Although Coca-Cola and your local fitness center may be as different as chalk and cheese, they do have one thing in common - and that’s their accounting equation.

The accounting equation is the foundation of double-entry bookkeeping which is the bookkeeping method used by most businesses, regardless of their size, nature, or structure. This bookkeeping method assures that the balance sheet statement always equals in the end.

We’ll explain what that means, along with everything else you need to know about the accounting equation as we go on.

In this guide you will learn about:

- What Is the Accounting Equation?

- What Are the Three Elements in the Accounting Equation Formula?

- What Is the Double-Entry Bookkeeping Method?

- 5+ Accounting Equation Examples

- What Are the Limitations of the Accounting Equation

What Is the Accounting Equation?

The finances of every business consist of two basic elements: what it owns, and what it owes.

Assets are the overall resources a business owns. The owner’s equity is the share the owner has on these assets, such as personal investments or drawings. Liabilities, on the other hand, show how much money is owed.

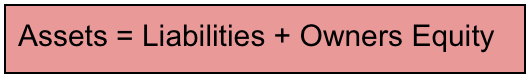

The relationship between these three financial components is expressed through the accounting equation, as shown below:

As we previously mentioned, the accounting equation is the same for all businesses. It’s extremely important for businesses in that it provides the basis for calculating various financial ratios, as well as for creating financial statements.

Before getting into how the accounting equation helps balance double-entry bookkeeping, let’s explain each element of the equation in detail.

What Are the Three Elements in the Accounting Equation Formula?

Assets

Assets represent the ability your business has to provide goods and services. Or in other words, it includes all things of value that are used to perform activities such as production and sales.

We divide assets into two main categories: short-term and long-term.

Short term assets are expected to be consumed within a year. They include:

- Cash and cash equivalents

- Inventory

- Accounts receivable

- Prepaid expenses

Long-term assets extend their use over the one-year period. They can be either tangible (physical) or intangible.

Tangible assets are buildings, land, and equipment. Intangible ones consist of patents, trademarks, or copyrights.

Liabilities

Liabilities (or obligations) are assets owed to creditors. Creditors include people or entities the business owes money to, such as employees, government agencies, banks, and more.

We classify liabilities the same way we do assets, based on current, or long-term periods of time.

Current or short-term liabilities are employee payroll, invoices, utility, and supply expenses. Long-term liabilities cover loans, mortgages, and deferred taxes.

Owner’s Equity

The owner’s equity is the value of assets that belong to the owner(s). More specifically, it’s the amount left once assets are liquidated and liabilities get paid off.

Let’s check out what causes increases and decreases in the owner’s equity.

- Increases in Owner’s Equity - Two main sources cause an increase in owner’s equity: investments by the owner, and revenue. Investments are the cash the owner personally puts into their business. These investments are recorded under a category called the owner’s capital. Revenues, on the other hand, represent profit made from business activities such as sales, fees, renting a property, lending cash, commissions, and more.

- Decreases in Owner’s Equity - Decreases in equity happen from drawings and expenses. Drawings are the cash the owner withdraws from the business accounts. While expenses are the cost that comes from consumed assets. For example purchase of equipment, wages expense, utility expense, taxes, and so on.

Extended Version of The Accounting Equation

Now, there’s an extended version of the accounting equation that includes all of the elements (described in the section above) that comprise the Owner’s Equity.

Here’s what it looks like:

This formulation gives you a full visual representation of the relationship between the business’ main accounts.

This isn’t the only type of rearrangement you can make to the accounting equation, though. It can be transformed and interpreted into two other forms:

1. Owner’s equity = Assets - Liabilities

At first glance, you probably don’t see a big difference from the basic accounting equation. However, when the owner’s equity is shifted on the left side, the equation takes on a different meaning.

It’s telling us that creditors have priority over owners, in terms of satisfying their demands. While the basic accounting equation’s main goal is to show the financial position of the business.

2. Net Worth = Assets - Liabilities

This is another form of the equation you may come across. It’s essentially the same equation because net worth and owner’s equity are synonymous with each other. Other names for owner’s equity you may face are also net assets, or stockholder’s equity (for public corporations).

