Have you ever wondered what truly drives a company’s financial success — profit margins, market share, or customer loyalty? The answer often lies in one core metric: sales revenue. It serves as the foundation upon which every other financial indicator is built, revealing how well a business converts its offerings into income. Whether you run a startup or manage an enterprise, understanding your sales revenue is the first step toward evaluating performance, forecasting growth, and making informed strategic decisions.

In the simplest terms, sales revenue represents the total income generated from goods sold or services rendered during a specific period. But beyond being just a number on a financial statement, it reflects your company’s ability to attract customers, price effectively, and maintain consistent demand. Monitoring sales revenue helps businesses identify which products are performing well, where improvements are needed, and how to allocate resources efficiently to maximize profitability.

However, tracking and managing sales revenue isn’t always straightforward. Factors like discounts, returns, deferred payments, and multiple income streams can complicate the process. Moreover, in an era driven by data and automation, relying on manual spreadsheets or outdated systems can lead to errors and missed opportunities. That’s where smart business solutions like Deskera ERP come into play.

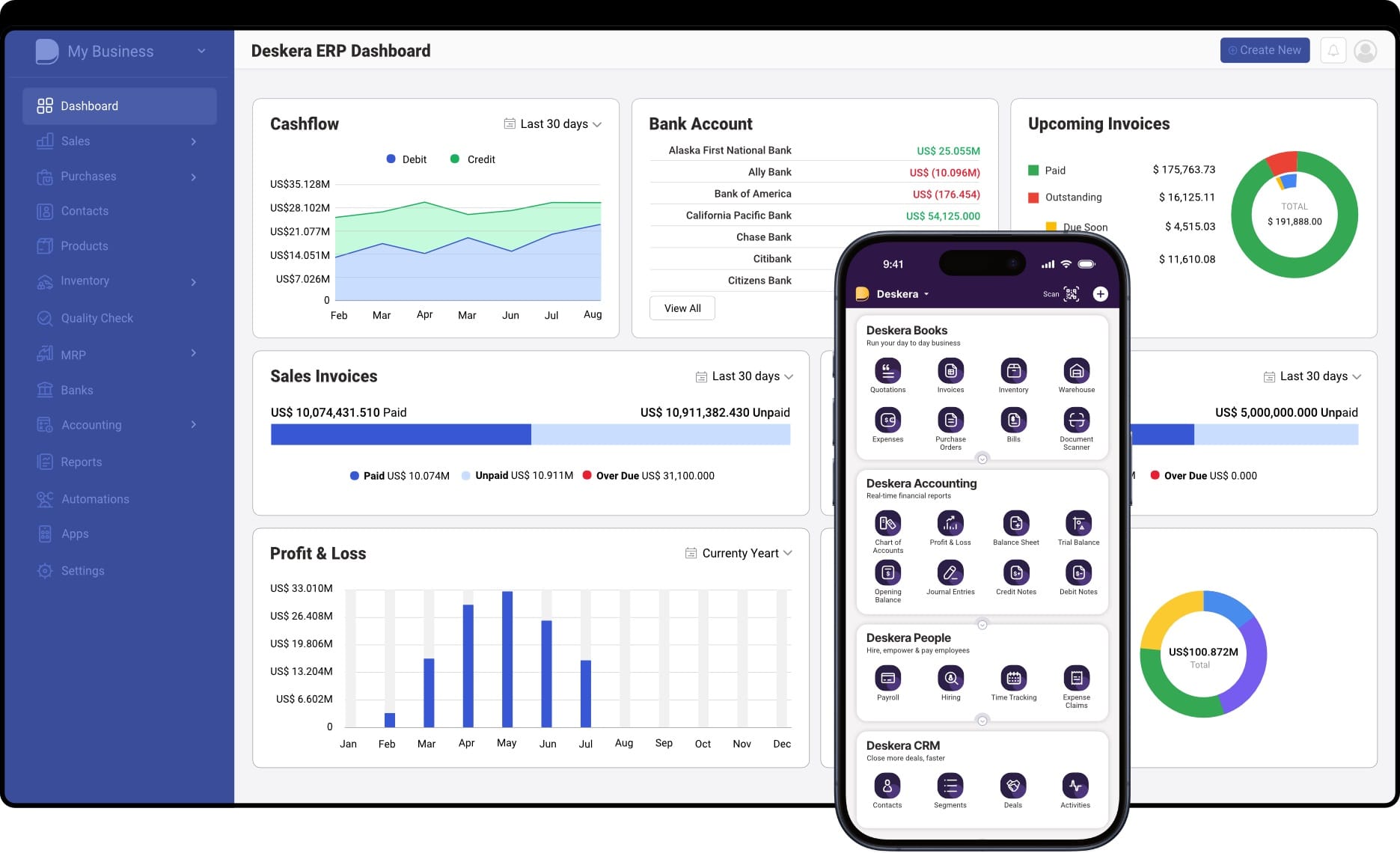

Deskera ERP simplifies sales revenue management through its powerful suite of accounting, CRM, and reporting tools. It provides real-time visibility into sales performance, automates revenue tracking, and integrates seamlessly with your other business functions. With advanced analytics, forecasting capabilities, and customizable dashboards, Deskera empowers businesses to make data-driven decisions and unlock new opportunities for growth.

What Is Sales Revenue?

At its core, sales revenue is the total income a company earns from selling its products or providing its services during a specific period. It represents the financial value of a business’s primary activities—what the organization was created to do. Simply put, it’s the top-line figure on an income statement that shows how effectively a company turns its offerings into income before accounting for expenses, taxes, or costs.

In accounting, the terms sales and revenue are often used interchangeably. However, it’s important to note that sales revenue doesn’t necessarily mean cash received. A portion may be paid immediately in cash, while another portion might come later through credit sales recorded as accounts receivable. This distinction is crucial because it reflects both realized and expected income, offering a more comprehensive picture of a company’s financial health.

Sales revenue can be presented on the income statement in two ways — gross sales revenue and net sales revenue. Gross sales revenue represents the total amount generated from sales before any deductions. Net sales revenue, on the other hand, accounts for adjustments such as sales returns, discounts, and allowances. While gross sales provide insight into how much a business is selling, net sales offer a clearer view of the actual income earned after accounting for these contra-revenue elements.

