It was in the year 2017 when the Government of India passed the GST (Goods & Services Tax) Act. GST is an indirect tax that replaced many indirect taxes such as the excise duty, VAT, services tax, and so on, with the idea of ‘one nation, one tax’.

Goods and services are divided into five different tax slabs for collection of tax: 0%, 5%, 12%, 18% and 28%. However, petroleum products, alcoholic drinks, and electricity are not taxed under GST and instead are taxed separately by the individual state governments, as per the previous tax system.

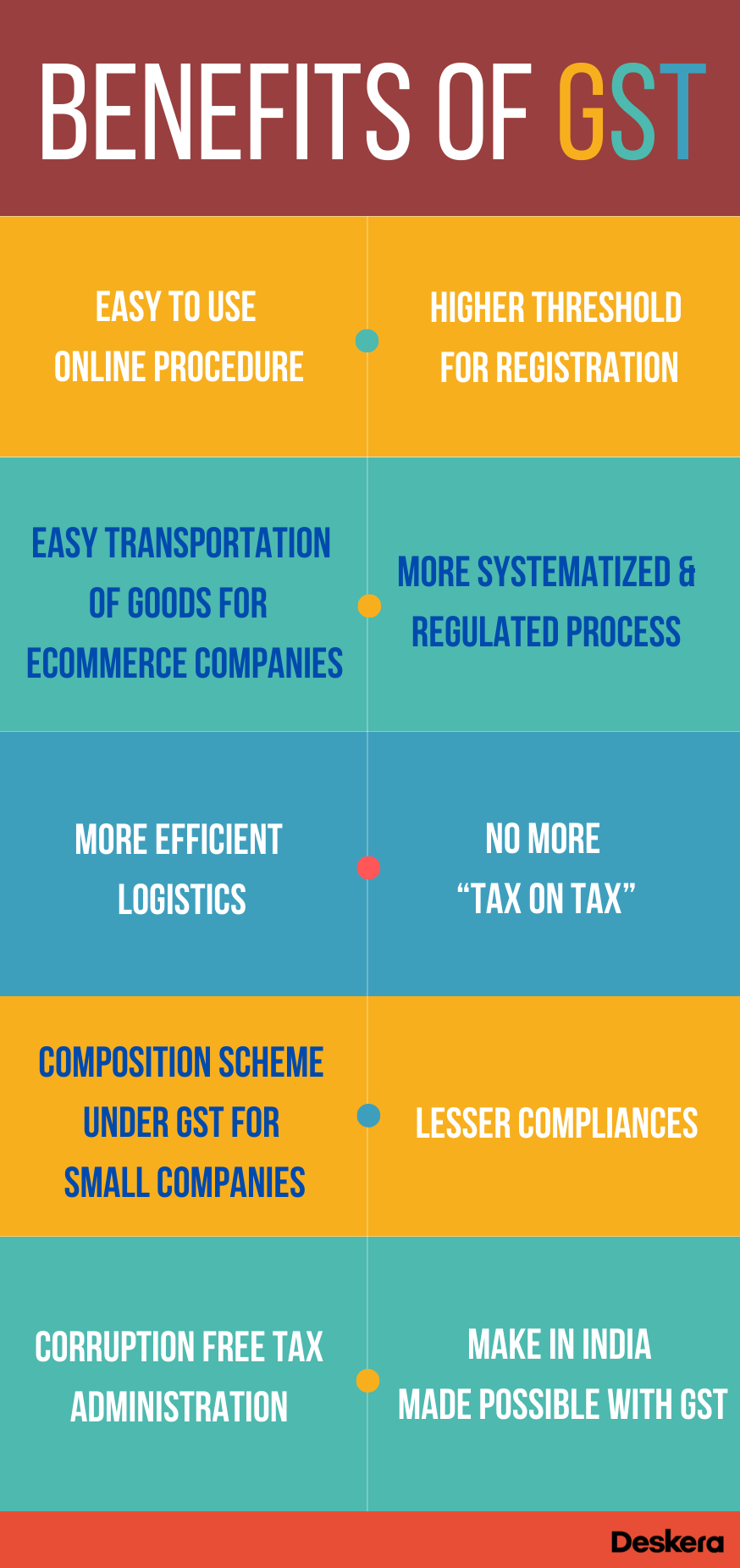

As it is one of the biggest reforms in India, it has many benefits for you as a business owner or just as a lay man in this country. To make you aware of these compelling benefits, we have this article ready for you. So, let us look at the big benefits of GST in India.

