Are you seeking to understand how you can leverage project accounting for profit optimization? If yes, then you are on the right page.

In today's dynamic and competitive business landscape, organizations strive not only for growth but also for sustainable profitability. One of the key drivers behind achieving this profitability lies in effective project management and financial oversight. Leveraging project accounting—a specialized approach that focuses on tracking and analyzing financial aspects of individual projects—offers a powerful tool for optimizing profits.

By integrating project accounting practices into an organization's strategies, decision-making processes, and operations, businesses can attain a comprehensive understanding of their financial performance on a project-by-project basis.

Profit optimization, the process of enhancing revenue and minimizing costs to achieve maximum profitability, is the ultimate objective of every business. In this era of data-driven decision-making, project accounting equips organizations with accurate and real-time financial insights.

These insights enable organizations to make informed choices about resource allocation, pricing, risk management, and project selection, all of which directly impact profitability. By strategically applying project accounting principles, businesses can uncover opportunities for revenue growth, cost reduction, and enhanced resource utilization.

This comprehensive approach to leveraging project accounting for profit optimization isn't confined to a specific industry or scale of business. From startups seeking sustainable growth to established enterprises aiming for improved margins, the integration of project accounting principles offers a roadmap to success.

Throughout this exploration, we will delve into the various facets of leveraging project accounting for profit optimization, discussing how each element contributes to the overarching goal of sustained profitability in an ever-evolving business landscape.

The topics covered in this article are:

- What is Project Accounting?

- What is Profit Optimization?

- Importance of Profit Optimization

- Leveraging Project Accounting for Profit Optimization

- How Does Project Accounting Integrate with Strategic Planning for Profit Optimization?

- Can Project Accounting Help in Scenario Analysis for Profit Optimization?

- Can Project Accounting Support Long-Term Profit Sustainability?

- Is Project Accounting Relevant to Businesses of All Sizes and Industries?

- How can Deskera Help You with Project Accounting?

- Key Takeaways

- Related Articles

What is Project Accounting?

Project accounting is a specialized form of accounting that focuses on tracking and managing financial information related to specific projects or tasks within an organization. It is commonly used by businesses, government agencies, and other entities that undertake projects as a significant part of their operations.

The main goal of project accounting is to provide accurate and detailed financial information for each individual project, enabling better decision-making, resource allocation, and performance evaluation. This type of accounting allows organizations to understand the financial health of individual projects and to assess their overall profitability and success.

Key aspects of project accounting include:

- Cost Tracking: Project accounting involves tracking all costs associated with a project, including direct costs (labor, materials, equipment) and indirect costs (overhead, administrative expenses). This helps determine the total cost of the project and provides insights into cost efficiency.

- Revenue Recognition: In project accounting, revenue is recognized as the project progresses and certain milestones are met. This contrasts with traditional accounting where revenue is recognized when a sale is made.

- Budgeting and Forecasting: Project accountants create budgets for each project, outlining expected costs and revenue. They then compare actual performance against these budgets and adjust forecasts as needed.

- Resource Allocation: Project accounting helps in allocating resources effectively by showing where resources are being utilized and if any adjustments are necessary to keep the project on track.

- Profitability Analysis: By comparing total costs with total revenue, project accounting determines the profitability of individual projects. This analysis is crucial in deciding whether to continue or terminate projects.

- Risk Management: Project accounting may involve assessing financial risks associated with projects and implementing strategies to mitigate them.

- Compliance and Reporting: Project accountants often need to adhere to specific reporting standards or regulations based on the industry they are operating in. This ensures transparency and accuracy in financial reporting.

- Performance Evaluation: Project accounting enables organizations to evaluate the success of their projects based on financial metrics. This evaluation can help identify areas for improvement and optimize future project management.

- Time Tracking: Especially for industries where billing is based on hours worked, project accounting involves tracking the time employees spend on various project tasks.

- Integration with General Accounting: While project accounting focuses on individual projects, it must also integrate with the organization's general accounting system to ensure consistency and accurate overall financial reporting.

Project accounting software is often used to streamline and automate these processes, making it easier to manage the financial aspects of multiple projects simultaneously.

In essence, project accounting provides organizations with a comprehensive view of the financial performance of individual projects, helping them make informed decisions and ultimately contribute to the overall success of the organization.

What is Profit Optimization?

Profit optimization refers to the process of maximizing the profitability of a business or organization by strategically managing various factors that influence revenue and costs. It involves making informed decisions and implementing strategies to ensure that the company generates the highest possible profits within the constraints of its resources, market conditions, and operational capabilities.

Profit optimization takes into account both short-term and long-term considerations and often involves a balance between increasing revenue and reducing costs. It goes beyond simple revenue generation and involves a deep analysis of various aspects of the business to identify opportunities for improvement.

Here are some key components of profit optimization:

- Pricing Strategy: Determining the optimal pricing for products or services to maximize revenue while remaining competitive in the market. This might involve pricing adjustments based on customer demand, competitor pricing, and perceived value.

- Cost Management: Identifying ways to reduce costs without compromising product or service quality. This can involve streamlining operations, negotiating better supplier contracts, optimizing inventory management, and minimizing waste.

- Sales and Marketing: Developing effective sales and marketing strategies to attract new customers and retain existing ones. This can include targeting the right customer segments, improving customer engagement, and enhancing the effectiveness of marketing campaigns.

- Product Mix and Portfolio Management: Evaluating the profitability of different products or services and focusing on those that contribute the most to overall profit. This might involve discontinuing underperforming products and promoting high-margin ones.

- Demand Forecasting: Accurately predicting customer demand and adjusting production or inventory levels accordingly. This prevents overstocking or stockouts, both of which can impact profitability.

- Resource Allocation: Allocating resources such as manpower, equipment, and capital to projects and activities that have the highest potential for generating profit.

- Operational Efficiency: Streamlining business processes to reduce inefficiencies and bottlenecks. This can lead to cost savings and improved productivity.

- Customer Segmentation: Identifying different customer segments and tailoring products, services, and marketing efforts to meet their specific needs and preferences, thereby increasing sales and customer loyalty.

- Cross-Selling and Upselling: Encouraging customers to purchase additional products or services or upgrade to higher-priced options, increasing the average transaction value.

- Data Analysis and Insights: Utilizing data analytics to gain insights into customer behavior, market trends, and operational performance. These insights can guide strategic decisions that impact profit optimization.

- Investment and Expansion Decisions: Assessing opportunities for expansion into new markets, product lines, or geographic regions that have the potential to generate higher profits.

- Risk Management: Identifying and mitigating potential risks that could impact profitability, such as changes in market conditions, regulatory changes, or supply chain disruptions.

Profit optimization is an ongoing process that requires continuous monitoring, analysis, and adjustment. It involves a holistic approach to managing various aspects of the business to achieve sustainable and long-term profitability.

Importance of Profit Optimization

Profit optimization is of paramount importance for businesses and organizations for several reasons:

- Financial Health: Maximizing profits ensures that a business remains financially healthy and sustainable. Profits are essential for covering operational costs, investments in growth, and providing returns to stakeholders.

- Survival and Growth: Profit optimization is a fundamental driver of business growth. Higher profits provide the resources needed to invest in research and development, expand into new markets, and innovate, which are all critical for long-term success.

