In any product-based business, controlling costs is a vital part of sustaining profitability—and among those costs, direct material costs play a central role. These are the raw materials directly used in the manufacturing of a product and can be specifically traced to individual units. From sheet metal in automotive parts to flour in baked goods, direct materials form the physical backbone of the final product.

Direct material costs are not only fundamental to production but also to overall financial strategy. In fact, they typically account for 30% to 70% of total product costs, depending on the industry. This substantial share makes them a key component in accurate pricing models, profitability analysis, and long-term strategic planning. If not managed efficiently, even small fluctuations in material costs can lead to significant impacts on margins.

Because direct materials are so closely tied to production output, their costs must be carefully monitored, forecasted, and optimized. A well-run material cost strategy can reduce waste, improve supplier negotiations, and enhance cash flow. On the other hand, poor oversight can lead to overstocking, underproduction, or cost overruns—all of which hurt competitiveness in today’s fast-moving markets.

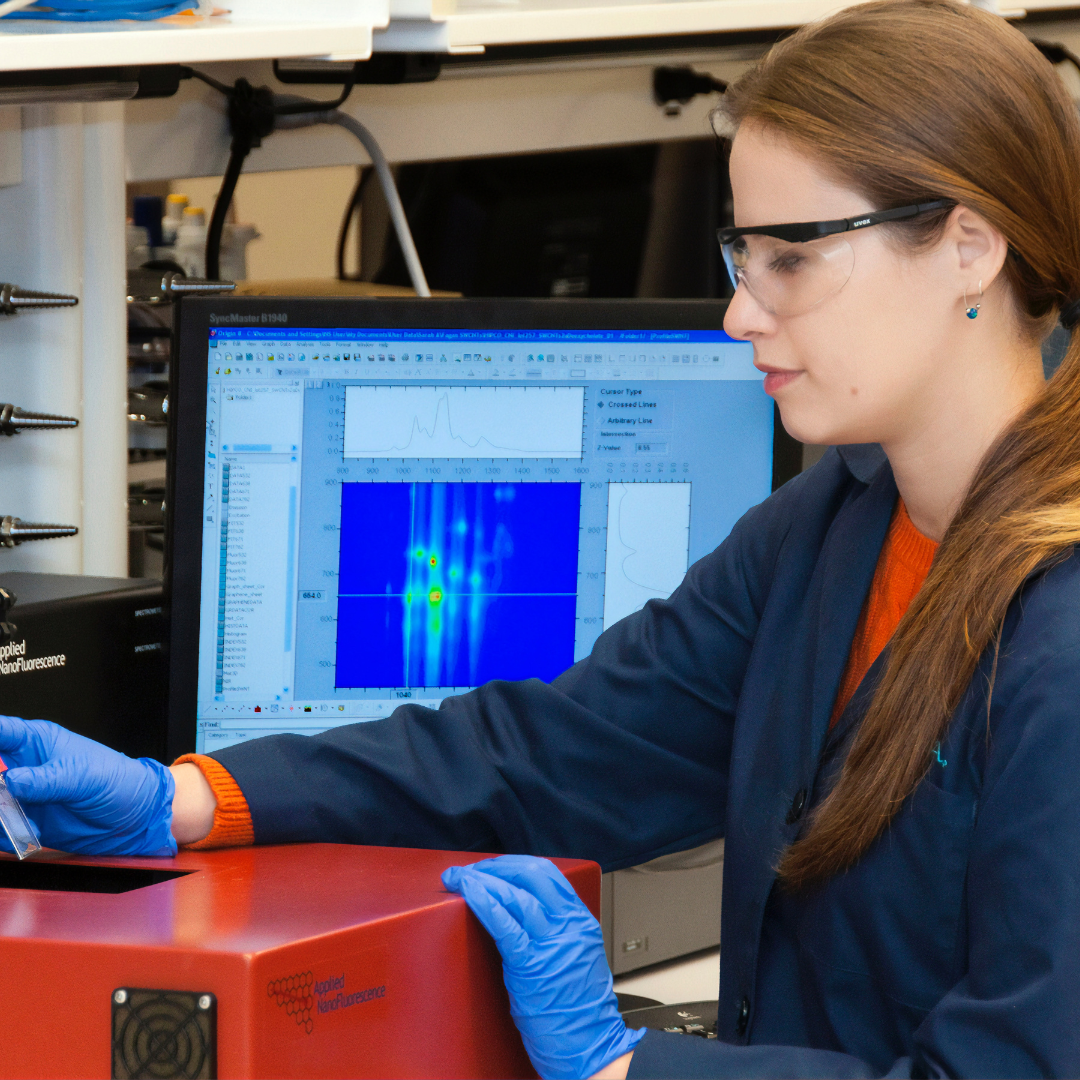

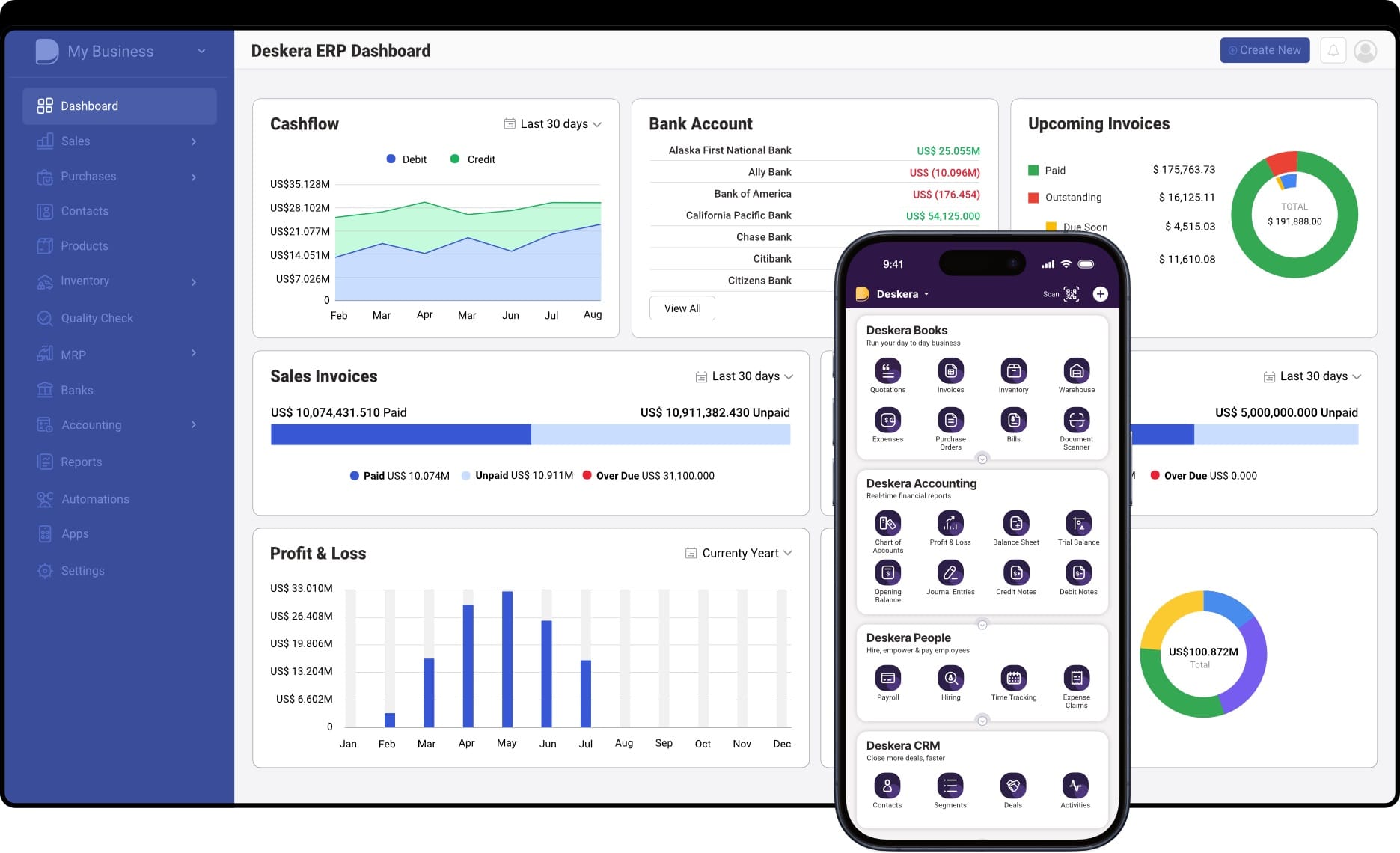

Modern ERP systems like Deskera ERP simplify this process by offering real-time tracking of raw materials, automated inventory updates, and intelligent demand forecasting. With built-in tools for purchase management, bill of materials (BOM) tracking, and costing analysis, Deskera empowers businesses to take full control of their direct material costs—ensuring better decision-making, reduced waste, and improved profitability.

What Are Direct Material Costs?

