Journalizing transactions is the process of recording and tracking any transaction that your business performs.

This recording is the building block for the business’ financial statements, which are created at the end of the fiscal year.

In this guide, we will go through the details of what journalizing means, the different ways and types of journalizing transactions, why they’re important, and every other question you might have about journalizing.

Read on to learn about:

- What Are Journalizing Transactions?

- Why Is Journalizing Important?

- What Are the Different Types of Journals?

- How to Journalize Transactions: Step-by-Step

- Journalizing Transactions Examples

- How to Journalize Transactions Using Accounting Software

- Journalizing Transactions FAQ

What Are Journalizing Transactions?

The business accounting cycle is a multi-step process that records and analyses your financial information. This cycle starts with journalizing transactions.

The process of journalizing transactions refers to the initial recording of all the financial transactions of a business. This recording is done by listing journal entries into the journal.

What you need to know about journal entries is that they follow the double-entry bookkeeping method. In double-entry, every recorded transaction causes a change in at least two accounts, where one gets debited and the other credited.

Once the journal entries are done, they go into the journal, which is the chronological, day-by-day accounting book that summarizes business transactions.

If you want to know more about the cycle financial transactions go through after they get posted into the journal, head over to our step-by-step guide on the accounting cycle.

What Is Double-Entry Bookkeeping?

As we previously stated, double-entry bookkeeping affects at least two accounts (hence the word double) with the appropriate debit and credit entries.

But what exactly are debits and credits?

A debit is an entry that:

- Increases an asset or expense account

- Decreases liability, equity, or revenue account

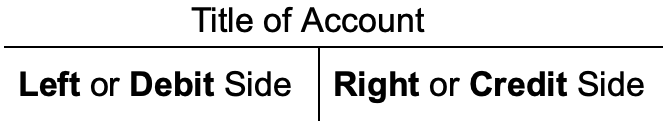

Debits come first and go into the left side of the journal entry.

Whereas a credit does the opposite, meaning it:

- Increases a liability, equity, or revenue account

- Decreases an asset or expense account

Credits are recorded after debits, on the right side of the entry.

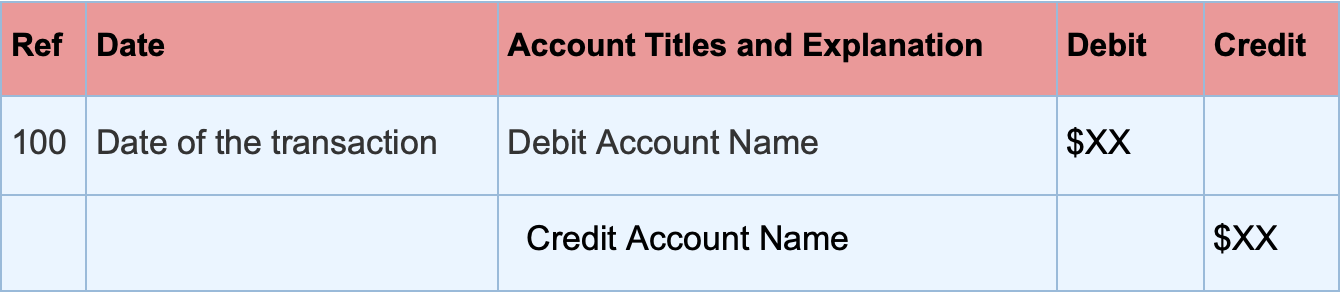

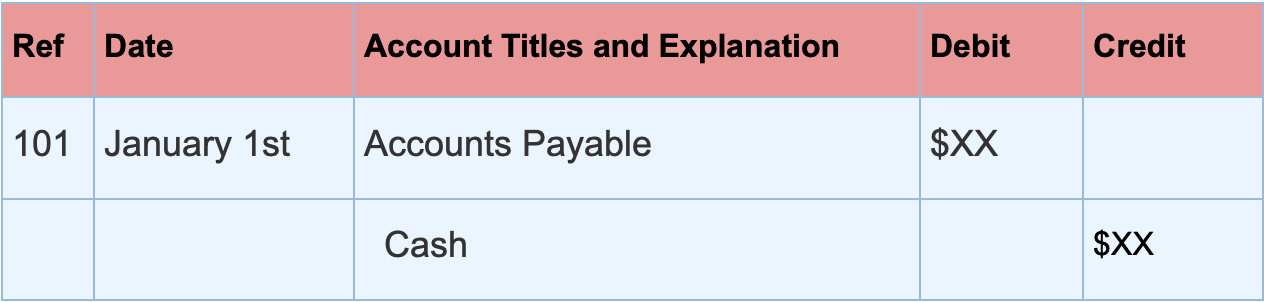

Here is an example of what debit and credit entries look like as a journal entry:

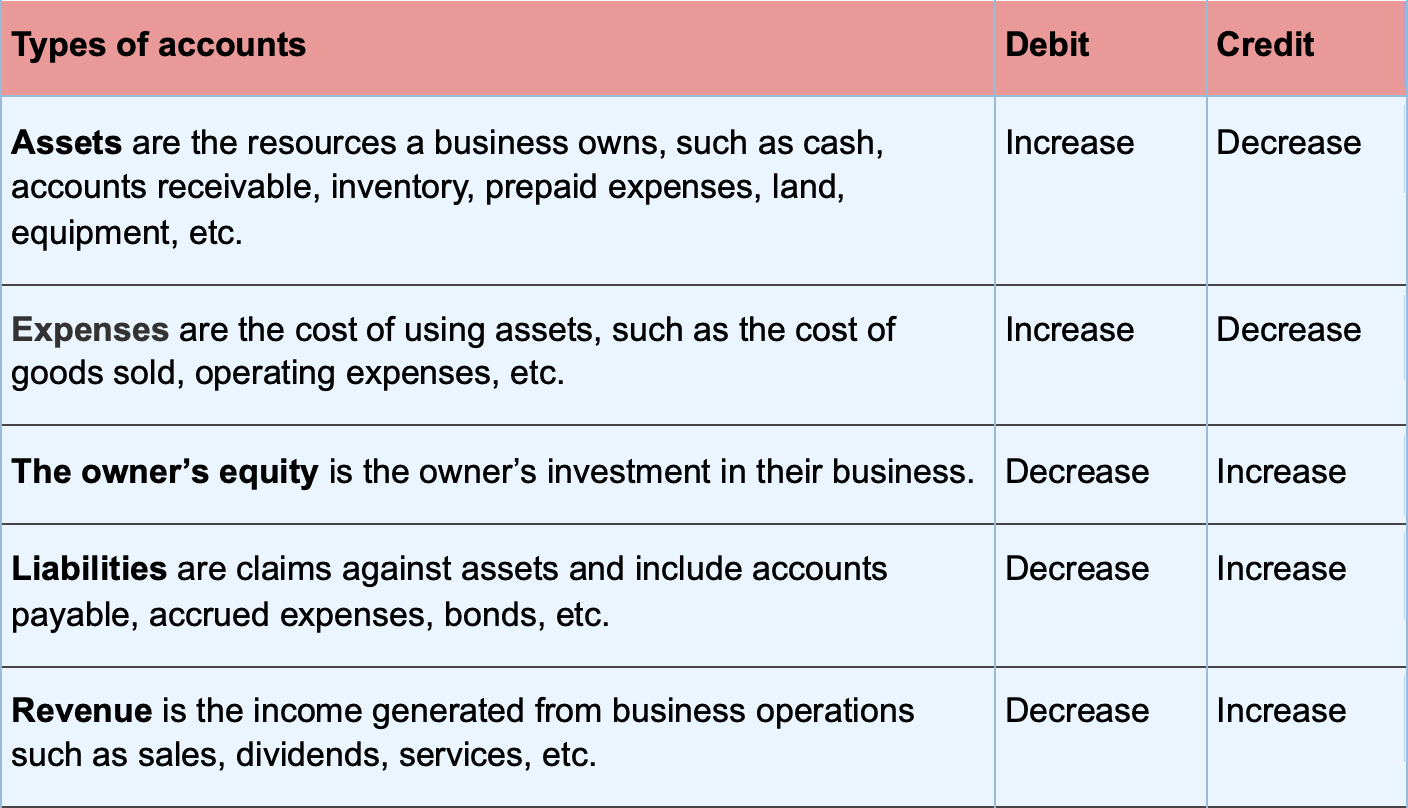

And here’s a cheat sheet for debit and credit rules, so you can easily remember them:

Why Is Journalizing Important?

The first and most important purpose of journalizing transactions is to keep your business’ finances accurate and well-organized. The journal records this data chronologically, through debits and credits, which makes the information clear to overview and accounting errors easy to spot.