- Competitive Advantage: Businesses that effectively optimize profits can allocate resources more strategically and invest in improvements that give them a competitive edge. This might involve offering better products, services, or customer experiences that set them apart from competitors.

- Investor Confidence: A profitable business is more likely to attract investors and secure funding for expansion and innovation. Strong profitability demonstrates that the business is well-managed and has a promising future.

- Employee Motivation: When a company is profitable, it can offer competitive compensation packages, employee benefits, and career development opportunities. This boosts employee morale and retention.

- Innovation: Higher profits provide the financial flexibility to invest in research and development, allowing businesses to create new products, services, or technologies that can lead to further growth.

- Sustainability: Profit optimization enables businesses to weather economic downturns and unexpected challenges. Having healthy profits acts as a buffer during tough times, helping the organization remain operational and recover faster.

- Effective Resource Allocation: Profit optimization helps in making informed decisions about where to allocate resources. It ensures that resources are directed toward areas that have the potential to generate the greatest returns.

- Quality Improvement: A focus on profit optimization often leads to process improvements, cost reduction, and enhanced quality control. This can result in higher customer satisfaction and loyalty.

- Strategic Decision-Making: Profits provide the means for businesses to make strategic decisions, such as entering new markets, acquiring other companies, or investing in technology upgrades.

- Debt Management: Higher profits enable businesses to manage and pay off debts more effectively, reducing financial risk and interest expenses.

- Stakeholder Value: Profit optimization directly impacts the value delivered to shareholders, stakeholders, and owners. It's a key factor in determining dividends, share prices, and overall business valuation.

- Long-Term Sustainability: By optimizing profits, a business is more likely to achieve long-term sustainability. This involves not only short-term profit maximization but also the creation of value over time.

- Continuous Improvement: The process of profit optimization encourages businesses to continuously evaluate their operations, adapt to changing market conditions, and seek opportunities for improvement.

- Resilience: A well-optimized profit strategy makes a business more resilient to external shocks and market fluctuations, as it has the financial strength to navigate through uncertainties.

In essence, profit optimization is central to achieving a well-rounded and successful business that can weather challenges, invest in growth, and provide value to both its customers and stakeholders. It's a dynamic process that requires careful consideration of various factors and a commitment to adapting to changing circumstances.

Leveraging Project Accounting for Profit Optimization

Leveraging project accounting can significantly contribute to profit optimization within an organization. By integrating project accounting principles and practices into your profit optimization strategy, you can gain better control over your projects, resources, costs, and revenue streams.

Here's how project accounting can help optimize profits:

Cost Visibility

Cost visibility refers to the ability to clearly and comprehensively see and understand all the costs associated with a project, process, or activity. In the context of project accounting, cost visibility involves capturing, tracking, and analyzing all the costs that are incurred during the lifecycle of a project.

This includes both direct costs (e.g., labor, materials, equipment) and indirect costs (e.g., overhead, administrative expenses). When implementing project accounting, cost visibility is achieved through accurate data collection, categorization, and reporting.

Significance for Profit Optimization: Cost visibility plays a crucial role in profit optimization for several reasons:

- Identification of Cost Overruns: With clear visibility into project costs, you can quickly identify instances where actual costs exceed budgeted amounts. This early detection allows you to take corrective actions promptly, preventing further cost overruns and minimizing the impact on profitability.

- Root Cause Analysis: Detailed cost visibility enables you to drill down into specific cost components. This helps in identifying the root causes of cost overruns or inefficiencies, whether they are related to specific tasks, departments, or resources.

- Informed Decision-Making: When making decisions about resource allocation, pricing strategies, and project prioritization, having a comprehensive understanding of costs is essential. Cost visibility ensures that decisions are based on accurate financial data, leading to more informed choices that align with profit optimization goals.

- Cost Control and Reduction: By knowing where costs are being incurred and how they are distributed across different aspects of a project, you can implement targeted cost-control measures. This might involve renegotiating supplier contracts, optimizing resource utilization, or identifying areas for process improvement.

- Profit Margin Analysis: Cost visibility allows you to calculate accurate profit margins for each project. This information helps you determine the projects that contribute the most to profitability and those that may need adjustments to achieve desired profit margins.

- Performance Evaluation: Cost visibility enables you to compare actual costs against budgeted costs, helping assess the financial performance of projects. This evaluation is essential for determining whether projects are on track to meet profit targets or need adjustments.

- Cost Allocation: When a project involves shared resources or overhead costs, cost visibility helps allocate these expenses accurately among different projects. This ensures that each project bears its fair share of costs, leading to a more accurate assessment of individual project profitability.

- Scenario Analysis: With detailed cost data, you can perform scenario analyses to understand the financial impact of different decisions. For instance, you can simulate the effects of changing resource allocation or pricing strategies on overall profitability.

- Transparency and Accountability: Cost visibility fosters transparency within the organization. Stakeholders can access detailed cost breakdowns, leading to increased accountability and a shared understanding of project financials.

Incorporating project accounting practices that prioritize cost visibility enables you to make proactive, data-driven decisions that contribute to profit optimization. It empowers you to manage costs effectively, identify opportunities for improvement, and align your projects with strategies that lead to higher profitability.

Resource Allocation

Resource allocation refers to the process of assigning and distributing resources such as personnel, materials, equipment, and finances to various projects, tasks, or activities within an organization. Effective resource allocation ensures that resources are utilized efficiently and in a way that aligns with the organization's goals and priorities.

Significance for Profit Optimization: Resource allocation is a critical aspect of profit optimization, and integrating project accounting practices can greatly enhance its effectiveness:

- Optimal Resource Utilization: With project accounting, you gain insights into the financial aspects of each project. This information helps you allocate resources to projects that offer the highest potential for profitability. By directing resources to projects with strong ROI prospects, you can enhance overall profitability.

- Prioritization of Profitable Projects: Through detailed cost and revenue analysis, you can identify projects that are more likely to generate higher profits. Proper resource allocation allows you to prioritize these projects over others, maximizing your return on investment.

- Mitigation of Resource Waste: Project accounting enables you to detect resource bottlenecks, inefficiencies, and redundancies across projects. By addressing these issues, you can minimize resource waste and ensure that resources are allocated where they are most needed.

- Reallocation of Underperforming Resources: If a project is underperforming or not meeting profit expectations, project accounting allows you to identify it early. You can then consider reallocating resources from such projects to those with higher profit potential, optimizing resource utilization.

- Balancing Workload: Project accounting helps you assess the workload of each project and allocate resources based on capacity and deadlines. This prevents overburdening teams and ensures that projects progress smoothly, avoiding costly delays.

- Accurate Budgeting: Project accounting facilitates accurate budgeting by providing historical cost data and insights from past projects. This allows you to allocate resources based on real-world costs and make more precise budget estimates for new projects.

- Alignment with Strategy: Resource allocation informed by project accounting ensures that resources are directed toward projects that align with the organization's overall strategic objectives and profit optimization goals.

- Cross-Project Collaboration: Project accounting can highlight areas of overlap or synergy between projects. This insight can lead to collaboration and resource-sharing across projects, maximizing resource efficiency.

- Flexibility and Adaptability: Project accounting's real-time data updates enable you to make agile resource allocation decisions. If market conditions change or project priorities shift, you can adjust resource allocation accordingly to maintain profitability.