Direct material costs refer to all expenditures associated with acquiring raw materials and components that become an integral part of the finished product. These materials are directly traceable to specific goods, meaning their usage can be clearly linked to individual units of production.

For instance, steel in automobile frames, flour in baked goods, or fabric in garments are all examples of direct materials. These costs are crucial inputs in calculating the overall cost of goods sold (COGS) and determining accurate product pricing.

Unlike indirect materials, which support the production process but aren’t directly assigned to a specific product (e.g., lubricants for machinery or cleaning supplies), direct materials become physically embedded in the final product. This traceability makes them a key component of job costing and process costing systems used in different types of manufacturing setups.

Direct material costs go beyond just the base purchase price of raw materials. They also include associated expenses such as freight-in charges, sales taxes, handling and storage fees, and packaging if it’s required to deliver the final product (e.g., glass bottles for beverages or boxes for electronics). In some cases, supplier discounts are also factored in, which can help businesses optimize procurement and reduce unit costs.

The approach to tracking direct material costs depends on the manufacturing model. Businesses that produce custom or small-batch goods—like bespoke furniture or tailored clothing—typically use job costing, which assigns material costs to specific orders or batches.

In contrast, companies involved in high-volume production—such as paint, beverages, or steel—use process costing, where material costs are attributed to departments or stages of production. While job costing offers greater accuracy, it’s not always feasible for mass production environments.

