Auditing originates from the Latin term “Audire”, which means “to hear,” - just as in ancient times auditors used to listen to officers and people of authority to confirm the validity of their words. Over the years, the role of auditing evolved to verifying written reports: specifically, the financial records of individuals and businesses.

By definition, auditing is an official inspection and verification of the credibility of financial reports. Audits can be conducted by either a business’s management as an internal control process or by the government, in case they notice suspicious financial activity.

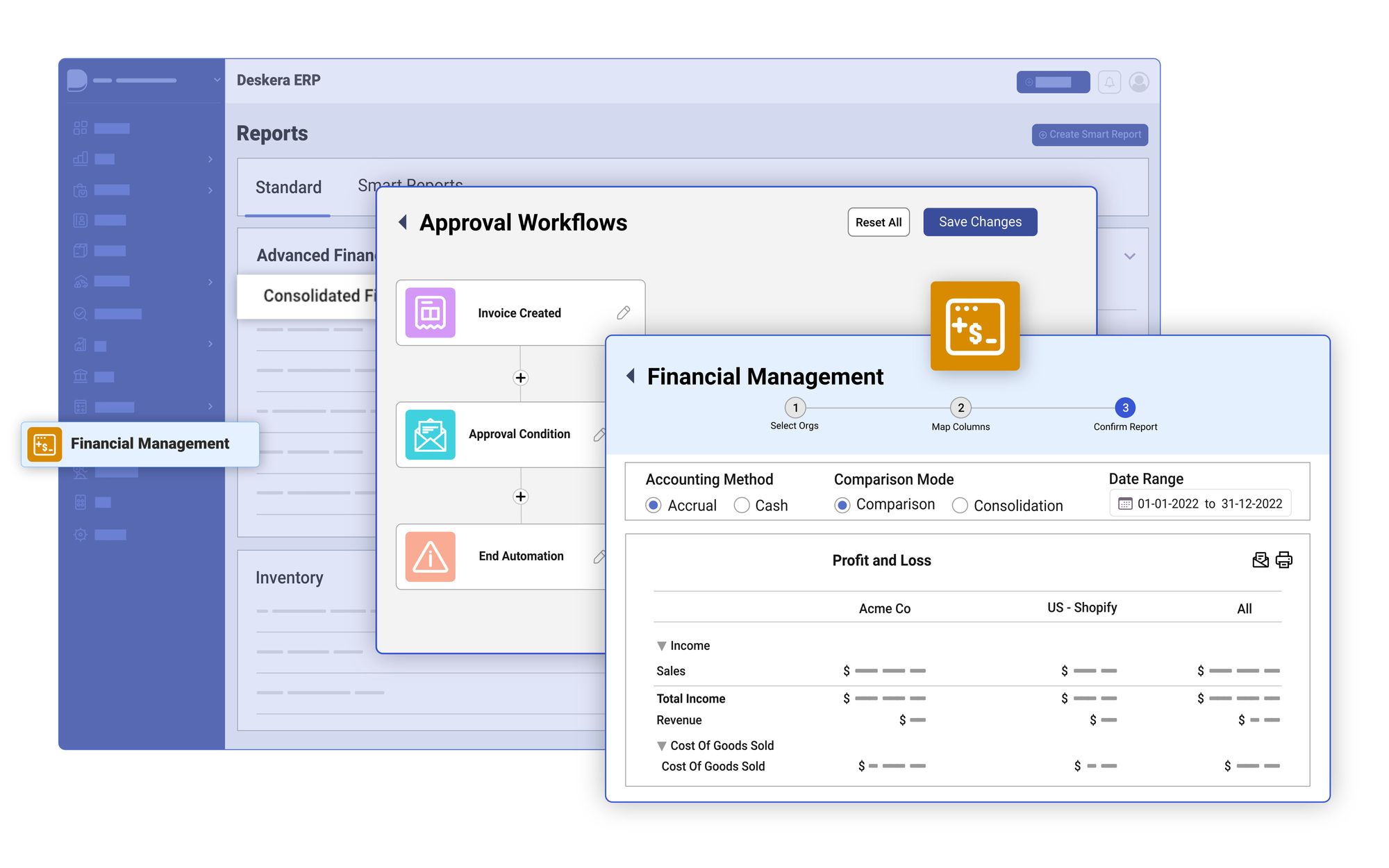

In recent years, advancements in technology have greatly facilitated the auditing process, with tools like Deskera ERP and ERP.AI are playing significant roles. Deskera ERP is a comprehensive enterprise resource planning software that streamlines business operations, including accounting and financial management. This integration aids auditors by providing a clear and organized trail of financial transactions, thereby simplifying the verification process.

