Money makes the world go round, but without proper financial planning, it's easy to get caught in a cycle of stress and uncertainty. Whether you're just starting out on your financial journey or looking to take your wealth to new heights, a solid financial plan can help you achieve your goals and secure your financial future.

So, let's dive into the world of financial planning and explore the key strategies and tools you need to build a strong financial foundation.

Here’s what we have covered in the post about financial planning:

- What is Financial Planning?

- Importance of Financial Planning

- Steps in Financial Planning

- Different Types of Financial Planning

- Tools and Strategies for Financial Planning

- Common Mistakes in Financial Planning

- Tips for Your Financial Plan

- Benefits of a Financial Plan

- When to Create a Financial Plan?

- How can Deskera Help You

- Key Takeaways

- Related Articles

What is Financial Planning?

Financial planning is the process of creating a comprehensive strategy to manage your finances and achieve your financial goals. It involves assessing your current financial situation, identifying your short-term and long-term financial objectives, and developing a plan to reach them.

Financial planning encompasses a wide range of activities, including budgeting, investing, tax planning, retirement planning, risk management, and estate planning. By taking a holistic approach to your finances, you can ensure that all aspects of your financial life are aligned and working together to help you achieve your goals.

The key to successful financial planning is starting early and regularly reviewing your plan. As your financial situation and goals change over time, your plan should evolve with them to ensure that you stay on track. A financial advisor or planner can help you develop a personalized plan and provide guidance and support along the way.

Importance of Financial Planning

Financial planning is essential for several reasons, including:

- Helps achieve financial goals: Financial planning enables you to set and prioritize your financial goals, such as saving for retirement, paying off debt, buying a house, or funding your child's education. By creating and following a plan, you can track your progress and ensure you're on track to achieve your goals.

- Provides financial security: Financial planning helps you build a solid financial foundation that can withstand unexpected events such as a job loss, medical emergency, or natural disaster. It allows you to establish an emergency fund, purchase adequate insurance coverage, and manage your debts and expenses, which can provide peace of mind and financial security.

- Enhances financial decision-making: With a clear financial plan in place, you can make informed financial decisions that align with your goals and values. You'll be able to weigh each decision's potential costs and benefits, consider the tax implications, and make decisions that maximize your financial well-being.

- Helps control spending: Financial planning involves creating a budget and tracking your spending, which can help you manage your cash flow and control your expenses. This can help you avoid overspending, reduce debt, and increase your savings and investments.

- Enables long-term financial success: A well-crafted financial plan can help you build wealth over the long term, by optimizing your investments, reducing taxes, and minimizing risks. This can help you achieve financial independence, retire comfortably, and leave a legacy for your loved ones.

By taking control of your finances and creating a plan, you can achieve your financial goals and enjoy greater financial security and freedom.

Steps in Financial Planning

Here are the general steps involved in the financial planning process:

- Set financial goals: The first step in financial planning is to define your financial goals. Determine what you want to achieve, such as saving for retirement, buying a home, or paying off debt.

- Assess your current financial situation: Once you have defined your financial goals, assess your current financial situation. This includes calculating your net worth, reviewing your income and expenses, and evaluating your debt and savings.

- Create a budget: Create a budget that reflects your income, expenses, and financial goals. This will help you manage your cash flow and allocate your money wisely.

- Develop a savings plan: Determine how much you need to save to achieve your financial goals and develop a savings plan to help you reach them. This may involve setting up automatic savings contributions, identifying areas to cut expenses, and prioritizing your savings goals.

- Manage debt: If you have debt, develop a plan to manage and pay it off. This may involve consolidating debt, negotiating lower interest rates, and creating a debt repayment plan.

- Invest wisely: Develop an investment plan that aligns with your financial goals and risk tolerance. Consider diversifying your portfolio, reviewing your investment performance regularly, and making adjustments as needed.

- Plan for taxes: Consider the tax implications of your financial decisions and develop a tax planning strategy to minimize your tax liability.

- Plan for retirement: Develop a retirement plan that considers your current financial situation, retirement goals, and timeline. This may involve calculating your retirement needs, determining how much you need to save, and identifying the best retirement savings vehicles.

