‘Expansion and Growth’ are the two common goals of an organization's operations. In case a company does not possess enough capital or has no fixed assets, this is difficult to accomplish. It is at this point that capital budgeting becomes essential.

The capital budget is used by management to plan expenditures on fixed assets. As a result of the budgets, the company's management usually determines which long-term strategies it can invest in to achieve its growth goals. For instance, management can decide if it needs to sell or purchase assets for expansion to accomplish this.

The purpose of capital budgeting is to make long-term investment decisions about whether particular projects will result in sustainable growth and provide the expected returns.

We shall learn about Capital Budgeting and all the details related to it in this article:

- What is Capital Budgeting in detail

- Features of capital budgeting

- Understanding capital budgeting and how it works

- Techniques/Methods of capital budgeting with Examples

- Process of capital budgeting

- Factors affecting capital budgeting

- Objectives

- Limitations of capital budgeting

What is Capital Budgeting?

Capital Budgeting is defined as the process by which a business determines which fixed asset purchases or project investments are acceptable and which are not. Using this approach, each proposed investment is given a quantitative analysis, allowing rational judgment to be made by the business owners.

Capital asset management requires a lot of money; therefore, before making such investments, they must do capital budgeting to ensure that the investment will procure profits for the company. The companies must undertake initiatives that will lead to a growth in their profitability and also boost their shareholder’s or investor’s wealth.

Features of Capital Budgeting

Capital Budgeting is characterized by the following features:

- There is a long duration between the initial investments and the expected returns.

- The organizations usually estimate large profits.

- The process involves high risks.

- It is a fixed investment over the long run.

- Investments made in a project determine the future financial condition of an organization.

- All projects require significant amounts of funding.

- The amount of investment made in the project determines the profitability of a company.

Understanding Capital Budgeting

While companies would like to take up all the projects that maximize the benefits of the shareholders, they also understand that there is a limitation on the money that they can employ for those projects. Therefore, they utilize capital budgeting strategies to assess which initiatives will provide the best returns across a given period. Owing to its culpability and quantifying abilities, capital budgeting is a preferred way of establishing if a project will yield results.

To measure the longer-term monetary and fiscal profit margins of any option contract, companies can use the capital-budgeting process. Capital budgeting projects are accepted or rejected according to different valuation methods used by different businesses. Under certain conditions, the internal rate of return (IRR) and payback period (PB) methods are sometimes used instead of net present value (NPV) which is the most preferred method. If all three approaches point in the same direction, managers can be most confident in their analysis.

How Capital Budgeting Works

It is of prime importance for a company when dealing with capital budgeting decisions that it determines whether or not the project will be profitable. Although we shall learn all the capital budgeting methods, the most common methods of selecting projects are:

- Payback Period (PB)

- Internal Rate of Return (IRR) and

- Net Present Value (NPV)

It might seem like an ideal capital budgeting approach would be one that would result in positive answers for all three metrics, but often these approaches will produce contradictory results. Some approaches will be preferred over others based on the requirement of the business and the selection criteria of the management. Despite this, these widely used valuation methods have both benefits and drawbacks.

Investing in capital assets is determined by how they will affect cash flow in the future, which is what capital budgeting is supposed to do. The capital investment consumes less cash in the future while increasing the amount of cash that enters the business later is preferable.

Keeping track of the timing is equally important. It is always better to generate cash sooner than later if you consider the time value of money. Other factors to consider include scale. To have a visible impact on a company's final performance, it may be necessary for a large company to focus its resources on assets that can generate large amounts of cash.

In smaller businesses, a project that has the potential to deliver rapid and sizable cash flow may have to be rejected because the investment required would exceed the company's capabilities.

The amount of work and time invested in capital budgeting will vary based on the risk associated with a bad decision along with its potential benefits. Therefore, a modest investment could be a wiser option if the company fears the risk of bankruptcy in case the decisions go wrong.

Sunk costs are not considered in capital budgeting. The process focuses on future cash flows rather than past expenses.

Techniques/Methods of Capital Budgeting

In addition to the many capital budgeting methods available, the following list outlines a few by which companies can decide which projects to explore:

#1 Payback Period Method

It refers to the time taken by a proposed project to generate enough income to cover the initial investment. The project with the quickest payback is chosen by the company.

