Are you thinking of buying a car through your business? The purchase of an automobile through your business is among the simplest ways to obtain one. Instead of paying employees to drive their own cars, businesses can frequently save time and money by buying cars under their corporate names that employees can use.

With ERP.AI, businesses can track vehicle-related expenses, depreciation, and tax implications in real time—helping ensure smarter financial decisions when purchasing assets like company cars.

Here is a comprehensive list of factors to think about before making your purchase that will aid you in selecting the best course of action for both you and your business.

On the surface, getting your firm to pay for a new car could seem like a smart idea if you are a limited company trader. However, before making a purchase, you must consider all the expenses involved as well as the tax repercussions.

Step by Step guide to buy a Car Through Your Business

Step 1: Business car finance requirements

Checking your personal and business credit ratings is one of the first things you must do when applying for business vehicle financing. This is so that lenders can determine your risk profile and your ability to repay the loan by looking at both.

Allowing the bank to check your credit history is one of the conditions of business auto financing, so it is best to be ready in advance. This will provide you the chance to explain any errors and make up for any unpaid bills. Additionally, you will be able to get in touch with the credit bureau and request that they fix any problems or errors you may notice. Make careful to follow the same procedure for both your personal and professional accounts.

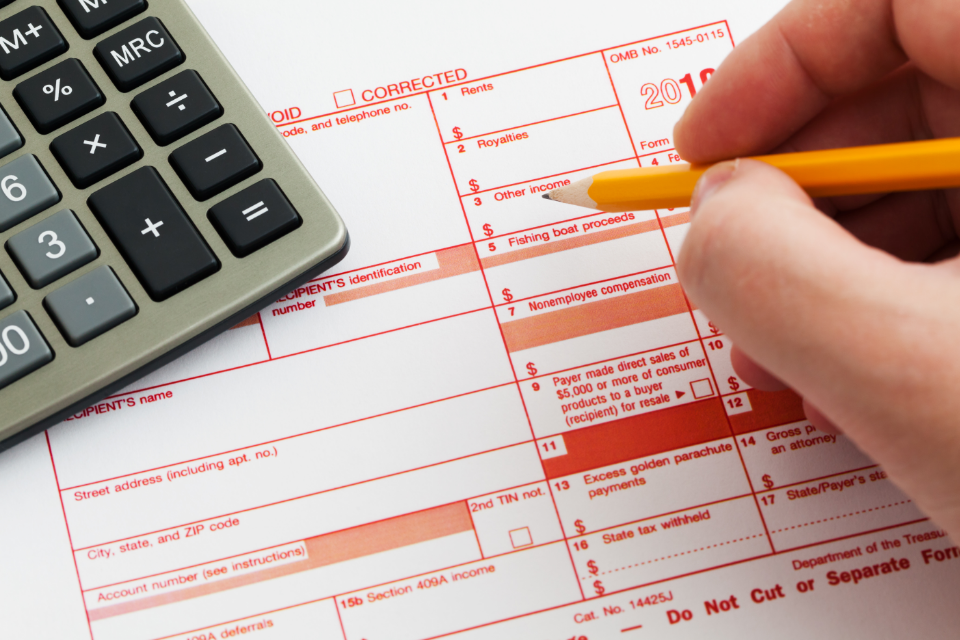

Get the right documents together

The proper documentation must be gathered in order to meet your lender's financial standards. These are some of the documents, for example:

The company's registration and VAT number, as well as copies of any partners' or shareholders' identification documents (if applicable)

• All contact information, including the corporate address;

• Information on the director, members, and trustees;

• The firm's banking information and balance statement; (if applicable)

• Information about the car you wish to finance

If applying online, you must complete the necessary forms and scan and upload the required paperwork before submitting your application to the lender.

Get a line of credit

Additionally, you want to think about requesting a business line of credit. The simplest technique to raise your company's credit score is through credit cards. Simply make sure to pay your bills on schedule.