What Is The Double-Entry Bookkeeping Method?

Every business transaction has a double effect on the accounting equation. For instance, if an asset increases, there is always one corresponding:

- Decrease in another asset

- Increase in a liability or

- Increase in owner’s equity.

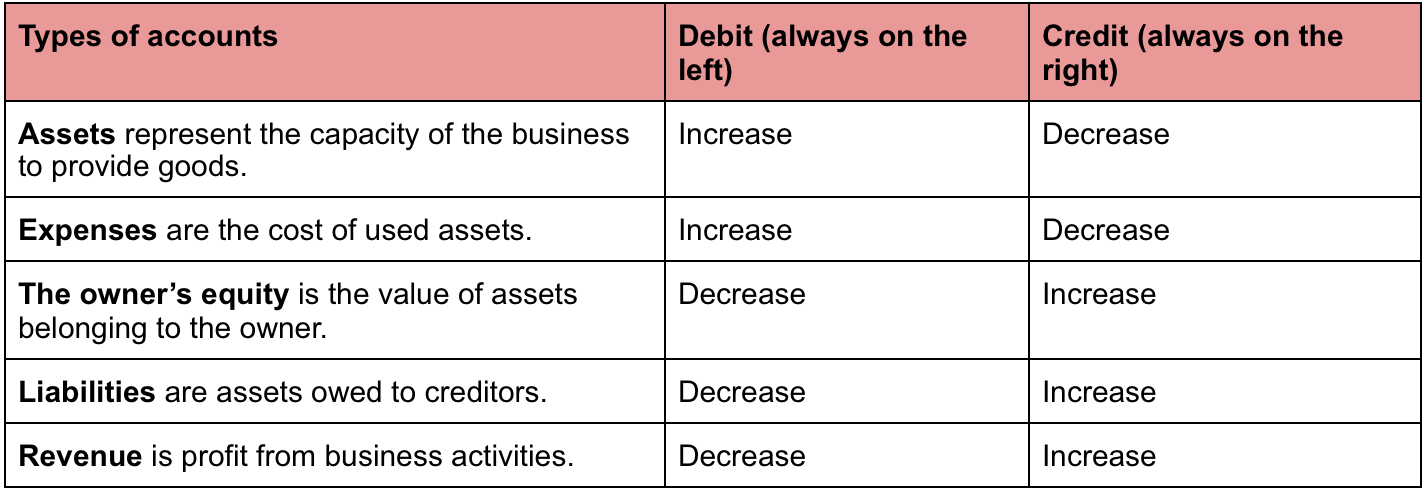

Now, these changes in the accounting equation get recorded into the business’ financial books through double-entry bookkeeping.

Double-entry bookkeeping is a system that records transactions and their effects into journal entries, by debiting one account and crediting another.

Debits are cash flowing into the business, while credits are cash flowing out.

For every debit entry, there has to be an equal credit entry. So debits and credits should always balance in the end.

To understand which accounts get debited or credited when money changes, we’ve made a cheat sheet so you can easily understand.

Don’t want to worry about doing double-entry bookkeeping for your small business? Use accounting software like Deskera to automate your business’ bookkeeping process!

Deskera integrates directly with your bank account, and automatically posts every purchase and expense made into the correct ledger accounts, with the corresponding debit and credit amounts. That way, you don’t have to worry about a thing!

And that’s not even the best part.

With Deskera you can automate other parts of the accounting cycle as well, such as managing inventory, sending invoices, handling payroll, and so much more.

Deskera Books is a time-saving strategy for managing your work contacts, invoicing, bills and expenses. You can also import opening balances and set up chart accounts through it.

Deskera Books is an online accounting software that enables you to generate e-Invoices for Compliance. It lets you easily create e-invoices by clicking on the Generate e-Invoice button.

A quick video tour will help you get a better understanding of the entire process in a few minutes.

Now that you have Deskera, you can easily manage your journals. A single interface gives you access to all remarkable features, including the ability to add products, services, and inventory.