Big 10 Benefits of GST in India

The introduction of GST significantly impacted the Indian economy. It brought the Indian economy together under one unified market. Manufacturers or be it the end customers both benefit from this GST. Here is a list of benefits of GST you must know about so that you don't miss out on its perks.

#1 Easy to Use Online Procedure

When you think of the GST process, you will quickly get an image of people standing in long queues at government offices, getting documentation done and so on. But that has exactly changed now. The process of registering for GST has now become technology driven.

The whole process of GST, be it registrations or filling GST returns, all can be done online within a few taps and it’s super simple. Apart from registration and return filing you also have the option to apply for refund online, respond to notices, and file consumer grievances.

This online process has especially been very beneficial to the companies just starting out in the industry. Had it not been for GST, the companies would be going from pillar to pillar to get the VAT, service tax, all taxes separately.

#2 Higher Threshold for Registration

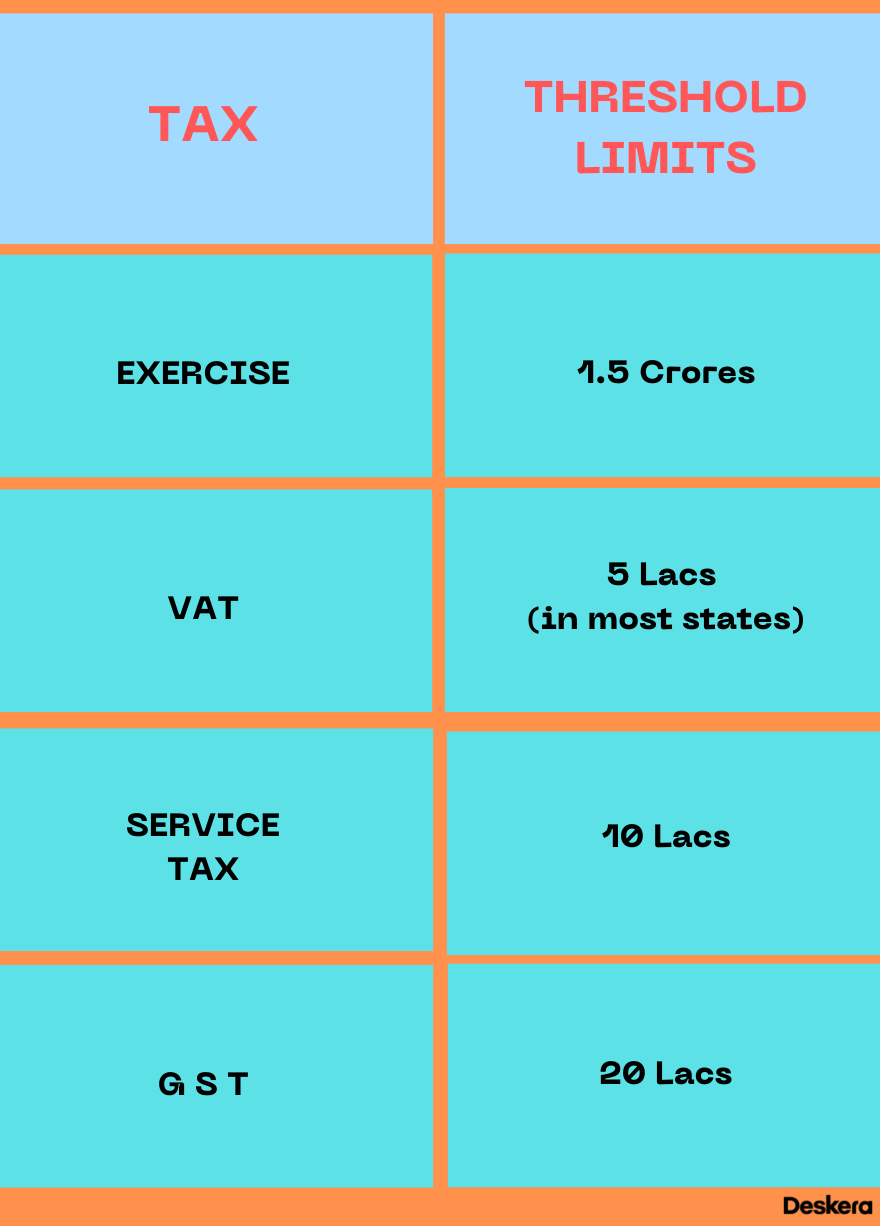

Before the introduction of the GST in India, in the VAT structure, any business with a turnover of more than Rs 5 lakh, in states was responsible to pay VAT. This value was different for every state.

Additionally, service tax was excluded for organizations with a turnover of not as much as Rs 10 lakh. Under the GST system, be that as it may, this edge has been expanded to Rs 20 lakh, which excludes numerous small traders and service providers in the sector.

#3 Easy Transportation of Goods for E- commerce Companies

Earlier, it was the process of movement of goods from one place to another, especially for the eCommerce companies like Amazon, Flipkart and others. This time with the GST system, it has clearly mapped out the provisions applicable to the e-commerce sector.

Moreover, now that it is applicable all over India, any part of the country, no matter how remorse, there should be no complication regarding the inter-state movement of goods anymore.

#4 More Systematized & Regulated Process

There are innumerable companies that lie under a specific industry , and amongst them there are construction companies, textiles companies, which are not very well regulated. Be it in terms of their internal functioning or their paperwork- such as taxation.

With GST, that has changed. The companies are no longer going haywire with their taxations. With all the provisions made possible, all the online compliances and installments, for profiting of information credit just when the provider has acknowledged the sum. This has gotten responsibility and guideline to these ventures.

#5 More Efficient Logistics

The logistics industry is a heavy business in India. It needs to keep up with numerous stockrooms across states to distance from the Central Service Tax (CST) and state section charges on between state development.

These distribution centers had to work underneath their ability, giving space for expanded working expenses. Under GST, nonetheless, these limitations on state development of goods, logistics have been done away with.

As a result of GST, logistic center administrators and online business aggregators players have shown revenue in setting up their stock items at key places, one of them being Nagpur, a city situated in the state of Maharashtra, India, which is also the zero-mile city of India. Instead of each and every city on their conveyance course.

This has assisted in doing away with the unnecessary extra costs that the companies have to bear. It has rather brought in a lot of benefits for organizations engaged in supply, production of goods.

#6 No More “Tax on Tax”

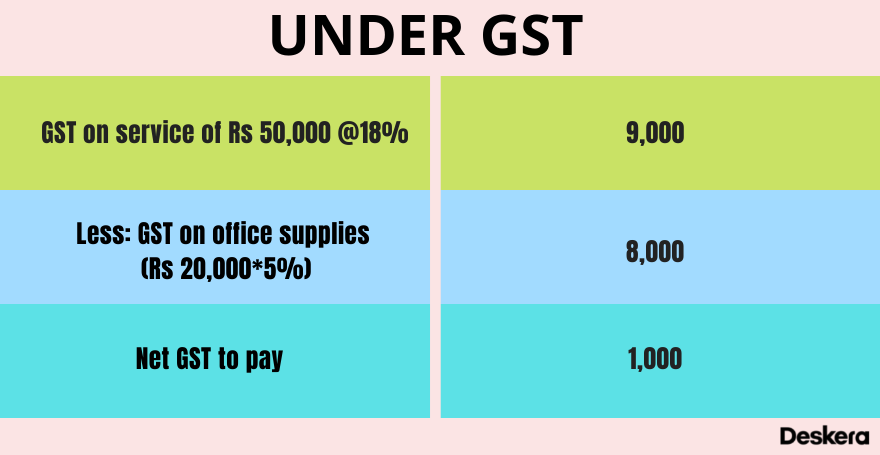

Here is a quick example to explain what we mean by no more to tax on tax with GST.

Before GST regime

Any official offering services for say, Rs 50,000 and charged a service tax of 15% to simplify, Rs 50,000 * 15% = Rs 7,500. Then, he would buy office supplies for Rs. 20,000 paying 5% as VAT which would be Rs 20,000 *5% = Rs 1,000.

He had to pay Rs 7,500 output service tax without getting any deduction of Rs 1,000 VAT already paid on stationery. That makes his total outflow as Rs 8,500.

Under GST:

#7 Composition Scheme Under GST to the Rescue of Small Companies

Composition Scheme is a simple and easy scheme under GST for taxpayers. Small taxpayers can get rid of tedious GST formalities and pay GST at a fixed rate of turnover. This scheme can be opted by any taxpayer whose turnover is less than Rs. 1.5 crore.

This scheme has cut down the expense and consistent trouble on numerous small ventures. To learn in depth about it, here is our article, Composition Scheme Under India GST.

#8 Lesser Compliances

Before GST there was VAT and service tax, each of which had its own returns and compliances. However, now there is just one, unified return to be filed. Therefore, the number of returns to be filed has drastically come down. Now, there are only about 11 returns under GST.

Amongst these 11, there are 4 basic returns that apply to all taxable people under GST. The main GSTR-1 is manually populated and GSTR-2 and GSTR-3 will be auto-populated.

#9 Corruption Free Tax Administration

Wherever taxes are involved there are high chances of fraudulence by companies and , corruption, that can happen. With the introduction of GST, one of the main aims was to help reduce corruption and increase the level of transparency between the government and the companies.

Following are some of the new developments that came with GST to make the taxations corruption proof:

- Syncing of GST registration and PAN

- Reporting and matching at the invoice level

- Reconciliation of credits

- Generation of e-way bills

- Tracking of movement of goods

- Appointment of GST Commissioner for Investigation

- Directorate General of Analytics and Risk Management

#10 Make in India Made Possible with GST

With the application of GST on imports and a boost to manufacturing with a reduction of unnecessary costs, GST forms the backbone of this initiative. The ease of transaction and the free flow of goods through the state border with the elimination of commercial check posts is another advantage.

By replacing the arbitrary taxation system, the GST model has unified the Indian market. Reduction of the costs of logistics, lesser transit hours, and relief from export taxes and refunds has given a considerable boost to manufacturing.

Hope this helps you gather some insights on the benefits of GST.

How Can Deskera Help You with GST?

Deskera is an award winning company that played a crucial role in helping SMEs transition from non-GST to GST regime in Malaysia in 2015. Thus it has hands-on experience of migrating SMEs to GST and is well aware of the issues and challenges that SMEs face.

With Deskera ERP a user can maintain multiple business units having different GSTN in a single URL. This allows the user to maintain a single book of accounts and also file multiple returns as per each GST business registration.

While creating a master or making a transaction a user is prone to unintentional mistakes. Consequently, GST returns would be impacted. To avoid this situation Deskera ERP notifies these mistakes to you via one of its kind, a mismatch report. It provides the details of those products / customers / vendors / sales invoice / purchase invoice which are invalid as per the guidelines.

Deskera ERP is a cloud-based business software that helps streamline inventories at multiple business units/ warehouses, thus providing real-time Input Tax Credits, which are most critical for GST filing.

To understand how Deskera can help you, here is a video to answer all your questions.

Looks like Deskera got you covered. So what you are waiting for, get your free trial today!

Key Takeaways

- It was in the year 2017 when the Government of India passed the GST (Goods & Services Tax) Act.

- GST is one of the biggest reforms in India.

- The process of registering for GST has now become technology driven.

- The GST system has clearly mapped out the provisions applicable to the e-commerce sector making transportation a less complicated process.

- With the online systematized process of the GST now, textile industry or the construction companies have everything regulated.

- GST has made logistic center administrators and online business aggregators players have shown revenue in setting up their stock items at key places.

- With GST now companies don’t have to pay tax over tax, it is all covered under one umbrella, making sure that companies are not shelling out unnecessary extra money.

- Composition scheme that came with GST, is a simple and easy scheme under GST for taxpayers. Small taxpayers can get rid of tedious GST formalities and pay GST at a fixed rate of turnover.

- Before GST there was VAT and service tax, each of which had its own returns and compliances. However, now there is just one, unified return to be filed.

- There is more transparency with the GST system.

Related Articles