Searching for a simple way to run payroll and stay compliant with payroll taxes for the United States? You’ve come to the right place!

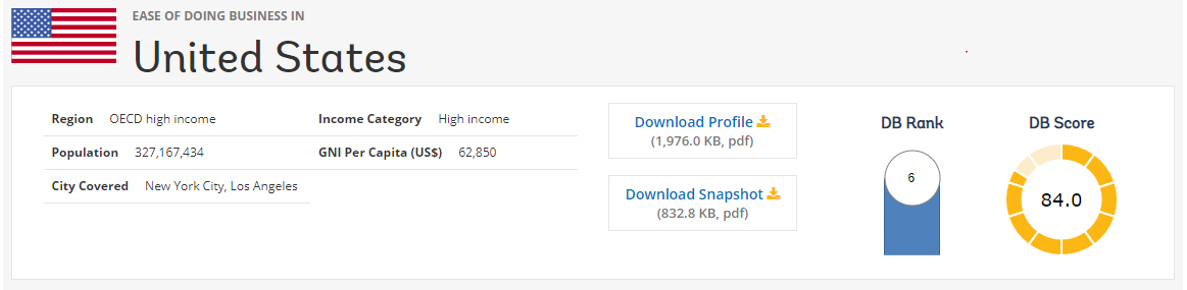

The United States is one of the largest economies in the world and is home to approximately 330 million people. For more than a century, it has been a leader in the global economy, and when the companies are looking to explore new markets, the United States(US) is usually at the top list.

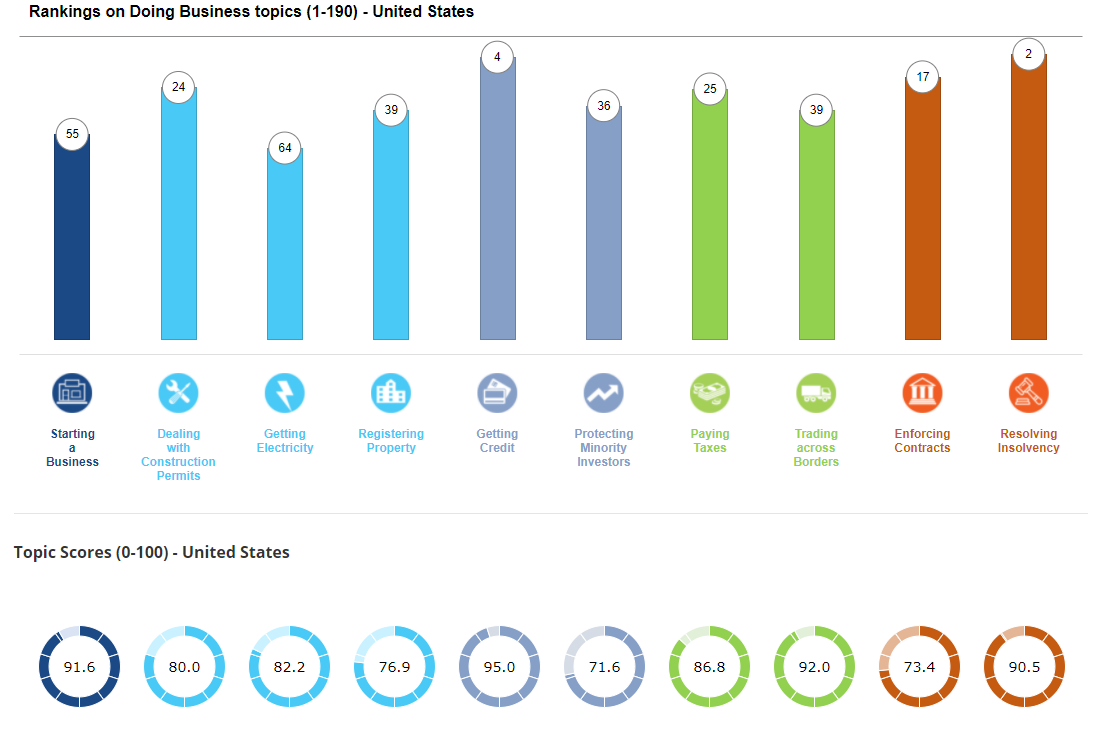

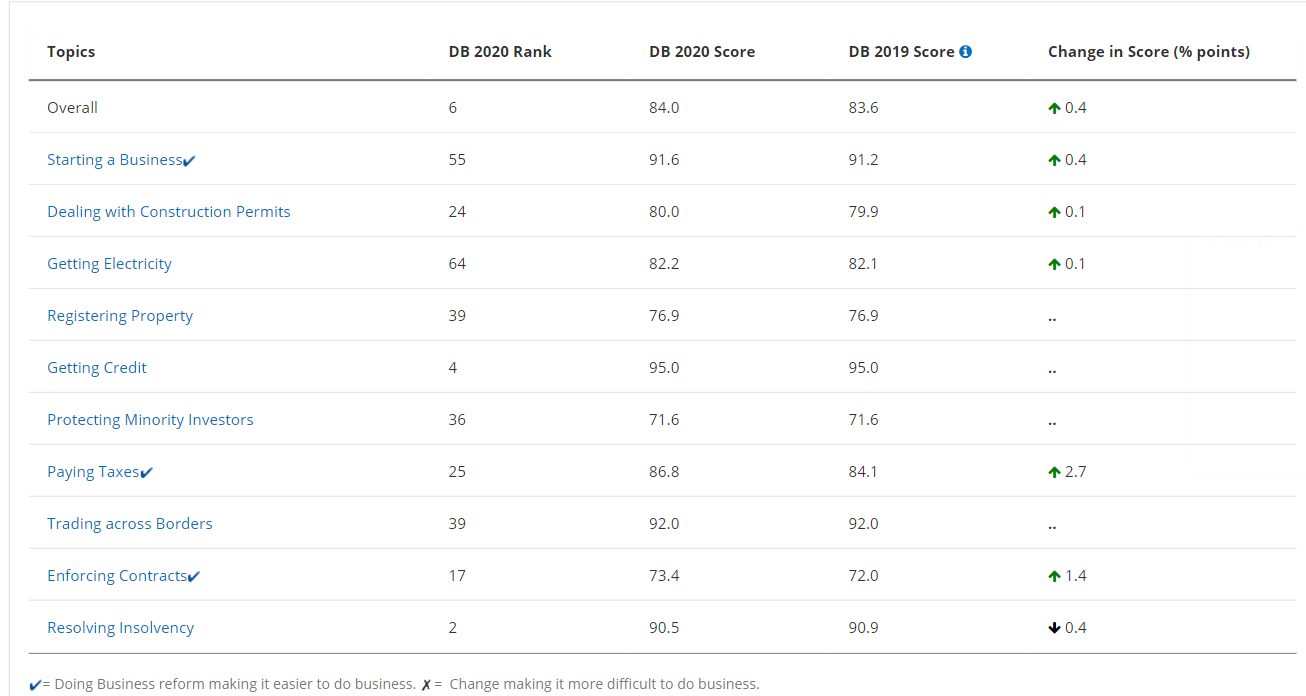

According to the World Bank, for starting a business the US ranks 55th in the world. However, to start a business, this process may differ by state and, sometimes even by city. All 50 states in the US have their own rules and regulations.

Determining which states of incorporation provide commercial or tax benefits can be challenging with lowering legal exposure for a particular industry or any business type.

However, due to the lack of state corporate income tax, states like Nevada and Wyoming are rising in popularity. Also, many businesses want to incorporate into the Delaware state because of various Delaware laws and courts protection offers.

Click here to see all reforms made by United States

Registering Your Business for Payroll in the United States

You need to do many things and make sure that you are covered, especially with the government, before starting a small business.

In many cases, most businesses that start will at least need one employee/contractor on your small business payroll. However, before you start paying your staff, you will need to do a few things to register your business with the government.

