It was May 2021 when the country was battling the second wave of the Coronavirus. Suresh Babu (34), a salaried employee, was working for a multinational firm when he suddenly felt uneasy. He called out to his wife, Maya. Hearing the urgency in his voice, his wife and Vijay, his seven-year-old son, rushed to his side.

On seeing the otherwise healthy Suresh in discomfort, Maya and Vijay rushed him to the nearby hospital. As the county was in the grip of the pandemic, the only way to get medical help was through casualty.

The nursing staff at the hospital informed Maya that Suresh's blood pressure was unusually high, and they needed to hospitalize him. They also told her that the hospital did not allow attendants due to covid protocol and assured her that Suresh would get the best treatment and would soon be home again. Suresh also convinced Maya to leave, citing that it was unsafe for Vijay.

At midnight Maya received a call from the hospital. Suresh's health had deteriorated, and he had a brain stroke and went into a coma. Suresh survived, but the damage from the brain stroke caused him to be bedridden.

Although Suresh can no longer go to work, he will still be able to fund his son's education, but how?

As Suresh was a salaried employee, he is entitled to gratuity payment. Suresh had nominated his younger brother to be his beneficiary when he joined the company. However, when Vijay was born, Suresh had submitted the notice of modification of gratuity nomination— the nomination change form to list son Vijay's nomination for gratuity payment. As Vijay is Suresh's legal hire and nominee, he is entitled to receive the gratuity due to his father on his retirement or at his father's death or any accident causing disability, whichever comes first.

However, as Vijay is a minor, the employer cannot transfer the gratuity amount immediately to him. But as per the directives of the payment of Gratuity Act, 1972, they must lodge it in a term deposit in a nationalized bank. Vijay will receive it when he is a major.

Thus Suresh fell sick when Vijay was still a little boy and could not go to work after that to provide for him. Thanks to the gratuity payment and other retirement benefits, he can still provide for his higher education and help him realize his dreams.

Continue to know more about Form H: this article's modification of nomination or the nomination change form.

- What is Gratuity Payment?

- How Should an Employee Nominate a Beneficiary for the Gratuity Amount in Case of Death or Disability?

- What are Gratuity Nominations?

- Who Can be a Nominee for Gratuity Payments?

- What Is The Nomination Change Form?

- Gratuity Payment Act, 1972 Guidelines Concerning Form H: Nomination Change Form

- Conclusion

- Key Takeaways

What is Gratuity Payment?

When an employee renders his services continuously to an employer for five years, the employer pays him gratuity in appreciation. As per the Gratuity Act of 1972, the employer must pay the gratuity amount at the time of the employee's retirement or superannuation.

However, there are certain exceptions to the above rule. The exception is when an employee dies or is disabled due to sickness or accident before his retirement, the employers must pay the gratuity amount to his nominee or legal heir even if the employee did not provide five years of continuous services to the employer.

What happens if the nominee or legal heir is a minor? In that case, the law directs the employer to deposit the gratuity amount in a nationalized bank's term deposit which the nominee can access when he comes of age.

How Should an Employee Nominate a Beneficiary for the Gratuity Amount in Case of Death or Disability?

As discussed in the previous section, although, under the gratuity law, the employer pays the gratuity amount only at retirement or superannuation if the employee is in service for five years and above, we also state an exception to the rule.

The exception is if the employee is disabled or dies before even completing a year of service, his legal heirs or those he nominates as beneficiaries will receive the gratuity benefit.

For this purpose, the employee must nominate a beneficiary for the gratuity amount in Form 'F'. The employee must submit the Form in duplicate by hand delivery and obtain a proper receipt for the same from the employer. Alternatively, the employee can submit the form F by registered post acknowledgment due to his employer.

Suppose the employer has been working for the organization for at least a year from the date of the commencement of the payment of gratuity rules the nomination in form F needs to be submitted within 90 days from the date of the applicability of the law.

However, if the employee joins service in the organization and completes at least a year of service before the payment of gratuity rules becomes applicable, he must nominate his beneficiary and intimate the same to his employer within ninety days from the date of the applicability of the law.

Furthermore, if the employee completes a year of service after the commencement of the gratuity, he must, as per the gratuity law, nominate the beneficiary and submit form F within thirty days from the date of the rule's applicability.

The employee can modify the nomination by submitting the nomination change form if he so wishes to at a later stage. We will discuss the procedure of submitting the nomination change form later in the article.

What are Gratuity Nominations?

All salaried employees must nominate the beneficiary for the gratuity payments, as per the Payment of Gratuity Act, 1972, the employee must make his nominations within 30 days of completing a year's service with his employer. However, in practice, most employers in India require their employees to submit nominations when they begin working for them.

By nominating a beneficiary, the employee indicates a person whom the employee must pay the gratuity amount due to him in case of his death or disability before his retirement.

Who Can be a Nominee for Gratuity Payments?

As per the Gratuity Act, only the employee's family can be nominated as beneficiaries of the gratuity payments. The family under the law for a male is his wife, children, his parent if they are dependents, his wife's parents if they are dependents, or his son's wife and children if his son is dead.

Similarly, for female employees, she may designate her husband or any or all her children, her dependent parents, in-laws (husband's parents who are her dependents), or her son's widow and children if her son is dead.

It is good to note here that a wife cannot remove the name from her list of nominees as per the Gratuity Payment Act, 1972. The provision in this regard was removed by an amendment in 1987. Also, a gratuity nomination does not get canceled automatically but needs to be modified by submitting the nomination change form.

What Is The Nomination Change Form?