- Enhanced Decision-Making: Project accounting provides the financial context needed to make informed decisions about resource allocation. This data-driven approach reduces the risk of resource misallocation and helps achieve desired profit outcomes.

- Quantitative Evaluation: By analyzing project costs, revenue, and resource allocation, you can quantitatively evaluate the effectiveness of resource allocation strategies. This feedback loop enables continuous improvement.

By incorporating project accounting principles into resource allocation, you create a dynamic framework that enables the organization to maximize its resource potential while aligning with profit optimization objectives. It fosters smarter decisions, greater efficiency, and improved project performance, all of which contribute to increased profitability.

Performance Analysis

Performance analysis involves the assessment and evaluation of how well a project or activity is meeting its objectives, targets, and expectations. In the context of project accounting, performance analysis focuses on comparing the actual financial outcomes of a project against the budgeted or expected outcomes.

Significance for Profit Optimization: Performance analysis is a crucial step in the profit optimization process, and integrating project accounting practices enhances its effectiveness:

- Early Detection of Variances: Project accounting provides detailed financial data for each project, allowing you to identify variances between actual and budgeted costs and revenue. Early detection of variances enables proactive intervention to address issues before they impact profitability.

- Data-Driven Decision-Making: Performance analysis based on accurate financial data enables data-driven decision-making. This ensures that decisions are grounded in evidence and aimed at optimizing profitability.

- Continuous Improvement: Through performance analysis, you can identify patterns, trends, and areas for improvement across projects. Lessons learned from past projects can be applied to future endeavors to enhance overall profitability.

- Identification of High-Performing Projects: Project accounting helps identify projects that consistently meet or exceed profit expectations. This knowledge can guide resource allocation decisions and potentially lead to the expansion of successful project models.

- Root Cause Analysis: When a project falls short of profit targets, project accounting allows you to conduct a root cause analysis. By examining cost breakdowns and revenue sources, you can pinpoint the factors contributing to underperformance.

- Resource Reallocation: Performance analysis helps in reallocating resources from underperforming projects to those with better profit potential. This ensures that resources are used where they can contribute the most to profitability.

- Timely Decision-Making: Real-time financial data provided by project accounting enables prompt performance analysis. This allows for timely decision-making, such as adjusting strategies, reallocating resources, or revising project plans.

- Profitability Insights: Performance analysis reveals insights into the profitability of different projects, highlighting factors that contribute to higher profits. These insights can guide future project selection and execution.

- Benchmarking: Project accounting allows you to compare the financial performance of similar projects. This benchmarking helps set realistic profit targets and expectations for new projects.

- Profit Margin Optimization: Through performance analysis, you can identify projects with suboptimal profit margins. By understanding the reasons behind low margins, you can implement strategies to improve profitability.

- Resource Efficiency Enhancement: By analyzing project performance, you can identify areas where resources are being underutilized or overutilized. This insight allows you to optimize resource allocation and enhance efficiency.

- Stakeholder Communication: Performance analysis based on concrete financial data provides clear insights for communication with stakeholders. Transparent discussions about project performance build trust and ensure alignment with profit optimization goals.

Incorporating performance analysis into your profit optimization strategy, with the support of project accounting principles, fosters a data-driven approach to decision-making. It empowers you to monitor, evaluate, and continuously improve project financial performance, ultimately leading to higher profits across the organization.

Pricing Strategy

Pricing strategy involves determining the optimal price at which to sell products or services in order to maximize revenue and profitability. It's a critical aspect of business strategy that directly impacts a company's financial performance and competitiveness.

Significance for Profit Optimization: Integrating project accounting practices into your pricing strategy can have a significant impact on profit optimization:

- Accurate Cost Calculation: Project accounting provides detailed cost breakdowns for each project, enabling a more accurate calculation of the costs associated with producing or delivering products and services.

- Cost-Plus Pricing: With project accounting, you have a clear understanding of all direct and indirect costs related to a project. This allows you to apply a cost-plus pricing strategy, adding a desired profit margin on top of the project's cost to ensure profitability.

- Profit Margin Analysis: Project accounting helps you calculate and analyze profit margins for different projects. This insight informs your pricing decisions, ensuring that products or services are priced to achieve the desired profit margins.

- Segmented Pricing: By understanding the costs associated with different customer segments or project types, you can implement segmented pricing strategies. This involves pricing products or services differently based on the value perceived by each segment, thus optimizing profits from each segment.

- Value-Based Pricing: Project accounting can provide insights into the value that specific projects or offerings bring to customers. This information supports value-based pricing, where prices are set based on the perceived value to the customer rather than just the cost.

- Competitive Positioning: With accurate cost data from project accounting, you can better assess how your pricing strategy compares to competitors. This helps in positioning your products or services in the market while ensuring competitiveness and profitability.

- Dynamic Pricing: Real-time data from project accounting can inform dynamic pricing strategies, where prices are adjusted based on market conditions, demand fluctuations, and supply constraints. This helps maximize revenue during peak times and optimize profits over the long term.

- Promotions and Discounts: Pricing strategy involves decisions about discounts, promotions, and bundling options. With accurate cost information from project accounting, you can determine the feasibility of such offers while maintaining profitability.

- Product Portfolio Management: Project accounting can help you assess the profitability of different products or services within your portfolio. This information guides decisions about which offerings to promote, modify, or phase out to achieve overall profit optimization.

- Long-Term Profitability: Pricing decisions based on project accounting data are more likely to contribute to long-term profitability. Ensuring that prices cover all costs and generate appropriate margins helps sustain the business over time.

- Scenario Analysis: Project accounting can facilitate scenario analysis where you model the impact of different pricing strategies on overall profitability. This helps you select the approach that aligns best with profit optimization goals.

- Price Sensitivity Analysis: Project accounting can support price sensitivity analysis, helping you understand how changes in pricing impact customer demand and revenue. This insight guides decisions about adjusting prices without negatively affecting profitability.

By leveraging project accounting data in your pricing strategy, you create a foundation for informed, strategic pricing decisions. This approach ensures that prices are aligned with project costs, customer value, market conditions, and profit optimization objectives, ultimately contributing to improved profitability.

Resource Efficiency

Resource efficiency refers to the optimal utilization of resources, including manpower, materials, equipment, time, and finances, to achieve the desired outcomes with minimal waste. Efficiently managing resources is essential for reducing costs, improving productivity, and maximizing overall profitability.

Significance for Profit Optimization: Integrating project accounting practices into resource efficiency efforts can yield several benefits for profit optimization:

- Cost Reduction: Project accounting provides insights into where resources are being utilized most effectively and where there might be areas of wastage. By identifying and addressing inefficiencies, you can reduce unnecessary costs.

- Accurate Cost Allocation: With detailed project accounting data, you can accurately allocate costs to specific projects or activities. This ensures that each project bears its fair share of costs, leading to a more accurate profitability assessment.

- Resource Optimization: Project accounting helps identify projects or tasks that consistently utilize resources more efficiently. This knowledge allows you to replicate successful resource management strategies across the organization.

- Resource Balancing: By analyzing resource allocation patterns, project accounting helps you balance resources among projects to avoid overloading or underutilizing teams and departments. This leads to smoother project execution and timely delivery.

- Minimized Overhead: Project accounting assists in tracking overhead costs associated with each project. By understanding how these costs impact profitability, you can implement strategies to minimize them and improve overall project cost-effectiveness.