In essence, sales revenue serves as the foundation of financial analysis and business decision-making. It is vital for measuring growth, forecasting future performance, evaluating profitability, and determining a company’s valuation. By understanding how sales revenue is calculated and what it represents, businesses can identify trends, set realistic goals, and implement strategies to drive sustainable growth.

Sales Revenue vs Revenue

Components of Sales Revenue

Sales revenue isn’t just a single number; it is made up of several components that together reflect a company’s earnings from its primary business activities. Understanding these components helps businesses track performance, identify growth opportunities, and make informed strategic decisions. Broadly, sales revenue is divided into gross sales revenue and net sales revenue, but it can also be categorized based on the type of income generated.

1. Product Sales

Product sales refer to the income a company earns from selling its physical goods. This is often the most straightforward component of sales revenue and represents the total amount received from customers purchasing products. For example, a manufacturing company generates product sales revenue based on the number of units sold multiplied by the selling price per unit. Monitoring product sales helps businesses understand which products are performing well and identify trends in customer demand.

2. Service Sales

Service sales are the earnings generated from providing services rather than tangible products. Companies like consulting firms, SaaS providers, or subscription-based businesses rely heavily on this component. Service revenue is often recurring and can include fees for ongoing support, subscriptions, or one-time professional services. This type of sales revenue is critical for businesses focusing on long-term client relationships and predictable cash flow.

3. Other Income from Core Operations

Some companies earn sales revenue through other income streams related to their primary business. This can include commissions, licensing fees, royalties, or affiliate income directly tied to the company’s operations. While not as prominent as product or service sales, these additional streams contribute to the total sales revenue and can help diversify income sources, reduce risk, and improve financial stability.

4. Gross vs. Net Sales Revenue

- Gross Sales Revenue: Represents the total money earned from sales before accounting for any deductions. It gives a broad picture of how much a business is selling but doesn’t reflect actual cash inflow.

- Net Sales Revenue: This figure adjusts gross sales by subtracting returns, discounts, and allowances. Net sales revenue provides a clearer understanding of the actual income a company brings in from its operations and is often used for profitability analysis and financial reporting.