Formula:

Example of Payback Period Method:

An enterprise plans to invest $100,000 to enhance its manufacturing process. It has two mutually independent options in front: Product A and Product B. Product A exhibits a contribution of $25 and Product B of $15. The expansion plan is projected to increase the output by 500 units for Product A and 1,000 units for Product B.

Here, the incremental cash flow will be calculated as:

(25*500) = 12,500 for Product A

(15*1000) = 15,000 for Product B

The Payback Period for Product A is calculated as:

Product A = 100,000 / 12,500 = 8 years

Now, the Payback Period for Product B is calculated as:

Product B = 100,000 / 15,000 = 6.7 years

This brings the enterprise to conclude that Product B has a shorter payback period and therefore, it will invest in Product B.

Despite being an easy and time-efficient method, the Payback Period cannot be called optimum as it does not consider the time value of money. The cash flows at the earlier stages are better than the ones coming in at later stages. The company may encounter two projections with the same payback period, where one depicts higher cash flows in the earlier stages/years. In such as case, the Payback Period may not be appropriate.

A similar consideration is that of a longer period, potentially bringing in greater cash flows during a payback period. In such a case, if the company selects the projects based solely on the payback period and without considering the cash flows, then this could prove detrimental for the financial prospects of the company.

#2 Net Present Value Method (NPV)

Evaluating capital investment projects is what the NPV method helps the companies with. There may be inconsistencies in the cash flows created over time. The cost of capital is used to discount it. An evaluation is done based on the investment made. Whether a project is accepted or rejected depends on the value of inflows over current outflows.

This method considers the time value of money and attributes it to the company's objective, which is to maximize profits for its owners. The capital cost factors in the cash flow during the entire lifespan of the product and the risks associated with such a cash flow. Then, the capital cost is calculated with the help of an estimate.

Formula:

Example of Net Present Value (with 9% Discount Rate ):

For a company, let’s assume the following conditions:

Capital investment = $10,000

Expected Inflow in First Year = $1,000

Expected Inflow in Second Year = $2,500

Expected Inflow in Third Year = $3,500

Expected Inflow in Fourth Year = $2,650

Expected Inflow in Fifth Year = $4,150

Discount Rate = 9%

Net Present Value achieved at the end of the calculation is:

With 9% Discount Rate = $18,629

This indicates that if the NPV comes out to be positive and indicates profit. Therefore, the company shall move ahead with the project.

#3 Internal Rate of Return (IRR)

IRR refers to the method where the NPV is zero. In such as condition, the cash inflow rate equals the cash outflow rate. Although it considers the time value of money, it is one of the complicated methods.

It follows the rule that if the IRR is more than the average cost of the capital, then the company accepts the project, or else it rejects the project. If the company faces a situation with multiple projects, then the project offering the highest IRR is selected by them.

Example:

We shall assume the possibilities exhibited in the table here for a company that has 2 projects: Project A and Project B.

Here, The IRR of Project A is 7.9% which is above the Threshold Rate of Return (We assume it is 7% in this case.) So, the company will accept the project. However, if the Threshold Rate of Return would be 10%, then it would be rejected as the IRR would be lower. In that case, the company will choose Project B which shows a higher IRR as compared to the Threshold Rate of Return.

#4 Profitability Index

This method provides the ratio of the present value of future cash inflows to the initial investment. A Profitability Index that presents a value lower than 1.0 is indicative of lower cash inflows than the initial cost of investment. Aligned with this, a profitability index great than 1.0 presents better cash inflows and therefore, the project will be accepted.

Formula:

Example:

Assuming the values given in the table, we shall calculate the profitability index for a discount rate of 10%.

So, Profitability Index with 10% discount = $15,807/$10,000 = 1.5807

As per the rule of the method, the profitability index is positive for the 10% discount rate, and therefore, it will be selected.

Process of Capital Budgeting

The process of Capital Budgeting involves the following points:

Identifying and generating projects

Investment proposals are the first step in capital budgeting. Taking up investments in a business can be motivated by a number of reasons. There could be the addition or expansion of a product line. An increase in production or a decrease in production costs could also be suggested.

