It was concluded by the US Social Security Administration that one in four 20-year-olds would become disabled before reaching their retirement age. It is because of this reason that long-term disability insurance policies have grown in importance. A long-term disability insurance policy costs 1% to 3% of your income while being able to protect salaries from $15,000 per year or higher.

While the purpose of long-term disability insurance is misperceived as being something that is to be used due to disabilities caused by accidents, its scope is wider and covers even disabilities that will hamper their work caused due to cancer, mental health problems, etc. Long-term disability insurance will thus become the replacement of your income in circumstances where your disability is preventing you from working.

The costs of your long-term disability insurance will be determined by your age, occupation, your source of earnings, and so on. In fact, if you have long-term disability insurance through your employer, then your premium rates might be subsidized.

Thus, there are several topics to be understood in order to know how you should pay for your long-term disability insurance premium. In order to do so, this article will cover the following topics:

- What is Disability Insurance?

- What Qualifies as a Disability?

- Long Term vs. Short Term Disability Insurance

- Factors that Determine Long-Term Disability Costs

- Where to Get Long-Term Disability Insurance?

- Pre-Tax and Post-Tax Disability Premium

- 5 Questions That Will Help in Choosing Between Pre-Tax and Post-Tax Disability Premium

- FAQs for Long-Term Disability Insurance Premium

- How Can Deskera Help With Premiums for Long-Term Disability Insurance Policy?

- Key Takeaways

- Related Articles

What is Disability Insurance?

Disability insurance is a form of income protection that will pay out benefits to you when you are unable to work due to an illness or injury. Depending upon your policy and the type of disability that you have, the level of income replacement would get determined. Additionally, the time period of how long your disability benefit will last will also get determined.

The three main types of disability insurance are:

- Long-term disability insurance is the one that will last for two years or up until your retirement. This disability insurance can even supplement your other coverage.

- Short-term disability insurance is the one that is usually tied to your employer and will last only for 3 to 12 months.

- Social security disability insurance is free, but it is very difficult to qualify for.

What Qualifies as a Disability?

It is common and, in fact, essential for all insurance policies to include a definition of disability that will inform you of all the conditions that you would need to meet in order to qualify for a benefit payment under your specific plan.

In most cases, you would not need to be totally and permanently disabled to receive long-term disability insurance benefits. You will qualify for disability insurance benefits if an injury or an illness makes you mentally or physically unfit to complete your job. This also includes an impairment that substantially limits your ability to carry out basic life activities.

The two main and most commonly used terms that will be used by your insurance company to define your disability will be:

- Own-occupation disability- This refers to a situation where you would not be able to work at your current job while you might still be able to work at another job.

- Any-occupation disability- This refers to a situation where you would not be able to work for any job.

Long Term vs. Short Term Disability Insurance

The major difference between long-term and short-term disability insurance is in their benefit period, which is the period of time for which you will receive benefits if you are unable to work.

In the case of short-term disability insurance, it will typically cover you for a term of around 13-26 weeks while replacing 40-70% of your income during that benefit period. In contrast, long-term disability insurance can give you benefits for 5, 10, and 20 years, or even until your retirement age, as mentioned in the plan chosen by you.

However, if you have a short-term as well as long-term disability policy, then you will get benefits from your short-term disability policy during the waiting period before the coverage of your long-term disability insurance begins. Once your coverage from the long-term disability policy begins, you will be transitioning from one policy to the next to receive benefits.

Factors that Determine Long-Term Disability Costs

Your premiums for the long-term disability policy will vary based on your health, length, type of your coverage, the benefit amount, and several other such factors. Through this section of the article, we will be discussing them all.

Age

Your premium rates will be lower the earlier you buy your disability insurance. This is because, with age, you are more likely to suffer from a disability or illness due to a decline in your health. However, you can opt to lock in the rates for life when you purchase your disability insurance when you are healthy.

Gender

Considering that women file claims for pregnancy and mental health conditions in their disability insurance, it is quite possible that the premiums for men would be lesser than the premiums for women.

However, the disability insurance rates increase at a faster rate for men than for women because typically, men pay 50% higher rates at the age of 40 and 191% higher rates at the age of 60 than they would be paying at the age of 24.

Occupation

Hazardous occupations like working with heavy equipment might pay more than someone who sits at a desk all day long.

Health

This is one of the most important determinants of your long-term disability insurance premium, as if you have a history of disabling conditions like back injuries, asthma, and arthritis, you would have to pay higher premiums.

