“There is one thing that is trickier and more time-consuming than your jobs and your businesses- Income Taxes.”

A few months down the road, when 2022 would be right here, you would be scrambling around figuring out your income tax bracket and paying what you owe the government. Or maybe you have some of it figured out, and the rest is still underway. But in whatever stage you are in this process, what remains unchanged is that you will have to pay your income taxes for the tax year 2021 to the US Federal Government by 15th April 2022.

The federal income tax rates have remained unchanged for the tax year 2021 at: 10%, 12%, 22%, 24%, 32%, 35% and 37%. However, the Internal Revenue Service did adjust income brackets affecting around 60 tax provisions, including tax rate changes as well as schedules for inflation.

This article will take you through the US income tax brackets and tax rate for 2021.

What are the Federal Income Tax Brackets?

A tax bracket refers to a range of incomes subject to a certain income tax rate as determined by the respective government. A tax bracket results in a progressive tax system wherein with an increase in an individual’s income, the income tax that they would have to pay would increase as well. Hence, a low income falls into a tax bracket with relatively low-income tax rates, whereas a high income falls into a tax bracket with relatively high-income tax rates.

Currently, the US has seven federal income tax brackets with the rates: 10%, 12%, 22%, 24%, 32%, 35% and 37%. If you are one of those lucky individuals who earns enough to fall in the 37% tax bracket, you should know that your entire income would not be subject to a 37% tax. Instead, 37% is only your top marginal tax rate. President Joe Biden has, however, recommended raising the top tax bracket up to 39.6%.

- So what does a marginal tax rate mean?

A marginal tax rate means that you would be paying a particular tax rate only on the amount of your income that is falling in a certain range. For example, the bottom tax rate is 10%. For single filers, all income between $0 and $9,950 is subject to a 10% tax rate. However, your taxable income is $10,150. In this case, $9,950 is subject to a 10% tax rate as per the bottom tax bracket, whereas the remaining $200 is subject to the next tax bracket of a 12% tax rate.

Federal Income Tax Brackets for 2021 (Filing Deadline: April 15, 2022)

There are certain rare cases like, for example, one of the spouses is subject to tax refund garnishing because of unpaid debts to the state or federal government. In such a case, opting for the tax bracket and status of - “married filing separately” is proven to be advantageous. Under normal circumstances, though, filing jointly will give you a tax break.

You should keep in mind that only if you are single should you opt for single filing status. This hence means that if you are a single taxpayer with dependents, then you should file as “head of household.” In order to qualify for this filing status under whichever tax bracket is applicable to you, you should be paying more than half of the household expenses, be unmarried, and have a qualifying child or dependent.

Hence, if someone is asking for your tax bracket, that person is most likely asking for your top marginal tax rate. The US's top federal income tax bracket has been varying quite a bit over a period of time. In fact, once upon a time, the topmost tax bracket used to be as high as 92%.

It was the tax reform passed by President Trump and Congressional Republicans that resulted in the lowering of the top rate of five out of seven tax brackets. They also increased the standard deduction to nearly twice its 2017 amount. For the tax year 2021, the standard deduction is $12,550 for single filers and married filers who file separately. Joint filers have a standard deduction of $25,100, whereas heads of households get $18,800.

How to Get Into a Lower Tax Bracket and Pay a Lower Federal Income Tax Rate?

Two of the ways through which you can reduce your tax bill are credits and deductions.

Tax Credits

Tax credits help in reducing the amount of tax that you owe directly. This does not affect the bracket that you are in. For example, earned income tax credit or child tax credit.

Tax Deductions

Tax deductions help in reducing the amount of your income that is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. Hence, if you fall in the 22% tax bracket, then a $1,000 tax deduction would save you $220. For example, charitable donations, deducting property taxes, deducting mortgage interest paid on home loans and property taxes, etc.

What is a State Income Tax?

A state income tax is a tax on the income earned by you in that state. They are similar to federal income tax, with the main difference being that they fund the state governments rather than funding the federal government.

While state income taxes get relatively less attention than federal income taxes, depending on the amount you are earning and where you are living and working, it can put a pretty large dent in your wallet.

The states of the United States of America follow these three types of income tax regimes:

- No income tax at all

- Flat tax- which means that they tax all the incomes, dividends, and interests (in some cases) at the same rate.

- Progressive tax- which means that people with higher taxable incomes pay higher state income tax rates.

This means that if you live and work in the same state, then you would most probably have to file only one state return each year. However, if you are living elsewhere and earning elsewhere or if you are earning in multiple states, then you would have to file several income tax returns.

The eight states with no income taxes are:

- Alaska

- Florida

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

New Hampshire has taxes but only at a rate of 5% and on interests and dividends only. While having no income taxes might want you to throw away everything and shift to these eight states, you should be aware of the probability that their property taxes, sales taxes, and other taxes and fees might be higher.

The ten states with flat income tax rates are:

However, based on the state that you are in, you need to be aware of what is considered as an “income” in that state. Is it taxable income? Interest and dividends? Or is it adjusted gross income?

