The Shops and Commercial Establishments Act is a crucial regulation enforced by every state in India; most businesses in the country are subject to the Act. The Act is intended to govern and regulate wages, working hours, leave, holidays, terms of employment, and other work conditions for employees employed in shops and commercial establishments.

The Department of Labor oversees the Shop and Establishment Act, which governs places where any trade, business, or profession is conducted. The statute governs not only commercial establishments, but also societies, charitable trusts, for-profit educational institutions, and places where insurance, banking, stock, or share broking is conducted.

Multiple other aspects such as the working hours, employee rest intervals, opening and closing hours, and closed days are considered in the Act. Furthermore, national and religious holidays, overtime work, rules for child employment, yearly leave, maternity leave, illness and casual leave, and so on are all covered by this legislation.

In this article, we will be focusing on the Shops Commercial Establishments Act in the Indian state of Madhya Pradesh.

- What is Madhya Pradesh Shops Commercial Establishments Act?

- An Overview: Shop and establishment Act in India

- How to Apply for Registration, Renewal, or Amendment under M.P. Shops and Establishment Act

- How can Deskera Help You?

- Key Takeaways

What is Madhya Pradesh Shops Commercial Establishments Act?

Madhya Pradesh Shops Act is a document that comprises eleven chapters and two schedules. It is an Act that supervises working and employment conditions in stores, commercial establishments, residential hotels, restaurants, eating establishments, theaters, and other public places related to recreation and entertainment. It has been enforced by the Madhya Pradesh Legislature in the Ninth Year of the Republic of India and consists of the terms and aspects as explained in the upcoming sections.

Chapter 1: Preliminary

1. Title, operation, and application

The Act is referred to as the Madhya Pradesh Shops and Establishments Act, 1958, and is applicable across the state of Madhya Pradesh. In the first instance, this Act will apply to the local areas listed in Schedule I. The State Government may direct that all or any of the provisions of this Act apply to any other local area named in the notification on the date specified in the notification, and various dates may be determined for different provisions of this Act and for different classes of establishments.

2. Definitions

The Act explains the definitions of the following terms:

Apprentice refers to a person who is engaged for the purpose of learning a trade, craft, business, or occupation at any establishment. They may or may not be paid.

A child means a person under the age of fourteen.

closed denotes that the establishment is not open to serving customers, conducting business, or performing labor related to the establishment.

Commercial establishment means any business, trade, or profession, or any work in connection with, or incidental or ancillary to, any business, trade, or profession, and includes the following:

- a registered or unregistered charitable trust that carries on any business, trade, profession, or work in connection with or incidental or ancillary to such business, trade, or profession; it could also be a society registered or considered to have been registered under the Madhya Pradesh Societies Registration Act, 1959 (1 of 1960)

- a business that engages in the advertising, commission agency, forwarding, or commercial agency activity, or is an administrative department of a factory or any other industrial or commercial undertaking;

- an insurance business, a joint-stock company, a bank, a broker's office, or a stock exchange.

However, it does not include residential hotels, shops, factories, restaurants, or any other place of public entertainment.

The term day refers to the twenty-four-hour period that begins at midnight and ends at midnight:

Day, for employees whose hours of work extend beyond midnight, indicates the twenty-four-hour period beginning when such employment commences.

Employee means a person who is entirely employed in or in connection with any establishment, directly or through any agency, for compensation or other consideration, and includes an apprentice but does not include a member of the employer's family.

An employer is a person who owns or has the ultimate authority over an establishment's activities. The term also includes the manager, agent, or any other person acting in the general management or control of such an establishment.

Establishment implies a shop, commercial building, residential restaurant, eatery, snacking place, auditorium, or other public places of amusement to which this Act applies. It also includes any other establishment that the Government may declare to be an establishment based on the guidelines of this Act.

Factory means any premises that are described in clause (m) of Section 2 of the Factories Act, 1948 or are declared to be a factory under Section 85 of the same Act.

All resources, commodities, and objects are considered goods.

A holiday means a day on which an establishment is closed or an employee is given a day off under the terms of the Act.

An Inspector appointed or considered to be appointed under the Act, whether by name or by virtue of office, is referred to as an Inspector.

Labor Commissioner means the person appointed by the Government and includes an officer not below the rank of Assistant Labor Commissioner for the purposes of such provisions of the Act and for such areas as the Government may instruct.

The term leave refers to the leave described in Chapter VII of this Act.

Local authority refers to a Municipal Corporation or Municipality established under any current statute.

A person designated as management under Section 6 is referred to as a manager.

A member of an employer's family is defined as the employer's husband, wife, son, daughter, father, mother, brother, or sister who lives with and is dependent on the employer;

Opened implies that the establishment is open for the service of any customer, any business conducted by the establishment, or any job associated with the establishment.

Explanation: Unless the contrary can be proven, an establishment is believed to be open in which people are present.

Period of work refers to the time when an employee is at the employer's disposal.

Register of establishment means a register kept for the purpose of registering businesses under this Act.

A registration certificate denotes a document certifying an establishment's registration;

A Residential hotel implies any place where a bona fide business of providing payment accommodation, board, and lodging to travelers and other public members is carried out, including a residential club.

A restaurant or eating-house means any place where the sole or primary business is the providing food or beverages to the general public or a specific group of the general public for consumption on the premises. This includes a Halwai shop; however, it excludes a restaurant or canteen attached to a factory if the people who work there are entitled to the benefits offered by the Factories Act, 1948.

Shop refers to any location where people sell goods. This could be either retail or wholesale or where customers receive service. This could also be an office, a store room, warehouse, or workplace, whether in the same location or elsewhere used in connection with a trade or business, but excludes a factory, a commercial establishment, residential hotel, restaurant, eating-house, theatre, or other places of public amusement or entertainment, or a shop attached to such a location.

