Salvage value is a critical concept in accounting and financial planning, representing the estimated residual value of an asset at the end of its useful life.

Accurately determining the salvage value is essential for calculating depreciation, understanding the total cost of ownership, and making informed financial decisions about asset purchases and disposals.

Any business that uses tangible assets may incur the costs associated with such properties. If in future periods an asset is expected to produce a benefit, some of these costs should be delayed rather than treated as an existing expense.

In its financial reporting, the company then records the cost of depreciation for the current year. Usually in the process, four criteria are involved: Cost of asset, its Salvage value, Useful life of the asset, and a Depreciation method.

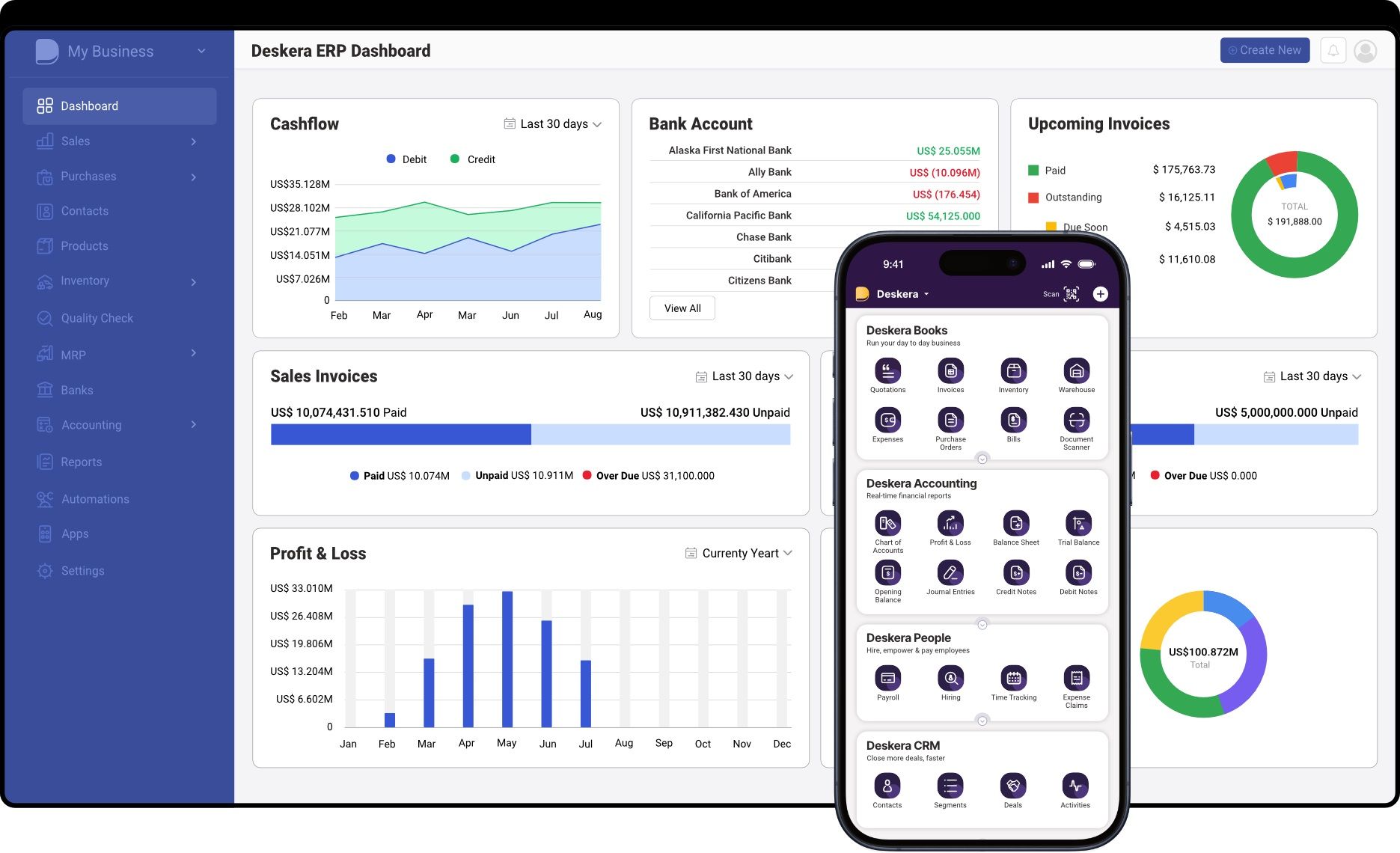

Incorporating a robust ERP system like Deskera can significantly enhance how businesses manage and calculate salvage value. Deskera ERP provides comprehensive asset management features that streamline the tracking, depreciation, and eventual disposal of assets. Also integrating an AI mechanism like ERP.AI to your ERP system can make it smarter by enhancing enterprise process, data governance & decision-making.