- Protect your assets: Review your insurance coverage to ensure you have adequate protection for your assets, income, and health. Consider purchasing life, disability, and long-term care insurance as needed.

- Review and revise your plan regularly: Financial planning is an ongoing process. Review your plan regularly and make adjustments as your financial situation, goals, or market conditions change.

Different Types of Financial Planning

There are several different types of financial planning, each of which serves a different purpose. Here are some of the most common types:

- Retirement Planning: Retirement planning involves creating a plan to fund your retirement lifestyle. It includes calculating your retirement needs, determining how much you need to save, and identifying the best retirement savings vehicles.

- Estate Planning: Estate planning involves developing a plan to distribute your assets after your death. This includes creating a will, establishing trusts, and identifying beneficiaries.

- Tax Planning: Tax planning involves developing a strategy to minimize your tax liability. This may involve taking advantage of tax deductions, credits, and deferrals, and making strategic financial decisions to minimize your taxes.

- Investment Planning: Investment planning involves developing an investment strategy that aligns with your financial goals and risk tolerance. It includes diversifying your portfolio, managing risk, and monitoring your investment performance.

- Risk Management Planning: Risk management planning involves identifying and mitigating potential risks that could impact your financial well-being. This includes purchasing insurance, creating an emergency fund, and managing debt.

- Cash Flow Planning: Cash flow planning involves developing a plan to manage your income and expenses, including creating a budget, managing debt, and saving for future expenses.

- Education Planning: Education planning involves saving for your children's education expenses. It includes identifying education goals, estimating education costs, and identifying education savings vehicles.

- Business Planning: Business planning involves developing a financial plan for your business. This includes identifying business goals, creating a budget, managing cash flow, and making strategic financial decisions.

Each of these types of financial planning can be customized to meet your individual needs and goals. Consider working with a financial planner or advisor to develop a comprehensive financial plan that aligns with your goals and helps you achieve long-term financial success.

Tools and Strategies for Financial Planning

There are many tools and strategies available to help with financial planning. Here are some of the most common ones:

- Budgeting Tools: Budgeting tools such as spreadsheets, budgeting apps, online business banking solution, and online budgeting software can help you track your income and expenses, create a budget, and identify areas where you can cut expenses.

- Retirement Planning Tools: Retirement planning tools such as retirement calculators and retirement planning software can help you estimate your retirement needs, determine how much you need to save, and identify the best retirement savings vehicles.

- Investment Tools: Investment tools such as investment calculators and investment tracking software can help you monitor your investment performance, evaluate investment options, and identify ways to diversify your portfolio.

- Debt Management Tools: Debt management tools such as debt calculators and debt payoff apps can help you manage your debt, create a debt repayment plan, and monitor your progress.

- Savings Strategies: Savings strategies such as automatic savings contributions, saving a percentage of your income, and saving for specific goals can help you build your savings over time and achieve your financial goals.

- Tax Planning Strategies: Tax planning strategies such as maximizing tax deductions and credits, contributing to tax-advantaged retirement accounts, and managing the timing of financial transactions can help you minimize your tax liability.

- Risk Management Strategies: Risk management strategies such as purchasing insurance, creating an emergency fund, and diversifying your investments can help you manage financial risks and protect your assets.

- Estate Planning Strategies: Estate planning strategies such as creating a will, establishing trusts, and identifying beneficiaries can help you distribute your assets according to your wishes and minimize taxes and other costs.

By using these tools and strategies, you can develop a comprehensive financial plan that aligns with your goals and helps you achieve long-term financial success.

Common Mistakes in Financial Planning

Financial planning is a critical aspect of achieving long-term financial success. However, even the best-intentioned plans can go awry if you make mistakes along the way. Here are some common mistakes to avoid in financial planning:

Not Having a Plan

One of the biggest mistakes people make is not having a financial plan at all. Without a plan, it's difficult to know where you're going or how to get there. A comprehensive financial plan should include your financial goals, income, expenses, assets, liabilities, and a strategy for achieving your goals.

Setting Unrealistic Goals

While it's great to have ambitious financial goals, it's important to be realistic. Setting unrealistic goals can set you up for failure, frustration, and financial stress. When setting goals, make sure they're achievable, measurable, and aligned with your financial resources.