What Is Included and Not Included in Sales Revenue

Understanding what counts toward sales revenue and what doesn’t is crucial for accurate financial reporting and business analysis. Sales revenue focuses strictly on the income generated from a company’s core operations, providing a clear picture of how much money is earned from selling products or services during a specific period.

What Is Included in Sales Revenue

- Sales of Products and Goods – All income generated from the sale of physical products produced or sold by the company.

- Sales of Services – Revenue from services directly offered as part of the business, such as repairs, consulting, or subscriptions.

- Timing of Recognition – Revenue is recognized when the product is delivered or the service is fulfilled, not necessarily when cash is received. For example, if a product is sold in August but delivered in September, the revenue is recorded in September.

- Core Operational Income – Any income that arises from the company’s primary business activities falls under sales revenue.

What Is Not Included in Sales Revenue

- Cost of Goods Sold (COGS) – Expenses directly tied to producing or delivering the products, such as materials or labor, are not included in sales revenue.

- Non-Core Income – Earnings from activities unrelated to the company’s main business, like interest income, dividends, asset sales, or rental income from third parties, do not count.

- Future or Deferred Sales – Deals that haven’t been fulfilled or products/services not yet delivered are excluded until completion.

- Sales Tax – Taxes collected on behalf of the government are not part of sales revenue because the business acts as an agent, not the recipient.

In short, sales revenue reflects the actual income generated from products or services delivered during a defined period. It is recorded on the income statement and is not considered an asset on the balance sheet. Accurate identification of what is included and excluded ensures businesses make informed decisions about profitability, growth, and resource allocation.

How to Calculate Sales Revenue

Calculating sales revenue is one of the most fundamental yet essential steps in understanding your business performance. It provides insight into how effectively your company is generating income from its core operations—whether through selling products, offering services, or both.

While the formula is fairly straightforward, the accuracy of your result depends on correct data entry, proper timing, and clear differentiation between gross and net revenue.

Sales Revenue Formula for Product-Based Companies

For businesses that sell physical goods, sales revenue is calculated using this simple formula:

Sales Revenue = Number of Units Sold × Price per Unit

This formula helps determine the total income generated from selling tangible products before any deductions for costs or returns.

Example: Imagine a small bakery named Anavrin Baked Goods.

- It sells 500 cakes at $20 each and 300 loaves of bread at $5 each in June.

- Sales revenue from cakes = 500 × $20 = $10,000

- Sales revenue from bread = 300 × $5 = $1,500

- Total Sales Revenue (June) = $11,500

If in July, the bakery sold 750 cakes and 400 loaves of bread, the total sales revenue would rise to $17,000, and if sales drop in August to 250 cakes and 200 loaves, it would total $6,000. Summing up all three months gives a total quarterly sales revenue of $34,500.

Sales Revenue Formula for Service-Based Companies

For businesses that provide services rather than physical goods, the calculation focuses on the number of clients served and the average price charged per service.

Sales Revenue = Number of Customers × Average Price of Services

Example: If a consulting firm serves 50 clients in a month and charges an average fee of $1,000 per client, then the sales revenue would be: 50 × $1,000 = $50,000.

This figure represents the total income from services rendered within that specific period.

Gross vs. Net Sales Revenue Calculation

- Gross Sales Revenue includes the total income from all sales before any deductions.

- Net Sales Revenue accounts for sales returns, discounts, and allowances, giving a more accurate reflection of actual income.

Formula for Net Sales Revenue:

Net Sales Revenue = Gross Sales Revenue − (Sales Returns + Discounts + Allowances)

Reporting Frequency

Companies can generate sales revenue reports monthly, quarterly, or annually, depending on their reporting cycle. In many cases, organizations also calculate revenue per product line or service category to evaluate the contribution of each stream to the overall income.

In short, while the sales revenue formula may appear simple, its accurate calculation and timely reporting are critical for financial analysis, budgeting, and growth forecasting. Tools like Deskera ERP automate this process by tracking every sale in real-time, generating instant reports, and helping businesses make informed decisions based on up-to-date sales data.

Importance of Tracking Sales Revenue

Tracking sales revenue goes far beyond maintaining accurate financial records — it’s about gaining actionable insights that can shape your business strategy, improve profitability, and ensure sustainable growth.