Get an EIN

Instead of using your personal Social Security number, this assists your business in establishing credit under the EIN. The government provides an EIN. It functions for a company in the same way that a Social Security number works for an individual. Your EIN will be used by lenders, suppliers, and governmental organizations to track business activities during tax season, including confirming that your company bought a car. In order to obtain an EIN number if you are still in the process of establishing your firm, follow these steps:

• Complete IRS form SS-4, which creates an EIN for a business. It is available on the IRS website. Online tools are available if you need them to guide you through properly filling out the EIN application.

• List your company with your state and include the new EIN after you receive your EIN number in the mail from the IRS.

Step 2: Purchasing the Car

Check your business credit score

You should obtain your company's credit score before visiting a dealership. Scores for business credit range from 0 to 100.

• To view your business's credit score, you must pay. Reach out to each office separately. For about $36,95, $99.99, and $61,99 respectively, you may obtain your credit score

• If your credit score is over 80, you should be eligible for loans.

• Consider leasing a vehicle in your company's name rather than purchasing one if your business's credit is poor.

Provide financial information

Before issuing a loan, lenders will want to view a range of financial data. They might ask to view financial documents like your company's balance sheet, for instance. The lender may also check your own credit history, so be prepared for that. For this reason, you ought to obtain a free copy of your credit report so that you can examine it for mistakes. Dispute inaccuracies with the credit reporting company that owns the inaccurate data.

Step 3- Obtaining a Car Loan Using Your Business Name

Finance in your company name

You have two options for financing: you can get a loan from the dealership or shop around for a car loan at nearby banks and credit unions. Never forget to mention that you are applying for a loan in the name of your company.

Compare interest rates and other terms to locate the loan that offers the best deal. Even while getting financing from the dealership may be the most practical, you shouldn't assume that they are giving you the best bargain.

Create a loan proposal

It's time to submit a loan proposal for the vehicle you want to buy with the help of your business once you've secured an EIN for it and built up a solid credit history. The loan proposal includes details on the loan amount you require as well as why your business needs the vehicle, who will use it, and for what purposes.

This loan proposal helps demonstrate to lenders that you have a firm grasp of the market and possess good management abilities, whether they are located at a bank, internet lenders, or dealership finance partnerships.

Create the loan proposal in writing

You must explain to any potential lenders why your company needs to buy a vehicle. Any time a financial institution lends money to a company, they must consider the risks involved and whether buying a car makes sense for all drivers.

Document all drivers

Additionally, be careful to record who will operate the vehicle. Using a vehicle for the business owner's wife may not be a sufficient justification, but if she works as a salesperson for the company and needs to visit clients in person, then it is. Clearly state who will use it and for what purposes.

Calculate how much money you'll need

Lenders also need to know how much money you require when applying for a loan for a vehicle for a business. You should also provide your down payment amount and whether you have any collateral.

Include your company's marketing initiatives in your loan request, along with information on the company's history and present success. This can support your argument to the lender about how well-rounded your company is as an investment.

Provide a guaranty for the loan

It's possible that your company's credit isn't strong enough to qualify for a loan in its sole name. You may be required to sign a guarantee by some lenders. This means that if your company stops making payments on the loan, you will be held personally liable.

Consider your options before acting. To collect on the loan, the lender may sue you and seize other of your personal belongings.

Make regular payments on the loan

The best you can do now that you've gotten the loan and used your business to buy a car is pay it back. Never forget to make car payments from your corporate bank accounts. Making payments from personal accounts gives the impression that your firm is a fraud. If you use your account, the IRS will flag the transactions and look into your company for tax fraud.

A business vehicle loan is necessary in order to obtain an auto loan through your company. Obtaining a company loan is a straightforward procedure. But keep in mind that business lenders will evaluate both you and your company before making an offer.

The lenders will still take into account your personal FICO credit score even if you use a company loan to finance your car.

However, they will consider the income and liabilities of your company. Your chances of obtaining better rates and conditions are always increased if your personal finances are in order and your credit score is high. However, you will get lower offers when you apply for a company auto loan if your personal finances are strong but your business finances aren't as strong.