- Data-Driven Decisions: Resource efficiency efforts guided by project accounting are rooted in data analysis. This enables you to make well-informed decisions about resource allocation and process improvements, leading to better outcomes.

- Real-Time Monitoring: Modern project accounting tools provide real-time updates on resource utilization. This allows you to monitor resource usage as projects progress and make timely adjustments as needed.

- Performance Metrics: Project accounting offers performance metrics that show how efficiently resources are being used within each project. These metrics serve as benchmarks for improving resource allocation in future projects.

- Predictive Analysis: By analyzing historical resource utilization data, project accounting can help predict future resource needs. This proactive approach ensures that resources are available when needed, reducing project delays.

- Cross-Functional Collaboration: Resource efficiency efforts based on project accounting insights encourage collaboration between departments and teams. Sharing best practices and resource management strategies can lead to organization-wide efficiency gains.

- Sustainable Practices: Resource efficiency aligns with sustainability initiatives. By minimizing resource waste, organizations can contribute to environmental conservation while optimizing profits.

- Feedback Loop: Project accounting facilitates a feedback loop for resource efficiency. After implementing resource allocation changes, you can use project accounting data to evaluate the impact on profitability and make further improvements.

By integrating project accounting practices into resource efficiency strategies, you establish a framework for proactive, data-driven resource management. This approach leads to cost savings, enhanced productivity, and streamlined operations, all of which contribute to profit optimization and overall business success.

Profitable Project Selection

Profitable project selection involves evaluating and choosing projects that align with the organization's profit optimization goals. It includes assessing potential projects based on their expected costs, revenue, and overall contribution to profitability.

Significance for Profit Optimization: Integrating project accounting practices into the process of selecting projects for execution can have a significant impact on overall profit optimization:

- Cost-Benefit Analysis: Project accounting provides detailed cost projections for potential projects. By comparing these costs with the expected benefits (revenue and profit), you can make informed decisions about which projects are likely to yield the highest returns.

- Risk Assessment: Project accounting supports risk assessment by providing financial insights into each project's potential risks and rewards. This helps you evaluate whether the potential profit justifies the associated risks.

- Resource Allocation: Detailed cost data from project accounting enables you to allocate resources effectively to projects that offer the greatest potential for profitability. This avoids allocating resources to projects that may not align with profit optimization goals.

- Profitability Forecasting: Project accounting allows you to forecast the profitability of potential projects based on historical data and performance metrics from similar projects. This forecasting informs your decision-making process.

- Strategic Alignment: Integrating project accounting into project selection ensures that chosen projects align with the organization's strategic objectives, including profit optimization.

- Avoiding Underperforming Projects: Through project accounting, you can identify projects that have historically underperformed or failed to meet profit targets. This knowledge helps you avoid selecting similar projects in the future.

- Value Prioritization: By analyzing the potential value of different projects, project accounting guides you in prioritizing projects that have the potential to contribute the most to overall profitability.

- Enhanced ROI: Project accounting enables you to calculate expected returns on investment for various projects. This information assists in selecting projects that offer higher ROI and better align with profit optimization goals.

- Portfolio Management: By assessing the financial viability of potential projects, project accounting helps in maintaining a balanced project portfolio that includes a mix of high-profit, moderate-profit, and strategic projects.

- Realistic Budgeting: Project accounting allows you to create more realistic budgets for approved projects. This ensures that budgeted costs are accurate and aligned with profit expectations.

- Transparent Decision-Making: Project accounting's data-driven approach provides transparency in the project selection process. Stakeholders can see how projects are evaluated and selected based on their potential impact on profitability.

- Resource Availability: By considering the resource requirements of potential projects, project accounting helps in assessing whether the organization has the capacity to execute the projects efficiently.

Integrating project accounting practices into the project selection process ensures that only projects with strong profit potential are chosen for execution. This strategic approach leads to improved resource allocation, increased profitability, and a more focused project portfolio that aligns with the organization's profit optimization objectives.

Real-Time Monitoring

Real-time monitoring refers to the continuous tracking and analysis of project-related data as it occurs. It involves collecting, processing, and presenting data in real-time or near-real-time to provide accurate and up-to-date insights into project performance and financials.

Significance for Profit Optimization: Integrating real-time monitoring into project accounting practices offers several advantages for profit optimization:

- Timely Decision-Making: Real-time monitoring provides immediate access to project data, allowing for swift decision-making. This is especially important when adjusting strategies, reallocating resources, or addressing deviations from profit targets.

- Proactive Problem-Solving: By monitoring projects in real time, you can detect issues, bottlenecks, or deviations from expected outcomes as they arise. This proactive approach enables you to address problems before they escalate and impact profitability.

- Resource Management: Real-time monitoring of resource utilization helps ensure that resources are being used efficiently and that adjustments can be made promptly if resources are being underutilized or overused.

- Budget Control: Real-time monitoring allows you to track project expenses as they occur, helping you stay within budget limits and avoid overspending that could negatively affect profitability.

- Revenue Tracking: Real-time monitoring of project revenue allows you to track how sales or revenue are accumulating as the project progresses. This helps in revenue recognition and overall profit assessment.

- Cost Variance Analysis: Real-time monitoring enables the tracking of actual costs against budgeted costs in real time. This helps identify cost overruns or potential savings early, allowing for timely corrective actions.

- Performance Metrics: Real-time monitoring provides access to key performance metrics as projects unfold. These metrics offer insights into project health and profitability, aiding in ongoing decision-making.

- Agile Adjustments: Real-time monitoring supports agile project management, allowing you to adapt to changing circumstances, market conditions, or customer needs quickly. This adaptability helps maintain or enhance profitability.

- Scenario Planning: With real-time project data, you can run scenario analysis to understand how different decisions may impact project outcomes and profitability in real-time.

- Stakeholder Communication: Real-time monitoring facilitates transparent communication with stakeholders by providing accurate and current project data. This transparency builds trust and ensures alignment with profit optimization goals.

- Project Risk Management: Real-time monitoring helps identify and manage project risks by identifying potential issues as they emerge. This prevents risks from evolving into significant profit-threatening challenges.

- Continuous Improvement: Real-time monitoring feeds into a continuous improvement cycle. Insights gained from ongoing monitoring can be used to refine processes, resource allocation, and overall project management for greater profitability.

By integrating real-time monitoring into project accounting practices, you enable proactive decision-making, efficient resource utilization, and agile adjustments that contribute to profit optimization. It empowers you to respond to changing conditions and challenges promptly, ultimately leading to improved project performance and overall business profitability.

Risk Management

Risk management involves identifying, assessing, and mitigating potential risks that could impact the successful outcome of projects or the overall performance of the organization. It's about proactively addressing uncertainties to minimize negative impacts and maximize positive outcomes.

Significance for Profit Optimization: Integrating risk management with project accounting practices can have a profound impact on profit optimization:

- Risk Identification: Project accounting provides detailed financial data and performance metrics, enabling you to identify potential risks that could impact profitability. This includes risks related to cost overruns, revenue shortfalls, market changes, and resource constraints.

- Risk Assessment: By analyzing project data, you can assess the likelihood and potential impact of each identified risk on project profitability. This allows you to prioritize risks based on their significance.

- Financial Impact Analysis: Project accounting helps quantify the potential financial impact of different risks. This information assists in understanding the potential loss or gain associated with each risk scenario.

