Are you still completing the project in the office on a national holiday or festival time? If you are an employee working in the national capital of India, Delhi, then you should know about the festival holidays granted by the Indian government as mandatory leaves under the Punjab Industrial Establishment Act, 1965. Furthermore, the employees can refer to the Delhi industrial establishments' national and festival holiday rules of 1965 to know about the rules for festival holidays applicable to the employees. We are going to discuss this Act in this article. Our article would be covering the following topics -

- What is the Delhi Shops Act, 1954?

- What are the definitions of this Act?

- What are the salient provisions of the Delhi Industrial establishments Act?

- What are the provisions relating to working on weekends or special days?

- Conclusion

- How can Deskera Assist You?

- Key Takeaways

What is the Delhi Shops Act, 1954?

According to available information on the internet, the Delhi Shops Act was enacted in the year 1954 and applies to the whole union territory of Delhi. This Act was formed to amend and consolidate the law relating to the regulation of hours of work, payment of wages, festival holidays, leave, terms of service and various other conditions of the employees/ workers employed in shops, commercial establishments, an establishment for public entertainment or amusement and to provide for certain matters connected therewith.

The Act has been enacted as follows -

- The Delhi Shops and Establishments Act of 1954 applies to the whole Union Territory of Delhi

- It shall come into force on such date as the Government might, by notification in the Official Gazette, appoint on this behalf.

- The Act shall apply in the first instance only to the Municipal Areas, Notified Areas and Cantonment limits of Delhi, New Delhi, Shahadra, Civil Lines, Mehrauli, Red Fort and Delhi Cantonment but Government may, by notification in the Official Gazette, direct that it shall come into force in any other local area or areas or shall apply to such shops or establishments or class of shops and establishments in such other areas as may be specified in the notification.

The Delhi Shops Act had got the assent of the then President on the 19th of June 1954 and came into force in the Union territory on the 1st of February 1955. According to the act, the festival holidays and other legislations are applicable only in Delhi and not outside the union territory. Moreover, the provisions of the Act will apply only to the shops and establishments that are located in Delhi and not to any other establishment that is situated outside Delhi.

What are the definitions of this Act?

As per the data available on the internet related to the Delhi Shops Act, there are a few definitions that employers and employees need to bear in mind while working in industrial establishments and other workplaces. These definitions are as follows -

- Adult - an individual who has completed his 18 years of age

Apprentice: An apprentice is a person who is employed by a business owner whether on the payment of wages or to train him in any trade, craft or employment in the industrial establishment

2. Child - A child refers to an individual who has not yet completed his twelfth year of age

3. Cose day - A close day is not counted as the festival holidays in Delhi. It is the day of the week on which the shop or industrial establishment will remain closed

4. Closing hour - It is the hour at which the shop or industrial establishment or commercial establishment closes

5. Commercial establishment - According to this Act, a commercial establishment is a premise where any kind of trade, profession or business or any other work which is any work in connection with or incidental or ancillary thereto is carried on and this centre includes a society that is registered under the Societies Registration Act, 1860.

6. Day - A day means twenty-four hours which begins at midnight

7. Employee - an employee refers to the individual who has been wholly or principally employed whether directly or otherwise. This individual can be whether on wages that are payable permanently, periodical paystubs, contract, piece-rate or commission basis. It can also be on other consideration about the business of an establishment and includes an apprentice and any person employed in a factory but not governed by the Factories Act, 1948 (43 of 1948), and for any matter regulated by this Act, also includes a person discharged or dismissed whose claims have not been settled by this Act.

8. Employer - An employer refers to the owner of any industrial establishment who handles its business, the number of professionals employed and where the business of the industrial establishment is not directly managed by the manager, agent or a representative of such an owner in the said business.

9. Establishment - An industrial establishment refers to a shop or commercial establishment, residential hotel, restaurant, eating house, theatre or other places of public amusement or entertainment to which the Act is applicable. Furthermore, it includes all the other establishments which the Government may receive by the notification in the Official Gazette for this Act.