Spread-over refers to the time between an employee's start and finish of work on any given day.

Theatre refers to any location that is primarily or exclusively used for the exhibition of pictures or other optical effects using a cinematograph or other suitable apparatus, for dramatic performances, or for any other kind of public enjoyment or entertainment.

Wages refers to the wages defined in the Payment of Wages Act, 1936 (4 of 1936).

A week is a period of seven days that begins at midnight on Saturday and ends at midnight on Sunday.

Year refers to the calendar year that begins on April 1st.

A young person is a person who is not a kid and has not reached the age of seventeen.

3. Areas where the Act is not applicable

Certain people and businesses are exempt from the Act.

(1) Nothing in this Act applies to the following:

{(a) persons employed in a confidential capacity not exceeding ten percent of the total number of employees in the establishment or three in number, whichever is less.

Or persons occupying positions of management and declared so under clause (a) of sub-section (2) of Section 6.}

(b) those whose jobs are essentially sporadic, such as travelers, canvassers, watchmen, or caretakers.

c) individuals only engaged in preliminary or auxiliary work, such as clearing or forwarding clerks, or messengers, who are responsible for the shipment of products by rail or other means of communication, as well as customs formalities.

d) individuals who work solely in the collection, delivery, or carriage of items;

e) the Reserve Bank of India, the State Bank of India, and the Life Insurance Corporation, as well as offices of the Union or State Governments or Local Authorities;

f) a facility for the treatment or care of sick, infirm, poor, or mentally ill people;

g) bazaars, fairs, or exhibitions for the aim of selling artwork for charitable or other non-profit purposes;

h) railway station stalls and refreshment rooms, or railway dining cars.

i) Deleted

j) clubs that are not residential; and

(k) any other class of establishments or people that the Government may exempt from the application of this Act by notification:

Provided, however, that if the State Government believes that the circumstances prevailing in any of the above-mentioned classes of cases necessitate the extension of all or any of the provisions of this Act, the State Government may extend all or any of the provisions of this Act to such class of cases, and such provisions shall thereafter apply to such cases.

2) The Government may direct, by notification, that any or all of the provisions of this Act shall not apply to such types of establishments or individuals as may be specified therein, subject to such terms and circumstances as may be indicated in such direction.

4. Application of the Act to other establishments

- Despite the guidelines or prescriptions in this Act, the Government may announce any establishment or any person to whom, this Act or any of its provisions does not apply, to be an establishment or a person to whom, this Act or any of its provisions shall apply from the date specified in the notification.

- Any such establishment or class of establishments, or any such person or class of persons, shall be deemed to be an establishment or class of establishments to which, or an employee or class of employees to whom, this Act applies, and all or any of the provisions of this Act shall apply to such establishment or class of establishments, or to such employee or class of employees, upon such declaration under sub-section (1).

5. Suspension of all or part of this Act's provisions: On account of any festivals or other special occasions, the Government may suspend the operation of all or part of the provisions of this Act by order published in the Gazette for such period and under such conditions as it deems appropriate.

Chapter 2: Registration of Establishments

This section speaks about the registration of establishments.

6. Registration of Establishments

i) All establishments to whom the Act is applicable must register under the provisions of the Act.

ii) Within thirty days of the date on which this Act applies to an establishment, the employer must send a statement to the Inspector of the concerned area for registration. They must apply through the prescribed form along with the prescribed fees. They must also add the following details:

(a) the name of the employer, the manager, and any other persons holding management positions;

(b) the establishment's postal address and the date on which it began doing business;

(c) the establishment's name, if any;

(d) the type of establishment, such as a shop, a commercial enterprise, a residential hotel, a restaurant, an eating-house, a theater, or another public amusement or entertainment venue; and

e) any other information that may be required.

iii) If the Inspector is satisfied with the application, they shall register the establishment in the Register of Establishments and issue a Registration Certificate. This certificate must be visibly presented or exhibited on the premises of the establishment.

iv) If the Inspector is not satisfied with the application or has concerns or doubts regarding it, then they shall present it before the Labor Commissioner. The Commissioner will take cognizance of the matter and as deemed fit, they shall determine the type of the establishment. The decision of the Labor Commissioner is final as prescribed by the Act.

v) The Government may require the renewal of Registration Certificates granted under this section at intervals of at least five years and for a fee as prescribed.

vi) The registration and renewal fees per establishment shall not be more than two hundred and fifty rupees.

7. Changes must be Informed to the Inspector

If there are any changes in the statement, then the employer must notify or inform the Inspector about the same. They must inform in the prescribed format within seven days since the change has taken place under Section 6.

Once the Inspector finds the corrections to be satisfactory, they shall make the corresponding amendments in the Registration certificate and issue a fresh certificate.

8. Closing of Establishment must be notified to the Inspector

Within ten days of closing of the establishment, the owner or the employer must inform the Inspector in writing. Once satisfied with the correctness of the information, the Inspector shall remove the establishment’s name from the Register of Establishments. Additionally, they shall cancel the Certificate of Registration.

Chapter 3: Shops and Commercial Establishments

9. Opening and Closing Hours

(1) On any given day, no store or commercial institution shall:

(a) open earlier than the hour determined by the Government by general or special order in this regard; or

(b) be kept open later than the hour specified by the Government by a general or specific regulation in this regard:

Provided, however, that any customer who was in the process of being served at the shop's closing hour may be served within the half-hour of the closing time

(2) The government may establish separate opening and closing hours for different types of businesses and commercial establishments, as well as different areas and seasons.

10. Hawking Disallowed before and after closing time of shops

(1) No person shall sell any goods on the same street or a public place before or after the opening and closing hours set forth in Section 9 for shops associated with the same class of goods in the locality in which such street or public place is located; however, this section shall not apply to the sale of newspapers.