Failing to Monitor Your Plan

Once you have a financial plan in place, it's important to monitor your progress regularly. Failing to track your progress and adjust your plan as needed can lead to missed opportunities, wasted resources, and a failure to achieve your goals.

Not Diversifying Your Investments

Putting all your eggs in one basket is a common mistake in financial planning. Diversifying your investments across multiple asset classes, industries, and geographies can help reduce risk and maximize returns.

Overlooking Tax Planning

Taxes can take a significant chunk out of your income and investments. Failing to plan for taxes can lead to missed opportunities to minimize your tax liability and maximize your after-tax returns.

Not Having Adequate Insurance

Insurance is an essential component of risk management. Failing to have adequate insurance coverage can leave you vulnerable to unexpected events, such as illness, disability, or property damage.

Making Emotional Decisions

Emotions can cloud judgment and lead to poor financial decisions. It's important to take a rational and objective approach to financial planning and avoid making decisions based on fear, greed, or other emotions.

Tips for Your Financial Plan

Here are some tips for creating and implementing a successful financial plan:

Set Clear and Achievable Goals

Start by defining your financial goals and make sure they are specific, measurable, and achievable. This will help you stay focused and motivated as you work towards achieving them.

Create a Budget

Develop a budget that accurately reflects your income and expenses. This will help you understand where your money is going and identify areas where you can reduce expenses or save more money.

Reduce Debt

High levels of debt can prevent you from achieving your financial goals. Focus on paying down high-interest debt first and consider consolidating your debt to reduce your interest rates.

Build an Emergency Fund

Create an emergency fund to cover unexpected expenses such as job loss, medical bills, or car repairs. Aim to save at least three to six months’ worth of expenses.

Save for Retirement

Start saving for retirement as early as possible. Take advantage of any employer-sponsored retirement plans and contribute to individual retirement accounts (IRAs).

Diversify Your Investments

Diversify your investments across different asset classes, such as stocks, bonds, and real estate. This will help reduce your overall risk and maximize your returns.

Review Your Plan Regularly

Review your financial plan regularly to ensure it is still aligned with your goals and adjust it as needed. This will help you stay on track and make any necessary changes to your plan.

Seek Professional Advice

Consider working with a financial planner or advisor to help you develop a comprehensive financial plan that meets your specific needs and goals. They can provide valuable insights and guidance to help you achieve your financial goals.

Benefits of a Financial Plan

Having a comprehensive financial plan can provide numerous benefits, including:

- Clear Financial Goals: A financial plan helps you establish clear and achievable financial goals. This gives you direction and helps you stay motivated and focused on achieving your objectives.

- Improved Financial Management: A financial plan helps you manage your finances more effectively by providing a framework for organizing and prioritizing your financial activities. This can help you reduce stress and make more informed financial decisions.

- Increased Savings: A financial plan can help you identify areas where you can save money, reduce expenses, and increase your income. This can help you build wealth and achieve your financial goals faster.

- Reduced Debt: A financial plan can help you develop a strategy for paying down debt and becoming debt-free. This can help reduce financial stress and improve your overall financial well-being.

- Investment Planning: A financial plan can help you develop an investment strategy that is tailored to your specific needs and goals. This can help you maximize returns and minimize risk.

- Retirement Planning: A financial plan can help you plan for your retirement and ensure that you have enough money to live comfortably in your golden years.

- Estate Planning: A financial plan can help you develop an estate plan that ensures your assets are distributed according to your wishes after you pass away.

- Peace of Mind: Having a financial plan in place can provide you with peace of mind, knowing that you have a roadmap for achieving your financial goals and securing your financial future.

When to Create a Financial Plan?

It's never too early or too late to start creating a financial plan. Ideally, you should create a financial plan as soon as possible, whether you are just starting out in your career or nearing retirement.

Here are some key life events or situations when you should consider creating or updating your financial plan:

- Starting a New Job: When you start a new job, it's a good time to review your financial situation and create a budget. You may also want to consider your retirement savings options and benefits offered by your employer.

- Starting a Family: If you're planning to start a family, it's important to review your financial plan to ensure that you can support your growing family's needs. This may include adjusting your budget, reviewing your insurance coverage, and planning for your children's education.