Employer Identification Number (EIN)

The very first step is to register for a Federal Employer Identification Number (FEIN/EIN).

Even if you don't have any staff, you need to do this step because this ID is used to identify a business entity separate from you. E.g., partnerships, corporations, etc.

Sole proprietors are the only people exempted from registering for an EIN who have no employees. However, they will have to get an EIN if they have paid any excise or payroll taxes.

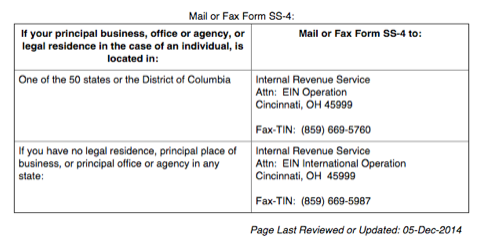

Applying for an EIN is very easy and you can do it all online by completing the IRS form SS-4. It is the most preferred method used for applying for EIN. To complete the form, you need to make sure you have a Tax Identification Number in hand.

As this is a free service provided by the IRS, you can complete your application online or send it in by fax/mail.

Registering Your Business for Payroll with Your State

Suppose your business is structured as a corporation, sole proprietorship, or a Limited Liability Corporation(LLC). In that case, your business needs to be registered with your specific state to secure any business permits or licenses to run your business.

For any state you are doing a business in, you need to register it, whether in a physical location or where your employee works.

Usually, there are two-state registration agency you need to complete-

i. Your state Department of Revenue

The Department of Revenue will allow your registration, not only for your taxes but also for sales and use taxes.

ii. Your state Department of Labor

The Department of Labor will allow your registration to cover your obligation for SUI - State Unemployment Insurance coverage.

Most of the time, you will register your business in the state that it operates. Still, suppose you run an internet-based company or some other kind of business that doesn’t have a brick-and-mortar location. In this case, you have the option to register your business in states like Wyoming, Nevada, Delaware.

It is not the solution for all small businesses as you will need to pay state taxes if you reside there or run your business in that state.

Click here to find information on doing business in your state, for a complete list of state government websites,

With Deskera People, as a business owner you can fill in your tax details such as FEIN, Business type, Federal Filer Type, and Federal Deposit Schedule.

The Electronic Federal Tax Payment System (EFTPS)

If your accountant or payroll provider manages all your tax payments for your business, then it is always good to enroll your company in this system(EFTPS), which will help keep track of all your filings. With your provider, you also need to check and understand what tax payments are being handled directly.

Online EFTPS

The Different Types of Work Permits in the United States

With the world's largest economy, the United States has largely driven the increase in immigrants. Several different visas are required for foreigners who wish to come to the U.S. for work purposes. Further, we will explore the most common work visas and eligibility criteria for each in the U.S. Following are the most common U.S. work visa types,

Below are the most common types of U.S. work visas:

- Temporary Non-Immigrant Visa

- Permanent (Immigrant) Workers

- Student and Exchange Visitors

- Temporary Visit for Business

Temporary Non-Immigrant Visa

For people looking to work in the United States for a fixed, these visas are issued. Before coming to the U.S., an employer often files a petition for this visa type with U.S. Citizenship and Immigration Services(USCIS). Also, the employee will still need to apply for a visa.

On the USCIS website, under this qualification, you can find many different categories of workers. Before coming to the U.S., spouses and family of holders of these visas will need to file for their own visas.

Listed below are the most common type of non-immigrant work visas:

Permanent (Immigrant) Workers

Approximately 140,000 employment-based green cards are available each year to those with the right job skills, and their children and spouses can apply for these jobs.

With the right combination of education, expertise, eligibility, and skill set, permanent residents in the U.S. can be obtained.

Most of these visas will call for an existing offer of employment from an employer who has the U.S. Department of Labor Certification—verifying that inadequate workers with this skill set within the United States will make sure that the hiring does not take the job away from the U.S. citizens.

Following are the five types of employment-based visas:

Student and Exchange Visitors

There are three types of students covered in this visa: academic students, vocational students, and those who have enrolled in cultural exchange or educational programs. These are not immigrant types of visas.

Temporary Visit for Business

For short-term business purposes, these visas are issued. People who can travel under these visas are, if a person, for example, is negotiating a contract, attending a convention, or settling an estate.

Federal, State, and Local Minimum Wage Law in the U.S.

The lowest amount you pay an employee per hour of work is known as a minimum wage. But, of course, if you want to, you can pay more than the minimum wage, however you cannot pay less than the stated minimum wage.

You might have various federal, state, and local minimum wage rates as per your business location. To make sure that your business is compliant with labor laws, let see more in detail below

Who Sets the Minimum Wage?

In the United States, the federal government sets a standard minimum wage that will apply to all employees. However, the state and locals can set their own minimum wage rates.

Federal Minimum Wage VS. State VS. Local

What will happen if the state's minimum wage is less than the federal minimum wage? And, also what if the local minimum wage is lower than the federal minimum wage?

If your state/local minimum were less than the federal minimum wage, you would need to pay your employees at least per the federal minimum wage rate.

What will happen if the state/local minimum wage is higher? If the minimum wage for state/local is higher than the federal rate, you need to pay your employees rate as per state/local, whichever is higher.

Pro tip: When choosing between federal, state, and local minimum wage law, always pay your employees the highest rate

What Is the Federal Minimum Wage?

The U.S. Department of Labor enforces the federal minimum wage and is regulated by the Fair Labor Standards Act (FLSA).

Since 2009, the federal minimum wage rate has not changed. So what is the federal minimum wage rate? The federal minimum wage rate is $7.25 per hour. However, in the upcoming years, the federal minimum wage could potentially increase under the administration of Biden.

Minimum Wage by State

Each state in the United States can set its minimum wage. If the state's minimum wage is more than the federal minimum wage rate, you will need to pay employees at least as per the state's minimum wage.

For example, if in Ohio, the minimum rate is $8.80 per hour, and if you have employees in Ohio, you will need to pay them at least the minimum wage as per state since it is more than the federal minimum wage of $7.25.

Below map will show which state follows the federal minimum wage rate and sets their own minimum wage rates.

You must want to know how much the minimum wage is in your state. Listed below is the state-by-state-wise minimum wage rate chart. Just keep in mind that the states with $7.25 will follow the federal wage base.

State minimum wages as of Jan, 2021

Local Minimum Wage

Some cities in the United States create a local minimum wage. In bigger cities, local wages are very common. If your city's minimum wage rate is higher than the state & federal minimum wage, you will need to pay your employees as per the local minimum wage rate.

For example, if the minimum wage rate in San Francisco is $16.07 per hour, then the employers in San Francisco will need to pay their employees as per the local base wage rate as it is greater than the state and federal minimums.

Local minimum wages as of Jan, 2021

How Do I Set Up Payroll for the First Time in the United States?