By continuously monitoring sales revenue, businesses can understand how their efforts translate into income, identify market opportunities, and respond swiftly to changing customer needs. Here’s why it’s essential for every business to track this vital metric.

1. Evaluates Business Performance

Sales revenue is one of the clearest indicators of how well a company’s products or services perform in the market. A steady increase reflects strong demand, effective marketing, and customer satisfaction.

On the other hand, a dip in sales revenue might highlight issues such as poor product-market fit, weak sales performance, or pricing mismatches. Tracking it regularly helps leaders pinpoint problems early and take corrective action before they affect profitability.

2. Supports Forecasting and Budgeting

Historical revenue data allows businesses to anticipate future trends and plan accordingly. By identifying seasonal fluctuations and customer behavior patterns, businesses can forecast demand, set realistic sales targets, and prepare for market changes. Accurate forecasting also leads to better budgeting — ensuring resources like inventory, staff, and marketing spend are optimized to meet expected revenue goals.

3. Informs Pricing and Marketing Strategies

Tracking sales revenue provides clarity on how pricing and promotional efforts affect overall sales. If revenue increases after a new pricing strategy or campaign, it signals success. If not, it may be time to adjust the approach. This insight helps companies fine-tune their pricing models, discount structures, and marketing initiatives to maximize profitability while maintaining competitiveness.

4. Improves Cash Flow Management

By knowing when and how revenue flows into the business, organizations can manage their cash more effectively. Tracking sales revenue helps forecast incoming funds and plan expenditures such as payroll, supplier payments, or new investments. Strong revenue visibility also reduces the risk of cash shortfalls and supports better liquidity management, particularly for small and growing businesses.

5. Facilitates Performance Benchmarking

Sales revenue data can be benchmarked against competitors, industry averages, or internal performance targets. This helps businesses evaluate their market position and measure progress toward goals. Benchmarking revenue across different product lines or geographic regions can also reveal which areas are underperforming or have the most growth potential.

6. Aids in Strategic Decision-Making

When leadership teams have real-time access to sales revenue data, they can make decisions based on facts rather than assumptions. Whether it’s launching a new product, entering a new market, or adjusting production levels, sales revenue insights provide the evidence needed to take confident, strategic actions.

7. Strengthens Investor and Stakeholder Confidence

Consistent and transparent reporting of sales revenue demonstrates financial health and operational efficiency — qualities that attract investors and build stakeholder trust. Investors often view revenue trends as a direct reflection of a company’s growth trajectory and market relevance.

8. Measures ROI on Sales and Marketing Initiatives

By linking sales revenue to specific campaigns or initiatives, businesses can measure the return on investment (ROI) for marketing and sales activities. This helps allocate budgets more effectively and focus efforts on strategies that yield the highest returns.

9. Identifies Growth Opportunities

Detailed sales revenue analysis reveals which products, services, or customer segments generate the most income. Businesses can use this information to expand high-performing product lines, enter new markets, or develop personalized offers for profitable customer groups.

10. Enhances Real-Time Visibility with Technology

Modern ERP platforms like Deskera ERP empower businesses to track, analyze, and forecast sales revenue effortlessly. Deskera integrates sales, accounting, and CRM data into one platform, providing instant insights through automated dashboards and reports. Businesses can monitor performance in real time, segment revenue streams, and detect trends early — enabling smarter, faster decision-making that drives sustainable growth.

Common Mistakes to Avoid in Sales Revenue Calculation

Even small errors in calculating sales revenue can lead to major discrepancies in financial reporting, profitability analysis, and business decision-making. Many businesses — especially growing ones — struggle with distinguishing between gross and net revenue, handling discounts correctly, or accounting for returns and deferred income. Avoiding these pitfalls ensures your revenue figures truly reflect business performance.

Here are some common mistakes to watch out for:

1. Confusing Sales Revenue with Profit

One of the most frequent mistakes is assuming that sales revenue equals profit. In reality, sales revenue only represents the total income from goods or services sold before subtracting expenses like cost of goods sold (COGS), operating costs, or taxes. Misinterpreting these figures can lead to overestimating profitability and making misguided financial decisions.

