Individual taxpayers have the option to choose between two tax regimes from the financial year (FY) 2020-2021. It includes— old tax or existing regime and the new tax or concessional regime.

If individuals are choosing the old tax regime, then they can continue with existing tax exemptions. It further includes leaving travel allowance, health rent allowance, and other deductions under certain sections of the Income-tax Act.

On the contrary, choosing for the new tax regime will have to relinquish the majority of tax exemptions and deductions under the old regime.

In addition, note that the old tax regime has three tax slabs and higher tax rates. However, the new tax regime includes six tax slabs and lower tax rates.

With the introduction of the new regime, you may get baffled. Hence, we are here to make things smoother for you. In this complete guide, we’ll cover:

- Income Tax Slab

- Distinct kinds of Taxable Incomes in India

- Income Tax Eligibility

- Example of Tax Payable under New Tax Regime

- Income Tax Slabs & Rates (FY 2021-22)

- Income Tax Slab for Individuals Under 60 years

- Income Tax Slab Rates Between 60-80 years

- Income Tax Slab Rate for Individuals Above 80 years

- Non-Resident Individuals (NRI) Income Tax Slab Rates

- Income Tax Slab for AOP, BOI, Artificial Juridical Person

- Income Tax Slab for Co-operative Society

- Income Tax Slab for Hindu Undivided Family (HUF)

- Income Tax Slab for Indian Companies

- Income Tax Slab for Foreign Companies

- Using E-calculator to Compare Tax Under old and new tax regimes

- Essential Factors about Income Tax rates in India

- Important Points to Save Income tax

- Income Tax Slabs in India FAQs

Without any further ado, let’s start!

Income Tax Slab

Income tax defines a tax amount that has to be paid by individuals groups, or entities. Generally, it depends upon their income or revenue during a financial year. Moreover, the income could be— actual, notional, or both.

In addition, the Indian Government decides the rate of income and relies on the union budget 2021.

We have a progressive system of taxation in India. It simply means— higher the income, the higher the payable tax. Moreover, the income tax is dependent on a slab system defined by the Tax Department.

Note that various tax incentives are also added for that category who needs to pay long-term dues. Further, the money put into various tax-saving methods is subsequently deducted from gross income. And, it also aids in lowering the amount of income tax due, which benefits the taxpayers.

Remember that the income tax brackets tend to fluctuate over time, always taking inflation into account.

Aside from that, the government assures that lower-income individuals receive an income tax rebate. Although, the fundamental goal of the income slab is to ensure that the country's tax arrangements are both progressive and equitable.

Note:

The gross tax revenue has increased by nearly 5% from 2019-20, according to the union budget for the year 2021-22. As a result, borrowings are likely to grow by 27% in FY 2019-20 compared to FY 2019-20.

Also Note:

Individuals' income tax return (ITR) filing date has already been extended to September 30, 2021, from the previous deadline of July 31, 2021.

Distinct kinds of Taxable Incomes in India

Following is the list of different kinds of taxable incomes in India. Let’s check:

1. Pension or Salary

This category of taxes typically includes a person's base income, taxable allowances, perquisites, and even any profit earned from their wage. Furthermore, it also means that a person's retirement pension is taxed using the income tax system.

Eventually, then income from pay and pension is then added to the taxable income calculation.

2. Businesses

This tax is usually derived from the presumed and even substantial income generated by a business or profession. Moreover, this could be used as a full charge or as a side and personal note. It is still included in the taxable income.

However, it is only done when the deductions that have been authorized have been adjusted.

3. House Property

Individuals often find that having multiple housing properties. And, renting them out is a simple method to supplement their income. However, the property's ownership remains in the hands of the original owner at the time.

Furthermore, based on this approach, the owner has assessed an income tax depending on the amount of rent received. So, any net income or loss made as a result of this will be added to or deducted from the income generated by the other properties.

4. Capital Gain

These types of gains are typically generated via the selling of assets. Further, these assets include real estate, gold, mutual fund units, stocks, and other similar assets.

Furthermore, it will be categorized as long-term or short-term capital gain. However, it depends on the sort of asset, how long a person has owned it, and the earnings made on it.

Despite the fact that these gains are subject to income tax, they are not included in the taxable amount that will be assessed.

5. Lottery, Betting, etc.

Even so, these are nonetheless taxable on the basis of income tax and are added to a person's total income. They are taxed in their own right. Note that these forms of earnings fall into a different category, with a different tax rate that applies and is assessed against them.