ERP.AI adds an intelligent layer to this by leveraging artificial intelligence to detect anomalies, flag inconsistencies, and automate audit trails, significantly reducing manual errors and increasing audit accuracy.

In this guide, we’ll be explaining what auditing is, why it’s so important, the different types of audits, and everything else you need to know about auditing for your small business accounting.

What Is Auditing?

Auditing, or a financial audit, is an official examination and verification of a business’s financial records.

The main goal of auditing is to make sure that a company’s financial statements are accurate and are following regulatory guidelines. Auditing also gives investors, creditors, and other stakeholders reasonable assurance that they can rely on a company and its integrity.

Now, it’s important to note that auditing doesn’t provide a complete guarantee that every digit recorded in a company’s financial reports is accurate. Auditors work within a specific, reasonable margin of error known as materiality. The volume of materiality depends on the size of the company and its reported revenue and expenses.

For small businesses, an accounting error of a few thousand dollars might be significant, but for a large corporation like Apple or Amazon, such a material mistake may be considered as a conventional mistake and not a cause for concern.

Want to learn how to correctly manage and prepare your financial reports? Head over to our guide on financial reporting for small businesses.

What is Auditing in Accounting?

Auditing in accounting refers to the systematic examination and verification of a company's financial records and statements by an independent party.

The primary goal is to ensure that these records are accurate, complete, and in compliance with relevant accounting standards and regulations. Auditing provides an objective assessment of a company's financial health and operational integrity.

The key aspects of auditing in accounting are:

Objective Verification

- Auditors independently verify financial statements and records to ensure they reflect the true financial position of the company.

- This involves checking the accuracy of financial transactions, balances, and disclosures.

Compliance with Standards

- Auditing ensures that financial statements are prepared in accordance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), as applicable.

- Compliance with these standards helps maintain consistency and reliability in financial reporting.

Internal Controls Assessment

- Auditors evaluate the effectiveness of an organization's internal controls over financial reporting.

- This includes assessing processes and procedures designed to prevent and detect errors and fraud.

Risk Management

- Auditing helps identify and assess financial risks that could impact the organization.

- Auditors provide recommendations to mitigate these risks and enhance the overall risk management framework.

Fraud Detection

- Auditors look for signs of fraud or financial irregularities.

- They conduct tests and procedures to detect any misrepresentations or intentional errors in the financial statements.

Stakeholder Confidence

- An independent audit enhances the credibility of financial statements, providing assurance to investors, creditors, regulators, and other stakeholders.

- This trust is crucial for securing financing, complying with regulatory requirements, and maintaining a good reputation.

Continuous Improvement

- Auditors provide feedback on areas where the organization can improve its financial processes and controls.

- This helps organizations enhance their financial practices and operational efficiency over time.

What is Materiality in Auditing?

Materiality in auditing is a key concept that refers to the significance of an amount, transaction, or discrepancy within the financial statements.

It is the threshold or benchmark used by auditors to determine the impact of potential misstatements or omissions on the financial statements and whether they could influence the economic decisions of users.

Key Aspects of Materiality in Auditing

The key aspects of materiality in auditing are:

Quantitative and Qualitative Factors

- Quantitative: Numerical thresholds, such as a percentage of net income, total assets, or revenue. For example, a misstatement amounting to 5% of net income might be considered material.

- Qualitative: Non-numerical factors that could affect users' decisions. These include the nature of the misstatement (e.g., fraudulent activity), the context (e.g., non-compliance with regulatory requirements), and the surrounding circumstances.

Determining Materiality

- Auditors set preliminary materiality thresholds during the planning phase of an audit based on professional judgment and industry standards.

- These thresholds guide the extent and nature of audit procedures. Materiality levels may be adjusted as the audit progresses and more information is gathered.

Application in Audit Procedures

- Planning: Materiality helps auditors decide the scope of the audit, including which accounts and transactions to examine more closely.

- Execution: Auditors apply materiality to identify significant misstatements. They perform tests and procedures to ensure that misstatements above the materiality threshold are detected and corrected.

- Evaluation: At the conclusion of the audit, auditors assess whether the aggregate of uncorrected misstatements is material and whether the financial statements as a whole are free from material misstatement.