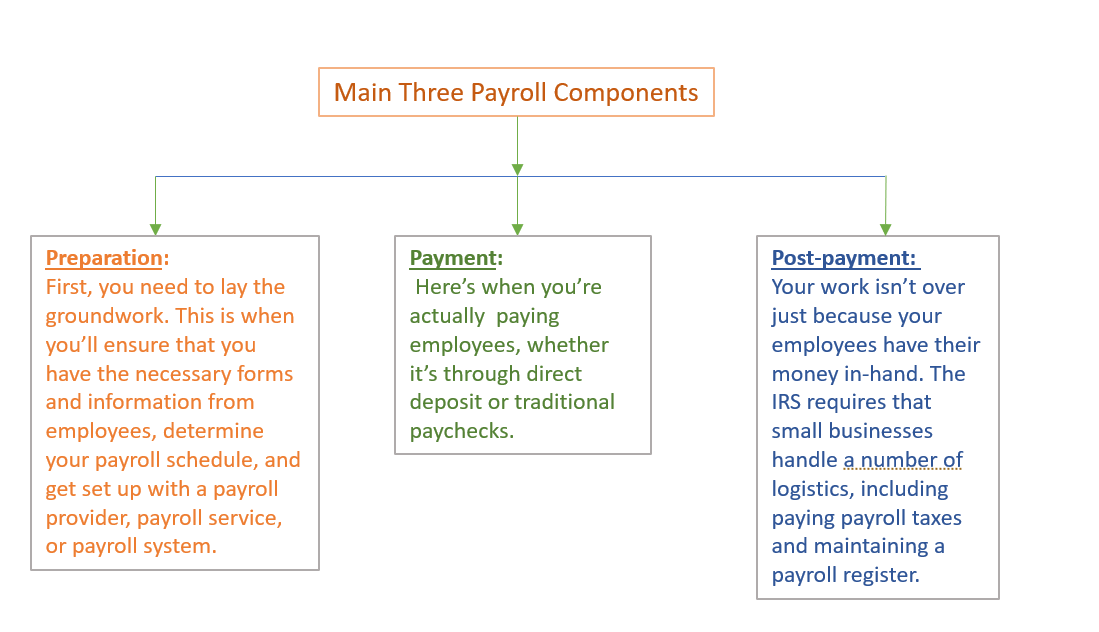

You might be overwhelmed if you are running payroll for the first time. There are a lot of new processes and terms to learn. You will have to learn how to set up payroll, gather employee information, run payroll and pay and file various taxes promptly.

To help you understand the payroll basics, this article breaks down all the steps you will need to take, and you will be able to set to run the payroll on your own

That's the basis of how to do payroll. So, with that broad context in mind, let's get into more of the nitty-gritty details that you need to know.

What Do You Need to Run a Payroll?

It is easy to think that the payroll process begins when you pay out your employee's wages.

However, if you want to run your payroll correctly, many things need to happen before employees get the money in their bank accounts. It all begins when you start hiring new employees.

Before you can pay your employees' wages, the following are some tasks that you will need to take care of:

Decide on an Accounting and Payroll System

Trying to handle all your accounting tasks manually only adds to your stress.

Trying to handle all of your accounting tasks manually will only add to your stress. Instead, it's better to get accounting and payroll software in place proactively so that you can keep all critical information centralized and organized, to begin with.

Want a simple way to run payroll? Deskera People is a great option!

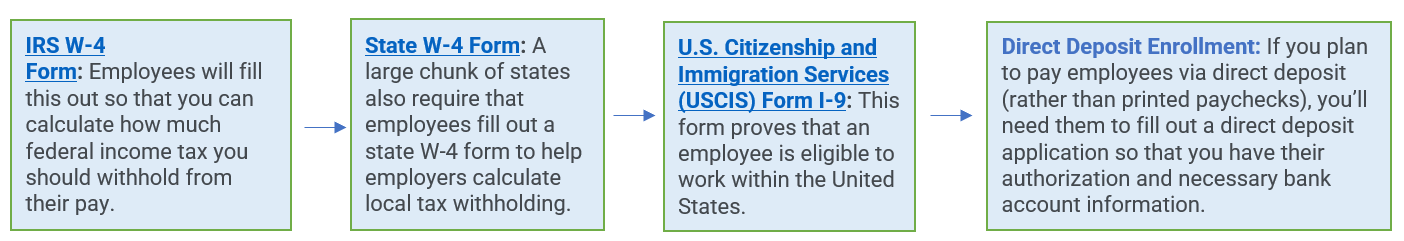

Gather the Required Information and Paperwork from Employees

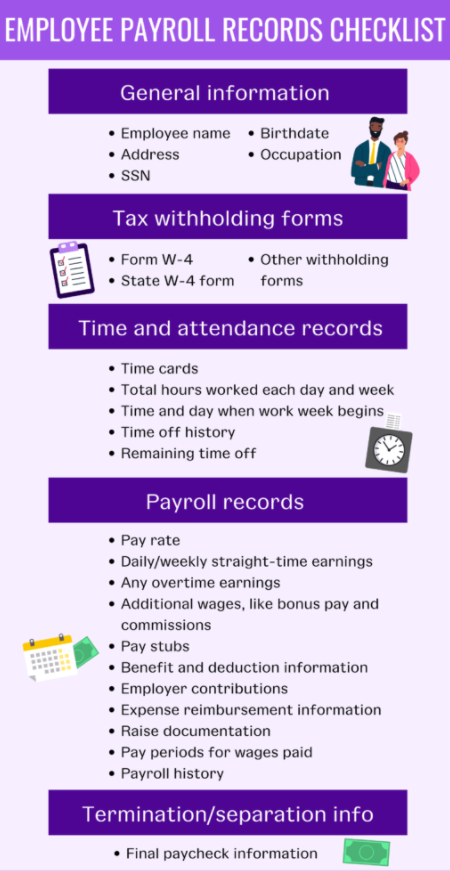

During the hiring process and when a new employee joins the team, you need to make sure that you gather the information needed from them. This includes,

Apart from the information mentioned above, you will also need to gather other information such as emergency contact number, benefits enrollment(health insurance, retirement, saving plans, etc.).

It is always good to create a simple checklist for yourself to make it easier to ensure that you get all these details right away with no delays.

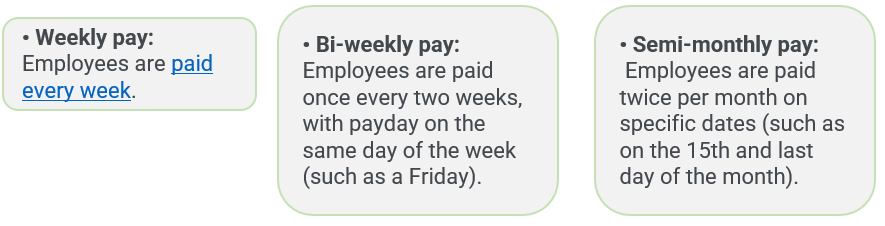

Determine Your Payroll Schedule

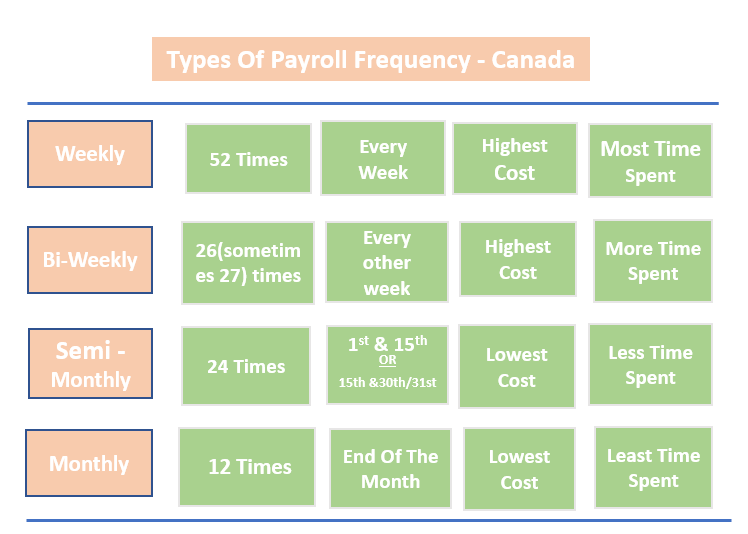

How often do you plan to payout your employees? Here you'll need to decide out your pay period, which is the recurring schedule you'll use to run payroll. Some of the most common options are:

However, you can always check if there are any compulsory payment frequencies within your state and confirm that you are complying with any laws about pay periods.

Establish a Payroll Bank Account

You might already have a business bank account set up. It is a significant first step. However, you might also need a separate bank account that you want to pay your employees.

