“Watch the costs, and the profits will take care of themselves” -Andrew Carnegie

This is why having an in-depth understanding of your costs is important not only for purposes of accounting but also for ensuring the success of your business. Cost is the monetary value of all expenses incurred by your company for manufacturing products and rendering services. The two main types of costs that you should be well aware of are:

- Fixed Costs

- Variable Costs

However, in order to be able to evaluate them both, knowing the difference between fixed costs vs. variable costs is very important. While variable costs vary with the amount of output produced, fixed costs remain the same no matter how much output your company produces.

This article will take you through the difference between fixed costs vs. variable costs, but first, let us go through their individual definitions.

Fixed Costs Definition

Fixed cost is a cost that remains constant at different levels of output produced by an enterprise. These are not affected by the momentary fluctuations in the activity levels of the organization. However, this does not mean that they would remain constant even in the future, but rather that in the short run, they will remain constant.

For example, if you are operating your business in a rented space, in that case, your rent for the space will become the fixed cost because regardless of whether you produce lots of output or no output, you will be required to pay it. Fixed costs are hence business capital expenditures from which you derive benefits over a period of time. In the case of rent, your fixed cost will change only when your rent increases, decreases or when it gets replaced by another fixed cost like getting your own space on a loan.

However, while the total fixed cost remains the same, fixed cost per unit changes. For example, if your fixed cost is INR 10,000 and the output produced in the 1st quarter is 5000 units, for the 2nd quarter it is 3000 units and for the 3rd quarter it is 4000 units, then the fixed cost for the 1st quarter will be 10,000/5000 = INR 2 per unit, for the 2nd quarter will be 10,000/3000 = INR 3.33 per unit and for the 3rd quarter will be 10,000/4000 = INR 2.5 per unit.

There are two types of fixed costs:

- Committed fixed cost

- Discretionary fixed cost

Variable Costs Definition

Variable cost refers to the costs that change with changes in the quantity of output produced. These are affected directly by the fluctuations in the activity levels of the enterprise. Variable costs and volume of the production are directly proportional.

Hence, with an increase in production, there would be the same percentage increase in the variable costs incurred and vice versa. Unlike in the case of fixed costs, no variable costs would be incurred in case of no production. Variable costs are, therefore, a part of operating expenses incurred to earn operating income.

Now, keeping in mind that variable costs remain the same per unit but changes in total, we will take up this example. If the variable cost is INR 6 per unit and the output produced in the 1st, 2nd, and 3rd quarter is 6000 units, 4000 units, and 5000 units respectively, in this case, the INR 6 per unit variable cost will not change in each quarter but the total would. Hence, in quarter 1, the total variable cost is 6 x 6000 = INR 36,000; in quarter 2, the total variable cost is 6 x 4000 = INR 24, 000 and in quarter 3, the total variable cost is 6 x 5000 = INR 30, 000.

The two categories of variable costs are:

- Direct variable costs

- Indirect variable costs

Difference Between Fixed Costs vs. Variable Costs

Meaning of Fixed Costs vs. Variable Costs

Fixed costs are those costs that does not vary with changes in the quantity of output, whereas variable cost is those costs that changes with the amount of output produced.

Nature of Fixed Costs vs. Variable Costs

Fixed costs are time-related, i.e., they remain constant over a period of time. Whereas variable costs are volume-related as they change with changes in the volume.

Incurred When

Fixed costs are definite and are incurred whether you produce something or not, whereas variable costs are indefinite and incurred only when you produce something.

Unit Cost of Fixed Costs vs. Variable Costs

Fixed cost change in per-unit price and is indirectly proportional to the quantity of output produced. Hence, with an increase in units produced, the fixed costs per unit will decrease and vice versa. In contrast, variable costs per unit remain constant.

Total Cost of Fixed Costs vs. Variable Costs

In the case of fixed costs, the total costs remain the same irrespective of the change in the quantity of output produced. However, in the case of the total variable costs, it varies with changes in the quantity of the output produced and is, in fact, directly proportional to it.

The Behavior of Fixed Costs vs. Variable Costs

For a decided period of time, fixed costs remain constant. Whereas variable costs change with changes in the level of output produced.

Inclusion of Fixed Costs vs. Variable Costs During Valuation of Inventory

Fixed costs are not included during inventory valuation, whereas variable costs are included during inventory valuation.

Effect on Profitability by Fixed Costs vs. Variable Costs

With higher levels of production, the fixed costs per unit decreases, hence improving the profitability. However, in the case of variable costs whose per-unit price does not get affected by levels of production, it also has no effect on profitability.

