With over 60 million people working as freelancers in the USA, you might have to deal with freelancers frequently. So, if you pay freelancers for their work, the IRS has proposed a modification that will almost certainly affect your business.

Beginning with the 2020 tax year, rather than declaring non-employee remuneration on Form 1099-MISC, prepare and submit Form 1099-NEC. It's a minor change, but you might face fines if you submit the incorrect form or don't provide your contractors with the statement.

With that said, this article will help you deal with the ins and outs of Form 1099-NEC. We will first understand Form 1099-NEC and then look at various other aspects.

Here are the things that we will cover in this article:

- What Is Form 1099-NEC: Nonemployee Compensation?

- Non-employee compensation–what does that mean?

- Who Can File Form 1099-NEC?

- What’s included on Form 1099-NEC?

- How to File Form 1099-NEC?

- What else should you know about filing 1099-NEC?

Let’s Start!

What Is Form 1099-NEC: Nonemployee Compensation?

Form 1099-NEC is a tax form used to report nonemployee compensation received by independent contractors, freelancers, and self-employed individuals. Here are some important points to keep in mind regarding this form:

- The 1099-NEC is used specifically for reporting nonemployee compensation. This includes payments made to independent contractors, freelancers, and other self-employed individuals who are not employees of a company. Examples of nonemployee compensation include fees for services, commissions, and other types of compensation for work performed by non-employees.

- In 2020, the IRS introduced Form 1099-NEC to replace box 7 of Form 1099-MISC. Previously, nonemployee compensation was reported in box 7 of the Form 1099-MISC. The introduction of Form 1099-NEC allows for separate reporting of nonemployee compensation, making it easier to track and manage for tax purposes.

- The deadline for issuing Form 1099-NEC to independent contractors is January 31st of the year following the tax year in which the payments were made. For example, if a company made nonemployee compensation payments in 2021, they must issue the corresponding 1099-NEC forms to the recipients by January 31, 2022. The deadline for filing Form 1099-NEC with the IRS is February 28th (or March 31st if filing electronically) of the same year.

- The company or individual issuing the Form 1099-NEC is required to provide the recipient with a copy of the form and also file a copy with the IRS. The form must include the recipient's name, address, and taxpayer identification number (TIN), as well as the total amount of nonemployee compensation paid during the tax year.

Before we proceed further, let's understand what non-employee compensation is.

Non-employee compensation–What does that mean?

Freelance contract workers who are not employees get non-employee remuneration. If that distinction is unfamiliar, keep reading to understand the contrast between employee and independent contractor job status.

Here's the distinction in terms of taxation:

- Employees: If you are an employee, the IRS will deduct many payroll taxes from your payment. Employees benefit from this withholding since it allows them to pay their taxes automatically as they go. Your employer will provide you with a Form W-2 during tax season.

- Independent Contractors: As for freelancers, the IRS will not deduct payroll taxes from your check. Paying as you go is now your headache. You'll get Form 1099-NEC at tax time, which will reflect your overall for the year.

To prevent an underpayment fine, pay taxes as you go rather than delay until tax season. You'll do it in quarterly installments rather than doing it paycheck by paycheck. You'll submit a tax bill to the IRS and any appropriate state and municipal taxation authorities four times.

So, now you know what non-employee compensation is. But, first, let's look at who can file the form 1099-NEC.

Who Can File Form 1099-NEC?

If you compensated anyone at least $600 throughout the year, which fits the following conditions, you must submit Form 1099-NEC:

- They are not one of your employees.

- You paid for services rendered during your business; this was not a personal payment.

- They are an individual, a partnership, or estates. Payments made to companies will also need to be included in select circumstances.

These payouts might include commissions, fees, rewards, and service awards. If you previously filed Form 1099-MISC for someone you paid for business services, you will now file Form 1099-NEC instead this year.

There are a few exceptions to this rule. You will not include any employee payments provided to employees, such as salary or business travel allowances. These payments may cause the use of Form W-2.