Components of Direct Material Costs

Understanding what makes up direct material costs goes beyond the raw material price tag. Several cost elements come together to form the total direct material cost, and accurately tracking each one is essential for proper budgeting, product pricing, and profitability analysis. Below are the key components:

1. Purchase Price of Raw Materials

This is the base cost paid to suppliers for the raw materials required in production. It often varies depending on factors like material grade, order quantity, and market conditions. For example, the cost of purchasing aluminum sheets or cotton fabric forms the foundation of the direct material cost.

2. Freight and Transportation Charges

Also known as "freight-in" costs, these are the expenses incurred in bringing raw materials to your production facility. Whether it’s domestic shipping or international import duties, transportation adds a significant portion to the overall cost of materials.

3. Handling and Storage Costs

These include expenses related to unloading, warehousing, and maintaining the condition of materials before they are used in production. For perishable or fragile items, these costs may be higher and should be directly factored into the material cost.

4. Sales Tax and Import Duties

Any non-refundable sales taxes or customs duties paid during material procurement are considered part of direct material costs. These charges are especially relevant for businesses sourcing raw materials internationally.

5. Packaging Materials

If specific packaging is required to deliver or protect the finished product—such as glass bottles for beverages or boxes for electronics—and is used in every unit sold, it qualifies as a direct material cost.

