Most of the company founders are coders, designers, marketers and more such specialists from different professions. While it is important for you to develop a business idea, and get a team that matches your vision, it is equally important to be on the right side of the law.

This means that even as you are pitching to prospects, closing deals, meeting with investors and developing your products, you should also get acquainted with how to register your company in India.

However, before reading further into it and hence embarking on your journey as an entrepreneur, make sure you follow the rule of thumb of not using your private bank account to make business transactions. Additionally, if you are looking for investors, your company should be registered with the correct company structure, either of which when missing or incorrect will have to be rectified first for the investors to invest in your company.

Hence, registering your company is of the utmost importance and this article will guide you through the legalities concerned with starting and registering your business.

3 Steps for Registering a Company in India

India has always been one of those lands with large potential for businesses to thrive in. This comes in the form of its wide customer base, an abundance of natural resources, technical expertise and a large workforce to mention its few advantages.

Setting up your business in India can hence reap large profits if done correctly and the first step towards doing it correctly is through incorporating your business legally to avoid any operational hiccups. This article is going to take you through the steps for company registration in India, which if followed, will help you get the certificate of incorporation of your business.

Choose Your Company Name

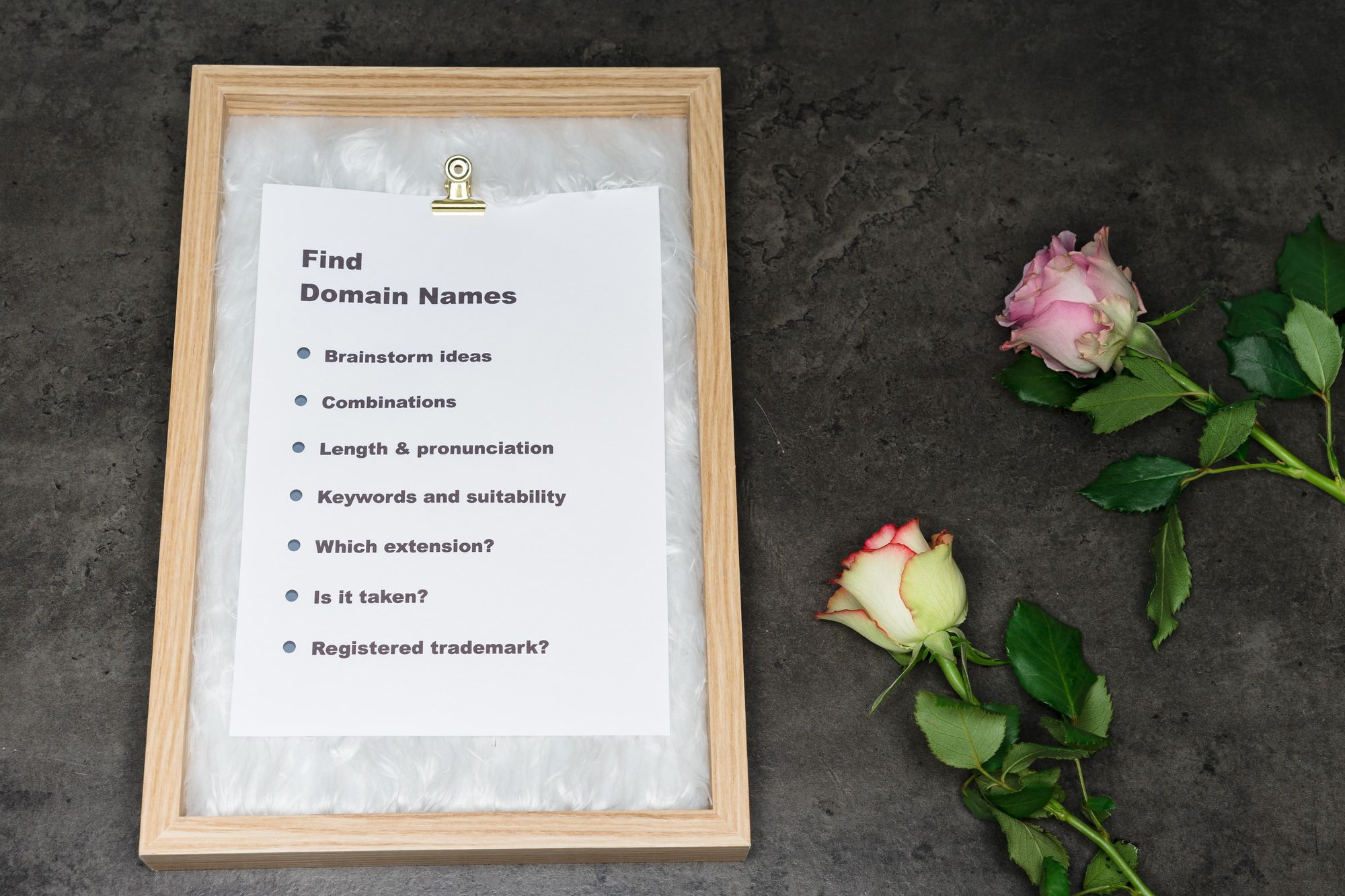

Deciding on a name for your company is as difficult as building your business. This is because the name that you decide would be how people would remember and associate with your company.

Your name would also be the first impression that your company would be leaving on your audience that would also determine the ratio of returning customers. Hence, your name should be strong as well as well-aligned to ensure it is not remembered for the wrong reasons.

The Indian Government’s Ministry of Corporate Affairs has made the process of registering your company under the Companies Act 2013, so simple and efficient that you can get your company registered within seven days, without even going to the government offices. But first, let us go through the basics and necessities for choosing your company name.

Things to Take Care of Before Registering Your Company Name

- Your name should be easy to remember, pronounce and short enough to communicate your brand to your customers. Your name should be short enough so that it can be communicated over the phone as well.

- Your name should reflect the mission of your business, such that it showcases what the company is all about and the products and services it sells.