Evaluating the project

It mainly consists of selecting all criteria necessary for judging the need for a proposal. In order to maximize market value, it has to match the company's mission. It is crucial to consider the time value of money here.

In addition to estimating the benefits and costs, you should weigh the pros and cons associated with the process. There could be a lot of risks involved with the total cash inflows and outflows. This needs to be scrutinized thoroughly before moving ahead.

Selecting a Project

Since there is no ‘one-size-fits-all’ factor, there is no defined technique for selecting a project. Every business has diverse requirements and therefore, the approval over a project comes based on the objectives of the organization.

After the project has been finalized, the other components need to be attended to. These include the acquisition of funds which can be explored by the finance department of the company. The companies need to explore all the options before concluding and approving the project. Besides, the factors like viability, profitability, and market conditions also play a vital role in the selection of the project.

Implementation

Once the project is implemented, now come the other critical elements such as completing it in the stipulated time frame or reduction of costs. Hereafter, the management takes charge of monitoring the impact of implementing the project.

Performance Review

This involves the process of analyzing and assessing the actual results over the estimated outcomes. This step helps the management identify the flaws and eliminate them for future proposals.

Factors Affecting Capital Budgeting

So far in the article, we have observed how measurability and accountability are two primary aspects that achieve the center stage through capital budgeting. However, while on the path to accomplish a competent capital budgeting process, you may come across various factors that may affect it.

Let us move on to observing the factors that affect the capital budgeting process.

Objectives of Capital Budgeting

The following points present the objectives of the capital budgeting:

- Capital Expenditure Control: Organizations need to estimate the cost of investment as it allows them to control and manage the required capital expenditures.

- Selecting Profitable Projects: The company will have to select the most appropriate project from the multiple possibilities in front of it.

- Identification of Source of funds: The businesses need to locate and select the most viable and apt source of funds for long-term capital investment. It needs to compare the various costs like the costs of borrowing and the cost of expected profits.

Limitations of Capital Budgeting

Although capital budgeting provides a lot of insight into the future prospects of a business, it cannot be termed a flawless method after all. In this section, we learn about some of the limitations of capital budgeting.

Cash Flow

It is a simple technique that determines if an enhanced value of a project justifies the required investment. The primary reason to implement capital budgeting is to achieve forecasting revenue a project may possibly generate. The problem could be the estimate itself. All the upfront costs or the future revenue are all only estimates at this point. An overestimation or an underestimation could ultimately be detrimental to the performance of the business.

Time Horizon

Usually, capital budgeting as a process works across for long spans of years. While the shorter duration forecasts may be estimated, the longer ones are bound to be miscalculated. Therefore, an expanded time horizon could be a potential problem while computing figures with capital budgeting.

Besides, there could be additional factors such as competition or legal or technological innovations that could be problematic.

Time Value

The payback period method of capital budgeting holds a lot of relevance, especially for small businesses. It is a simple method that only requires the business to repay in the predecided timeframe. However, the problem it poses is that it does not count in the time value of money. This is to say that equal amounts (of money) have different values at different points in time.

Discount Rates

The accounting for the time value of money is done either by borrowing money, paying interest, or using one’s own money. The knowledge of discount rates is essential. The proper estimation and calculation of which could be a cumbersome task.

Even if this is achieved, there are other fluctuations like the varying interest rates that could hamper future cash flows. Therefore, this is a factor that adds up to the list of limitations of capital budgeting.

How can Deskera Help Your Business?