It will help keep your payroll separate from any other business expenses and allow for easy and more accurate record-keeping.

Set Up Direct Deposit (if necessary)

Suppose you plan to offer direct deposit for employees. You will need to use the information that has been listed on their direct enrollment deposit form to get them to set their deposits through your accounting or payroll software.

How To Do Payroll in the U.S.: 5 Simple Steps to Follow

As you have already seen, what things are required to run a payroll for your small businesses. Now, after this, be ready to start paying your employees. Following are the simple steps covered for payroll processing,

Figure Out the Employee's Gross Pay

For each employee, you will start determining the gross pay. Gross pay is nothing but the total amount you owe them, without any withholdings/deductions.

So how do you calculate the gross wages of your employees? It all depends on whether your employee is an hourly or salaried employee.

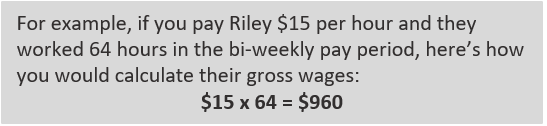

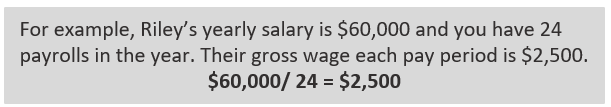

For hourly employees, you need to multiply the total hours they have worked during the pay period as per their hourly wages.

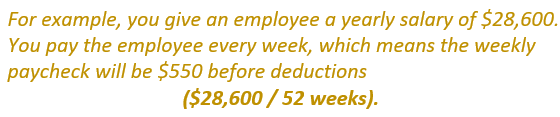

For salaried employees, you will need to divide employees total annual salary by the number of pay periods you have throughout the year

Gross wages will also include:

- Overtime pay

- Sick and vacation pay

- Bonuses

- Commissions

- Tips

If your employee has any of these during a pay period, you will need to add them to their base wages.

Calculate Withholding and Deductions

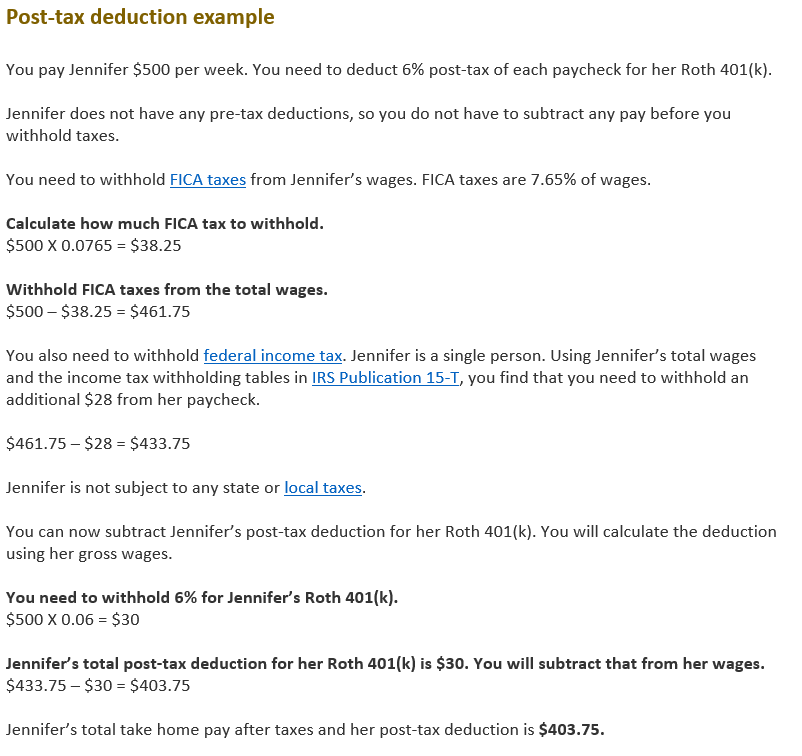

Employees don't get to collect their gross pay. From the employer side, there are many deductions that you will need to calculate, that includes federal, state, and local income taxes and payroll taxes.

Payroll tax is a larger bucket that consists of Social Security and Medicare taxes (FICA taxes), state unemployment taxes (SUTA) and federal unemployment taxes (FUTA).

So, whenever you hire a new employee, you must collect those required initial forms, as you will use this information and determine the withholding tax you need.

In addition, if employees contribute towards the retirement saving plan, health insurance, or any other benefits, that will also need to be deducted from the employee's paycheck.

Distribute Payments

In this step, now it is the time for your employees to get the money they owe. You will issue their paychecks or transfer direct deposits.

Make Payroll Tax Deposits

Once you have paid your employees, you will need to pay payroll tax to the IRS.

These deposits include the withheld amount from employees related to their federal income tax, the withheld amount from Social security and Medicare, and the amount you owe for Medicare Taxes and social security.

These payments are made semi-weekly or every month; that depends on your payroll size. By using the IRS' electronic filing system. it is relatively easy to file your payroll taxes.

Employers previously also used Form 8109. However, the IRS discontinued this in 2011, and all business owners need to make the federal tax deposits electronically.

In addition to that state's requirements, you will also need to make your state income tax deposit based.

Update Your Payroll Register

You need to keep correct payroll processing records for your payroll, and this is where your payroll register comes into the picture. It is a document that displays the following for each employee:

- Total gross pay

- Total and type of each deduction

- Total net pay

Are you ready to start using a payroll system? Try Deskera People online payroll software for small businesses in the U.S. It’s all in the cloud, meaning you don’t have to do updates. We guarantee accurate calculations, and we will even handle tax deposits and filing for you. You can test the software for free. Start your trial now!

What Are the Components of Payroll in the United States?

Let us see the breakdown of the U.S payroll components in detail such as

- employee information,

- hours worked,

- salaries and wages,

- deductions, and

- net and gross pay.

Employee Information

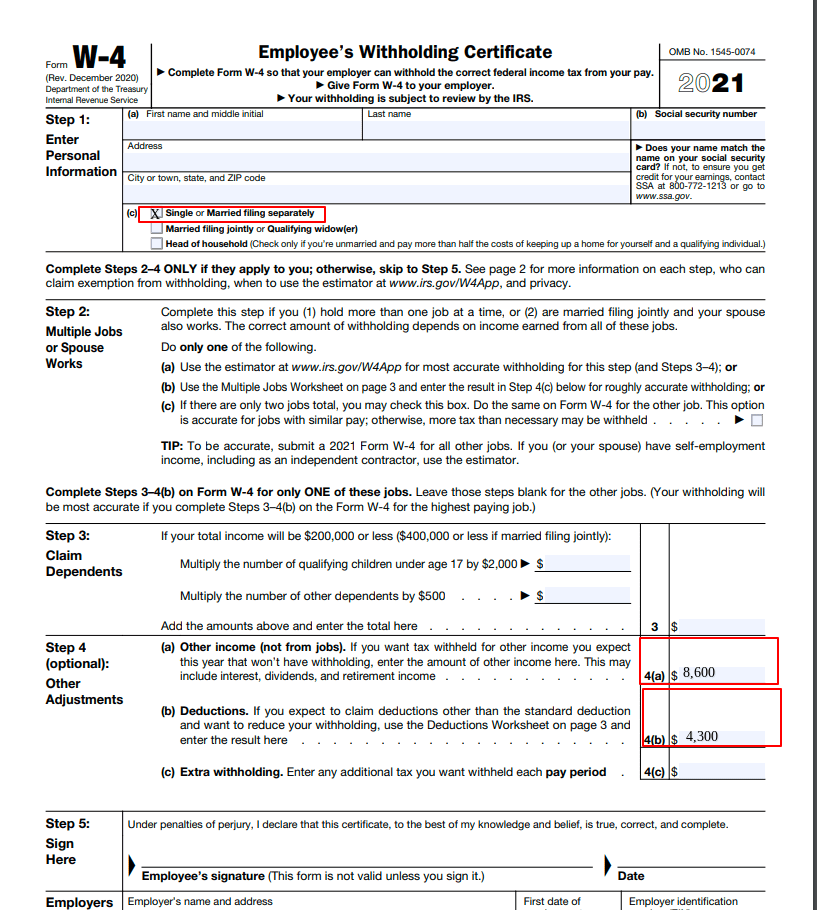

Before running payroll, you need to gather some information from your employees. Each employee will need to fill out Form W-4. This form helps provide the information regarding their federal income tax withholding and details such as an address, name, and SSN. This information is required to run payroll properly and distribute payroll.

