Massachusetts has a 5.00 percent flat income tax rate and a 6.25 percent flat statewide sales tax rate. There are a few things to keep in mind because Massachusetts has a lot of payroll tax legislation.

If you are new to payroll or are used to processing in a state that follows federal requirements, doing payroll in Massachusetts may appear to be a difficult undertaking, but this article will help you through the process. The following are the topics that were discussed:

- Payroll Laws and Taxes in Massachusetts

- Blue Laws in Massachusetts

- How to Do Payroll in Massachusetts?

- Massachusetts Payroll Tax Filing Deadlines

- Massachusetts Tax Exemptions and Exclusions

- Payroll Forms

- File Scheduled Withholding Tax Payments and Returns

- Key takeaways

Payroll Laws and Taxes in Massachusetts

This section will cover everything you need to know about Massachusetts payroll taxes, legislation, and regulations. There are a few things that aren't covered by federal regulations. There are state income taxes in Massachusetts, as well as obligations for unemployment insurance, workers' compensation, minimum pay frequency, and final pay legislation.

You will be obligated to pay Social Security and Medicare (known as FICA) taxes regardless of which state you handle payroll in. FICA is 7.65% of an employee's pay—6.2% for Social Security and 1.45% for Medicare. The same amount must be deducted from the employee's take-home pay. The IRS receives both amounts.

Income Taxes in Massachusetts

Massachusetts has a 5.00 percent income tax rate. This rate is applied to all taxable income in the same way. There are no tax brackets in Massachusetts, unlike the federal income tax. Residents of the state might pay a higher income tax rate if they choose to contribute more to the state's finances. Only a small percentage of taxpayers choose to do so.

Although Massachusetts does not have a standard deduction, it does offer many of the same itemized deductions as the federal government, as well as a few more. Child care expenses, college tuition (if it exceeds 25% of Massachusetts adjusted gross income), some commuter costs, rental payments (up to $3,000), and student loan interest payments are all examples of tax deductions.

Taxpayers can also claim a personal exemption to reduce their taxable income in addition to those deductions.

Massachusetts Personal Exemption Amounts

Residents of Massachusetts must additionally pay a penalty if they do not have health insurance, which is deducted from their tax refund. For health coverage lapses, there is a three-month grace period after which the penalty accrues on a monthly basis, up to around $119 per month. The overall penalty is determined by the amount of money earned.

Capital Gains Tax in Massachusetts

In Massachusetts, capital gains are taxed at one of two rates. The standard income tax rate of 5.00 percent applies to most long-term capital gains, as well as interest and dividend income. On the Massachusetts income tax return, capital gains in those categories are recorded as taxable income.

Short-term capital gains, which are realized in less than a year, as well as long-term gains on the sale of collectibles, are taxed at a rate of 12 percent.

Massachusetts Sales Tax

Massachusetts' state sales tax rate is 6.25 percent. There are no additional municipal taxes collected, therefore the rate is 6.25 percent no matter where you are in the state. The tax is levied on "tangible personal property" that is purchased or used. With a few exceptions, this contains almost any purchasable good.

The majority of food sold at supermarkets is completely tax-free. Clothing purchases up to $175 are exempt, including shoes, jackets, and even costumes. Above $175, a product is taxable, therefore a $200 pair of shoes would be taxed at 6.25 percent on the $25 over the exemption limit. Newspapers, admittance tickets (for movies or sporting events), professional or personal services, and most health care products are also exempt.

State Unemployment Insurance (SUTA)

For the first three years of an employer's existence in Massachusetts, the unemployment tax rate is 2.42 percent. After the fourth year, your rate is determined using the reserve ratio approach, which takes into account both your company's account balance and the current yearly rate schedule. Your rate could range from 0.056 percent to 18.55 percent.

You may be eligible for a 5.4 percent discount on your federal unemployment insurance taxes if you pay SUTA (FUTA). On the first $7,000 paid to each employee in a given year, the FUTA rate is 6.0 percent.

Property Taxes in Massachusetts

Property taxes are one of the most important sources of revenue for municipal governments in Massachusetts. Property taxes in some counties exceed $4,000 per year on average. The average effective property tax rate in the state is 1.17 percent (taxes paid as a proportion of market value).