Other exclusions are:

- Most corporations, both S-corporations, and C-corporations, get payments. However, payments to companies would only be a part of it if they were for cash purchases, attorney's fees, or payments made by a federal executive agency.

- Payments for products, telegrams, phone calls, freight, storage, and other related services.

- Rent paid to property managers or real estate brokers.

- Contributions to a tax-exempt organization.

Next, let’s look at the information that you must include on Form 1099-NEC.

What’s included on Form 1099-NEC?

Form 1099-NEC, like form 1099-MISC, is a relatively short form with many copies. Form 1099-NEC contains the following information:

- Information about the payer includes identity, residence, and taxpayer identification number (TIN)

- Information on the recipient, such as name, address, and TIN

- The entire amount is paid as non-employee remuneration

- Withheld federal and state income taxes

The simplest approach to getting personal information from a non-employee is to have them complete a W-9 form. With it plus the details from your financial statements, you should be able to complete the 1099-NEC.

There are several copies of the form that you must send. These are the copies:

- Copy A to the IRS

- Copy 1 to your state's tax department

- Copy B to the addressee

- Copy 2 also to the addressee

- Copy C is for your tax records

Here are the key things that are included on Form 1099-NEC:

- Nonemployee compensation: Form 1099-NEC is specifically designed to report nonemployee compensation, which includes payments made to independent contractors, freelancers, and other self-employed individuals. This includes fees for services performed, such as consulting, writing, design, or IT work.

- Threshold: Only nonemployee compensation of $600 or more paid during the year is required to be reported on Form 1099-NEC. This threshold was lowered from $600 on Form 1099-MISC to $600 on Form 1099-NEC starting with tax year 2020.

- Identification: The Form 1099-NEC includes the name, address, and taxpayer identification number (TIN) of the person or entity receiving the payment, as well as the name, address, and TIN of the person or entity making the payment.

- Dates: The form includes the dates that the nonemployee compensation was paid and the date the payment was reported to the payee.

- Other payments: Form 1099-NEC is not used to report other types of payments that were previously reported on Form 1099-MISC, such as rent or royalties. Those payments will now be reported on Form 1099-NEC.

- Backup withholding: If the payee does not provide their TIN, the payer may be required to withhold taxes at a backup withholding rate of 24% and report the withheld amount on Form 1099-NEC.

- State reporting: Some states may also require Form 1099-NEC to be filed with the state tax agency, so it's important to check with your state's requirements.

Now, you must have got a basic idea of what to include on Form 1099-NEC. With that, let's look at how to file Form 1099-NEC.

How to File Form 1099-NEC?

Filing form 1099-NEC is simple. The following are the five major sections:

- Information about the payer: This includes information about your company

- The information of the receiver: This includes information about your contractor, non-employee, or freelancer

- NEC amount: This will be more than $600, but you must also submit Form 1099-NEC to anybody for whom you withheld federal income tax under backup withholding rules, even if the amount is less than $600

- Withheld federal income tax: This would typically be $0.0 unless you get a backup withholding order from the non-employee

- State-specific data

The most important box to look at is Box 1, where you'll enter the full amount you paid the contractor in the previous year.

Here are the steps for filing Form 1099-NEC:

- Gather information about the payments made to nonemployees: Businesses must gather information on all payments made to nonemployees for services rendered. This includes any individuals or businesses that were paid $600 or more in nonemployee compensation during the tax year.

- Verify information provided by the recipient: It is important to verify the information provided by the recipient of the payment, including their legal name, address, and tax identification number (TIN). The TIN can be a Social Security Number (SSN) or an Employer Identification Number (EIN).

- Obtain Form W-9 from the recipient: Businesses should obtain Form W-9 from the recipient of the payment. This form provides the necessary information needed to fill out Form 1099-NEC.

- Fill out Form 1099-NEC: Businesses must complete Form 1099-NEC accurately and completely. The form requires information about the recipient, including their name, address, and TIN, as well as information about the payment, such as the amount paid and the date of payment.