- Mitigation Strategies: Armed with financial insights from project accounting, you can develop targeted mitigation strategies for identified risks. These strategies may involve adjusting project plans, reallocating resources, or revising timelines to minimize negative impacts on profit.

- Contingency Planning: Project accounting data informs the creation of contingency plans that outline actions to take if certain risks materialize. These plans ensure that responses are ready to be executed if necessary, minimizing disruptions and profit loss.

- Resource Allocation Adjustments: If a risk threatens project profitability, project accounting allows you to adjust resource allocation to address the risk and mitigate its impact on the project's financial outcomes.

- Scenario Analysis: By running scenario analyses with project accounting data, you can simulate how different risk scenarios would affect project profitability. This informs decision-making by considering both upside and downside potential.

- Real-Time Monitoring: Project accounting supports real-time monitoring of project metrics, allowing you to detect risk indicators early and take corrective actions before they escalate.

- Communication and Transparency: Project accounting data enhances transparency in risk communication. When stakeholders have access to accurate financial data, discussions about risk and its potential impact on profitability are more informed.

- Learning from Past Projects: Project accounting captures historical data that can be used to analyze the outcomes of past risks and mitigation strategies. This learning informs future risk management efforts.

- Profitability Analysis Under Risk: Project accounting enables the analysis of project profitability considering potential risks. This more holistic approach helps in making decisions that align with overall profit optimization goals.

- Profit Margin Protection: By addressing risks that could lead to reduced revenue or increased costs, you protect profit margins and ensure that project outcomes remain aligned with expectations.

By integrating risk management practices with project accounting, you create a comprehensive approach to profit optimization. This approach helps you identify, assess, and mitigate risks that could undermine profitability, ensuring that projects remain on track and align with your profit optimization objectives.

Accurate Revenue Recognition

Revenue recognition is the process of accounting for and recording revenue in the financial statements when it is earned and realizable. Accurate revenue recognition ensures that revenue is recognized in the appropriate period and reflects the value delivered to customers.

Significance for Profit Optimization: Integrating accurate revenue recognition with project accounting practices is crucial for profit optimization:

- Timely Recognition: Project accounting provides insights into project milestones and progress. This enables accurate and timely recognition of revenue as milestones are achieved, ensuring that revenue is recorded when earned.

- Profit Margin Calculation: Accurate revenue recognition contributes to precise profit margin calculation. When revenue is recognized in line with project milestones, profit margins can be calculated more accurately.

- Prevention of Premature Revenue Recognition: Project accounting prevents premature revenue recognition, which could inflate reported profits before the actual value is delivered to the customer.

- Transparency and Compliance: Accurate revenue recognition practices, supported by project accounting data, enhance transparency in financial reporting. Compliance with accounting standards ensures that revenue recognition aligns with industry regulations.

- Project Performance Assessment: Accurate revenue recognition assists in assessing project performance by correlating revenue with completed project deliverables. This helps determine whether projects are meeting profit expectations.

- Billing Accuracy: Project accounting data helps ensure that invoices are generated accurately and aligned with the actual work completed. This reduces the risk of billing discrepancies that could impact revenue and profit.

- Customer Satisfaction: Accurate revenue recognition leads to accurate billing, which enhances customer satisfaction. This positive relationship with customers can lead to repeat business and increased profitability.

- Risk Management: Project accounting contributes to accurate revenue recognition by providing insights into project progress and completion. This mitigates the risk of recognizing revenue for incomplete or unsatisfactory work.

- Audit Trail: Project accounting creates an audit trail of revenue recognition processes, ensuring that financial statements are supported by accurate, verifiable data.

- Long-Term Sustainability: Accurate revenue recognition contributes to the long-term sustainability of the business by maintaining credibility with stakeholders and avoiding financial misstatements.

- Resource Allocation Alignment: Accurate revenue recognition helps align resource allocation with actual revenue generated. This prevents over-allocating resources to projects that are not generating expected revenue.

- Risk of Overstatement Mitigation: Project accounting minimizes the risk of overstating revenue, which could lead to false profit figures. Accurate revenue recognition helps ensure that reported profits are reliable.

Integrating accurate revenue recognition with project accounting practices ensures that the organization's financial statements reflect the true value delivered to customers.

This accuracy supports profit optimization by providing reliable data for decision-making, and project performance assessment, and ensuring transparent and compliant financial reporting.

Data-Driven Decision-Making

Data-driven decision-making is the process of making informed choices based on data, analysis, and evidence rather than relying solely on intuition or gut feelings. It involves collecting, analyzing, and interpreting relevant data to guide business decisions.

Significance for Profit Optimization: Integrating data-driven decision-making with project accounting practices is essential for effective profit optimization:

- Informed Resource Allocation: Data from project accounting enables you to allocate resources to projects that are likely to yield the highest returns. By considering project financials, you can ensure that resources are used efficiently and effectively.

- Cost Control: Data-driven decision-making helps identify areas of cost overruns or inefficiencies, allowing you to implement strategies to control costs and improve profitability.

- Pricing Strategies: With accurate financial data, you can analyze different pricing strategies based on cost structures, profit margins, and market conditions. This leads to pricing decisions that align with profit optimization goals.

- Project Selection: Data-driven analysis helps in evaluating potential projects based on their expected costs, revenue, and profitability. It ensures that projects selected for execution align with profit optimization objectives.

- Risk Management: Data-driven insights allow you to assess risks and their potential impact on profitability. This information guides risk management strategies and helps make informed decisions to mitigate negative outcomes.

- Performance Evaluation: Data-driven decision-making facilitates the evaluation of project performance based on actual financial results. This evaluation informs strategies for enhancing project profitability.

- Market Segmentation: By analyzing project accounting data, you can segment customers or projects based on their profitability. This insight supports targeted marketing efforts and resource allocation.

- Continuous Improvement: Data-driven analysis of past projects helps identify areas for improvement. Lessons learned from data enable continuous process enhancements that contribute to profit optimization.

- Benchmarking: Project accounting data allows for benchmarking project performance against industry standards or internal targets. This information helps identify areas where profitability can be improved.

- Scenario Planning: Data-driven decision-making supports scenario analysis to evaluate different strategies and their potential impact on profitability. This helps you select the approach that aligns best with profit optimization goals.

- Transparency and Accountability: Data-driven decisions are transparent and based on factual information. This fosters accountability among team members and stakeholders involved in profit optimization initiatives.

- Feedback Loops: Data-driven decisions contribute to a feedback loop of continuous improvement. Analysis of outcomes informs future decisions, allowing for refinement and optimization over time.

Integrating data-driven decision-making into project accounting practices ensures that decisions are grounded in reliable information. This approach leads to more accurate resource allocation, effective risk management, and strategic choices that align with profit optimization goals, ultimately contributing to improved profitability for the organization.

Cross-Project Comparison

Cross-project comparison involves evaluating and analyzing multiple projects side by side to identify patterns, trends, similarities, and differences. This allows organizations to gain insights that can inform decision-making, resource allocation, and overall project performance improvement.

Significance for Profit Optimization: Integrating cross-project comparison with project accounting practices offers several benefits for profit optimization:

- Performance Benchmarking: Cross-project comparison allows you to benchmark the financial performance of different projects against each other. This helps identify projects that are consistently more profitable and provides insights into best practices.