- Your name should not be similar to the existing competitors.

- Once you have decided on a name, getting it reviewed by a lawyer before registering your company under it is important. This will ensure that in case of similarities with the competitors, you will be alerted of it before you expend over the marketing of your brand. This will improve the cash flow of your business.

- In the era of digital marketing and selling, your business needs to have a website. Hence, choosing a company name whose domain name is not taken by someone else and is available is a must. What also needs to be taken care of is the extension that you include with your domain name. This extension is decided based on the country you are targeting. For example, if you are doing business in India, “.in” is preferred. If your business is global, “.com” is preferred.

Guidelines for Naming a Company

Based on the Companies Act 2013 and Companies Incorporation Rules 2014, some of the directions for naming your company are:

- “The company who deals with financial activities needs to have a name related to financial aspects.

- Few names need the approval of the Central Government that holds Union, Prime Minister, Statutory, Scheme, National, Small Scale and Federal.

- All of the companies established as Nidhi can include the words Nidhi Limited at the end of the company name.

- The name should be in resonance with the principal object of the company.

- Names that include the words Insurance, Venture Capital, Bank and Mutual Fund need to get regulatory compliance from the regulatory bodies like SEBI, IRDA and RBI.

- You can change the name only after three years."

Limitations on Naming a Company

- "Generic names which have the place name or other general names are not allowed. For instance, names like solar power, corporate technology, Karnataka business are not allowed.

- A proposed name should not violate the emblems, trademarks or include offensive words.

- A name cannot imply a foreign embassy or foreign government.

- The name cannot be used if it's similar to a limited liability partnership name.

- The proposed name is identical to the company name dissolved as the liquidation results.

- The Government Company can only utilize the term State in its name. Few instances are Karnataka State Tourism Development Limited, Karnataka State Construction Corporation Limited, etc."

Choosing Your Business Structure

As a founder, you should be clear about the name as well as the type of your business. Registering your entity under a specific business type comes with its own sets of technicalities that you should be well aware of.

Before going through each type of business structure, make sure you are clear about the kind of business you are into, your goals and your objectives. It is important to have clarity about this as each type of business structure has its legal implications and impacts your income tax returns.

According to Section 3 of companies, a company is a legal entity registered and formed under the 1956 Companies Act. In India, the 5 main types of companies that you can register under are:

Sole Proprietorship

A sole proprietorship is the easiest type of company registration in India. It is that type of company in which there is only one owner, who is a sole proprietor. This type of company is ideal if you want full control of your business.

The key advantages of the sole proprietorship are:

- No government registration required

- No compliance to be fulfilled

- No government regulatory paperwork is required

- All the profits earned are yours

- There is no need for double taxation

- Income tax returns need to be paid only on your income

For registering as a sole proprietorship, the documents that would be required are:

- Aadhaar card

- PAN card

- Bank account

- Registered office proof (rental agreement or utility bills will do)

After having these documents, you will need to go to a Chartered Accountant for a registration certificate.

One Person Company

One person company is a new type of business structure that was introduced by the Indian Government in 2013. Up till 2013, to incorporate a company, at least 2 directors were needed as a single person could not incorporate the company.

Incorporating a company was a must for many as against going for sole proprietorship as an incorporated company helped the entrepreneurs to limit their liabilities and avail more tax benefits. One Person Company or OPC hence became that business structure through which an individual can incorporate a company as well as have 100% ownership over it.

Other benefits of OPC as a company type are:

- Lesser compliance compared to a private limited company

- Limited liability for directors which meant that the owner’s personal assets would not be at risk in case of any unfortunate event

- Legal recognition

- Make it easier to get loans from the bank

- Complete control of the company

- Easy to manage

For registering as a One Person Company, the requirements that need to be fulfilled are:

- Obtain Digital Signature Certificate (DSC)

- Obtain Director Identification Number (DIN)

- Apply for Name Approval

The documents that would be required are:

- Memorandum of Association (MoA)

- Articles of Association (AoA)

- Proof of registered office

- Affidavit and consent of the director

- A declaration that all compliances have been made

The other remaining steps would be:

- File all forms with the Ministry of Corporate Affairs (MCA)

- Collect your certificate of Incorporation

A Chartered Accountant would be able to help you through this process.

Partnership Firm

If your business has partners, your company type should be a partnership firm. To have a partnership firm, the main requirement would be to have a partnership deed which is an agreement between all the partners. This agreement will include all the duties and obligations between the partners and how they will be sharing profits amongst themselves.

The details that will have to be mentioned in the partnership deed are:

- Name and address of all the partners

- Name and address of the partnership firm

- Starting date of the firm

- Capital each partner has invested

- Profit share ratio among partners

- Salaries/commissions to be paid out to partners

- Rights of each partner

- Duties and obligations of each partner

- Other clauses which are mutually agreed upon

However, it is not mandatory to register the partnership firm, but if agreed to do so by all the partners, it can be registered under Indian Partnership Act 1932.

The benefits of partnership companies are:

- Easy and convenient to form

- Risks would be shared between the partners

- There is no need to submit the annual returns to the Ministry of Corporate Affairs

- Statutory audit is not mandatory

- Easy to wind up

- The work can be divided among the partners based on their specialization

- It is a flexible type of company

Limited Liability Company

Limited Liability Company (LLC) is one of the most flexible company types as it takes advantage of the corporation, partnership and sole proprietorship from other business structures. LLC is that company type that separates personal and business liabilities with each owner sharing their tax liabilities.

The key advantages of LLC type of company are:

- The paperwork in LLC is the least as compared with the registration of other company types. This makes it more flexible and easier to form.

- LLCs are designed in such a way that it keeps their members safe from liabilities like personal debts and legal hearings.

- Another main advantage of this company type is that it has tax flexibility. This means that incomes, expenditures and profits can become a part of the owner’s tax returns.

- To run LLC, following a business structure is not necessary.

- Sharing of profits and profit margins is also flexible in LLC.

Steps for setting up an LLC are:

- Fill a form online to apply for DPIN (Designated Partner Identification Number)

- Acquire your Digital Signature Certificate and register it on the platform of the Ministry of Corporate Affairs

- Get the approval for the name of your LLC by the Ministry of Corporate Affairs

- After you have received the approval, fill up the incorporation form to register your LLC and obtain your LLC agreement.

Private Limited Company

A Private Limited Company, also known as LTD. is a type of company with a minimum of 2 members and a maximum of 200 members. This type of company can neither raise funds from the public nor issue its shares publicly. Additionally, the Indian Government no longer requires a paid-up capital to set up a Private Limited Company.

Benefits of having a Private Limited Company are:

- The liability of the company’s owners concerning the company’s debt is only limited to their shares.

- The shares of the company are easily transferable to other people.

- Money can be raised easily by them by issuing debentures and hence receiving funds from public platforms.

- LTDs have more tax benefits. Additionally, they also have lesser applied taxes as compared to other types of company registrations.

Steps for registering a Private Limited Company are:

- Obtain Directors Identification Number(DIN), which is a unique code that requires you to have a PAN card, Aadhaar card, bank statement, phone and electricity bill

- Then fill a name registration application.

- Draft an MOA (Memorandum of Association) which will state the objectives of the company and AOA (Article of Association) which will specify the rules and regulations of the company.

- After completing all of the above steps, an application needs to be filled through the SPICE E-form on the Ministry of Corporate Affairs’ website, to obtain PAN (Permanent Account Number) and TAN (Tax Deduction Account Number) applications.

Registering Your Company

After fulfilling all these basic requirements for registering your company, the procedures needed to be fulfilled under the Companies Act 2013 are:

Obtaining a DSC (Digital Signature Certificate)

The first step for company registration in India as per the Companies Act 2013 is obtaining a DSC of the directors. DSC is an e-signature that will enable you to complete the online company registration process in India. After submitting your documents, obtaining a DSC takes 2 days.

DSCs hence are the digital equivalent of physical identities, which can be used to prove your identity to access information or services on the internet or to digitally sign certain documents.

Registration of the DSC can be done on the Ministry of Corporate Affairs website. Considering that all companies will be filing their applications online. MCA requires all the companies to have their DSC. What needs to be kept in mind is that to obtain your DSC, you will be needing the same identification documents that you will be used for obtaining your DIN, including your passport and address proof.

Additionally, all the filing done by the LLPs and companies under the government program of MCA21 is needed to be filed utilizing the digital signatures by the person who is authorized to sign the documents.

Obtaining DIN (Director Identification Number)

The second step for your company registration in India is to get an identification number. This is mandatory according to the 2006 Amendment Act. This amendment act applies to every existing as well as intending director.

To get your DIN, you will need to file a DIN e-form, found on the Ministry of Corporate Affairs’ website. The documents needed for filing for your DIN e-form, also known as the DIR-3 form are:

- Passport

- Proof of address

- Educational qualifications

- Current occupation

- Passport-sized photograph

After your DIN is generated, you should inform your organization of the same. Your company should also inform the ROC (Registrar of Corporate) regarding all DIN of the directors via the DIN-3 form.

In case there is a change in any of the DIN, or any details like for example the personal details or address needs to be updated, the director will have to initiate the changes through an e-form, DIN 4 forms.

Preparing Your Application for Registration for Filing Online with RoC

After you have checked for the company name availability on the website maintained by MCA which allows you to do so, obtained your DSC and DIN and completed e-form 1A wherein you will have to list a minimum of 4 possible company names and a maximum of 6 in the order of preference, the RoC will approve one of your names based on availability and appropriateness in around 2 days. However, while filing this form, you will have to pay INR 500.

After your company name has been approved by the RoC, you will have 6 months for filing for your company’s registration. During these 6 months, you or your legal counsellor will have to draft MoA and AoA which will have to be signed by at least 2 members of your company in their own handwriting in the presence of a witness. After they are drafted, these should be filed online so that they can be vetted by the RoC.

After the RoC approves of them, they should be printed and prepared for notarization. To do this, they should be taken to a proper stamping authority for the Indian geographic region in which you register your company. After having the notarized copies, these should be scanned and filed online with other completed application materials.

The last step before you can file your application for registration with the RoC is paying all the prescribed registration and application fees on MCA’s website. This application needs to be filed in the RoC’s office which is in the Indian state where you want to register your business.

This will hence take you to the final part of the company registration in India which will involve

- Incorporating the company name

- Notice for appointment of managers, secretary and company directors

- Registering the opinion of the situation of office and office address

The checklist for the documents required for your company registration are:

- DSC - Digital Signature Certificate

- Form - 1 for Incorporation of Company in India

- Form-32 for particulars of managers, secretary, and proposed directors

- Director Identification Number of all proposed company directors

- Original copy of the formal letter which is published by ROC about company name availability

- Form- 18 for address or situation of the proposed company.

The other formalities that would be required to be followed are as follows:

- Obtain a TAN card

- Documents obeying act of shop and establishment if required

- Registration document of STPI (Software Technologies Parks of India) if required

- Both foreign and Indian directors need to have authorized agencies digital signature certificates

- Obtain a PAN (Permanent Account Number) from the income tax department of India

- Registration documents of IEC (Import Export Code) from foreign trade director general for international trade if required

- RBI approval for investing in FIPB and India support of foreign companies if required.

Incorporating the Company

If on vetting your application, the RoC finds all the documents to be satisfactory, it will issue the Certificate of Incorporation, and you can start conducting your business in India. However, if RoC finds the application to be dissatisfactory, it will inform you which documents are missing or what other information you need to provide on the application forms. Once you have made the required corrections, you can re-file your application.

How Can Deskera Assist You Once Your Company is Registered?

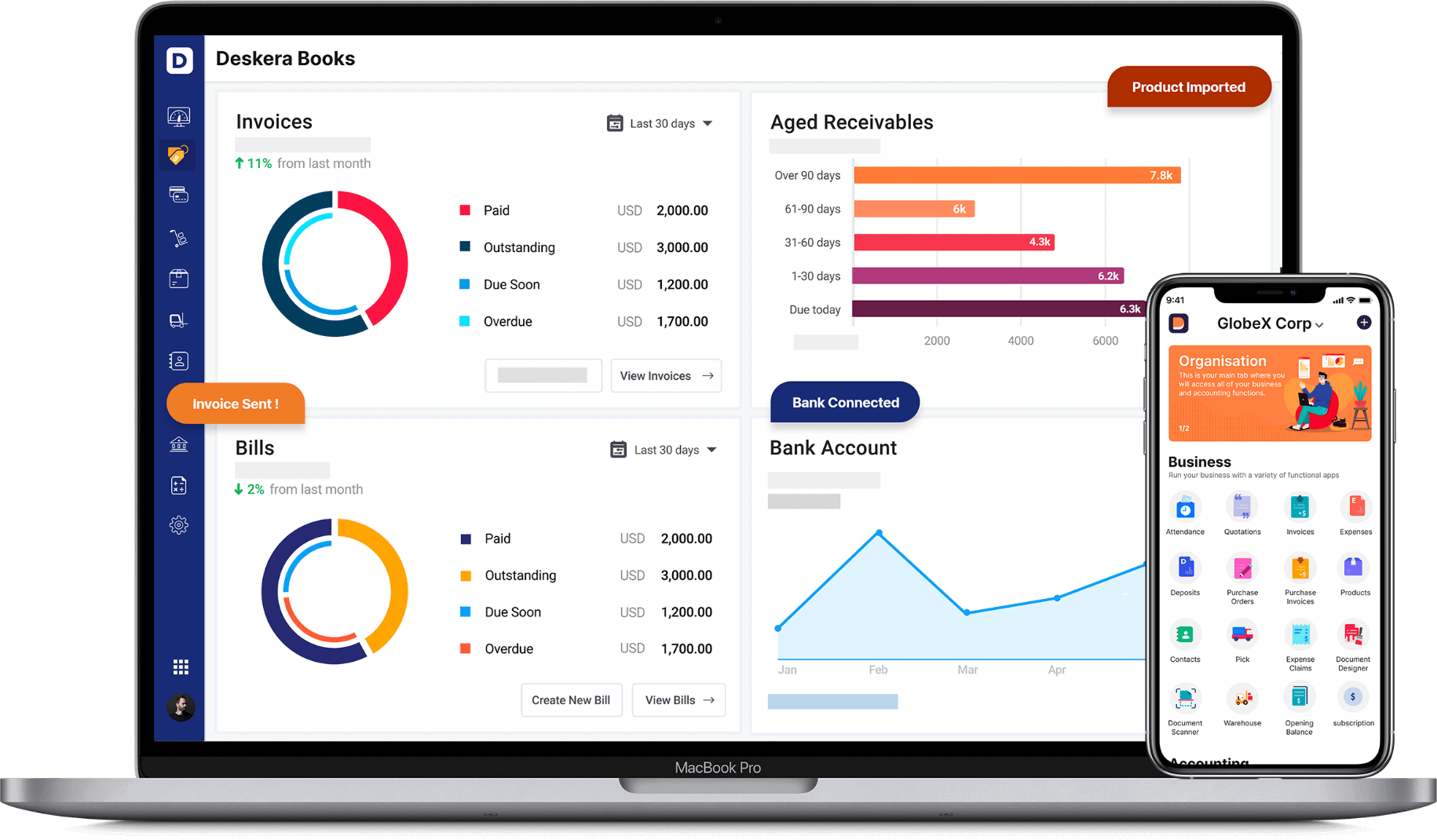

Deskera is your go-to software for all your business needs. Whether this is in terms of managing the sick leaves of your employees or generating your tax payables, it does it all for you from one platform that can be accessed across different devices. This section of the article will give you a deeper understanding of how Deskera will be able to assist you once your company is registered.

Deskera Books is the accounting software that will help you track all of your financial KPIs, marketing KPIs and have a dashboard of insights for the same. These insights will help you figure out your strengths and weaknesses and will even help you to identify the opportunities and threats for your company. This will help you to prepare yourself in advance.

For instance, if creating an eBook landing page or a webinar landing page or any such landing page with CTAs will give you high-quality leads, increased sales and higher gross profits, then through Deskera CRM+, you will be able to design your landing page, publish it and track its performance. Such content marketing and performance marketing insights in terms of cash flow can be seen on Deskera Books.

Additionally, lead management, along with email marketing campaigns can be undertaken through Deskera CRM. Deskera CRM will also assist in contacts and deal management, along with customization of the sales pipeline, ensuring the voice of the customer by having a platform for customer feedback and assisting the customer success manager with necessary insights so that they can ensure customer satisfaction. When your company’s customers are satisfied, customer retention, as well as customer loyalty, improves.

Deskera Books will help you improve your cash flow by keeping a real-time track of your operating expenses and operating income. This will ensure that your company has healthy financial statements like balance sheets, income statements and profit and loss statements. It will also help you to identify those practices that increase your net sales and therefore your revenue.

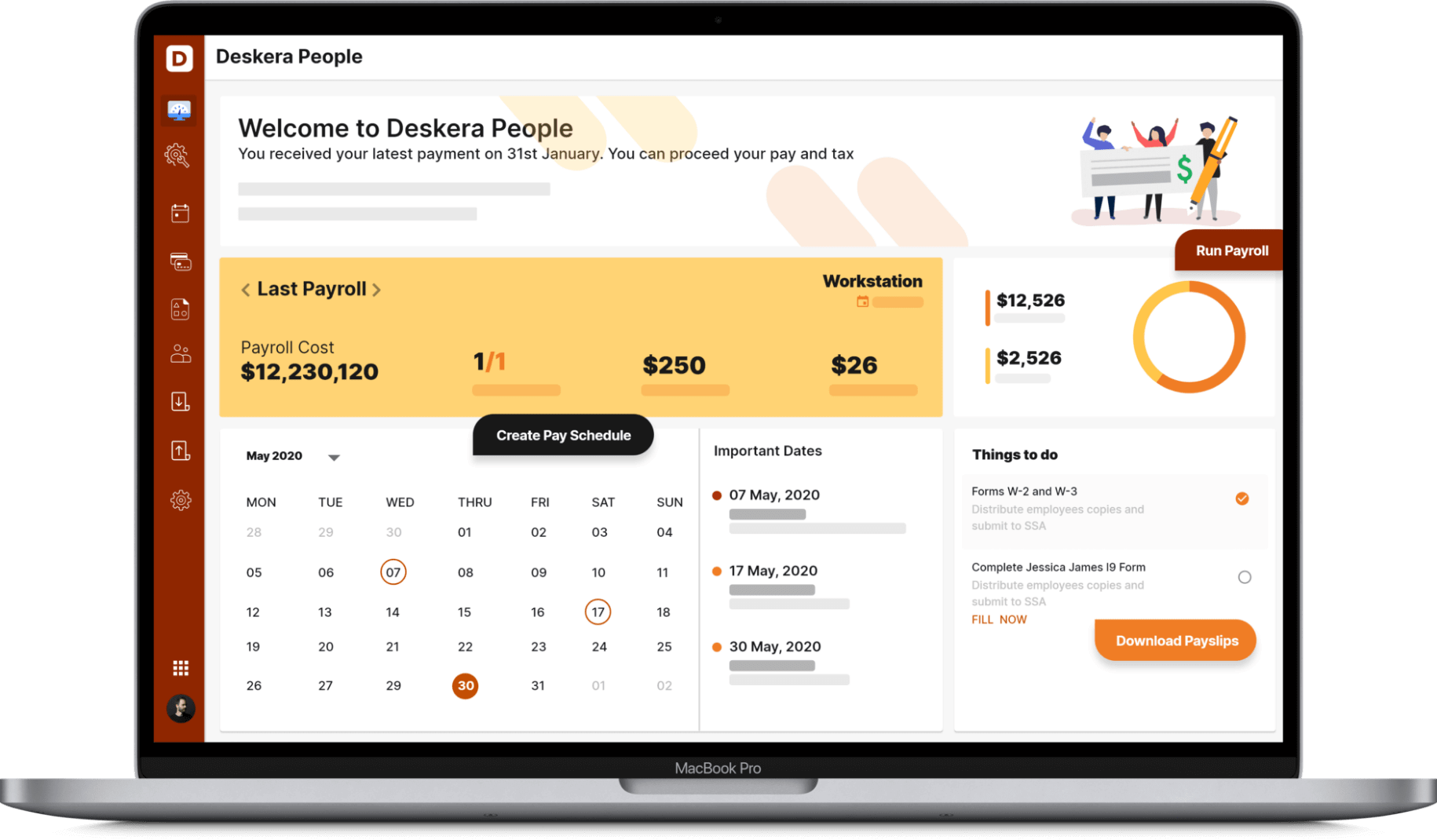

Lastly, through Deskera People, income tax can be calculated post ITR. In addition to this, it is also that platform through which the employees will be able to declare their investments. Deskera people can also calculate the professional tax that needs to be paid by each of your employees. This automation will ensure your company’s as well as your employees' compliance with taxation regulations of India.

Key Takeaways

To ensure the smooth functioning of your company and get all the benefits of a registered, incorporated company, your company registration must be completed at the earliest and in compliance with the Indian laws. The 3 key steps for company registration in India are:

- Choose Your Company Name

- Choosing Your Business Structure

- Register Your Company

Within each of these main steps, are several sub-steps or options which need to be considered before your process of company registration is completed. For instance, in choosing your company name, you will have to go through the guidelines and limitations on naming your company as given by the Ministry of Corporate Affairs.

In contrast, in the case of choosing your business structure, you have 5 available options as follows:

- Sole Proprietorship

- One Person Company

- Partnership Firm

- Limited Liability Company

- Private Limited Company

Lastly, in case of registering your company, the final steps in accordance with the Ministry of Corporate Affairs are:

- Obtaining a DSC (Digital Signature Certificate)

- Obtaining DIN (Director Identification Number)

- Preparing Your Application for Registration for Filing Online with RoC

- Incorporating the Company

As compared to a few years and even a decade ago, the Indian Government has been changing the rules and regulations in order to make it easier for businesses to get registered and carry on with their operations. While the ease of doing business is still a work in progress, it has improved considerably.

Related Articles