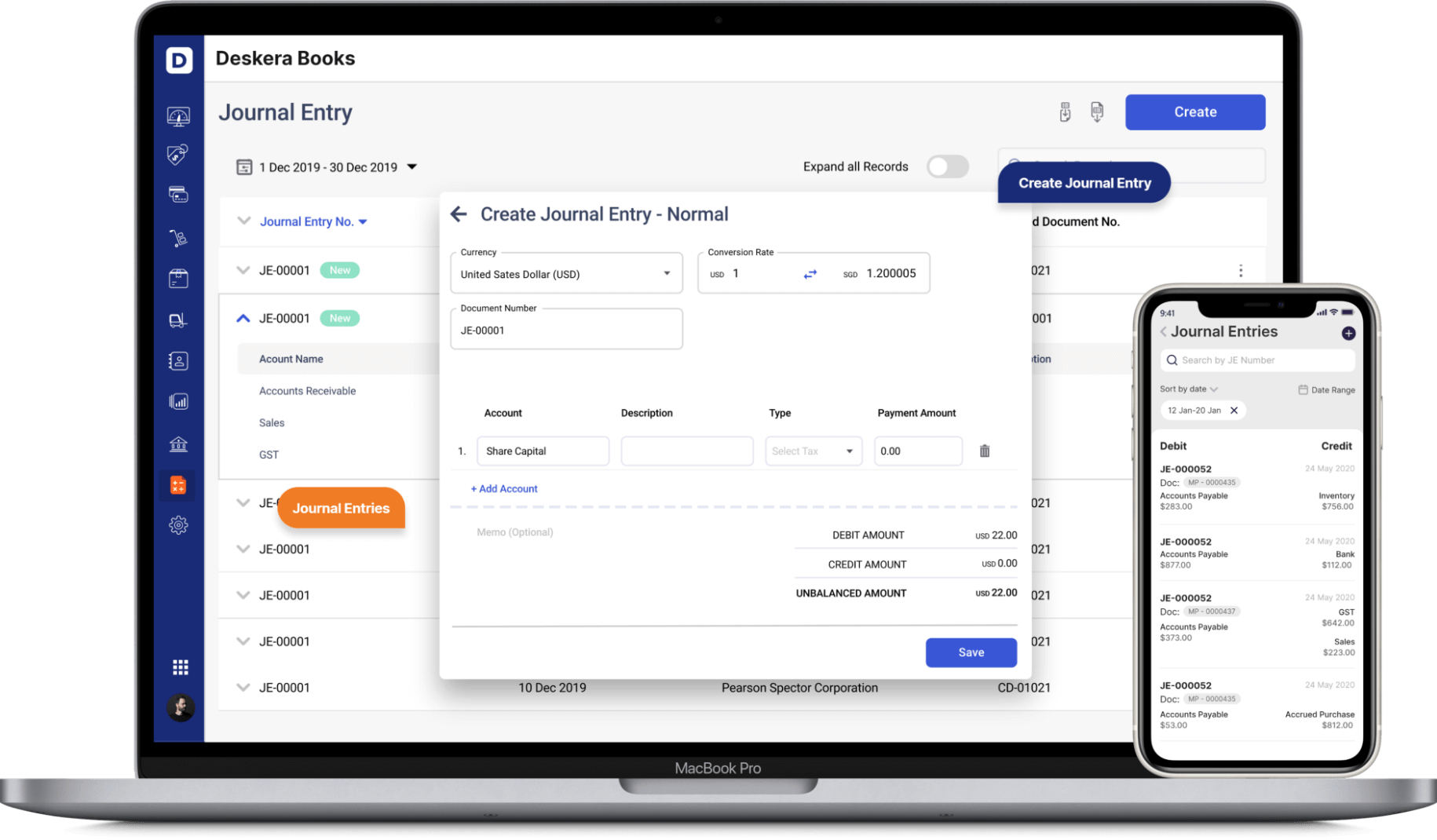

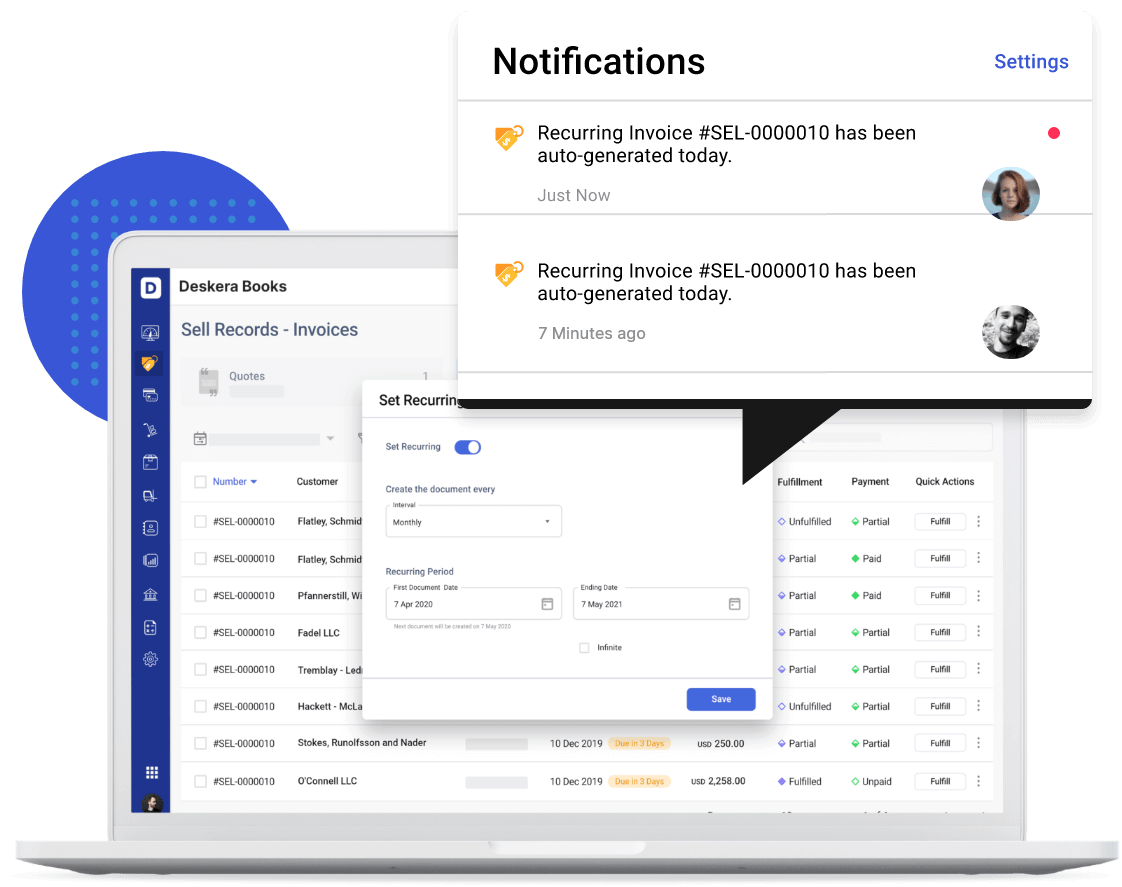

Deskera is a cloud system that brings automation and therefore ease in the business functioning. It reduces the admin time while also increasing efficiency. Deskera Books can be especially useful in improving cash flow and budgeting for your business.

One of its usability lies in creating invoices on behalf of your business which can then be sent out immediately. Through Deskera books, a payment link can also be attached with your invoice. This payment link will have many options available like Stripe, VIM, PayPal and more being constantly added to the Deskera platform.

Through Deskera Books, reminders can be set with the invoices that are not being paid out, which are then sent out to the customers. Even in the case of recurring invoices, Deskera Books will become very handy especially with a payment link added to the invoice.

All in all, the follow-up system for all the invoices can be passed on to the system of Deskera Books and it will look into it for you. You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant. Such cloud systems substantially improve cash flow for your business directly as well as indirectly.