Coverage Amount

This is that factor that will vary from person to person. Coverage amount refers to the benefit amount that you would receive each month when you are unable to work. Usually, the coverage amount covers 60% to 80% of your monthly salary.

Usually, the benefit of an individual policy is not taxed unless you have paid from your pre-tax salary. However, in the case of a group plan, which is paid in part by your employer or in full, the benefit will be taxable.

Benefit Period

The benefit period refers to the length of the time period for which you will receive benefits when you are unable to work. This again is one of those factors that vary from person to person.

In the case of the short term disability policy, typically, the benefit period will not be more than a year, whereas, in the case of a long term disability policy, the benefit period can range from two years to covering your income up till your retirement, or until you recover from your disability. Your premium for your long-term disability insurance will get determined accordingly. The longer the benefit period, the higher your disability insurance premiums will be.

Waiting Period

This is also known as the elimination period and refers to the amount of time after you are disabled until you can start receiving benefits. The waiting period is generally shorter for short-term disability insurance than it is for long-term disability insurance.

Thus, the shorter the waiting or elimination period, i.e., the sooner that the benefits are paid out, the higher your premiums would be.

Addition of Riders

Obtaining additional coverage through riders will increase your premium as well. Some of the riders you can add are:

- Enhanced partial disability rider, which will make up for the portion of your salary when you are able to work only part-time due to a disability.

- Cost of living rider, which will account for inflation by increasing your disability payout by at least 3% each year.

- Future increase option rider lets you get additional long-term coverage without having to go through the application process a second time. This rider is especially useful when you have reached a certain age, or you are getting a raise.

- Catastrophic disability rider is one that will pay for your long-term care if you have suffered from loss of speech, hearing, sight or the use of your hands or feet, or if you are unable to do your daily activities like bathing and eating, or dressing without assistance.

Where to Get Long-Term Disability Insurance?

The two potential ways through which you can get long term disability insurance are:

Group Disability Insurance Through Your Work or an Association

As part of your employee benefits package, your company might offer you short-term disability insurance or long-term disability insurance. In case you are self-employed, then you might also get disability insurance through a professional association.

Irrespective of how you are getting your long-term disability insurance as a member of a group, it is an excellent option because the premium tends to be lower when long-term disability insurance is purchased for a large group of people than when it is purchased for an individual. Additionally, the HR of your work or association might have more leverage as well as expertise to get favorable terms in your group disability insurance.

One of the other benefits of group disability insurance is that your employer might choose to contribute and therefore subsidize a portion of your premium, thereby lowering your premium for your long-term disability insurance even more.

However, in the case of getting your long-term disability insurance through your company or association, which will be purchased in bulk, you would have lesser opportunities to tailor it as per your needs.

Additionally, if your premiums are paid from pre-tax income, which is usually the case in the case of employee benefits, then the income benefit that you would get through your long-term disability insurance will be taxed down the road. Lastly, it is quite possible that you would lose your coverage if you leave your company or the association through which you got the group disability insurance.

Individual Disability Insurance

This refers to long-term disability insurance that you would be purchasing for yourself, tailored as per your needs. In the case of individual long-term disability insurance, the premiums would be paid from after-tax income, which means that your replacement income or benefit income will be tax-free.

Pre-Tax and Post-Tax Disability Premium

How you should pay for your long-term disability insurance premium is a vital question that needs to be answered. In the answer, you will be able to identify the way that is the best and most affordable way of getting it. The two options for the same are:

- Pre-Tax Disability Premium- This is where you will be paying the premium before taxes are deducted from your salary. In this scenario, your premium will usually be deducted directly from your paycheck.

- Post-Tax Disability Premium- This is where you will be paying your coverage after taxes have been already deducted from your income as per your tax bracket.

5 Questions That Will Help in Choosing Between Pre-Tax and Post-Tax Disability Premium

Choosing between pre-tax and post-tax disability premium depends on some variables. To help you navigate through these variables, you should ask yourself the following five questions:

Would You Prefer to Pay Taxes Now or When You Are on Disability Leave?

It is mandatory to pay your income taxes, but where you do have an option is in choosing when you pay it. If you choose the pre-tax disability premium, then you will have to pay your taxes when you go on your disability leave and receive your disability insurance payout.

If, however you choose post-tax disability premium, then you would have already paid your share of taxes before paying your disability premium. This means that you would not have to pay taxes again if and when you receive your disability insurance payout.

It is recommended to choose the post-tax disability premium because it will reduce or rather eliminate your tax obligation during a period when your finances might be tight. Consequently, this will increase your income during your period of disability.

Are You Living Paycheck to Paycheck?