Step 4- Find a car dealership with a commercial division

Try to find a dealership that has a separate business sales department. They will have greater experience selling automobiles with ELDs to companies, which will help make sure that everything goes properly and that you get the greatest deals.

These divisions offer specific assistance to corporations purchasing and registering their vehicles. Ask if a dealership has a commercial sales division when you stop by; this can simplify the car purchase.

Select the proper vehicle. If you own a catering company, for instance, purchasing a mini-van would be acceptable. However, purchasing a sports automobile can cause the IRS to object.

You should never buy a car for personal use through your business.

Research dealerships

Find a dealership that finances and sells vehicles to businesses by researching the numerous dealerships in your neighborhood. If you buy numerous vehicles, many of companies may provide special programs and even fleet discounts. Among the most well-known lenders are:

• Banks where you have accounts for your firm. Check to see whether they provide discounted pricing for companies who have accounts with them.

• Online lenders with a focus on business-related auto loans.

• A bigger dealership with a loan division.

Compare dealerships

This can assist in eliminating auto dealers with poor client reviews. Select the top three options from the list based on their prices and terms. Keep your longer list because you might not be eligible with your top lenders.

Call the lenders on your short list and find out what they need in terms of a company's credit history and rating. Be ready if your credit rating and business history prevent you from receiving a loan from the lender.

Ask for recommendations

Find out where other companies who own company cars purchased them. You can also seek for online reviews of a specific dealership from other companies. You must return to your list and select at least three additional people to call if your original choices do not fit with your current credit situation and business history. You should keep eliminating lenders from the list until you discover one with conditions and interest rates you can live with.

Browse the inventory

Check the dealer's websites to see what inventory is offered and whether they have a commercial division with information for businesses buying vehicles. While it shouldn't be the determining factor, price should play a significant role in your comparison of the prices offered by the many dealers you are interested in working with.

Pick a Good Vehicle

Pick a commercial vehicle that suits your requirements. First, decide which kind of car suits you the most. Think about the car's passenger capacity, mpg rating, where you'll drive it, and how you want to utilize it. Additionally, the car should be functional for your business. If you require a vehicle for mobility, get one that gets great gas mileage. In contrast, a delivery company would require a pickup vehicle or mini-van.

Think about how you can market your company when you purchase a vehicle through your company. Select a vehicle that best represents your company from the start. You might wish to buy a more expensive automobile to impress your high-end clients.

Basically, the car needs to advertise your company without being overt about it.

Since you're purchasing a vehicle through your company, it would be advantageous if it has extra technological capabilities like GPS, telematics, and so forth. When you travel for work to new locations, GPS can be useful.

In order to learn how to purchase a car through your company, you should focus on fuel efficiency. This is crucial if your line of work entails making lengthy trips to deliver products or see consumers. To cut your business expenses, you should get a vehicle with a lower fuel economy. Additionally, driving a fuel-efficient vehicle may provide tax advantages.

Type Of Vehicle

What kind of car you intend to buy is one of the most important factors to take into account. The rigorous rules that come with purchasing a car through your business could lead to all kinds of wonderful tax benefits, but they could also result in additional expenditures and result in a bad purchase.

However, if you want to buy a van or vehicle through your limited company, you'll be freed from many of these annoying restrictions. HMRC permits "insignificant" amounts of private use, so as long as the vehicle is still solely being used for business, you can drive it home.

This makes it much easier to claim all of the vehicle's cost, so buying a van through your company will usually be a lot better option than doing it on your own. You should also think about getting van insurance.

If you intend to purchase a car, van, truck, or motorcycle through your limited company, you should carefully consider all the relevant issues and determine whether this is the best course of action for you. Although the final decision on your purchase will be based on your individual situation, we hope that we have been able to allay some of your larger worries.

Step 5- Registering the Vehicle

After purchasing a vehicle, you must register it with the DMV. Depending on your home state, you may need to submit different documents and pay different costs to write a business car. Regardless of where you live, it would benefit if you were ready to show proof of insurance. The steps to effectively registering your automobile are as follows:

Get insurance

You should research commercial auto insurance if you use your vehicle mostly for work. Personal auto insurance, however, can be preferable if you just use the vehicle occasionally for work. Also take into account how many staff will be using the vehicle.

