Are you in search of affordable health insurance? Have you spent days looking for it and considered even multiple health insurance options but still not found a match? Or are you confused between the available options? Are you considering getting some help to make a firm and fruitful decision in regards to your health insurance?

If your answer to these questions is yes, then you are on the right page. This article is aimed at helping you understand who are health insurance brokers and their roles. A health insurance broker is someone who would help you in saving time and money by simplifying the process of buying health insurance by finding one whose coverage is well-suited to your needs.

A health insurance broker is a licensed benefits professional who will represent you during your purchase of the health insurance. They will help you from the start till the end of the entire process revolving around attaining health insurance for yourself or your family, or your company. One of the ways in which they do so is by drawing up a comparative analysis of different health insurance policies to help you choose the one that suits you the most.

However, there is more to know about health insurance brokers before you choose to work with one. Thus, the topics covered in this article are:

- What is a Health Insurance Broker?

- Exactly What Does a Health Insurance Broker Do?

- Differences Between Health Insurance Broker and Health Insurance Agent

- What to Expect When You Talk to a Health Insurance Broker?

- Benefits of Having a Health Insurance Broker

- Characteristics of a Good Health Insurance Broker

- How do Health Insurance Brokers Earn Money?

- How Can Deskera Help?

- Key Takeaways

- Related Articles

What is a Health Insurance Broker?

A health insurance broker is someone who represents the health insurance buyer (i.e., you). He or she also draws up a comparative analysis of different health insurance policies for you to assess and choose from according to your medical and financial needs. It is the responsibility of a health insurance broker to help you choose the health insurance that suits your needs the most.

In fact, a health insurance broker is someone who will help you in managing your insurance plan, help in cases of issues with a claim, coverage eligibility, etc. A health insurance broker is thus someone who will smoothen out your entire process of obtaining and using health insurance.

A health insurance broker is someone who claims to act in the interest of his or her customer and, therefore, in case of dispute, can be taken to the court of law. Thus, health insurance brokers and his or her customers share a fiduciary (legal) relationship based on trust.

Exactly What Does a Health Insurance Broker Do?

Considering that a health insurance broker is a licensed benefit professional, he or she can help you or your business in managing the health insurance selection process from start to finish.

Having the assistance of a health insurance broker will ensure that you do not feel overwhelmed by the process of buying health insurance and are, in fact, able to choose the health insurance that is compatible with your finances as well as health needs.

Typically, a health insurance broker functions as a liaison between the insurance company and the policyholder. However, with the widespread accessibility of the internet, the nature of the health insurance industry is changing. Customers like you can now check the health care options available to you as well as what each of the policies will offer you.

However, what has not changed is that not every agent is licensed by every company to be a health insurance broker, and thus, a health insurance broker might not be able to offer the exact policy that you have liked. This has increased the burden and even workplace stress on the health insurance brokers to be aware of all the available policies and be able to offer comparable offerings to those health insurance policies that they may not be able to sell.

The age of the internet, however, has not only increased the burden on the health insurance workers but also empowered them; while it once took the health insurance brokers long administrative hours to transfer information with the insurance company, they can now do it immediately.

Additionally, one more change in the trend of the health insurance industry that was brought about by the internet era was that health insurance brokers started specializing in specific industries.

Thus, for example, you will need a different specialist for non-profit health insurance, then you will need for the travel industry health insurance. This specialization has enabled health insurance brokers to specialize not only in policy options but also in typical wants, needs, and budgets of a given industry.

Therefore, what exactly a health insurance broker does changes with the evolving trends, but their base role- giving you assistance with health insurance and its processes, remains constant.

Differences Between Health Insurance Broker and Health Insurance Agent

What to Expect When You Talk to a Health Insurance Broker?

This is what you should expect when you talk to a health insurance broker:

The Broker Will Try to Understand Your Situation

To do so, the health insurance broker may ask you questions like:

- Are you buying health insurance for the first time?

- Do you currently have health insurance coverage? If yes, why are you looking for options to switch plans?

- How often do you go to your doctor? Do you see any specialists? Would you like to continue with your current doctors?

- Currently, are you taking any prescription drugs? Do you require the branded version of any medications?

- What is your budget for health insurance?

- Would you be adding any spouse or dependents to your plan?

- Which pharmacies do you use?

You are Presented with Plans that Match Your Needs

Once your health insurance broker has identified what you are in need of, he will suggest plans that meet your needs. He or she will do so by making a portfolio or a comparative analysis of all the available options and giving it to you.

You would then have to understand and consider the following:

- Difference between insurance plan types- You should have your health insurance broker walk you through different insurance plan types like HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), EPO (Exclusive Provider Organizations), and POS (Point of Service). While taking you through the different insurance plan types, your health insurance broker will also explain the pros and cons of each of the types with you. Additionally, they will also inform which of these formats will require referrals, which of these formats offer out-of-network coverage, etc.

- Understanding pricing terms- To learn how exactly your health insurance coverage options differ from each other, you should understand key pricing terms like deductible, premium, coinsurance, copay, and so on. Post this, you should sit and discuss with your broker to narrow down and then select health insurance that suits your healthcare and financial needs in the best possible manner.

- Find the Right Health Insurance Carrier- In this, you would take the help of your health insurance broker to identify carriers offering plans that meet your needs.

- Compare Provider Networks- If you want to continue receiving care from a particular doctor, then you should check the provider networks of each plan option. During this, you should also ensure that your doctor will be considered in-network under these plans.

- Know On- and Off- Exchange Plan- Considering the push to stop incentivizing marketplace plans, you should make sure that your broker clarifies which of your options are ACA (i.e., Affordable Care Act) marketplace plans and which are off-exchange non-ACA plans. You can then also ask them to show you plans that they have not yet shared with you.

Select a Plan

There are a few things that you must keep in mind before and after selecting a plan. These are:

- If you are angling towards selecting an ACA marketplace plan, will your broker help you determine whether you are eligible for a subsidy or not? If you are, will he or she be able to help you process a subsidy application?

- Can your health insurance broker be able to walk you through your policy’s Summary of Benefits? One of the purposes of doing so is to ensure that you have clarity on key points like provider network size, premium, and coinsurance cost amounts, whether or not you need to meet a plan deductible before your insurance begins to cover a portion of your healthcare costs, etc.

- You should also ask your health insurance broker to share the details of a designated point person as appointed by your insurance carrier. This is the person you would be contacting if and when you have queries about your coverage. You should also ask your health insurance broker if this point person is also someone who would be able to help you with the filing of claims.

- Make sure that all your drugs are covered by the health insurance plan chosen by you.

- If your health insurance plan includes access to a Flexible or Health Savings Account, ask your broker about the process to establish an account and access and manage your account funds.

Benefits of Having a Health Insurance Broker

Getting your health insurance through your health insurance broker will give you the peace of mind that you have a plan that offers you the right coverage at the most affordable price. In addition to this benefit, the other benefits of having a health insurance broker are:

Quick Access to Support

Health insurance brokers have a designated person and the right resources to help you solve any health insurance problems that you might face, like claim payments, coverage eligibility, access to care, and other such issues. This is a facility that you cannot find on the insurance provider’s website.

Personalized Recommendations

Having a health insurance broker would also mean that you would have the pros and cons of each of the available plans noted down for you and even explained to you by them. Post that, they would even give you personalized advice to help you select a plan that suits you the best.

Provide Specialized Health Insurance Knowledge

Your health insurance broker would also be able to help you understand key healthcare coverage terms and make sense of the options available to you. They would also be able to help the elderly consumers better understand their Medicare coverage and options for long-term care.

Characteristics of a Good Health Insurance Broker

Having a health insurance broker who understands your individual needs or the needs of your business employees is of utmost importance. A health insurance broker should be able to understand the financial and health care needs of not only you but also of your employees (if applicable) and be able to guide in the selection of the most compatible health insurance plans.

Some of the characteristics to expect from your health insurance broker that will make him or her good are:

- Considering that they get paid through commissions, the services provided by a health insurance broker should be free of cost.

- An exceptional health insurance broker is someone who would have an in-depth understanding of employee benefits plans and individual health plans that will suit you the best. Additionally, they should have proper communication skills, through which they would be able to better explain the options that are available to you, such that they become easy for you to understand. Your health insurance broker should not just be sharing health insurance plans and their quotations with you but also be focused on aligning those health benefit plans with your or your employees’ healthcare and financial needs.

- A health insurance broker is good when it is easy to get in touch with them. They should be communicative. This also means they should return your call promptly if they were unavailable when you called earlier.

- Your health insurance broker should be able to provide you with the contact information of an assigned benefits representative. This point person should be accessible and easy to reach, and you should be able to contact him or her about your insurance claims, coverage levels, or any other questions that you might have.

- Your health insurance broker should make a side-by-side comparison table in the weeks preceding and during the open enrollment so that it becomes easy for you to compare and evaluate the different health plan options available to you.

- You should expect to receive information and educational materials detailing your benefits, coverage, and provider network.

- Your health insurance broker should also be able to make sure that your health plans are compliant with federal and state laws. This is very important, especially when you are choosing your health plans for your employees.

Thus, a good health insurance broker is someone who would be able to guide you through the entire process, from how to choose the right physician and how to file claims to how to pick the right plan for your family or employees. He or she should be able to do so after helping you pick a health plan that is the most compatible with your requirements.

How do Health Insurance Brokers Earn Money?

A health insurance broker is a professional who acts as an intermediary between the insurance company and the customer. A health insurance broker represents the customers and helps them in finding policies that suit them the best, and earns money through commissions from selling insurance to individuals or businesses.

Usually, the commissions tend to range from 2% and 8% of total annual premiums; however, the exact rates do depend on the state regulations for the same. Thus, the primary way of earning money is through commissions and fees on sold policies, the other ways through which a health insurance broker earns money are:

- They might continue earning ongoing annual residual income payments as a smaller percentage of the commission on the premium over the sold policy’s life.

- Providing consultative and advisory services to clients for a fee.

- Charging transaction fees, like, a health insurance broker charging fees for initiating changes and helping to file claims.

- Sometimes, insurers give commissions or bonuses to health insurance brokers who have performed well to incentivize them. These compensations are often based on the past performance of the health insurance broker, which is used as motivation to continue certain behaviors that generate revenue. However, considering that health insurance brokers are supposed to work in the clients’ best interest, this way of earning money is frowned upon and controversial and might even hamper the broker’s customer retention and customer loyalty.

How Can Deskera Help?

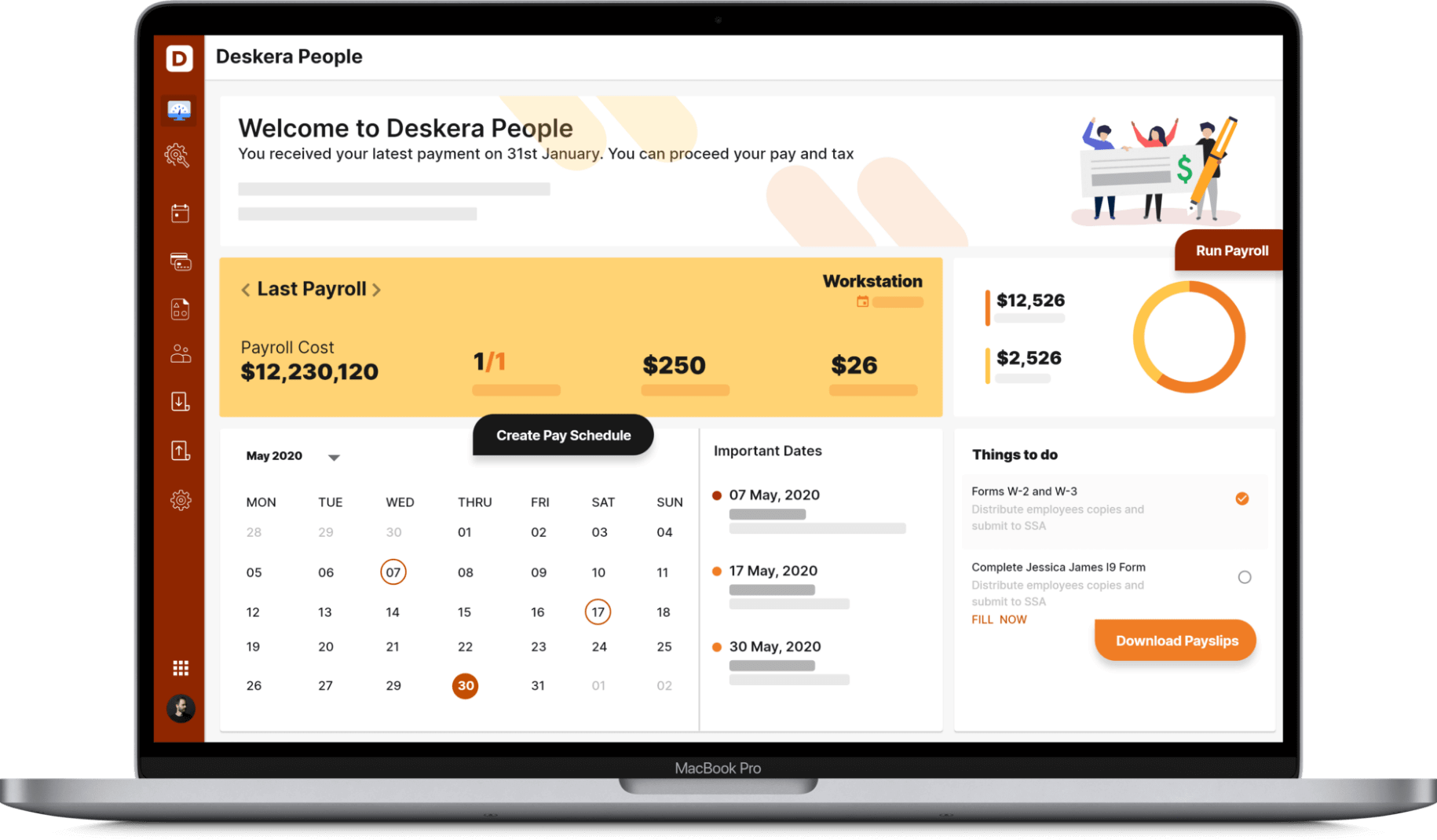

With Deskera People, you would be able to easily keep track of your business expenses by breaking them down into different categories. For example, the premiums of health insurance of your employees might be categorized under employee benefit expenses.

In fact, by using Deskera People, you would even be able to create a custom category to organize expenses specific to your business’s unique requirements. The reports generated from these expenses will be easily visible on your dashboard, after referring to which you can work towards improving your business metrics, find ways to retain your top talent, and even improve your financial statements.

Additionally, through Deskera People, you would be able to ensure data integrity by granting users role-based access to the specific modules of information that they need while also ensuring that it acts as a self-service portal for employees for applying for leaves, filing claims and expenses, and so on.

Key Takeaways

In the age of the internet, as well as the vast availability of options even in health insurance plans, having someone to guide you through the entire process and thus helping you choose a health plan that is right for you is a relief. This is what a health insurance broker does. He or she helps you evaluate the pros and cons of all the available health plans and helps you choose the best one.

In case of conflicts, they even back you up and represent you. Additionally, they also help you get in touch with a point person in the insurance company who can assist you when you have queries or problems. In exchange for their services, a health insurance broker earns commissions- sometimes only once for the entire duration of the policy, at other times, a huge chunk in the first year, and smaller ones till the duration of the plan. Additionally, they also earn from consultancy fees and transaction fees.

If you are someone who needs a particular kind of coverage, but you have not finalized on an insurance provider, then you need a health insurance broker and not a health insurance agent who would represent a specific insurance company and not you.

Lastly, to better keep track of your business expenses like health insurance for employees and get analytical reports for the same, you should use Deskera People.

Related Articles