- Purchasing a Home: When you're ready to purchase a home, it's important to create a financial plan that includes budgeting for the down payment, closing costs, and ongoing mortgage payments.

- Planning for Retirement: As you approach retirement age, it's important to review your financial plan to ensure that you have enough savings to support your retirement lifestyle. This may include reviewing your retirement accounts, pension plans, and Social Security benefits.

- Facing Financial Challenges: If you're facing financial challenges such as job loss, medical bills, or high levels of debt, it's important to review your financial plan to identify areas where you can reduce expenses and increase savings.

How can Deskera Help You?

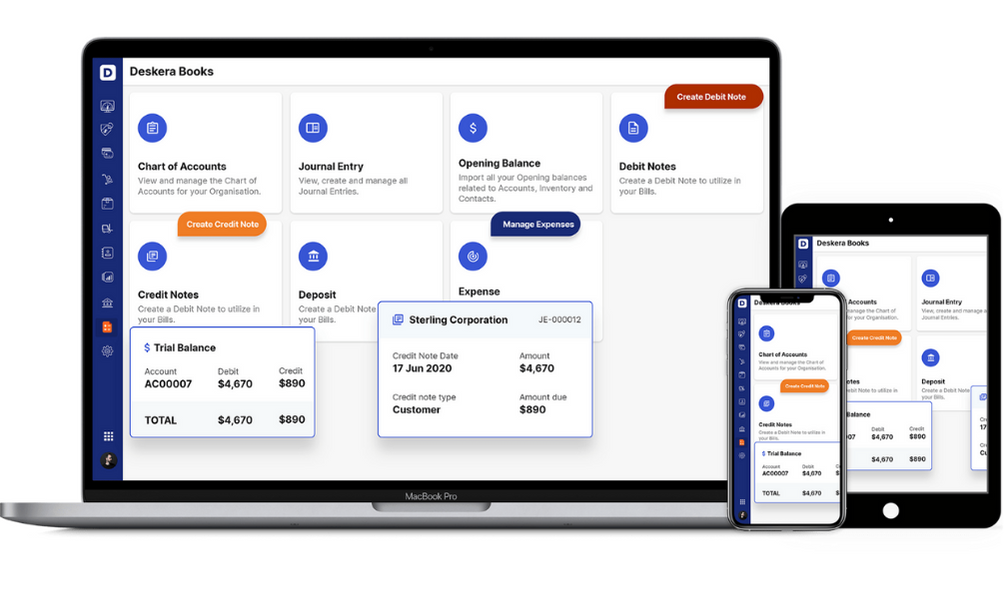

Deskera is a cloud-based software that provides an extensive suite of business tools, including accounting, CRM, inventory management, and payroll management. While Deskera is not specifically designed to manage trusts, it can help with certain aspects of trust management, such as record-keeping and financial reporting.

For example, Deskera Books can be used to track income and expenses related to the trust, while its reporting tools can generate financial statements for the trust.

Additionally, Deskera's CRM module can be used to manage communication with beneficiaries and other stakeholders, while its inventory management module can help track physical assets held in the trust.

Key Takeaways

- Financial planning is the process of creating a roadmap to achieve your financial goals, both short-term and long-term.

- Financial planning involves assessing your current financial situation, setting financial goals, developing a plan to achieve those goals, implementing the plan, and regularly reviewing and adjusting it as needed.

- Financial planning is important for everyone, regardless of age or income level, and can help you achieve financial stability and security.

- There are several steps involved in the financial planning process, including setting financial goals, creating a budget, managing debt, saving for emergencies, investing for the future, and planning for retirement.

- There are various types of financial planning, such as retirement planning, estate planning, and tax planning, among others.

- Financial planning requires the use of various tools and strategies, such as budgeting apps, investment accounts, and insurance policies.

- Common mistakes in financial planning include failing to set clear goals, ignoring the impact of inflation, and taking on too much debt.

- Some tips for creating an effective financial plan include being realistic about your goals, seeking professional guidance if needed, and regularly reviewing and adjusting your plan.

- Benefits of having a financial plan include increased savings, improved financial management, reduced debt, and peace of mind.

Related Articles