2. Ignoring Discounts and Allowances

Businesses often offer trade discounts, seasonal discounts, or allowances to boost sales. However, failing to adjust the gross revenue for these reductions can inflate reported revenue. Always record the net sales revenue — after deducting all applicable discounts — for accurate reporting.

3. Overlooking Returns and Refunds

Customer returns and product refunds are an inevitable part of sales. Many businesses forget to factor them into the revenue calculation, leading to overstated figures. Net sales revenue should always subtract returns and allowances to present a realistic picture of total earnings.

4. Misclassifying Non-Sales Income

Income generated from sources other than sales — such as interest, rent, or asset sales — should not be included under sales revenue. Mixing operational and non-operational income can distort key financial ratios and hinder accurate performance analysis. Maintain clear segregation between sales revenue and other income in financial statements.

5. Recording Revenue Before It’s Earned

Recognizing revenue too early — before goods are delivered or services are rendered — can mislead stakeholders about the company’s actual performance. According to accrual accounting principles, revenue should only be recorded once the sale is realized or earned, not merely when an order is placed or payment is received in advance.

6. Neglecting Deferred Revenue

When customers pay in advance for products or services yet to be delivered, this amount should be recorded as deferred revenue, not immediate sales. Failing to account for it correctly can lead to inflated income figures and potential compliance issues.

7. Ignoring Multi-Currency and International Sales Adjustments

For global businesses, not adjusting for currency fluctuations or exchange rates can result in inaccurate revenue reporting. Companies dealing in multiple currencies must convert sales to the base reporting currency at the correct exchange rate to maintain accuracy and comparability.

8. Poor Integration Between Sales and Accounting Systems

When sales and accounting systems are not synchronized, discrepancies in data entry, timing, or classification can occur. This often leads to inconsistent revenue figures across departments. Automated and integrated systems ensure seamless data flow, real-time reconciliation, and error-free reporting.

9. Not Tracking Revenue by Product or Channel

Aggregating all revenue into one figure can obscure performance insights. Businesses should track revenue by product line, region, or sales channel to identify high-performing areas and optimize underperforming ones. Granular tracking helps refine strategy and improve profitability.

10. Lack of Regular Auditing and Verification

Without routine checks, even small inconsistencies in revenue reporting can accumulate into significant issues over time. Regular auditing ensures compliance, accuracy, and transparency — strengthening both internal controls and investor confidence.

Effect of Sales Revenue on Different Financial Statements

Sales revenue is not just a number—it’s the foundation of a company’s financial health and the starting point for most financial analyses. As the first line on the income statement and a key driver across all financial reports, sales revenue influences profitability, liquidity, and overall business valuation.

Its ripple effect extends beyond just income—it impacts the balance sheet and cash flow statement, making it one of the most critical figures in accounting and financial planning.

Let’s explore how sales revenue affects each of the main financial statements:

1. Sales Revenue on the Income Statement

Sales revenue takes center stage on the income statement, commonly referred to as the “top line” because it appears at the very beginning of the report. It represents the total income earned from the sale of goods or services before any expenses are deducted.

- Starting Point for Profit Calculation: Sales revenue serves as the baseline from which profitability is derived. The cost of goods sold (COGS) is subtracted from total revenue to arrive at gross profit. Subsequently, operating expenses such as selling, general, and administrative (SG&A) costs, depreciation, and amortization are deducted to determine operating income (EBIT).

- Determining Net Income: Once interest and taxes are subtracted from EBIT, the result is net income, which represents the company’s bottom line. Therefore, a fluctuation in sales revenue—whether positive or negative—directly affects the net income figure.

- Forecasting and Analysis: In financial forecasting, sales revenue acts as an anchor point. Analysts project future revenue trends and use them to estimate other items, such as COGS and expenses, often as a percentage of revenue. This top-down approach makes sales revenue a key indicator of financial performance and growth potential.

2. Sales Revenue and the Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time—showing assets, liabilities, and equity. While sales revenue itself isn’t directly listed on the balance sheet, it significantly influences several components:

- Assets: Sales revenue drives an increase in current assets, particularly cash and accounts receivable. When customers make purchases, either cash inflows or receivables are generated, boosting total assets.

