The selling, general and administrative expense (SG&A) comprises all business operating expenses that are not included in the cost of goods sold. Management should maintain tight control over these costs, since they increase the break-even point of a business.

In this article, we will tell you all about selling, general and administrative expenses. Learn what these expenses are and their benefits for your company.

This article covers the following:

- What are SG & A expenses?

- What are the benefits of SG & A?

- What is the difference between selling, general, administrative, and operating expenses?

- How to calculate SG & A expenses?

- High SG & A expenses.

- Steps to prepare SG & A budget

What is SG & A Expenses?

Selling, General, and Administrative expenses, aka SG & A, are the daily operating costs of running a business that isn’t related to producing a good or service. Let’s look at these expenses separately.

Selling Expenses

Selling expenses are three kinds of expenses that make up a company’s operating expenses. These are any sales or marketing expenses your business incurs. They can be broken down into direct and indirect selling expenses:

Direct selling expenses are incurred when a product or service is sold.

These include things like:

- Any sales commissions you pay to a salesperson

- Shipping supplies and delivery charges

Indirect selling expenses are incurred when the product is manufactured or the service is conducted, and after.

These include things like:

- Any wages you pay to a salesperson or marketer

- Payroll taxes associated with sales or marketing staff

- Travel and entertainment costs for business trips

- Advertising expenses (i.e., Google and social media ads, newspaper advertisements, billboards, etc.)

- Any costs associated with promotional materials (i.e., brochures, business cards, promotional videos, landing pages, etc.)

Selling Expenses Analysis

In addition to reducing labor and materials costs, SG&A expenses are an excellent place to look for savings opportunities because they take up so much of a company’s operating budget.

Their mention is a staple on earnings calls, lately in the context of a phrase like “discretionary spending cuts” in relation to those line items. Controlling these costs as demand for products or services grows is crucial to a business's profitability, but finding a balance is crucial to sustaining that growth.

One way to use selling expenses as part of profitability analysis is the ratio of SG&A to sales. Divide SG&A by gross profit (revenue minus the cost of goods sold) to get the percentage of the gross profit that is going into SG&A expenses.

There is no hard and fast number on what that should be. It will differ according to the industry as well as the consistency of the gross profit number overall. However, within the SG&A bucket, one study showed that best-in-class wholesale distribution companies concentrate spending in the selling category, including making investments in the sales force, account management, and technology to support it all.

Benefits of Selling Expenses

By tracking selling expenses, a business can:

Correctly assess its tax burden

Tracking selling expenses is important for tax compliance and for ensuring the business is correctly calculating deductions to reduce its tax burden.

Control spending

While the general and administrative bucket is often where companies start cost reduction measures, the items in the selling expense bucket are the biggest opportunities to better control costs.

For instance, travel expenses are a selling expense that represents a cost-containment opportunity. Accenture research shows that travel expenses comprise 10% to 12% of a business's annual budget and represent about 1% of its revenue.

Start to develop KPIs

Accurate selling costs help the business work toward getting key sales metrics such as the Customer Acquisition Cost (CAC). That’s calculated by dividing the total cost of getting customers by the number of customers acquired for a given period.

General expenses

General expenses are the costs a business incurs as part of its daily operations, separate from selling and administration expenses. Together, general, selling, and administration (SG&A) expenses make up a company’s operating expenses. These general expenses include:

- Rent

- Utilities

- Bank & ATM fee expenses

- Technology and equipment costs

- Office supplies

- Insurance

- Subscriptions (i.e., publications, software, services)

- Other small, petty cash expenses

Types of General Expenses

Building expenses

Building expenses pertain to any costs related to operating the facility that houses the company. Rent or mortgage on the building is one example of any property insurance the organization holds, such as fire and flood. Utilities are also common costs, which include electricity and water. Even minor operating expenses like lawn service and cleaning fall in this category.

Salaries and wages

Employee salaries and wages are other major components of general and administrative expenses. In addition to an employee's actual pay rate, costs like paid time off, health insurance and training also qualify as G&A. Some other employee-related G&A costs include relocating a new hire and paid travel for job-related training.

Insurance

In addition to insurance that protects business property, many organizations require insurance on personnel or the company itself. For instance, medical facilities and law offices are often required to carry malpractice insurance to cover their staff.

Other types of insurance include business income insurance, which protects a company if production stops, or workers’ compensation insurance, which ensures employees receive a payment if they're injured on the job.