By integrating financial data and automating calculations, Deskera ERP ensures accuracy and consistency in determining salvage values across various asset categories.

What is Salvage Value?

Salvage value is defined as the book value of the asset once the depreciation has been completely expensed. It is the value a company expects in return for selling or sharing the asset at the end of its life.

We can also define the salvage value as the amount that an asset is estimated to be worth at the end of its useful life.

As the salvage value is extremely minimal, the organizations may depreciate their assets to $0. The salvage amount or value holds an important place while calculating depreciation and can affect the total depreciable amount used by the company in its depreciation schedule. Salvage value is also known as scrap value or residual value and is used when determining the annual depreciation expense of an asset.

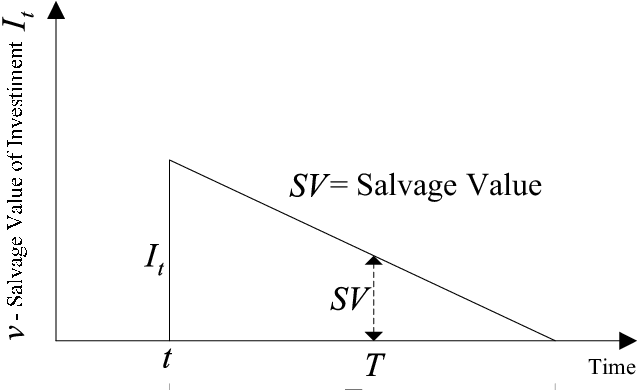

When calculating depreciation in your balance sheet, an asset's salvage value is subtracted from its initial cost to determine total depreciation over the asset's useful life.

Depreciation measures an asset's gradual loss of value over its useful life, measuring how much of the asset's initial value has eroded over time. Depreciation is an essential measurement because it is frequently tax-deductible.

How is Salvage Value Calculated?

As is clear from the definition, the value of equipment or machinery after its useful life is termed the salvage value. Simply put, when we deduct the depreciation of the machinery from its original cost, we get the salvage value.

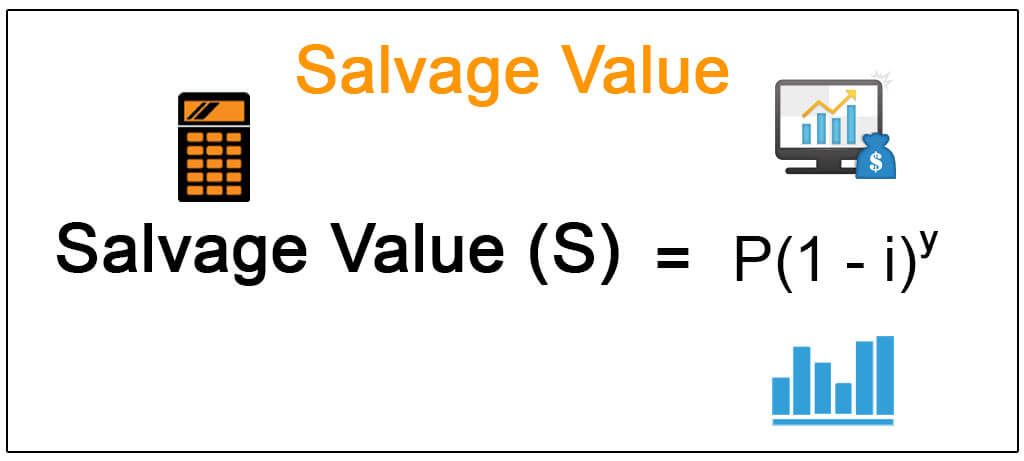

Based on this, let’s take a look at the formula for calculating salvage value:

Formula:

S = P- ( I * Y )

Where

S = Salvage Value

P = Initial Price

I = Depreciation

Y = Number of Years

With a large number of manufacturing businesses relying on their machinery for sustained productivity, it is imperative to keep assessing the equipment they own. Constant use and other factors like the nature and quality of these assets cause a continual deterioration. The overall expenses also affect the production process.