Economies of Scale

The higher the fixed costs your company has, the more sales it would target on making in order to reach the break-even point. Also, remember that fixed costs get reduced with more output produced as it gets divided more. Variable costs, in contrast, remain flat in nature and do not change with increased production, therefore having no advantage like economies of scale that fixed costs have.

Risk Associated With Fixed Costs vs. Variable Costs

Fixed costs tend to be capital intensive and are hence exposed to more risk when the company does not achieve an adequate production level. In the case of variable costs, which increase at a constant per unit rate with an increase in production, there are lesser risks associated with it.

Level of Control on Fixed Costs vs. Variable Costs

Fixed costs are not easily controllable and are payable at already determined levels irrespective of how your business is doing. In contrast, variable costs can be controlled by controlling the volume of production.

Combination of Fixed Production Overhead Costs

Fixed costs are a combination of fixed production overhead costs, fixed administration overhead costs, and fixed selling and distribution overhead costs. On the other hand, variable costs are a combination of direct material, direct labor, direct expenses, variable production overhead costs, and variable selling and distribution overhead costs.

Contribution Margin

Fixed costs are not considered during the calculation of contribution margin. On the other hand, contribution margin is calculated by deducting variable cost per unit from selling price per unit to ascertain the profitability of your product. The higher the contribution, the better is your product.

Alternative Names of Fixed Costs vs. Variable Costs

Some of the alternative names of fixed costs are overhead costs, period costs, and supplementary costs. On the other hand, the alternative names of variable costs are prime costs and direct costs as they directly affect the output levels.

The Formula of Fixed Costs vs. Variable Costs

In the case of fixed costs, it is calculated as total fixed costs divided by the number of units produced. In contrast, total variable cost is calculated by multiplying the variable cost per unit with the number of items produced.

Examples of Fixed Costs vs. Variable Costs

Examples of fixed costs include depreciation, rent, salary, insurance, tax, employee salaries, loan payments, telephone and internet costs, etc. In contrast, examples of variable costs include materials consumed, wages, commission on sales and other sales compensation plan, packing expenses, etc.

Importance of Distinguishing Between Fixed Costs and Variable Costs

As a business owner, it is essential to understand how the various costs change with changes in the volume and output level. The breakdown of these expenses then assists you in determining the sales pricing of the products and services that you are offering, in addition to many other aspects of your overall business strategy like brand marketing, marketing, customer service, and many more.

Hence, the two main important reasons behind distinguishing between fixed costs vs. variable costs are,

Break-Even Analysis

To identify a profitable price level for your products and services, it is important to know your fixed and variable costs. A profitable price level is found by doing a break-even analysis as follows:

The volume needed to break even = Fixed Costs/ (Price - Variable Costs)

This equation will not only help in determining the selling price of your products and services but also help in answering other important questions like:

- Feasibility of expansion

- Determining projected profits for the coming year

- Determining the units of output needed and at what price they need to be sold to have a profit margin and earn gross profits. You would also be able to assess whether these numbers seem realistic and attainable or not.

Economies of Scale

Understanding your fixed costs and variable costs will also help you to identify economies of scale. This cost advantage is established in the fact that as output increases, fixed costs are spread over a larger number of output items.

What needs to be remembered is that it is fixed costs as well as variable costs that give a clear picture of the overall structure of your business. By understanding the difference between them both, you would be better able to make rational decisions about business expenses. This will have a direct impact on your profitability and is hence very crucial.

How Can Deskera Help Your Business With Accounting?

