New Mexico is a state in the United States which has a progressive income tax system, with its income taxes being relatively low as compared to the rest of the country. It is known as the Land of Enchantment, with there being four income tax brackets. In fact, the income tax rates of New Mexico are ranked in the bottom 20 on a nationwide scale comparing all.

Some of the commendable rankings of New Mexico in regards to its taxations are:

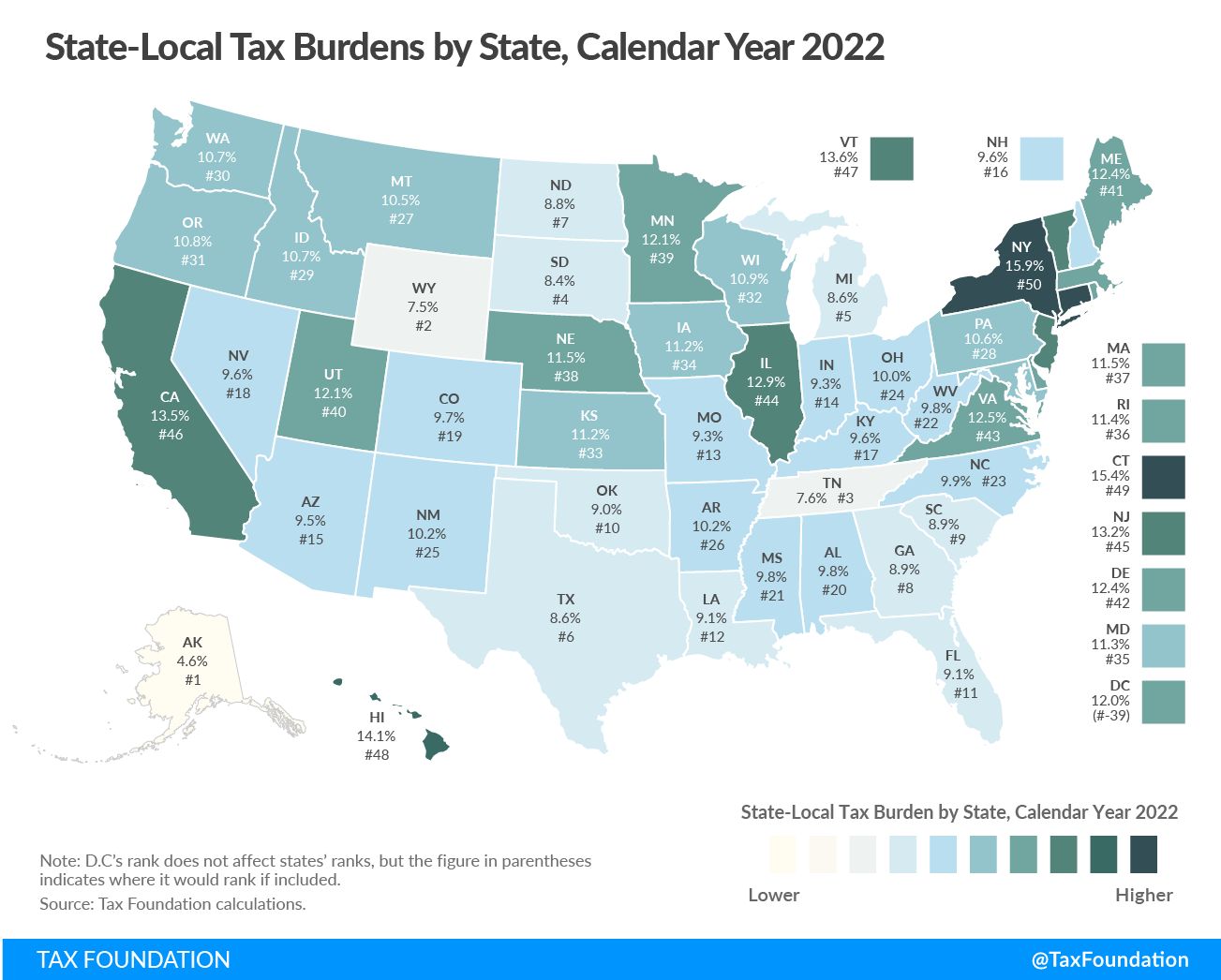

- At 10.2%, it ranks 25 in the state and local tax burden in 2022.

- As per the 2017 studies, it ranked 38 at $758 for the state and local individual income tax collections per capita.

- In the 2022 comparative studies of state business tax climate index ranking, it ranked 28.

- For the combined state and average local sales tax rate, it ranked 15, putting it on the higher side in regards to the combined state and average local sales tax rate.

- As per the 2017 studies, it ranked 45 at $884 for the state and local property tax collections per capita.

Thus, as it is evident through these statistics and studies, payroll processing in New Mexico would not be very complex as its labor laws for hours, time off, and overtime closely aligns with the federal laws about the same. However, knowing about New Mexico’s payroll and the tax system will ease your critical business functions and save you from penalties arising out of non-compliance.

Therefore, this article would be covering the following topics:

- New Mexico Taxes

- New Mexico Payroll Laws, Taxes, and Regulations

- New Mexico HR Laws that Affect Payroll

- New Mexico Payroll Forms

- Federal Payroll Forms to be Filed by New Mexico Employees and Employers

- New Mexico Payroll Tax Resources and Sources

- How Can Deskera Help with New Mexico Payroll and Taxes?

- Key Takeaways

- Related Articles

New Mexico Taxes

New Mexico follows a progressive income tax system with rates that rank among the 20 lowest in the United States. It ranges from 1.7% to 5.9%. A similar trend is also observed in its average effective property tax rate, which is also on the lower side at 0.78%.

When talking about the sales tax, New Mexico does not collect a sales tax, but rather it collects a gross receipts tax on businesses. This often gets passed to consumers. The gross receipts tax of 5.125% to 9.25% effectively acts like a sales tax in New Mexico. In terms of the gas tax, New Mexico charges 17.00 cents per gallon of regular gasoline and 21.00 cents per gallon of diesel.

Thus, the taxpayers in the state of New Mexico find themselves primarily paying three forms of state and local taxes:

- A state income tax

- Local property tax

- State and local gross receipts taxes

In each of these taxes, New Mexico ranks below the national average. However, the impact of each of these taxes does vary depending on the financial circumstances of each taxpayer.

Through this section of the article, you will be given a closer look at the rules and exceptions for each of these taxes individually, as well as on a few of the other taxes imposed by the New Mexico government.

New Mexico Income Taxes

While it has fewer income tax brackets and significantly lower rates, New Mexico’s income taxes are modeled after the federal income tax. Thus, the rules for filing taxes in New Mexico are very similar to the federal tax rules, with the itemized and standard deductions matching the federal deductions.

Therefore, for the tax year 2021, the single filers of New Mexico can claim a standard deduction of $12,550, while the joint filers could claim a standard deduction of $25,100. However, state and local taxes are not deductible in New Mexico, thus, any filers claiming that itemized deduction on their federal tax return must add it back to their state taxable income.

In addition to these federal exemptions, low and middle-income earners may claim a $2,500 exemption for each federal exemption claimed. For single filers, anyone earning $36,667 or less may claim this exemption. For married couples filing separately, the cutoff for this exemption is $27,500, while for married couples filing jointly and head of households, the cutoff for this exemption is $55,000.

Note: Deduction amounts for personal exemptions have been suspended for the tax years 2018 till 2025 by the Federal Tax Cuts and Jobs Act.

However, after the initial tax amount has been determined, there are certain credits and rebates that can be claimed to reduce the amount of taxes owed. These are:

- Low-income comprehensive tax rebate is available to earners making less than $36,000 per year.

- Child daycare credit

- Refundable medical care credit for taxpayers aged 65 or more

- Special needs adopted child tax credit

- Working families tax credit

New Mexico Capital Gains Tax

In New Mexico, capital gains are taxable as personal income. However, the state does allow taxpayers with income from capital gains to claim a special tax deduction that is equal to up to 40% of the total income from net capital gains or $1,000 of the net capital gains reported, whichever is larger.

New Mexico Sales Tax

Technically, New Mexico does not have sales tax. This is because the businesses of New Mexico are charged a gross receipts tax that is collected at the state, county, and city levels. Often, this is passed on to the consumers by either explicitly spelling it out on the invoice or by adding it to the price of the product or service.

The state-wide gross receipts tax rate is 5.125%, while the county and city taxes can add up to a total of 4.125%. There are, however, some exceptions to this gross receipts tax. The most significant exemption in this is food and prescription drugs; however, food that is intended for immediate consumption, for example, food ordered at a restaurant, is not exempt.

New Mexico Property Tax

New Mexico imposes property taxes as revenue from these is then used to support local governments and schools. However, the state’s average effective property tax rate (annual tax payments as a percentage of home value) is 0.78%, making it one of the lowest property tax rates in the country.

New Mexico Cigarette Tax

New Mexico charges cigarette tax at the rate of $2.00 per pack. This is in line with the average for cigarette taxes in the United States. In addition to the cigarette taxes, New Mexico also imposes a Tobacco Products Tax, which is applicable on the manufacture as well as the purchase of other types of tobacco products. Tobacco Products tax is equal to 25% of the value of any tobacco product.

New Mexico Alcohol Tax

Depending upon the beverage being sold, the excise taxes on alcohol in New Mexico gets determined. For example, hard liquor like whiskey and vodka are taxed at a rate of $6.06 per gallon, beer is taxed at a rate of 41 cents per gallon or at 3.8 cents per 12-ounce beer, and wine is taxed at a rate of $1.70 per gallon.

New Mexico Estate Tax

There is no inheritance or estate tax in New Mexico since it was phased out on January 1, 2005.

New Mexico Payroll Laws, Taxes, and Regulations

Irrespective of the state that you are in, it is mandatory for you- as an employer, to follow federal law on withholding money from employee paychecks for income taxes, Medicare (1.45% from each employee paycheck and a matching 1.45% from your bank account), Social Security (6.2% from each employee paycheck and a matching 6.2% from your bank account), and Federal Unemployment Insurance (6% of each employee’s first $7,000 earned).

In addition to this, employers in New Mexico are obliged to pay state unemployment insurance (SUTA) every quarter and state income tax withholdings on a monthly basis. It also requires you to find a private insurer for your workers’ compensation if you have hired more than three employees. An exception here is if you have more than 100 employees and your business is large enough to self insure.

However, though New Mexico has state income taxes, it does not have any particular local income taxes. All of this makes its payroll a less complicated process. However, the certain obligations that you are obligated to fulfill are:

State Income Taxes

The law states that if you withhold federal income taxes for an employee, then it is a must that you withhold state income taxes. This includes agricultural workers under some conditions. However, Native Americans, who are members of a New Mexico federally recognized tribe, pueblo, or Indian nation, and who live on the lands where they are enrolled are exempted.

The income tax rates of New Mexico are from 1.7% to 5.9%. All income is taxed, and the applicable income tax rate depends on the filing status and annual income.

Unemployment Insurance

New Mexico does charge SUTA taxes, and if you have employees, you are liable to pay them. In general, you need to pay SUTA taxes if:

- You paid an individual $450 or more in any calendar quarter in the current or preceding calendar year.

- If you have employed one or more persons, including part-time workers, in each of the 20 different calendar weeks of the current or previous calendar year.

There are, however, different rules for domestic, farm, and non-profit organizations.

New Mexico’s SUTA is based on a taxable wage base of $27,000. For experienced employers, the SUTA tax rates range from 0.33% to 5.4%. Your SUTA tax rate will be calculated and assigned based on your:

- Benefit ratio

- Reserve factor (1.6528 for 2021 and determined by Unemployment Trust Fund Solvency)

- Experience history factor

If, after all the calculations, your SUTA tax rate exceeds 5.4%, then you will have to add an excess claims rate, which is a pre-adjusted contribution rate minus 5.4%, then multiplied by 10%. Remember, your excess claims rate cannot be higher than 1%.

If, however, you are a new employer, then you will be charged SUTA taxes at your industry’s average of 1%, whichever is greater.

Note: When you pay SUTA, you may qualify for up to a 5.4% discount on your federal unemployment insurance taxes (FUTA).

Workers’ Compensation Insurance

If your business is in New Mexico, and you have three or more employees anywhere in the United States, with at least one working in New Mexico, then you are liable to have New Mexico’s workers’ compensation insurance.

However, if you do work that requires licenses by the Construction Industries Licensing Act, then it is mandatory for you to have workers’ compensation coverage, even if you have less than three employees.

There are three types of coverage under the workers’ compensation insurance:

- Conventional, which is for most of the businesses.

- Assigned risk pool, if you are in a high-risk industry

- Self-insurance, if you are one of those larger, qualifying companies

You will get workers’ compensation insurance from a qualified insurance broker.

Minimum Wage Laws in New Mexico

Like several states in the United States, New Mexico has been raising the minimum wage as well. However, it has not posted any rate increases past 2023.

According to New Mexico’s minimum wage laws, most of the employers must pay a $10.50 minimum wage, with at least $2.55 for tipped employees, where the rest is made up in tips. However, if you are training employees under the age of 20, then the minimum wage for them would be $4.25 per hour for the first 90 days.

If your employee is a student in a work-study, then the minimum wage for them is $8.93 for the first 20 hours per week.

In 2022, the hourly minimum wage in New Mexico was increased to $11.50, or $2.80 for tipped employees. For tipped employees, that is $12 or $13.

Note: The rates for minors in training and student work-study have not been published.

Some of the counties and cities of New Mexico have different rates. This means that if there is a conflict like, for example, in the case of tipped workers (as cities do not list different rates for students or work-study), then you should defer to the highest rates.

The exemptions to New Mexico’s Minimum Wage rules are:

- Minors under 18

- Individuals employed in a bona fide executive, profession, or administrative capacity and forepersons, superintendents, and supervisors

- An individual engaged in the activities of an educational, religious, charitable, or non-profit organization where there is no employer-employee relationship. For example, volunteers.

- Salespersons or employees are compensated upon piecework, flat rate schedules, or commission basis.

- Registered apprentices and learners otherwise provided by law.

- Seasonal employees of an educational, charitable, or religious youth camp or retreat who are furnished room and board in connection with such employment.

- Any agricultural worker who is a family member is paid on a piece-rate basis or whose employer did not, during any calendar quarter during the preceding calendar year, use more than 500 person-days of agricultural labor.

New Mexico Overtime Regulations

As per New Mexico’s overtime regulations, if your employee has worked more than 40 hours in a week, then their overtime pay for the same cannot be less than 1.5 times the regular applicable minimum wage rate.

The overtime regulations of New Mexico also state how the hotels, cafes, or restaurants should not make their employees work for more than 10 hours in a 24-hour period or 70 hours in a 7-day period. While this law specifically states male employees, you should apply this rule to all your workers. To ensure that you are complying with this rule, you must keep time records for employees.

In case of firemen, law enforcement officers, or farm or ranch hands, whose duties require them to work for longer hours, or employees who are primarily in a stand-by position, may not be required to work for more than 16 hours in any 24-hour period except in emergencies.

Different Ways to Pay Employees

The payroll laws and regulations of New Mexico permit you to pay your employers by cash or check, or direct deposit if agreed upon by you and your employee. In fact, even payroll vouchers work if they can be converted to cash at full value.

Pay Stub Laws

New Mexico’s pay stub laws require you to give a written statement or printed statement detailing your employee’s pay information. These statements must include:

- Name and details of the employer and employee

- Gross pay

- Number of hours worked

- Total wages and benefits

- Itemized listing of deductions

These records must be preserved by you for a year.

Minimum Pay Frequency

As per the New Mexico state rules, the paydays of employees in New Mexico should not be more than 16 days apart. This usually means the 16th and the end of the month as the payday. There are, however, exceptions for professionals, executives, supervisors, outside salespersons, and others as defined in the federal Fair Labor Standards Act. It is allowed if these exceptions are paid once per month.

Paycheck Deduction Rules

The employers of New Mexico can make deductions for:

- Cash shortages

- Damages or loss of employer property

- Uniforms

- Required tools

- Other items necessary for employment

As an employer, you can also create deductions that are permitted by law or that your employees have agreed to in writing, such as for retirement or benefits.

Final Paycheck Laws

As per the final paycheck laws of New Mexico, if you fire or lay off an employee, then you are required to pay all wages within five days of their discharge if the wages are fixed. However, if the wages are based on a task, piece, or commission basis, then you must pay the final paycheck within ten days.

Accrued Time Off

Under the New Mexico laws, it is not mandatory for you to provide paid or unpaid vacation benefits to your employees. Additionally, you are not required to provide holiday leave or premium pay on holidays unless the time worked qualifies as overtime.

However, if you do decide to give accrued time off, then you should provide an agreement in writing for the same and adhere to it, in order to then avoid legal action that can arise if you do not adhere to it.

New Mexico HR Laws that Affect Payroll

The labor laws of New Mexico are relatively basic and quite similar to the federal labor laws. However, in the instances where there are differences between the two, make sure that you are meeting the needs of both. Thus, the HR laws of New Mexico that will affect your payroll and which you should comply with are:

New Mexico New Hire Reporting

As per federal laws, you will be required to report your new hires or rehires within 20 days of their date of hire. You will have to do this at the New Mexico New Hire Directory. To do so, you will need your EIN and contact information and employee’s information, including their Social Security Number and date of hire.

You can report electronically through mail to the New Mexico New Hire Directory at P.O. Box 2999, Mercerville, NJ 08690, or by fax at (888) 878-1614. Remember that if you are submitting your reports electronically, then you will have to do so in two monthly transmissions that are not more than 16 days apart.

You will not have to report anything if you have had no new hires since the last report.

Paid Sick Leave and Caregiver Leave

It is not mandated by the New Mexico laws to give your employees paid sick leave. However, in accordance with the Family and Medical Leave Act or other federal laws, it does make it mandatory for you to provide unpaid sick leaves.

If you provide sick leave to an employee, then under The Caregiver Leave Act, you must allow your employee to use that same leave to care for their family members under the same terms. This means that you cannot discharge, threaten to discharge, or retaliate against an employee who uses their leave.

Voting Leave

If your employees’ workday begins two hours before voting begins and ends less than three hours before the polls close, then New Mexico law allows employees two hours of leave to vote.

As an employer, you are allowed to set up the time for leave to vote.

Lunch and Other Break Time Requirements

It is not mandated by the New Mexico laws to give lunch and other breaks. But it does state that if your breaks are of 30 minutes or less, then you cannot deduct your employees’ pay for them. However, if your employee is free to do whatever he or she wants during lunch or long breaks, then you do not need to pay for them.

Hiring Minors

For children who are aged 14 and 15, you need a work permit to work in New Mexico. Additionally, during the school year, they cannot work between 7 p.m. and 7 a.m. outside the school year; these hour timings are changed to 9 p.m. and 7 a.m.

Additionally, minors are not allowed to work for more than three hours per day or eighteen hours per week during their school hours. They are also not allowed to work around heavy machinery, electrical hazards, explosives, door-to-door sales, or in other similarly dangerous jobs as listed in the New Mexico Statutes Chapter 50, Article 6.

Note: There are exceptions for children in film or TV productions.

New Mexico Payroll Forms

It is preferred by New Mexico that you pay and file forms online. Additionally, you can also get the forms at your district office. New Mexico’s payroll and tax forms that must be filed by employers are:

New Mexico State W-4 Form

New Mexico does not have a state withholding form. Thus, to determine how much you will have to withhold from each paycheck, you should use the withholding information on the employee’s federal W-4 form with the withholding tables for New Mexico.

ES802 (A, B, C, and O)

These are the forms that will let you opt to become liable for payments instead of contributing to unemployment insurance and to submit surety bonds or certificates.

Form ACD- - 31015, Business Tax Registration Form

If you want to change your business address or cancel your CRS number, then this is the form you should use.

WWT-PV Wage Withholding Tax Payment Voucher

You should use this form to pay withholdings if you are not paying online.

Federal Payroll Forms to be Filed by New Mexico Employees and Employers

In addition to the New Mexico state payroll forms, the federal payroll forms to be filed by New Mexico employers and employees are:

- Form W-4: Form W-4 is for helping you to calculate your taxes to withhold from employee paychecks.

- Form W-2: Form W-2 is for reporting total annual wages earned. You will have to file one form for each employee.

- Form W-3: Form W-3 is for reporting total wages and taxes for all employees.

- Form 940: Form 940 is for reporting and calculating unemployment taxes due to the IRS.

- Form 941: Form 941 is used for filing quarterly income and FICA taxes withheld from paychecks.

- Form 944: Form 944 is used for reporting annual income and FICA taxes withheld from paychecks.

- Form 1099: Forms 1099 are used for providing non-employee pay information that will help the IRS collect taxes on contract work.

New Mexico Payroll Tax Resources and Sources

The New Mexico payroll tax resources and sources are:

- New Mexico Tax Website: To get the forms and information, as well as you can pay online here.

- New Mexico Department of Workforce Solutions: Here, you can learn about unemployment, UI taxes, child labor laws, and more.

- New Mexico Employer Guidebook (Workers’ Comp): This is a downloadable PDF that has all the information that you will need about workers’ compensation.

- FYI Form 104: This has New Mexico’s tax laws and tables.

- Wage Withholding Tax Return: This will give you all the information that you will need on withholdings.

How Can Deskera Help with New Mexico Payroll and Taxes?

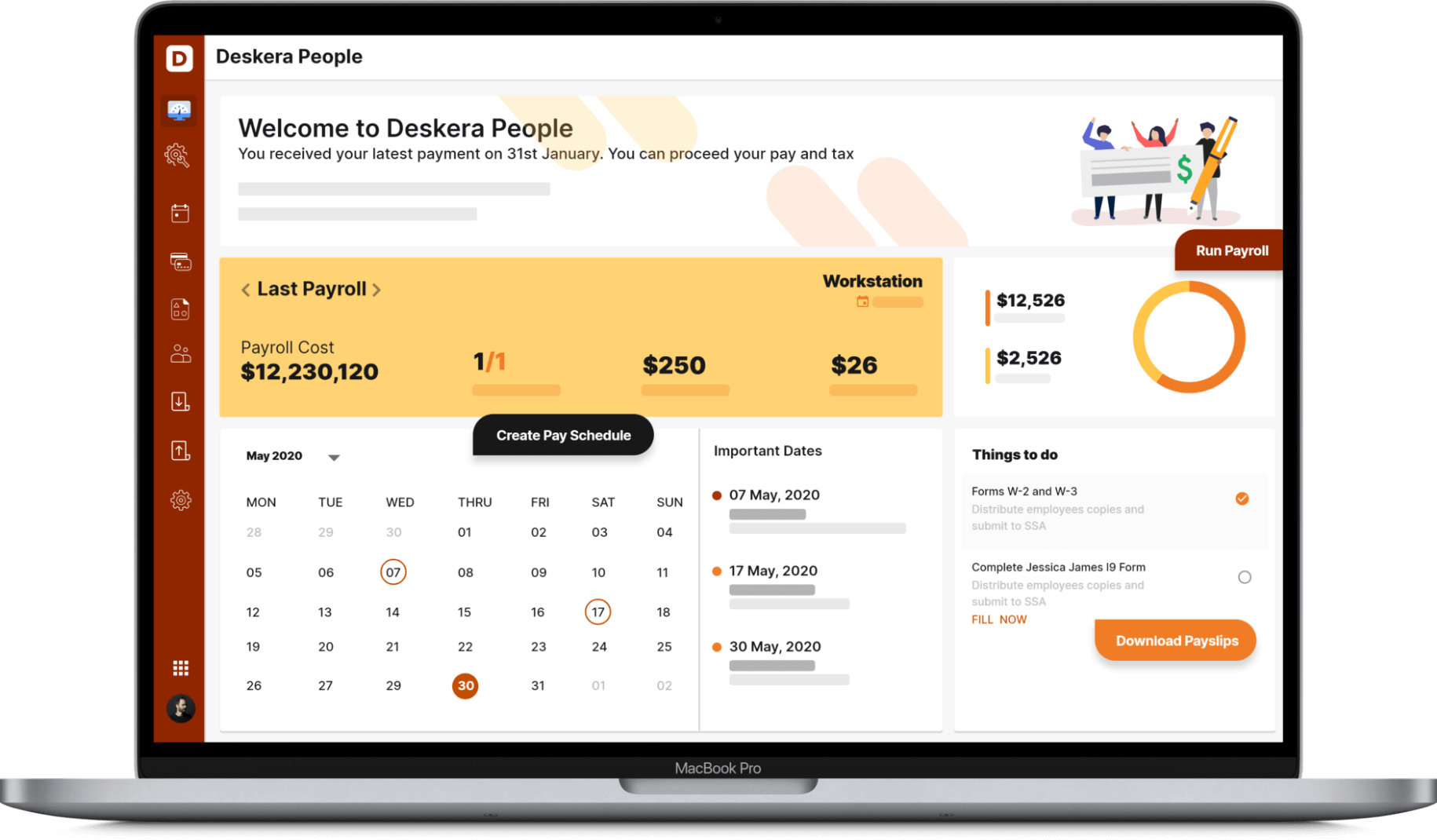

Deskera’s cloud-based HR and payroll software- Deskera People, is the one that would be able to assist you the most with New Mexico’s payroll and taxes. One of the main features that makes it the right choice for your assistance is that it comes with inbuilt statutory and tax compliances for the United States and its states.

Additionally, it will run your payroll for you in three easy steps, with you just having to complete your portion of work in it. These three steps are: adding employees, selecting the amount, and paying them. In fact, you would even be able to directly deposit the wages in your employee’s account if they agree to it through this software.

Lastly, Deskera People will also let you choose your own payroll schedules for different groups of employees based on their payment schedules like monthly, semi-monthly, weekly, and more.

Key Takeaways

While New Mexico does have lesser labor regulations than several other states of the United States, it does charge SUTA and state income taxes while also requiring you to purchase workers’ compensation insurance. Thus, it is important for you to know all the applicable regulations and adhere to them in order to ensure that you are being compliant with them all.

Having an automated HR and payroll software like Deskera People would thus be a huge help here, as it will not only increase your accuracy but also save your resources like time and people while making the whole process easier overall. In fact, to get better insights into your payroll, you would even be able to access payroll reports on its dashboard, which will also mention your payroll tax obligations.

Related Articles