Income Tax Eligibility

Paying Income tax levied depends on the person’s annual income and the Government of India can adjust as they see fit.

Furthermore, those with an annual income of roughly RS. 2.5 lakhs, on the other hand, are currently subject to a 0% income tax. Those with earnings of between Rs. 2.5 lakh and Rs. 5 lakh are subject to a 5% tax deduction.

In addition, this pattern continues as the income level advances. Further, with 20% levied on individuals earning between Rs. 5 lakhs and 30% assessed on those earning more than Rs. 10 lakhs yearly.

On the other hand, Health and education are taxed at 4% regardless of income level. However, people with incomes between Rs. 50 lakhs and Rs. 1 crore are subject to a 10% surcharge. Furthermore, those with an annual income of more than Rs. 1 crore are subject to a 15% tax surcharge.

Moreover, individuals with a total income of roughly Rs. 5 lakhs after certain deductions are eligible for a tax rebate of up to Rs. 12,500 under section 87A of the constitution.

However, if the taxable income exceeds Rs. 5 lakhs, the traditional method of tax computation will be used.

Example of Tax Payable under New Tax Regime

Here’s an example for your reference of payable tax under the New Tax Regime. Check out:

Income Tax Slabs & Rates (FY 2021-22)

Because of the crisis that the country faced in 2020, the central government decided not to modify the income slab for FY 2020-21 and instead carry it over to FY 2021-22.

However, there was an exception made for the new slab. Moreover, the exception applies to Senior persons over the age of 75. Those senior individuals who rely heavily on their pensions and other sources of income have been spared from filing tax returns. And, banks will deduct TDS (Tax Deducted at Source) automatically in their circumstances.

Income Tax Slabs and Rates in India (FY 2020-21 (AY 2021-22))

Individuals have been provided the option to decide from FY 2020-21 by Budget 2020. Moreover, they can either choose between the old regime or the new regime.

Following is the list of tax slabs for all categories. Check out:

Income Tax Slab for Individuals Under 60 years

Income Tax Slab Rates Between 60-80 years

For the fiscal year 2020-21 (AY 2021-22), resident senior citizens will be able to pick from a variety of income slabs.

Income Tax Slab Rate for Individuals Above 80 years

For the fiscal year 2020-21 (AY 2021-22), non-residents will be able to choose from a number of different income slabs.

Non-Resident Individuals (NRI) Income Tax Slab Rates

For the fiscal year 2020-21 (AY 2021-22), non-residents will be able to pick from a range of income slabs.

Income Tax Slab for BOI, AOP, Artificial Juridical Person

In comparison to last year, there has been no change in the income slabs limits for BOI, AOP, and Artificial Juridical Persons for FY 2020-21.

Income Tax Slab for Co-operative Society

For the fiscal year 2020-21 (AY 2021-22), the Co-operative Society will be able to pick from a number of different income slabs.

Income Tax Slab for Hindu Undivided Family (HUF)

For the fiscal year 2020-21 (AY 2021-22), the Hindu Undivided Family (HUF) will be able to pick from a number of income slabs.

Income Tax Slab for Indian Companies

Companies with gross receipts exceeding Rs. 400 crore.

The tax would be charged at 30% + 4% Cess + Surcharge at appropriate rates.

Companies with gross receipts of up to Rs. 400 crore

Taxed at a rate of 25% + 4% Cess + Surcharge at the appropriate rates.

Note: Domestic businesses have the option of paying tax at the following lower rates.

- Section 115BAA (domestic corporations) — a tax would be charged @ 22% + 4% cess + 10% Surcharge.

- Section 115BAB (Manufacturing companies) — a tax would be charged @ 15% + 4% cess + 10% Surcharge.

- As proposed in Budget 2020, a manufacturing producing company can now opt for Section 115BAB.

- In the case of these decreased rates, some exemptions and deductions, including MAT (Minimum Alternate Tax) rules, will not apply.

Income Tax Slab for Foreign Companies

- If royalties are received from the government or an Indian company, or if technical fees are paid in accordance with an arrangement recognized by the Central Government. Then, the tax will be imposed at 50% + 4% Cess + Surcharge at appropriate rates.

- Any other income tax would be imposed at a rate of 40% + 4% cess + appropriate surcharge.

Using E-calculator to Compare Tax Under old and new tax regimes

Follow these below-mentioned steps to compare and finalize which tax regime would work for you:

Step 1: Visit the Income Tax India E-Filing Website.