Each time you hire a new employee, they will need to fill in form W-4.

Hours worked

If you have employees who work on an hourly basis, you need to keep track of the hours they work. It will make sure your employees are paid correctly and on time.

If you have employees on salary, you need to track the hours they work and make sure they have put in all of their time in work.

Salaries and Wages

A fixed amount that you can pay an employee is known as a salary. Generally, an employee is given a yearly salary divided by the total number of pay periods in that year.

A wage means an amount you pay your employees based on the hours worked. For each hourly employee, you will need to set a specific rate of pay. For calculation of the total employee wage, you will need to multiply the pay rate by the number of hours the employee works.

Overtime pay

All non-exempt employees must receive overtime pay. It will include both salary and hourly workers. Overtime hours will begin only after an employee will work 40 hours a week. Overtime pay is one and a half times the normal pay rate.

Complete List: 2021 Overtime Laws by State

Check your state overtime requirements.

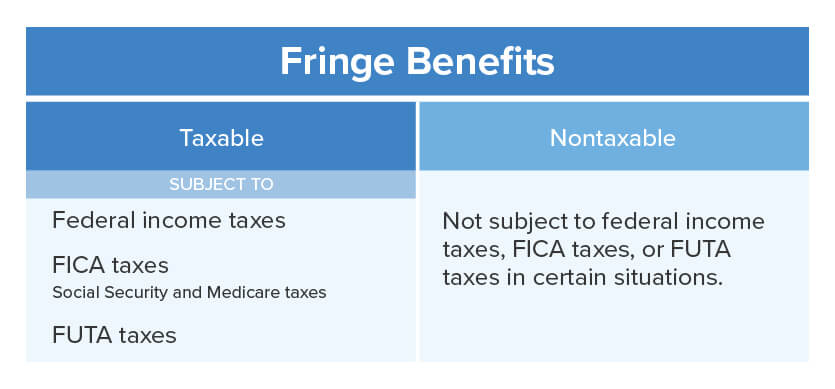

Fringe benefits

It is a type of compensation. These benefits include health insurance, education assistance, retirement plans, and employee discounts. Any benefits that are offered shall be included in payroll. Also, some benefits are taxable. Some taxable fringe benefits include paid personal time off, cash bonus pay, and vehicles for business purposes.

Other pay

Employees can also have an additional pay source. E.g., service workers can receive tips. Employees will need to report all these tips to you, and there are also payroll taxes on tips. Other pay can also include when you pay your employees commission or bonus pay. These pays will be included when you run payroll.

Deductions

A deduction is any amount you deduct from an employee's total wages.

Payroll Taxes

For every employee, you will need to deduct payroll taxes from their wages. The withheld amount will vary from each employee depending on the total earning and information in form W-4.

Payroll taxes consist of,

- federal income tax,

- state income tax,

- local income tax,

- federal unemployment tax,

- state unemployment tax,

- Medicare tax, and

- Social Security tax.

Garnishments

A garnishment is a post-tax deduction. It is used to pay off the employee's overdue debt. To pay off an employee's overdue debt, a garnishment is used. To pay for defaulted loans, unpaid taxes, and overdue child support, you can be instructed to deduct money from an employee's paycheck in case you will need to remove a garnishment; you will get a notice from a court.

Net and Gross Pay

On a paystub, you will show an employee's net and gross pay. Employees' total pay is gross pay. IRS forms generally ask for the employee's gross pay.

An employee's pay after all deductions are subtracted is net pay. Employees' take-home pay is the net pay.

Gross Pay – Payroll Deductions = Net Pay

What Are the Types of the Payroll Frequencies in the United States?

The payroll frequency means how often you pay your employees. Each employer will need to follow a payroll schedule to know when exactly they will get paid.

Following are the four most common pay frequencies in the U.S.,

- Weekly

- Bi-weekly (once every two weeks)

- Semi-monthly (twice a month)

- Monthly

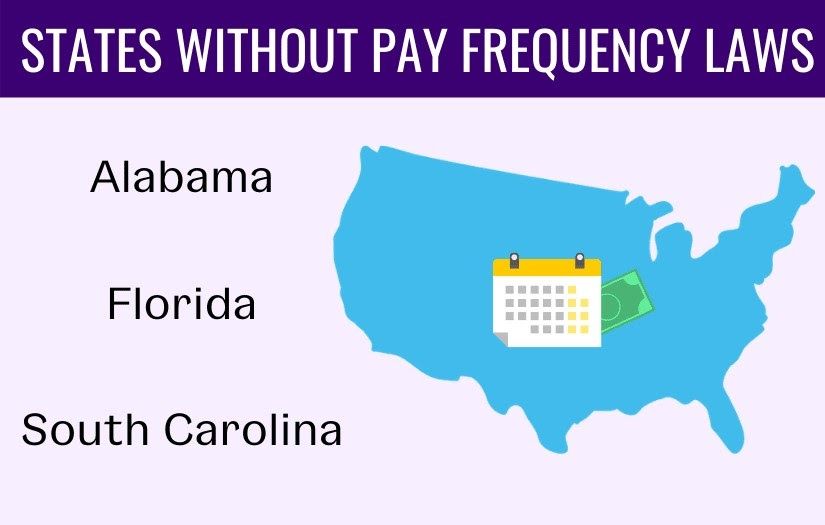

Pay Frequency Requirements by State

State laws decide how often you need to pay your employees. Each state has set unique regulations.

Look at the pay frequency laws by state chart below to determine your state’s requirements.

Note -

- If “X” is there in the box under a pay frequency, it means the state needs you to use at least that pay frequency.

- If your state has more than one “X,” you might be able to use either pay frequency, depending on restrictions.

Before you select a pay frequency, Make sure you know your state’s payday laws, before you select a pay frequency. For more information about pay frequency laws, check with your state or the Department of Labor

Need a way to keep your payroll under control? With Deskera People you can set different payroll frequencies for each employee. Get your 30-days free trial today!

Payroll Taxes and Income Taxes Deductions in the United States

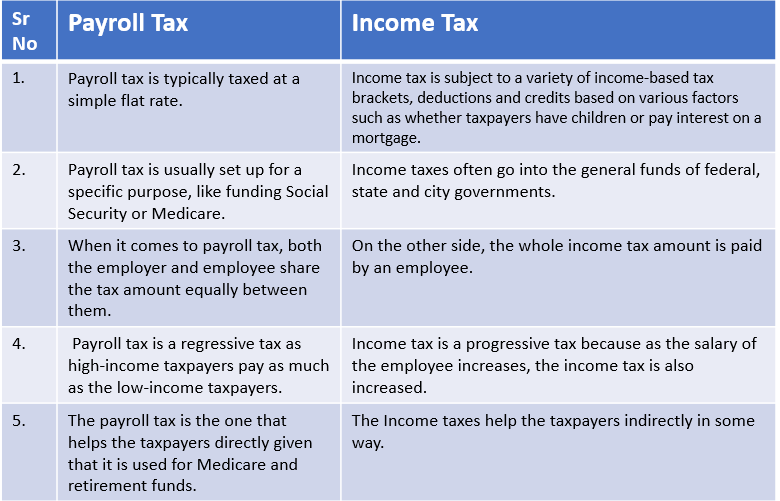

From the employee wages, employers are responsible for withholding taxes. Whenever the employees are paid certain taxes the employers have to withhold from the employee's paychecks. From each employee's gross wages, employment taxes are taken out and are broken down into payroll tax and income tax. Most people use these terms interchangeably. However, they are different.