- Send copies of Form 1099-NEC to the recipient and the IRS: Businesses must provide a copy of Form 1099-NEC to the recipient of the payment by January 31st of the year following the tax year. Additionally, the business must submit a copy of the form to the IRS by February 28th (or March 31st if filing electronically).

- Retain copies of Form 1099-NEC for at least four years: Businesses must retain copies of Form 1099-NEC for at least four years after the date of filing. This is important in case of an audit or any disputes that may arise.

- Consider using an online filing service: Online filing services can simplify the process of filing Form 1099-NEC, as they often provide tools for importing recipient information and can file the forms electronically with the IRS.

As you can see, filling out Form 1099-NEC is straightforward. Let's look at some more crucial information that you should know about filing a 1099-NEC.

What else should you know about filing a 1099-NEC?

Calculating and paying self-employment taxes is another stage. As an independent contractor, you pay Social Security and Medicare taxes. Schedule SE will calculate your self-employment taxes. In addition, you may claim the qualifying business income deduction as an independent contractor. This updated deduction allows you to deduct 20% of your pass-through revenue.

And that's everything that you should know about 1099-NEC. Now, let's look at some of the most frequently asked questions regarding form 1099-NEC.

Frequently Asked Questions

When is the 1099-NEC form due?

To file a 1099-NEC with the IRS, you must do so by January 31. In addition, recipient copies must be postmarked by January 31.

Is it necessary to track credit card payments to merchants for income?

Even if you paid the receiver more than $600 last year, you are not obligated to issue a 1099-NEC if you paid the contractor with a credit card or other online payment provider. For electronic payments, the payment processor will take care of any mandatory reporting.

What exactly is the W-9 Form?

A signed W-9 shows that the signer is giving correct information about their company type, federal tax classification, and TIN. A vendor may claim that they are incorporated and do not need to produce a W-9 form or get 1099 at the end of the year, but this is not true.

With that, we have reached the end of the article. Let’s take a quick summary of everything we have covered in this article.