Licenses and fees

Businesses of all kinds require licensure to operate. Restaurants, for example, must have food and beverage licenses to serve customers. Cosmetologists must have state licenses to perform their services. The cost to apply for and renew these licenses count as general and administrative expenses.

Fees are a broad category and include professional memberships like a local Chamber of Commerce. Specific industries also have membership-based organizations.

For instance, the hospitality industry has the American Hotel and Lodging Association and many more. G&A for organizations like these are important because they establish a company's credibility and expose them to new customers.

Supplies

Although many supplies are non-G&A costs, such as concrete for a construction project, any costs that do not directly aid a project qualify as general and administrative expenses, for instance, stationery, office equipment and machine components for a factory are expenses a company has regardless of whether it's producing a specific item. Even minor items like snacks for employees can count as supply costs.

Miscellaneous

Other general and administrative expenses can vary. Examples of miscellaneous G&A costs include company outings or catering for a company party. Businesses might also pay for employee training sessions or continuing education.

Why are General Expenses Important?

General expenses factor into the company's overall revenue and costs, which has an impact on the bottom line. These costs can also be complex to calculate and track, and doing so may require a company to hire an accountant.

General costs are necessary for businesses to operate, they also count as deductions on a company's tax return. Calculating these costs and reporting them properly can save the company money.

How to Reduce General Expenses?

Some general expenses are variable or semi-variable, which means an organization can sometimes save money if it strategizes expenditures for instance, printer ink and paper count as non-overhead supplies that fall in the general category.

If you're in charge of these expenses, you can potentially save money by going paperless. Another way of reducing general expenses would be to move your company’s office to a less expensive facility or consider moving some or all of the workforce to remote positions. Reducing costs in areas like these can increase efficiency in company spending and improve its overall value.

Administrative Expenses

Administrative expenses are expenses an organization incurs that are not directly tied to a specific core function such as manufacturing, production, or sales. These overhead expenses are related to the organization as a whole, as opposed to individual departments or business units.

- Salaries of company executives, administrative staff, and human resources

- Fees paid to on-staff accountants, IT personnel, lawyers, etc.

- Consulting fees

Here is a quick example for you:

XYZ Company spends ₹ 4,000 per month on electricity and reports it as an administrative expense. It can apportion the cost based on the amount of space each department takes up. Assume

The production space is 2,000 square feet.

The manufacturing space is 1,500 square feet.

The accounting office has a square footage of 750 square feet.

The sales office has a square footage of 750 square feet.

The company has a 5,000-square-foot office. The following is an example of how the electric bill could be divided:

Production: ₹ 1,600 or (2,000 / 5,000) x ₹ 4,000

Manufacturing: ₹ 1,200 or (1,500 / 5,000) x ₹ 4,000 Accounting: ₹ 600 or (750 / 5,000) x ₹ 4,000

Sales: ₹ 600 or (750 / 5,000) x ₹ 4,000

Benefits of Administrative Expenses

- An office does not run on its own. Your teams require a high-functioning ambiance in which they can work comfortably without having to worry about trivial issues.

- A good ambiance aids in the recruitment of quality employees who tend to stay for long with the organization. Small indulgences like comfortable seating cheerful interiors add to the ambiance.

- Urban culture involves company meetings, project evaluation activities, and office meetings which are now held in cafeterias and open spaces. Every penny spent on these tasks is accounted for in the administrative budget.

Most administrative costs may appear insignificant in contrast to other costs. The next question is whether or not we should account for them. When you add them all up, they have the potential to have a big impact on your total business.

As a result, all such costs should be recorded and reported in the financial statement. These administrative expenses should be accounted for during the period in which they were incurred, not during the period in which they were paid.

Some Non-Operating Expenses

These are usually listed separately from SG&A, but income statements will sometimes bundle them together with SG&A. Non-operating expenses are anything you spend money on that isn’t related to the day-to-day operations of your business, including:

- Obsolete inventory expenses

- Depreciation

- Legal fees (for incorporating a business, settling a lawsuit, etc.)

With a handle on the SG&A meaning, let’s dig into how you can use this information for your business.

If you are a small business owner or are attempting to launch a startup, understanding why operational, administrative, and sales expenses are often separated is crucial in budgeting and forecasting.

Understanding where your expenses will grow and where they will stay stagnant will help you determine how to allocate capital and grow the business. It can also help existing and potential investors see how you manage capital and that you, as a savvy business owner/entrepreneur, know how to properly scale and allocate resources.