6. Supplier Discounts and Rebates

Volume discounts, early payment rebates, or seasonal offers from suppliers can reduce the overall material cost. These savings should be reflected in the net cost calculation to give a more accurate picture of expenses.

By tracking and optimizing each of these components, companies can achieve better cost control, avoid budget overruns, and improve their product margins. Leveraging tools like ERP systems can automate and centralize this process, ensuring visibility into every layer of direct material spending.

Direct Material Costs vs. Indirect Material Costs

Understanding the distinction between direct and indirect material costs is essential for accurate cost accounting and financial reporting. While both are necessary for production, they differ in traceability, accounting treatment, and impact on pricing strategies.

1. Traceability to Products

- Direct Material Costs: These materials are easily identifiable and can be directly traced to a specific product. For example, the leather used to manufacture a pair of shoes or the microchip inside a smartphone is a direct material.

- Indirect Material Costs: These are not directly assignable to a single product. Instead, they support the production process as a whole. Examples include lubricants for machinery, cleaning supplies, or safety gloves for factory workers.

2. Role in Costing Methods

- Direct Materials: Included in prime costs and directly affect Cost of Goods Manufactured (COGM) and Cost of Goods Sold (COGS).

- Indirect Materials: Treated as manufacturing overhead and spread across multiple products or cost centers using allocation methods.

3. Cost Behavior

- Direct Materials: Variable in nature—costs increase directly with production volume.

- Indirect Materials: Often semi-variable or fixed—may not change directly with production levels.

4. Accounting Treatment

- Direct Material Costs: Debited directly to Work-in-Progress (WIP) inventory.

- Indirect Material Costs: Accumulated in overhead accounts and then allocated to WIP using predetermined overhead rates.

5. Examples at a Glance

Recognizing this distinction helps companies better allocate costs, control spending, and make informed decisions about pricing, production planning, and profitability. ERP systems like Deskera allow you to categorize and track both types of materials seamlessly, ensuring accurate reporting and cost control.

How to Calculate Direct Material Costs

Accurately calculating direct material costs is essential for product pricing, inventory valuation, budgeting, and profitability analysis.

These costs include not just the raw material price but also other associated expenses like indirect taxes, freight, storage, and packaging.

A clear and consistent calculation method allows manufacturers to identify cost trends, optimize procurement, and make informed production decisions.

Direct Material Cost Formula

The general formula for calculating direct material costs is:

Direct Material Cost = [(Raw Material Cost + Indirect Tax) – Discounts] + Freight-in + Storage + Packing

This formula accounts for all relevant cost components directly tied to raw material acquisition and preparation. While the exact structure might vary slightly depending on a company’s operations, applying this consistently across accounting periods provides an accurate picture of production expenses.

Example Calculation

Let’s consider a hypothetical example: A company manufactures 100 wooden tables. Here are the associated direct material costs:

- Raw Materials (solid oak boards): $4,500

- Indirect Taxes (10%): $450

- Supplier Discount (5%): $225

- Freight & Storage: $300

- Packing Materials: $175

Now, plugging these values into the formula:

Direct Material Cost = [($4,500 + $450) – $225] + $300 + $175 = $4,950 – $225 + $300 + $175 = $5,200

So, the total direct material cost is $5,200, or $52 per table for this batch of 100 tables.

Important Notes:

- This figure represents only the direct material costs. Indirect materials like screws, glue, or finishing products are classified as manufacturing overhead and handled separately.

- Accurate tracking of direct material costs is a foundational part of Cost of Goods Sold (COGS) and ultimately affects gross profit and financial health.

- When calculated consistently, these costs provide visibility into spending efficiency and help businesses make data-driven decisions regarding procurement, pricing, and production planning.

Using ERP systems like Deskera, businesses can automate the tracking and calculation of direct material costs in real time. By integrating purchase records, tax data, freight charges, and discounts, Deskera ensures that direct material costs are captured with precision—improving forecasting, financial reporting, and profitability management.