Massachusetts Estate Tax

Massachusetts has its own estate tax, which is imposed on any estate valued at more than $1 million. A Massachusetts estate tax return must be submitted if the gross value of the estate (before any deductions) exceeds that threshold. However, if the taxable estate (after deductions) exceeds $1 million, estate tax is owed.

Massachusetts Estate Tax Rates

Massachusetts Cigarette Tax

Massachusetts has some of the nation's highest cigarette taxes. The tax is $3.51 every pack of 20 cigarettes, bringing the total price to roughly $10.00 per pack in Massachusetts.

Paycheck Deduction Regulations

In Massachusetts, you can only deduct money from an employee's check if state and federal law allows it (i.e., income taxes, Social Security, and Medicare). If the employee agrees, deductions for the employee's benefit (such as union dues, 401(k) contributions, and medical benefit premiums) can be made.

Even if the employee agrees, other expenses directly relevant to the employee's job, such as clothes, supplies, and materials, cannot be deducted.

Final Paycheck Laws

If an employee voluntarily resigns in Massachusetts, you must pay them on the next paycheck or by the Saturday after the person leaves, whichever comes first.

In Massachusetts, if an employee is fired unwillingly, you must pay them on the same day.

Insurance for Workers' Compensation

Even if you're the sole employee, Massachusetts law requires you to provide workers' compensation insurance for your employees. Domestic workers who work less than 16 hours a week are the lone exception. Employees who are injured on the job are covered for medical bills and some missed earnings under this policy.

Workers' compensation insurance costs about $.73 each $100 of payroll you process. A company processing $250,000 in payroll, for example, should expect to spend roughly $1,825 in insurance.

To avoid fines and penalties, it is critical to follow Massachusetts' requirements for workers' compensation. For example, if you don't have workers' compensation insurance, you'll be fined at least $100 a day and have your business shut down until the coverage is activated and the fine is paid.

Overtime

In Massachusetts, you must pay employees 1.5 times their regular hourly rate for all hours worked above 40 in a workweek, according to federal requirements. There are some exceptions for specific jobs. Employees in "office" jobs earning more than $80 a week, agriculture/aquaculture workers, and hospitality workers are all examples of these occupations.

The Massachusetts Legislature's website lists all exceptions. If an employee works more than eight hours per day in Massachusetts, you are only required to pay overtime if they work more than 40 hours per week.

Alcohol Tax in Massachusetts

Massachusetts, on the other hand, has among of the lowest alcohol taxes in the country. Beer costs 11 cents per gallon, wine costs 55 cents per gallon, and liquor costs $4.05 per gallon.

Minimum Wage and Tips

With a few exceptions, most jobs will require you to pay at least minimum wage. Tipped employees, students, and some agricultural laborers are examples of such exceptions.

Massachusetts' non-tipped minimum wage is $13.50 per hour, making it one of the highest in the US. The minimum pay for tipped employees are $5.55 per hour, but only if the following conditions are met:

- They are paid $13.50 per hour plus tips

- They are aware of the legislation

- All tips go to the employee or a qualified tipped pool

Minimum Pay Frequency

Employees in Massachusetts must be paid within six to seven days of the end of their pay period. The number of days people work within a calendar week from Sunday to Saturday determines whether they work six or seven days. Below is a table that explains the differences.

In Massachusetts, you should pay employees weekly or biweekly for these reasons. Salaried employees have the choice of being paid monthly or semimonthly, whereas hourly employees must be paid weekly or biweekly.

Massachusetts Gas Tax

Massachusetts' gasoline and diesel taxes are both 24 cents per gallon.

- In 1620, pilgrims who were on board the Mayflower founded Plymouth, Massachusetts.

- Harvard University, founded in Boston in 1636, is the oldest institution of higher education in the United States, despite being the seventh smallest state in terms of territory in the United States.

State New Hire Reporting

Massachusetts requires that you report any new hiring within 14 days of the employee's start date. New employees can be reported online, by mail (PO Box 55141, Boston, MA 02205-5141), or by fax (617) 376-3262. You must record new hiring online if your company has 25 or more employees.

If you have workers or contractors in other states, you can register them with the state of Massachusetts, which will forward the information to the appropriate agencies in the state where they work.

Massachusetts Payroll-Related HR Laws

When it comes to payroll processing legislation, Massachusetts is a complicated state. Many of its legislation are aimed at giving workers more resources, such as limiting working hours and enhancing Paid Family Medical Leave.

