Are you a business owner in the state of Haryana? Do you wish to acquaint yourself with the Haryana Code on Wages Rule, 2021, so that you can ensure compliance with them?

If your answer to both of these questions is yes, then you are on the right page.

This article will help you get a complete understanding of Haryana Code on Wages Rules 2021 by covering the following topics:

- What is Haryana Code on Wages Rules 2021?

- Applicability of the Haryana Code on Wages Rules 2021

- Important Provisions of Haryana Code on Wages Rules, 2021

- Compliances as per the Haryana Code on Wages Rule 2021

- FAQs related to Haryana Code on Wages Rule 2021

- How can Deskera Help You?

- Key Takeaways

- Related Articles

What is Haryana Code on Wages Rules 2021?

The Code on Wages, Haryana, Rules, 2021 is a set of regulations that have been enacted by the Haryana State Government to implement the provisions of the Code on Wages Act, 2019 in the state of Haryana.

The Code on Wages Act, 2019 is a comprehensive legislation that replaces four existing labor laws related to wages, namely:

- The Payment of Wages Act, 1936

- The Minimum Wages Act, 1948

- The Payment of Bonus Act, 1965

- The Equal Remuneration Act, 1976.

It includes various provisions related to the following:

- Payment of wages: The rules specify the manner in which wages are to be paid to employees, including the frequency of payment, the mode of payment, and the components that are included in wages.

- Fixation of minimum wages: The rules provide guidelines for the fixation of minimum wages for different categories of employees, taking into account factors such as skill level, geographical location, and nature of work.

- Payment of bonus: The rules outline the eligibility criteria for employees to receive a bonus, the calculation of the bonus amount, and the manner in which it is to be paid.

- Maintenance of registers and records: The rules require employers to maintain various registers and records related to wages, including a register of wages, a register of fines, and a register of deductions.

- Inspections and penalties: The rules empower authorities to conduct inspections to ensure compliance with the provisions of the Code on Wages Act, 2019, and prescribe penalties for non-compliance.

Overall, the Code on Wages, Haryana, Rules, 2021 seeks to simplify and streamline the various labor laws related to wages, and ensure that employees receive fair and timely remuneration for their work.

Applicability of the Haryana Code on Wages Rules 2021

The Draft Rules upon coming into force shall extend to the whole of the State of Haryana, and they shall come into force from the date of their final publication in the Official Gazette after the date of the commencement of the Code on Wages, 2019.

The Draft Rules upon coming into force shall repeal:

- The Punjab Minimum Wages Rules, 1950;

- The Punjab Payment of Wages (Procedure) Rules, 1965 and

- The Punjab Payment of Wages Rules, 1937

Note: The Draft Rules of Haryana for the Code on Wages (“Draft Rules”) has been notified in the gazette on 16 September 2021.

Important Provisions of Haryana Code on Wages Rules, 2021

Section 1: Short Title, Extent and Commencement

(i) These rules may be called the Code on Wages (Haryana) Rules, 2021.

(ii) These rules extend to whole of the State of Haryana.

(iii) They shall come into force from the date of their final publication in the Official Gazette after the date of the commencement of the Code on Wages, 2019 (Central Act 29 of 2019).

Section 2: Definitions

(1) In these rules, unless the subject or context otherwise requires,—

(a) “authority” means the authority appointed by the State Government under sub- section (1) of section 45 of the Code, by notification in the Official Gazette;

(b) “appellate authority” means the appellate authority appointed by the State Government under sub- section (1) of section 49 of the Code, by notification in the Official Gazette;

(c) “appeal” means an appeal preferred under sub-section (1) of section 49;

(d) “Board” means the Haryana State Advisory Board constituted by the State Government under sub-section (4) of section 42;

(e) “chairperson” means the Chairperson of the Board;

(f) “Code” means the Code on Wages, 2019 (Central Act 29 of2019);

(g) “committee” means a committee appointed by the State Government under clause (a) of sub-section (1) of section8;

(h) “day” means a period of 24 hours beginning at mid-night;

(i) “Form” means a form appended to these rules;

(j) “highly skilled occupation” means an occupation which requires in its performance a specific level of perfection and required competence acquired through intensive technical or professional training or practical occupational experience for a considerable period and also requires of an employee to assume full responsibility for his judgment or decision involved in the execution of such occupation;

(k) “Inspector-cum-Facilitator” means a person appointed by the State Government, by notification in the Official Gazette under sub-section (1) of section 51;

(l) “member” means a member of the Board and includes its Chairperson;

(m) “metropolitan area” means a compact area having a population of forty lakhs or more comprised in one or more districts;

(n) “non-metropolitan area” means a compact area having a population of more than ten lakhs but less than forty lakhs, comprised in one or more districts;

(o) “population” means the population as ascertained at the last preceding census of which the relevant figures have been published;

(p) “registered trade union” means a trade union registered under the Trade Union Act, 1926 (Central Act 16 of 1926) or Industrial Relations Code, 2020 (Central Act 35 of 2020);

(q) “rural area” means the area which is not the metropolitan area or non-metropolitan area;

(r) “Schedule” means the Schedule appended to these rules;

(s) “section” means a section of the Code;

(t) “semi-skilled occupation” means an occupation which in its performance requires the application of skill gained by the experience on job which is capable of being applied under the supervision or guidance of a skilled employee and includes supervision over the unskilled occupation;

(u) “skilled occupation” means an occupation which involves skill and competence in its performance through experience on the job or through training as an apprentice in a technical or vocational institute and the performance of which calls for initiation and judgment;

(v) “State Government” means the Government of the State of Haryana in the administrative department;

(w) “unskilled occupation” means an occupation which in its performance requires the application of simply the operating experience and involves no special skills;

Note: Words and expressions used herein and not defined shall have the meanings respectively assigned to them under the Code.