The remaining states that are following progressive tax structures are:

Note: The dollar amounts in the income tax brackets apply to single filers. In many states, these double for joint returns. As is applicable in the case of federal income tax returns, the amount that you will have to pay to your state would also be determined by your marital status, whether you have dependents or not and whether you qualify for a tax deduction and tax credits.

Points to Note for the Tax Items for Tax Year 2021

- For the tax year 2021, the personal exemption remains at 0 same as that in 2020. It was through the Tax Cuts and Jobs Act that personal exemption was eliminated.

- For the tax year 2021, as was the case in 2020, 2019, and 2018, there is no limitation on itemized deductions. It was through the Tax Cuts and Jobs Act that the limitation on itemized deductions was eliminated.

- For the tax year 2021, The Alternative Minimum Tax Exemption amount is $73,500 and begins to phase out at $523,600 ($114,600 for married couples filing jointly for whom the exemption begins to phase out at $1,047,200).

- The tax year 2021 maximum Earned Income Credit amount is $6,728 for qualifying taxpayers who have three or more qualifying children. This is more than the $6,660 that was applicable in the tax year 2020. The revenue procedure contains a table providing the maximum Earned Income Credit amount for other categories, income thresholds, and phase-outs.

- $270 remains the monthly limitation for the qualified transportation fringe benefit remains, as is the monthly limitation for qualified parking for the tax year 2021.

- For the taxable years beginning in 2021, for contributions to health flexible spending arrangements, $2,750 remains the dollar limitation for employee salary reductions. For cafeteria plans that permit the carryover of unused amounts, the maximum carryover amount is $550. This has hence seen an increase of $50 from taxable years beginning in 2020.

- Participants who have self-only coverage in Medical Savings Account, their plan must have an annual deductible that is not less than $2,400 for the tax year 2021. However, this deductible should not be more than $3,600. Both of these amounts have hence seen an increase by $50 when compared against the tax year 2020. For self-only coverage, the maximum out-of-pocket expense amount is $4,800, which too has seen an increase of $50 when compared to the amount of 2020. When considering participants with family coverage for the tax year 2021, their floor for the annual deductible is $4,800, which too has increased by $50 when compared with the tax year 2020. In this case, too, the deductible cannot be more than $7,150, which too has increased by $50 from 2020. For family coverage, the out-of-pocket expense limit is $8,750 for the tax year 2021, an increase of $100 from the tax year 2020.

- The adjusted gross income amount used by the joint filers to determine the reduction in the Lifetime Learning Credit is $119,000 for the tax year 2021, as against $118,000 for the tax year 2020.

- $108,700 is the foreign earned income exclusion for the tax year 2021. This too has seen an increase from $107,600 of the tax year 2020.

- Estates of decedents who die during 2021 have a basic exclusion amount of $11,700,000. This is in contrast to the $11,580,000 basic exclusion amount for estates of decedents who died in 2020.

- The annual exclusion for gifts is $15,000 for the calendar year 2021. This is the same as that in the calendar year 2020.

- For tax years beginning in 2021, § 6039F authorizes the Treasury Department and the Internal Revenue Service to require recipients of gifts from certain foreign persons to report these gifts if the aggregate value of gifts received in the tax year exceeds $16,815. (added May 17, 2021)

- The maximum credit allowed for adoptions for the tax year 2021 is the amount of qualified adoption expenses up to $14,440, which has seen an increase from $14,300 for the tax year 2020.

Tips for Tax Filers

After going through this entire article on US tax brackets and tax rates, these two crucial tips will most likely become very helpful to you and in your tax compliance. They are:

- If you are in need of more time to file your taxes, in that case, you should use Form 4868 to get a maximum extension of 6 months, i.e., for the tax year 2021, up till October 15, 2022. However, this extension does not apply to payments. This hence means that if you owe taxes to the federal or the state government, you should estimate what you owe. Out of that amount, you should pay whatever you can so as to avoid penalties and interests.

- If you are precise with numbers and good at record-keeping, using tax preparation software like Deskera Books would be sufficient for you. However, in case if you are not good with numbers and record-keeping, then you should hire a financial advisor who specializes in taxes.

How Can Deskera Help You Comply with Your Income Tax Regimes?

