Employers need to carry out a hoard of activities to ensure their business is running successfully. This not only involves introducing innovative products in the market but also making efforts for the proper employee management as they are the backbone of the organization. The entrepreneurs and business owners in Maharashtra are required to fill the form q which is under Maharashtra Shops and Establishment Act. Let us understand this act and form q in more detail through this article. We would be covering the following points in this article -

- Maharashtra Shops and Establishment Act, 1948

- What is a muster roll?

- What are the rules for form q?

- How to fill the form q?

- Conclusion

- How can Deskera Assist you?

- Key Takeaways

Maharashtra Shops and Establishment Act, 1948

According to available data on the internet, the Maharashtra Shops and Establishment Act was enabled in the year 1948. It got extended to the entire rest of the state of Maharashtra by 1961. This Act was drafted to consolidate and amend the laws for regulating the conditions of employees/ workers for work and employment in shops, residential hotels, restaurants, and commercial establishments. It was also for the employees working in the eating houses, theatres, other places of public amusement or entertainment and other establishments.

The Maharashtra Shops and Establishment Act (Regulation of Employment and Condition of Service) of 2017 can be found on the webpage - https://mahakamgar.maharashtra.gov.in/lc-the-maharashtra-shops-establishment.htm

The Maharashtra Shops and Establishment Act had laid down a few definitions for the employees and business owners under this Act which are -

- Apprentice: This is an employee who is employed based on particular wages. If the employer has hired him for a training period with no particular paycheck, it means the purpose is to provide training to the worker in any trade, craft or skill in the establishment

- Child: As per this act, a child refers to the employee who has not completed his fifteen years of age; but does not include a person who has, before the date of commencement of Bombay Shops and Establishments (Amendment) Act, 1977 (Maharashtra LXIV of 1977) completed his 12th year of age if not fifteen years.

- Closed: It means the business or establishment is not open for the service of any customer or business or work with the help of any employee working in it.

- "Commercial establishment" means an establishment which carries on, any business, trade or profession or any work in connection with, or incidental. or ancillary to, any business, trade or profession [and includes an establishment of any legal practitioner, medical practitioner, architect, engineer, accountant, tax consultant or any other technical or professional consultant and also includes] a society registered under the Societies Registration Act, 1860 (XXI of 1860), and a charitable or another trust, whether registered or not, which carries on [whether for purposes of gain or not,] any business, trade or profession or work in connection with or incidental or ancillary thereto but does not include a factory, shop, residential hotel, restaurant, eating house, theatre or other places of public amusement or entertainment;

- ( "Day" means twenty-four hours beginning at midnight:

Provided that, in the case of an employee whose hours of work extend beyond midnight, day means twenty-four hours beginning when such employment commences irrespective of midnight

6. "Employee" means a person - wholly or principally employed, whether directly or through any agency, and whether for wages or other consideration, in or in connection with any establishment; and includes an apprentice, but does not include a member of the employer's family;]

7. "Employer" means a person owning or having ultimate control over the affairs of an establishment;

8. "Establishment" means a shop, commercial establishment, residential hotel, restaurant, eating house, theatre, or other places of public amusement or entertainment to which this Act applies and includes such other establishment as the [State] Government may, by notification in the Official Gazette, declare to be an establishment for this Act;

9. "Factory" means any premises which is a factory within the meaning of [clause (m) of section 2 of the Factories Act, 1948, (LXIII of 1948) or which is deemed to be a factory under section 85 of the said Act];

10. "Goods" includes all materials, commodities and articles;

11. "Holiday" means a day on which an establishment shall remain closed or on which an employee shall be given a holiday under the provisions of this Act;

12. "Inspector" means an Inspector appointed under section 48;

13. "Leave" means leave provided for in Chapter VII of this Act;

14. "Local area" means any area or combination of areas to which this Act applies;

15. "Local authority" means a body specified in Schedule I-A and includes any other body which the State Government may, by notification in the Official Gazette, declare to be a local authority for this Act;]

16. "Manager" means a person declared to be a manager under section 7;

17. "Member of the family of an employer" means the husband, wife, son, daughter, father; mother, brother or sister of an employer who lives with and is dependent on such employer;