Administrative expenses include wages and benefits for specific employees, such as accounting and IT personnel. Administrative expenses include all executive salaries and benefits. Building leases, insurance, subscriptions, utilities, and office supplies are all examples of administrative expenses.

Depreciation expenses can be categorized as a general, administrative, or selling (marketing) expense, depending on the asset being depreciated. Consulting and legal fees may also be included as administrative expenses by organizations. Research and development (R&D) costs, on the other hand, are not considered administrative costs.

A corporation may distribute administrative expenses to each of its departments based on a proportion of revenue, expenses, square footage, or other variables to get a complete picture of the costs associated with running various business divisions. Internally, this enables management to make decisions concerning the expansion or contraction of specific business divisions.

Administrative Expenses for an Investor

As an investor looking to grow your savings, understanding a company’s administrative expenses can help you better evaluate how a company invests resources.

It can help you know what proportion of their capital a company is spending on indirect or support expenses relative to direct operating costs, as well as to their relative cash position.

It is important to better understand and qualify a potential investment and ascertain whether a company’s operations are sustainable or headed towards financial distress.

ROI is critical to any investor, and knowing how a company is allocating its administrative expenses is a crucial facet of being a successful and savvy investor.

One of the misconceptions that exist, especially among small businesses, is that only larger expenses are riskier. Because of this, businesses fail to track small and petty expenses. Bigger expenses are not riskier always but not knowing your complete spending’s even on the little expenses is the risk.

Why? Just like a small leak will sink a great ship, little expenses when you put together have the potential to impact your business in several ways.

What are the Benefits of SG & A Expenses?

SG&A plays a key role in a company's profitability and the calculation of its break-even point. That's the point at which the company's revenue generated and its expenses incurred are the same. It's also one of the easiest places for management to look when trying to boost profitability.

SG&A expenses are an important benchmark as to the company's break-even point. Regardless of sales, a business needs to cover this mostly fixed overhead cost before it can begin to turn a profit, so understanding SG&A is important for management to understand.

SG&A expense and its revenue ratio play a key role in explaining company profitability. Companies and investors often use a ratio that compares SG&A expense with sales revenue as one way to measure a company's financial health. If the ratio is too high or increases with time, this may indicate difficulties sustaining profitability.

After mergers or in times of financial hardship, SG&A expense is the first area that management would examine to cut costs without impacting manufacturing or sales. At the same time, companies need to act wisely in making these decisions. Aggressive cuts in spending may yield short-term improvements while resulting in a long-term decline in revenue.

SG&A expense ratios vary widely by industry and should therefore only be used in comparison with like industries. Pharmaceutical and healthcare have some of the highest SG&A expenses as a percent of revenue, while energy typically has a much lower ratio.

A good look at your SG&A expenses can help you make many vital decisions about your business. It will help you to answer the following questions.

- What can you afford to offer your sales team in terms of bonuses?

- Is your team spending more on travel than you anticipated?

- Can you afford to increase your marketing this quarter?

Here is a comprehensive list of benefits of SG & A benefits:

- The costs associated with SG & A can be regularized easily or can be cut down without disturbing the production process in order to enhance the profitability of the company.

- These costs are very important for the business to keep it going and help to compute the profitability of the company as operating income is calculated by deducting SG & A expenses from the Gross profit of the company.

- During the process of Mergers or acquisitions, this is the first place where managers look at. Here the manager easily reduces the SG & A expenses by removing the number of employees in repeated positions and increasing the earnings of the company.

Moreover, for many businesses, SG&A expenses are one of the first places you can look to start to trim down your budget and develop a more effective plan when sales drop.

Suppose your selling, general, and administrative expenses exceed a reasonable ratio. In that case, you’ll know it’s time to cut back, and an accurate look at those expenses can make it easier to see what cuts you need to make.

Revenue

Seizing control of selling, general, and administrative expenses (SG&A) plays a key role in maximizing productivity and staying competitive. SG&A Expenses proportionately increase with the sales revenue amount.

In the firms with low sales revenue, SG&A expenses and material cost impact will be equal. In medium revenue firms, SG&A expenses impact is more on the operating income than on the material costs.

In firms with high sales revenue, the SG&A expenses impact earnings. Andersonet al. (2007) explained the SG&A relation to future earnings based on revenue incline and decline.