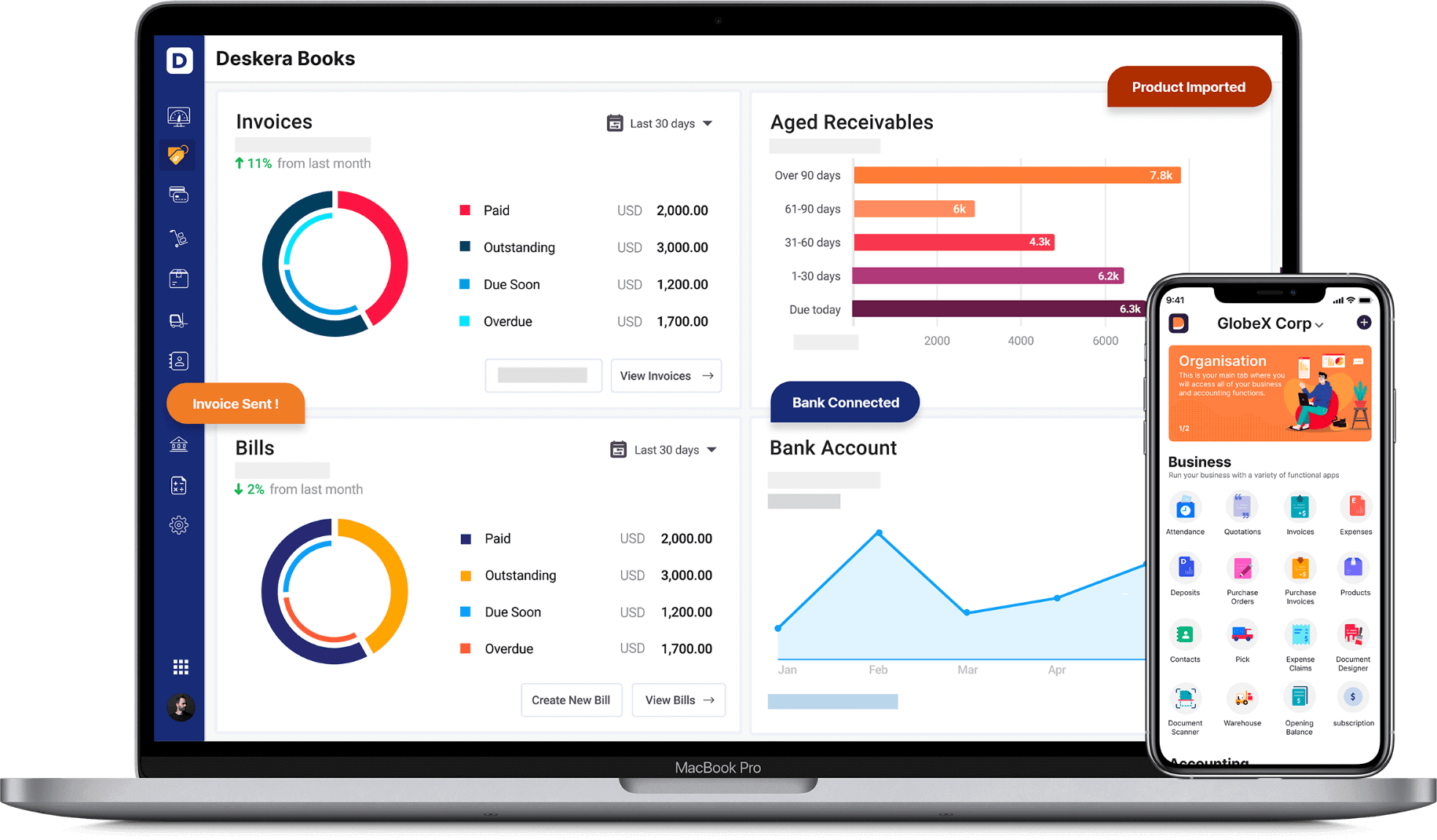

Deskera comes equipped with a series of software that is specialized in meeting your business needs. When it comes to accounting, it is Deskera Books that you should use. Deskera Books is an online invoicing, accounting, and inventory software for your business.

Through it, you will be able to track all your expenses, create your invoices and even get a real-time view of your inventory as well as of your financial statements and reports. Additionally, you would also be able to track all the relevant financial KPIs, analyzing which give you further insights into your future activities.

Another highlight of Deskera Books is how it will let you manage your orders and sales from start to finish, from creating estimates to creating invoices upon order confirmation. It also facilitates receiving and automatically recording online payments while also keeping track of your cost of goods sold. One of the other advantages of Deskera Books is that it also maintains exchange rates for over 110 currencies, which allows you to create your invoices and bills in multiple currencies while also letting you get a forex gain/loss report.

In fact, by using Deskera Books, you would even be able to record your purchase orders and bills in a few clicks. This will further help you in keeping track of your account payable and account receivables through one place. You would also be easily able to track your outstanding receivables and payables, as well as your credit notes, debit notes, and upfront payments. This will improve your cash flow.

While you focus on quotations, invoices, receipts, payments, and selling your products, Deskera Books will take care of all your accounting needed for reporting and compliance for you. To make this easier, it even comes with pre-configured accounting rules, tax codes, invoice templates, and charts of accounts, among other things.

Lastly, you would be able to assess all your reports- be it income statement, profit and loss statement, cash flow statement, balance sheet, trial balance, or any other relevant report from your laptop and your mobile phone. All of these can also be accessed by your accountant once you have invited them through their email address.

Key Takeaways

While fixed costs and variable costs are completely opposite to each other, they both play important roles in financial analysis. This is because while a higher volume of production helps in reducing fixed costs per unit and therefore increases profitability, variable cost per unit is instrumental in ascertaining the contribution margin at the product level.

Considering this unique usage of both types of costs, it is crucial to have an in-depth understanding of them so that you can apply them correctly and accurately in relevant business scenarios. Remember, whether you are a small company or a big company, it is both of these costs together that are helping you sustain.

Related Articles