- Profitability Assessment: By comparing the profitability of various projects, you can determine which projects contribute the most to the organization's bottom line. This insight guides resource allocation and strategic decisions.

- Resource Allocation Optimization: Cross-project comparison helps identify resource allocation patterns that lead to higher profitability. By replicating successful resource management strategies across projects, you can optimize resource utilization.

- Risk Identification: When comparing projects, you can identify recurring risks that impact profitability across different endeavors. This knowledge allows you to develop targeted risk mitigation strategies.

- Cost Efficiency Insights: Cross-project comparison highlights projects that consistently achieve cost efficiencies. Learning from these projects can lead to cost-saving measures being applied to other projects.

- Pricing Strategy Evaluation: By comparing the financial outcomes of projects with different pricing strategies, you can determine which strategies are most effective in achieving profit optimization.

- Project Selection Guidelines: Insights gained from cross-project comparison can inform guidelines for selecting new projects that align with profit optimization goals based on historical trends and successful practices.

- Resource Balancing: By analyzing resource allocation across various projects, you can ensure that resources are balanced and distributed optimally to achieve profitability across the entire project portfolio.

- Market Segmentation Insights: Cross-project comparison can reveal which customer segments or industries are more profitable. This information supports targeted marketing efforts and resource allocation.

- Scenario Analysis: Using historical project accounting data, cross-project comparison enables scenario analyses that explore how different decisions would impact multiple projects' profitability.

- Performance Improvement: Learning from projects that have consistently achieved high profitability allows you to implement improvements across the organization, enhancing overall project performance.

- Continuous Learning: Cross-project comparison encourages a culture of continuous learning and improvement. Insights from successful projects can be applied to new endeavors to enhance profitability.

By integrating cross-project comparison with project accounting practices, you gain a holistic understanding of project performance and profitability. This insight guides decision-making, resource allocation, and strategy formulation for maximum profit optimization across the entire project portfolio.

Forecasting and Planning

Forecasting involves making informed predictions about future trends, outcomes, and events based on historical data and analysis. Planning involves developing strategies, tactics, and actions to achieve desired goals and objectives.

Significance for Profit Optimization: Integrating forecasting and planning with project accounting practices is crucial for profit optimization:

- Accurate Revenue Projection: Project accounting data allows you to forecast revenue based on historical performance and ongoing project activities. Accurate revenue projection is vital for setting profit optimization targets.

- Resource Allocation: Forecasting future resource needs based on historical project data and ongoing demands ensures that resources are allocated optimally, supporting profitable project execution.

- Cost Estimation: Project accounting data aids in accurate cost estimation for future projects. This information is crucial for budgeting and ensuring that projects remain within cost limits.

- Risk Assessment: Historical project data helps identify potential risks and their impact on profitability. Forecasting allows you to assess how these risks might unfold in the future and plan mitigation strategies.

- Scenario Analysis: Using project accounting data, you can run a scenario analysis to understand how different decisions and external factors might impact profitability. This informs strategic planning.

- Market Trends: By analyzing historical project outcomes, you can identify trends in customer preferences, market demand, and economic conditions. This informs business planning and adaptation strategies.

- Long-Term Profitability: Forecasting and planning supported by project accounting data help ensure that profitability goals are not only achieved in the short term but sustained over the long term.

- Resource Capacity Planning: Based on historical project data, you can forecast resource capacity and plan projects accordingly. This prevents resource shortages or overloads that could impact profitability.

- Optimal Pricing Strategies: Forecasting future demand and market conditions using project accounting data helps you develop pricing strategies that align with profit optimization goals.

- Investment Decisions: Using project accounting insights, you can forecast the potential return on investment for different projects. This aids in prioritizing projects that contribute the most to profitability.

- Resource Alignment with Strategy: Forecasting and planning ensure that resource allocation aligns with the organization's strategic goals and profit optimization objectives.

- Flexibility and Adaptation: By forecasting and planning based on project accounting data, you can build adaptable strategies that respond to changing market conditions, ensuring ongoing profit optimization.

Integrating forecasting and planning with project accounting practices enables you to make proactive, data-driven decisions that align with profit optimization goals. This approach supports efficient resource allocation, risk mitigation, and strategic planning, ultimately contributing to sustained profitability and business success.

Continuous Improvement

Continuous improvement is an ongoing process of identifying, analyzing, and implementing enhancements to processes, strategies, and practices to achieve better outcomes. It involves a commitment to learning from past experiences and adapting to changes for sustained growth and success.

Significance for Profit Optimization: Integrating continuous improvement with project accounting practices is fundamental for achieving long-term profit optimization:

- Learning from Past Projects: Project accounting captures historical project data and performance metrics. By analyzing this data, you can identify successes, challenges, and areas for improvement in previous projects.

- Root Cause Analysis: Continuous improvement involves conducting root cause analysis to understand why certain projects performed well or underperformed. This insight informs strategies to replicate success and rectify shortcomings.

- Process Refinement: Project accounting supports the evaluation of project management processes. Continuous improvement helps refine these processes based on data-driven insights, leading to greater efficiency and profitability.

- Resource Efficiency: Through continuous improvement, you can identify resource allocation patterns that have consistently yielded better results. Applying these patterns across projects enhances resource efficiency and reduces waste.

- Risk Mitigation Strategies: Learning from past risks and their outcomes allows you to develop more effective risk mitigation strategies. This prevents similar risks from impacting profitability in future projects.

- Pricing Strategy Enhancement: Continuous improvement helps refine pricing strategies based on historical data. Adjustments can be made to pricing models to better align with profit optimization goals.

- Feedback Loop: Integrating continuous improvement with project accounting creates a feedback loop. Insights gained from data analysis inform improvements, while ongoing data collection validates the effectiveness of changes.

- Innovation: Continuous improvement fosters an environment of innovation. Data-driven insights can lead to the identification of new approaches, technologies, or business models that drive profitability.

- Benchmarking: By analyzing historical project outcomes, you can benchmark performance against industry standards or internal targets. This highlights areas where continuous improvement is needed.

- Employee Engagement: Involving employees in the continuous improvement process encourages their engagement and contributions to optimizing project performance and profitability.

- Strategic Alignment: Continuous improvement ensures that project accounting practices and strategies are continuously aligned with the organization's profit optimization goals.

- Agile Adaptation: Continuous improvement enables organizations to quickly adapt to changing market conditions, technologies, and customer preferences, ensuring continued profit optimization.

By integrating continuous improvement with project accounting practices, you create a culture of ongoing enhancement and adaptation. This approach leads to more efficient processes, better resource utilization, reduced risks, and overall increased profitability over time.

How Does Project Accounting Integrate with Strategic Planning for Profit Optimization?

Project accounting plays a crucial role in integrating with strategic planning for profit optimization. Let's explore how project accounting and strategic planning work together to achieve this objective:

- Financial Insights for Strategy: Project accounting provides accurate and detailed financial data from ongoing and completed projects. This data serves as a foundation for strategic planning, enabling decision-makers to understand project costs, revenue streams, and profitability.

- Resource Allocation Alignment: Strategic planning involves allocating resources to projects that align with the organization's long-term goals. Project accounting data guides this allocation by identifying projects that have historically demonstrated strong profitability, ensuring that resources are directed where they can have the most impact.