If the income that you take home now is the priority, then you should choose a pre-tax disability premium as it will be cheaper while also reducing your taxable income, and therefore end-of-the-year taxes for you as you would be taxed on a lower gross income.

Additionally, if you choose a pre-tax disability premium through your employer, then you would also be able to avoid half of your Federal Insurance Contributions Act (FICA) tax on that amount and a higher federal income tax payment which tends to range between 10% and 37% of your total income. In fact, depending on where you live, you might also be able to save on your state income taxes.

Thus, if you need extra dollars for the smooth running of your day-to-day life, then you should opt for a pre-tax disability premium. However, if you do claim disability in the future, then the benefit income that you receive will be subject to the applicable taxes.

Is Your Primary Focus the Benefit, Not Your Contribution?

If your concern is more about the benefit if you ever need it than the income that you are taking home now, then you should opt for a post-tax disability premium as the payout when claimed, will not be taxed. Thus, you would have more money in hand during the time when you are disabled or injured and unable to work to earn.

Will You Have a Family or Others to Support You With Your Disability Payments?

Choosing between pre-tax disability premium and post-tax disability premium primarily depends on your priorities. In order to make your decision regarding the same, you will need to think about your own future needs. For example, if you get injured and are unable to work, who else would be affected?

Questions like who relies on the income that you bring home each month? Is it just you? Or do you have a partner, kids, and other family members or loved ones who rely on your paycheck?

It is recommended that if you have dependents, then a post-tax disability premium would be the best option for you, as, at the time of the disability, you would not be required to pay taxes on your benefit income.

This is because you would be getting only two-thirds of your paycheck, and having to pay 30%-40% taxes on top of it would be a big inconvenience, as well as problematic in your already difficult times.

Does Your Employer Offer Both- Pre-Tax Disability Premium and Post-Tax Disability Premium Options?

Sometimes, employers provide long-term disability insurance to their employees in two ways-

- Through a pre-tax disability premium option wherein the premiums would be deducted from your paychecks.

- Through a post-tax disability premium option

Even if you decide to take advantage of your employer’s pre-tax disability premium option while also selecting the voluntary post-tax disability premium plan, then you will be required to pay taxes on the benefits that you will be receiving from your employer’s pre-tax disability plan, as the premium for the same was paid before the applicable taxes can be deducted from it.

FAQs for Long-Term Disability Insurance Premium

- Can the cost of individual disability insurance rise as your earnings grow?

If you are part of a graded premium policy, then it would let you pay lower premiums initially, which will then increase according to a predetermined, guaranteed schedule. In fact, you might even have the option to convert to a “level” premium, which is a fixed premium that never increases.

- Should I buy individual disability insurance in addition to the group plan offered by my employer?

This is something that you should opt for if you are looking for more protection, as it will give you extra coverage on top of your group long-term or individual disability plan. In fact, supplemental disability insurance available through your employer would be a great add-on for you, as it will help you protect a greater percentage of your income, bonuses, or commissions.

A supplemental disability insurance policy will even help you in covering the difference between what you will receive from your current group's long-term disability policy and what you will need to maintain your current lifestyle in the times when you are unable to work due to an injury or illness.

- Approximately how much will long-term disability insurance cost per month?

While the cost of a disability policy, especially an individual policy, varies based on several factors like benefit length, benefit amount, gender, age, occupation, and riders, you should expect to pay somewhere between 1 and 3 percent of your annual salary. Thus, if you are making $100,000, then you can expect to pay between $83 to $250 per month.

- When does long-term disability begin?

Long-term disability benefits begin after the elimination period, which is usually 90 days long. While short-term disability benefits payout immediately, they do not last for as long. Though, if you have a short-term as well as long-term disability plan, then the short-term disability plan will cover your benefits during the waiting period before your long-term disability plan takes over.

How Can Deskera Help With Premiums for Long-Term Disability Insurance Policy?