Section 3: Manner of Calculating the Minimum Rate of Wages

(1) For the purposes of sub-section (5) of section 6, the minimum rate of wages shall be fixed on the day basis keeping in view the following criteria, namely:-

(i) the standard working class family which includes a spouse and two children apart from the earning worker; an equivalent of three adult consumption units;

(ii) a net intake of 2700 calories per day per consumption unit;

(iii) 66 meters cloth per year per standard working class family;

(iv) housing rent expenditure to constitute 10 per cent of food and clothing expenditure;

(v) fuel, electricity and other miscellaneous items of expenditure to constitute 20 percent of minimum wage; and

(vi) expenditure for children education, medical requirement, recreation and expenditure on contingencies to constitute 25 percent of minimum wage;

(2) When the rate of wages for a day is fixed, then, such amount shall be divided by eight for fixing the rate of wages for an hour and multiplied by twenty six for fixing the rate of wages for a month and in such division and multiplication the factors of one-half and more than one-half shall be rounded as next figure and the factors less than one-half shall be ignored.

Section 4: Norms for Fixation of Minimum Rate of Wages

(1) While fixing the minimum rate of wages under section 6, the State Government shall divide the concerned geographical area into three categories, that is to say the metropolitan area, non-metropolitan area and the rural area.

(2) The State Government shall constitute a technical committee for the purpose of advising the State Government in respect of skill categorization, which shall consist of the following members, namely:-

(i) Administrative Secretary, Labour Chairperson

(ii) Labour Commissioner, Haryana Member Secretary

(iii) a representative from the Skill Development Mission, Haryana Member

(iv) Director General, Employment Department, Haryana Member

(v) One representative from the Finance Department, Member Haryana

(vi) two technical experts in wage determination as nominated by the State Government Members

(vii) Economic and Statistical Advisor, Haryana, Department of Planning Member

(3) The State Government shall, on the advice of the technical committee referred to in sub-rule (2), categorize the occupations of the employees into four categories that is to say unskilled, semi-skilled, skilled and highly skilled by modifying, deleting or adding any entry in the categorization of such occupations specified in Schedule-E.

(4) The technical committee referred in sub-rule (2),shall while advising the State Government under said sub-rule, take into account, to the possible extent, the national classification of occupation or national skills qualification frame work or other similar frame work for the time being formulated to identify occupations.

Section 5: Time Interval for Revision of Dearness Allowance

Every year, efforts must be made to ensure that the cost of living allowance and the cash value of the concession for necessities sold at a discount are computed once before the first of April and once again before the first of October in order to update the dearness allowance paid to employees earning the minimum wage.

Section 6: Number of Hours of Work which shall Constitute a Normal Working Day

(1) The normal working day under clause (a) of sub-section (1) of section 13 of the Code shall comprised of eight hours of work and one or more intervals of rest which in total shall not exceed one hour.

(2) The working day of an employee shall be so arranged that inclusive of the intervals of rest, if any, it shall not spread over more than twelve hours on any day.

(3) The provisions of sub-rule (1) and (2) shall, in the case of an employee employed in agricultural employment, be subject to such modifications as may, from time to time, be determined by the State Government.

(4) Nothing in this rule shall be deemed to affect the provisions of the Occupational Safety, Health and Working Conditions Code, 2020 (Central Act 37 of 2020).

Section 7: Weekly Day of Rest

(1) Subject to the provisions of this rule, an employee shall be allowed a day of rest every week (hereinafter referred to as “the rest day”) which shall ordinarily be Sunday, but the employer may fix any other day of the week as the rest day for any employee or class of employees:

Provided that an employee shall be entitled for the rest day under this sub-rule if he has worked under the same employer for a continuous period of not less than six days:

Provided further that the employee shall be informed of the day fixed as the rest day and of any subsequent change in the rest day before the change is effected, by display of a notice to that effect in the place of employment at the place specified in this behalf.

(2) Any such employee shall not be required or allowed to work on the rest day unless he has or will have a substituted rest day for a whole day on one of the five days immediately before or after the rest day:

Provided that no substitution shall be made which will result in the employee working for more than ten days consecutively without a rest day for a whole day.

(3) Where in accordance with the foregoing provisions of this rule, any employee works on a rest day and has been given a substituted rest day on any one of the five days before or after the rest day, the rest day shall, for the purpose of calculating the weekly hours of work, be included in the week in which the substituted rest day occurs.

(4) An employee shall be granted-

a. wages for rest day calculated at the rate applicable to the next preceding day; and

b. where he works on the rest day and has been given a substituted rest day,then, he shall be paid wages for the rest day on which he worked, at the overtime rate and wages for the substituted rest day at the rate applicable to the next preceding day: Provided that where-

i. the minimum rate of wages of the employee as notified under the Code has been worked out by dividing the minimum monthly rate of wages by twenty- six;or

ii. the actual daily rate of wages of the employee has been worked out by dividing the monthly rate of wages by twenty-six and such actual daily rate of wages is not less than the notified minimum daily rate of wages of the employee, then, no wages for the rest day shall be payable; and

iii. the employee works on the rest day and has been given a substituted rest day, then, he shall be paid, only for the rest day on which he worked, an amount equal to the wages payable to him at the overtime rate; and, if any, dispute arises, whether the daily rate of wages has been worked out in accordance with the provisions of this proviso, quasi judicial authority may as notified by State Government, on application made to him in this behalf, decide the same, after giving an opportunity to the parties concerned to make written representations.

Provided further that in case of an employee governed by a piece-rate system, the wages for the rest day, or the substituted rest day, as the case may be, shall be such as the State Government may, from time to time determine having regard to the minimum rate of wages fixed under the Code, in respect of the employment.

(5) The provisions of this rule shall not operate to the prejudice of more favourable terms, if any, to which an employee may be, entitled under any other law or under the terms of any award, agreement or contract of service, and in such a case, the employee shall be entitled only to more favourable terms aforesaid.