Importance of Direct Material Costs in Cost Accounting

Direct material costs play a foundational role in cost accounting, particularly for manufacturing and production-centric businesses.

As one of the major components of total production costs, accurately calculating and managing these expenses is critical for maintaining profitability, ensuring competitive pricing, and making informed operational decisions.

Here's why direct material costs hold such strategic importance:

1. Key Component of Product Pricing

Direct materials often account for a significant share—typically between 30% and 70%—of total production costs. If these costs are underestimated or overlooked, the final product may be priced too low to generate profit or too high to remain competitive. Accurate material costing ensures that businesses can set realistic, profit-generating price points.

2. Insights into Profitability

By calculating direct material costs per unit, managers gain a clear picture of whether products are being manufactured at a profitable margin. If the material cost exceeds the revenue generated, it’s a red flag that prompts immediate review of sourcing, pricing, or production methods.

3. Supplier Evaluation and Negotiation

Material cost data helps businesses assess whether suppliers are offering fair pricing. With this information, managers are better equipped to negotiate discounts, renegotiate terms, or switch suppliers when necessary—all with the goal of reducing overall expenses without compromising quality.

4. Operational Efficiency

Tracking direct material costs also helps identify production inefficiencies such as excessive scrap, material waste, or procurement delays. These insights prompt corrective actions, such as process improvement or inventory management adjustments, that directly enhance bottom-line performance.

5. Decision-Making and Strategic Planning

Knowing the direct cost of materials for each product allows companies to evaluate their most and least profitable items, guiding resource allocation and strategic priorities. It also supports budget forecasting, inventory control, and product development planning.

In short, direct material costs provide a transparent view into a company’s cost structure. Accurate cost tracking—especially when automated through platforms like Deskera ERP—enables smarter pricing strategies, more informed supplier negotiations, and data-driven financial planning that fuels sustainable business growth.

Factors That Influence Direct Material Costs

Direct material costs are not fixed—they’re dynamic and influenced by a variety of internal and external factors. Understanding these factors is essential for maintaining cost control, enhancing forecasting accuracy, and developing effective procurement strategies.

Below are the key drivers that impact direct material costs:

1. Supply Chain Disruptions

Interruptions in the supply chain—caused by events like natural disasters, geopolitical tensions, or global health crises—can lead to material shortages, longer lead times, and increased transportation costs. These issues often result in sudden spikes in direct material costs. Companies can mitigate this risk by diversifying suppliers, maintaining safety stock, and building resilient sourcing networks.

2. Raw Material Market Prices

Fluctuations in commodity and raw material prices—such as metals, lumber, or agricultural inputs—have a direct impact on procurement costs. These price changes are often driven by global demand and supply dynamics, seasonality, and economic shifts. Monitoring market trends and using hedging strategies or long-term supplier contracts can help stabilize material costs.

3. Waste and Spoilage

Inefficient production processes can lead to higher levels of material waste, scrap, or spoilage, effectively increasing the per-unit cost of direct materials. Lean manufacturing, quality control systems, and process automation can reduce waste, improving both cost-efficiency and sustainability.

4. Supplier Relationships and Changes

Changes in suppliers or renegotiation of terms can significantly impact pricing. While new suppliers might offer cost advantages, it’s critical to assess product quality, on-time delivery performance, and service consistency. Long-term relationships with reliable suppliers often provide volume discounts and favorable payment terms that reduce overall material costs.

5. Currency Exchange Rates

For businesses that import raw materials, currency volatility can create unpredictability in material costs. A weaker local currency means higher costs for the same materials. To manage this risk, companies may adopt currency hedging, negotiate contracts in stable currencies, or source from domestic suppliers when feasible.

6. Regulatory and Compliance Costs

Environmental regulations, import/export restrictions, and safety standards can affect the cost structure of direct materials. Compliance with new laws may require sourcing alternative materials or investing in certifications and testing—each contributing to higher procurement costs. Staying informed and planning proactively can help mitigate compliance-related disruptions.