18. "Opened" means open for the service of any customer, or any business of the establishment, or work, by or with the help of any employee of or connected with the establishment;]

19. "Period of work" means the time during which an employee is at the disposal of the employer;

20. "Prescribed" means prescribed by rules made under this Act;

21. "Prescribed authority" means the authority prescribed under the rules made under this Act;

22. "Register of establishment" means a register maintained for the registration of establishments under this Act;

23. "Registration certificate" means a certificate showing the registration of an establishment;

24. "Residential hotel" means any premises used for the reception of guests and travellers desirous of dwelling or sleeping therein and includes [residential club];

25. "Restaurant or eating house" means any premises in which is carried on wholly or principally the business of the supply of meal or refreshments to the public or a class of the public for consumption on the premises;

26. "Schedule" means a Schedule appended to this Act;

27. "Shop" means any premises where goods are sold, either by retail or wholesale or where services are rendered to customers and includes an office, a store-room, godown, warehouse or workplace, whether in the same premises or otherwise, [mainly used] in connection with such trade or business but does not include a factory, a commercial establishment, residential hotel, restaurant, eating house, theatre or other places of public amusement or entertainment;

28. "Spread over" means the period between the commencement and the termination of the work of an employee on any day;

29. "Theatre" includes any premises intended principally or wholly for the exhibition of pictures or other optical effects using a cinematograph or other suitable apparatus or dramatic performances or any other public amusement or entertainment;

30. "Wages" means wages as defined in the Payment of Wages Act, 1936 (IV of 1936);

31. "Week" means seven days beginning at midnight on Saturday;

32. "Year" means a year commencing on the first day of January;]

33. "Young person" means a person who is not a child and has not completed his seventeenth year.

Reference - http://www.bareactslive.com/MAH/MH253.HTM

What is a muster roll?

Every employer needs to maintain a muster roll for his employees - be it a big organization, small scale industry, shop or any other commercial establishment in business. It can be considered as an employment attendance register by the business owner which tells him about the specific worksite. This muster register can also be used by the employer as an acknowledgement of employee attendance. In addition to this, it can be used by the employees to claim funds for those who are concerned with the wages in their employment.

According to the available information, a muster roll was first used by the employers in the context of maritime law. It referred to the shipmaster’s account that listed the name, age, nationality and cadre of every employee on the ship. It has been used by employers and business owners in general work over the years and is referred to as labour attendance register, commonly known as muster roll wage register at the worksite.

As per the law, every employer has to maintain a muster roll with the salary or wage particulars of all the employees working in his organization or business. The employer must maintain the contents of the muster roll by showing the details listed below -

- Name and Address of the Factory or Establishment

- Name and Address of the Contractor (if any)

- Name and Address of the Principal/ Employer

- Place of work

- Month and Year

- Name of the employee

- Employee’s Father’s Name or Husband’s Name

- Gender

- Employee ID Number (EID)

- Designation/ Department

- Date of Joining

- ESI number

- PF number

- Day-wise attendance for the month

- Number of Payable days

- Component-wise Salary or wage details

- Component-wise Details of deductions

- Net Salary or Wages payable

- Employee or Receiver’s Signature or Thumb impression

The muster roll wage register can be understood from the image given below -

What are the rules for form q?

Every employer or business owner in Maharashtra needs to fill out the form q under the Shops and Establishment Act. He is liable to follow certain rules while filling the form q. These are under Rule 26 which is for the maintenance of registers and records. The rules under this form are as follows -

- The employer shall maintain a Muster-Roll cum Wages Register in form q: If the employer or business owner maintains a Muster Roll cum Wages register under sub-rule (1) of rule 27 of the Maharashtra Minimum Wages Rules, 1963 framed under the Minimum Wages Act, 1948, it is not imperative for him to maintain the Muster Roll cum Wages Register according to the provisions of the subrule(1)

- The employee or concerned manager of the company or business in charge of this register needs to maintain every entry in this register or record so that they shall be authenticated digitally or manually by the employer/ business owner/ entrepreneur or any other professional who has authority over the individual. Furthermore, the entries that are related to overtime must be immediately for an employee after the completion of his overtime work. In case, the employer or manager is absent or on leave for the day, then the muster entries shall be authenticated by another professional who has been authorized in writing by the employer.