Secondly, these records are necessary for businesses to eventually create their financial statements, which is the essential goal of the accounting cycle. With these financial statements, auditors can analyze how transactions impact a business.

And lastly, journalizing is also important for stakeholders and other interested third parties.

Creditors, investors, shareholders, tax authorities, all require full financial transparency to decide whether or not your business is worth investing in and/or following accounting principles.

If you want to learn more about how to properly maintain accounting for your small business, head over to our guide on small business accounting.

What Are the Different Types of Journals?

No transaction can get into the accounting records without first being recorded in the journal.

Also known as the “book of original entry”, the journal has every day-to-day financial transaction that takes place within a business.

Now, since businesses are diverse in size and service, there are several types of journals a firm can keep. We divide them into two main categories: general and special.

The general journal is the most common type of journal, and it keeps a record of any and all transactions that take place within a business. The general journal is more common for smaller firms that don’t run many business transactions.

However, this type of recordkeeping isn’t convenient for larger trading or manufacturing companies. As such, they need separate special journals to record specific routine transactions quickly.

There aren’t any rules for the design or content of special journals. They are tailored based on the business needs, activities, and resources.

With that being said, some of the most common types of special journals include:

- Purchase Journal

- Sales Journal

- Cash Payment Journal

- Owner’s Equity Journal

- Accounts Receivable Journal

- Accounts Payable Journal, etc.

But remember: a business might still need a general journal for every transaction that doesn’t fit into any of its special journals. These transactions might include adjusting entries, closing entries, or other unexpected events such as lawsuit fees.

How to Journalize Transactions: Step-by-Step

To perfectly journalize your transactions, there are three simple steps you have to follow.

1. Figure Out the Accounts Affected

The very first thing you have to do when journalizing is an analysis of the transaction to figure out what accounts change and by how much.

For example, let’s say a company receives $500 in service revenue for their repair services on January 29th. Cash and revenue both increase by $500 since cash is coming into the business.

If you want to learn more about the different types of accounts in business and how to recognize them, check out our guide on the chart of accounts.

2. Translate the Changes Into Debits and Credits

This is the most complicated part of journalizing transactions.

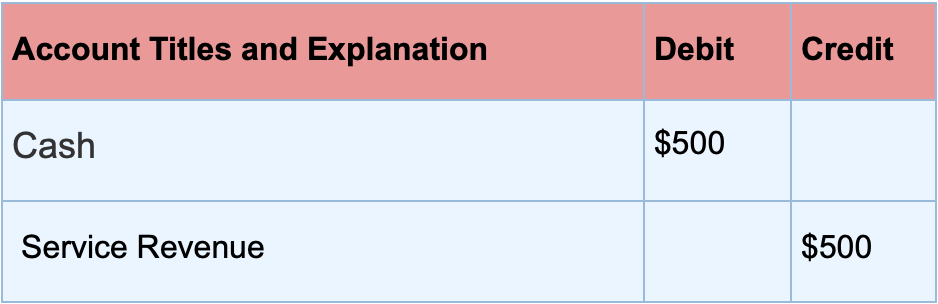

In our previous example, we said that both the service revenue and cash account experience an increase.

Cash is an asset account since it’s a resource the business owns. While service revenue is clearly a revenue account and represents income from repair services.

If we look at the debit and credit cheat sheet, we’ll see that debits increase assets, and credits increase revenue. That’s why:

- Cash Account will be debited for $500

- Service Revenue Account will be credited for $500.

The journal entry so far would look like this:

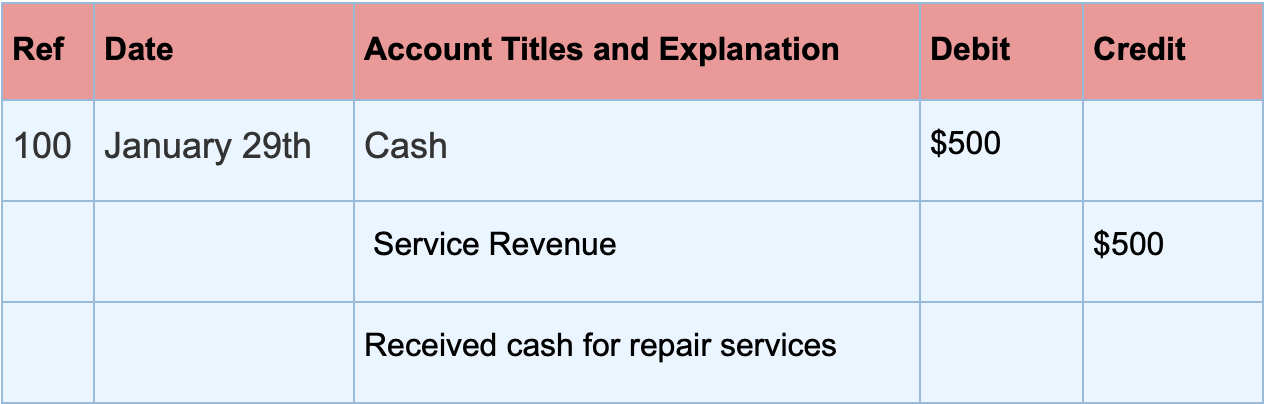

3. Write the Date, Reference Number, and Description

After you’re done with debits and credits, add the date of the transaction, reference number, and a brief description.

The date of the transaction for our example is January 29th, as mentioned.

The reference number is company-assigned and can be any number (as long as it’s unique for every entry).

The description needs to be short and to the point, for instance: “Received cash for repair services).

The finished journalized transaction of our example would look like this in the Journal:

Journalizing Transactions Examples

Some of the most common types of journalizing transactions (besides sales) you’ll have to deal with as a small business owner include the following:

1. Journal Entry for Sales Return

Journalizing for a sales return involves:

- Reversing the revenue recorded at the time of the sale

- Reversing the inventory

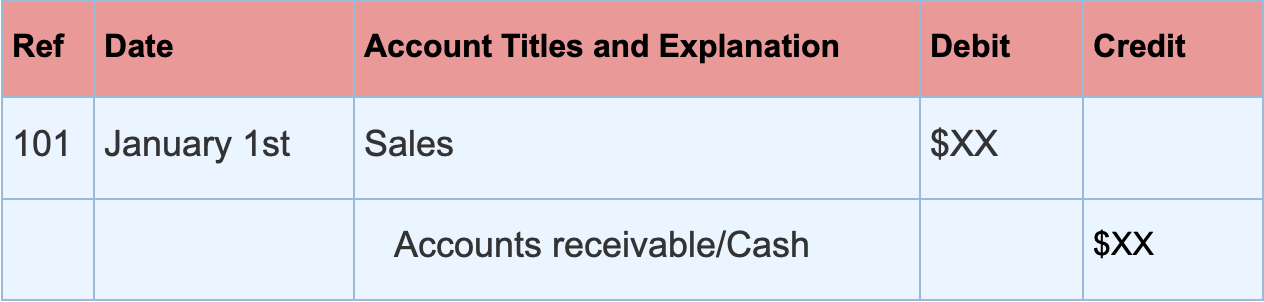

To reverse the revenue you directly debit sales and credit accounts receivable (or cash if the client paid for their sale):

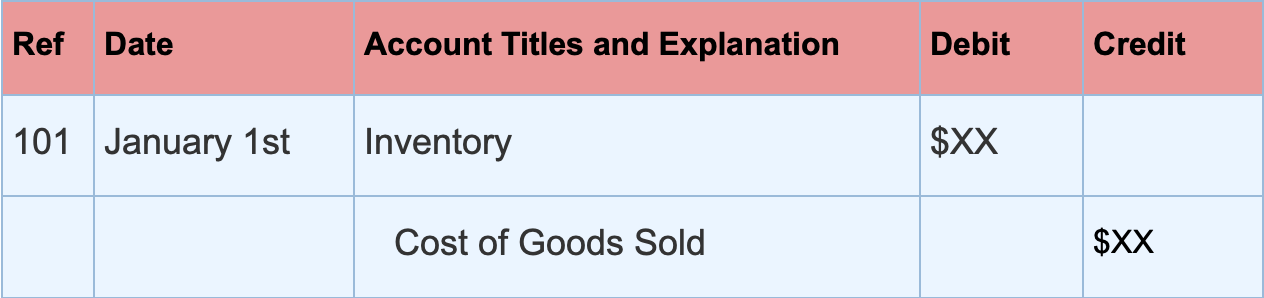

Then, since a product is physically returned from a sales return, inventory increases and the related cost of goods sold (COGS) decreases.