By recognizing and addressing these factors, businesses can gain better control over their direct material costs, protect margins, and make informed operational decisions. Tools like Deskera ERP help track these cost influencers in real-time by integrating procurement data, supplier insights, and inventory analytics—all within a unified platform for smarter cost management.

How to Control and Optimize Direct Material Costs

Direct material costs are one of the most substantial expenses in manufacturing, but they’re also one of the most controllable—with the right strategies. Companies that successfully manage and reduce these costs often rely on a combination of supplier negotiation, process improvement, sustainable sourcing, and smart use of technology.

Here’s how you can effectively control and optimize direct material costs:

1. Negotiate Strategically with Suppliers

Strong supplier relationships are essential for controlling material costs. Strategies include:

- Bulk purchasing to secure volume discounts and reduce unit costs.

- Long-term contracts that ensure stable pricing and priority supply.

- Multi-supplier sourcing to avoid over-reliance on one vendor and improve bargaining power.

Building trust and transparency with suppliers can also lead to collaborative cost-saving initiatives, such as joint demand forecasting or shared logistics.

2. Implement Waste Reduction Techniques

Reducing scrap and rework directly cuts material costs. Key approaches include:

- Lean manufacturing and Six Sigma to eliminate inefficiencies and boost yield.

- Material recycling programs to reuse leftover components.

- Better process design that minimizes overproduction and overprocessing.

Even small improvements in waste control can translate into significant savings over time.

3. Explore Alternative Sourcing and Materials

Looking beyond traditional suppliers and materials can unlock cost advantages:

- Use local suppliers to reduce shipping and customs costs.

- Consolidate material usage across product lines to qualify for better rates.

- Consider sustainable or recycled alternatives that lower both cost and environmental impact.

Switching to more cost-efficient materials must be done carefully to maintain product quality and compliance.

4. Leverage Technology for Process Optimization

Digital tools are increasingly essential for accurate cost tracking and predictive decision-making:

- Advanced analytics can forecast demand and optimize raw material ordering.

- IoT sensors can monitor material usage in real time to prevent waste or overstocking.

- Augmented reality can assist workers in reducing assembly errors, conserving materials.

These technologies help ensure material is used efficiently from procurement through production.

By implementing these strategies, manufacturers can significantly reduce their direct material costs while also increasing supply chain resilience and operational sustainability.

Tools like Deskera ERP support these efforts by integrating procurement, inventory, and production data into a centralized platform—making it easier to track costs, optimize material usage, and generate actionable insights in real time.

Common Mistakes to Avoid When Managing Direct Material Costs

Even with the best intentions, businesses often make avoidable mistakes that inflate direct material costs or compromise product quality. Recognizing and addressing these missteps early can lead to more accurate costing, improved supplier relations, and better financial outcomes.

Below are some of the most common pitfalls:

1. Ignoring Hidden Costs

Many businesses calculate only the base price of materials and overlook additional expenses like freight-in charges, taxes, storage fees, and packaging materials. Failing to account for these can lead to underpricing and margin erosion.

2. Relying on a Single Supplier

Depending solely on one supplier may result in better rates short term, but it exposes businesses to risks like supply disruption, price hikes, and lack of negotiating power. A diversified supplier base offers both cost flexibility and risk resilience.

3. Infrequent Cost Reviews

Market conditions and material prices change frequently. If you’re not regularly reviewing and updating material costs, your pricing models and profitability analysis may become outdated and inaccurate.

4. Overlooking Waste in Production

Inefficiencies such as excess scrap, rework, or poor inventory management can quietly drive up material costs. Failing to track and control this waste leads to unnecessary spending and reduced cost-effectiveness.

5. Choosing Price Over Quality

Opting for the cheapest material source without evaluating quality, lead time, or reliability can result in production delays, higher defect rates, and long-term losses. Short-term savings shouldn’t compromise product integrity.