Requirements for breaks, lunches, and time off

When it comes to lunch breaks and sick leave, Massachusetts' time off rules are more employee-friendly than federal guidelines. A summary is provided below.

Breaks and Lunches

In Massachusetts, for every six hours working in a day, you must provide a 30-minute food break. Whether or not the break is compensated and whether or not employees are required to take it is up to the firm. Employees must also be able to leave the workplace and be free of their duties. Furthermore, if an employee agrees to work during a break, the break must be compensated.

Sick Leave

Workers are entitled to one hour of job-protected sick leave for every 30 hours worked, up to a total of 40 hours per calendar year. Sick leave can be taken without pay if you have fewer than 11 employees; otherwise, it must be compensated. When an employee leaves, unused sick time does not have to be paid out.

PTO and Vacation Leave

Employers in Massachusetts are not required to provide vacation or paid time off (combined vacation and sick). If you do offer paid time off, it must be at least as generous as the federally mandated sick leave of up to 40 hours per year. You must also present each employee with a copy of the vacation or PTO policy, and the employee must certify in writing that they understand the policy.

You must follow the current policy until you inform employees that it is being altered. Please visit our full guide to Paid Time Off for more information on how to create a PTO policy.

Small Necessities Leave

Employees can take up to 24 hours off per year for their child's school activities, medical and/or dental appointments, and healthcare or well-care appointments for an older relative. These hours may or may not be compensated.

Medical and Family Leave

In addition to the federal Family and Medical Leave Act, Massachusetts has its own state-sponsored leave program (FMLA).

In Massachusetts, an employee can take up to 20 weeks of paid medical leave, 12 weeks of paid family leave, and a total of 26 weeks of family and medical leave in a year. An employee can take paid medical leave and family leave to care for oneself or a family member.

When taking a leave, employees should aim to give the employer at least 30 days' notice, but this is not required.

A Massachusetts tax is levied on both employees and employers to pay the paid family leave program. For employees, the tax is based on a percentage of wages reported to the Department of Unemployment Insurance, and for qualifying contractors; it is based on a percentage of payments reported to the IRS.

Please note that if your contractors account for more than 50% of your staff and match the following conditions, they are eligible.

- The contractor's performance is not based on the company's routine activities

- The contractor's performance is not dependent on your direction or guidance

- The contractor is working in a related field that has been independently established.

- Auditors and accountants are two examples of these contractors.

- Contributions for medical and family leave for twenty-five or more employees

- If you have 25 or more employees/independent contractors, the total tax is 0.75 percent, with a 0.62 percent contribution for medical leave and a 0.13 percent contribution for family leave.

- You must pay at least 60% of the medical leave contribution as an employer.

- You are not compelled to pay any of the family leave contribution; the worker may be able to pay the entire amount through a paycheck deduction. You have the option of covering more than the required share.

Medical and Family Leave Contributions for Companies with Twenty-five or Fewer Employees

- If you have fewer than 25 employees/independent contractors, the total tax is 0.378 percent, including a 0.248 percent contribution for medical leave and a 0.13 percent contribution for family leave.

- You are exempt from the medical leave contribution as a smaller business.

- You are not required to pay any of the family leave contribution; but, that amount of the tax may be paid in full by the employee through a paycheck deduction. For the family leave contribution, however, you are entitled to cover more than the required share. Overall, in this instance, the greatest amount that can be withheld from a worker's paycheck is 0.378 percent.

Different Ways to Pay Employees

You can pay employees in Massachusetts using normal payment methods. Payment via check or cash is required by law, and direct deposit is available on the government's website.

Although the statute does not specifically address payroll via pay cards, Massachusetts now permits it. Regardless of the option you select, the employee should be able to get their funds without incurring any additional costs.

Pay Stub Laws

You must provide a free pay stub to your employees that include the following information:

- Name of the company

- Name of the employee

- A pay date expressed in months, days, and years

- Worked hours within the pay period

- Hourly pay

- Deductions from pay (i.e., benefit costs)

- Increases in pay (i.e., shift pay)

Blue Laws in Massachusetts

The Massachusetts Blue Laws are a collection of regulations that govern which businesses are permitted to operate on Sundays and certain legal holidays. Please see the Massachusetts Blue Laws section of the Massachusetts government website for more particular information. The following is a high-level overview:

Retail Businesses: With the exception of businesses serving alcohol, most retailers are permitted to open on Sundays and holidays without prior authorization. You must contact the Alcoholic Beverage Control Commission for those retailers.