Payroll Tax vs. Income Tax

Both payroll tax and income tax are technically separate groups, and both refer to all employment taxes. Both these tax types are taken out of paychecks and are different types of taxes.

Key Differences Between Payroll Tax and Income Tax

Now let us see more in detail about the Payroll taxes and Income taxes in the U.S.

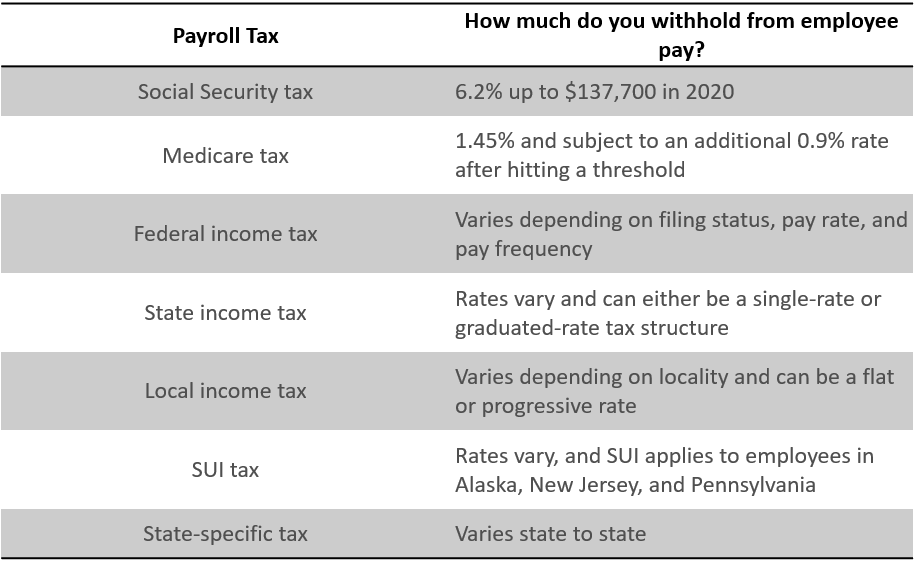

Payroll Taxes in the United States

From the employee paycheck, an employer will need to withhold several employment taxes and insurances. In case you are self-employed, you need to pay employment taxes too.

So, what exactly are the payroll taxes? and how much do you need to withhold?

What Are Payroll Taxes?

Payroll taxes consist of Medicare and Social Security taxes. Medicare tax funds are medical benefits provided for people once they reach the age of 65. On the other side social security tax funds benefit for retirement, for retired workers dependents, and the disabled and their dependents.

Together, these taxes are known as FICA (Federal Insurance Contributions Act) taxes. Half of the FICA taxes will be withheld from employee wages, and the remaining half are employer payroll taxes that you pay.

Self-employed individuals will also have to pay federal payroll taxes. So instead of paying FICA tax, they need to pay self-employment tax.

Other taxes

As an employer, you also have to pay unemployment taxes such as federal unemployment taxes(FUTA) and state unemployment tax(SUTA)

Now, let's look into all these payroll taxes in detail.

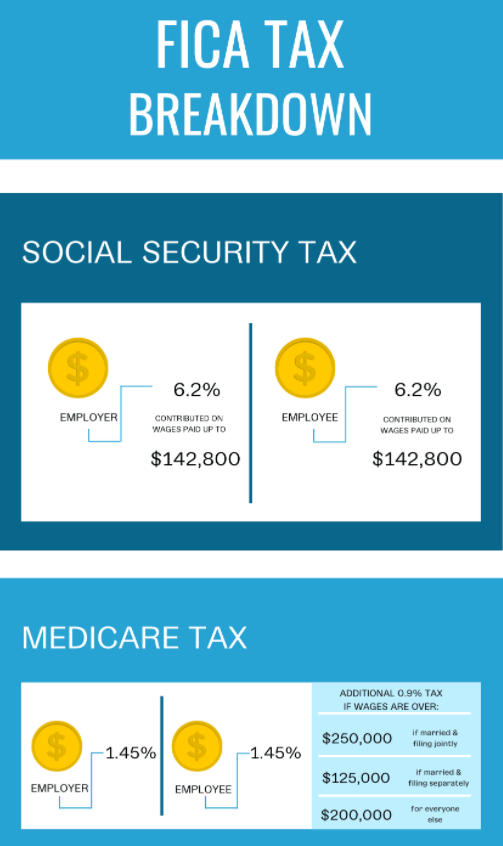

What Is FICA Tax?

FICA tax is a payroll tax that is mandatorily divided between employees and employers. FICA tax is a percentage of each taxable wage of employees, unlike the federal income tax.

FICA Tax consists of two types of taxes,

- Social Security Tax

- Medicare Tax

Part of the percentage of FICA goes towards social security, and the other part goes towards Medicare. From the employee's when you collect the FICA tax and pay the employer portion, you will be contributing towards Social Security and Medicare programs.

How Much Is FICA Tax?

Both employees and employers contribute to the FICA tax rate of 7.65%, which goes to the Social Security and Medicare taxes. To each employees' taxable wages, this rate is applied. Thus, on each employee's wages for FICA tax, all in all, the IRS receives 15.3%.

You will withhold 7.65% of each employee's wages during each pay period, and you contribute equally 7.65% for the employer portion.

Of this FICA tax amount of 7.65%, 6.2% goes toward Social Security tax, and 1.45% goes toward Medicare tax.

Following is the breakdown of FICA tax:

- Employee: 6.2% Social Security / 1.45% Medicare

- Employer: 6.2% Social Security / 1.45% Medicare

Social Security

Social Security is 6.2% of taxable wages of employees. Social security rate contributes funding aid for retirement, disabled and dependents of disabled workers.

Social security for employees and employers is not constant. There is a wage base for social security.

The Social Security employee-employer tax isn't constant. There's a Social Security wage base if an employee earns above the wage base, stop withholding and contributing the FICA tax's 6.2% Social Security portion.

The wage base rate for 2021 is $142,800. Therefore, if you mistakenly withhold Social Security tax as per past the wage base limit, you need to refund your employees.

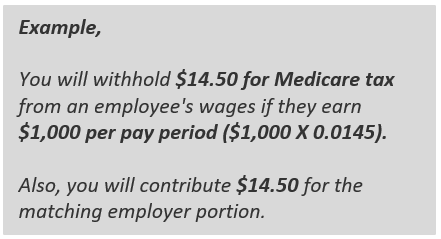

Medicare

Medicare is withheld 1.45% of an employee's taxable wages and contributes equally. Therefore, Medicare tax contributes to things like hospice care and healthcare.

In the case of Medicare tax, there is no wage base limit. Instead, there is an additional Medicare Tax. As per the employee's filing status, the wage of this additional amount depends.

- Single: $200,000

- Married filing jointly: $250,000

- Married filing separately: $125,000

Of an employee's wages, the additional Medicare tax is 0.9%. Therefore, if an employee's wages are subject to the additional Medicare tax, withhold 2.35% (1.45% + 0.9%).

There is no need to match the additional Medicare Tax. It is only applicable to the employees. But you must continue paying the matching portion of 1.45%

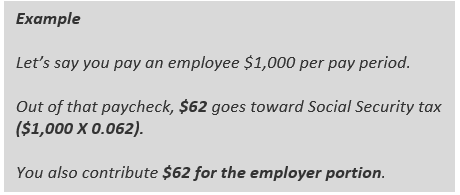

FICA Example

How Do You Pay and Report FICA taxes?