Impact on Audit Opinion

If auditors find misstatements that are material and not corrected by the entity, they may modify their audit opinion to reflect this. For instance, they might issue a qualified opinion, adverse opinion, or disclaimer of opinion, depending on the nature and extent of the misstatement.

Professional Judgment

Determining materiality involves significant professional judgment. Auditors consider the expectations of reasonable users of the financial statements, the size and nature of the entity, including top software companies, and the context of the financial information. This comprehensive approach ensures that all relevant factors are taken into account to assess what is material to the users of those financial statements.

Examples of Materiality Considerations

- Size: A $10,000 error in a small business might be material, whereas the same amount might be immaterial for a large corporation with billions in revenue.

- Nature: A small misstatement that leads to a breach of debt covenants or changes a profit into a loss can be material, regardless of its size.

- Impact: Errors that impact key performance indicators or compliance with regulatory requirements might be considered material due to their potential effect on users' decisions.

Importance of Materiality

- Decision-Making: Helps ensure that financial statements provide a true and fair view, enabling users to make informed economic decisions.

- Efficiency: Allows auditors to focus their efforts on areas that have the most significant impact on the financial statements.

- Regulatory Compliance: Ensures that financial reporting meets legal and regulatory requirements, avoiding potential penalties and legal issues.

Materiality is fundamental in auditing as it shapes the audit approach, influences the assessment of audit findings, and ultimately affects the audit opinion. It ensures that audits are both efficient and effective in providing reasonable assurance that the financial statements are free from material misstatement.

The Importance of Auditing

Credibility and Reliability

With an internal auditing system, your business can create accurate and reliable financial reports through which you can gain insights on which segments or product lines are performing best and how to properly allocate resources. Additionally, regular auditing will make your shareholders trust that your accounts are true and fair and that it’s safe to invest in your business.

Preventing Payroll Errors and Fraud

If the government audits your financial statements and finds that your business has been manipulating its financial health, or hiding revenue and losses, you’ll likely deal with severe fees and legal punishments. Your business will also acquire a bad reputation, and you will most likely lose reliability in the eyes of your customers and stakeholders.

Recurring internal audits by a professional auditor or accountant of the company play an important role in detecting these fraud cases before they become substantial and problematic. Having a rigorous auditing system set in place alone prevents and scares employees or vendors from attempting a scheme to defraud your business in the first place.

Payroll errors are common due to manual data entry, even with automation. Regular audits not only catch mistakes and prevent fraud, such as ghost employees, but also help avoid government penalties for financial manipulation, safeguarding the business's reputation and stakeholder trust. Implementing a robust internal audit system deters potential fraud, making it a crucial preventative measure.

Main Types of Audits

Audits can be classified into several types, each serving a different purpose and focusing on various aspects of an organization’s operations and financial health.

Here are the main types of audits:

Financial Audit

- Definition: A financial audit is an examination of an organization's financial statements and related operations to ensure they are accurate and conform to accounting standards.

- Purpose: To provide assurance that financial statements are free of material misstatement and to give stakeholders confidence in the organization's financial integrity.

- Who Conducts It: External auditors (e.g., certified public accountants) or internal auditors.

Internal Audit

- Definition: An internal audit is conducted by an organization's own staff to evaluate the effectiveness of its internal controls, risk management, and governance processes.

- Purpose: To identify areas for improvement, ensure compliance with policies and regulations, and safeguard assets.

- Who Conducts It: Internal auditors employed by the organization.

Compliance Audit

- Definition: A compliance audit assesses whether an organization adheres to external laws, regulations, and internal policies.

- Purpose: To ensure that the organization is following legal and regulatory requirements and internal guidelines.

- Who Conducts It: External auditors, regulatory agencies, or internal auditors.

Operational Audit

- Definition: An operational audit evaluates the efficiency and effectiveness of an organization's operations and procedures.

- Purpose: To identify opportunities for operational improvements and cost savings.

- Who Conducts It: Internal auditors or external consultants.

Information Systems Audit

- Definition: An information systems audit examines an organization's IT infrastructure, policies, and operations.

- Purpose: To ensure the integrity, confidentiality, and availability of information systems and data.

- Who Conducts It: IT auditors, internal auditors, or external specialists.

Forensic Audit

- Definition: A forensic audit investigates financial records to detect and prevent fraud, embezzlement, or other financial misconduct.