Note: For the purposes of this rule, ‘week’ shall mean a period of seven days beginning at midnight on Saturday night.

Section 8: Night Shifts

Where an employee in an employment works on a shift which extends beyond midnight, then,-

(a) A rest day for the whole day for the purposes of rule 7 shall, in this case means a period of twenty- four consecutive hours beginning from the time when his shift ends; and

(b) The following day in such a case shall be deemed to be the period of twenty-four hours beginning from the time when such shift ends, and the hours after midnight during which such employee was engaged in work shall be counted towards the previous day.

Section 9: Extent and Conditions for the Purposes of Sub-section (2) of Section 13

In case of employees-

(a) engaged in any emergency which could not have been foreseen or prevented;

(b) engaged in work of the nature of preparatory or complementary work which must necessarily be carried on outside the limits laid down for the general working in the employment concerned;

(c) whose employment is essentially intermittent;

(d) engaged in any work which for technical reasons has to be completed before the duty is over; and

(e) engaged in a work which could not be carried on except at times dependent on the irregular action of natural forces;

the provisions of rules 6, 7 and 8 shall apply subject to the condition that –

(i) the spread over of the hours of work of the employee shall not exceed 16 hours in any day; and

(ii) the actual hours of work excluding the intervals of rest and the periods of inaction during which the employee may be on duty but is not called upon to display either physical activity or sustained attendance shall not exceed 9 hours in any day.

Section 10: Longer Wage Period

For the purposes of minimum rate of wages under section 14 of the Haryana code on wages rules, shall be by the month.

Section 11: Circumstances under Clause (ii) of the Proviso to Section 10

An employee shall not be entitled to receive wages for a full normal working day under section 10, if he is not entitled to receive such wage under any other law for the time being in force.

Section 12: Recovery under Sub-section (4) of Section 18

If the total deductions permitted by subsection (2) of section 18 are greater than fifty percent of an employee's wages, the excess shall be carried forward and recovered from the wages of the following wage period or wage periods, as the case may be, in such installments so that the recovery in any given month does not exceed fifty percent of the employee's wages in that month.

Section 13: Appointment of Authority under Sub-section (1) of Section 19

The Deputy Labour Commissioner shall be the prescribed authority for the purpose of sub-section (1) of section 19.

Section 14: Manner of Exhibiting the Notice under Sub-section(2) of section 19

A notice referred to in sub-section(2) of section 19 shall be displayed in both the languages i.e. English and Hindi at the conspicuous places in the premises of the work place in which the employment is carried on, so that every concerned employee may be able to easily read the contents of the notice and a copy of the notice shall be sent to the Inspector- cum-Facilitator having jurisdiction of that area.

Section 15: Procedure under Sub-section (3) of Section 19

The employer shall give an intimation in writing specifying therein, the detailed particulars for obtaining the approval of the imposition of fine to the authority referred in rule 13, who shall, before granting or refusing the approval, give opportunity of being heard to the employee and the employer concerned.

Section 16: Intimation of Deduction

(1) Where an employer makes any deduction in pursuance of the proviso to sub- section (2) of section 20, he shall give intimation of such deduction to the Inspector-cum- Facilitator having jurisdiction within ten days from the date of such deduction explaining therein the reason of such deduction.

(2) The Inspector-cum-Facilitator shall, after receiving intimation under sub-rule (1), examine such intimation and if he finds that the explanation given therein is in contravention of any provision of the Code or the rules made thereunder, issue the notice of illegal deduction made and direct employer to comply with notice made thereunder and in case of non compliance, he shall initiate appropriate action under the Code against the employer, after giving opportunity to the employer.

Section 17: Procedure for Deduction under Sub-section (2) of Section 21

Any employer desiring to make deduction for damages or loss under sub-section (1) of section 21 from the wages of an employee shall in the Form-I.

(i) explain to the employee personally and also in writing the damage or loss of goods expressly entrusted to the employee for custody or for loss of money for which he is required to account and how such damages or loss is directly attributable to the neglect or default of the employee; and

(ii) thereafter, give the employee an opportunity to offer any explanation and deduction for any damages or loss, if made, shall be intimated to the employee within fifteen days from the date of such deduction.

Section 18: Conditions Regarding Recovery of Advance under Section 23

The recovery, as the case may be of,

(i) advances of money given to an employee after the employment begins under clause (b) of section 23;or

(ii) advances of wages to an employee not already earned under clause (c) of section23, shall be made by the employer from the wages of the concerned employee in installments determined by the employer, so as any or all installments in a wage period shall not exceed fifty percent of the wages of the employee in that wage period and the particulars of such recovery shall be recorded in the register maintained in Form-I.

Section 19: Deduction for Recovery of Loans under Section 24

Deductions for recovery of loans granted for house building or other purposes approved by the State Government, and the interest due in respect thereof shall be, subject to any direction made or circular issued by the State Government from time to time regulating the extent to which such loans may be granted and the rate of interest shall be payable thereon.

Section 22: Computation of Gross Profits under Clause (a) of Section 32

The gross profits derived by an employer from an establishment in respect of the accounting year shall in the case of banking company, be calculated in the manner specified in Schedule B.

Section 23: Computation of Gross Profits under Clause (b) of Section 32

The gross profits derived by an employer from an establishment in respect of the accounting year in a case other than banking company, be calculated in the manner specified in Schedule C.

Section 24: Deduction of Further Sums under Clause (c) of Section 34

The further sums as are specified in respect of the employer in Schedule D shall be deducted from the gross profit as prior charges under clause (c) of section 34.

Section 25: Manner of Carrying Forward under Sub-section (1) of Section 36

When the allocable surplus for a given accounting year exceeds the maximum bonus that can be paid to the employees in the establishment under Section 26, the excess may be carried forward for application in the following accounting year, up to and including the fourth accounting year, subject to a cap of 20% of the total salary or wage of the employees employed in the establishment at the time. This should be done as illustrated in Schedule A.