If your company has more than seven employees, you must pay a premium rate on Sundays and the following holidays: New Year's Day, Memorial Day, Juneteenth Independence Day, Independence Day, Labor Day, Columbus Day (after noon), and Veteran's Day (after 1 p.m.).

In short, it is really designed for your hourly, nonexempt employees. A table with premium rates is listed below:

Please keep in touch with the Massachusetts government to see if anything changes in the coming years. Furthermore, most firms cannot require employees to work on Sundays other restricted holidays, and no company can discipline an employee who refuses to work on certain days.

Non-Retail Businesses: Most non-retail businesses are unable to function on Sundays. Please see the Massachusetts Legislative Website's section on work on Sunday for a list of exemptions.

If you have any further questions, please call (617) 626-6952 or (617) 727-3465, respectively, the Department of Labor Standards Minimum Wage Program and/or the Attorney General's Fair Labor Division.

If you are exempt from the Blue Laws, your local police chief in your place of business can offer you a permit to work on Sundays. Permits can only be provided for work that cannot be completed on another day without causing significant discomfort or inconvenience.

How to Do Payroll in Massachusetts?

Step 1: Establish your company as an employer. You'll need your Employer Identification Number (EIN) and an account with the Electronic Federal Tax Payment System (EFTPS) for the federal government (EFTPS).

Step 2: Register with the Massachusetts Department of Revenue. In Massachusetts, you must register with the Department of Revenue online.

You will need the following information to register:

- EIN (Employer Identification Number) (this number may be the same as your Social Security number if you are a sole proprietor)

- Your official name

- Your company's mailing address

- The inception date of your company

The Massachusetts Department of Revenue has a video to assist new employers with registration.

Step 3: Create a payroll system. You'll need to figure out how often you'll pay employees, how you'll pay them, whether you need to track work hours, which payroll forms to collect and when, how you'll do payroll calculations, and so on. You have the option of doing your own payroll, using Excel payroll templates, or using a payroll service.

Step 4: Collect employee payroll paperwork in step four. During your new hire orientation, the best time to gather payroll forms is. W-4, I-9, and direct deposit information will be included on federal payroll forms. You must also file a Form M-4 in Massachusetts.

Step 5: Collect, evaluate, and approve time sheets in step 5. You'll need to gather time sheets from all hourly employees and salaried nonexempt employees. You have three possibilities for doing so:

- Use a paper time sheet

- Use time and attendance software that is free or inexpensive

- Use a payroll service that includes a time and attendance system

Step 6: Pay staff by calculating payroll (including taxes). Payroll tax payments, employee paycheck amounts, paid time off balances, and so on will all need to be calculated. You have a variety of options for paying your employees (i.e., cash, check, direct deposit, pay cards). The EFTPS should be used to send federal taxes.

Step 7: Register with the federal and state governments to file payroll taxes. Forms and instructions for submitting federal taxes, including unemployment taxes, are available from the IRS. In addition, the IRS allows you to order tax forms. You must also report withholding tax on Massachusetts state taxes according to the schedule below.

Massachusetts Payroll Tax Filing Deadlines

The MassTaxConnect website allows you to file your taxes online.

In order to submit salary and employment reports and pay unemployment insurance premiums, you must also register with the Department of Unemployment Assistance (DUA). Help is available in the form of instructions and a user registration guide.

Step 8: Keep track of your payroll data. It is critical to keep records for all employees, including those who have left your organization, for several years. Please visit our post on preserving payroll records for further information on which records to keep.

Payroll records must be kept for three years in Massachusetts. The employee's name, address, job title, amount paid each payroll, and daily/weekly hours worked must all be included in these documents.

Step 9: Complete your year-end payroll tax returns. W-2s (for employees) and 1099s (for non-employees) are the government documents that must be completed (for contractors). Employees and contractors should get these forms by January 31 of the following year. Massachusetts also requires W-2 forms, which must be submitted by January 31.