- Risk Assessment and Mitigation: Strategic planning requires assessing potential risks and developing strategies to mitigate them. Project accounting contributes by identifying risk factors based on historical project data, aiding in the development of risk management plans that safeguard profitability.

- Goal Setting and Prioritization: Project accounting insights help in setting specific profit optimization goals. By understanding past project performance, organizations can set realistic targets and prioritize projects that are most likely to contribute to these goals.

- Pricing Strategy Formulation: Project accounting assists in formulating pricing strategies that align with strategic goals. Accurate cost data from project accounting allows organizations to set prices that not only cover costs but also maximize profit margins.

- Scenario Analysis: Project accounting data enables scenario analysis, where different strategic decisions can be simulated to assess their impact on profitability. This guides strategic planning by providing insights into potential outcomes.

- Market and Customer Insights: Strategic planning involves understanding market trends and customer preferences. Project accounting can offer insights into which projects or products have been more profitable in the past, guiding strategic choices.

- Long-Term Sustainability: Integrating project accounting with strategic planning ensures that profit optimization is not only achieved in the short term but is sustainable over the long term. Strategic plans can be designed with a focus on continuous profitability improvement.

- Adaptive Strategies: Project accounting data reveals patterns and trends in project performance. This information aids in developing strategies that can adapt to changing market conditions, contributing to ongoing profit optimization.

- Transparency and Alignment: Strategic planning requires alignment across the organization. Project accounting provides transparent financial data that ensures everyone is on the same page, working towards the same profit optimization goals.

By integrating project accounting with strategic planning, organizations create a synergy between financial data, project performance, and long-term objectives. This integration enables data-driven decision-making, efficient resource allocation, risk management, and pricing strategies that collectively contribute to profit optimization and sustained success.

Can Project Accounting Help in Scenario Analysis for Profit Optimization?

Yes, project accounting can be a valuable tool for conducting scenario analysis to optimize profit. Here's how:

Scenario analysis involves evaluating different potential scenarios or outcomes based on varying assumptions, decisions, or external factors. By applying project accounting data to scenario analysis, organizations can assess how different choices might impact profitability.

How Project Accounting Supports Scenario Analysis:

- Accurate Financial Data: Project accounting provides accurate and detailed financial data for each project. This data forms the foundation for scenario analysis, ensuring that the analysis is based on reliable information.

- Cost and Revenue Inputs: Project accounting data includes information about costs incurred and revenues generated throughout a project's lifecycle. These inputs are crucial for calculating profit and evaluating scenarios.

- Resource Allocation: Project accounting data shows how resources were allocated in past projects. Scenario analysis can explore different resource allocation scenarios and their potential impact on profitability.

- Pricing Strategies: Project accounting aids in understanding how different pricing strategies affect revenues and profit margins. Scenario analysis can model changes in pricing to gauge their impact on overall profit.

- Market Trends: Project accounting helps identify trends in project performance related to market conditions. Scenario analysis can simulate how changes in the market might affect project profitability.

- Risk Assessment: By analyzing past project risks and their outcomes, project accounting informs scenario analysis about potential risks and their financial implications on profitability.

- Decision Impact: Scenario analysis can evaluate how various strategic decisions would affect financial outcomes. Project accounting provides the data to assess how decisions influence profit.

Benefits of Using Project Accounting for Scenario Analysis:

- Informed Decision-Making: Scenario analysis allows decision-makers to evaluate potential outcomes before making strategic choices. Project accounting ensures that the analysis is based on accurate financial data.

- Risk Mitigation: By considering different scenarios, organizations can identify potential risks and develop strategies to mitigate negative outcomes, preserving profitability.

- Optimized Resource Allocation: Scenario analysis helps optimize resource allocation to maximize profit. Project accounting data assists in assessing resource needs and availability for different scenarios.

- Strategy Testing: Organizations can use scenario analysis to test different strategies, such as market expansion or new product development, to determine their potential impact on profit.

- Continuous Improvement: Insights from scenario analysis can be used to refine strategies and approaches, contributing to a culture of continuous improvement in profit optimization.

Incorporating project accounting data into scenario analysis enhances its accuracy and relevance, enabling organizations to make more informed decisions that align with profit optimization goals.

Can Project Accounting Support Long-Term Profit Sustainability?

Yes, project accounting can significantly support long-term profit sustainability for an organization. Here's how:

- Accurate Financial Insights: Project accounting provides accurate and detailed financial data from individual projects. This data helps organizations understand the profitability of various projects, allowing them to focus resources on projects with a history of strong financial performance.

- Informed Decision-Making: With project accounting data at their disposal, decision-makers can make informed choices about resource allocation, project selection, pricing strategies, and risk management. These decisions contribute to sustained profitability over time.

- Efficient Resource Allocation: Project accounting enables organizations to allocate resources effectively based on historical project performance. Efficient resource allocation ensures that resources are used optimally, reducing waste and enhancing profitability.

- Cost Control: By tracking project costs and expenses, project accounting helps identify areas of inefficiency and overspending. This cost control measure directly contributes to long-term profit sustainability.

- Risk Mitigation: Project accounting aids in identifying potential risks by analyzing historical project data. This information allows organizations to develop strategies to mitigate risks and minimize potential profit losses.

- Scenario Analysis: Project accounting allows for scenario analysis, where different strategic decisions can be simulated to evaluate their impact on profitability. This foresight helps organizations make choices that align with long-term profit sustainability.

- Continuous Improvement: Learning from past projects through project accounting helps organizations refine processes, strategies, and approaches. This continuous improvement approach enhances overall efficiency and profitability over time.

- Strategic Planning: Integrating project accounting into strategic planning ensures that long-term goals are aligned with historical and real-time financial data. Strategic plans can be adjusted based on actual project performance, contributing to sustained profit optimization.

- Transparency and Accountability: Project accounting promotes transparency by providing accurate financial data. This transparency fosters accountability among teams and stakeholders, supporting long-term profit sustainability.

- Adaptation to Market Changes: Project accounting allows organizations to adapt their strategies based on changing market conditions and customer preferences. This adaptability ensures that the organization remains competitive and profitable in the long run.

- Optimized Pricing Strategies: Through accurate cost calculations, project accounting supports the development of pricing strategies that maximize profit margins while remaining competitive. This pricing optimization contributes to long-term profitability.

By incorporating project accounting practices into their operations, organizations can enhance their ability to sustain profits over the long term. The combination of accurate financial insights, data-driven decision-making, resource efficiency, risk management, and strategic alignment ensures that the organization's profitability remains resilient in a constantly evolving business environment.

Is Project Accounting Relevant to Businesses of All Sizes and Industries?

Yes, project accounting is relevant to businesses of all sizes and across various industries. Here's why:

- Startups and Small Businesses: Startups and small businesses often have limited resources and need to make every investment count. Project accounting helps them track costs, optimize resource allocation, and make informed decisions to ensure profitability.

- Medium-Sized Enterprises: Medium-sized businesses handle a variety of projects. Project accounting helps them manage multiple projects simultaneously, analyze performance, and make strategic choices for sustainable profit growth.

- Large Corporations: Large corporations deal with complex project portfolios. Project accounting provides the necessary visibility to assess each project's contribution to profitability, enabling effective resource management and risk mitigation.