It is the employer's responsibility to deposit FICA and prepare reports about these taxes to the IRS.

Depositing FICA-

All of your payroll taxes, including FICA, need to be deposited electronically using the IRS's Electronic Federal Tax Payment System (EFTPS). There is a limited exception for small businesses, annual total payroll taxes, FICA, and income tax withholding of $1000 or less for the entire year. For such an employer's payment can be done by check. The deposit schedule is dependent on your payroll size.

Reporting FICA to the IRS-

Using Form 941 you can report FICA payments, withholding from your employers and employees four times a year. Small employers can be allowed by the IRS to file annually by using Form 944.

Reporting FICA to employees-

The FICA amount withheld from the employee's paycheck needs to be reported on the employee pay stub. It will be reported on the employee's Form W-2

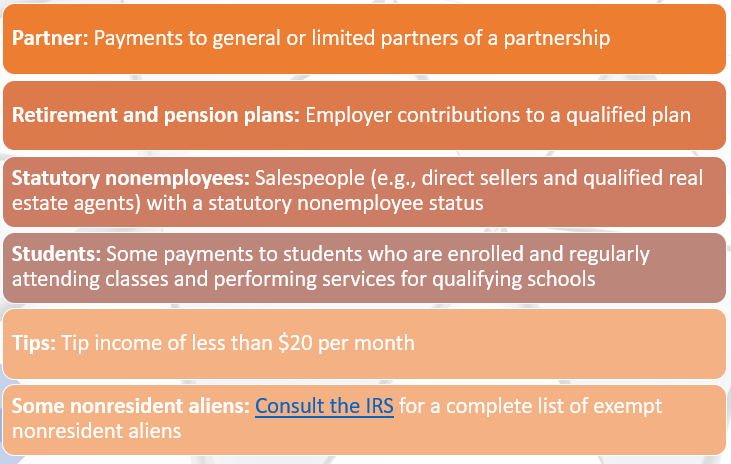

FICA Tax Exemptions

Most of the people in the U.S. will need to pay Social Security and Medicare taxes. You will have to withhold FICA tax, with most of the compensation types.

However, there are some cases where compensation is exempt from FICA tax. Listed below are few examples

Check out IRS Publication 15, for more information on FICA tax exemption.

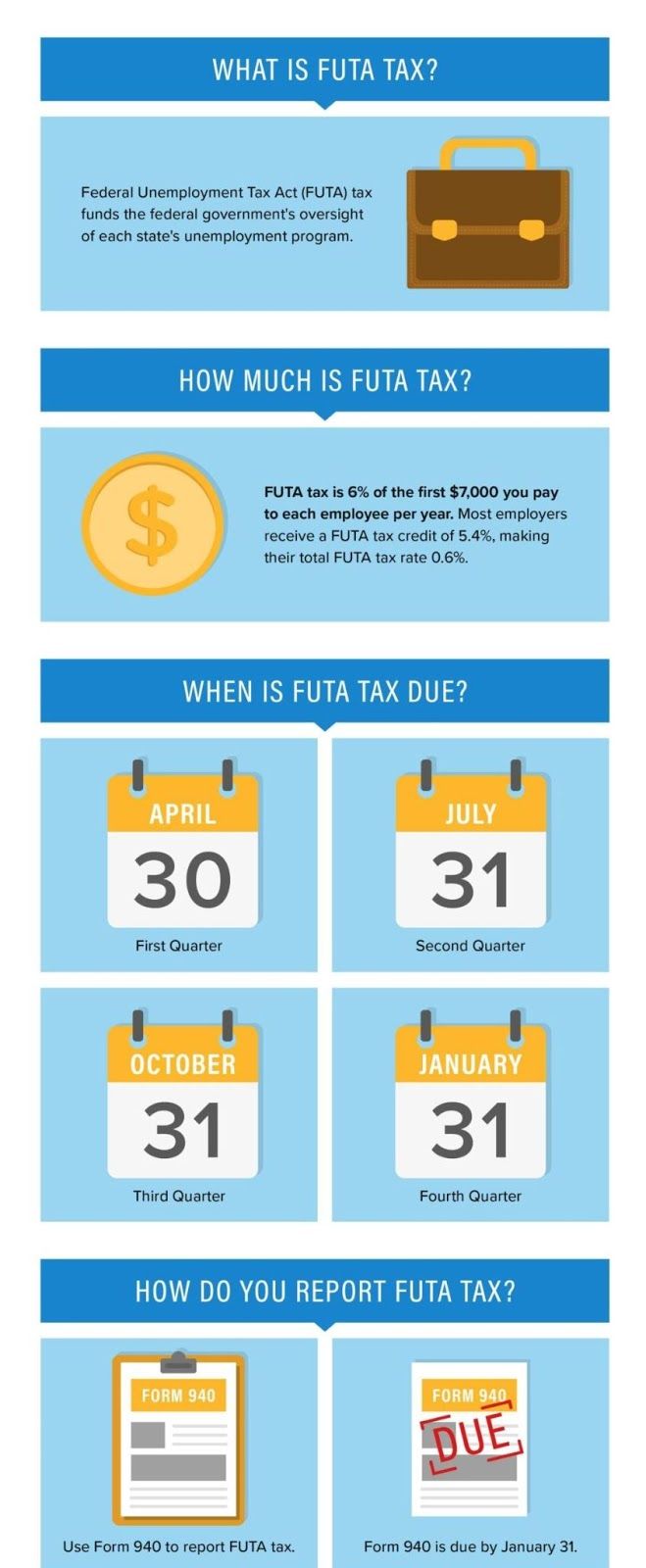

What Is FUTA Tax?

The federal law imposes an unemployment tax on employers as the Federal Unemployment Tax Act(FUTA).The FUTA tax funds oversights the federal governments of each state's unemployment program. Only the employers need to pay FUTA tax. The FUTA tax needs to be deposited annually and file an annual form.

Only employers pay FUTA tax. You must deposit the tax quarterly and file an annual form.

State Unemployment Tax Programs

For funding the unemployment benefits, each state has its own unemployment tax. Depending on the state, the state unemployment taxes go by many names such as SUTA tax, state unemployment insurance, and reemployment tax.

When a state lacks the money to pay for unemployment benefits, the state will borrow money from the federal government. The money that the federal government lends comes from the FUTA taxes.

How Much Is FUTA Tax?

The rate of the FUTA tax is 6%. In the calendar year, the federal unemployment tax applied only to the first $7000 you pay to each of your employees. This threshold of $7000 is known as the wage base. Once you pay the employees more than $7000 in a year, you need to stop paying FUTA taxes on an employee's wages.

The enormous tax amount of FUTA you will pay each employee is $420 ($7,000 x 0.06).

Thus every time you run a pay calculate the FUTA tax, this way it will help you know when to stop paying FUTA tax on employee's wages/

FUTA Tax Credit

On the tax rate, most employers receive a FUTA tax credit. This credit will reduce your tax rate for federal unemployment.

The enormous possible FUTA tax credit is 5.4%. Therefore, on the first $7,000 of each employee's wages per year, employers will owe a maximum credit of 0.6%(6% - 5.4%).

If you qualify for a maximum tax credit, the most you will pay each employee is $42 ($7,000 x 0.006).

Not all employers need to qualify for the maximum tax credit. For example, if an employee works in a credit reduction state, you will have a reduced FUTA tax credit.

View a current list of credit reduction states on the Department of Labor’s website.