Massachusetts Tax Exemptions and Exclusions

Senior Exemption (Clause 41C)

If you meet the requirements for one of the personal exemptions permitted under Massachusetts law, you may be able to decrease all or a portion of the taxes imposed on your residence. Age, ownership, domicile, disability, income, and assets are some of the requirements.

Gross Receipts/Income Cannot Exceed

- $24,911 if single: $20,000 + (SS/RR allowance)

- If Married: $30,000 + (SS/RR allowance): $37,367

- SS Deduction = $4911 (worker); $2456 (spouse); $7367 (combined)

The Value of the Entire Estate/Assets Cannot Exceed

If you're single, you'll pay $40,000; if you're married, you'll pay $55,000.

Unused home equity loans, savings accounts, bank accounts, CDs, IRAs, 401Ks, equities, bonds, mutual funds, annuities, motor vehicles, second residences, and so on are examples of assets.

Senior Tax Exemption Information

The Department of Revenue (DOR) created this fact sheet to provide general information on local property tax exemptions for seniors.

It is not intended to answer all queries or handle all issues, and it makes no changes to Massachusetts General Laws. To learn more about your city or town's specific eligibility and application requirements, contact the board of assessors. The DOR is unable to assess your eligibility or provide legal advice.

The DOR does not assess or collect property taxes; instead, cities and towns do. Only your board of assessors, as the local tax administrator, has the authority to determine whether you qualify for an exemption under state law. You can appeal to the state Appellate Tax Board if you disagree with its ruling.

Please fill out the application in its entirety. If a value isn't applicable, use zeros or write N/A.

- Every year, veterans must provide their VA letter with percentage of disability and DD-214 Discharge Form (first-time applicants) or 100% disability.

- Tax returns are required for 41C, 41A, and CPA applicants. If the applicant does not file a tax return, he or she must submit all end-of-year income statements as well as a 4506T Form. A 4506T request for a tax return transcript must be completed and submitted to the IRS.

- Asset-based and income-based

Single: $24,911 maximum income; $40,000 maximum assets; $1500 maximum exemption

Married: Maximum income is $37,367; maximum assets are $55,000; maximum exemption is $1500.

- Applicants who are 17D do not need to fill out the income/gross revenues section of the application. Asset-based: maximum of $40,000; exempt up to $350

- Applicants for Blind Exemptions must submit a copy of their Certificate of Blindness; they are exempt from paying $437.50.

- All exemption petitions require the completion of a bank form by bank personnel (Veterans and CPA applicants are accepted).

- A birth certificate is required for first-time applicants, and motor vehicle values can be obtained on your excise bill.

Deadlines for submitting applications

- Exemption applications for FY22 will be available beginning July 1, 2021, and must be submitted by April 1, 2022.

- The Board of Assessors would appreciate it if you returned the completed application by October 1, 2021, in order to speed the exemption process and avoid applications not being filed on time. Fill in the blanks with zeros where nothing is reported.

- If you submit your application before October 1, 2021, and it is signed by the board of assessors, you should see the exemption reflected on your third and fourth quarter tax bills.

- Applications will be returned if they are not entirely filled out.

If applications are not received by October 1, 2021, the exemption may not appear on your third and fourth quarter bills; however, you will be able to deduct half of the exemption amount from your third and fourth quarter bills, as in the past. The fourth-quarter CPA exemption would still be deducted.

Veterans (Clause 22)

If you meet the requirements for one of the personal exemptions permitted under Massachusetts law, you may be able to decrease all or a portion of the taxes imposed on your residence. Age, ownership, domicile, disability, income, and assets are some of the requirements.

You may be eligible for a veteran's exemption if you are a disabled veteran with at least a 10% disability, a surviving spouse of a disabled veteran, or a Purple Heart recipient.

Prior to entering the service, veterans must have lived in Massachusetts for at least five years. As of July 1st, you must own and occupy property. The Veterans Administration must certify that a veteran has a service-related impairment of at least 10%. This exemption is also available to unmarried spouses of soldiers or surviving spouses of veterans.

Veterans with the Congressional Medal of Honor, the Distinguished Service Cross, the Air Force Cross, or the Navy Cross are also eligible. Exemptions for disabled veterans differ depending on the degree of the impairment. Veterans who are eligible for the Veterans exemption may also be eligible for the CPA exemption.

Veteran Tax Exemption Information

This fact sheet was developed by the Department of Revenue (DOR) to give general information about local property tax exemptions for veterans. It is not intended to answer all queries or handle all issues, and it makes no changes to Massachusetts General Laws. To learn more about your city or town's specific eligibility and application requirements, contact the board of assessors.

The DOR is unable to assess your eligibility or provide legal advice. The DOR does not assess or collect property taxes; instead, cities and towns do. Only your board of assessors, as the local tax administrator, has the authority to determine whether you qualify for an exemption under state law. You can appeal to the state Appellate Tax Board if you disagree with its ruling.

Must be filed with assessors by April 1st, or three months after actual (not preliminary) tax bills for the fiscal year are received, whichever comes first.

Blind (Clause 37A)

If you meet the requirements for one of the personal exemptions permitted under Massachusetts law, you may be able to decrease all or a portion of the taxes imposed on your residence. Age, ownership, domicile, disability, income, and assets are some of the requirements.

Information on the Tax Exemption for Legally Blind People

This fact sheet was produced by the Department of Revenue (DOR) to give general information about local property tax exemptions for the legally blind.

It is not intended to answer all queries or handle all issues, and it makes no changes to Massachusetts General Laws. To learn more about your city or town's specific eligibility and application requirements, contact the board of assessors. The DOR is unable to assess your eligibility or provide legal advice.

The DOR does not assess or collect property taxes; instead, cities and towns do. Only your board of assessors, as the local tax administrator, has the authority to determine whether you qualify for an exemption under state law. You can appeal to the state Appellate Tax Board if you disagree with its ruling.

If you meet all of the requirements for a personal exemption as of July 1st, you may submit an application. You can also apply if you are the personal representative of an estate or a trustee under a will of someone who was eligible for a personal exemption on July 1st.

Community Preservation Act (CPA)

The Community Protection Act allows a community to set its goals, prepare for the future, and have the resources to make those plans a reality. Residents form a Community Preservation Committee that offers recommendations on how the cash should be spent.

The Act creates a Community Preservation Fund, which will be funded by property tax surcharges and matching funds from the Commonwealth of Massachusetts. The Act establishes new financing streams that can be used to address key community needs, including:

- Assists with meeting the housing requirements of local families

- Restoring and preserving historic houses

- Purchases and protects open area for recreational and conservation purposes.

- It safeguards scenic regions.

- Prevents future growth of farmland and woods

As of January 1st, I am 60 years old. HUD-imposed income limits must be met. By July 1st, you must own and occupy the property.

The application must be filed with assessors by April 1st, or three months after the actual (not preliminary) tax bills for the fiscal year are mailed, whichever comes first.

Deferral (Clause 41A)

If you meet the requirements for one of the personal exemptions permitted under Massachusetts law, you may be able to decrease all or a portion of the taxes imposed on your residence. Age, ownership, domicile, disability, income, and assets are some of the requirements.

Age 65 as of the fiscal year's first day of July / Massachusetts resident for 10 years or more / identical income and asset restrictions as 41c

When a taxpayer's present expenses make maintaining ownership of his or her property impossible, a tax deferral option should be examined. The money that has been postponed will become a lien on the property. It's also worth mentioning that tax deferral can be combined with other exemption programs.

The deferred taxes, unlike a property tax exemption, must be reimbursed with interest when the property is sold, transferred, or the owner passes away. The rate of interest is 4% / 16 percent.

Tax Deferrals for Qualifying Persons Information

This fact sheet was produced by the Department of Revenue (DOR) to give general information on local property tax deferrals for seniors. It is not intended to answer all queries or handle all issues, and it makes no changes to Massachusetts General Laws. To learn more about your city or town's specific eligibility and application requirements, contact the board of assessors.

The DOR is unable to assess your eligibility or provide legal advice. The DOR does not assess or collect property taxes; instead, cities and towns do. Only your board of assessors, as the local tax administrator, has the authority to determine whether you qualify for a deferral under state law. You can appeal to the state Appellate Tax Board if you disagree with its ruling.

Must be filed with assessors on or before April 1st, or 3rd months after actual (not preliminary) tax bills are mailed for fiscal year if later.

Surviving Spouse and Minor Child (Clause 17D)

Must be filed with assessors by April 1st, or three months after actual (not preliminary) tax bills for the fiscal year are received, whichever comes first.

If you meet the requirements for one of the personal exemptions permitted under Massachusetts law, you may be able to decrease all or a portion of the taxes imposed on your residence. Age, ownership, domicile, disability, income, and assets are some of the requirements.

If you're single or married, you can't have more than $40,000 in total assets.

Unused home equity loans, savings accounts, bank accounts, CDs, IRAs, 401Ks, equities, bonds, mutual funds, annuities, motor vehicles, second residences, and so on are examples of assets.

Age 70 or older as of July 1st / No maximum income / Maximum assets: $40.000 / Amount exempted: $350

For at least 5 years, you must have owned and occupied the property. Unless the property is greater than a three-family home, the prorated share of the property's value is to be considered, exclusive of the value of any mortgage, in addition to savings or checking accounts, IRAs, CDs, stocks, bonds, the value of a motor vehicle, any real estate, or any other assets.

A completed bank form is required. Taxpayers who qualify for the Senior exemption also qualify for the CPA exemption.

Seniors, Surviving Spouses, and Minor Children (of Deceased Parent) Information

The Department of Revenue (DOR) has released a fact sheet that details local property tax exemptions for seniors, surviving spouses, and minor children of a deceased parent. It is not intended to answer all queries or handle all issues, and it makes no changes to Massachusetts General Laws. To learn more about your city or town's specific eligibility and application requirements, contact the board of assessors.

The DOR is unable to assess your eligibility or provide legal advice. The DOR does not assess or collect property taxes; instead, cities and towns do. Only your board of assessors, as the local tax administrator, has the authority to determine whether you qualify for an exemption under state law. You can appeal to the state Appellate Tax Board if you disagree with its ruling.

If you meet all of the requirements for a personal exemption as of July 1, you may submit an application. You can also apply if you are the personal representative of an estate or a trustee under a will of someone who was eligible for a personal exemption on July 1.

Payroll Forms

The state-specific and federal forms you'll need for Massachusetts are listed below:

State Payroll Forms

M-4 Form: Used by employers to calculate state taxes to withhold from employee pay.

New Hire Reporting Form: Used by employers to report new workers and independent contractors to the Massachusetts Department of Revenue.

W-4 Form: Used by companies to figure out how much tax to deduct from employee paychecks.

W-2 Form: Reporting total annual wages earned (one per employee)

W-3 Form: Reports total wages and taxes for all employees

Form 940: Reports and calculates unemployment taxes due to the IRS

Form 941: Filing quarterly income and FICA taxes deducted from paychecks

Form 944: Reporting annual income and FICA taxes withheld from paychecks

1099 Forms: Information about non-employee pay that assists the IRS in collecting taxes on contract labor.

File Scheduled Withholding Tax Payments and Returns

Withholding taxes in Massachusetts might be paid weekly, monthly, quarterly, or annually, depending on the payment schedule. Your payment schedule will eventually be determined by the average amount deducted from employee paychecks over the course of a year. The more you withhold the more withholding tax payments you'll have to make.

The specific financial thresholds for the various payment plans, as well as other rules, may vary over time, so check with the DOR at least once a year for the most up-to-date information.

Payment deadlines are as follows:

- Weekly: Payment is required on the 7th, 15th, 22nd, and last day of each month within three business days.

- Monthly: Payments must be received by the 15th of the month following the month in which the tax was withheld.

- Quarterly: Payments must be received by the last day of the month after the quarter's conclusion.

- Payment is required annually on the last day of the month following the calendar year (last day of January).

The due date is extended to the next business day if the payment is due on a Saturday, Sunday, or holiday.

Regardless of their annual tax liability, all new enterprises are expected to make payments and file returns online. To make payments, go to the state's WebFile for Business website. Older firms may still be able to file documents on paper.

Weekly payments are made on Form M-941W, monthly payments are made on Form M-942, quarterly payments are made on Form M-941, and annual payments are made on Form M-941A. Weekly payers must also file Form M-941D, a quarterly return that reconciles their payments for the period.

How Deskera Can help You?

