According to the Bureau of Labor Statistics' 2022 labor report, 9.9 million Americans, or 6% of the total population, are classified as "self-employed." Every self-employed person is required to pay self-employment taxes for Social Security and Medicare. This tax is analogous to FICA taxes, which are the Social Security and Medicare taxes withheld from employees' paychecks.

All references to self-employment tax in the text below relate to Social Security and Medicare taxes alone, and do not include any additional taxes that self-employed people may be obliged to file. Learn how to compute self-employment tax in a few simple steps in this article to avoid unpleasant surprises at tax time. Here's what we'll talk about:

- What is Self-Employment Tax?

- Steps to calculate self-employment tax

- What Are the Effects of Self-Employment Taxes on Your Personal 1040 Tax Bill?

- What Impact Does My Business Type Have on Your Self-Employment Earnings?

- How to Make a Self-Employment Tax Payment?

- Key takeaways

What is Self-Employment Tax?

Individuals who work for themselves are subject to the self-employment tax, which is made up of Social Security and Medicare levies. It's identical to the Social Security and Medicare taxes taken from most wage employees' paychecks, which total 15.3% of your wages. As a reminder, people who work for themselves must pay both income tax and self-employment tax because they are both the employer and the employee, and thus are taxed on both sides. SECA Tax (Self-Employed Contributions Act) is another name for this tax.

Most wage earners' Social Security and Medicare taxes are calculated by their employers. Schedule SE, on the other hand, is used to calculate self-employment tax (SE tax) (Form 1040 or 1040-SR). Also, when calculating your adjusted gross income, you can deduct the employer-equivalent share of your SE tax. Taxes on Social Security and Medicare cannot be deducted by wage workers.

Whether you work for yourself or for a company, you will almost certainly be required to contribute to Social Security and Medicare. The fact that your employer splits the Social Security and Medicare taxes with you when you are given compensation as an employee is a significant difference. You are accountable for the entire 15.3 percent if you are self-employed.

What Does Being Self-Employed Mean?

If either of the following applies to you, you're self-employed, according to the Internal Revenue Service (IRS):

- You are a sole proprietor of a trade or business.

- You are a member of a partnership or limited liability company (LLC) that carries on a trade or business and files a Form 1065, U.S. Return of Partnership Income.

If you run your own firm, even if it's only part-time, you're self-employed. If you're an independent contractor or freelancer who works for someone but isn't an employee, you're considered self-employed.

You get a 1099-NEC tax form from someone for whom you work.

You are NOT self-employed:

- If you're an owner (shareholder) of a corporation, you're not self-employed.

- If you simply get a W-2, you're not self-employed (the annual tax report for employees).

In one job, you can be self-employed, while in another, you can be an employee.

What Is the Rate of Self-Employment Tax?

The self-employment tax rate is made up of three parts:

The base rate is: The self-employment tax rate is 15.3% of net self-employment income, although the Social Security share of this tax is capped at the maximum annual Social Security income. If your net earnings from self-employment are $400 or more during the year, you must pay self-employment tax and file Schedule SE.

For 2021, any combination of the Social Security part of self-employment tax, Social Security tax, or railroad retirement (tier 1) tax will apply to the first $142,800 of your combined salary, tips, and net earnings. For 2022, the amount has been doubled to $147,000. (For prior-year SE tax rates, see the Schedule SE for that year.)

All of your current year's combined salaries, tips, and net profits are liable to the 2.9 percent Medicare portion of the Self-Employment tax, Social Security tax, or railroad retirement (tier 1) tax.

As Adjustment, Self-employment tax is applied on 92.35 percent of your net self-employed earnings. The Medicare tax applies to all of your wages, including the additional Medicare tax for higher-earning persons.

Employer-equivalent credit, before calculating your adjusted gross income on the owner's tax return, half of the computed self-employment tax is credited back to the firm owner. The "employer-equivalent" portion of your self-employment tax is what the IRS refers to. This deduction has no impact on your self-employment net earnings or self-employment tax.

Wages, compensation, and self-employment income above a threshold amount received in taxable years beginning after December 31, 2012 are subject to an extra 0.9 percent Medicare tax rate.

Who Must Pay Self-Employment Tax?

You may be required to pay self employment tax depending on your business structure and tax filing status. If you match one of the following conditions, you are eligible.

• You're a sole proprietor.

• You own a single-member LLC;

• You operate as an independent contractor;

• You are a partner in a lawful commercial partnership; and

• You are a member of a partnership LLC.

What if you earn a living as an employee while also working on a side project? Then you could have to pay self-employment tax on your side hustle profits. In this instance, you'll almost certainly want to use the Long Schedule SE to ensure that the FICA taxes paid through your W-2 job are taken into account. In a nutshell, the Long Schedule SE should keep you from paying too much SE tax.

If you make all of your money through self-employment (i.e., you don't get a W-2), you should probably look at the Short Schedule SE, which is really, incredibly short.

Tax Deduction for Self-Employment

In calculating your adjusted gross income, you can deduct the employer-equivalent share of your self-employment tax.

Only your income tax is affected by this deduction. It has no impact on either your self-employment net earnings or your self-employment tax.

You may be eligible for the Earned Income Tax Credit if you file a Form 1040 or 1040-SR Schedule C. (EITC). Find out more about the EITC or use the EITC Assistant to see if you qualify.

Steps to calculate self-employment tax

It's time to put your third-grade cap on and learn some multiplication tables. But this time, the figures are bigger (and stranger). Knowing how to calculate self-employment tax is a useful skill that will help you file your taxes more efficiently.

To figure out how much you owe, follow the instructions below. Always seek the advice of a tax specialist or accountant if you are unsure.

1st step: Get your 1040 Form out of the drawer.

When you work for yourself, you'll need to become acquainted with a personal income tax return, Form 1040, and Schedule SE, which calculates your self-employment tax. Although you won't use this form to crunch the numbers, we'll show you where to keep track of critical computations because you can deduct a portion of your SE taxes.

Use Schedule SE, Self-Employment Tax, for specific information that applies to all scenarios. Form 8959, Additional Medicare Tax, is used to calculate the amount of Additional Medicare Tax.

The IRS provides these forms and schedules as part of the Form 1040 set of forms.

2nd step: Calculate the portion of your earnings that is subject to the self-employment tax.

Work out your net earnings.

To begin, figure out your annual net earnings. This number is commonly calculated by subtracting total expenses from gross income or sales for self-employed individuals.

Gross Business Income - Total Business Expenses = Net Earnings

Assume your self-employment earnings in 2020 are $100,0000. The SE tax would apply to the majority, but not all, of your total profits, according to the IRS. Multiply your profits ($100,0000) by.9235 to find out what's taxable. In this situation, the total is $92,3500.

Why is 92.35 percent of your income subject to tax? Because that 7.65% deduction accounts for the employer's portion of the FICA tax, which the company might deduct if you were paid as an employee.

That's why, as a self-employed person, you're allowed to deduct that amount.

3rd step: Calculate the amount of self-employment taxes you owe.

Then multiply your taxable self-employment income ($92,3500 in this scenario) by 15.3 percent to get $14,1295.5.

Recognize the Self-Employed Tax Rate

A quick Google search can turn up various calculators that will help you figure out how much self-employment tax you owe. Fortunately, the formula is straightforward.

You simply multiply your net earnings by 15.3 percent, which is the assumed self-employment (SECA) tax rate.

Calculate your tax rate based on your net earnings.

Multiply your net profits by the tax rate.

SECA = 15.3 percent of net earnings (Tax Rate)

Only 92.35 percent of your self-employment earnings are subject to the 15.3 percent tax rate, which may or may not apply for income tax reasons. Keep this criterion in mind if you decide to use an automatic calculator or manually compute your tax liability.

And there you have it: the entire amount you owe for the SE tax. If you have your 1040 Form handy, enter the total SE tax amount under "Other Taxes" on the 1040 Form.

Earnings from Social Security are an exception.

The Social Security part of SECA taxes will apply to the first $142,800 in net profits in 2021. This represents a rise over the previous year. Calculate accordingly if your firm generates more revenue than this.

4th step: As an adjustment, report half of your self-employment tax.

There's one more step: You can deduct half of your total SE tax from your gross income, resulting in a lower overall income tax bill. This is the employer-equivalent portion of your self-employment tax, according to the IRS.

So, to return to our example: We can get $70,647.75 by dividing your full SE tax of $14,1295.5 in half. As an adjustment to your income, provide this number on your 1040 Form.

In a nutshell, that's how the self-employment tax works. When the salt and pepper are passed around at a gathering, you'll know it's time to bring up everyone's favorite dinner topic: Social Security and Medicare.

Take Advantage of Deductions

Self-employed people who need or wish to decrease their tax obligation can take advantage of a variety of deductions. One of the most significant tax benefits is the ability to deduct up to half of your self-employment tax from your taxable income.

You should also keep track of any company income deductions that could help you lower your overall tax bill. This includes things like continuing education, home office equipment, website expenses, and any other investment that directly supports your self-employment income.

What Are the Effects of Self-Employment Taxes on Your Personal 1040 Tax Bill?

On your personal income tax return, your self-employment taxes are added to your income taxes.

To begin, figure out how much self-employment taxes you'll owe depending on your business's net income. After that, add these taxes to the total amount owed in taxes. Both self-employment taxes and income taxes are included in your overall tax bill.

What Impact Does Business Type Have on Your Self-Employment Earnings?

You're deemed self-employed if you're a lone proprietor, a member (owner) of an LLC, or a partner in a partnership, and your percentage of net income from your firm is liable to self-employment tax.

For each of these business categories, the calculation of net income is done in essentially the same way.

If you're a partner in a partnership or a member of an LLC, you'll get a portion of the business's net profits based on the rules of your partnership. Even if the money stays in the firm, you'll have to pay self-employment tax on it.

How to Make a Self-Employment Tax Payment?

If the following circumstances apply, you usually make self-employment tax payments with your quarterly projected tax payments:

• You expect to owe $1,000 or more when you submit your tax return;

• Your withholding and refundable credits are expected to be less than the lesser of:

o 90% of the tax stated on your most recent tax return

o 100% of the tax reported on your previous year's tax return if the tax return covers the entire 12-month period

Form 1040-ES is used to make quarterly estimated tax payments. This is a basic guideline; unique circumstances may necessitate different actions. If you expect to owe less than $1,000 in self-employment taxes, you can pay them when you file your income tax returns.

Self-Employment Taxes and Income Reporting

Individuals who are self-employed must record their business revenue on their personal tax returns.

• Schedule SE is used by all self-employed people to calculate and report self-employment tax.

• Schedule C is used by sole proprietors and single-member LLC owners to report company net income

• Schedule K-1.5 is used to record business net income for partnerships and multiple-member LLCs.

If you're self-employed, you must pay self-employment tax on the net income of your business, not the money you take out to pay yourself.

You should be aware of the following exceptions.

Of course, there are exceptions to any rule. Some "passive activities" that generate revenue through your firm, for example, may not be subject to SE tax. However, because this is a tax issue, you should consult with your accountant.

Similarly, if your net self-employment income is less than $400, you may be excluded from paying SE taxes. However, the IRS reminds you that "if your net profits from self-employment were less than $400, you must still file an income tax return if you meet any other filing requirement mentioned in the Form 1040 and 1040-SR instructions (PDF)." In addition, if you have more than one self-employment business, the IRS will very certainly require you to determine the aggregate net from all enterprises mentioned on your Schedule SE. One final point to consider:

Because self-employment taxes are not deducted routinely throughout the year, many self-employed people must make anticipated tax payments before the end of the year if they owe more than $1,000 in income and self-employment tax.

Tax Deduction for Self-Employed Health Insurance

Self-employed individuals can deduct the expense of health insurance for income tax purposes under Section 2042 of the Small Business Jobs Act. When computing net profits from self-employment, this deduction is taken into account. For information on calculating and claiming the deduction, see the instructions for Form 1040 or 1040-SR and Schedule SE.

How Deskera Can help You?