Big insurance providers offer insurance. Additionally, look in your phone book for nearby insurers who might provide better prices. Contact the insurance agent who sold you the business liability insurance if you don't know where to start looking.

Register the Vehicle

Given that you obtained the automobile through your firm, you ought to register it in that name. You might need to fill out a form, provide some paperwork, and make a payment to the DMV. The following are the documents you'll probably need to supply, even if the requirements differ from state to state:

• Application for a title

• Vehicle's title or proof of origin

• Damage disclosure information

• Disclosure declaration for odometers

• Identification

• Evidence of insurance

• Highway use tax

• Title-certification fee (varies depending on the state)

• Cost of registration (varies depending on the state)

• County charge (in a few places)

You must buy the vehicle in your own name if you only want it for personal use or if you don't intend to use it exclusively for work.

Although you can frequently buy a car through your company and drive it privately, you should first think about the tax ramifications. Less money can be saved, and filing your taxes will take longer, the more non-business driving the vehicle is used for.

You can significantly reduce your tax liability and maximize your tax benefits by buying a vehicle through your company. However, if you use the vehicle for an excessive number of non-qualifying activities, it won't be worth the bother to purchase it in your company's name.

Keep a mileage journal

The car may be used for both personal and professional purposes. You can only claim a tax deduction for the business-related component, though. Company mileage is travel expenses incurred during regular business operations. This may entail going to appointments, attending business meetings, and going to temporary job sites. Keep a mileage log, if necessary, in which you record how far you traveled for work.

You can either claim a flat fee depending on your mileage or your entire business's expenses.

Mileage-Based Deductions

You can deduct $0.585 (for the first half of 2022) and $0.625 (for the last half of 2022) for each mile traveled for business purposes during the 2022 tax year, an increase of $0.025/$0.065 from 2021. That substantial tax break has a catch, though. You cannot use the available depreciation or expense-based deductions if you pick a mileage-based deduction.

It is logical to anticipate that the mileage-based deduction will result in greater savings if your car is in good condition and is fuel-efficient.

Usually, the actual expense-based deduction is more advantageous. Before making a choice, you must weigh all the potential costs associated with your automobile.

Claim a tax deduction

Whether you own the vehicle as an LLC, one-member LLC, corporation, or partnership will affect the complex tax deduction requirements. For further details, speak with a tax expert.

One advantage of purchasing a car through your company is the potential tax deduction. Depending on whether your company is a partnership, corporation, or LLC, the amount of tax deduction varies. Some of the most typical tax deductions for a company automobile include the following:

• Capital allowance, a reduction in the price of the vehicle

• Insurance reimbursement for the automobile's insurance coverage

• Tax reimbursement for any taxes owed on the car

A business can reduce its corporation tax at the end of the fiscal year by using tax deductions. As a result, you cannot start taking advantage of them as soon as you register your vehicle with the firm.

Expense-Based Deductions

You will have to put in more effort to save money if you choose to take an expense-based deduction. When it comes time to submit your company's taxes, you must gather all of your receipts and total them all. This takes more time than merely dividing the mileage for the tax year by 0.625 to obtain a mileage-based deduction.

However, you can write off far more with the expense-based deduction than just each mile you drive for work.

You may also assert:

– Gas payments

– Repairs/Maintenance

– Oil changes

– Car washes

– Insurance payments

– Lease payments (if applicable)

– Tires and rims changes

– Parking/Tolls

Your daily commute costs and mileage are not tax deductible. Even if your vehicle was acquired through your company, that regulation still applies. Therefore, you must deduct the miles you log for travel from the vehicle's overall mileage.

The regulations governing commuter expenses include just one exception. The costs incurred by an employee who drives a corporate vehicle to work from home are fully deductible, as are any later reimbursements.

As long as everything is properly documented as the vehicle being used only for business purposes, it doesn't matter if they are simply travelling from home to the office.

In the first year after purchase, you are not eligible to claim the full cost of the vehicle. If you buy a car outright, you can write off 12.5 percent of the cost of the car each year you hold it as capital allowances (depreciation).

The computed value in vehicles with CO2 Category A, B, and C is restricted to €24,000. It is 50% less for Category D & E and not permitted for Category F & G. If the cost of the car exceeds €24,000, the cost of leasing payments may be decreased pro rata rather than totally written off.

Claim for the cost or lease of the car

For accounting and taxation purposes, the corporation receives a different treatment for any assets purchased (such as motor cars).

The asset will be written down annually for accounting purposes based on its anticipated useful life. Therefore, if you spend £20,000 on an item that will last 4 years, a charge of £5,000 will be recorded annually in the accounts.

However, the asset will have a varied tax treatment, and there are various laws for various assets from a tax standpoint.

In terms of autos, you may only claim a certain amount of tax relief each year, depending on how much CO2 emissions the car creates. A capital allowances claim is the portion of the cost of the car that you are permitted to deduct from your taxable profit each year. There are basically three types of cars to take into account for Capital Allowances claims:

• If the automobile's CO2 emissions are 75g/km or less, you can deduct 100% of the cost of the car from the company's income in the year that you acquire it, so long as the car was bought brand new.

• On an annual basis, your company's profit can be reduced by 18 percent (on a declining balance basis) if the CO2 emissions are between 76g/km and 130g/km.

• For CO2 emission levels above 130g/km, a yearly deduction from your company's profit of 8% of the car's price (on a declining balance basis) is allowed.

For the firm to receive any meaningful tax benefit for the initial purchase price of your car, it is obvious that ownership of the vehicle must be maintained for a number of years.

Because the benefit in kind is based on the cost of your corporate automobile when new rather than its used value, you can also find yourself paying more tax than the cost of the car itself.

Therefore, from both your and the company's perspectives, buying an eco-friendly vehicle would be necessary for your business to save the most money on taxes (either electric or low emission).

Leasing the car

Whether you decide to buy a car through your company will largely rely on how you plan to pay for it. You must choose whether leasing the car is better for your company than buying it altogether because there are always several financing choices available, including asset finance.

You yourself are subject to the same regulations as if your business had purchased the vehicle outright.

The restrictions are considerably simpler for the company, though; if the car's emissions are above 130 g/km, the firm can only deduct 85 percent of the entire leasing expenses from its corporation tax bill. Otherwise, the company can deduct 100 percent of the annual lease costs.

It's also important to keep in mind that only the interest payments made on a business loan used to acquire the vehicle, as well as those made on a hire-purchase agreement, can be claimed as business expenses.

Benefits of Buying a Car Through Your Business

You can gain a lot by purchasing a car through your company, particularly if you also plan to use the vehicle for personal travel. The benefits of purchasing an automobile under your company name are as follows.

• The company assumes responsibility for far financing repayments

• The firm covers all operating expenses, including gas, maintenance, repairs, and insurance. • You can deduct tax payments by treating the vehicle as a business asset.

• Your business may submit a depreciation claim.

Business tax liability

When utilized for commercial purposes, your vehicle's operating expenses are tax deductible. However, only the expenses related to driving a company car on official business can be written off. Any usage of the vehicle for personal purposes will not be subtracted from your pay; in some situations, it will even be added as a perk of the employer. If your car is used solely for business purposes, you will benefit from tax breaks to the fullest extent possible.

Heavier vehicle

You may deduct up to $25,000 if the vehicle you wish to buy qualifies as a heavier vehicle.

A section 179 deduction is available for a lot of SUVs and pickup trucks. The cars must fulfil at least one of the following conditions in order to be compliant with current regulations:

- Have a fully enclosed driver's compartment, no seating behind the driver's seat, and no part of the body sticking out more than 30 inches.

- Have nine or more passenger seats behind the driver's seat.

- Drive a truck-trailer.

Reimburse your employees

Only if you pay your employees back for their out-of-pocket expenses will you be able to take advantage of these deductions.

You cannot deduct costs that your employees incur without first paying them back, according to the IRS. The simplest method to accomplish this is to let your staff to make all of their auto purchases using a business credit card, which eliminates the need for you to reimburse them (you'll still need their receipts, though!). You can save a lot of money if you have workers who must travel frequently for work. If you pay for their costs after they've been incurred, all of them are tax deductible.

Numerous apps exist that simplify this task. You will need to keep track of your employees to deduct your reimbursements to them, regardless of the system you choose to employ.

Capital Allowances

Since it will be considered a fixed asset if you choose to buy the car entirely, you will be eligible to claim tax relief under capital allowances (you may also be able to get some tax exemption through asset financing). The amount of capital allowance that may be claimed is subject to rigorous regulations, and it is mostly based on the vehicle's CO2 emissions.

In other words, the amount of tax relief you may claim decreases as emissions increase. The majority of vehicles have emissions levels exceeding 130g/km, in which case 8% of the purchase price can be deducted from your yearly profits; however, any automobiles with emissions levels under 130g/km can be claimed at 18% annually.

A new car with CO2 emissions under 50 g/km is eligible for a first-year deduction of 100% of the purchase price.

Benefit-in-Kind (BIK)

When an employee or director has access to a corporate car for personal use, they are subject to the tax known as BIK.

The OMV (Original Market Value) of a car is multiplied by 30% to arrive at the calculation.

OMV = €40,000

Rate = 30%

BIK = €12,000 (Cash equivalent)

OMV (Original Market Value) is the cost of the vehicle if it was purchased new.

Method of reducing BIK

If you have a lot of business kilometers then you may reduce the BIK % as per below table:

|

Lower Limit

(Km) |

Upper Limit

(Km)

|

% of OMV |

|

Zero |

24000 |

30 |

|

24000 |

32000 |

24 |

|

32000 |

40000 |

18 |

|

40000 |

48000 |

12 |

|

48000 |

more |

6 |

The considered cash advantage of using your business automobile for personal usage is determined by multiplying the list price by the vehicle's CO2 emissions rate. Any upgrades installed both before and after the car was first made available that cost more than £100 should be included in the list price used for the computation.

You may find the percentage of CO2 emissions here.

In essence, a bigger percentage is charged to the list price of the car the more CO2 emissions it produces. Therefore, a high emission car will have a high cash advantage whereas a low emission car will have a low presumed cash benefit.

Fuel

There are several regulations to take into account while giving fuel to yourself or your staff. It is crucial to distinguish between private gasoline and business fuel once more.

The post basically entails the following:

a) All fuel-related VAT can be recovered if the fuel is only used for business purposes.

b) Your VAT return needs to be adjusted if private fuel is also paid for by your business. In order to cover the estimated private use component, the company pays an appropriate fuel scale charge to HMRC after claiming all of the applicable VAT on fuel expenditures.

The fuel scale fee is determined by your car's CO2 emissions.

The employee will be judged to be getting a taxable benefit if any fuel is provided for private use based on the CO2 emission percentage as determined above multiplied by £21,700. Therefore, the taxable benefit in the VW Golf example above would be £3,255. Regardless of how much fuel has actually been delivered to the employee for private mileage, the £21,700 is a fixed figure.

There is no benefit in kind and no additional tax due if fuel is only provided for business usage; nevertheless, HMRC would demand evidence that none of the fuel was utilized for private purposes.

This could be proven by precise mileage records or employee reimbursements to the employer for any personal gasoline used. One thing to keep in mind is that regular commuting is not considered business travel, therefore the same standards apply.

From the perspective of the corporation, there is also the fuel's VAT to take into account. The VAT on the fuel can be fully reclaimed if it is only utilized for commercial purposes. The use of fuel for private purposes that is funded by the business must be considered. Applying this involves paying a fuel scale charge.

In essence, the business will pay HMRC the appropriate fuel scale fee to cover the estimated private use component after reclaiming all of the fuel's VAT. Once more, this fee is determined by the vehicle's CO2 emissions.

In keeping with the VW Golf example, the quarterly fuel scale fee would be £26 and would need to be put on to the overall VAT liability if private gasoline were purchased by the firm with full VAT reimbursement.