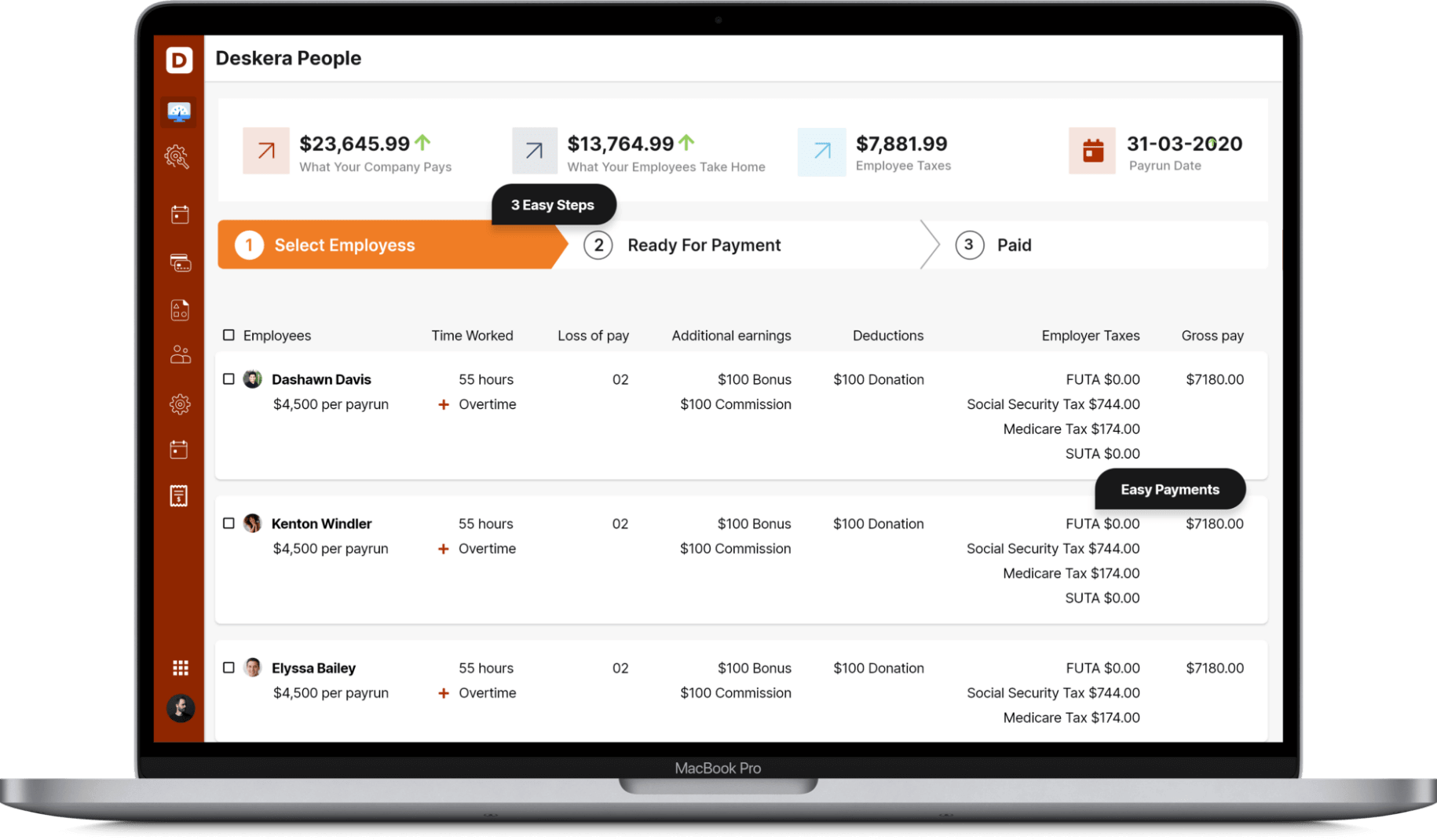

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key takeaways

- In Massachusetts, you must account for state taxes, but they are quite simple because the state has a flat income tax. Employees are taxed at a rate of 5% regardless of their earnings. In Massachusetts, there is no local income tax.

- The quantity of worker safeguards provided in Massachusetts payroll sets it apart from other states. Blue laws, paid family leave, required workers' compensation, payroll frequency, and final pay regulations are just a few examples. Massachusetts has a number of items that you should be aware of, in addition to its state income taxes.

- The most important taxes in Massachusetts are the sales and income taxes, which are both paid at a single rate by citizens across the state. The income tax rate in Massachusetts is 5.00 percent. The 6.25 percent statewide sales tax is one of the lowest in the country (when including the local taxes collected in many other states).

Related articles