So inventory gets debited, and COGS credited, as shown below:

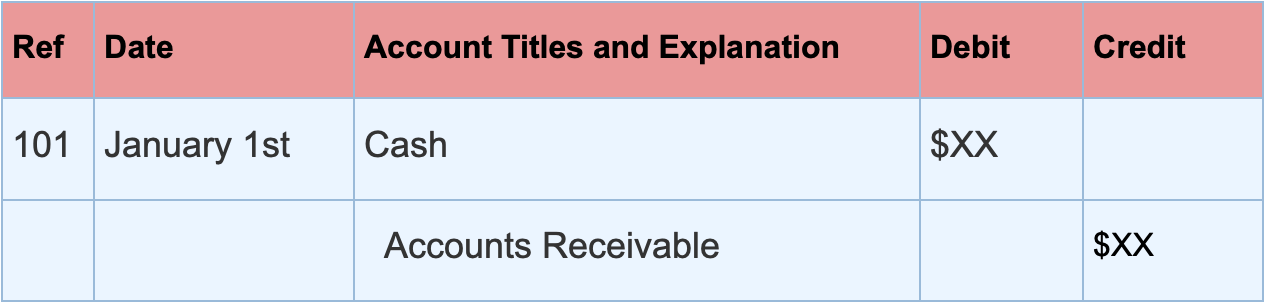

2. Journal Entry for Receiving An Invoice Payment

When a client pays for a sales invoice, cash is debited and accounts receivable credited:

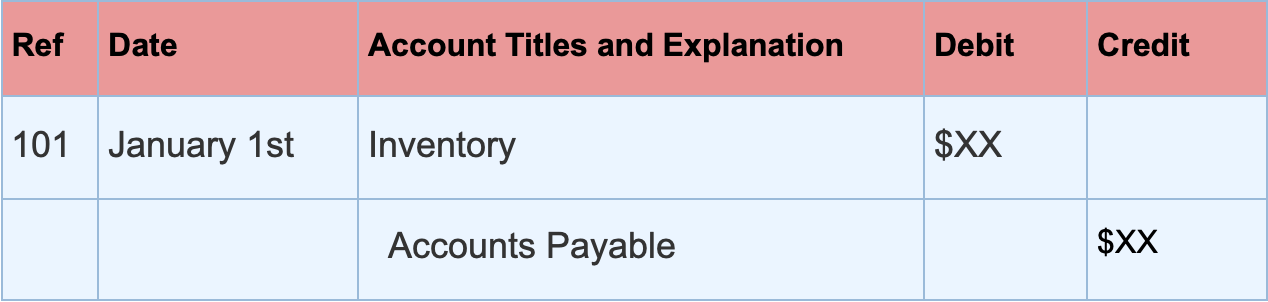

3. Journal Entry for Purchasing Goods

When you purchase from vendors on credit, inventory increases and gets debited, and accounts payable which is a liability account also increases and is credited:

4. Journal Entry for Making an Invoice Payment

Journalizing invoice payments involves decreasing both accounts payable (credit entry) and cash (debit entry), as shown below:

5. Journal Entry for Owner’s Equity

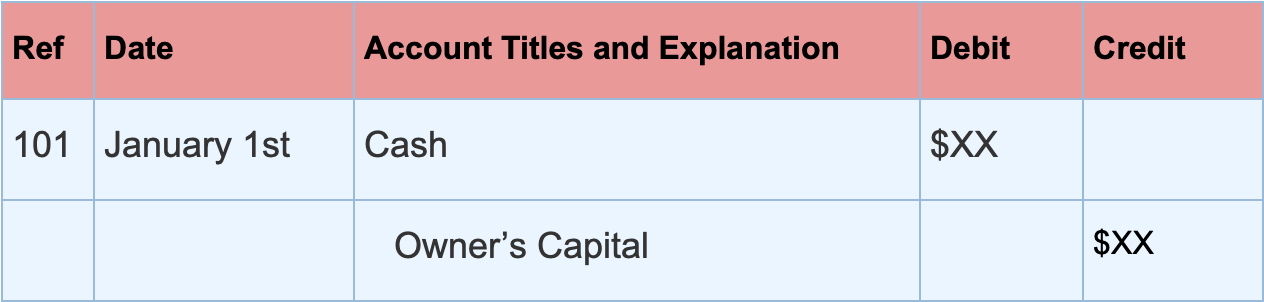

If the owner makes an investment in the business, cash and owner’s capital increase at the same time:

How to Journalize Transactions Using Accounting Software

If you’re running your own business, you probably don’t have a lot of spare time to journalize business transactions by hand. Not only is it tedious and time-consuming, but manually recording entries will likely lead to making a ton of accounting errors.