10. Factory - A factory means an industrial establishment that is declared or registered under the Factories Act, 1948

11. Family - A family indicates the husband, wife, son, daughter, father, mother, brother, sister or grandson of an employee, living with and wholly dependent on such employee

12. Government - In this Act, the government refers to the Chief Commissioner Delhi

13. Holiday - A holiday refers to the day on which the industrial establishment shall remain closed or on which an employee can be given a festival holidays under the provisions of the Act

14. Hours of work - Hours of work or working hours are the during which the individual is employed or works with the employer and are exclusive of any interval allowed for rest and meals and hours worked

15. Inspector - An inspector is a professional who is appointed under section 36 of the Act

16. Leave - a leave is a time off for a day provided under this Act

17. Occupier - An occupier denotes a person owning or having charge or control of an establishment and includes the manager, agent or representative of such occupier

18. Opening hour - This indicates the hour at which a shop or commercial establishment opens for the service of the customers in Delhi

19. Prescribed - prescribed by the rules under this Act

20. Register of establishments - This refers to the register which has been maintained for the registration of industrial or commercial establishments under this Act

21. Registration certificate - It is a certificate that shows the registration of an establishment

22. Religious festival - A religious festival adheres to any festival that the Government by notification in the Official Gazette declare to be a religious festival for this Act and for which the employees must be given festival holidays if applicable

23. Residential hotel - It means any premises in which business is carried on for the supply of dwelling accommodation and meals on payment of a sum of money by a traveller or any member of the public or a class of the public and includes a club

24. Restaurant or eating house - It means any premises in which is carried on wholly or principally the business of the supply of meals or refreshment to the public or a class of the public for consumption on the premises

25. Retail trade or business0 This refers to all types of businesses carries out by the business owner, or employer. It also refers to and includes the business of a barber or hair-dresser, the sale of refreshment of intoxicating liquors, and retail sales by auction

26. Schedule - It denotes the schedule appended to this Act

27. Shop - As per the industrial establishment act, a shop refers to any premise where the goods are sold either by retail or wholesale or where services are provided to the customer and the establishment has an office, storeroom, godown, or warehouse within the same premises or is in connection with such trade or business but does not include a factory or commercial establishment

28. Spread over - spread over refers to the periods between the commencement and termination of the work of an employee on any day

29. Summer - summer means the period covering the months of April, May, June, July, August and September

30. Wages - wages refer to the salary or paycheck given to an employee and are defined in section 2 of the Minimum Wages Act, 1948 (11 of 1948);

31. Week-week means seven days beginning at midnight on Saturday

32. Winter - Winter refers to the period covering the months of October, November, December, January, February and March

33. Year - it refers to the calendar year

34. Young person - a young person cannot be considered an employee or apprentice as he is not a child but has not even completed eighteen years of his age

What are the salient provisions of the Delhi Industrial establishments Act?

According to the Delhi Industrial establishments act, every employee has the right over festival holidays in Delhi. As per the provisions mentioned in this Act, every employer in Delhi is required to allow three national holidays and a minimum of four festival holidays in a year. In addition to this, the days such as Independence Day on the 15th of August, Republic Day 26th of January and Gandhi Jayanti 2nd of October are counted as the mandatory national holidays by the government of India.

As per available information on the internet, there is also a provision for seven days of casual leave and 14 days of sick leave available to the employees at half pay in a year. However, the employees that are entitled to sickness benefits from the employers under the Employee State Insurance Act 1948are not considered for sick leave. This Act requires the maintenance of a register by the employees that contains details of Casual and Sick leave availed by the employees

In addition to this, there is also a provision for the mutual consultation between the management and the employees of the industrial establishment or shop or other business under this Act and the Rules made there under for the decision of days to be observed as festival holidays in the factory by the employer.

What are the provisions relating to working on weekends or special days?

According to available information provisions relating to working on the weekend are not specified under any law or act. However, provisions relating to work days are provided in the Standing Orders of establishments as per the Industrial Employment (Standing Orders) Act, 1946 which specifies provisions relating to employees' working days and their off days for working on weekends.

There are some Acts relating to specific schedules of employment. One of them is The Weekly Holidays Act, 1942[1] which provides provisions relating to weekly holidays to persons employed in shops, restaurants and theatres. Provisions relating to it are as follows:

- Every shop shall remain entirely closed on one day of the week, which day shall be specified by the shopkeeper in a notice permanently exhibited in a conspicuous place in the shop.