They stated that in revenue declining periods, the SG&A costs are positively related to the future earnings, and in revenue incline periods, the SG&A costs are negatively associated with future earnings.

Baumgarten et al. (2010) stated that in the cost-efficient firms, the increase in SG&A ratio has a positive relation with future earnings. In cost-inefficient firms, the increase in the SG&A ratio has negative relation with future earnings.

Sidhanta & Chakrabarty (2010) empirical study showed that SG&A expenses have a significant impact on sales revenue and profits. They found the inverse relation between the debt to equity ratio and expenses.

Banker et al. (2006) studied the effect of SG&A expenditure on future economic benefit. They stated that current SG&A expenditure has a positive impact on future earnings.

Assets

Leveseque et al. (2012) studied the spurring growth of the company on the increase of R&D and SG&A expenses. The spending on innovation and research will influence the growth of the company.

The spending on the SG&A expenses increases the brand image. Both R&D and SG&A expenses together will increase the profitability and growth of the company, but managers need to balance between R&D and SG&A expenses to have profitability and growth of the company.

Banker et al. (2006) inferred that investors do not consider all SG&A expenditure as an expense in the current period. Investors feel that some component of SG&A expenses will be used for enhancing the asset base of the firm.

Biddle et al. (1997) studies found the role of advertising expenditure in creating an intangible asset. A large component of SG&A is selling expenditure other than advertising that includes sales promotion, customer development, and distribution channel management.

Both marketing and selling expenditure is capitalized as an adjustment to earnings in calculating EVA. Cleland & Bruno (1996) studies revealed that expenditure on employee training or customer satisfaction systems would create intangible assets that may be associated with future financial performance.

Profitability

Future operating profits are improved as a result of increasing current selling, general, and administrative expenses for SG&A-cost-efficient firms. Future operating profits are improved mainly through a reduction in the future cost of goods sold.

If the firms with declining sales had managed SG&A costs efficiently, greater improvements would be seen in operating profitability in the future. Enekweet al. studied the relationship between profitability with debtors' turnover ratio, creditors' velocity, and total assets turnover ratio.

There is a negative relationship between all independent variables with profitability. It also revealed that debtors' turnover ratio, creditors' velocity, and total assets turnover ratio have no significant relationship on the profitability of the company, while only inventory turnover ratio shows a significant relationship with profitability.

Brynjolfsson & Hitt study showed that many component items SG&A expenditure have a long-run impact on a firm’s future performance. i.e., operating performance is positively associated with lagged IT spending. Eli et al. found that revenues and expenses are fundamentally proportional to one another but are likely to be disproportionately affected by transitory items or economic shocks.

Gross Margin

As per the experts’ opinion, a holistic approach should be considered for managing the total SG&A expenses. Management gives the power to control the SG&A expenses by adding value to the organization.

Approximately 25-50% of SG&A expenses can be reduced if the management follows the holistic approach to control the costs. SG&A expenses are proportional to the gross margin but not to any driver.

The more they have, they spend more. Converse's (1955) study on drug stores revealed that the increase in SG & A expense increased the gross margin. The increased sales caused increased revenue and increased gross margin.

Stasz (2003) study showed that gross margin could be improved by integration strategy methodology. New methodologies allow companies to take a systematic approach to improve profitability and gross margin without having to undergo a massive transformation.

Wright (2009) study offered a new solution to the advertising budgeting problem, developed through empirical optimization. In his empirical optimization, the author showed that for advertising budgeting, if advertising elasticity is 0.10, the optimal advertising budget is always 10 percent of gross margin.

Financial Sustainability

For financially well-performing firms, there is a positive relationship with environmental management systems (EMS) or sustainability with financial performance.

For the less well-performing firms, a negative relationship exists between sustainability and financial performance. Vitezic et al. (2012) research confirmed that the sustainability concept of performance positively relates to financial performance.

These firms disclose their corporate social responsibility activities to have a competitive advantage over the other companies. The research concluded that companies with good financial performance and large in size are more aware of their corporate social responsibility.

Sustainability is a multi-faceted concept frequently invoked in environmental discourse. A business that is not financially sustainable will only be able to survive in the market for so long.

Eventually, all of its savings will be used up, and there will be no assets to sell to cover the expenses. This is what makes financial sustainability such an important part of managing a business's success now and into the future.

What is the Difference Between SG & A and Operating Costs?