- Service Industries: Businesses in service industries, such as consulting, marketing, and IT, often work on client projects. Project accounting helps them accurately bill clients, manage project costs, and ensure profit optimization.

- Manufacturing: Manufacturing companies undertake diverse projects for product development, process improvements, and more. Project accounting aids in tracking costs, managing resources, and optimizing profit margins.

- Construction: Construction projects involve multiple phases and expenses. Project accounting allows construction firms to monitor costs, manage subcontractors, and ensure projects remain within budget while maintaining profitability.

- Software Development: Software projects have unique challenges, such as changing requirements. Project accounting helps manage resources, control development costs, and align project outcomes with profit goals.

- Research and Development: R&D projects require careful cost tracking and performance analysis. Project accounting ensures that investment in research translates into profitable products or innovations.

- Healthcare: Healthcare organizations manage various projects to improve patient care and operational efficiency. Project accounting supports cost management and profit optimization in this industry.

- Nonprofits: Even nonprofits have projects, like fundraising campaigns or community initiatives. Project accounting helps them allocate resources efficiently and ensure that the initiatives are financially viable.

- Education: Educational institutions run projects for curriculum development, facility expansion, and more. Project accounting assists in managing budgets, costs, and resource utilization for long-term sustainability.

- Retail: Retail businesses run projects for store openings, renovations, and marketing campaigns. Project accounting helps in cost management and ensuring projects contribute positively to profit margins.

In essence, project accounting's principles can be tailored to fit the specific needs and characteristics of different industries and sizes of businesses. It provides a structured approach to managing projects' financial aspects, ensuring that profit optimization remains a central focus regardless of the organization's context.

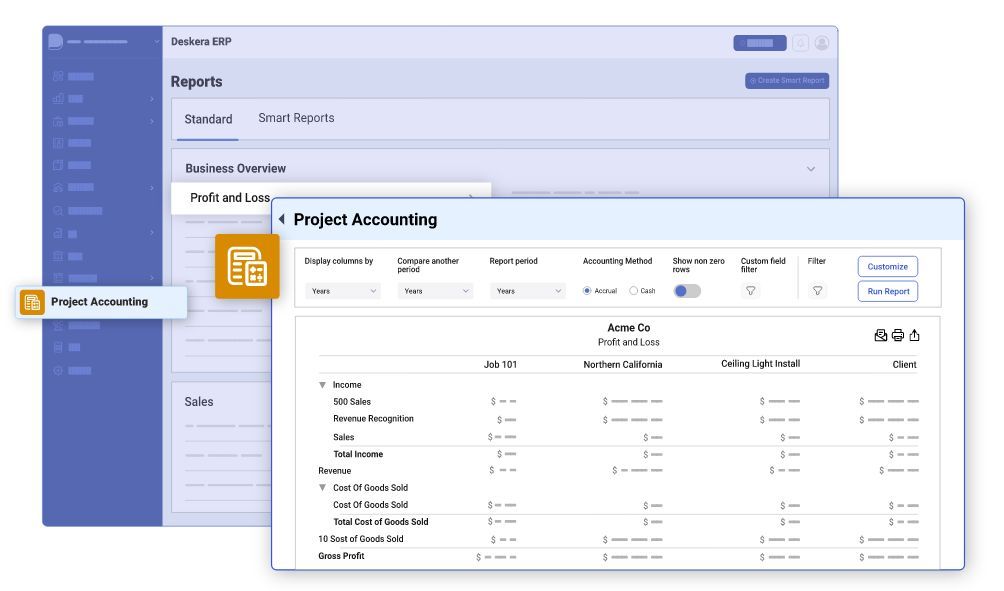

How can Deskera Help You with Project Accounting?

Deskera ERP offers a comprehensive suite of cloud-based business software solutions that can assist organizations with various aspects of project accounting.

Here's how Deskera can help you with project accounting:

- Bill of Quantities: This will help you accurately track project costs and revenue. This is because Deskera automatically calculates prices, discounts, taxes, and other factors for each item, while also ensuring real-time updates of a project’s bill of quantities.

- Project Time Tracking: Through Deskera, you would be able to monitor your project progress because it automatically logs time spent on tasks and projects. It also ensures accurate billing based on actual project time. Deskera ERP also enables efficient project tracking and management.

- Payment Milestones: With Deskera, you will be able to create payment milestones to streamline accounts payable, set custom payments with specific dates and amounts, and ensure timely payments by setting reminders and notifications.

- Revenue Recognition: With Deskera you will be able to ensure timely invoicing because it enables upfront recognition of revenue. It also allows cost-based accounting for revenue recognition. Lastly, Deskera ERP ensures accurate reporting of revenue.

- Project Costing and P&L: Deskera will assist you in tracking financial health by monitoring, managing, and tracking project costs. It will also help in identifying and analyzing cost overruns, as well as monitoring and reviewing budget performance. Deskera ERP will also generate real-time Profit and Loss reports, and analyze cost and benefit performance, while also giving you financial visibility.

Moreover, you can use these features to create detailed reports and dashboards that provide you with an in-depth understanding of your project finances. With Deskera ERP, you can easily keep track of your project's financials and make better decisions that lead to increased profitability.

Key Takeaways

Project accounting involves tracking and managing the financial aspects of individual projects. It relates to profit optimization by providing insights into project costs, revenues, and performance, allowing businesses to make informed decisions that maximize profitability.

Here's how project accounting can help optimize profits:

- Cost Visibility: Project accounting provides detailed insights into the costs associated with each project. This visibility allows you to identify areas of cost overruns, inefficiencies, and areas where costs can be minimized without compromising project quality.

- Resource Allocation: With project accounting, you can allocate resources more effectively based on project priorities and profitability. This ensures that resources are utilized where they can generate the most value and contribute to higher profits.

- Performance Analysis: Project accounting enables you to analyze the financial performance of each project individually. By comparing actual costs and revenue against budgeted figures, you can identify projects that are underperforming and take corrective actions to improve profitability.

- Pricing Strategy: With accurate cost data from project accounting, you can set more informed pricing for your products or services. You'll have a better understanding of the costs involved and can price them to maximize profit margins.

- Resource Efficiency: Project accounting helps identify resource bottlenecks and areas of inefficiency. By streamlining processes and optimizing resource utilization, you can reduce waste and improve overall operational efficiency.

- Profitable Project Selection: Project accounting assists in evaluating the profitability of potential projects before they are undertaken. This allows you to prioritize projects that align with your profit optimization goals and have the potential for higher returns.

- Real-Time Monitoring: Modern project accounting tools offer real-time monitoring of project costs and progress. This allows you to intervene promptly if a project is deviating from its profitability targets and take corrective actions.

- Risk Management: Project accounting involves assessing financial risks associated with projects. By understanding the potential risks, you can implement strategies to mitigate them and avoid potential profit losses.

- Accurate Revenue Recognition: Proper revenue recognition practices, often facilitated by project accounting, ensure that revenue is recognized in accordance with project milestones. This prevents overestimating profits prematurely.

- Data-Driven Decision-Making: Project accounting provides data-driven insights that guide decision-making. These insights can help you make informed choices about which projects to invest in and which areas to improve for maximum profitability.

- Cross-Project Comparison: By comparing the financial performance of different projects, you can identify patterns and strategies that lead to higher profitability. This knowledge can be applied across projects to optimize profits organization-wide.