & benefits, and net salary. It is used by lenders, potential employers, and other institutions to understand your earnings. Employers usually have a digital record of pay stubs available, and by submitting a simple request, you should be able to access it. Make sure your pay stubs accurately display all the necessary information.

Related Articles