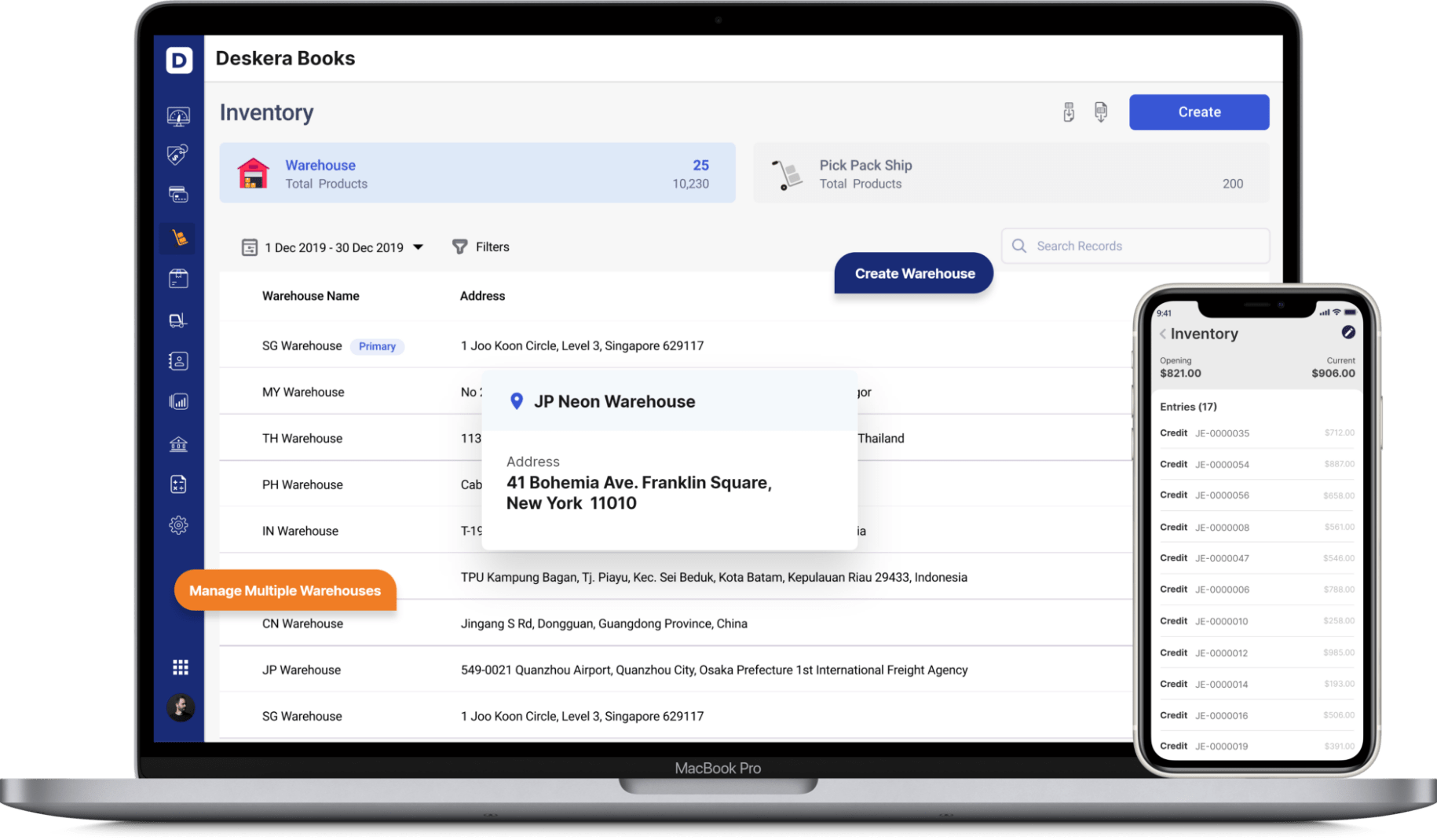

Deskera can also help with your inventory management, customer relationship management, HR, attendance and payroll management software. Deskera can help you generate payroll and payslips in minutes with Deskera People. Your employees can view their payslips, apply for time off, and file their claims and expenses online.

Key Takeaways

Before we wrap up the post, let us peep into the important points with context to Capital Budgeting:

- Capital Budgeting is defined as the process by which a business determines which fixed asset purchases are acceptable and which are not.

- Capital budgeting leads to calculating the profitable capital expenditure.

- Determining if replacing any existing fixed assets would yield greater returns is a part of capital budgeting

- Selecting or denying a given project is based on its merits.

- The process of capital budgeting requires calculating the number of capital expenditures.

- An assessment of the different funding sources for capital expenditures is needed.

- Payback Period, Net Present Value Method, Internal Rate of Return, and Profitability Index are the methods to carry out capital budgeting.

- The process of capital budgeting involves the steps like Identifying the potential projects, evaluating them, selecting and implementing the projects, and finally reviewing the performance for future considerations.

- Capital return, accounting methods, structures of capital, availability of funds, and working capital are some of the factors that affect the process of capital budgeting.

Related Links