You can automatically generate and send invoices using this accounting software. Further, creating financial statements has become considerably easier thanks to the software, which lets you draft balance sheets, income statements, profit and loss statements, and cash flow statements.

From setting up your organization to inviting your colleagues and accountant, you can achieve all this with Deskera Books. You can witness the easy implementation of the tool and try it out to get a renewed experience while handling your accounting system.

Acquaint yourself with a new-age system that takes care of Accounting, finance, inventory, and much more, all under one single roof.

The Balance Sheet

The balance sheet is a more detailed reflection of the accounting equation. It records the assets, liabilities, and owner’s equity of a business at a specific time. Just like the accounting equation, it shows us that total assets equal total liabilities and owner’s equity.

Creating the balance sheet statement is one of the last steps in the accounting cycle, and it is done after double-entry bookkeeping.

To prepare the balance sheet and other financial statements, you have to first choose an accounting system. The three main systems used in business are manual, cloud-based accounting software, and ERP software.

5+ Accounting Equation Examples

To understand the accounting equation better, let’s take a few practical transactions and analyze their effect.

Assume the following examples are transactions for XYZ company during their first month of work:

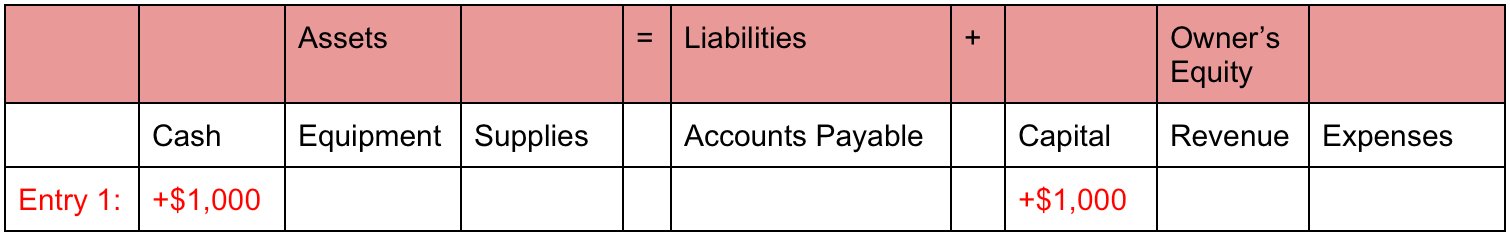

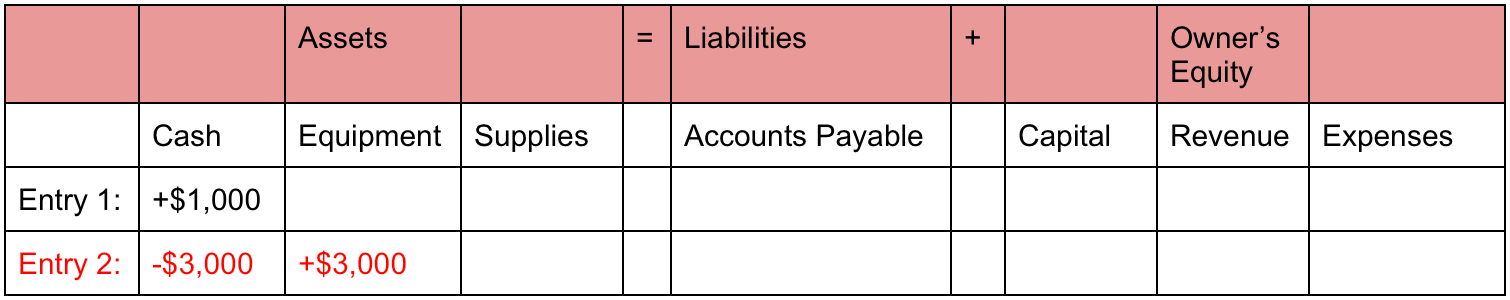

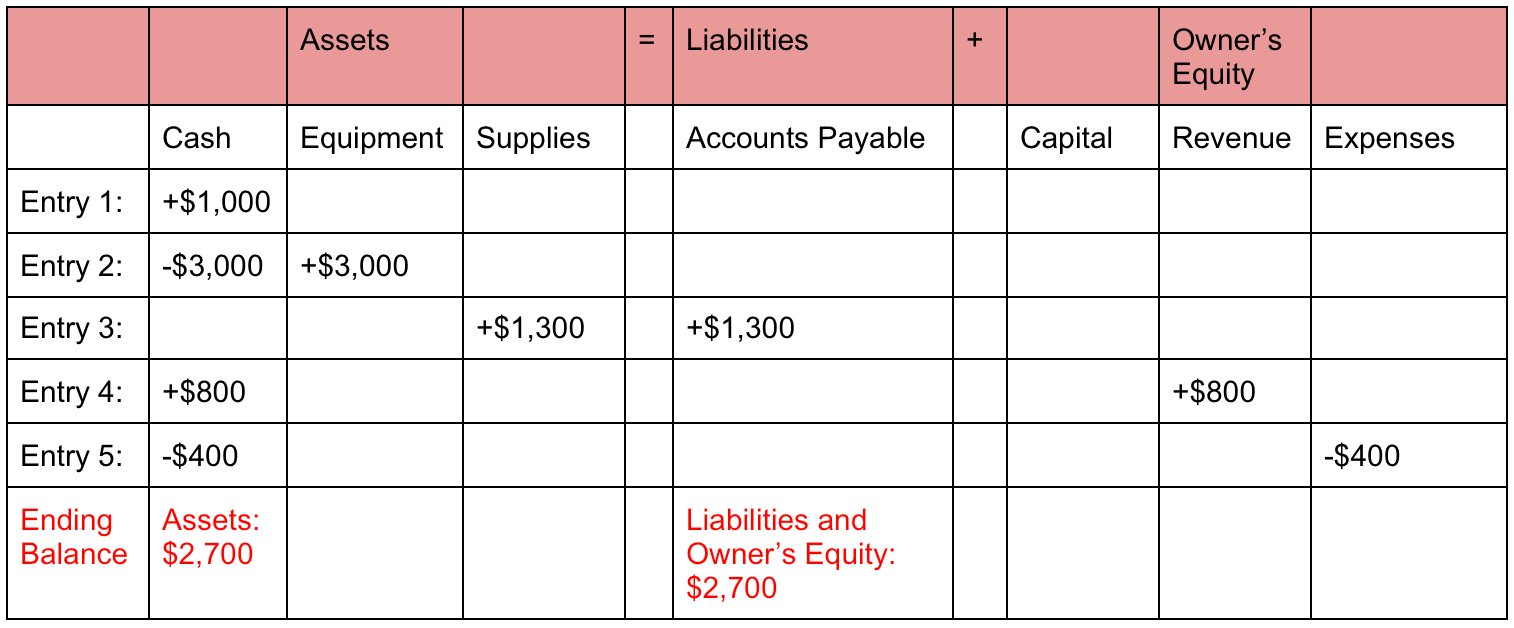

1. The business owner invests $10,000 in Company XYZ. This transaction will result in an increase of $10,000 in both the cash asset and owner’s equity capital. The equation would look as shown below:

2. Company XYZ purchases $3,000 of equipment. In this case, there is an increase and decrease of $3,000 on assets. The cash account will decrease, while the equipment account increases. This is how the entry would look like in the equation:

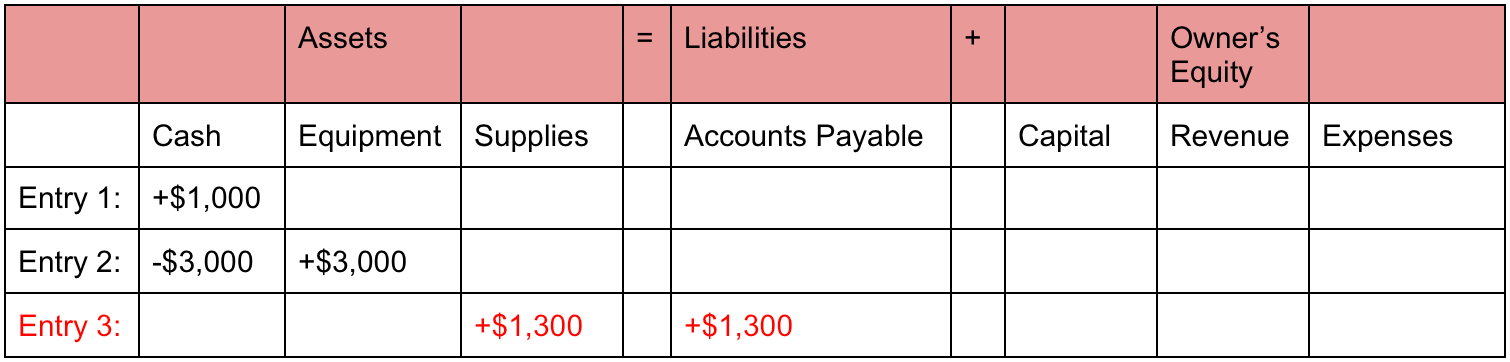

3. Company XYZ purchases $1,300 of supplies on credit. This transaction causes an increase of $1,300 in both assets and accounts payable liability. Concretely, the accounts affected are the supplies and accounts payable. This third transaction would appear like this in the equation:

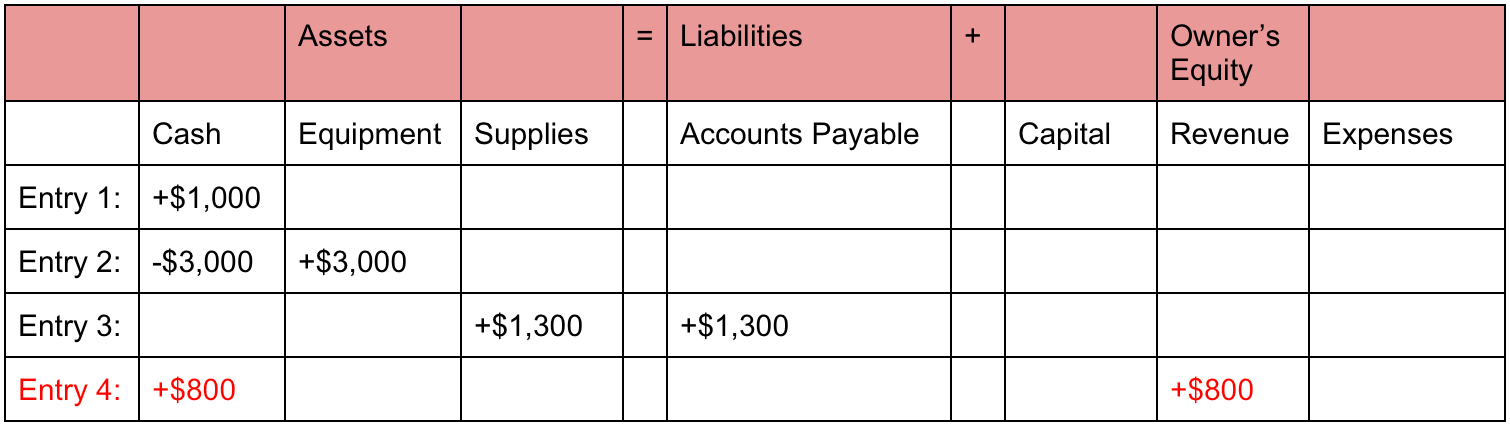

4. XYZ receives $800 cash from customers for services provided. When receiving cash from services the two accounts that increase by $800 are the cash and revenue ones. The accounting equation would look like this:

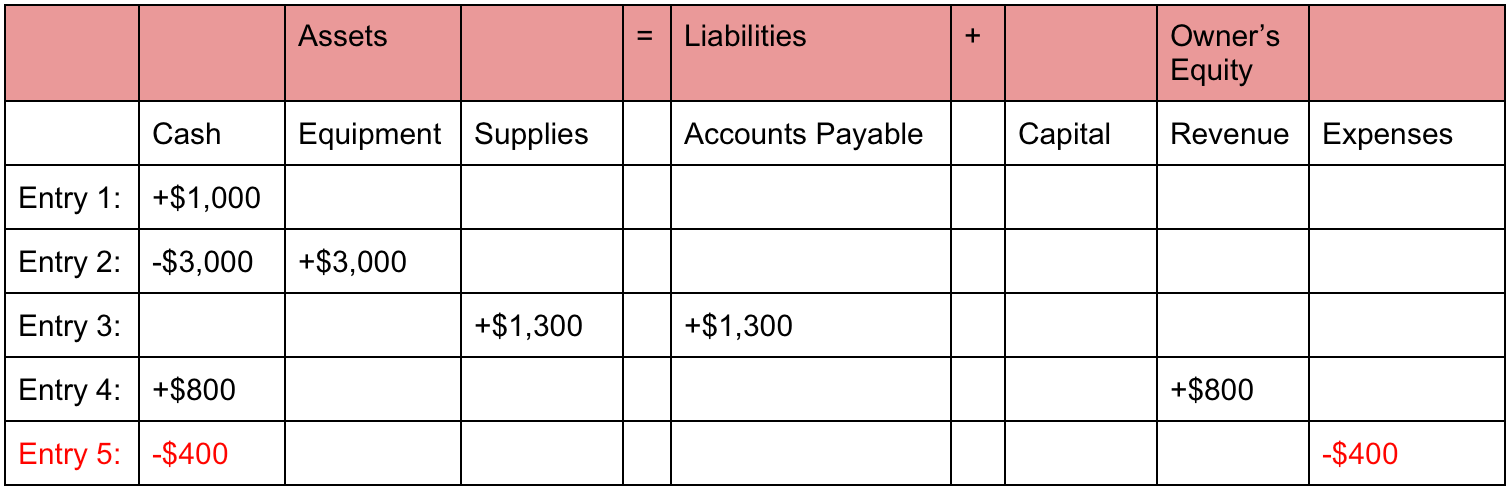

5. XYZ pays $400 expense for employee salaries. The effect of this payment is an equal decrease of $400 on the cash account, and expenses account. This transaction would look as follows:

If we add up both sides of the equation they will equal to $27,00 and balance, as shown below:

Want to learn more about recording transactions and doing accounting for your small business? Read our ultimate guide to small business accounting.

What Are The Limitations of The Accounting Equation

As helpful as the accounting equation is in doing accounting for your business, it has its own limitations.

For starters, it doesn’t provide investors or other interested third parties with an analysis of how well the business is operating.

Additionally, it doesn’t completely prevent accounting errors from being made. Even when the balance sheet balances itself out, there is still a possibility of error that doesn’t involve the accounting equation.

If you want to know more about accounting errors and how to spot them, we recommend reading Common Accounting Errors - A Practical Guide With Examples.

Key Takeaways

And that’s a wrap on our accounting equation guide! We hope you found it helpful.

To recap, here are some main points we’ve covered:

- The accounting equation is the fundamental tool that enables double-entry bookkeeping for all businesses, no matter their size or purpose. It represents the relationship between three main entities: assets, liabilities, and owner’s equity.

- Assets are the business resources, such as cash, inventory, buildings. Liabilities are obligations to creditors such as invoices, loans, taxes. The owner’s equity represents assets belonging to the owner or shareholders.

- The accounting equation can be rearranged into three different ways:

- Assets = Liabilities + Owner’s Capital - Owner’s Drawings + Revenues - Expenses

- Owner’s equity = Assets - Liabilities

- Net Worth = Assets - Liabilities

- Changes in the accounting equation get recorded through double-entry bookkeeping.

- The balance sheet is a financial statement which represents the accounting equation in a more detailed and expanded manner.

- The main limitation of the accounting equation is that it doesn’t provide an analysis of how well the business is operating.

Related Articles