While shopping for supplies in the supermarket, you are sure to stop and look closely at the merchandise that offers a gift, a little extra, a discount or a bonus.

For instance: suppose you pass by a store and see a poster on the shop window announcing a sale or an opportunity to receive free merchandise you would step into the store and check it out. And if they state that for every Rs 5000 worth of merchandise you buy, you would get a gift voucher of Rs 5000 you try to buy something even if you don't need it to raise your bill to Rs 5000, only to avail the offer.

You are sure to receive a salary for your services. If you unexpectedly receive a higher sum than the salary due, you will check your salary statement to see if the accountant has made a computational error.

But suppose you see, an additional entry is a bonus! You did not expect it, nor was it due to you; how would you feel when you receive some extra money as a reward from your employers? Untold joy for sure.

We are sure that bonus payments are helpful to employees, but what about employers? Do they benefit from maintaining a bonus register?

Continue reading about maintaining the bonus register or central bonus paid statements.

- What is a Bonus?

- Bonus Register as per Payment of Bonus Act

- Form A

- Form D

- Why Should an Organization Maintain a Bonus Register?

- Case Study To Stress the Need for Organizations To Maintain A Bonus Register

- Legal Compliances that Necessitate the Mantainence of the Bonus Register

- What are the Criteria for an Organization to Maintain a Bonus Register?

- When can an Organization Remove an Employee's Name from the Bonus Register?

- Entries of Minimum and Maximum Limits in the Bonus Register

- Minimum Bonus Limit

- Maximum Bonus Payments

- Conclusion

- Key Takeaways

What is a Bonus?

Business organizations generally reward their employees for services by paying them a little more than their salary. Although bonus payment is not guaranteed, employers reward employees typically with bonuses depending on their performance.

The amount to pay as bonuses to an employee or a team depends on their contribution to attaining specific targets and completing events or during festivals.

Companies pay bonuses as per the discretion of the top management and may pay bonuses in various forms depending on a specific quota, the individual performance of an employee or team, or may even reward one level of employees.

Bonus Register as per Payment of Bonus Act

All organizations that are five years or older and have a minimum of twenty employees on any day in the financial year must maintain a bonus register in compliance with the Payment of Bonus Act in India.

The bonus register Rules state that:

- As per the Payment of Bonus Act, sections 17 and 18, announcements all details of each employee and the bonus amount due to them

- The bonus register must state the bonus amount each employee receives in a prescribed format

The bonus register comprises four forms as follows:

Form A

As per section 2, clause 4 of the Act— Form A of the bonus register must reflect the allocable surplus computation.

Template of Form A—Bonus Register

Form B

As per the requirement of Section 15 of the Payment of Bonus Act, Form B of the bonus register contains the set-off and set on amounts of the allocable surplus.

Template of Form B—Bonus Register

Form C

Section 25, rule 4 of the Payment of Bonus Rules, 1975 requires the Form C of the bonus register to contain the bonus amount due to each employee, the deduction of bonus paid under Sections 17 and 18 if any, and the actual bonus remittance to the employees.

Template of Form c—Bonus Register

Form D

Section 19 of the Payment of Bonus Rules specifies a timeframe for the bonus payment.

The Rules also require business organizations to send an annual return within 30 days of the expiry of the timeframe to the inspector appointed by the Act.

Template of Form D—Bonus Register

Why Should an Organization Maintain a Bonus Register?

Let us understand how important it is for an organization to maintain a bonus register from the point of view of its smooth running before we look into legal compliance.

Case Study To Stress the Need for Organizations To Maintain A Bonus Register

The Circumstances

A dentist running his practice made it a habit to pay a bonus to his employees annually. The employees had assumed this was a custom in the firm and were sure to receive a yearly bonus.

Unfortunately, in the current financial year, the dentist did not have enough patients, and the low productivity brought the income to an all-time low. The dentist thus decided not to pay bonuses to his employees and made an adjustment for the same in the bonus register.

The Consequence

As the employees got into the habit of receiving the bonus amount, they relied on it to meet their expenses. Some were upset and angry when they did not receive the bonus in the current financial year, and their performance levels dropped.

The drop in staff performance caused a further decline in production levels, and the practice started failing miserably. Some employees could not continue without the annual raise because they depended on it.

The outcome was that three of the staff member left the job, one of whom was a senior member who managed the staff and scheduled patient appointments. As a result of the resignations, especially of the manager, the practice almost closed down.

Here is what we must consider:

- It is understandable if an organization cites low productivity and cancels out bonus payment when the employee's performance is not up to the mark or if they already pay a high employee remuneration.

- But it would be wrong to think that your employees (who have worked hard) would understand if you do not pay because the business is going through a bad patch.

- The firm must consider that every employee aims to earn more and dislikes a reduction in pay. The only way to solve the problem would be to find a way to keep motivating the employees without further straining the budget.

Here is what an organization can do:

- Formulate a self-liquidating bonus plan and enter the same in your bonus register

- Encourage team collaboration to generate increased revenue and share the same among those who worked in achieving the increase

Assumptions

For an organization to function smoothly, it is necessary to have a team of satisfied employees, and a bonus is an effective way of fostering employee satisfaction. Based on the above case study, it is clear that an incentive in some form is essential for the business to continue to function well and motivate its employees to work better.

Legal Compliances that Necessitate the Mantainence of the Bonus Register

All organizations in India pay bonuses to their employees in compliance with the Payment of Bonus Act, 1965. The primary aim of the Act is to encourage employers to share the revenue the company earns with their employees. For this purpose, all organizations must maintain a bonus register.

The Payment of Bonus Act, 1965 requires all employees who do not have a monthly salary of more than INR 21,000 to have a legal right to share in the company's profits; The bonus register must have all such details.

The Payment of Bonus Act 1965 defines an employee as someone other than an intern or apprentice on the company's payroll and earning a monthly salary of not more than INR 21,000. The bonus details of all such employees are found in the bonus register.

The compliance applies to all industries and includes both skilled and unskilled labor. The labor could be manual, clerical, supervisory, technical, managerial, or administrative, and the terms of employment may be implied or expressed.

According to the Payment of Bonus Act, 1965, wages are the remuneration an employer pays his employees daily. In compliance with the Act for the calculation of bonus, the wages are the total earnings (basic) of an employee, including dearness allowance. If the amount exceeds INR 21,000, the employee is not eligible for a bonus, and the employer need not enter his details in the bonus register.

What are the Criteria for an Organization to Maintain a Bonus Register?

The Payment of Bonus Act, 1965 applies to all organizations that satisfy the following criteria:

- All organizations at least five years old must maintain a bonus register

- Every establishment that has twenty or more employees at any time in the financial year must enter the bonus details of each employee in the bonus register

- The employer must enter the details of every employee who earns INR 21,000 or less in the bonus register as they are eligible for bonus payments as per the law

- All organizations whose financial statements reflect a profit must maintain a bonus register and pay the bonus to their employees accordingly

When can an Organization Remove an Employee's Name from the Bonus Register?

Irrespective of what the law states, an employer can remove the name of an employee from the bonus register and deny paying him a bonus if he is found guilty of,

- Committing fraudulent practices within the organization and expelled from service

- Exhibits violent or riotous behavior within the premises of the organization

- Stealing from the organization

- Misappropriation of the funds of the organization

- Deliberately caused damage or sabotaged the property of the organization

Entries of Minimum and Maximum Limits in the Bonus Register

In the past, all organizations entered the higher amount between the minimum bonus limit of 8.33% and the maximum bonus limit of 20% of a monthly salary amounting to Rs 3500 in their bonus register.

However, as per the amendment to the Payment of Bonus Act, the employers must enter the minimum and maximum bonus limits in the bonus register as follows:

Minimum Bonus Limit

- Suppose the organization has low productivity, causing low earnings, and does not have an allocable surplus to pay bonuses to their employees in a financial year; in that case, they are not exempt from bonus payments. They must calculate the bonus amount as 8,33% of the basic salary after including dearness allowance. The employers must enter the bonus amount against the employee's name and the bonus payment date in the bonus register

- An organization must pay a minimum bonus of INR 100 to all employees working with them for more than 15 years

- If the employees work for the organization for less than 15 years, employers must pay them a minimum bonus of INR 60

Maximum Bonus Payments

- At a financial year-end, the employer will take note of the allocable surplus after accounting for set-off and set-on amounts. If the allocation surplus exceeds the minimum bonus amount, the law requires the employer to pay 20% of the employee's salary or wages in that financial year.

Conclusion

Maintenence of a bonus register is a necessary compliance for the HR of an organization to meet. All organizations running for a minimum of five years must pay their employees the bonus; however, employers can choose an appropriate time to pay it.

Suppose the organization pays the bonus in parts, for instance, a small portion during festivals. In that case, they can deduct the bonus amount already paid for the accounting year and pay only the balance amount to their employees.

How Can Deskera Assist You?

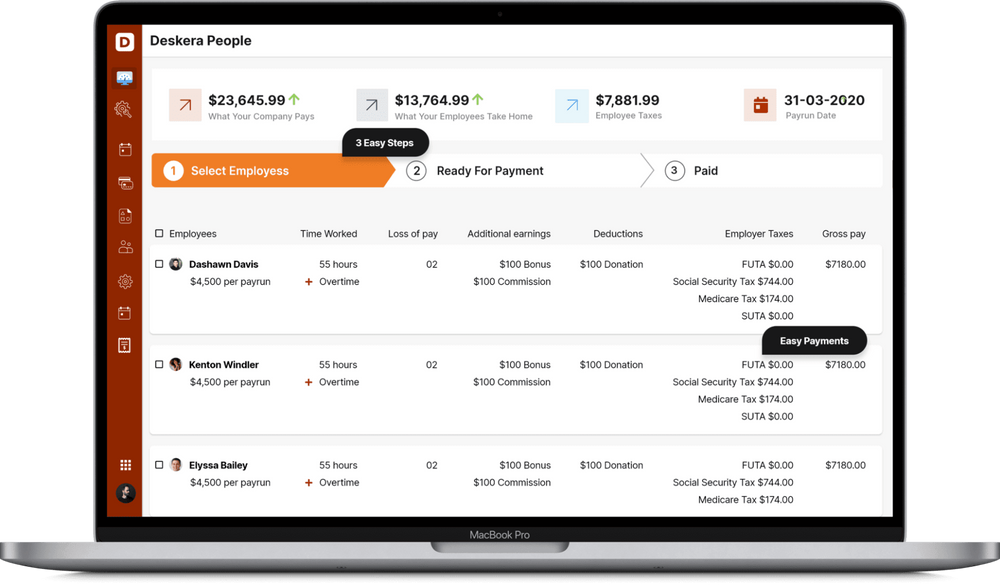

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

- All organizations who are five years or older must maintain a bonus register if they have twenty employees or more on any day of the financial year

- The Payment of Bonus Act in India aims at providing the employees with a share of the organization's profits

- According to the law, all organizations must pay a minimum bonus amount of 8.33% of the employee's monthly salary

- The employer can pay a maximum bonus of 20% of the monthly salary of the employee

- Bonus need not be paid all at once but can be remitted as it is convenient to the employee and employer

- Bonus paid in part is deductible from the total payable bonus amount, and the employer must pay only the balance at the end of the year

- The bonus register must record all information concerning bonus payment and eligible employees

Related Articles