Step 2: Choose Age.

Step 3: Input Estimated Annual Income.

Step 4: Input Exemptions and Deductions.

Step 5: Tap on the ‘Compare’ button.

Step 6: See Results.

Once you have the results, then compare the figure to the Tax Payable under the Old Regime and the Tax Payable under the New Regime.

Interestingly, the tax benefit will also be displayed in the calculator. Eventually, make an informed decision by using the E-calculator as a reference.

Essential Factors about Income Tax rates in India

Here are some key factors to remember about India's income tax rates.

- Various tax rates apply to different people depending on their classification.

- The income tax rates are determined by the terms of the Income Tax Act.

- The tax brackets may or may not vary on a yearly basis.

- Make sure you pay your taxes. Also, timely file your tax returns.

- Keep a record of your investments.

Important Points to Save Income tax

Here are some suggestions to help you save money on your taxes.

- Invest in life insurance.

- Long-term fixed deposits are a good investment.

- Rent receipts must be submitted.

- The interest on a student loan is tax-deductible.

- Invest in health insurance.

- Invest in PPF, NPS, and NSC (Public Provident Fund, National Pension System, and National Savings Certificate).

Income Slabs in India FAQs

We have covered several FAQs to clear all your doubts. Let’s check:

1. Is a family pension considered salary income for tax purposes?

No, family pensions will be taxed as ‘income from other sources,’ not as salary income.

2. Is it true that income up to Rs.5 lakh is tax-free?

No, income up to Rs.5 lakh is not exempt from taxation. Further, individuals with an annual income of up to Rs.2.50 lakh, on the other hand, are exempt from paying tax.

3. Are there different slab rates for men and women?

No. Males and females have the same income slab rates.

4. If I work as an agriculturist, will my earnings be taxed?

Agricultural income is not subject to income tax. Non-agricultural income, on the other hand, would be taxable for an agriculturist.

5. Is it necessary for me to submit an Income Tax Return (ITR) if my annual income is less than 2.5 lakh rupees?

If your yearly income is less than Rs.2.5 lakh, then you do not need to submit an ITR. But you should file a ‘Nil Return' only for the record, as there are many situations where you can use it as proof of work.

6. Who is eligible for reimbursement under Section 87A?

Any resident Indian with a total annual income of less than Rs.5 lakh can claim a rebate under Section 87A. Moreover, the maximum rebate available under section 87A is Rs.12,500.

7. What time period is taken into account for income tax purposes?

In India, income tax is calculated on an annual basis. It is calculated for the fiscal year that begins on April 1st and ends on March 31st.

8. Is the tax return filing deadline the same for all taxpayers?

No. The deadline for filing an income tax return differs for each taxpayer. HUFs and Individuals who do not want to be audited have until July 31st to file their returns.

9. What is the classification of a taxpayer's income?

The taxpayer's income is classified under five different income heads under Section 14 of the Income Tax Act. It includes— salaries, individuals, and business income. Furthermore, gains in the capital, Gains/profits from a profession or business, income from a home, and other sources of income

10. Who sets the IT slab rates, and are they subject to change?

Yes, rates for IT slabs can be modified. If the IT slab rates change during the fiscal year, they are included in the budget for that year and presented to Parliament.

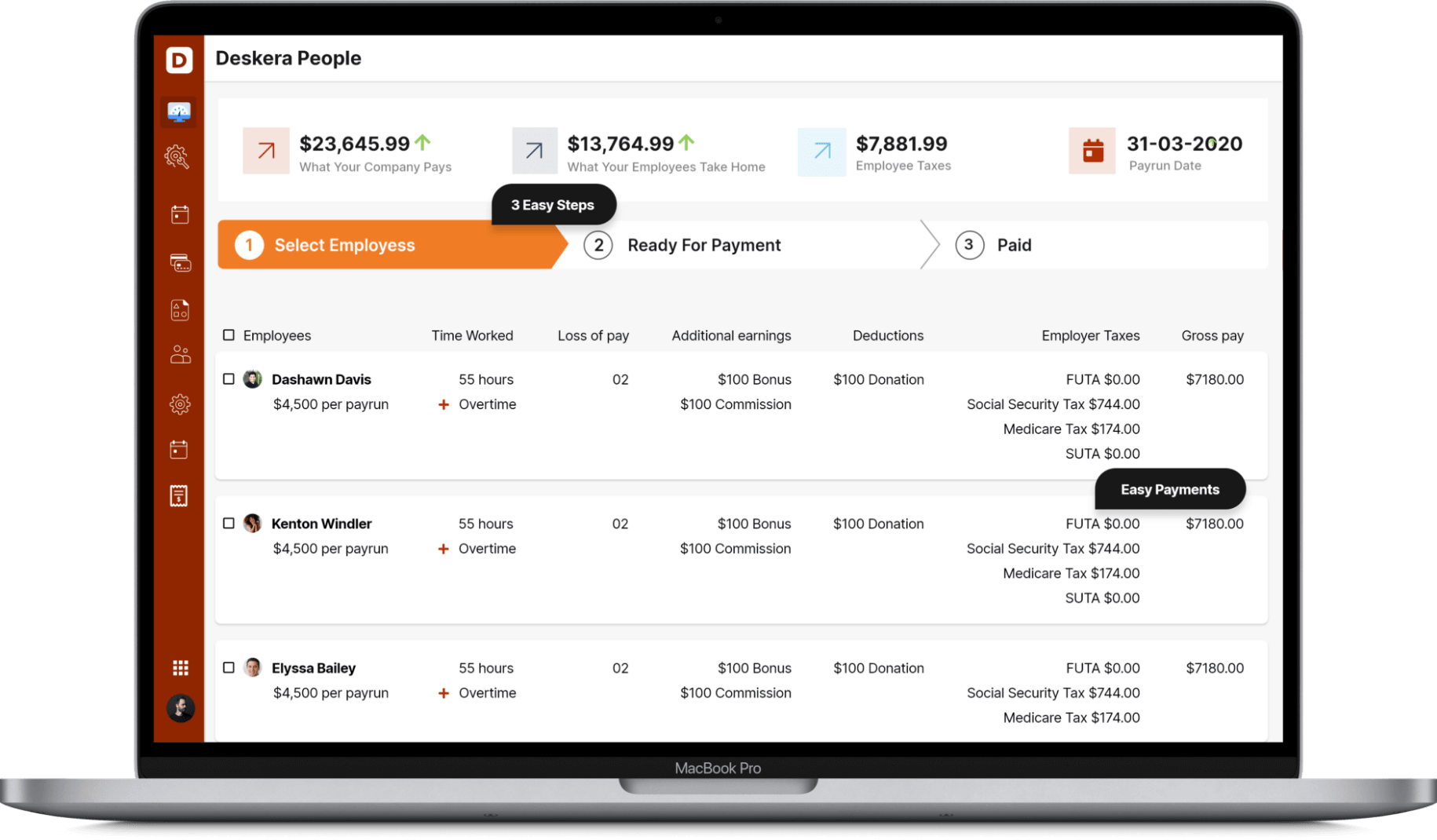

Manage Income Tax With Deskera People

Deskera People helps digitalize and automate HR processes like hiring, payroll, leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

A 15-day free trial will enable you to become familiar with the enterprise features. Deskera People provides you with an amazing HRMS system that helps you manage your employees from end to end. From managing payroll, employee onboarding, leave and attendance management, Deskera also helps you with salary management.

Employees can declare the investments that they have made and submit proofs for the same, and Deskera People will auto - calculate the Income Tax based on the type and amount of each investment. The main incentive for employees’ to declare their investments is that it reduces their net taxable income, thereby decreasing the amount they need to pay as Income Tax.

Once the IT Declarations are submitted by all the employees, the employers can view the status of these submission. Other than payroll management, Employee Provident Fund (EPF) and EPS contribution are also calculated in Deskera People

Key Takeaways

We have covered the important points of this detailed guide for your reference. Let’s learn:

- Income tax defines a tax amount that has to be paid by individuals, groups, or entities.

- Individual taxpayers have the option to choose between two tax regimes— the old tax or existing regime and the new tax or concessional regime.

- Higher the income, higher the payable tax

- The government assures that lower-income individuals receive an income tax rebate.

- List of different kinds of taxable incomes in India— Pension or Salary, Businesses, House Property, Capital gain, Lottery/Betting, etc.

- Senior persons over the age of 75 who rely heavily on their pensions and other sources of income have been spared from filing tax returns.

Related Articles

https://www.deskera.com/blog/online-tds-payment/

https://www.deskera.com/blog/itr2/

https://www.deskera.com/blog/itr3/

https://www.deskera.com/blog/itr1/