- Purpose: To gather evidence for legal proceedings and to uncover financial irregularities.

- Who Conducts It: Forensic accountants and auditors with specialized training.

Tax Audit

- Definition: A tax audit examines an organization's or individual’s tax returns and financial records to ensure accuracy and compliance with tax laws.

- Purpose: To verify that taxes have been correctly reported and paid.

- Who Conducts It: Tax authorities (e.g., the IRS) or internal tax auditors.

Environmental Audit

- Definition: An environmental audit evaluates an organization's compliance with environmental regulations and the impact of its operations on the environment.

- Purpose: To ensure compliance with environmental laws and to promote sustainable practices.

- Who Conducts It: Environmental auditors or external environmental consultants.

Performance Audit

- Definition: A performance audit assesses whether an organization is achieving its objectives effectively, efficiently, and economically.

- Purpose: To evaluate the performance of programs and initiatives and recommend improvements.

- Who Conducts It: Internal auditors or external performance auditors.

External Audit

- Definition: An external audit is an independent examination of an organization's financial statements and related operations by external auditors.

- Purpose: To provide an unbiased opinion on whether the financial statements present a true and fair view of the company's financial position and performance. It ensures accuracy, completeness, and compliance with accounting standards and regulations.

- Who Conducts It: Certified public accountants (CPAs) or external auditing firms.

Surveillance Audit

- Definition: A surveillance audit is a periodic review conducted to ensure that an organization continues to comply with specific standards and maintains the required certifications.

- Purpose: To monitor ongoing compliance with standards (e.g., ISO 9001 for quality management systems) and to identify areas for continual improvement.

- Who Conducts It: Certification bodies or external auditors who initially granted the certification.

IRS Audit

- Definition: An IRS audit is an examination of an individual's or organization's tax returns and financial records by the Internal Revenue Service (IRS) to ensure accuracy and compliance with tax laws.

- Purpose: To verify that the taxpayer's income, deductions, credits, and other tax-related information are reported correctly and comply with the tax code.

- Who Conducts It: IRS agents or tax auditors.

Payroll Audit

- Definition: A payroll audit is an examination of an organization's payroll processes and records to ensure accuracy and compliance with labor laws and internal policies.

- Purpose: To verify that employees are compensated correctly, payroll taxes are calculated and remitted accurately, and to identify any discrepancies or potential fraud.

- Who Conducts It: Internal auditors, external auditors, or specialized payroll auditing firms.

Each type of audit provides unique insights and helps organizations improve different aspects of their operations, ensuring overall health and compliance.

5+ Auditing Tips

- When conducting an internal audit, make sure that you have a clear goal about what you’re looking to achieve. Ask yourself why you’re conducting the audit, and what actions you’re going to take depending on the result.

- Internal auditing involves reviewing a huge pile of information. To avoid wasting time, prioritize processes that require immediate auditing, based on the audit’s goal.

- Make sure you’ve claimed valid business deductions. Keep all of your expense receipts, and don’t mix up your expenses as business deductibles.

- Know your accounting cycle. The accounting cycle is the multi-step process that analyses and records your financial data, and translates them into financial statements. By following it accordingly, you’re keeping accurate, up-to-date journal entries of your transactions, complying with federal regulations, and avoiding government audits.

- Use the right tools. A great way to do this is by streamlining your processes with cloud-based accounting software like Deskera. With Deskera, you can automate most of your accounting tasks like journalizing transactions, calculating payments, or generating financial statements. Say goodbye to most of your typical accounting errors, eliminate fraud, and fear nothing in case you’re ever audited by the government. Try the software out yourself right away, with our completely free trial.

How AI Enhances Auditing Processes

Through continuous monitoring and automated data analysis, AI systems can flag anomalies, detect potential fraud, and ensure real-time compliance with regulatory standards. This reduces human error and enables auditors to focus on strategic insights rather than repetitive checks.

These tools automatically scan transactions, reconcile reports, and provide real-time alerts on any discrepancies. This not only streamlines internal audits but also strengthens external audit readiness—saving time, improving governance, and ensuring compliance.

How Can Deskera Help You With Auditing?

Deskera ERP can significantly aid the auditing process in several ways:

- Real-Time Data Access: Deskera ERP provides real-time access to financial data, ensuring that all records are up-to-date and accurate. Auditors can quickly retrieve the necessary information without delays, enhancing the efficiency of the audit process.