Operating costs, aka (OPEX) are expenses companies incur during normal operations. An operating expense is an ongoing cost of running a business. Operating expenses include all of the expenses that aren’t covered under the cost of goods sold, such as rent, equipment, and marketing.

OPEX and SG&A expenses are generally one and the same. They both consist of costs that are not included in the COGS. The only real difference between operating expenses and SG&A is how you record them on the income statement.

Some businesses prefer to list SG&A as a subcategory of operating expenses on the income statement. Other companies may prefer to separate selling expenses from the G&A costs on the financial statement instead.

The way you list your SG&A and operating expenses on your income statement is completely up to you.

How to Calculate SG & A?

The SG&A formula simply adds together selling expenses and general & administrative expenses as follows:

Formula to calculate SG & A expenses:

SG & A= Selling Expenses + General & Administrative Expenses

High SG & A Expenses

High SG&A costs in relation to revenue can be a problem for almost any business. Management often attempts to keep SG&A costs limited to a certain percentage of revenue, but that figure may vary a great deal, depending on sector and industry. It can also vary from company to company. Firms target their own models.

Suppose that a bank invests heavily in its customer service experiences. It spends far more than many other banks. It, therefore, has higher selling costs on its income sheet, but it also has higher sales.

Better customer interaction leads to more deposits. More deposits mean more customer loans. The profitability, therefore, increases as well, offsetting those higher costs.

Firms must often reduce SG&A costs through cost-cutting moves, such as employee layoffs, when they grow too large without a rise in sales. The same might happen when sales drop for a long stretch of time.

Many companies have had bloated SG&A costs in the past. They cost shareholders billions in profit. Warren Buffet was shocked in the 1980s to find that one of his investments, television network ABC, was spending $60,000 on florists, as well as providing stretch limos and private dining rooms for its executives.

The ABC executives also squandered shareholders' capital through out-of-control expenses. It was later revealed that ABC had artificially padded its earnings by selling the original Jackson Pollock and Willem de Kooning paintings it owned. The sales kept the figures up so the company could avoid cutting spending.

Though selling, general, and administrative expenses are not directly attributable to the manufacturing and selling of products, they should increase in proportion to the sales.

If these items keep on increasing, but the sale is dropping, the company must bring down these expenses. An excessive increase in the SG&A costs might bring down the profitability of the company.

Companies can bring down selling, general and administrative expenses by adopting various cost-cutting and restructuring measures, such as reducing the non-sales personnel salaries, decreasing travel costs, lay-offs, and more.

Moreover, a company should maintain tight control over these costs with the help of continual review of discretionary costs, comparisons of the budget with actual costs, trend analysis, zero-based budgeting, and more.

Steps to Prepare SG & A Budget

Here are the steps to prepare an SG&A budget:

- Determine the time period used for the entire forecasted budget, i.e., one year, and prepare the SG&A budget for the same time period.

- Look at last year's SG&A budget and determine which items should stay on the new forecasted budget and which are no longer relevant. You should use a growth rate based on past growth plus any new information you have to estimate fixed costs.

- Determine if there are new SG&A expenses that should be added to the new forecasted budget and include them along with a forecasted cost.

- Look at the fixed expense budget. Decide if all the items on it are still fixed expenses or if any portion is variable.

- Look at the variable expense budget. Decide if the variable expenses are likely to still be variable for the next year. If not, change them. If everything's the same, include them as is after checking on the cost. The variable expense budget must be driven by variable costs per unit forecasted to be sold.

- Remember that the SG&A budget is for non-manufacturing costs only, and double-check this.

- Classify your expenses first into fixed and variable and next into selling, general, or administrative expenses.

- Finalize the SG&A budget to be included as part of the operating budget.

How Can Deskera Assist You?