Owing to these factors, the companies need to make the asset cost-efficient. Besides, the companies also need to ensure that the goods generated are economical from the customer’s perspective as well. Overall, the companies have to calculate the efficiency of the machine to maintain relevance in the market.

What is after Tax and before Tax Salvage Value?

Salvage value is also called scrap value and gives us the annual depreciation expense of a specific asset. It must be noted that the cost of the asset is recorded on the company’s balance sheet whereas the depreciation amount is recorded in the income statement.

With these facts in mind, we move on to other concepts of salvage value.

When an asset is sold for less than its book value then the difference in cost will be recorded as a loss for tax calculations.

Before-Tax Salvage Value: When a good is sold off, its selling price is the salvage value and this is called the before tax salvage value.

After-Tax Salvage Value: The price at which a good is sold becomes an income on the statement and therefore, attracts tax. After deducting the tax, the value/ amount you are left with is called after-tax salvage value.

Income - Tax = Salvage Value after Tax

Let’s move on to the next section to look at examples of Salvage Value Before and After Tax.

Example of salvage value calculation for a car belonging to a business for after and before tax

Let’s take an example of a company that buys a car for its internal use. Here are the assumptions:

Initial cost of car = $10,000

Useful Life in years = 6

Depreciation = 10% per year

So, after 6 years if the company sells the car,

60% depreciation is reported over 6 years and salvage value is 40% of the initial cost of the car.

Salvage value of 40% = 4000

So, this becomes Salvage value Before Tax.

Now, say you have to pay a tax of 20% on this amount,

20% on $4,000 = $800

So $4,000 - $800 = $3,200

$3,200 is the salvage value After Tax of the car.

|

Purchase Price of

Machinery (P) |

$80,0000 |

|

Depreciation (I) |

$90,000 |

|

Useful Life (Y) |

5 |

|

Salvage Value (S) |

S = P - (I*Y) |

|

Salvage Value Formula |

= $800,000-($90,000*5) |

|

Salvage Value |

= $350,000 |

How is Salvage Value used in Depreciation Calculations?

Moving on, let’s look through the details of how the salvage value can be used in depreciation calculations. We can understand the concept through an example.

One of the best examples or scenarios to consider here is a motor accident. In such cases, the insurance company decides if they should write off a damaged car considering it a complete loss, or furnishing an amount required for repairing the damaged parts. So, in such a case, the insurance company finally decides to pay for the salvage value of the vehicle rather than fixing it.

From this, we know that a salvage value is used for determining the value of a good, machinery, or even a company. It is beneficial to the investors who can then use it to assess the right price of a good. Similarly, organizations use it to examine and deduct their yearly tax payments.

Taking another example:

A company wants to sell one of its machines that is no longer operable for $5,000. Let’s consider the following values:

Initial Cost of the machine = $50,000

Selling price = $5,000

Total depreciation amount over useful life = $45,000

This information is sufficient to calculate each year’s depreciation.

Applying straight-line depreciation, where the depreciation value will be the same every year:

Useful Life = 15 years

So, total depreciation of $45,000 spread across 15 years of useful life gives annual depreciation of $3,000 per year.

From this, we can deduce that the salvage value plays an important role in the calculation of depreciation and the entries made for it.

|

Purchase

Price of Machinery (P) |

$1,0000 |

|

Useful

Life (Y) |

4 Years |

|

Salvage

Value (S) |

= $200 |

|

Year |

Book

Value |

Depreciation |

Book

Value (End Year) |

|

1 |

$1000 |

$200 |

$800 |

|

2 |

$800 |

$200 |

$600 |

|

3 |

$600 |

$200 |

$400 |

|

4 |

$400 |

$200 |

$200 |

What is the Impact of Salvage Value on Accounting?

Salvage value is important in accounting as it displays the value of the asset on the organization’s books once it completely expenses the depreciation. It exhibits the value the company expects from selling the asset at the end of its useful life.

We can see this example to calculate salvage value and record depreciation in accounts.

Once you know the salvage value, you may go ahead to calculate depreciation.

Step 1: Calculating asset’s initial price

An eminent chocolatier purchases a refrigerator. This is how he determines the purchase price of the refrigerator:

Upfront Payment = $10,000

Sales Tax = $1,000

Installation cost = $500

Total Purchase price = $11,500

Step 2: Determine Depreciable Value

This is calculated as:

Purchase Price - Salvage Value = Value of Depreciation

Here, we make certain assumptions.