Section 26: Manner of Carrying Forward under Sub-section (2) of Section 36

If, for any accounting year, there is no available surplus or the allocable surplus in respect of that year is less than the minimum bonus payable to the establishment's employees under Section 26 and there is no amount or insufficient amount carried forward and set on under Rule 25, then, as applicable, such minimum amount or the deficiency shall be carried forward for the following accounting year and so on up to and inclusive of the fourth accounting year in such manner illustrated in Schedule A.

Section 27: Constitution of the Haryana State Advisory Board and Other Committees under Sub- section 4 and 6 of Section 42

The Haryana State Advisory Board shall consist of the following members, including the Chairperson –

(1) State Government Representatives: -

(a) Administrative Secretary to Government, Haryana, Labour Department Chairperson

(b) Labour Commissioner, Haryana Member Secretary

(c) Special Secretary / Secretary to Government, Haryana, Finance Department Member

(d) Economic and Statistical Advisor, Haryana Member

(e) Director General / Director Employment Department, Haryana Member

(f) One technical expert in wage determination as nominated by State Government Members

(2) All official members shall be deemed to be independent persons.

(3) Representing Employers.

(4) Representing employees. Provided that the number of members representing employers shall not exceed six and the number of representing employees shall be equal in number of the members representing employer. Provided further that one third member of the Board shall be women.

(5) The Board may constitute committees and sub-committees under sub-section (5) of section 42 thereof, which may consist of persons––

(a) Representing employers;

(b) Representing employees, which shall be equal in number of the members specified in clause (a); and

(c) Independent persons, not exceeding one-third of the total members of the committee or sub-committee, as the case may be.

Note: Provided that one-third of the members of committee or sub-committee shall be women and one among the members specified in clause (c) shall be appointed by the Haryana State Advisory Board as the Chairperson of the committee or sub- committee, as the case may be.

Section 29: Meeting of the Board

The Chairperson may, subject to the provisions of rule 31, call a meeting of the Board, at any time he thinks fit:

Provided that on requisition in writing from not less than one half of the members, the Chairperson shall call a meeting within thirty days from the date of the receipt of such requisition.

Section 30: Notice of Meetings

The Chairperson shall fix the date, time and place of every meeting and a notice in writing containing the aforesaid particulars along with a list of business to be conducted at the meeting, shall be sent to each member by registered post and electronically at least fifteen days before the date fixed for such meeting:

Provided that in the case of an emergent meeting, notice of seven days only may be given to every member.

Section 31: Functions of Chairperson

The Chair person shall-

(i) preside over the meetings of the Board. Provided that in the absence of the Chairperson at any meeting, the members shall elect from amongst themselves by a majority of votes, a member who shall preside over such meeting;

(ii) decide agenda of each meeting of the Board.

(iii)where in the meeting of the Board, if any, issue has to be decided by voting, conduct the voting and count or cause to be counted the secret voting in the meeting.

Section 32: Quorum

No business shall be transacted at any meeting unless at least one-third of the members and at least one representative member each of both the employers and an employee are present:

Provided that, if at any meeting less than one-third of the members are present, the Chairperson may adjourn the meeting to a date not later than seven days from the date of the original meeting and it shall thereupon be lawful to dispose of the business at such adjourned meeting irrespective of the number of members present:

Provided further that the date, time and place of such adjourned meeting shall be intimated to all the members electronically or by a registered post.

Section 33: Disposal of Business of the Board

All business of the Board shall be considered at a meeting of the Board, and shall be decided by a majority of the votes of members present and voting and in the event of an equal number of votes, the Chairperson shall have a casting vote:

Provided that the Chairperson may, if he thinks fit, direct that any matter shall be decided by circulation of necessary papers and by securing written opinion of the members:

Provided further that no decision on any matter under the preceding proviso shall be taken, unless supported by not less than two-third majority of the members.

Section 34: Method of Voting

Ordinarily, votes in the Board are cast by show of hands, but if a member requests a secret ballot or if the Chairperson so determines, the vote will be cast in the manner the Chairperson specifies.

Section 35: Proceedings of the Meetings

(1) The proceedings of each meeting of the Board showing inter alia the names of the members present there, shall be forwarded to each member and to the State Government as soon after the meeting as possible, and in any case, not less than seven days before the next meeting.

(2) The proceedings of each meeting of the Board shall be confirmed with such modification, if any, as may be considered necessary at the next meeting.

Section 36: Summoning of Witnesses and Production of Documents

(1) The Chairperson may summon any person to appear as a witness if required in the course of the discharge of his duty and require any person to produce any document.

(2) Every person who is summoned and appears as a witness before the Board shall be entitled to an allowance for expenses by him in accordance with the scale for the time being in force for payment of such allowance to witnesses appearing before a civil court.

Section 38: Term of Office of the Members of the Board

(1) The term of office of the Chairperson or a member, as the case may be, shall be normally two years commencing from the date of his appointment or nomination, as the case may be, under sub-section (6) and sub-section (7) of section 42:

Provided that such Chairperson or a member shall, notwithstanding the expiry of the said period of two years, continue to hold office until his successor is appointed or nominated, as the case may be.

(2) Member of the Board, nominated to fill a casual vacancy shall hold office for the remaining period of the term of office of the member in whose place he is nominated.

(3) The official members of the Board shall hold office till they are replaced by other official members.

(4) Notwithstanding anything contained in sub-rule (1), (2) and (3), the members of the Board shall hold office during the pleasure of the State Government.

Section 39: Travelling Allowance

The chairperson and every member of the Board shall be entitled to draw travelling and halting allowance for any journey performed by him in connection with his duties at the rates and subject to the conditions applicable to a Group A officer of the State Government.

Section 40: Eligibility for Re-nomination of the Members of the Board

The State Government may designate such officers and personnel to the Board, as it may deem essential for the Board's operation, along with a Secretary to the committee of the Board (not below the rank of Group A officer of the Labor Department).

Section 41: Eligibility for Re-nomination of the Members of the Board

An outgoing member shall be eligible for re- nomination for the membership of the Board for not more than total two terms.

Section 42: Resignation of the Chairperson and Other Members of the Board

(1) A member of the Board, other than the Chairperson, may, by giving notice in writing to the Chairperson, resign his membership and the Chairperson may resign by a letter addressed to the State Government.

(2) A resignation shall take effect from the date of communication of its acceptance or on the expiry of thirty days from the date of resignation, whichever is earlier.

(3) When a vacancy occurs or is likely to occur in the membership of the Board, the Chairperson shall submit a report to the State Government immediately and the State Government shall, then, take steps to fill the vacancy in accordance with the provisions of the Code.

Section 43: Cessation of Membership

If a member of the Board, fails to attend three consecutive meetings, without prior intimation to the Chairperson, he shall, cease to be a member thereof.

Section 44: Disqualification

(1) A person shall be disqualified for being nominated as, and for being a member of the Board–

(i) if he is declared to be of unsound mind by a competent court; or

(ii) if he is an un-discharged insolvent; or

(iii) if before or after the commencement of the Code, he has been convicted of an offence involving moral turpitude.

(2) If any question arises whether a disqualification has been incurred under sub-rule (1), the decision of the State Government thereon shall be final.

Section 45: Payment under Clause (a) of Sub-section (1) of Section 44

When a payment due to an employee under the Code is due after the employee's passing or because his whereabouts are unknown and the payment could not be made to the employee's nominee until three months had passed when the payment was due then, such amount shall be deposited by the employer with the

authority as appointed under sub-section (1) of section 45 of the Code having jurisdiction, who shall disburse the amount to the person nominated by the employee after ascertaining his identity within two months of the date on which the amount was so deposited with him.

Section 46: Deposit of the Undisbursed Dues under Clause (b) of Sub-section(1) of Section 44

(1) Where any amount payable to an employee under this Code remains undisbursed because either no nomination has been made by such employee or for any other reason, such amounts could not be paid to the nominee of employee until the expiry of six months from the date the amount had become payable. All such amounts shall be deposited by the employer with the authority as appointed under sub-section (1) of section 45of the Code having jurisdiction, before the expiry of the fifteenth day after the last day of the said period of six months.

(2) The amount referred to in sub-rule (1) shall be deposited by the employer with the said authority through bank transfer or through a crossed demand draft obtained from any scheduled bank in India drawn in favour of the said authority.

Section 47: Manner of Dealing with the Undisbursed Dues under Clause (b) of Sub-section (1) of Section 44

(1) The amount referred to in sub rule (1) of rule 46 deposited by the employer with the authority appointed under sub-section (1) of section 45 shall remain with him and be invested in the Central or State Government Securities or deposited as a fixed deposit in a scheduled bank.

(2) The said authority shall after obtaining the approval of the State Government, exhibit, as soon as maybe possible, a notice containing such particulars regarding the amount, considers sufficient for information, at least for fifteen days on the notice board and also publish such notice in any two newspapers being circulated in the language commonly understood in the area in which undisbursed wages were earned.

(3) Subject to the provision of sub-rule (2), such authority shall release the amount to the nominee or to that person who has claimed such amount, as the case may be, in whose favor such authority has decided, after giving the opportunity of being heard, the amount to be paid and a detailed intimation in this regard shall be submitted to the State Government.

(4) If the undisbursed amount remains unclaimed for a period of five years, the same shall be transferred to the account of the Haryana Labour Welfare Board by the said authority.

Section 48: The Form of a Single Application

A single application may be filed in duplicate under sub-section (5) of section 45 in Form-II along with documents specified in such Form, one copy of which shall bear such court-fee as may be specified.

Section 49: Authorisation

The authorisation to act on behalf of an employee under section 45 shall be given in Form-VIII and shall be presented to the authority bearing the application and shall form part of the record.

Section 50: Permission to Appear

Any person desiring the permission of the Authority to act on behalf of any employee or employees shall present to the authority a brief written statement explaining his interest in the matter and the authority shall record an order on the statement which in the case of refusal, shall include reasons for the order and shall incorporate in the record.

Section 51: Presentation of Documents

(1) Applications or other documents relevant to an application may be presented in person to the authority at any time during working hours, or may be sent to him by registered post.

(2) The authority shall at once endorse or cause to the endorsed, on each document the date of the presentation or receipt, as the case may be.

Section 52: Refusal to Entertain Application

(1)The authority may refuse to entertain an application presented under rule 51, if after giving the applicant an opportunity of being heard, the authority is satisfied, for reasons to be recorded in writing, that -

(a) the applicant is not entitled to present an application; or

(b) the application is barred by reason of the provisions to sub-section (6) of section 45; or

(c) the applicant shows no sufficient cause for making a direction under section 45.

(2) The authority may refuse to entertain an application which is insufficiently stamped or is otherwise incomplete and, if he so refuses, shall return it at once with an indication of the defects. If the application is presented again after the defects have been made good, the date of representation shall be deemed to be the date of presentation for the purpose of sub-section (6) of section 45.

Section 53: Appearance of Parties

(1)If the application is entertained, the authority shall call upon the employer by a notice in Form IX to appear before him on a specified date together with all relevant documents and witnesses, if any and shall inform the applicant of the date so specified.

(2) If the employer or his representative fails to appear on the specified date, the authority may proceed to hear and determine the application ex parte.

(3) If the applicant fails to appear on the specified date, the authority may dismiss the application: Provided that an order passed under sub-rule (2) or sub-rule(3) may be set aside and the application reheard on good cause being shown within one month of the date of the said order, notice being served on the opposite party of the date fixed for hearing.

Section 54: Record of Proceeding

(1) The authority shall in all cases enter the particulars indicated in Form X, the date, time of passing order and shall sign and mention the date in Form.

(2) In a case where no appeal lies, no further record shall be necessary.

(3) In a case where an appeal lies, the authority shall record the substance of the evidence and shall append it under the signatures to the record of order or direction.

Section 55: Signatures on Forms

Any Form which is required by these rules to be signed by the authority may be signed by him or under his direction and on his behalf by any officer subordinate to him appointed by him in writing for this purpose.

Section 56: Exercise of Powers

In exercise of powers of a civil court conferred by sub-section (7) of section 45, the authority and the appellate authority shall be guided in respect of procedure by the relevant orders of the first Schedule of the Code of Civil Procedure, 1908 (Central Act 5 of 1908), with such alterations as the authority may find necessary, not affecting their substance, for adopting them to the matter before him and save where they conflict with the express provisions of the Act of these rules.

Section 57: Appeals

(1) Any person aggrieved by an order passed by the authority under sub-section (2) of section 45 may prefer an appeal under sub-section (1) of section 49 in Form-III, along with documents mentioned by the appellant in such Form, to the appellate authority having jurisdiction.

(2) An appeal shall be preferred in duplicate in the form of a memorandum, one copy of which shall bear the prescribed court fees, setting forth concisely the grounds of objection to the order on an application made under sub-section (4) of section 45, as the case may be and shall be accompanied by a certified copy of the said order or direction.

(3) When an appeal is lodged a notice shall be issued to the respondent in Form XI.

(4) The appellate authority after hearing the parties and after such further enquiry, if any, as it may deem necessary may confirm, vary, or set aside the order or direction for which the appeal is preferred and shall make an order accordingly.

Section 58: Order or Direction When to be Made

The authority or the appellate authority, as the case may be, after the case has been heard, shall make the order or direction either at once or, as soon thereafter as may be practicable, on some future date; and when the order or direction is to be made on some future date, it shall fix date for the purpose of which due notice shall be given to the parties or their pleaders.

Section 59: Inspection of Documents

Any employee or any employer or his representative, or any person permitted under sub-section (4) of section 45, to apply for a direction, shall be entitled to inspect any application, memorandum of appeal, or any other documents filed with the authority or the appellate authority, as the case may be, in a case to which he is a party and may obtain copies thereof on the payment of such fees as may be specified.

Section 60: Cost

(1) The authority or the appellate authority, for reasons to be recorded in writing, may direct that the cost of any proceeding pending before it shall not follow the event. Provided that said cost shall be deposited with the district legal service authority and receipt to this effect shall be produced on the record file by the depositor with the authority.

(2) The cost which may be awarded shall include :

(i) expense incurred on account of court fees;

(ii) expense incurred on subsistence money to witness; and

(iii) advocates fees to the extent of one thousand rupees provided that the authority in any proceeding may reduce the fees to a sum not less than five hundred rupees of for reasons to be recorded in writing or increases it to a sum not exceeding five thousand rupees:

Provided that where there are more than one advocate or more than one applicant or opponent the authority may, subject to aforesaid condition award such cost as it may deemed proper to the successful party or parties: Provided further that the authority may, if in its opinion the applicant is a pauper, exempt him wholly or partly from the payment of such cost.

Section 61: Court Fees

The court fee payable in respect of proceedings under sub-section (2) section 45 shall be :

(i) for every application - twenty five rupees in respect to summon a witness or each witness:

(ii) for every application - ten rupees made by or on behalf of individual: Provided that the authority may, if in its opinion the applicant is a pauper, exempt him wholly or partly from the payment of such fees:

Provided further that no fee shall be chargeable in respect of an application presented by Inspector-cum-Facilitator.

Section 62: Form of Register, etc.

(1) All fines and all realizations thereof referred to in sub-section (8) of section 19 shall be recorded in a register to be kept by the employer in Form – I, electronically or otherwise.

(2) All deductions and all realizations referred to in sub-section (3) of section 21 shall be recorded in a register to be kept by the employer in Form- I, electronically or otherwise.

(3) Every employer of an establishment to which the Code applies shall maintain registers under sub-section (1) of section 50 in Form I, Form IV and Form VII, electronically or otherwise. Provided that where an establishment has been permanently closed, the Inspector- cum-Facilitator may demand the production of the registers and records in his office or such other place as may be nearer to the employer.

Section 63: Wage slip

Every employer shall issue wage slips, electronically or otherwise to the employees in Form-V under sub-section (3) of section 50, before a day prior to payment of wages.

Section 64: Manner of Holding Enquiry under Sub-section (1) of Section 53

(1) When a complaint is filed before the officer appointed under sub-section (1) of section 53 (hereinafter referred to as the concerned officer) in respect of the offences referred to in the said sub-section either by the concerned officer authorized for such purpose by the State Government or by an employee aggrieved or by a registered trade union registered under the Trade Unions Act, 1926 / Industrial Relations Code, 2020 or an Inspector-cum-Facilitator, the concerned officer, after considering such evidences as produced before him by the complainant, is of the opinion that an offence has been committed, shall issue summons to the offender on the address specified in the complaint fixing a date for his appearance.

(2) If the offender to whom the summons has been issued under sub rule (1) appears or is produced before the concerned officer, he shall explain the offender the offence complained against him and if the offender pleads guilty, the officer shall impose penalty on him in accordance with the provisions of the Code and when the offender does not plead guilty, the officer shall take evidence of the witnesses produced by the complainant on oath and provide opportunity of cross examination of the witnesses so produced. The concerned officer shall record the statement of the witnesses on oath and in cross examination in writing and take the documentary evidence on record.

(3) The concerned officer shall, after the complainant’s evidence is complete, provide opportunity of defence to the accused person and the witnesses produced by the accused shall be cross examined after their statements on oath by the complainant and documentary evidence in defence shall be taken on record by the concerned officer.

(4) The concerned officer shall, after hearing the parties and considering the evidences both oral and documentary, decide the complaint in accordance with the provisions of the Code.

Section 65: Manner of Imposing Fine under Sub-section (1) of Section 56

(1) An accused person desirous of making composition of offence under sub-section (1) of section 56 may make an application in Form VI electronically or otherwise to the Gazetted Officer notified under said sub-section(1) of section 56.

(2) The Gazetted Officer referred to in sub-rule (1), shall, on receipt of such application, satisfy himself as to whether the offence is compoundable or not under the Code and if the offence is compoundable and the accused person agrees for the composition, compromise the offence for a sum of fifty per cent of the maximum fine provided for such offence under the Code, to be paid by the accused within the time specified in the order of composition issued by such officer.

(3) Where the offence has been compromised under sub-rule (2) after the institution of the prosecution, then the officer shall send a copy of such order made by him for intimation to the officer referred to in sub-section (1) of section 53for needful action under sub-section (6) of section 56.

Section 66: Timely Payment of Wages

Where the employees are employed in an establishment through contractor, then, the company or firm or association or any other person who is the proprietor of the establishment shall pay to the contractor the amount payable to him or it, as the case may be, before the date of payment of wages so that payment of wages to the employees shall be made positively in accordance with the provisions of section 17 of the Code.

Note: For the purpose of this rule, the expression “firm” shall have the meaning as assigned to it in the Indian Partnership Act, 1932 (Central Act 9 of 1932).

Section 68: Responsibility for Payment of Minimum Bonus

Where in an establishment, the employees are employed through contractor and the contractor fails to pay minimum bonus to them under section 26 of the Code, then, the company or firm or association or other person as referred to in the proviso to section 43 of the Code shall, on the written information of such failure, given by the employees or any registered trade union or unions of which the employees are members and on confirming such failure, pay such minimum bonus to the employees.

Section 69: Inspection Scheme

(1) For the purposes of the Code and these rules, there shall be formulated an inspection scheme by the Labour Commissioner with the approval of the State Government.

(2) In the inspection scheme referred to in sub-rule (1), apart from other structural facts, a number shall be specified in the scheme for each Inspector-cum-Facilitator and establishment.

Section 70: Repeal and Savings

The Punjab Minimum Wages Rules, 1950, the Punjab Payment of Wages (Procedure) Rules, 1965 and the Punjab Payment of Wages Rules, 1937 as applicable to the State of Haryana are hereby repealed. Provided that any order issued or any action taken under the aforesaid rules so repealed, shall be deemed to have been issued or taken under the corresponding provisions of these rules.

Compliances as per the Haryana Code on Wages Rule 2021

- Form I - Register of Wages, Overtime, Fine, Deduction for damage and Loss [Rule 17, 18 and 62]

- Form II - Single Application u/s 45 (5) before the Authority appointed u/s 45(1) of the Code on Wages, 2019 [Rule 48]

- Form III - Appeal u/s 49(1) of the Code on Wages, 2019 before the Appellate Authority [Rule 57(1)]

- Form IV – Employee Register [Rule 62(3)]

- Form V – Wage Slip [Rule 63]

- Form VI – Application u/s 56(4) for Composition of Offense [Rule 65(1)]

- Form VII – Bonus Paid to Employees for the Accounting Year ending on the ……….[Rule 62(3)]

- Form VIII - Certificate of Authorization [Rule 49]

- Form IX - Notice for the disposal of application [Rule 53(1)]

- Form X - Record of order or direction [Rule 54(1)]

- Form XI - Notice to respondent of the day fixed for the hearing of the appeal under section 45 (2) of the Code on Wages, 2019 [Rule 57(3)]

FAQs related to Haryana Code on Wages Rule 2021

- What is the Code on Wages, Haryana, Rules 2021?

The Code on Wages, Haryana, Rules 2021 is a set of rules and regulations formulated by the Haryana government to regulate and enforce wage-related laws for workers in the state.

- Who does the Code on Wages, Haryana, Rules 2021 apply to?

The Code on Wages, Haryana, Rules 2021 applies to all workers in Haryana who are engaged in any kind of employment, whether in the organized or unorganized sector.

- What is the minimum wage as per the Code on Wages, Haryana, Rules 2021?

The minimum wage as per the Code on Wages, Haryana, Rules 2021 varies based on the skill level of the worker. For unskilled workers, the minimum wage is Rs. 9,572 per month, while for skilled workers, it is Rs. 11,655 per month.

- Can an employer pay wages below the minimum wage prescribed by the Code on Wages, Haryana, Rules 2021?

No, an employer cannot pay wages below the minimum wage prescribed by the Code on Wages, Haryana, Rules 2021. Doing so is a punishable offense.

- How are wages calculated as per the Code on Wages, Haryana, Rules 2021?

Wages are calculated on the basis of the number of hours worked by the worker. For workers who are paid on a daily basis, wages are calculated by multiplying the daily wage rate with the number of days worked. For workers who are paid on an hourly basis, wages are calculated by multiplying the hourly wage rate with the number of hours worked.

- Are there any restrictions on the deductions that can be made from a worker's wages as per the Code on Wages, Haryana, Rules 2021?

Yes, there are restrictions on the deductions that can be made from a worker's wages. Deductions cannot exceed 50% of the worker's total wages.

- Can an employer withhold payment of wages as per the Code on Wages, Haryana, Rules 2021?

No, an employer cannot withhold payment of wages. Doing so is a punishable offense.

- Are there any provisions for overtime pay as per the Code on Wages, Haryana, Rules 2021?

Yes, there are provisions for overtime pay. Workers who work beyond their normal working hours are entitled to overtime pay at a rate of twice their normal wage rate.

- What is the frequency of wage payments as per the Code on Wages, Haryana, Rules 2021?

Wages must be paid at least once a month as per the Code on Wages, Haryana, Rules 2021.

- What are the penalties for non-compliance with the Code on Wages, Haryana, Rules 2021?

Non-compliance with the Code on Wages, Haryana, Rules 2021 can result in penalties ranging from fines to imprisonment, depending on the severity of the offense.

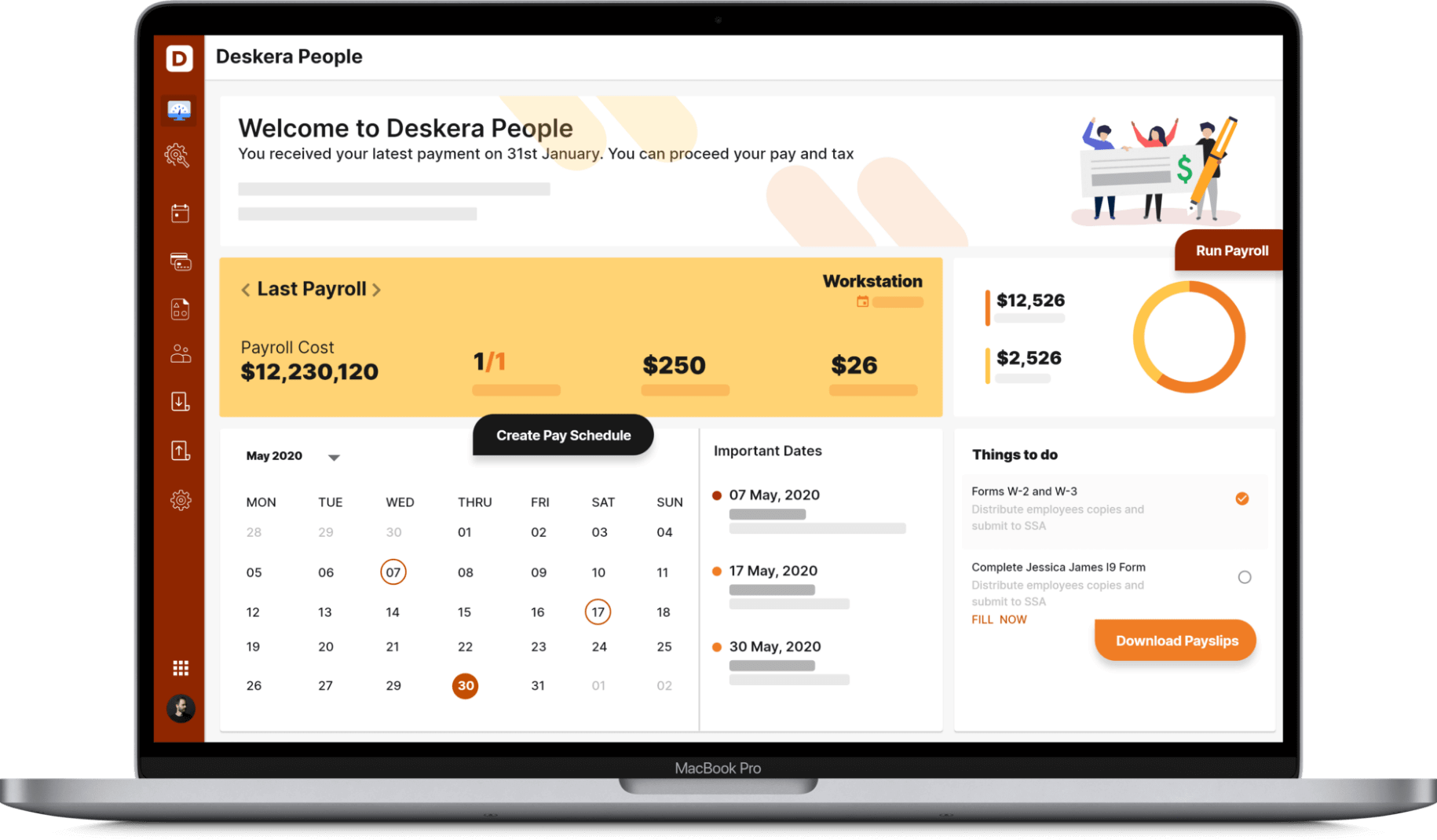

How can Deskera Help You?

Deskera can help with code on wages, Haryana, rules, 2021 in the following ways:

- Compliance Management: Deskera can help businesses stay compliant with the new code on wages, Haryana, rules, 2021. The platform can help organizations keep track of changes in the laws and regulations, and provide real-time updates and alerts.

- Payroll Management: Deskera People has a payroll management system, which can automate the calculation of wages, taxes, and other deductions based on the new code on wages, Haryana, rules, 2021. This can save time and reduce the risk of errors.

- Record-Keeping: The new code on wages, Haryana, rules, 2021, requires businesses to maintain accurate records of employee wages, benefits, and deductions. Deskera's People, its HR software can help businesses keep track of this information and generate reports as needed.

- Employee Self-Service: Deskera's HR software includes an employee self-service portal, which allows employees to view their pay stubs, request time off, and update their personal information. This can reduce administrative burden on HR departments and improve employee satisfaction.

- Reporting: The new code on wages, Haryana, rules, 2021, requires businesses to file various reports, such as annual returns and audit reports. Deskera's reporting tools can help organizations generate these reports accurately and quickly.

Key Takeaways

The Code on Wages, Haryana, Rules, 2021 is a set of regulations that have been enacted by the Haryana State Government to implement the provisions of the Code on Wages Act, 2019 in the state of Haryana.

It includes various provisions related but not limited to the following:

- Payment of wages

- Fixation of minimum wages

- Payment of bonus

- Maintenance of registers and records

- Inspections and penalties

The Haryana Code on Wages Rules, 2021 is applicable to the entire state of Haryana, and was notified in the official gazette on 16th September, 2021.

Deskera can help your business navigate the new code on wages, Haryana, rules, 2021, and ensure compliance with the regulations. The platform can also streamline HR processes and improve efficiency.

Related Articles