- Liabilities and Equity: As revenue translates into profit, retained earnings (a component of equity) increase, thereby strengthening the company’s financial standing. Conversely, if sales decline, it can lead to reduced retained earnings and potential liquidity issues.

- Deferred Revenue: In cases where customers prepay for products or services, the amount received is recorded as a liability (deferred revenue) until the goods or services are delivered. This ensures accurate revenue recognition and aligns with accrual accounting standards.

3. Sales Revenue and the Cash Flow Statement

The cash flow statement tracks the actual movement of cash in and out of the business. Sales revenue affects the operating activities section, which reflects cash generated from core business operations.

- Cash Inflows from Operations: When customers pay for goods or services, the inflows increase the company’s cash position, directly enhancing operational liquidity.

- Timing Differences: It’s important to note that sales revenue recorded on the income statement may not immediately translate into cash on the cash flow statement due to credit sales or deferred payments. Hence, monitoring cash collections becomes vital for maintaining healthy cash flow.

- Indirect Cash Flow Method Impact: Under the indirect method, net income (which originates from sales revenue) is adjusted for non-cash expenses and changes in working capital. Thus, strong sales performance positively influences the starting point of cash flow calculations.

4. Interrelationship Across Financial Statements

Sales revenue serves as the common link connecting all three financial statements.

- The income statement quantifies profitability from sales.

- The balance sheet reflects the cumulative impact of revenue on assets and equity.

- The cash flow statement showcases the real cash movement resulting from these sales activities.

This interconnection underscores why accurate revenue reporting is vital — errors in recording or forecasting sales can distort the entire financial picture of a business.

10 Strategies to Increase Sales Revenue

Increasing sales revenue is essential for business growth, profitability, and long-term sustainability. While every company has unique circumstances, certain proven strategies can help maximize revenue streams and ensure consistent growth. Below are 10 actionable strategies to boost your sales revenue:

1. Optimize Pricing Strategies

Regularly reviewing and optimizing pricing ensures that your products or services are competitive while maintaining healthy profit margins. Price adjustments should factor in operating costs, competitor pricing, price elasticity, and customer segments. A well-optimized pricing strategy can significantly increase revenue without necessarily increasing sales volume.

2. Expand Customer Reach

Reach new audiences by exploring untapped customer segments and additional sales channels. This can include social media platforms, online marketplaces, resellers, partnerships, or affiliate programs. Expanding reach increases the potential customer base and drives additional revenue streams.

3. Enhance Customer Experience

Providing a seamless and enjoyable experience encourages repeat purchases and customer loyalty. Strategies include improving product usability, streamlining the checkout process, personalizing interactions, and offering loyalty incentives. Happy customers are more likely to spend more and refer others, further boosting revenue.

4. Launch New Products or Services

Diversifying your offerings can attract new customers and increase revenue from existing ones. Adding complementary or upgraded products allows businesses to maximize customer lifetime value and capture more of the market share.

5. Implement Cross-Selling and Upselling

Cross-selling encourages customers to buy related products, while upselling convinces them to purchase higher-value alternatives. Both strategies increase the average order value and overall revenue. Personalized product recommendations, both online and in-store, can make these tactics highly effective.

6. Invest in Marketing Strategies

Targeted marketing ensures that promotional efforts reach the right audience. Strategies include defining the target audience, creating content for each stage of the customer journey, building email lists, maintaining social media presence, and turning customers into advocates. Data-driven marketing ensures higher conversion rates and revenue growth.

7. Improve Customer Service Quality

Exceptional customer service drives repeat purchases and strengthens loyalty. Invest in training, live chat support, conversational AI, and self-service portals to improve efficiency and customer satisfaction. A strong support experience encourages customers to return and increases overall revenue.

8. Expand Into New Markets

Geographical expansion, targeting new customer segments, exploring new sales territories, or partnering with new distribution channels can open additional revenue streams. Entering complementary markets allows businesses to scale and tap into previously untapped opportunities.

9. Utilize Data Analytics

Analyzing sales data helps identify trends, customer preferences, and high-performing products. Data-driven insights allow businesses to optimize pricing, marketing campaigns, and sales strategies. Monitoring metrics like average order value, revenue per channel, and repeat purchase rates informs better decisions for revenue growth.