The useful life of refrigerator = 7 years

Salvage value = $1,000

So, the depreciable value = $11,500 - $1,000 = $10,500

Step 3: Select the method to calculate depreciation

You may choose any of the following methods for the purpose:

- Straight line

- Double Declining balance

- Sum of the years

- Units of Production

Step 4: Draw a Depreciation Schedule

A depreciation schedule helps you with mapping out monthly or yearly depreciation.

Going with the straight-line method,

Yearly depreciation = Depreciable value / Useful years

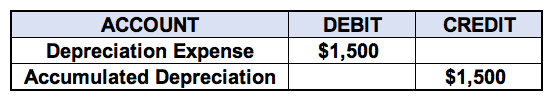

Step 5: Creating Depreciation Journal Entry

Now, you are ready to record a depreciation journal entry towards the end of the accounting period.

For this example, this is how the entries would look like:

This way, the salvage value helps in determining the depreciation; which is an integral part of accounting.

Salvage Value vs Residual Value

By definition, Residual value is the value of an asset at the end of its useful life.

This is also how we define salvage value. So, to summarize, the two terms are interchangeable and imply the same.

Another term known as scrap value can also be used as a synonym for salvage value or residual value.

How AI Can Improve Asset Management and Depreciation Forecasting

With AI-powered systems, companies can automate asset tracking, predict wear and tear, and estimate end-of-life value more precisely. These tools analyze historical data, usage patterns, and market conditions to improve salvage value forecasts—helping businesses plan better for asset disposal or resale.

AI also enhances depreciation forecasting by dynamically adjusting schedules based on real-time data, reducing human error and ensuring compliance with accounting standards. This enables finance teams to optimize tax planning and make smarter capital investment decisions.

How Can Deskera Help You With Salvage Value?

Deskera ERP can assist businesses in managing and determining salvage value through several key features and functionalities:

1.Asset Management: Deskera ERP provides a comprehensive asset management module that allows businesses to track their assets throughout their lifecycle. This includes recording purchase details, useful life, depreciation methods, and estimated salvage values.

2.Depreciation Calculation: The system automates the calculation of depreciation based on the chosen method (e.g., straight-line, declining balance). By incorporating salvage value into these calculations, Deskera ERP ensures that depreciation expenses are accurately reflected in financial statements.

3.Accurate Record-Keeping: Deskera ERP maintains detailed records of each asset, including acquisition cost, depreciation accumulated, and remaining book value. This information is essential for determining the salvage value at the end of the asset’s useful life.

4.Compliance and Reporting: The ERP system generates compliant financial reports that include depreciation and salvage value information. These reports can be customized to meet specific accounting standards and regulatory requirements, ensuring transparency and accuracy.

5.Real-Time Data and Insights: With real-time data capabilities, Deskera ERP allows businesses to monitor asset performance and value continuously. This real-time insight helps in making timely decisions regarding asset disposal or replacement, ensuring optimal use of resources.

6.Integration with Financial Planning: Deskera ERP integrates asset management with broader financial planning and budgeting processes. This holistic approach ensures that salvage value considerations are factored into financial forecasts and capital expenditure plans.

7.Scenario Analysis: The ERP system can simulate different scenarios involving asset lifecycles and salvage values. This helps businesses assess the financial impact of different depreciation methods and salvage value estimates, supporting better strategic decision-making.

8.Auditing and Compliance: Deskera ERP’s robust auditing capabilities ensure that all asset transactions, including those related to salvage value, are accurately recorded and traceable. This is crucial for internal audits and external compliance.

Key Takeaways

Here are the key points before we wind up the article:

- The salvage value/ residual value/ scrap value of an asset is the value of the asset at the end of its useful life.

- When a good is sold off, its selling price is the salvage value and this is called the before tax salvage value.

- The price at which a good is sold becomes an income on the statement and therefore, attracts tax. After deducting the tax, the value/ amount you are left with is called after-tax salvage value.

- Salvage value plays a pivotal role in calculating depreciation and its subsequent accounting.

- By leveraging Deskera ERP, businesses can enhance their asset management practices, ensure accurate depreciation calculations, and make informed decisions regarding asset disposal and salvage value. This leads to better financial management and improved resource allocation.

Related Articles

-5.jpg?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=MnwxMTc3M3wwfDF8c2VhcmNofDN8fGJ1c2luZXNzfGVufDB8fHx8MTY1ODg0MTM5NQ&ixlib=rb-1.2.1&q=80&w=2000)