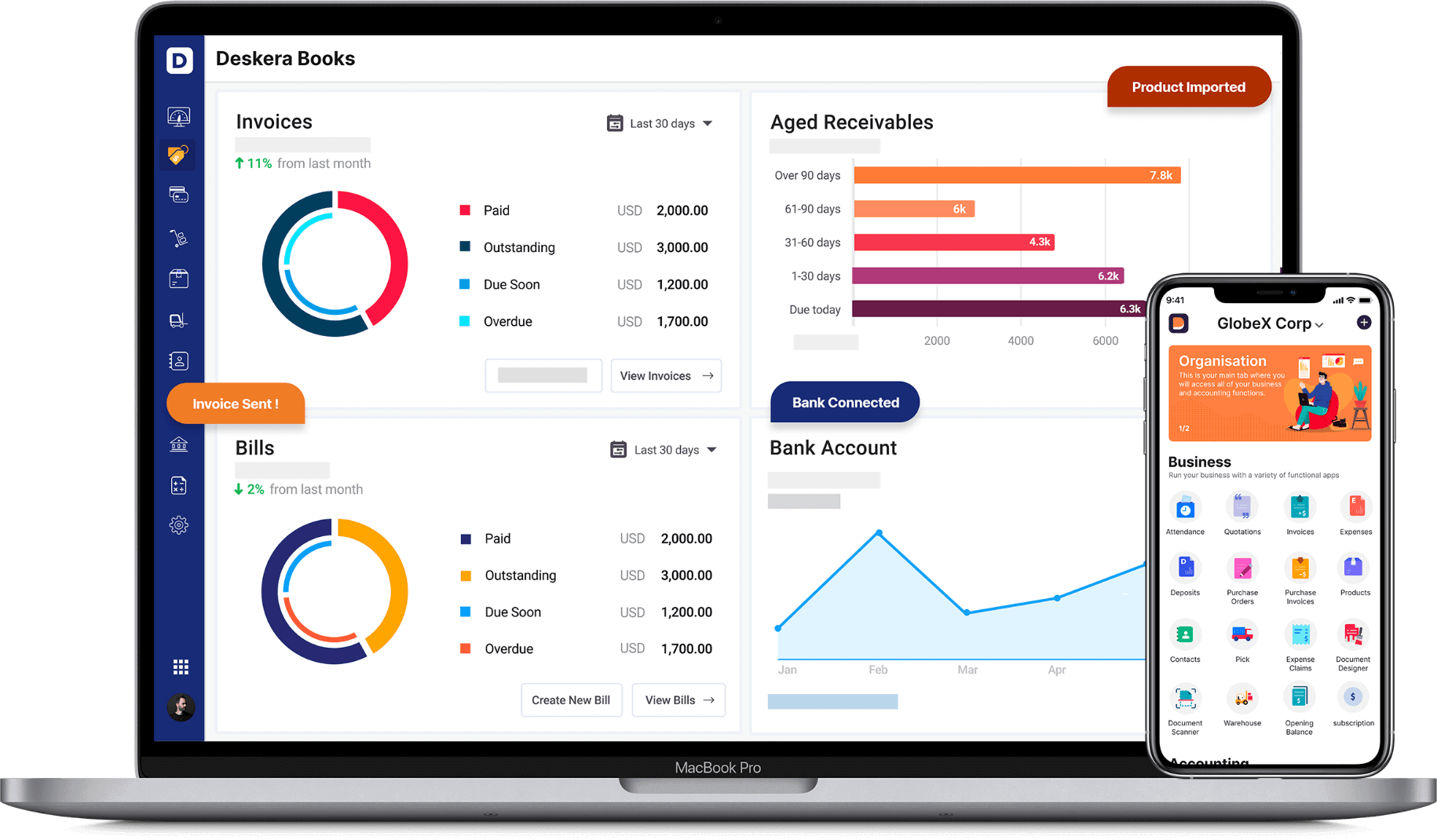

Deskera Books can help you automate your accounting and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Key Takeaways:

- Selling, General, and Administrative expenses are the daily operating costs of running a business that isn’t related to producing a good or service.

- Direct selling expenses are incurred when a product or service is sold.

- Indirect selling expenses are incurred when the product is manufactured or the service is conducted, and after.

- SG&A expenses are an excellent place to look for savings opportunities.

- Tracking selling expenses is important for tax compliance and for ensuring the business is correctly calculating deductions to reduce its tax burden.

- General expenses are the costs a business incurs as part of its daily operations, separate from selling and administration expenses.

- Building expenses pertain to any costs related to operating the facility that houses the company.

- Employee salaries and wages are other major components of general and administrative expenses.

- General expenses factor into the company's overall revenue and costs, which has an impact on the bottom line.

- Some general expenses are variable or semi-variable, which means an organization can sometimes save money if it strategizes expenditures.

- As per the experts’ opinion, a holistic approach should be considered for managing the total SG&A expenses.

- These firms disclose their corporate social responsibility activities to have a competitive advantage over the other companies.

- SG&A plays a key role in a company's profitability and the calculation of its break-even point.

- SG&A expense and its revenue ratio play a key role in explaining company profitability.

Related Articles: