Ever since the introduction of GST in India and the announcement for mandatory compliance on it by all the businesses, the small business owners as well as the established ones often wonder if the process is too complicated to get it done.

Keeping this in mind, the government is constantly trying to make processes simpler for the companies by introducing new schemes and ways. One of these ways include IFF i.e Invoice Furnishing Facility. Have heard of it but never quite understood all about it? Worry not. This short article will take you through the nuances and processes of IFF. Just exactly all you need to know about it. This article will explore the following the points:

- What is the Invoice Furnishing Facility (IFF)?

- Who can go for IFF?

- Importance of IFF.

- Advantages of IFF.

- List of details that are to be submitted for IFF.

- How to use IFF?

So, let’s delve right into it.

What is the Invoice Furnishing Facility?

In force from January 1, 2021, the Invoice Furnishing Facility is a discretionary component that permits you to transfer invoices for the initial two months of a quarter. (currently under the QRMP scheme). You can utilize IFF to add data identified with your B2B invoices and CDNR (Credit/Debit Notes-Registered) during these two months. For the last month of the quarter, you should record the returns with Form GSTR-1.

For instance, for the quarter running from January to March, you can transfer invoices through IFF for January and February. Invoices for March must be transferred in Form GSTR-1.

Any invoice that you transfer in IFF need not be entered again in Form GSTR-1 that you record in the third month. The invoices that you have documented through IFF will be reflected in Form GSTR-2A/2B of your purchaser.

Points to remember while filing for IFF:

- IFF is an optional facility. Even if it is not used there will be no late fee charged.

- The invoices relating to the last month of a quarter are to be uploaded in the GSTR-1 return only.

- There is no requirement to upload invoices in GSTR-1 if the same has been uploaded in the IFF.

- The total value of invoices that can be uploaded per month is restricted to Rs.50 lakh.

- The details submitted in IFF will be reflected in the GSTR-2A and GSTR-2B of the recipients.

- The Invoice Furnishing Facility will come into effect from 01.01.2021 and the first cut-off date was 13th February 2021 for January 2021.

However, the question remains, who can file for the IFF? Let’s find out in the next section.

Who Can File for IFF?

The small scale taxpayers going for QRMP filing their GSTR-1 returns each quarter can use the Invoice Furnishing Facility. Note that if someone doesn't upload the invoices through the IFF, he/she needs to transfer all the invoices for the three months of the quarter in the GSTR-1 return.

The total value of invoices for each month cannot exceed 50 lakh INR and If invoices are not furnished using IFF, you will have to upload the required information for all three months at the end of the quarter in Form GSTR-

Also remember that you can only use IFF for B2B invoices and credit/debit notes with the following tables.

- 4A, 4B, 4C, 6B, 6C - to add details of B2B invoices

- 9A - to add details of amended B2B invoices (B2BA)

- 9B - to add details of Credit/Debit Notes-Registered (CDNR)

- 9C - to add details of amended Credit/Debit Notes-Registered (CDNRA)

Importance of IFF

The taxpayers whose aggregate turnover is under Rs.5 Crore in the first monetary year can document their GSTR-1 and GSTR-3B each quarter by going for the QRMP scheme. This is permitted to reduce the consistency trouble on the small taxpayers. Notwithstanding, this creates issues for citizens who make purchases from QRMP taxpayers in asserting Input Tax Credit (ITC).

This is why, IFF has been introduced under the QRMP scheme to remove these hardships allowing the QRMP taxpayers to upload selective or all B2B invoices on the GST portal using IFF for the first two months of the quarter. In turn, it helps the buyers in claiming ITC without any delay.

Moreover, If you have a large number of B2B invoices, this facility to upload invoices each month will ease your tax burden and will reduce the number of invoices that you need to upload at the end of the quarter.

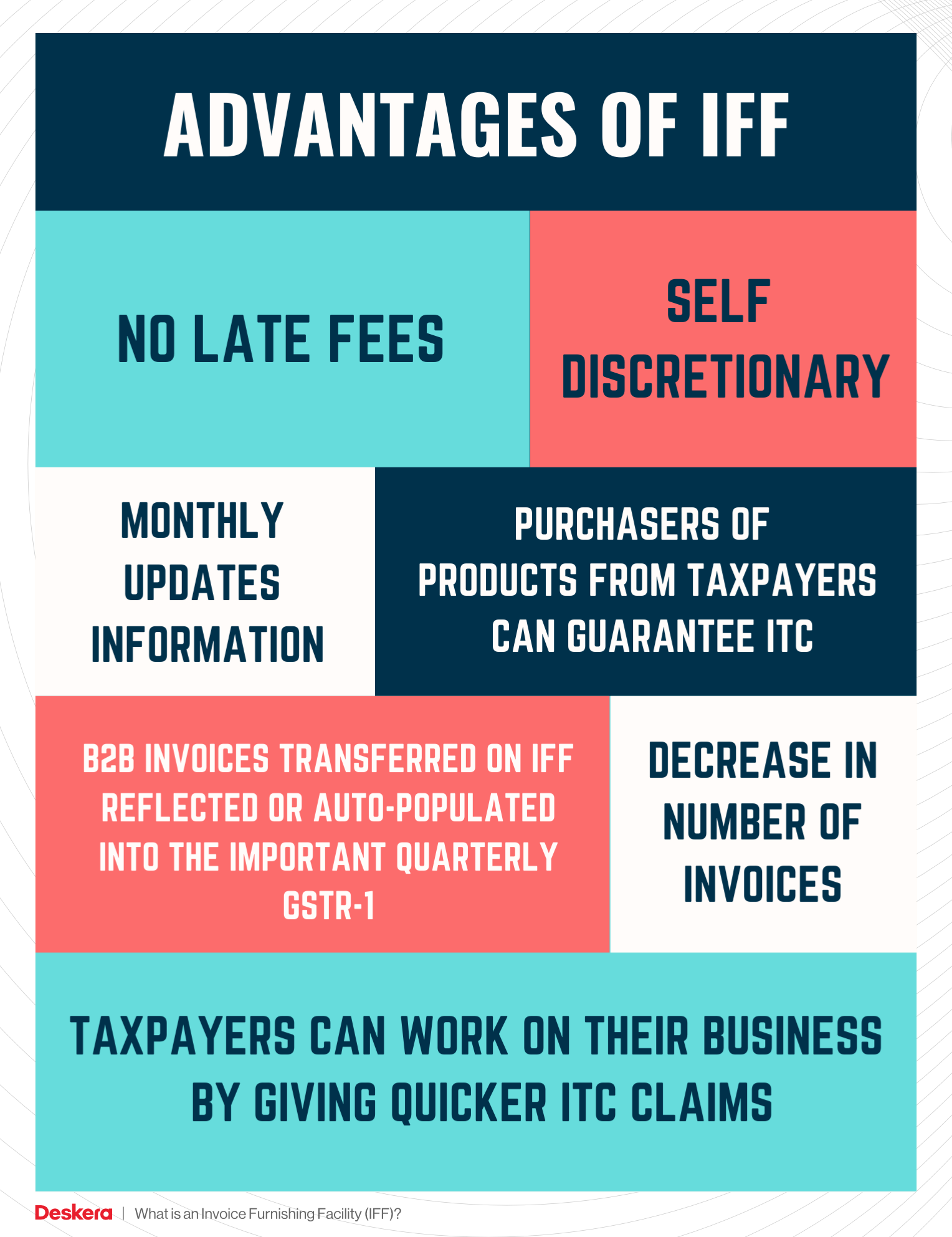

Key Advantages of IFF

- Any late transfer of B2B invoice, past thirteenth of the following month won't ever draw in late fee dissimilar to GSTR-1. In any case, the enlisted purchasers may at the most lose the input tax credit for that month as it gets conceded to the following month.

- IFF is discretionary and in case it was picked in the primary month of a particular quarter, there is no standard that it should be picked for the second month of the same quarter.

- Purchasers of products from taxpayers can guarantee ITC consistently.

- The B2B invoices transferred on IFF will get reflected or auto-populated into the important quarterly GSTR-1, accordingly eliminating the need to return the invoices.

- It pushes for a month to month compromise of information and that will eventually make quarterly return recording simpler.

- Taxpayers can work on their business by giving quicker ITC claims.

- Assume the QRMP taxpayer has just presented the B2B information on IFF by thirteenth of the following month however neglected to get done with recording IFF for the month by thirteenth. He will in any case be permitted to record IFF after thirteenth, given the information is now submitted prior to thirteenth of the following month.

- Facilitates the consistency trouble by decreasing the volume of invoices to be transferred toward the finish of the quarter.

IFF is meant to help both small taxpayers and buyers from small taxpayers. It indirectly helps small taxpayers to enhance their business by providing faster ITC claims to their buyers. However, this may increase the compliance costs for them. Moreover, the data must be segregated as B2B and non-B2B transactions for reporting on the IFF.

Once the invoices are uploaded and filed on IFF, it gets auto-populated into the quarterly GSTR-1, making it non-editable or not editable. This calls for the taxpayer to make a comparison between the benefits of IFF and the cost involved.

It is good to opt-in for this facility if the QRMP taxpayer raises comparatively larger volumes of B2B invoices than B2C invoices in a quarter. Further, the impact on business relations with their registered customers must be understood well.

To finally help you proceed with IFF, we have a list of details prepared for you that you need to submit for IFF.

List of Details to be Submitted for IFF

Here is a list of documents/details that you need to submit in order to proceed with IFF.

In the first two months of filing, you should submit:

- All the details of your B2B invoices.

- All the details of the credit and debit notes of your B2B invoices issued during that month.

Fill the following tables that appear in the Invoice Details page of the GST portal:

- 4A, 4B, 4C, 6B, 6C - to add details of B2B invoices

- 9A - to add details of amended B2B invoices (B2BA)

- 9B - to add details of Credit / Debit Notes Registered (CDNR)

- 9C - to add details of amended Credit/Debit Notes-Registered (CDNRA)

As we have mentioned before, you can upload and file invoices for a particular month till the 13th day of the following month. For example, for the month of July, you can upload invoices till the 13th of August.

After this 13th, you cannot use this facility for the previous month’s invoices. In case there are any invoices that you had left out previously, you can upload them via the IFF in the following month or in the quarterly Form GSTR-1.

Note: It is important that the taxpayer uploads all B2C invoices of the quarter while filing quarterly GSTR-1.

Now let us find out how to use IFF.

How to Use IFF?

As the Invoice Furnishing Facility is optional for the taxpayers under the QRMP scheme, the GST portal gave a timeline to opt-in or out of the scheme, i.e. it was 31st January 2021 for the quarter January-March 2021.

Once the small taxpayers stayed in the scheme, the GST portal provided this facility for the first two months of the quarter only. The B2B invoices should be uploaded in IFF from 1st to the 13th of the month subsequent to the relevant month.

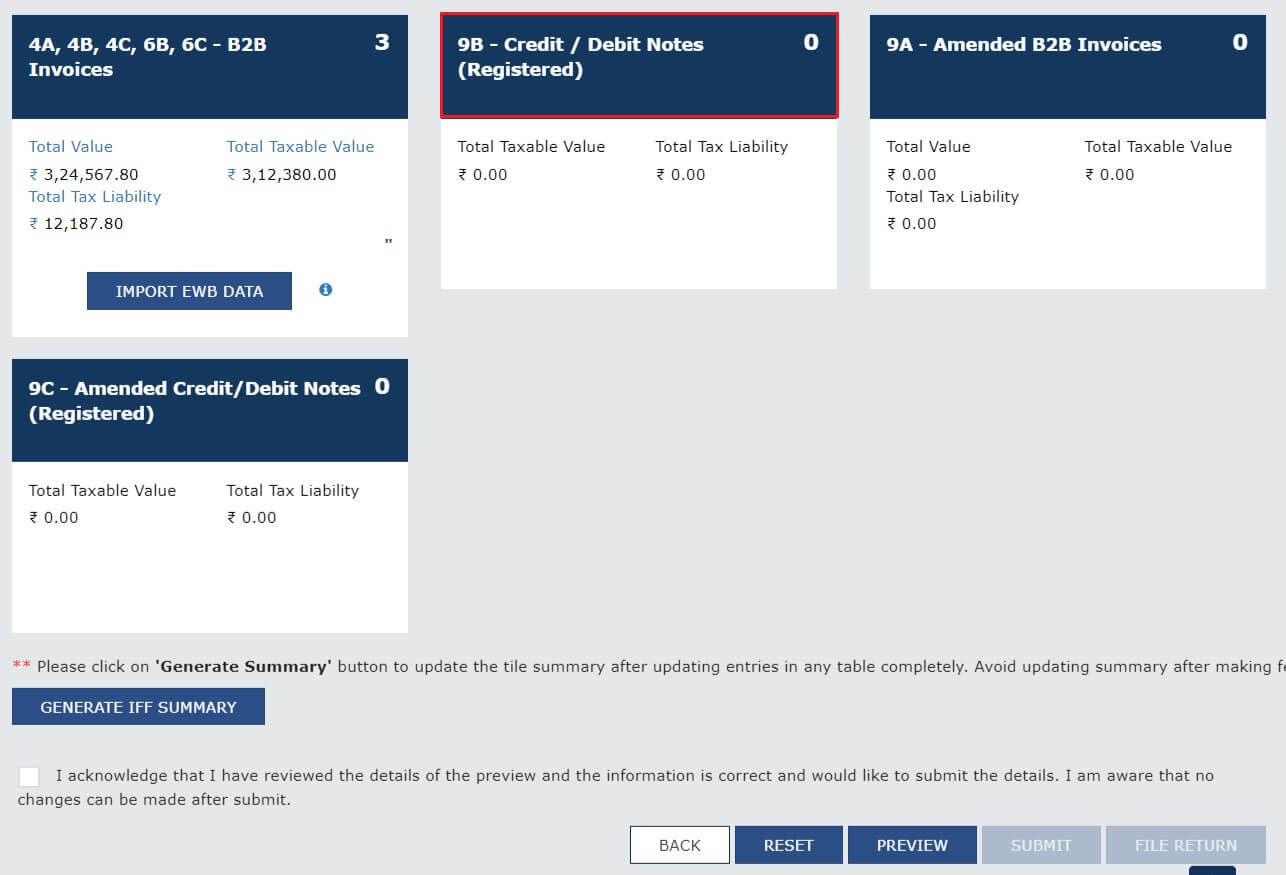

Here is a step-by-step guide on how to submit and file IFF in GST portal:

- Log in to the GST portal.

- Go to Services > Returns > Returns Dashboard.

- In the File Returns page, choose the financial year and the return filing period (first or second month of the quarter) and click Search.

- Choose the IFF option.

- Choose Prepare online if you want to file via the GST portal, or choose Prepare offline if you want to use the Returns Offline Tool and upload the JSON files containing the required details.

- Once you have provided the details, click Generate IFF summary at the bottom of the page, and then click Submit. Once you have submitted this, you cannot delete the information you have provided.

- If you wish to file Form GSTR-1, click File Return to enter the details and choose either file with DSC i.e Digital Signature Certificate or file with EVC i.e Electronic Verification Code.

Deskera: One Stop Solution for Every Business

Discover how you can combine accounting, finances, inventory, and much more under one roof with Deskera Books. It's now easier than ever to manage your Journal entries and billings with Deskera. The remarkable features, such as adding products, services, and inventory, will all be available to you from one place.

Deskera is an all-in-one software through which you can combine accounting, financial management, inventory management, and many more such features using Deskera Books.

While the taxation regimes followed by most countries tend to be intimidating and nerve-wracking, the key to understanding them is by starting to understand each of their nitty-gritty. In the case of GST in India, this involves understanding the Forms GSTR-1, GSTR-2A, GSTR-2B, GSTR-3B, the difference between GSTR-9 and GSTR-9C, reverse charge mechanism under GST, and many more such details.

While this seems a lot to take in, the businesses can be relieved that Deskera Books handle their accounting. Be it tracking financial KPIs, marketing KPIs, journal entries, financial statements, invoices, account receivables, and accounts payable, Deskera Books will do it all for them- including making it easier to comply with the taxation regime of the base country.

Here is a turtorial on how to setup and manage GST in India with Deskera and find out for yourself how helpful the software it.

Deskera Books is a time-saving strategy for managing your work contacts, invoicing, bills and expenses. In addition, opening balances can be imported, and chart accounts can be created through it.

Key Takeaways

- Invoice Furnishing Facility is an optional feature that allows you to upload invoices for the first two months of a quarter.

- Any invoices that you upload in IFF need not be entered again in Form GSTR-1 that you file in the third month.

- You have to be a quarterly taxpayer filing GSTR-1 under the QRMP scheme.

- Total value of invoices for each month cannot exceed 50 lakh INR.

- IFF is beneficial for you and your buyers, as your buyers can claim Input Tax Credit every month, instead of waiting till the end of each quarter.

- If you have a large number of B2B invoices, this facility to upload invoices each month will ease your tax burden, reducing the number of invoices.

- You can upload invoices till the 13th of the next month.

- Small taxpayers can improve their business by providing faster ITC claims.

Related Articles