Nowadays, the process of efile Income Tax returns via online mode is simple and quick. It is an electronic filing of income taxes, which needs to be submitted every year to the Income Tax Department of India.

Earlier, we had to fill the Income Tax return papers, submit the forms to the Income Tax Department, and wait to get the confirmation of the return being processed. However, with changing times and tax rules, we have started e-filing our Income Tax Returns.

And, it has also helped us to improve our overall efficiency and safety as well. Moreover, it is the responsibility of every citizen of India to e-file Income Tax Returns.

In this comprehensive guide, we will walk you through all aspects of eFiling your Income Tax Returns. We’ll cover:

- Methods to do E-Filing

- Required Documents to e-file Income Tax

- Step-by-Step Guide to File your Income Tax Returns (ITR)

- Advantages of e-Filing Income Tax Return

- Terms and Conditions of e-filing Income Tax Returns

- Income Tax Forms

- Income Tax Returns FAQs

- Final Takeaways

Let’s start.

Methods to do E-Filing

Following is the list of three methods involved to do e-filing. Let’s discuss:

Method 1: Digital Signature Certificate (DSC)

Users can make use of a Digital Signature Certificate (DSC) to file their income tax. Interestingly, a DSC is a perfect way for signing documents electronically. Also, it is the digital alternative to physical certificates.

Method 2: Verifying Aadhar Number

You also have the option to file your income taxes without a DSC. The 'Income Tax Return–Verification' or ITR-V form, which is a one-page document, is generated in this scenario. However, if the Aadhar details on the Income Tax website are not updated on the Income Tax website. Then, the form must be printed, signed, and mailed to the Central Processing Centre (CPC) in Bangalore within 120 days after the e-filing date.

Method 3: Mailing ITR-V form

Users have the option to e-file income tax return without a DSC and have it verified using your Aadhar number or a bank. In this situation, the ITR-V does not need to be filed to the CPC.

Required Documents to e-file Income Tax

Following is the checklist of necessary documents needed to file Income Taxes. It includes:

- Bank account details

- PAN

- Aadhar (it should be linked to PAN)

- Salary Slips

- Form 26AS

- Form 16A/16B/16C

- TDS Certificate

- Insurance and Loan details

- Interest certificates from deposits and savings accounts

- Rent receipts for claiming House Rent Allowance(HRA)

- Investment details liable for deductions

- Interest certificates from deposits and savings accounts.

- Other proofs of income ( such as income from capital gains, income from house property)

Note that: You can consult a Chartered Accountant (CA) that helps to make sure all your exemptions and deductions are in your tax liability.

Step-by-Step Guide to File your Income Tax Returns (ITR)

Following is the step-to-step guide that assists you to file your Income Tax Returns. You can implement these steps once you register on the e-filing Income Tax Department website. Let’s follow:

1. Collect your all Documents

The first and foremost step is to collect all your essential documents. It includes TDS certificates (Form16/16A), capital gains statements, and more.

Further, all these documents are required to file your ITR such as salary slips, Form 16, interest certifications, and more. In addition, these documents will aid you to compute your gross taxable income. Also, it will provide you with important details of tax deducted at source (TDS) from your income.

Moreover, if tax is deducted from your pay income, your company will provide you a Form 16 TDS certificate. In a similar way, your bank must issue Form-16A for TDS deducted on fixed deposit interest payments to you. Ascertain that all TDS certifications you get from deductors are in the TRACES format.

You should obtain a digitally signed TDS certificate. Then, they'll have a checkmark next to them indicating that the signature has been confirmed. Furthermore, on the TDS certificate, non-verified signatures will be marked with a question mark. It will be necessary for you to validate it.

Remember that your long-term capital gains from equities shares and equity mutual funds exceed Rs 1 lakh in FY 2019-20. Then, you must pay tax on them. The tax will be paid at a rate of 10%, with no indexation. As a result, it is critical to determine whether or not one has any capital gains and to gather the capital gains statement in order to compute the amount.

2. Form 26AS Download

Form 26AS is your tax passbook, and it contains all of the information about the taxes deducted from your earnings and deposited against your PAN for the fiscal year 2019-20.

Moreover, you must cross-check your TDS certificates with Form 26AS to guarantee that tax deducted from your income is deposited with the government and applied to your PAN. These certificates include salary, interest, and dividends, and more.

3. Check Errors, if any

In case the amounts represented on your TDS certificates (Form 16, Form 16A, and more) and Form 26AS are not the same, then you must contact your deductor. They will further help you to rectify those mistakes or errors. You can also request your deductor (employer, bank, or others) to correct the data.

Nevertheless, if you are unable to rectify those errors, then you are unable to claim the credit on that deducted tax.

If the amounts on your TDS certificates (Form-16, Form-16A, and so on) and Form 26AS do not match, you must contact your deductor to get the inaccuracies corrected. Request that the deductor, who could be your company, bank, or someone else, correct the data.

Therefore, Chartered Accountants suggest monitoring and analyzing your Form 26AS during the financial year. Consequently, it helps to stay on track without facing any financial hassle while filing ITR.

According to the circulars, income tax officers shall not harass the deductee. So, if your TDS is deducted but not deposited with the government, and your deductor ignores your complaints, the Central Board of Direct Taxes (CBDT) has issued circulars to address the situation.

4. Calculate the total income for the fiscal year

You must compute the total income chargeable to tax once you have gathered all of the necessary documentation and verified all of the taxes deducted from your income.

Further, total income is calculated by aggregating incomes from five distinct sources, claiming all relevant deductions allowed under the Income-Tax Act, and offsetting losses, if any, to arrive at total income.

Remember that filling your income information in an ITR is easy. It is because the information needed may be obtained in Form-16. Furthermore, you must provide source-by-source bifurcation of the taxable income under the heading 'Income from other sources.'

5. Calculate your Tax Liability

You must determine your tax liability after calculating your total income by applying the tax rates in effect for FY 2019-20 to your income slab. However, in comparison to the previous year, the income tax slabs and rates have stayed constant for FY 2019-20.

6. Compute Final Tax Payable(if any)

After you've calculated your tax burden in the previous step, deduct the taxes you've already paid during the year through TCS, TDS, and Advance Tax. Then, add interest, if any, due under sections 234A, 234B, and 234C.

Further, Individuals who owe additional taxes can pay them in person with a check or online with challan ITNS 280. Moreover, payment of self-assessment tax is income tax paid after March 15 of the financial year for which a return must be submitted.

In addition, within 2-3 working days from the date of payment, it should appear on your Form 26AS. Make sure to double-check. However, as the rush to deposit self-assessment tax intensifies toward the close of the financial year, this time frame may be extended.

7. File your Income Tax Returns once you pay all your taxes

You can begin the process of filing your ITR once you have paid any taxes that were due. However, if you wish to claim a refund from the IRS, you must first file your ITR.

As a result, even if you are not obligated to do so by law, you will have to file your ITR. If you're filing an ITR, then make sure you're using the correct ITR form. If you file your ITR on the inaccurate form. Then, it will be considered a faulty return, and you will have to resubmit it.

Every assessment year, the income tax department sends out ITR forms. The assessment year is the year that follows the financial year during which the return is due. The assessment year for FY 2019-20 is 2020-21.

You can easily file your ITR by downloading utilities such as Excel or Java. However, taxpayers who are entitled to file Forms ITR-1 and ITR-4 can do so online without having to download any software.

Moreover, if you are eligible to file an ITR-1, then you can use the 'Prepare and submit online' option. In this way, you can avoid having to download the Excel software.

8. ITR Verification

Verification is the final stage in the ITR filing procedure. Also, you may check your ITR in six different ways. There are five electrical methods and one physical verification method.

Moreover, you will not be required to provide any documentation to the tax department if you want to check your tax return electronically.

However, if you want to physically check your return, send a duly signed copy of your ITR-V/Acknowledgement to 'CPC, Post Box no. 1, Electronic City Post Office, Bangalore- 560100, Karnataka, India.'

Remember that you have 120 days to check your ITR after filing it. However, if you don't verify your ITR, it'll be assumed that you didn't file one. In addition, you can submit a request to your assessing officer if you neglect to validate your ITR before the deadline.

9. E-Verification

If you choose an electronic way to validate your ITR, you will instantly receive confirmation from the tax department. It will further provide the information that your ITR has been verified.

Moreover, if you send your ITR-V to the I-T department by mail, then you will receive an email. It will confirm that your ITR-V was received by the I-T department and that your return has been confirmed.

Note that you will receive the confirmation at your registered email address. Therefore, make sure to provide a relevant email address to the Income Tax Department e-filing website.

10. Processing of Tax Returns

The income tax department will begin processing your efiling income tax return when it has been checked. Moreover, it can be checked either electronically or physically, to confirm that all of the information you provided is correct as per the Income Tax Act, and to cross-check the information you provided with other data.

Further, when the return is processed, the I-T department sends you an email to your registered email address. In case, any differences are discovered, you may be asked to provide more information or remedy any errors made when filing the initial ITR.

Advantages of e-Filing Income Tax Return

Certain activities benefit greatly from the filing of income tax returns. Moreover, those who file income tax returns find it simple at every step of the way, whether it's qualifying for a loan, traveling overseas, or coping with financial losses.

Following is the list of benefits of efiling Income Tax Returns. It includes:

Credit card

You will grab certain benefits of a credit card. Also, credit card providers want to know if the credit card application will be able to repay the debt. In addition, the income tax return is a document that details a person's earnings. You might not be able to receive a larger credit limit if you don't have your tax returns.

Loans

Banks will require you to provide tax returns for the previous several years as part of the documentation for any loan. Further, the returns will be used to figure out where you stand financially. Your application may be rejected if you do not have any returns.

Refund

Tax Deducted at Source (TDAS) deducts a portion of a taxpayer's income, whether they are salaried or self-employed (TDS). However, if you have made investments that are tax-deductible. Then, your real tax dues as determined by your income tax bracket may be significantly lower than what you have previously paid. Only if you file your taxes can you claim and get a refund for the extra tax you paid.

Loss adjustment

An individual can carry forward losses to offset future taxable income under current tax legislation. Moreover, this can be repeated for up to eight years in a row. In addition, you can use your income tax returns to create a case and carry forward/adjust your losses against future taxable income if you have them.

Visa

Most countries require a visa for international travel. Note that: As an Indian citizen, you must have filed your tax returns within the last several years in order to obtain your visa. These returns must be shown to officials from the embassy or consulate of the destination country.

Terms and Conditions of e-filing Income Tax Returns

Following are the charts of the Income Tax slab for the financial year 2020-2021, for regular citizens, for senior citizens, for super senior citizens, and for domestic companies. Check out:

For Regular Citizens

For Senior Citizens

For Super Senior Citizens

Domestic Companies

Note that: According to the latest income tax rules, regular citizens having a net tax taxable income of up to Rs. 5 lakh are eligible for a complete refund of up to Rs. 12,500 under Section 87A, effectively eliminating their tax liability.

Income Tax Forms

The Income Tax Department's approved forms are known as income tax forms. Furthermore, these are the ones that taxpayers utilize to provide information about their earned income and taxes paid for that fiscal year.

Moreover, there are seven different forms in total, each of which corresponds to a particular group of taxpayers. Following is the chart for your reference. Check out:

Income Tax Returns FAQs

1. Is it mandatory for individuals to e-file?

Yes, it is mandatory for individuals.

2. Register for e-file Income Tax Returns

Follow these simple steps to register for e-filing Income Tax Returns. Check out:

- Visit the e-file Income Tax website by clicking on this link.

- Tap on the option ‘Register Yourself.’

- Choose the user type.

- Input the important credentials such as first name, surname, date of birth, and PAN number.

- Complete the registration form.

- Verify using the OTP received on your registered mobile number and email address.

3. Can I correct my e-file Income Tax Return Online?

Yes, you can correct your Income Tax Return by filing a revised return.

4. Who can file the ITR via the offline method (physical documents)?

Only certain categories of people are allowed. It includes those who are over the age of 80 at any time during the year and those whose yearly income is less than Rs. 5 lakhs and is not claiming any government rebate, are allowed to file their returns through offline methods.

5. How can I e-verify a return?

Follow these mentioned steps to e-verify your return. It includes:

- Visit and log in to the e-file Income Tax Return website.

- Go to the ‘My Account’ tab and choose the ‘E-Verify’ option.

- Then, the e-verify option will pop up.

- E-verification can be implemented via four methods as described in the window.

- Further, Choose the desired option. Then, OTP will be generated.

- Input the OTP sent to you on your phone number and email address.

- Your e-file Income Tax Return is successfully verified.

Note that: If you are unable to e-verify using the four methods provided, you must send a signed copy of your ITR to CPC Bangalore.

6. If my annual salary is Rs 50 Lacs, which form do I need to fill?

ITR 2 is the annual return form that must be filed if the taxpayer's annual income is equal to or exceeds Rs. 50 lakhs. Consequently, the individual then becomes ineligible to submit ITR 1.

Moreover, the taxpayer must also reveal the specifics of the owned assets. In the Schedule AL of the ITR form, assets and liabilities must be listed.

7. Enrollment of Aadhar Card Number in ITR?

You will find a separate section to mention the 28 digits Aadhar card enrollment number in the ITR. Further, input your 14-digits Aadhar card number. Next, enter the date.

8. Consequences of not filing the ITR?

In case, the returns do not get filed on or before the due dates, a penalty of Rs. 5,000 is imposed under section 234F. Moreover, if the taxpayer's yearly income is less than or equal to Rs. 5 Lacs, the penalty amount will not exceed Rs. 1000.

In addition, if the taxpayer has an annual income of more than Rs 5 lacs and files his returns after the 31st of December, a penalty of Rs 10,000 is imposed under section 234F.

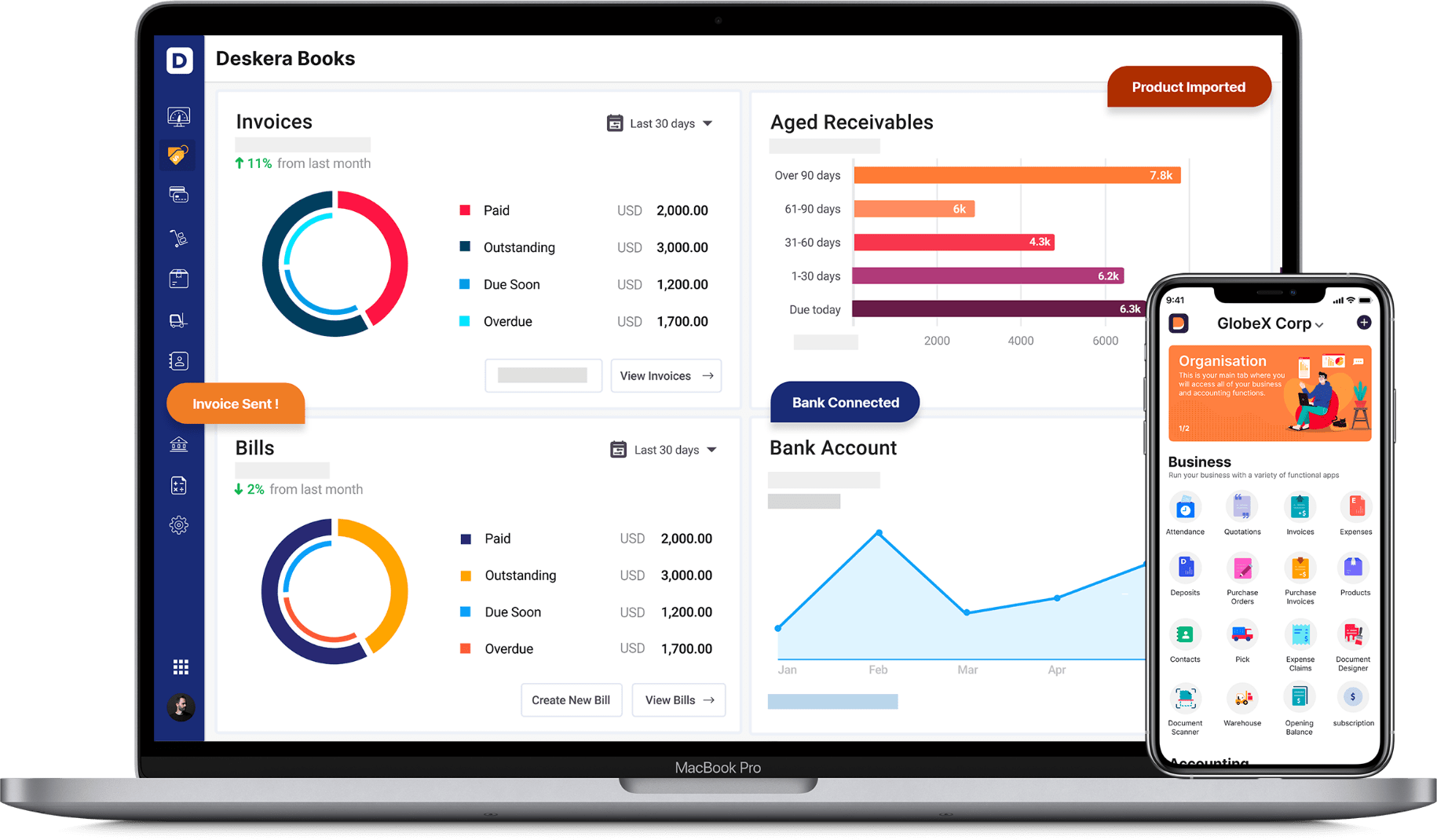

How can Deskera help you in your business?

Want to manage your finances and budgets? Look no further than Deskera. Whether it is invoicing, inventory, CRM, accounting, or HR & payroll, as a business owner you need to manage thousands of things. This is where Deskera Books can help you.

Deskera works on a cloud-based business model to make business functioning a smooth process. It reduces the admin time while enhancing efficiency.

Deskera helps you manage tangible and intangible assets and keep your books in order with ease. Your company can benefit from accounting software that tracks journal entries, balance sheets, inventories, and production costs. An efficient financing system that meets the business's unique needs is crucial to its success.

With Deskera Books, you can automate journal entry creation so that you can save time. For each sale and purchase transaction, a double-entry record will be automatically generated in terms of debits and credits. As part of the Deskera system, the ledger accounts consolidate all transaction data. The corresponding financial reports will be generated based on their values.

You can get ready-made financial reports in just a few minutes with Deskera, including Profit and Loss Statements, Balance Sheets, and more. With Deskera, you can benefit from an all-in-one tool for generating leads for your business, managing customers, and generating revenue.

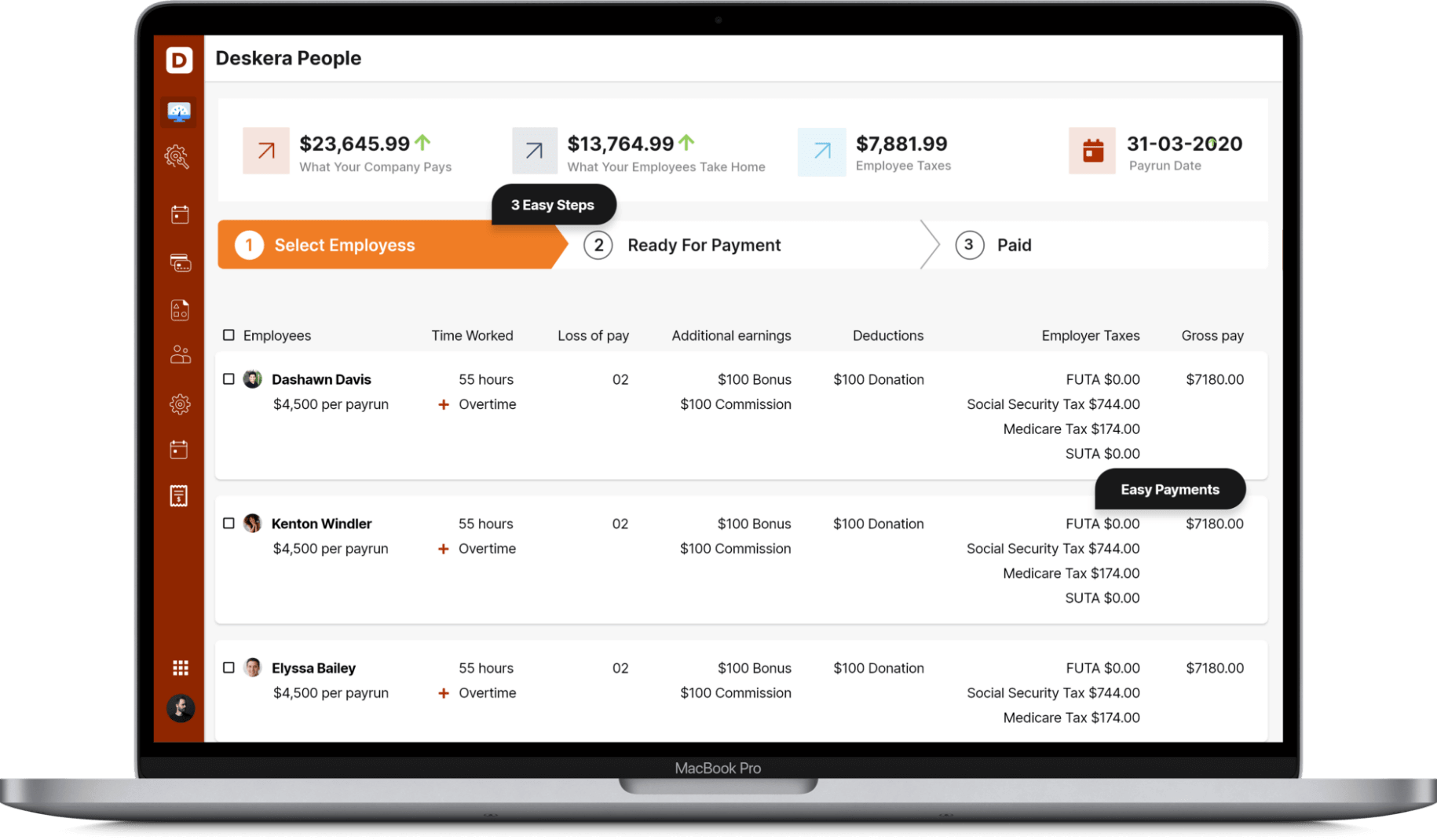

Deskera HRMS is all in one; it has many functions that will come in handy. Some areas are common as other HRMS and some that you have probably never heard of but can do wonders for your company.

To start with, you have excellent payroll software that will ease out the payroll process of your company. And the best part of the Deskera HRMS is you can do it in just three steps. Simply add employees to the system, select the amount to be paid, and pay them off.

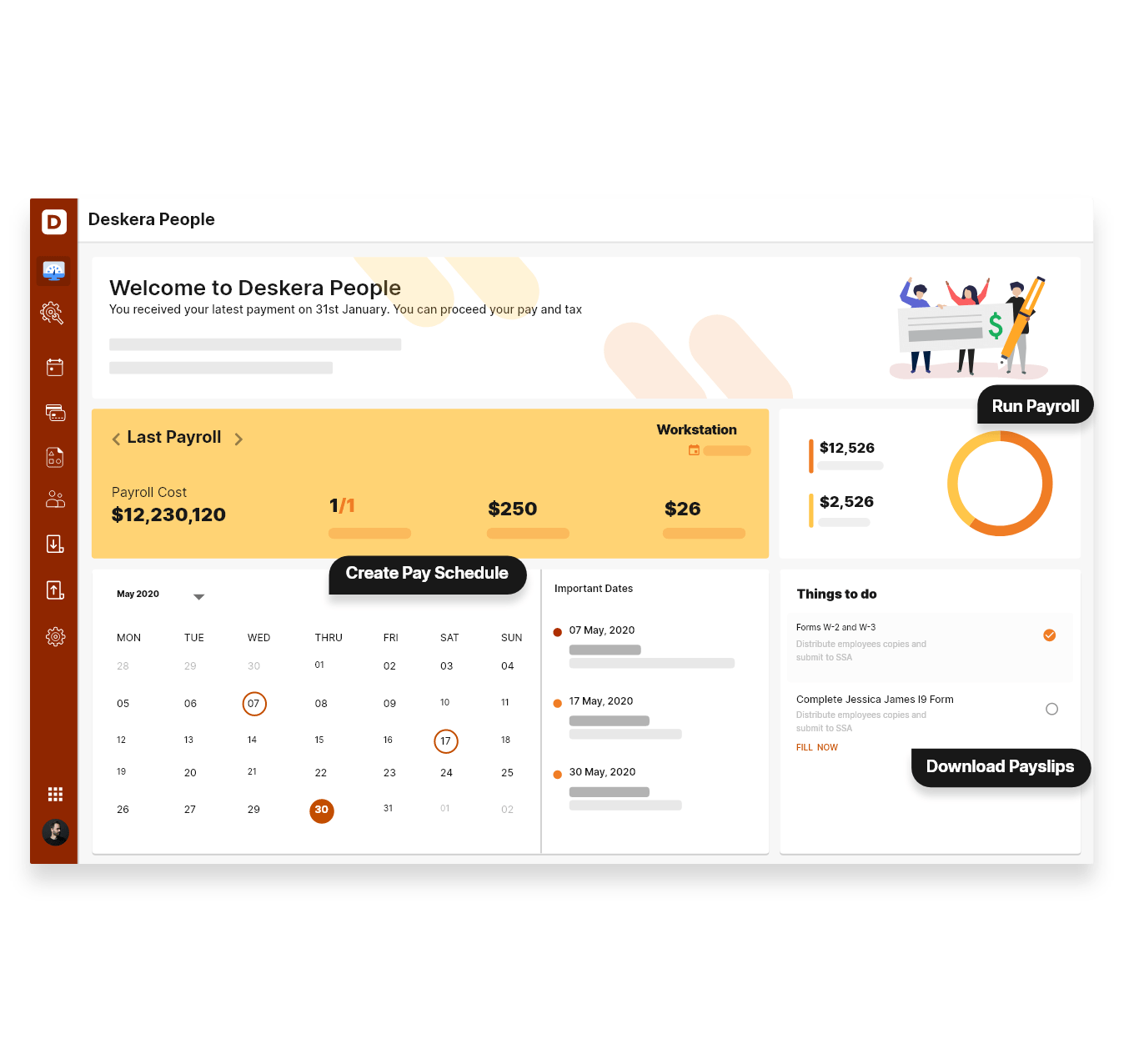

Secondly, all you need to do is access one dashboard, and you have all your employee information aligned together. The People Dashboard depicts all the pertinent information like the cost of the previous pay run and estimates of the upcoming one.

It also illustrates the year-to-date cost in a graphical interface. The calendar embedded in the Dashboard helps you identify the upcoming pay run dates for you to take action.

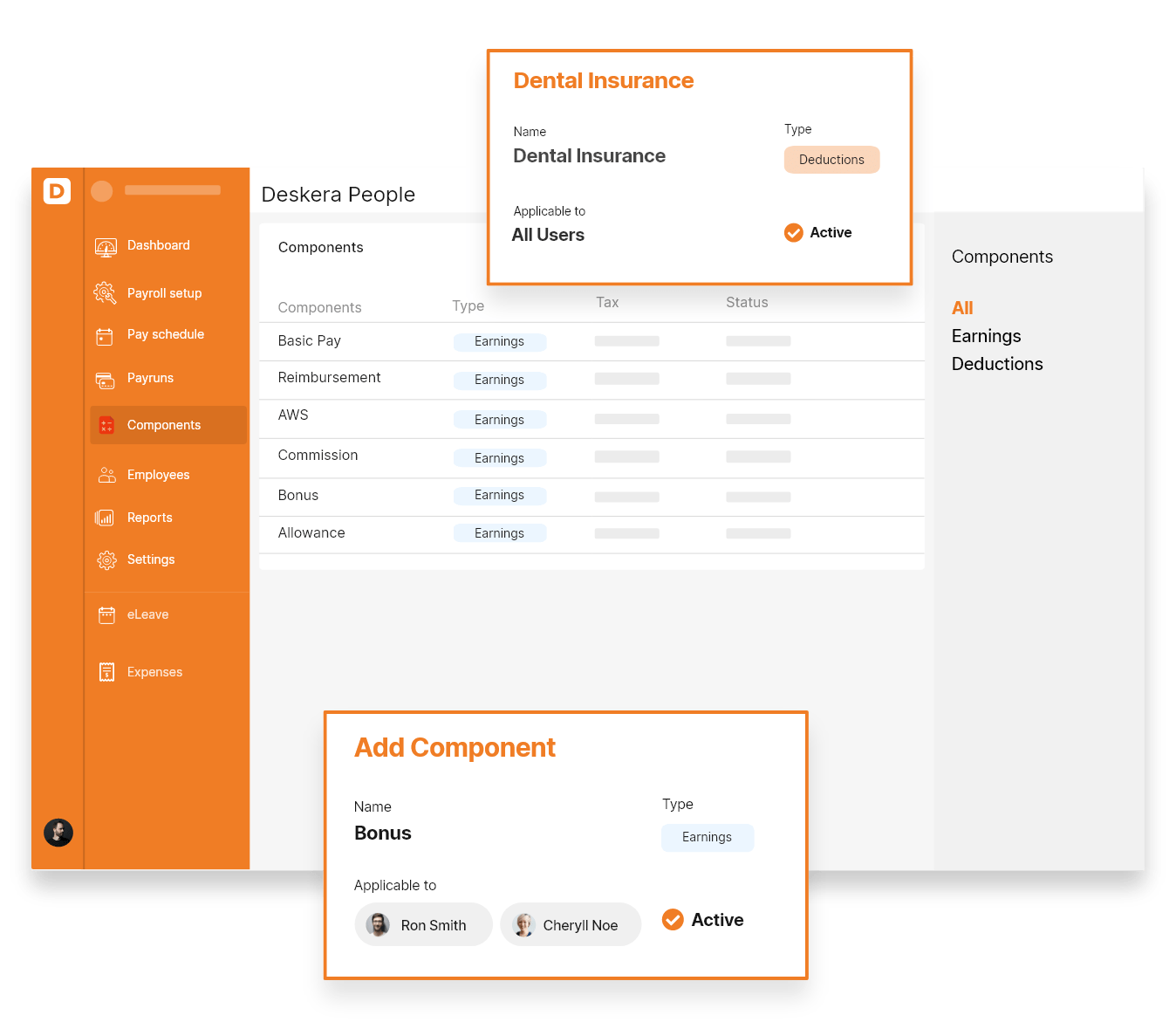

With Deskera, you can also add and deduct salary components easily without much hassle. Simply set up employee bonuses, voluntary deductions, taxes, and so on.

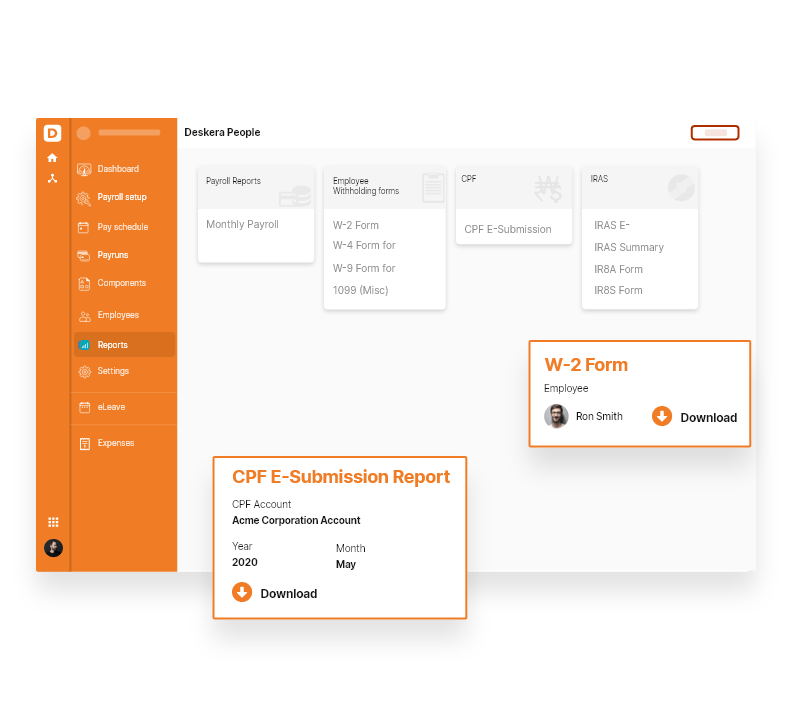

Deskera also develops extensive reports on your payroll, taxations, and all you need to know about your company. As a result, you are always prepared for any inspections taking place or if you have to go through any specific information.

Final Takeaways

E-file Income Tax Returns— definitely is a vast concept. And, we hope this guide helped to understand and learn all aspects of e-file Income Tax returns effectively.

Now as we have reached the end of this detailed guide. We have summarised all the important elements for your reference. Let’s learn:

- e-file Income Tax returns via online mode is quite simple and quick.

- There are three methods involved to do e-filing — Digital Signature Certificate (DSC), Verifying Aadhar Number, and Mailing ITR-V form.

- Step-to-Step guide that assists you to file your Income Tax Returns: Collect your all Documents, Form 26AS Download, Check Errors, Calculate the total income for the fiscal year, Calculate your Tax Liability, Compute Final Tax Payable(if any), File your Income Tax Returns once you pay all your taxes, ITR Verification, E-Verification, Processing of Tax Returns.

- Benefits of e-filing Income Tax Returns— Credit card, Loans, Refund, Loss Adjustment, Visa.

- Regular citizens having a net tax taxable income of up to Rs. 5 lakh are eligible for a complete refund of up to Rs. 12,500 under Section 87A.

- The Income Tax Department's approved forms are known as income tax forms. It includes— ITR 1(SAHAJ), ITR 2, ITR 3, ITR 4 (SUGAM), ITR 5, ITR 6, ITR 7.

Related Articles