6. Poor Forecasting and Inventory Planning

Inaccurate demand forecasts often lead to over-purchasing or stockouts—both of which impact cost efficiency. Investing in better demand planning and using tools like ERP software can reduce these risks.

Avoiding these mistakes requires a proactive, data-driven approach to procurement and cost tracking. With platforms like Deskera ERP, companies can centralize their material cost data, monitor changes in real time, and automate alerts to prevent costly errors before they escalate.

How Can Deskera ERP Help You Manage Direct Material Costs?

Managing direct material costs efficiently requires real-time visibility, accurate tracking, and integration across procurement, inventory, and production. Deskera ERP offers an all-in-one cloud-based platform that simplifies this complexity—empowering manufacturers to control costs and improve operational efficiency.

Here’s how Deskera ERP supports your direct material cost management:

Real-Time Material Cost Tracking

Deskera helps you track the exact cost of every raw material used in production—including taxes, freight-in, storage, and packaging. You can view detailed cost breakdowns and analyze trends over time to identify cost-saving opportunities.

Integrated Procurement and Inventory Management

From purchase orders to goods receipt, Deskera automates your procurement workflows and syncs them with your inventory. This ensures that all material-related transactions are recorded accurately, avoiding duplicate entries or data silos.

Supplier Management and Rate Optimization

You can manage multiple suppliers, compare their rates, track lead times, and maintain historical pricing data. This helps in negotiating better contracts and ensuring you're always buying at the best available rates.

Accurate Demand Forecasting

Deskera uses historical data and AI to forecast raw material needs, helping you avoid overstocking or last-minute purchasing at higher prices. This leads to smarter budgeting and reduced material wastage.

Production Planning and BOM Automation

With Deskera, your Bill of Materials (BOM) is directly tied to your production workflows. This automates material planning and helps you calculate exact quantities needed per product, which in turn improves cost accuracy.

Insightful Reporting and Cost Analysis

Built-in reporting tools offer instant insights into your material costs, cost of goods sold (COGS), inventory valuation, and profitability. Custom dashboards make it easy to monitor performance and make informed decisions.

In short, Deskera ERP not only helps reduce and control direct material costs, but also enhances transparency, traceability, and agility across your entire manufacturing operation—all from a single platform.

Key Takeaways

- Direct material costs can account for 30% to 70% of total product costs, making them a critical focus area for accurate pricing, profitability, and cost control. Tools like Deskera ERP can streamline tracking and management for better strategic planning.

- Direct material costs include all expenses directly tied to raw materials that become part of a finished product and can be specifically traced to it—such as wood in furniture or flour in baked goods.

- These costs encompass not just raw material prices but also indirect taxes, freight-in, storage, packaging, and any discounts received—forming the complete landed cost of materials.

- Direct materials are traceable and form part of the final product, whereas indirect materials—like lubricants or glue—support production but are not directly attributable to specific units.

- Use the formula: Direct Material Cost = [(Raw Material Cost + Indirect Tax) – Discounts] + Freight-in + Storage + Packing, to calculate a product’s true material expense and make informed pricing decisions.

- Variables such as supply chain disruptions, raw material market rates, waste, supplier changes, exchange rates, and regulatory shifts can all impact direct material cost trends.

- Understanding and tracking direct material costs allows managers to price products accurately, assess profitability, negotiate better deals, and identify inefficiencies in production or sourcing.

- Strategies like supplier negotiation, lean manufacturing, sustainable sourcing, and leveraging technology can help businesses reduce material costs while improving quality and sustainability.

- Avoiding pitfalls like ignoring hidden costs, relying on a single supplier, infrequent cost reviews, and poor forecasting is key to maintaining accurate and efficient material cost control.

- Deskera ERP enables real-time tracking, supplier management, demand forecasting, and automated reporting to help businesses manage and reduce direct material costs with greater accuracy and efficiency.

Related Articles