- Automated Financial Reporting: The software automates the generation of financial reports, reducing the manual effort and potential for human error. These reports are crucial for auditors as they provide a clear and concise overview of the company's financial health.

- Comprehensive Record-Keeping: Deskera ERP maintains detailed records of all financial transactions, including sales, purchases, expenses, and payroll. This comprehensive record-keeping is essential for auditors to verify the accuracy and completeness of financial statements.

- Audit Trails: The system creates an audit trail for every transaction, documenting who made changes, what changes were made, and when they were made. This feature helps auditors trace the history of transactions and identify any discrepancies or unusual activities.

- Compliance and Regulatory Support: Deskera ERP helps businesses comply with various financial regulations and standards by ensuring that all financial processes and reports meet legal requirements. This compliance support is vital for auditors to confirm that the business adheres to relevant laws and regulations.

- Internal Controls: The software includes features for setting up internal controls, such as approval workflows and access permissions. These controls help prevent unauthorized access and ensure that financial data is handled appropriately, making the auditing process more reliable.

- Data Security: Deskera ERP employs advanced security measures to protect financial data from breaches and unauthorized access. Auditors can be assured of the integrity and confidentiality of the data they are reviewing.

- Integration with Other Systems: Deskera ERP can integrate with other business systems and applications, ensuring that all financial data is consolidated in one place. This integration facilitates a more comprehensive audit by providing a complete picture of the company's financial activities.

By leveraging these features, Deskera ERP helps streamline the auditing process, making it more efficient, accurate, and reliable. This ultimately leads to better financial management and transparency for businesses.

Auditing FAQs

1. What Does an Auditor Do?

Auditors are specialists who evaluate and review your company’s finances to make sure they’ve been kept accurately and comply with legal requirements. Auditors can also act as advisors and suggest risk management or cost-saving actions.

2. What Triggers Tax Audits?

Some of the main reasons why the government conducts tax audits include math errors, failing to report a part of your income, claiming a lot of charitable donations, deducting too many business expenses, and more.

3. What Happens During an IRS Audit?

There are three resolutions to an IRS audit: agreement, disagreement, or no change.

By agreeing, you confirm that changes need to be made and agree with the proposed amendments made by the IRS agents. By disagreeing, you do not accept the proposed amendments and as a result, you can either choose to file for an appeal or discuss a dispute mediation. In case there’s no change, your information is examined, reviewed, and confirmed, and nothing will happen.

4. What is Auditing in Business?

Auditing in business involves a thorough examination of financial records, operations, and internal controls to ensure accuracy, compliance, and integrity. It helps verify financial information, improves internal controls, supports decision-making, detects fraud, helps in complying with regulations, and provides assurance to stakeholders.

5. What Do Accountants Do?

Accountants play a vital role in managing financial information for businesses and individuals. They handle tasks such as preparing financial statements, recording transactions, analyzing financial data, and ensuring compliance with tax laws and regulations.

Accountants also provide financial advice, help with budgeting and forecasting, conduct audits, and assist in strategic planning. Overall, their expertise contributes to sound financial decision-making and the efficient operation of organizations.

Key Takeaways

And that’s a wrap!

Here’s a quick recap of the main points we’ve covered:

- Auditing is the process of reviewing and confirming your financial reports.

- Audits verify that you’ve created accurate and reliable financial reports and that no fraudulent activities are happening within the business.

- Auditing serves as a crucial tool for detecting and preventing fraud, by identifying irregularities and discrepancies in financial statements.

- Through transparent and accurate financial reporting, auditing helps build trust among stakeholders, including investors, creditors, and regulators.

- By providing reliable financial information and insights, auditing supports informed decision-making and strategic planning within organizations.

- Various types of auditing, such as financial, internal, compliance, operational, and forensic audits, serve specific purposes in assessing different aspects of an organization's operations and financial health.

- Internal audits are made by qualified auditors within the business, external audits are conducted by external third parties, whereas government audits are tax reviews by the IRS.

- Materiality is a critical concept in auditing, defining the threshold above which missing or incorrect information in financial statements could significantly impact users' decisions. It guides auditors in determining the scope of their examination and assessing the significance of identified issues.

- Deskera ERP plays a vital role in streamlining the auditing process by providing comprehensive financial management features. With Deskera ERP, businesses can maintain accurate and up-to-date financial records, automate reporting processes, and ensure compliance with accounting standards and regulations.

Related Articles