- The day so specified shall not be altered by the shopkeeper more often than once in three months.

- Every person employed otherwise than in a confidential capacity or a position of management in any shop, restaurant or theatre shall be allowed each week a holiday of one whole day. And there will not be any deduction in their salary/wages for the day.

There are provisions relating to National Holidays and weekend holidays which are mentioned under the Shops and Establishment Act of the concerned states. So their applicability depends upon the state legislation. These state laws provide provisions for holidays that are to be provided by establishments to the person employed in the jurisdiction of that state.

Conclusion

It is important to follow the rules of the area where the company or industrial establishment is located in India. The business owners in Delhi must abide by the concerned Act for festival holidays of the employees in their work schedule calendar. It not only sends a positive signal to other candidates looking for recruitment in the organization or business but also portrays the business owner has an employee welfare attitude which is essential for their overall development.

How can Deskera Assist You?

Proper management of leaves and festival holidays is necessary to keep the employees happy and ensure they work for longer tenure at the workplace. Hence, a businessman or owner of an industrial establishment in Delhi should use software to keep the attendance of his employees registered.

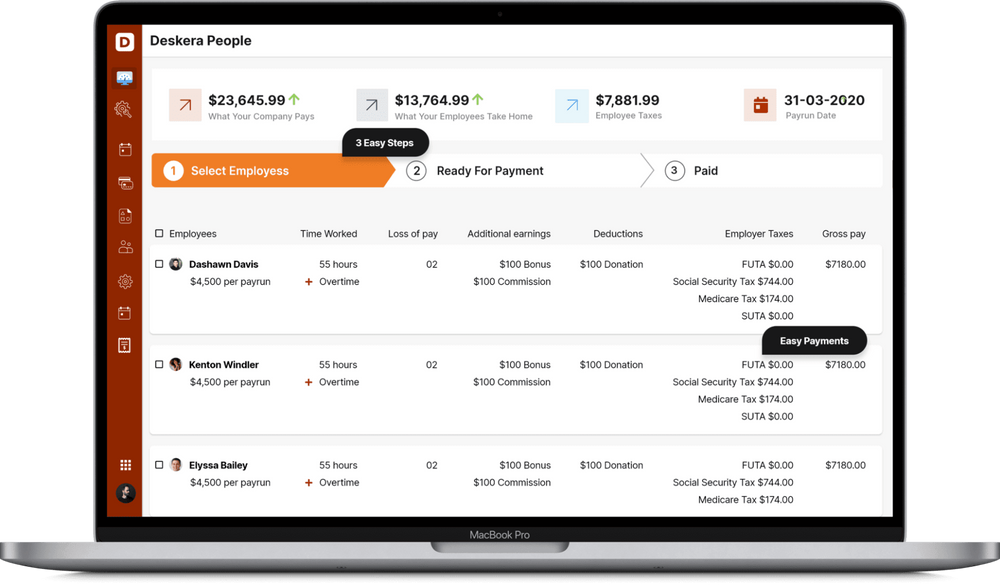

Deskera People is the right platform for handling employee wages, leave management, payroll, and generating payslips for giving it to the employees in a digitized manner.

With the use of cutting-edge technology and digitized software, it is possible to do away with the human errors in the form q for every business owner in Maharashtra.

Key Takeaways

- The Delhi Shops and Establishment Act applies to all the shops and business centres that fall within the jurisdiction of the union territory. It was enacted in the year 1954 and came into effect in February 1955.

- This act consolidates the different laws that are related to the working hours, festival holidays, leaves, work time and other important points for the employee.

- The law has permitted three national holidays, namely Independence Day, Republic Day and Mahatma Gandhi Birth Anniversary as mandatory holidays in addition to the fourteen sick leaves for the employees in Delhi.

- The Act has clearly defined different definitions for the ease of understanding of terms in industrial establishments for both the business owner and the employees.

- It is clearly stated in this Act that every shop must remain closed at least once a week and no deductibles must be done from the employee wages.

Related Articles