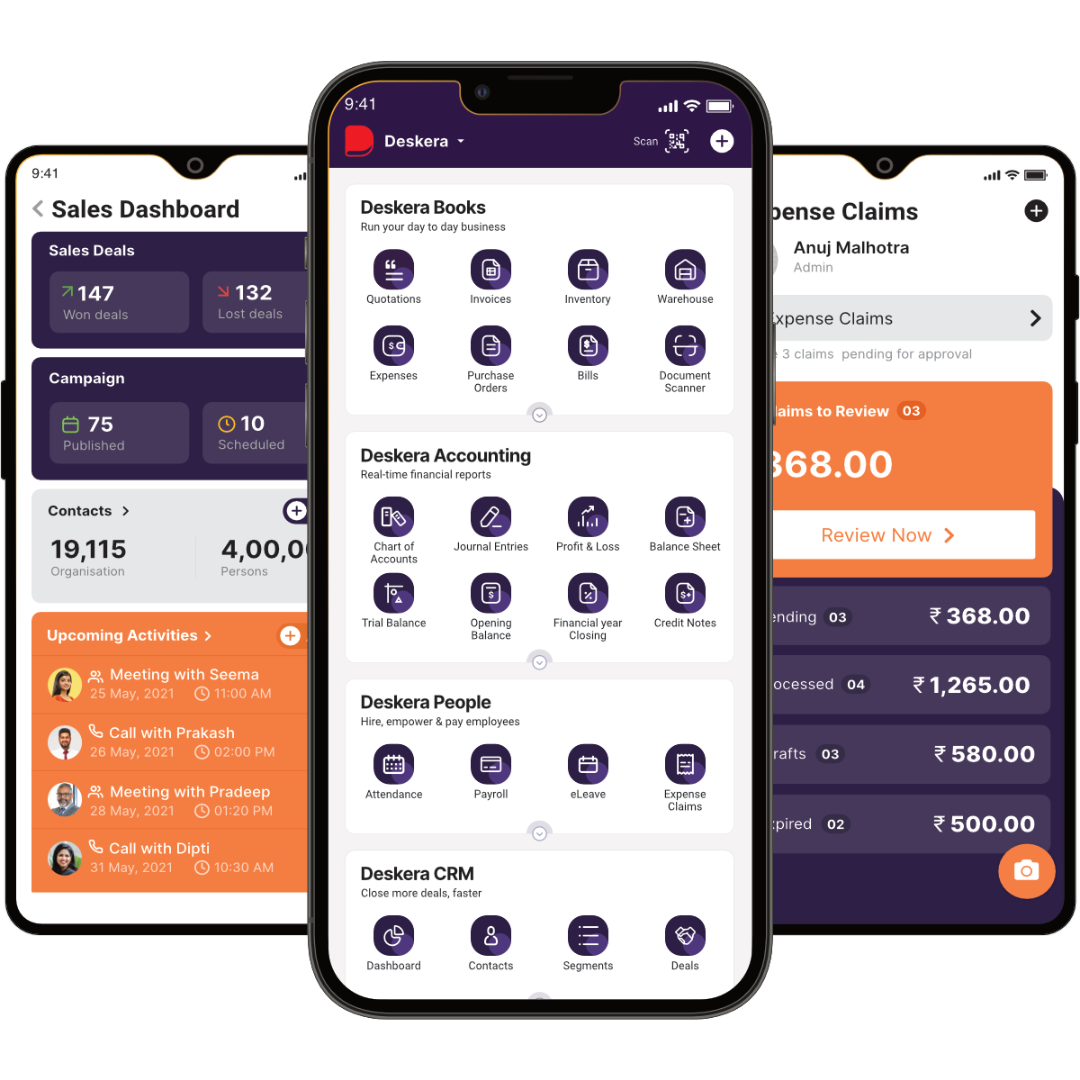

How Deskera Can Assist You?

Deskera MRP allows you to closely monitor the manufacturing process. From the bill of materials to the production planning features, the solution helps you stay on top of your game and keep your company's competitive edge.

Deskera ERP and MRP system can help you:

- Manage production plans

- Maintain Bill of Materials

- Generate detailed reports

- Create a custom dashboard

Deskera ERP is a comprehensive system that allows you to maintain inventory, manage suppliers, and track supply chain activity in real-time, as well as streamline a variety of other corporate operations.

Deskera Books enables you to manage your accounts and finances more effectively. Maintain sound accounting practices by automating accounting operations such as billing, invoicing, and payment processing.

Deskera CRM is a strong solution that manages your sales and assists you in closing agreements quickly. It not only allows you to do critical duties such as lead generation via email, but it also provides you with a comprehensive view of your sales funnel.

Deskera People is a simple tool for taking control of your human resource management functions. The technology not only speeds up payroll processing but also allows you to manage all other activities such as overtime, benefits, bonuses, training programs, and much more. This is your chance to grow your business, increase earnings, and improve the efficiency of the entire production process.

Learn about the exceptional and all-in-one software here:

Key Takeaways

- The new form for reporting non-employee earnings, sometimes known as compensation from independent contractor employment, is the 1099-NEC

- Businesses formerly reported this revenue on Form 1099-MISC. If you were formerly an independent contractor and received that form, you will now receive Form 1099-NEC instead

- Non-employee pay is paid to freelance contract workers who are not employees

- Pay your taxes as you go rather than waiting until tax season to avoid an underpayment penalty

- Businesses must file a Form 1099-NEC for each non-employee individual to whom they paid $600 or more throughout the fiscal year

- Commissions, fees, prizes, and service awards are examples of payments

- Form 1099-NEC includes payer and receiver data, paid amount, and federal and state taxes deducted

- Filing form 1099-NEC is simple. The following are the five major sections: Information about the payer, the information from the receiver, NEC amount, Federal income tax withheld, State-specific data

- The most important box to look at is Box 1, where you'll enter the full amount you paid the contractor in the previous year

Related Articles