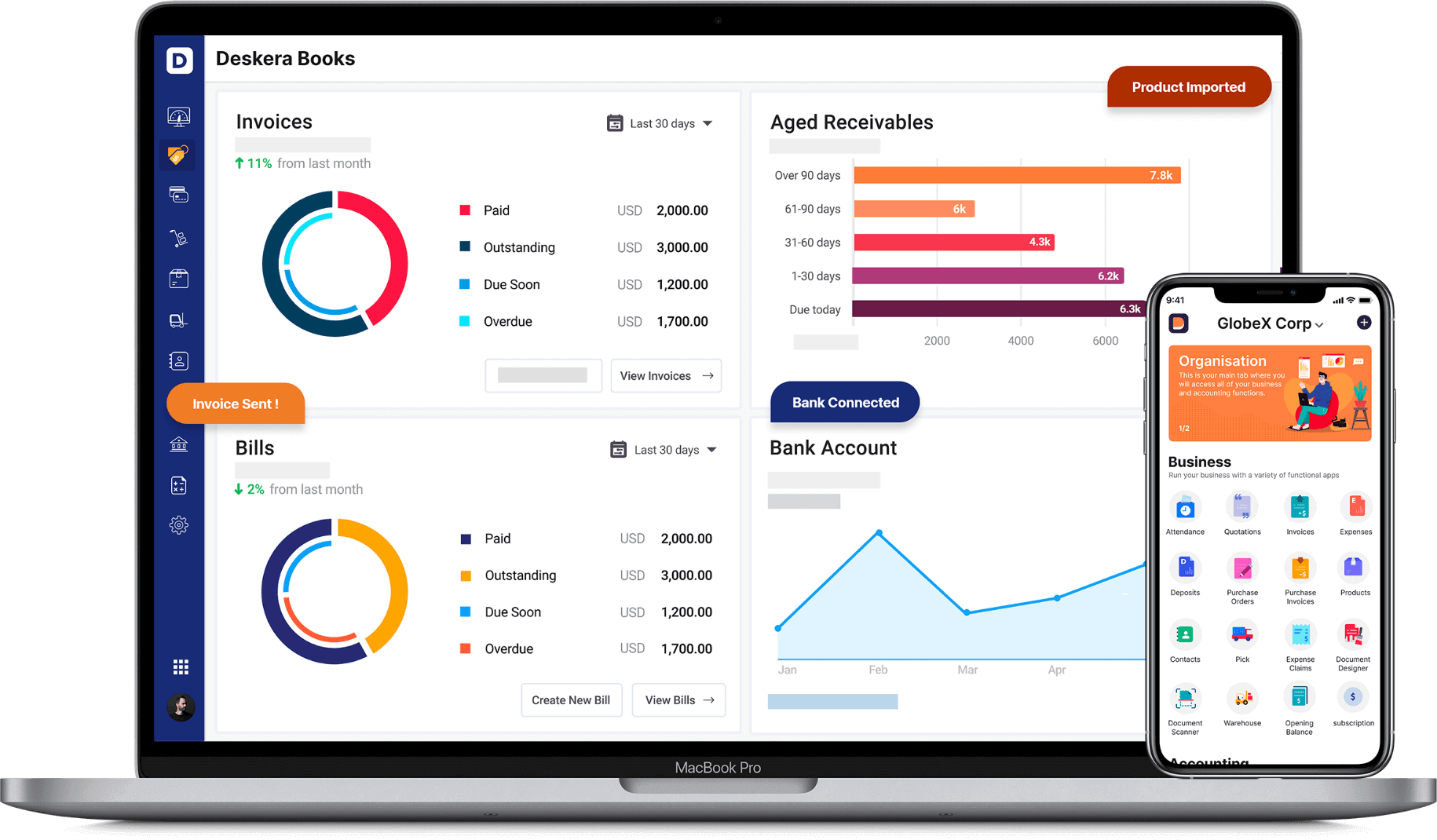

Deskera is a software that specializes in meeting all of your needs. Deskera Books is one that is devoted to meeting all your financial needs, including complying with your income tax regimes.

One of the ways to comply with your tax regimes is by having an efficient accounting system in place. Through Deskera Books, your accounting would be handled by it, with all that you would need to do is update your invoices, your account receivables, and accounts payable, and the operating expenses incurred as well as operating income earned on the software. In fact, you can even delete or edit the existing debit notes and credit notes, as is applicable.

Following the US accounting rules, it will process all these financial transactions and make financial statements like balance sheets, profit and loss statements, cash flow statements, income statements, and so on.

It would be all of this data, updated in real-time, which will facilitate Deskera Books to complete filing for your income tax returns. Deskera Books has one more benefit that it also allows you to transfer your data from your previous accounting software by updating the details in the spreadsheet available on Deskera Books.

Additionally, the entire setting up process on Deskera Books is super easy, with you having to only sign-up using your email address or social authentication, and half of your work would be done. Once you have registered on Deskera Books, you would get pre-configured accounting rules, invoice templates, tax codes, and a chart of accounts, to mention a few vital features. Lastly, your accountants can be added to your Deskera Books account for free by just inviting them to use the system.

With so many features at your disposal, making your accounting, reporting, and compliance easier, what are you waiting for?

Key Takeaways

Soon, all of the USA tax filers will need the 2021 federal income tax brackets as well as the 2021 state income tax brackets when filing their taxes in 2022. Your top tax bracket is determined not only by your income but also by your other sources of income like interest, capital gains, and even deductions.

Depending upon where you are placed in the tax brackets, a deduction can help you go to a lower tax bracket, hence reducing your money tax liability or increasing the size of your tax refunds.

One of the most efficient ways of dealing with this complex scenario of tax brackets, tax rates, and their filing is through Deskera Books which is pre-equipped and updated with the US's taxation regime.

Related Articles