Indian employer requires their employees to disclose the nomination when they join duty in their firm or within the time stipulated by the Gratuity law. If, however, at the later stage, the employee would like to make any modification to the nomination, he needs to do so only through the submission of Form H —nomination change form.

For better understanding, we have inserted a template of the nomination change form.

What is the Need for Nomination Change Form?

The Gratuity Payment Act necessitates the modification of the nomination in the following scenarios:

- If the employee did not have a family during the nomination, he might have nominated someone who is not defined as a family by the gratuity law. Later, the law allows modification via the nomination change form when he has a family. However, a fresh nomination through Form F should follow the modification of the nomination through the nomination change form

- If the employee was not married at the time of nomination, he could later change his nomination list by submitting a modification in the nomination via the nomination change form to include his wife as his nominee

- After the birth of his children, the employee may make additions to the list of nominees by submitting the nomination change form

- As gratuity nominations do not change on their own as per change in the employee's status, all changes should be incorporated by submitting the nomination change form

- If the nominee predeceases, the same needs to be intimated to the employers by the employee by submitting the nomination change form

Gratuity Payment Act, 1972 Guidelines Concerning Form H: Nomination Change Form

During the nomination disclosure, an employee was unmarried and may have nominated one of his blood relatives to be the beneficiaries of the gratuity payment. However, when he gets married, he may want modification in the nomination via a nomination change form to include his wife on the list of nominations. He will have to use the nomination change form at the birth of his children to include them on his list of nominees for gratuity payment.

Continue reading to know the gratuity payment law and the modification of nominations —nomination change Form as follows:

An employee who has no family at the time of making a nomination shall, within ninety days of acquiring a family, submit in the manner specified in sub-rule

(1), a fresh nomination, as required under subsection (4) of section 6, duplicated in Form 'G' to the employer, and after that, the provisions of the sub-rule apply

(2) shall apply mutatis mutandis as if it was made under sub-rule:

(1) A notice of modification of a nomination or the nomination change form, including cases where a nominee predeceases an employee, shall be submitted in duplicate in Form 'H' —nomination change form to the employer in the manner specified in sub-rule (1), and after that the provisions of sub-rule

(2) shall apply mutatis mutandis.

- A nomination or a fresh nomination or a notice of modification of nomination shall be signed by the employee or, if illiterate, shall bear his thumb impression in the presence of two witnesses, who shall also sign a declaration to that effect in the nomination, fresh nomination or notice of modification of nomination, as the case may be

- A fresh nomination or notice of modification (or nomination change form) of nomination shall take effect from the date of receipt thereof by the employer

Conclusion

Humanity witnessed the most devasting times in recent history because of the coronavirus pandemic. So many people died or were left destitute because of expensive medical bills. Most of those who lost their lives were breadwinners of the family, and their dependents could move to new beginnings only because of their gratuity benefits.

But some were even deprived of these benefits because the deceased family member on whom they were dependent did not know that they needed to modify the nominations by submitting the Form H—nomination change form before submitting fresh nominations to include them in the list of their nominees.

We write this article about modifying gratuity nomination to educate salaried employees about its importance. If you are an employee, follow the guidelines in the article to make the necessary modifications to your gratuity nomination by using the nomination change form so that the right person will receive the benefit in an untoward situation.

How Can Deskera Assist You?

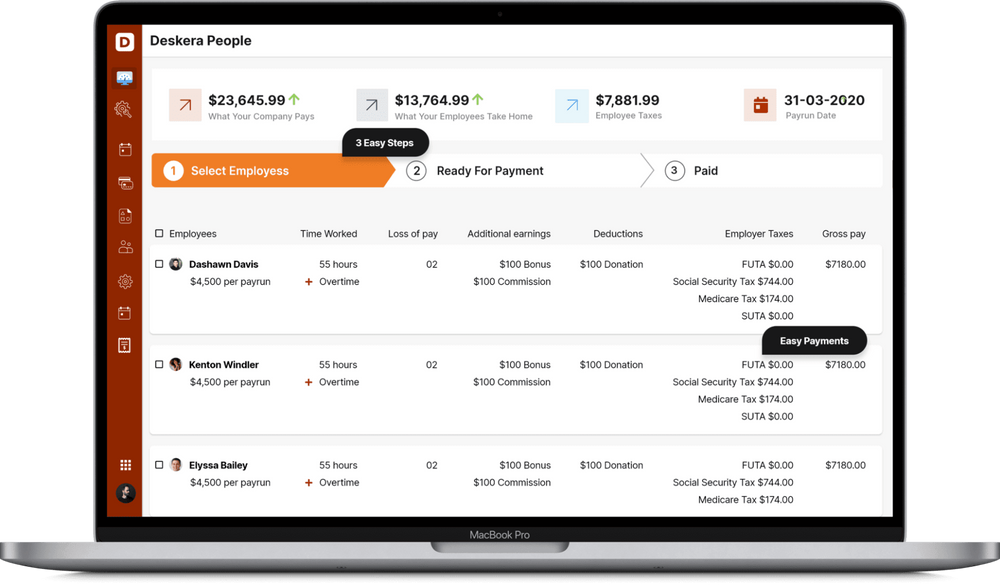

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

- The employee receives employment benefits only on his retirement or superannuation, provided he works for the organization for at least five years

- Suppose the employee dies or is disabled to such an extent that he cannot work again— his nominees will receive the gratuity benefit irrespective of the duration he has worked for the organization

- The employee must disclose his nominee either at the time of joining the organization or within a year as per the company's policies concerning gratuity procedures

- The gratuity nomination does not change on its own

- Every change in gratuity nomination is through the nomination change form

Related Articles