- According to the Maharashtra S&E Act for form q, every register, record and notice required to be maintained, exhibited or given under the rules shall be written in either Marathi or English language.

- As per the rule for form q, it is required that every manager or employer shall preserve the inspection records of the Facilitator for at least 3 years. In addition to this, he shall present or produce the records whenever demanded by the Facilitator.

- If the employer has an office, store-room, godown, warehouse, or workplace that is used in connection with his trade, business or company and is situated at different premises than the company, business or establishment location, then he needs to maintain a muster roll cum wage register for the store-room or additional place as well. He should have a separate form q for this premises and its muster rolls must be maintained under the Act which is in respect to office, store-room, warehouse, godown or the workplace.

How to fill the form q?

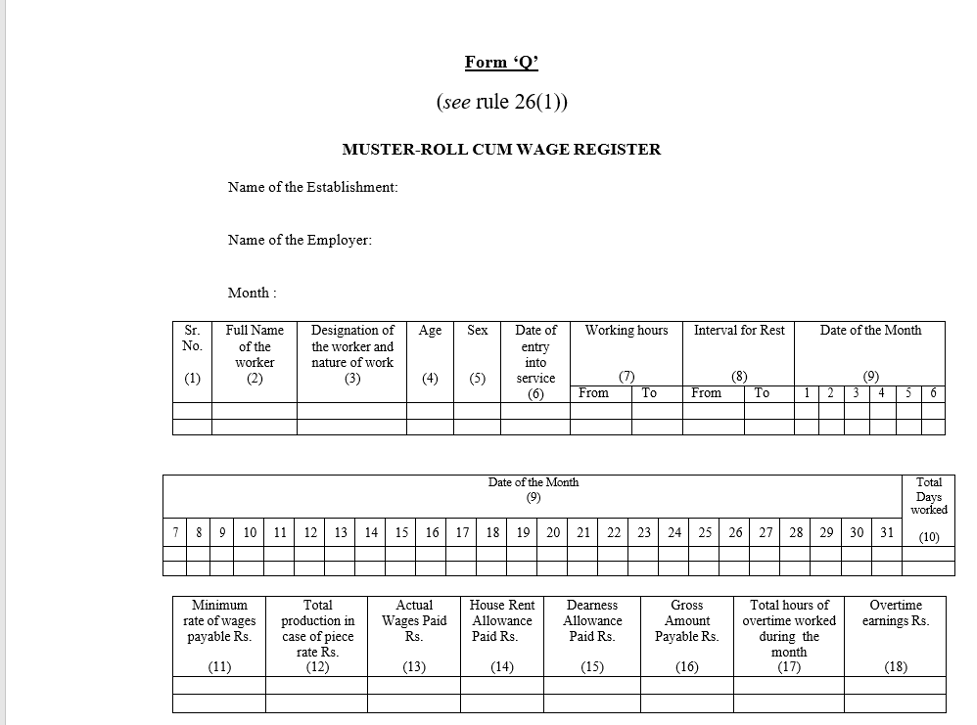

If you are a business owner who has just ventured into the business for the first time and has no idea about what the form q looks like, you can refer to the figure above. The above picture gives a complete representation of form q that is related to the Maharashtra Shop And Establishment Act. As per the rule, the business owner or employer needs to fill out this form to give complete details about the workers or employees employed by him.

As visible in the image, form q is a muster roll cum wage register that needs to be practised by every business owner, factor owner or employer in Maharashtra under the Act. In this form q, it is expected that the employer maintains accurate attendance and wages paid to every employee working in his firm or business.

- As visible in the picture of form q above, in the first line the employer must mention the name of his establishment or business

- On the next line in this form, the employer must mention his name

- As easily understood, this form q is to be filled every month, and the employer must maintain a proper register for recording the working days and wages given to employees. He should fill in the details such as the full name of the worker, his designation and nature of the work at the worksite, age, and sex. In addition to this, the employer must also write about his joining date on the form q, working hours, and what interval time is given to the worker for rest for all the days in a month. At the end of the month, the employer must mention the number of days the employee or worker has worked at the workplace.