How AI Supports Smarter Business Asset Purchases

AI supports this by automating asset tracking, calculating depreciation schedules, and estimating tax deductions. It also helps forecast long-term cost impacts and compare financing options using historical financial data. AI-driven tools evaluate cash flow readiness, model scenarios, and ensure compliance with accounting standards.

For companies making capital purchases, AI streamlines the decision-making process, making it easier to align business growth with financial health. Whether it's a vehicle or other fixed assets, AI tools helps ensure every investment is strategic and well-documented.

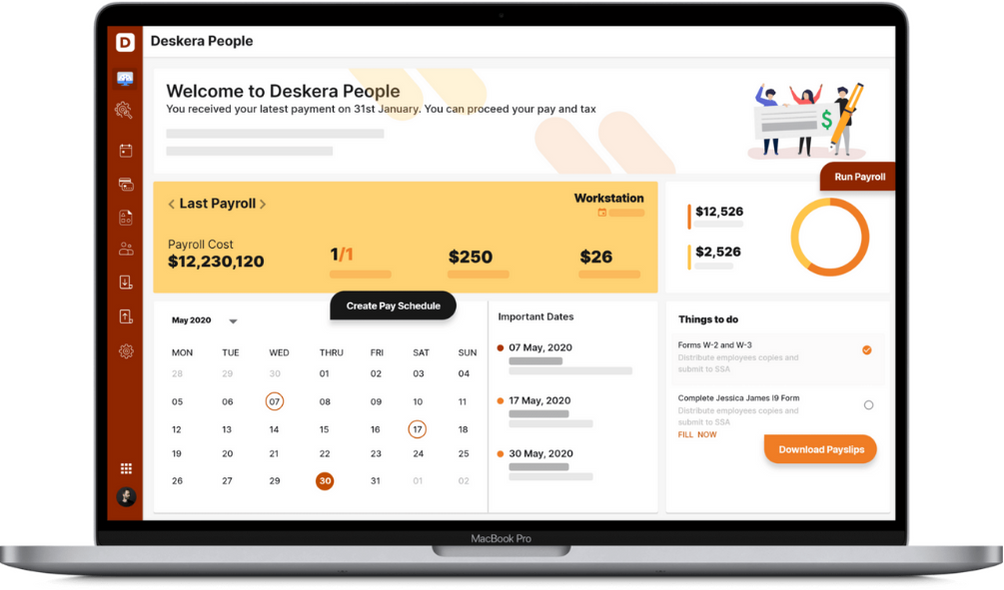

How Deskera Can help You?

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key Takeaways

- You should head straight to the showroom and hunt for a suitable automobile after making sure your firm has a solid credit rating. The next step is to obtain financing, register the vehicle, and use it for both personal and professional purposes. One advantage of purchasing a car through your company is that your annual corporation tax will be lower. Therefore, it is the ideal method for obtaining the automobile you require.

- Your annual corporate tax obligation may decrease if you purchase a vehicle for work or personal usage. For instance, a car used for business, charitable, or medical purposes qualifies for an operating cost deduction.

- You will receive tax advantages by having your company pay for the automobile. You can commute in the car every day in addition to utilizing it for business. You can avoid having to pay for them out of your own cash by having your company cover all costs associated with the vehicle, including fuel, repairs, and insurance.

- If you have solid credit and can convince the lender why you need the money to buy a vehicle for your business, you will have no trouble qualifying for a business car loan. Have one of our skilled mechanics perform a pre-purchase car examination on the vehicle you plan to buy for your company to ensure there are no unforeseen issues.

- The requirements for business automobile financing may seem difficult to handle, but they are simple once you know what is required. After you have checked your personal and company credit histories, you must give the lender all the required paperwork. Prior to buying a car, business vehicle financing also mandates that you have insurance, so make sure to choose the best option for your requirements.

- You shouldn't have any trouble obtaining a car loan if your firm has been around for a while. You might need to look further to locate a lender ready to work with you if your business is new and has no credit history.

Related articles