(2) Anyone who violates the provisions of subsection (1) risks having his or her property taken by an Inspector.

(3) The goods taken under subsection (2) shall be released to the person from whom they were seized upon the payment of rupees [fifty] as security for his appearance before the Court.

(4) If the person fails to make the deposit, the confiscated property must be delivered immediately before a Court, which may issue temporary custody orders.

(5) If no prosecution is brought for violating the provisions of sub-section (1) within the time limit set by the Court, the Court shall order their return to the person from whom they were taken.

(6) Based on the provisions of the previous sub-section, the provisions of the [Code of Criminal Procedure, 1898 (No. V of 1898)] shall apply to the disposition of the commodities seized under this Section.

11. Hours of work in shops and commercial establishments

[(1) (a) No employee in a shop or commercial establishment shall be compelled or allowed to work for more than 48 hours in a week.

(b) Except as provided in clause (a) employees shall not be required for the following:

(i) for more than nine hours on any given day in any store or shop;

(ii) for more than ten hours on any given day in any business enterprise.]

(2) Any employee may be required or permitted to work in a shop or commercial business for a period in excess of the limit set forth in subsection (1) if the duration is not more than six hours per week.

(3) Any employee may be required or allowed to work in a shop or commercial establishment in excess of the period fixed under sub-section (1) on not more than six days per year, which the Government may fix by rules made in this behalf. This is prescribed for purposes of making accounts, settlements, or other prescribed occasions if such excess duration is not more than twenty-four hours.

12. Spread-over in commercial buildings and shops

An employee at a store or business establishment may not work more than twelve hours each day:

Provided, however, that if a shop or commercial business is closed for a continuous period of at least three hours on any given day, the spread-over on that day shall not be more than thirteen hours:

However, if an employee works under the provisions of Section 11's sub-section (2), the spread-over on any given day shall not be more than fourteen hours. Also, where he works under the provisions of Section 11's sub-section (3), the spread-over shall not be more than sixteen hours on any given day;

Furthermore, the Government may extend the spread-over duration subject to such restrictions as it deems appropriate, either generally or in the case of a particular kind of commercial entities.

13. Holidays in a week in commercial buildings and shops

(1) The shops and all commercial establishments must remain closed for one day in a week. The employer must set this date at the start of the year, notify the Inspector, and describe it in a notice prominently on the premises of the shop or commercial enterprise.

The employer shall not change the notice in the shop more than once every three months after such day. They shall also notify the Inspector of the change, and shall make the required changes in the notice in the shop or commercial business:

However, if any shop or commercial establishment comes within the jurisdiction of this Act for the first time at the commencement of any year, the employer shall also fix the day of the week on which the shop shall stay closed and inform the Inspector inside one month of the date on which the shop comes within the scope of the Act.

(2) If a day considered a holiday under subsection (1) falls on a day of a public festival, the employer may keep the shop or commercial establishment open on that day; however, they must keep it closed on another day within three days before or after the date of the public festival. Also, the shop owner must inform the Inspector of the change at least seven days before the day of the public festival.

(3) It is unlawful for an employer to call for an employee to the shop or commercial establishment for any work in connection with the business on a day when the shop or commercial establishment is closed.

(3-A) Despite the prescriptions in sub-section (1), the State Government or any officer authorized by it on this behalf may fix any day of the week as the closed day for all or any class of shops or commercial establishments in any or all of the local area or part thereof, and the closed day so fixed shall be deemed to have been fixed under sub-section (1);

(4) There should be no deductions from the employees' wages on the day the commercial establishment remains closed, under this section.

If an employee is paid on a daily basis, he or she will be paid earnings for the weekly holiday according to the average of his or her daily salary for the previous six working days. If an employee is paid on a piece-rate basis, he will be paid his wage for the days the shop or commercial establishment is closed at a rate equal to the daily average of his wages for the days he has actually worked during the six days prior the closed day, exclusive of any overtime earnings. The statements in this subsection shall not apply to an employee whose total employment duration is less than six days.

Chapter 4: Residential Hotels, Eating Houses, and Restaurants

14. Opening and Closing times of restaurants and eateries

(1) Restaurants or eateries shall not open before 5 a.m. or remain open after 1.30 a.m. for service, on any day.

Provided, however, that an employee in such a restaurant or eating establishment may be expected to report to work, not before 4.30 a.m. and no later than 2 a.m.:

Provided, however, that any customer who was being served at the restaurant's or eating-closing house's hour may be served during the half-hour immediately following such hour;

(2) Subject to subsection (1), the Government may establish various opening or closing hours for different dining establishments, at different localities, or different times of the year.

(3) Despite the statements mentioned in this section or any other implementation in force at the time, the Government may set such opening and closing hours for different restaurants, as it deems appropriate, for specific periods in a year on festive or special occasions.

15. Restrictions on Sale of Goods

No items of the kind sold in such shops shall be sold in any restaurant or eating-house save for consumption on premises before and after the hours established for the opening and closure of shops under Section 9.

16. Working hours in residential hotels, restaurants, and eating establishments

(1) Employees in a residential hotel, restaurant, or eating-house shall not be compelled or permitted to work more than 48 hours per week and 9 hours per day.

(2) Any employee may be required or permitted to work in a residential hotel or restaurant for a period in addition to the limit set forth in subsection (1) if the additional period is not more than six hours per week.

(3) Irrespective of the provisions of subsections (1) and (2), an employee is expected or permitted to work in a residential hotel or restaurant on a day that may be informed under subsection (3) or Section 14 in surplus of the period prescribed under subsection (1) if the additional period is not more than three hours on any given day.

17. Spread-over

In a residential hotel, restaurant, or eating-house, an employee's shift should not be more than fourteen hours:

The Government may extend the spread-over time, subject to any conditions it imposes on the days that may be declared under Section 14's sub-section (3).

18. Holidays in a week

(1) Every employee of a residential hotel or eating establishment is entitled to at least one weekday off.

This subsection does not apply to an employee who works for less than six days in any given week.

(2) On a day when an employee has a holiday, an employer may not call or send an employee to his or her residential hotel or eating-house or any other location for any work in connection with their business.

(3) No deduction from the pay of any employee in a residential hotel, restaurant, or eating-house for any holiday granted to him under sub-section (1) shall be made (1). If an employee is paid on a daily basis, he or she will be paid earnings for the weeklong holiday equal to the average of his or her daily salary for the previous six working days.

18A. Employers in residential hotels and other similar establishments must provide staff with identification cards

Every employee in a residential hotel or eating-house must be given an identity card, which must be held by the employee while on duty and produced upon demand by an Inspector. The following information, as well as any other relevant information, must be included on the card:

a) the employer's name;

b) the establishment's name, if any, and postal address;

c) the employee's name and age;

d) the employee's working hours, rest intervals, if any, and vacation days;

e) the employer's signature (together with the date);

f) an employee's identity mark; and

g) the employee's signature or thumb impression

Chapter 5: Theatres or other such Places of Public Amusement or Entertainment

19. Closing hours of theatres and other places of public amusement or entertainment

A theatre or other place of public amusement or entertainment shall not close later than 1 a.m. on any day, notwithstanding anything stated in any other statute currently in force.

20. After the closing hour of stores, theatres or other places of public enjoyment or entertainment are prohibited from selling goods similar to those sold in shops.

No goods of the kind sold in shops shall be sold in any theatre or other venue of public amusement or entertainment after the hour established for shop closing under Section 9, save for consumption on the premises.

21. Working hours in theatres or other public amusement or entertainment establishments.

1) No employee in a theatre or other public amusement or entertainment establishment shall be required or allowed to work more than 48 hours per week and 9 hours per day.

2) Any employee may be required or allowed to work in a theatre or other public place of amusement or entertainment for a period in addition to the maximum set out in subsection (I) if the additional duration is not more than six hours per week.

22. Spread-over

On any given day, an employee in a theatre or other public place of amusement or entertainment shall not work more than twelve hours;

Provided, however, that the Government may extend the spread-over period under certain situations, whether in general or in the case of a specific theatre or other public amusement or entertainment facility.

23. Holidays in a week

1) Every employee of a theatre or other venue of public amusement is entitled to at least one day off per week.

However, this subsection does not apply to an employee who works for less than six days in any given week.

2) On a day when an employee has a holiday, an employer may not call or send an employee to his or her theatre or other places of public amusement or any other location for any work in connection with the business.

3) Employers should make no deduction from an employee's salary at a theatre or other place of public pleasure or entertainment for any holiday given to him under sub-section (1). If an employee is paid on a daily basis, he or she will be paid earnings for the weeklong holiday equal to the average of his or her daily salary for the previous six working days.

23A. An employer in a theater, for example, must provide an employee with an identity card

Every employee at a theatre or other public amusement or entertainment establishment must be given an identity card, which must be held by the employee while on duty and provided on demand by an Inspector. The following information, as well as any other information that may be required, must be included on the card.

a) the name of the company or organization

b) the establishment's name and postal address, if applicable

c) the employee's name and age

d) the employee's working hours, rest intervals, if any, and vacation days

e) the employer's signature (together with the date)

f) an employee's identity mark

g) the employee's signature or thumb impression.

Chapter 6: Employment of Children, Young Persons, and Women

24. Children not permitted to work in any establishment

No child shall be required or allowed to work in any establishment, whether as an employee or otherwise, despite the fact that the child is a member of the employer's family.

25. Young people and women should work between the hours of 7 a.m. and 9 p.m.

Young persons or women should be compelled or allowed to work in any establishment, whether as an employee or otherwise, between the hours of 7 a.m. and 9 p.m. unless they are a member of the employer's family.

25A. Working hours for young people on a daily basis

1) Irrespective of statements mentioned in this Act, no young person shall be required or allowed to work in any place for more than five hours on any day, whether as an employee or otherwise.

2) No young person should be forced or allowed to work in any place for more than three hours in any day, whether as an employee or otherwise, provided he is given at least a half-hour break.

25B. Employment of young people and women in dangerous jobs is prohibited

Young people or women working in any establishment, whether as an employee or otherwise, shall not be required or allowed to perform any work that the State Government may declare, by notification, to be dangerous to life, health, or morals.

Chapter 7: Leave With Pay and Payment of Wages

26. Employees' right to casual and privileged leave

1) A person employed in an establishment covered by this Act is entitled to the following:

(a) one month of privilege leave after every 12 months of continuous employment; and

b) Casual leave of up to 14 days once a year

Provided, however, that the leave granted under sub clause (a) may not be accumulated for a duration of more than three months at any time. It must also be noted that the holidays under Sections 13, 18, or 23 that fall during the time of such leave shall also be included in the leave granted:

Provided, however, that casual leave and privilege leave may not be combined.

2) If an employee entitled to leave under subsection (1) is discharged by his employer before the leave is granted, or if an employee who has requested for and been denied leave quits his job before the leave is granted, the employer must pay him the amount due under Section 27 for the leave.

3) If an employee who is entitled to leave under subsection (1) is denied the leave, he may notify the Inspector or any other authority authorized by the Government in this regard. The Inspector must record the information in a register that is kept in the form that is prescribed.

27. Pay during leave

During the term of their leaves, all employees shall be paid at a rate equal to the daily average of their salary for the days on which they really worked during the preceding three months, exclusive of any overtime earnings.

28. When will payment be made?

An employee who has been granted leave under Section 26 will be paid half of the entire sum payable to him for the duration of absence before it begins.

29. Inspector's authority to act for employees’ rights

Any Inspector may bring legal action on behalf of any employee in an establishment to which this Act applies to recover any payment due under this Chapter from an employer who has failed to pay it.

30. The Payment of Wages Act, 1936, and its application and Amendment

1) Irrespective of the statements mentioned in the Payment of Wages Act, 1936 (No. IV of 1936), the State Government may direct that all or any of the provisions of the Act shall apply to all or any establishment or to all or any class of employees to whom this Act for the time being applied, subject to the provisions of sub-section (2).

2) The Inspector appointed under this Act shall be assumed to be the Inspector for the purposes of enforcing the provisions of the said Act within the local limits of his jurisdiction when the provisions of the said Act are applied to any establishment or to any employee under subsection (1).

Chapter 8: Health and Safety

31. Cleanliness

Every establishment's premises must be well maintained and kept clean. They should be kept free of any odor emanating from any drain, privy, or other nuisance, and they must be cleaned at the times and using the prescribed methods. Color-washing, painting, varnishing, disinfecting, and deodorizing are some of these processes.

32. Ventilation

Every establishment's premises must be ventilated according to the criteria and procedures that may be required.

33. Fire precautions

All establishments or classes of establishments must take fire precautions as prescribed.

Chapter 9: Enforcement and Inspection

34. Local government powers and responsibilities

1) Except as otherwise provided in this Act, it shall be the duty of any Local Authority that the Government may empower in this regard to enforce the provisions of this Act within the area subject to its authority, subject to the Government's control.

2) The Local Authority empowered under subsection (1) may delegate to any of its officers any of the powers and tasks exercisable or performable by it under this Act (except for the right to make bye-laws under Section 35).

3) The Government may revoke an order enabling a Local Authority under subsection (1) at any time.

4) To enable the Government to exercise effective control over a Local Authority in the performance of the duties entrusted to it under this Act, Government may authorize any officer of the rank of a Labor Officer to supervise the enforcement of this Act within the area subject to the Local Authority's jurisdiction. The officer shall have all of the powers of an Inspector under this Chapter for this purpose.

35. The ability to enact bylaws

With the prior approval of the Government, a Local Authority empowered under Section 34 to enforce the provisions of this Act may make bye-laws that are not in conflict with the Act's provisions, or the rules or orders issued by the Government thereunder, for the purpose of carrying out the Act's provisions.

36. Annual report submission

Every Local Authority authorized under Section 34 shall submit to the Government, within three months after the close of the year, a report on the operation of the Act within the local area under its authority during that year. It must submit to the government any annual or periodic returns that may be required from time to time.

37. Delegation

1) The Government may direct that any authority except the authority to enact regulations under Section 59, or any duty conferred or imposed on the State Government by this Act, shall be exercised in the circumstances and under the conditions indicated in that direction will be exercised by the office in charge.

2) Nothing in this Act shall derogate from the right of the Government to exercise any or all the functions delegated to any Local Authority or officer subordinate to it.

38. Power of Government to offer the performance of duties on default by Local Authority

1) If a Local Authority fails to discharge any duty imposed under this Act, the Government may appoint someone to do so. It may also direct that the expenditure of doing so, along with a reasonable salary for the person chosen to do so, be paid immediately by the Local Authority.

2) If the remuneration is not paid, the Government may direct the bank in which any money of the Local Authority is deposited to pay such remuneration, irrespective of any other law for the time being in force.

Every payment made in accordance with such order is enough to release such bank or person from any liability to the Local Authority in respect of any amount paid by it.

39. Expenditure of Local Authority to be paid out from its fund

under and for the purposes of this Act shall be paid out of the municipal or local fund, as the case may be, notwithstanding anything contained in any statute with reference to any municipal or local fund.

40. Appointment of Inspectors

1) For the purpose of carrying out the provisions of this Act, every Local Authority empowered under Section 34 shall appoint a sufficient number of persons with the requisite qualifications as Inspectors for the area under the authority.

2) The Government may appoint such people with the necessary qualifications as Inspectors for the purposes of this Act, by name or by virtue of office, within local limits. It may also assign establishments to each Inspector, by notification.

41. Duties and Powers of Inspectors

1) Within the local limits for which he is appointed, an Inspector may carry out the following actions:

a) enter, at all reasonable times with assistants who are persons in the service of the Government or of any Local Authority at any place which is or which he has reason to believe is an establishment;

(b) examine the premises, prescribed registers, records, and notices essential for carrying out the purposes of this Act; and

c) exercise his powers as prescribed and which are essential pertaining to the Act

Provided, however, that no one shall be obliged to answer any question or provide any evidence tending to incriminate himself under this section.

(2) An Inspector has the same powers as an Officer-in-Charge of a Police Station under the [Code of Criminal Procedure, 1898 (V of 1898)] for investigating cognizable offenses under this Act, save that he does not have the authority of arrest.

42. Inspectors to be public servants

All Inspectors appointed under Section 40 shall be considered public servants as defined in Section 21 of the IPC (Indian Penal Code), 1860 (XLV of 1860).

43. Employer to produce registers, and records for inspection

Every employer shall on demand produce for inspection of an Inspector all registers, records, and notices required to be kept under and for the purposes of this Act.

Chapter 10: Offenses and Penalties

44. Contravention of specific provisions and offenses

a) If an employer does not share with the Inspector the statement within the duration mentioned in Section 6 or does not inform about a change as prescribed in Section 7 or does not inform about the closing of his shop or building as mentioned in Section 8; OR

b) if any establishment violates the provisions mentioned in Sections 9, 13, 14, 15, 19, 20, 31, 32 or 33 or any orders under them; OR

c) if an establishment compels a person to work as against the provisions of Section 11, 12, 16, 17, 18, 21, 22 or 23; OR

d) if an establishment compels a child, woman, or a young person to work as against the provisions of Section 24, 25-A or 25-B; OR

e) if any employer violates the provisions of Section 43, 54, 57 or 58; OR

f) if an establishment violates any section or law mandated under this Act, the employer or the manager shall be punished with a fine of at least fifty rupees and up to five hundred rupees if convicted.