- The employer must also mention the minimum wages paid to the worker or employee in this form q. In addition to that, HR must give complete detail about his paystub by specifying the different types of allowances offered by the employer. This includes house rent allowance, dearness allowance, gross salary given to the employee, number of hours worked overtime by the employee, overtime payment due from the employer etc.

- The form q also has a mention of different funds that are considered deductibles from an employee’s salary. It includes various deductions such as the provident fund, ESI contribution, family pension, professional tax, income tax as applicable in India, loan and interest as well as other details. At the end of this row after various deductions, the final net payable amount given to the employee is mentioned in the form q by the employer

- In the ending section of the form q, the employer has to mention the date of payment when the salary is deposited in the concerned employee’s account. He should include additional details such as the bank account number of the worker to whom the form q is related. He should also mention the cheque number or RTGS number or NEFT number for the employee in this form and the date on which the transfer was done. The HR must include the total amount deposited as salary in the employee or worker’s account in the form q as well as take his signature or thumb impression upon transferring the salary for the month.

Conclusion

Every employer or business owner in Maharashtra needs to maintain a form q for all his employees under the Maharashtra Shop And Establishment Act. in this form, he is responsible for giving all details related to the working hours and payments did to employees every month.

How can Deskera Assist you?

Payroll management and salary are integral and vital parts of the business. Every employer must maintain a muster roll and wage register for his employees.

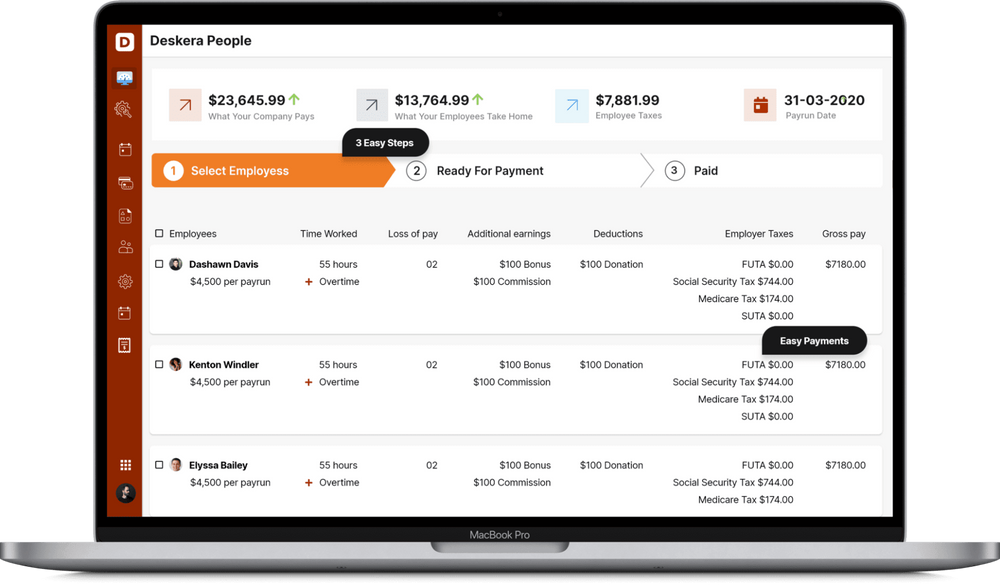

Deskera People provides tools for payroll, leave management, attendance and generating payslips for your employees in a digital way.

With the use of cutting-edge technology and digitized software, it is possible to do away with the human errors in the form q for every business owner in Maharashtra.

Key Takeaways

1. Every employer, business owner or factory owner needs to maintain a muster roll cum wage register that is required to fill the form q each month in Maharashtra.

2. The Maharashtra Shops and Establishment Act was formed to amend the working conditions for workers in the state and ensure their proper welfare of them in the workplace or establishments. It ensures that the employees are given appropriate wages, paid for overtime, and given proper intervals in their working hours.

3. The employer or business owner must fill in all the details of the employee in his form q. It includes the date of joining, PF number, ESI number, wages, working hours, overtime, payment for overtime, gender of the employee, attendance for the month and the number of payable days for every employee working in his organization or business.

4. If the employer or business owner has a separate godown for his company apart from the organization premises, then he should maintain two separate muster roll cum wages registers to fill the form q independently for both the locations.

Related Articles