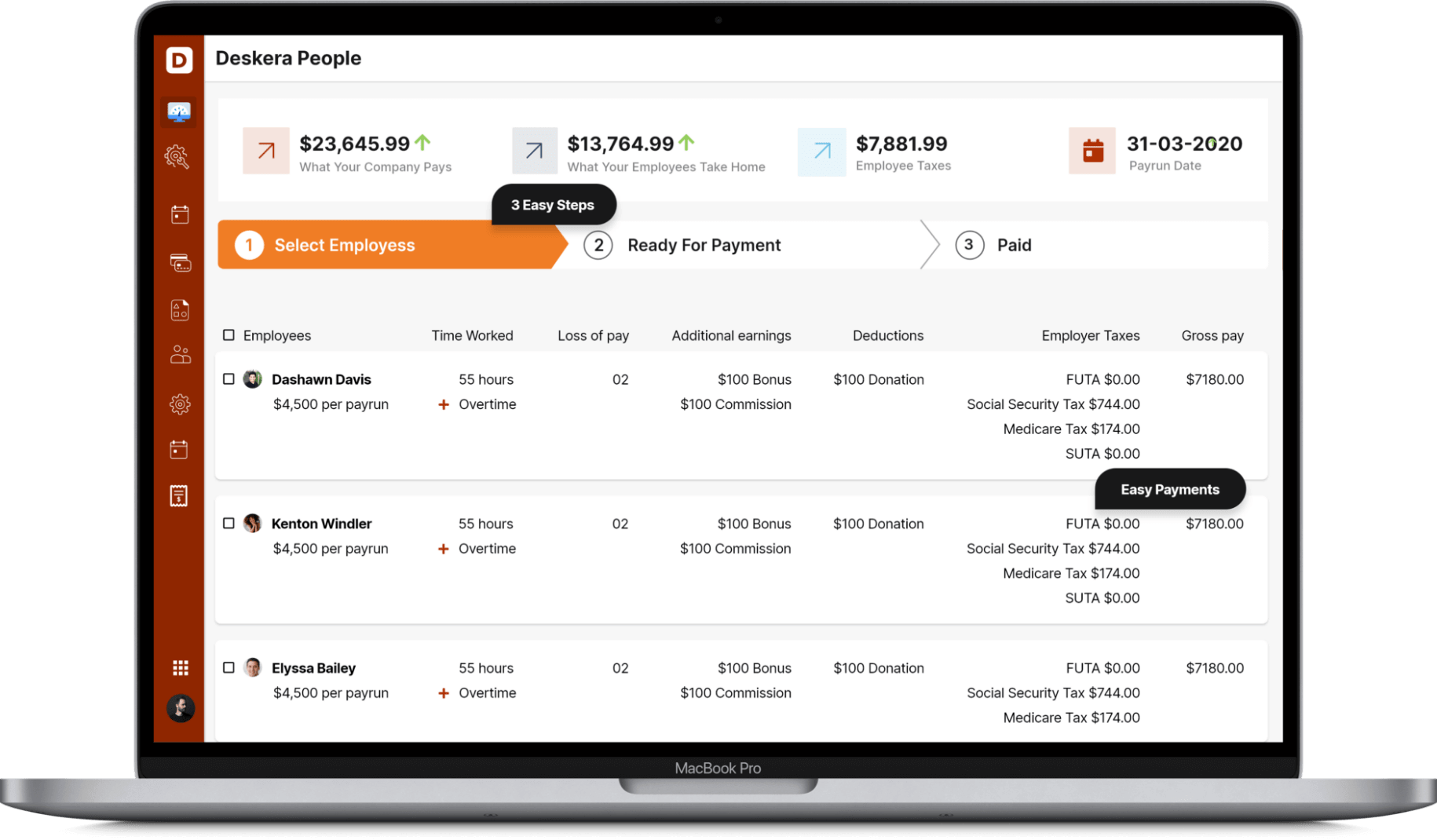

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key takeaways

- The tax rate on self-employment is 15.3 percent. The rate is divided into two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9 percent for Medicare (hospital insurance).

- It's critical to understand your payment duties under US tax rules as a self-employed business owner. To avoid any surprises, make sure you appropriately record your income and self-employment taxes.

- For Social Security and Medicare eligibility, self-employment taxes are paid to the Social Security Administration. If this tax sounds familiar, it's because it's effectively the same as the employee contributions to Social Security and Medicare, but with a different name.

Related articles