That’s why most businesses prefer recording their journal entries through accounting software, instead. Now you may be thinking: don’t you need technical knowledge to use accounting software?

For the most part, that’s true, but we at Deskera prioritize small business owners.

We’ve spent over 10 years working with small business owners from over 100+ countries to build a cloud accounting software that suits any type of business. With Deskera you can effortlessly manage and oversee your invoices, inventory, business expenses, financial reports all in one place.

Here’s the step-by-step process of journalizing transactions with Deskera Books.

1. From the dashboard go to Accounting > Journal Entry

In the accounting dashboard, you’ll also be able to view and manage the chart of accounts, debit and credit notes, opening balances, expenses, and any deposits of the business.

As you can see, on the Journal Entry section you are able to view, create, and manage all journal entries. The main details such as entry number, date, type, and related document number are displayed for every journalized transaction.

2. Press Import on the top right of the page to record existing transactions

If you have preexisting journal entries in Excel spreadsheets, you can easily enter them into the software by using the Import feature. All you have to do is upload the Excel/CSV file, and the data will be mapped for you automatically.

3. Press Create to manually record a journal entry

To manually create a journal entry, press the Create button at the top right of the page.

You can choose between making a normal journal entry or a fund transfer. This entirely depends on the type of entry you’re making.

4. Click JE - Normal to go to the General Journal page

On the top half of the page, you can find the auto numbering format, currency, journal date, and an “include in the tax report” option. Then on the bottom half, you can select the account name, description, type (debit or credit), and the amount.

On the right of the page, there’s a sidebar with quick actions you can take such as global custom fields, and set recurring.

5. Fill in all of the relevant entry information and press Save on the bottom right. And you’re done!

This was the manual journal entry creation. But with Deskera you can also automate your entire journalizing transactions process within seconds.

When the business creates an invoice, the corresponding entry is automatically posted to the respective ledger account for Accounts Receivable, Sales, Cash, etc.

At the same time, Deskera lets you integrate directly with your business bank account. This way, every time an expense gets made, the journal entry is automatically mapped to the appropriate ledger account.

Still not convinced Deskera is the right accounting software for your business?

Luckily, you can try the platform out yourself right away, with our free trial. No credit card details needed.

Journalizing Transactions FAQ

#1. What’s the Difference Between Accounting and Bookkeeping?

Bookkeeping handles the day-to-day recording of financial transactions, such as sales, purchases, receipts, payments.

Whereas accounting requires analytical work, and is more subjective, as it deals with giving business owners financial insights from their bookkeeping data.

#2. What’s the Difference Between Posting and Journalizing?

Journalizing is the initial recording of business transactions as a journal entry. While posting is the process of transferring these journal entries into ledger accounts.

The simplest form of a ledger account is the T-account, which has three elements: title of account, debit side, credit side:

#3. What is the Accounting Equation?

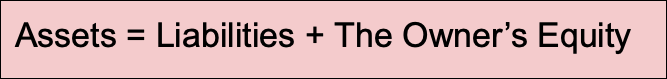

The accounting equation is the foundation of double-entry bookkeeping. It represents the relationship between assets, owner’s equity, and liabilities as follows:

The balance sheet of a company reflects this equation in detail.

#4. What is Single-Entry Bookkeeping?

Single-entry bookkeeping is an accounting system where transactions are recorded through one entry only.

The elements of a single-entry include the date, description, and negative or positive value of the financial transaction.

Key Takeaways

We hope our guide was helpful in understanding the journalizing transaction process, and why it’s important that it is done correctly.

For a quick recap, here are some of the main points we’ve covered:

- The process of journalizing transactions involves making journal entries for a business’ financial transactions into the journal. The journal can be either general or special.

- The general journal is the most common type of journal for small businesses and keeps a record of every type of transaction. Special journals record specific routine transactions.

- Journalizing transactions is what keeps the finances of a business accurate and well-organized. These records are also the foundation of the financial statements, and they interest third parties such as shareholders, creditors, investors, etc.

- Journalizing is based upon double-entry bookkeeping, in which every transaction affects at least two accounts with debit and credit entries.

- To journalize transactions you have to follow three simple steps:

- Figure out the accounts affected

- Translate the changes into debits and credits

- Enter the date, reference number, and description

- Use accounting software like Deskera to automate the journalizing transactions process within seconds.

Related Articles