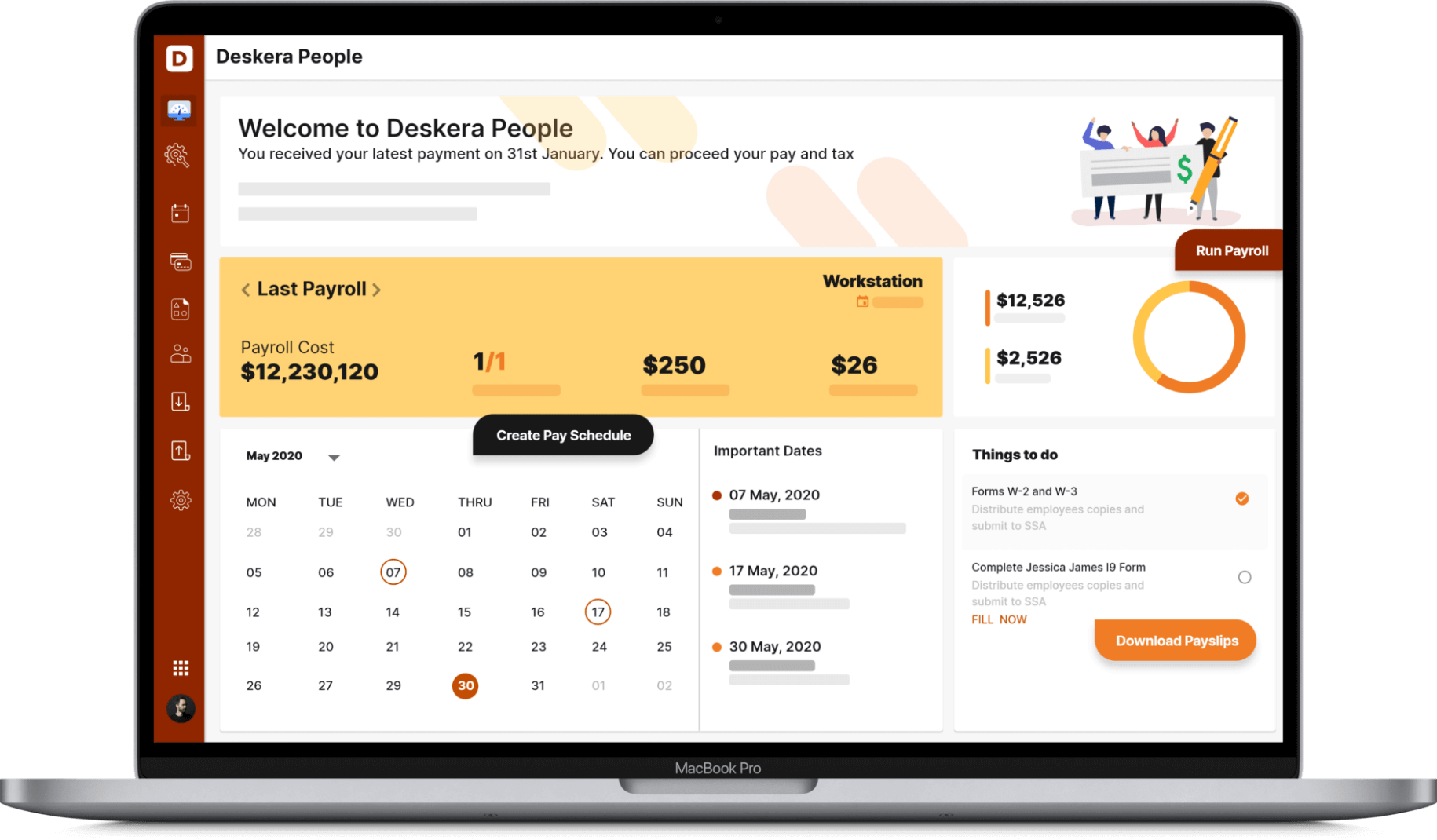

With Deskera People, employers would be able to process payroll faster and more easily with built-in tax calculations. Additionally, the employers would also be able to create and assign custom pay components to an employee based on their requirements. This will also involve setting up voluntary employee deductions like premiums for their long-term disability insurance policy.

As an employee, you would be able to view all your payroll details, as well as the estimates for the upcoming one, through your personalized dashboard. One of the other added advantages involves the seamless transfer of employees’ data from other applications, as well as inbuilt statutory and tax compliances for the USA.

Thus, Deskera People will help you automate deduction as well as tax compliance for your premiums for long-term disability insurance.

Key Takeaways

Everyone’s life is unpredictable, to say the least. Considering this, and how income is the vital safety security net for everyone in today’s world, without which resources become inaccessible to you and your family, it is recommended that you opt for a long term disability insurance policy that will support you and your family if you face a disability that disables you from working for a period of time, or until your retirement.

The cost of your premium for your long term disability insurance depends on several factors like:

- Gender

- Occupation

- Age

- Health

- Waiting period

- Benefit period

- Addition of Riders

- Coverage amount

And so on, which do vary from individual to individual, especially based on their financial preferences and needs. Based on the same, they would also decide whether they want to opt for a pre-tax disability premium or a post-tax disability premium.

Related Articles