Provided that if the employer continues to violate the provisions of sub-sections (2) and (5) of Section 6 after the tenth day after conviction, the employer shall be fined an additional amount of up to fifty rupees for each day the contravention is so perpetuated.

45. Contravention of Section 10

A person violating provisions of Section 10 is punishable with a fine of up to one hundred rupees.

46. Employees who violate Sections 13 (3), 18, 25, and 57

If an employee violates sections and subsections as mentioned, then they will be fined up to rupees fifty.

47. Employer or Manager making false entries

1) If a manager or an employer makes false entries or claims in a register, record, or notice which violates the provisions of the Act, they shall be imprisoned on conviction. The imprisonment could be up to one year or they may be fined one thousand rupees or both. The offense could include making willful omissions and making false claims about any material.

2) An offense as described in subsection 1 shall be tried in the Court of Judicial Magistrate of competent jurisdiction.

48. The penalty could be enhanced in specific cases with a record of conviction

An employer who is already convicted for an offense as prescribed under the subsection (1) of Section 9 or Section 11, 12, or 13 or sub-section (1) of Section 14 or Section 16, 17, 18, 19, 21, 22, 23, 24, 25, 25-A, 25-B, 43, 49, 54 or 58 commits an offense again shall be punished with an extended penalty.

If such an employer has violated any provision, they shall face a penalty of at least fifty rupees which may be extended to one thousand five hundred rupees.

49. Penalty for Obstructing the Inspector

If a person blocks an Inspector with the powers mentioned in section 41 or prevents an employee from appearing before the Inspector shall be fined. On conviction, such a person will have to pay a fine ranging from fifty rupees to one thousand rupees.

50. Persons who may be liable to be prosecuted against and punished

1) Where the owner of an establishment is a firm or other association of individuals, all the partners or members thereof may be prosecuted and punished under this Act for any offense for which an employer in an establishment is punishable.

2) If the owner of an establishment is a corporation, all of its directors, or in the case of a private corporation, all of its stockholders, may be prosecuted and punished under this Act for any offense for which the establishment's employer is liable.

3) Where an offense under this Act is committed for the first time, the employer or management is presumed to be guilty of the offense and is entitled to be prosecuted and punished accordingly, irrespective of anything in sub-sections (1) and (2).

51. Cognizance of Offenses

1) No prosecution under this Act or the rules or orders under them shall be initiated except by an Inspector unless they have prior permission of the local authority or any person authorized by the Government.

2) Deleted

51A. Summary Disposal of Cases

1) Unless the offense is one of the Sections 47, 48, or 49, the Court taking cognizance of an offense under this Act shall specify on the summons to be issued on the accused person that he:

(a) may appear on behalf of a pleader rather than in person; or

b) may plead guilty to the charge by registered letter by the date prior to the hearing of the charge as may be indicated, and remit to the Court the money as the Court specifies, subject to the minimum and maximum fine limitations provided for the said offense.

2) No further procedures in relation to the offense shall be instituted against an accused person who pleads guilty and repays the sum in line with the provisions of sub-section (1).

51B. Executive Magistrate Trial of Offenses

Except as specified in Section 47, the State Government may give powers of a Judicial Magistrate of the First Class or the Second Class to an Executive Magistrate the powers for the trial of offenses under this Act. The Executive-Magistrate on whom powers are so conferred shall be considered to be a Judicial Magistrate of the First Class or the Second Class, as the case may be, for the purposes of the Code of Criminal Procedure, 1973 (No. 2 of1947).

52. Limitation on prosecutions

The Court shall take no cognizance of a crime under this Act or any rule or order made unless a complaint is filed within three months of the day on which the alleged acts of the offense were brought to the Inspector's attention.

53. The nature of Offense

1) Subject to any conditions imposed by the Labor Commissioner, any officer up to the rank of a Labor Officer if authorized by the Labor Commissioner by notification, may, either before or after the institution of proceedings under this Act, permit any person charged with an offense punishable under Section 44, 55, or 46. They may compound the offense on payment of a sum, not less than rupees fifty and not more than the maximum amount imposed by the Labor Commissioner by notification, permitting any person charged with an offense.

2) When a person pays the full amount as prescribed by the Labor Commissioner or an officer appointed by the Labor Commissioner, then:

- No deliberations will be initiated or continued against such a person

- If there are any ongoing proceedings, they shall be discontinued.

Chapter 11: Miscellaneous and Supplementary

54. Maintenance of Registers and Records, and Displaying Notices

An employer must keep or cause to be kept such registers and records, and post notices on the premises, as prescribed, subject to general or particular regulations from the government. All such records and registers must be kept on the premises of the business to which they pertain.

55. Wages for Overtime Work

When employees work for an additional duration to the limit of hours, they are entitled to receive overtime wages. These overtime wages must be at a rate twice that of the regular rate of wages.

Explanation: In this section, the ‘limit of hours’ implies the following:

a) the limits are prescribed in sections 11, 16, and 21 (for the establishments to which these sections apply)

b) for other establishments, the limit of hours can be as prescribed

56. Proof of Age

1) When an act or conduct is considered a punishable offense under this Act involves a person under or above a specific age, considered by Court under or over that age, the obligation lies with the accused to prove that he or she is not under or over that age.

2) For the purposes of this Act, a written declaration by a qualified Medical Practitioner related to an employee that they have personally inspected the employee and that they deem him to be under or over the age set forth in such declaration is legally valid of the employee's age.

Explanation: For this particular section, the definition of a qualified Medical Practitioner will be the same as described in the Factories Act, 1948 (LXIII of 1948).

57. Prohibiting Double employment during leave or Holidays

Based on the provisions of this Act, employers cannot demand employees to work on a holiday or while they are on leave.

58. Notice of Dismissal

1) Except for sufficient cause and without giving such employee at least one month's notice or wages in place of such notice, no employer may terminate the services of an employee who has been employed for three months or more:

If the services of such employees are dispensed with on a charge of misbehavior backed by reasonable evidence recorded at an inquiry held by the employer for the purpose, such notice is not required.

2) a) An employee who has been dismissed or discharged may appeal to the authority within the stipulated timeframe. The grounds for doing so could be either that there was no good reason to discharge them or that they were not guilty of the offense, or on the grounds that the punishment was too severe for the offense.

b) After giving notice to the employer and the employee in the prescribed format, the Appellate Authority may dismiss the appeal, and order the employee's reinstatement with or without pay for the time he was out of work. Alternatively, the authority may order compensation without reinstatement, or grant whatever other relief it deems appropriate in the circumstances of the case.

3) The Appellate Authority's decision is final and binding on both parties, and it must be implemented within the timeframe provided in the Appellate Authority's order.

59. Rules

1) The Government has the authority to prepare rules for the enactment of the Act.

2) Such rules may be made for all or any of the following matters, without prejudice to the generality of the foregoing provision:

a) i) for submitting a form of statement to the Inspector, along with the prescribed fees and other particulars as mentioned under sub-section (2) of Section 6

(ii) the way in which an establishment is registered in the register of establishments, as well as the form in which a Registration Certificate is granted to the employer under Section 6 (3);

(iii) requiring the renewal of a Registration Certificate pursuant to Section 6's subsection (5);

(b) the format in which a change under Section 7 must be reported to the Inspector;

c) setting aside six days per year for extra overtime and prescribing occasions under section 11's sub-section (3);

d) the form of the register to be kept under Section 26 for recording refusals of leave;

(e) establishing cleaning times and techniques under Section 31; establishing ventilation standards and procedures under Section 32; and prescribing which establishments are excluded from the provisions of, and fire precautions to be taken under Section 33;

(f) yearly or periodic reports required to be filed with the government under Section 36;

(g) Inspectors' qualifications who will be appointed under Section 40, as well as the powers that these Inspectors will have under Section 41;

(h) the registers and records that must be kept, as well as the notice that must be posted on the establishment's premises under Section 54;

i) the work-hours restriction set forth in clause (c) of Section 55

(j) the authority to which a dismissed, fired, or retrenched employee may appeal and the time limit within which an appeal may be lodged;

(k) any other issues that are to be prescribed or that may be prescribed.

(3) The regulations made under this section are subject to prior publication and are presumed to be part of this Act once they are published.

60. Protection for persons acting under the Act

No action, prosecution, or other legal procedure shall be brought against any person for anything done or intended to be done under this Act in good faith.

61. Rights and privileges under other laws remain unaffected

Nothing in this Act affects any rights or privileges that an employee in any establishment has under any other law, contract, custom, or usage applicable to such establishment, or any award, settlement, or agreement binding on the employer and the employee in such establishment if such rights or privileges are more favorable to him than the rights or privileges provided by this Act.

62. People employed in Factories to be governed by the Factories Act rather than this Act

Nothing from this Act shall apply to factories to which the Factories Act, 1948 applies (No. 63 of 1948, to be precise).

The requirements of this Act shall apply to any shops or commercial establishments located within the boundaries of a factory that are not involved with the factory's manufacturing process:

Furthermore, the State Government may, by notification, apply all or any of the provisions of the Factories Act, 1948 (No. 63 of 1948) to any shop or commercial establishment located within the corridors of a Factory, and the provisions of this Act shall cease to apply to such shop or commercial establishment.

63. Provisions of the Workmen's Compensation Act

The provisions of the Workmen’s Compensation Act of 1923 and its rules shall apply to all the employees in the establishment.

64. Provisions of the Provident Fund

All employers must provide a provident fund for the benefit of all their employees as directed by the Government. They are also required to contribute an amount equivalent to the one contributed by the employee every month. The amount should not be more than six and a quarter of the wages. This section shall apply to the employers and establishments as directed by the Government.

65. Repeal

The enforcements mentioned in Schedule II shall stand repealed starting from the date mentioned under Section 1, subsection 3.

However, the following shall be the criteria:

a) Every rule under the provisions of any enactment that is consistent with the provisions of this Act, unless superseded by any rule under this Act;

b) Any procedure relating to the prosecution of any penal offense under the terms of any repealed enactment must be maintained and concluded. This would be carried out as if the enactment had never been revoked. Any penalty imposed in such procedures is recoverable under the repealed enactment.

Schedules

Schedule I: Refer to Section 1(4)

1. Jabalpur Corporation Limits

2. The Municipal Limits of, Rajnandgaon, Raipur, Khandwa, Sagar, Burhanpur, Raigarh, Chhindwara, Bilaspur, Seoni, Katni-Murwara, Damoh, Itarsi, and Durg.

3. Sagar Cantonment limits

4. Bilaspur Railway Market area.

5. Indore Municipal Corporation limits and three miles around it.

6. The Municipal (Corporation) limits of the following locations: Gwalior, Lashkar, and Morar including the industrial area.

7. The Municipal limits of Madhonagar, Ujjain, Ashok Nagar, Vidisha, Mandsaur, Dewas, Morena, Guna, Neemuch, Khargone, and Badnagar.

8. Ratlam Municipal limits and two miles around it.

Schedule II: Refer to Section 65

An Overview: Shop and Establishment Act in India

Commonly used terms and their definitions are explained in great depth throughout the Act. The list of definitions includes apprentice, closed, child, salaries, commercial establishment, day, and employee. It also includes the following terms:

- Employer

- Establishment

- Factory

- Goods

- Holiday

- Inspector

- Labor commissioner

- Leave

- Local government

- Manager

- members of an employer's family

- A period of work

- Establishment register

- Registration certificate

- Residential hotel

- Restaurant or lunch rooms

- Shops

- Theatre

- Week

- Year

- Young person

People who work irregular hours, such as travelers, canvassers, watchmen, or caretakers, are exempt from the Act. Employees of the Reserve Bank of India, the State Bank of India, and the Life Insurance Corporation, as well as those engaged in the offices of the Union, State Government, or municipal authorities, are exempt.

How to Apply for Registration, Renewal, or Amendment under M.P. Shops and Establishment Act

If you are a shop owner or business owner and need to understand the process for applying for registration, renewal, or amendment under the M.P. Shops and Establishment Act, then this section will help you out. Here is how you can proceed. Registration can be done through the portal: https://labour.mponline.gov.in/Portal/Services/Shram/default.aspx

Select Shops and Establishments Act once you are on the page.

Documents Required

A. two passport size photographs of the applicant

B. Original challan of remitting registration fees(download)

C. Photo id of the owner - any one of the following documents

- AADHAR Card

- Voter ID

- Passport

- IT Pan Card

- Driving License

D. Owner’s address proof. You can attach any of the following documents:

- Ration Card

- Telephone Bill

- Electricity Bill

- Ownership Deed

- LPG Connection Documents

- Rental Agreement

E. Address Proof of Location of the Shop. You can provide any of the following documents.

- Memorandum of Article if it is a Company

- Telephone Bill

- Electricity Bill

- Ownership Deed

- Rental Agreement

- Partnership Deed if it is a Partnership Firm

There are a few important notes to be remembered which are as follows:

- Please make your registration fee payment to the following account:

- The original copy of the Challan, as well as photocopies of the other documents, must be supplied.

- Original Registration Certificate must be presented for Renewal or Amendment of an existing Registration.

Fees structure for shops registration, renewal, and amendment

The following tables give away the information regarding the various amounts of fees required for different processes:

2. Fee For Amendment in Old Registration

3. Fee For Renewal with an amendment in old Registration

4. Late Fee and Compounding Fee for Renewal and Amendment in Old Registration Certificate

Once you have all this information, you can click on the link that says Proceed for Online Registration. Clicking it will take you to the following screen.

You may then select the option that applies to you.

How can Deskera Help You?

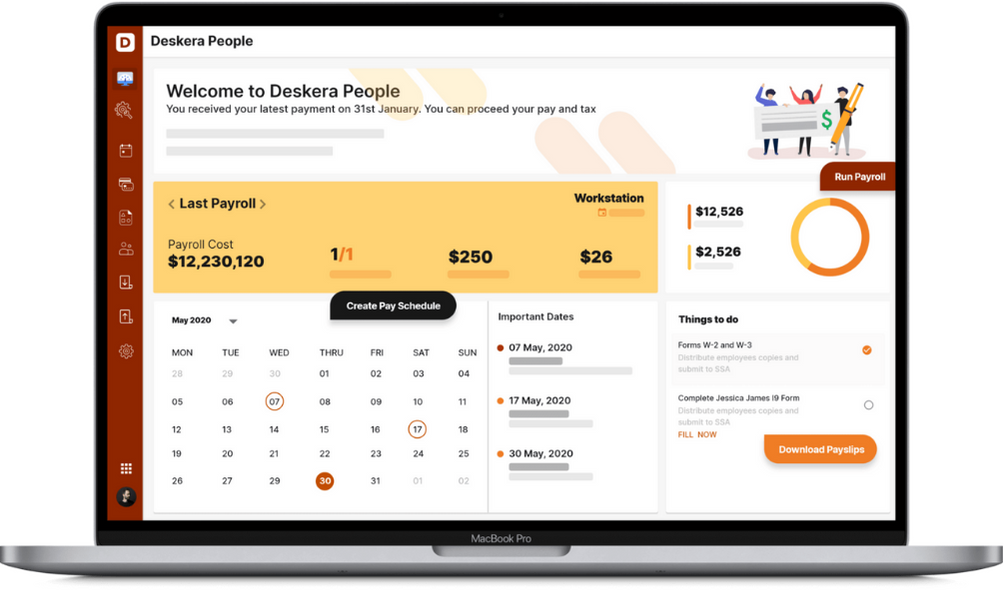

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. Features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning and uploading expenses, and creating new leave types make your work simple.

Key Takeaways

Madhya Pradesh Shops Act is a document that comprises eleven chapters and two schedules.

- In India, the Shop and Establishment Act is enacted by the state and may differ slightly from one state to the next.

- All operating stores and commercial establishments are protected by the appropriate Shop & Establishments Act, according to the Act.

- Shops include an office, a storeroom, a godown, a warehouse, or a workhouse or workspace, and are described as facilities where items are sold either retail or wholesale or where services are offered to consumers.

- Shops, commercial establishments, residential hotels, restaurants, eating-houses, theaters, and other places of public enjoyment or entertainment are all considered establishments.

- Furthermore, establishments, as defined by the act, may include any other buildings that the government defines by notification in the Official Gazette.

- The eleven chapters of the Act provide information related to the various important definitions in the Act, procedure of registration under the Act, and describing shops and establishments under it.

- Furthermore, it also discusses employment of young persons, children, and women. We also get to learn about the payment of wages and the concept of paid leaves under the Act.

- Health and safety of the employees, enforcement, inspection, offences and penalties are all prescribed and explained in the document very clearly.

- Registration can be done through the portal: https://labour.mponline.gov.in/Portal/Services/Shram/default.aspx

- Key documents required for the registration are Aadhar card, IT PAN card, driving license, voter id card, or passport. The applicants also need to furnish their address proof and location of the shop.

Related Articles