10. Leverage Technology and Sales Tools

Investing in tools like CRM systems, ERP platforms, marketing automation, and sales enablement software streamlines operations, enhances customer targeting, and improves sales efficiency. For example, Deskera ERP integrates sales, inventory, and accounting, giving businesses real-time insights into revenue streams, helping forecast demand, and supporting informed strategic decisions.

Implementing these strategies in a coordinated way — optimizing pricing, improving customer experience, leveraging data, and utilizing technology — can create a sustainable path for increasing sales revenue. By continuously monitoring performance and adapting to market trends, businesses can maximize both profitability and growth.

How Deskera ERP Can Help You Boost Sales Revenue

Increasing sales revenue requires more than just strategies—it demands accurate data, streamlined processes, and real-time insights. This is where Deskera ERP comes in. As an integrated enterprise resource planning platform, Deskera ERP connects your sales, inventory, accounting, and customer management systems, providing a unified view of your business operations.

Here’s how it can help drive revenue growth:

1. Real-Time Sales Tracking

Deskera ERP allows you to monitor sales performance in real time. From tracking units sold to revenue by product or region, you can quickly identify trends, best-selling products, and underperforming items. This visibility helps you make timely adjustments to pricing, promotions, and sales strategies to maximize revenue.

2. Streamlined Sales Processes

With Deskera ERP, sales workflows are automated and simplified. Quoting, invoicing, and order management are integrated, reducing errors and delays. A smoother sales process improves the customer experience, enabling faster order fulfillment and higher customer satisfaction — both of which contribute to increased sales revenue.

3. Data-Driven Decision Making

Deskera ERP consolidates all sales and customer data into one platform. With built-in analytics and reporting tools, you can segment customers, track sales by channel, and analyze buying patterns. This enables targeted marketing campaigns, personalized upselling and cross-selling, and better forecasting — all strategies that directly impact revenue.

4. Inventory and Demand Management

By integrating inventory with sales data, Deskera ERP ensures you have the right products in stock at the right time. Avoiding stockouts and overstocking reduces lost sales and improves cash flow. Proper inventory management also allows businesses to capitalize on high-demand periods and seasonal trends, driving revenue growth.

5. Improved Customer Relationship Management (CRM)

Deskera ERP’s CRM capabilities help you manage leads, track customer interactions, and nurture relationships effectively. By understanding customer preferences and history, your sales team can create personalized offers, upsell premium products, and retain loyal customers — increasing lifetime value and overall sales revenue.

6. Accurate Forecasting and Planning

With historical sales data and predictive analytics, Deskera ERP helps you forecast future revenue more accurately. Businesses can plan production, inventory, and marketing strategies based on data-driven insights, reducing risks and optimizing sales revenue opportunities.

In summary, Deskera ERP acts as a central hub that aligns sales, finance, and operations. By providing real-time insights, streamlining workflows, and supporting data-driven strategies, it empowers businesses to not only track sales revenue but actively increase it.

Key Takeaways

- Sales revenue represents the total income generated from the sale of goods or services before deducting expenses. It is a crucial top-line metric that drives profitability, forecasting, and strategic decision-making.

- While sales revenue refers specifically to income from core business activities, total revenue includes all income streams, such as interest, investments, or asset sales. Understanding this distinction is essential for accurate financial reporting and analysis.

- Sales revenue is composed of gross revenue (total sales before deductions) and net revenue (gross revenue minus returns, discounts, and allowances). Recognizing these components helps businesses evaluate both sales performance and profitability.

- Sales revenue includes all income from products and services sold during a specific period but excludes costs of goods sold, taxes, non-operating income, and deferred revenue. Accurate classification ensures proper accounting and reporting.

- Sales revenue is calculated by multiplying units sold by price per unit for products or number of customers by average price of services for service-based businesses. Accurate calculations enable monitoring, benchmarking, and growth planning.

- Sales revenue impacts all major financial statements: it serves as the top-line metric on the income statement, influences assets and equity on the balance sheet, and drives cash inflows in the cash flow statement. Its accuracy is critical for holistic financial management.

- Key strategies to boost sales revenue include optimizing pricing, expanding customer reach, enhancing customer experience, launching new products, upselling and cross-selling, investing in marketing and employee training, entering new markets, leveraging data analytics, and using sales technology.

Related Articles