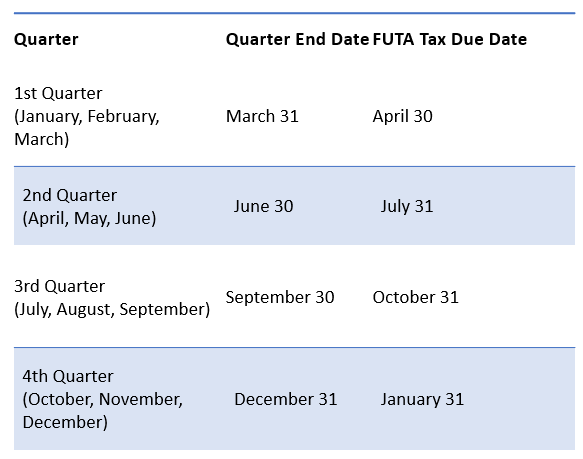

FUTA Tax Deposits

Every quarter, you will need to deposit your FUTA taxes. By the last day of the month after the end of the quarter, you need to deposit your FUTA taxes.

For example, the first quarter ends on March 31. Therefore, your taxes are due by April 31.If the due date comes on a legal holiday or weekend, you can deposit it on the next business day.

- During a calendar quarter, if your business payroll liability for FUTA $500 or less, you do not need to deposit your FUTA at the end of the quarter. Instead, you can rollover your tax liability to the next quarter.

- During a quarter, if your business FUTA tax liability exceeds $500, you need to deposit the tax through EFT( Electronic Fund Transfer).

- In the fourth quarter, if your tax liability is more than $500, you need to pay your FUTA by January 31. However, if your tax liability is less or $500, you will make an EPT deposit, pay taxes with a credit card, or pay taxes with Form 940.

For more information, see Publication 15 and the Instructions for Form 940.

FUTA Tax Reporting

You will need to file Form 940 to report your FUTA Taxes. It is an annual form that needs to be filed by January 31 every year for the previous calendar year.

For example, if you owed FUTA tax in 2020, you must file Form 940 by January 31, 2021. If all the quarterly deposits are made on time, you need to file Form 940 by February 10.

Want an easy way to calculate and file employment taxes? Try Deskera People. You just need to enter your payroll information, and we will do the calculations, deposit the taxes, and file the necessary forms. Sign up for a free trial today!

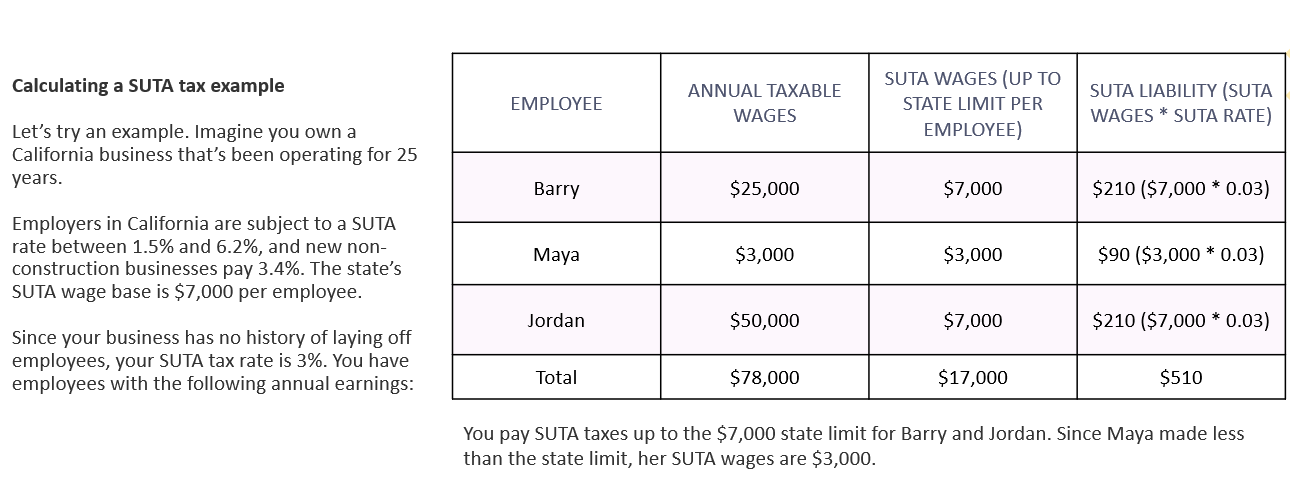

What Is SUTA Tax?

The State Unemployment Tax Act (SUTA) is a payroll tax required for employees, also known as State Unemployment Insurance (SUI). Once paid, these taxes are put into each state's unemployment fund, used by employees separated from their employment place.

Employers who do not pay SUTA or SUI taxes will be subject to penalty and fines fees. If there are any severe cases against employers, criminal penalties can also be brought.

Who Pays SUTA Tax?

In most of the states in the U.S, the SUTA or SUI is only an employer tax. However, in Alaska, New Jersey and Pennsylvania employees must also pay SUI tax. In any of these three states if you have employees, the SUTA tax is withheld from their wages and remit it to the state.

Certain businesses in some states might be exempt from paying SUTA tax. For example, If a state with non profit organization and business with few employees will be exempted from paying state unemployment taxes.

The SUTA tax component includes the SUTA wage base and rates.

SUTA Wage Base

Each state sets its SUTA tax wage base. The threshold or the taxable wage base is the maximum amount of employees' income taxed.

For all employees in the state, the SUTA wage base is the same. For example, for Washington state, the wage base for employees for 2020 is $52,700. Thus, in Washington state, all employers who are not exempted from the SUTA withholding tax will need to pay the tax on the employee's wage until they earn this amount.

Every year the wage base rate changes for each state. To ensure that your withholding amount of the SUTA tax for each employee is correct, you need to stay up to date with your SUTA wage base.

SUTA Rates

Following are the 2021 SUTA employer tax rate range.

How Often is SUTA Tax Paid?

Most of the states in the U.S. pay SUTA every quarter of the calendar year. E.g., in California, quarterly returns for SUTA and other states, payroll taxes are due on April 30, October 31, and January 31.

How Do I Register for a SUTA Account?

When you hire your first employee, the IRS and the state will consider you as an employer.

It means that you are getting, in addition, an EIN, registering for workers' compensation insurance, and paying local taxes. With your state tax authority, you have to sign up for a SUTA tax account.

For example, if you are located in California, you have to pay SUTA after paying an employee more than $100 in a calendar quarter. You need to pay the SUTA to California with the Employment Development Department (EDD) and register online using EDD's e-Services for Business.

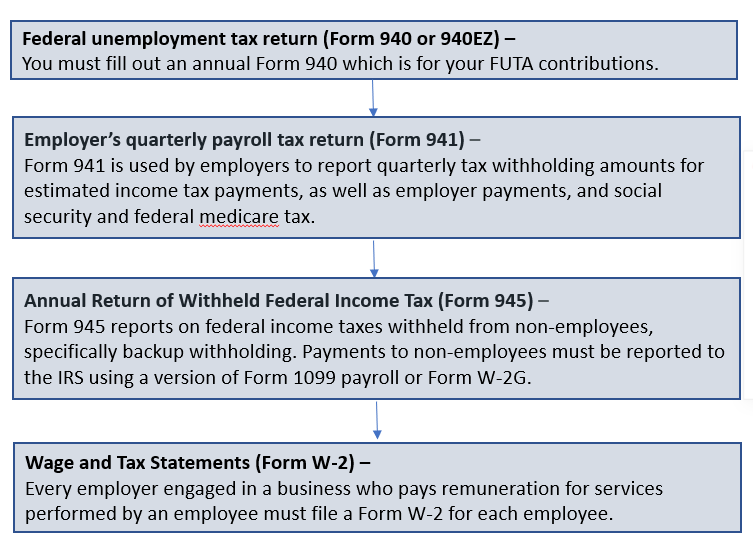

Paying And Reporting Quarterly Payroll Taxes

After the calculation is done and the amount is collected, your employees have to pay taxes, and it is time for filing payroll taxes. As an employer, you must abide by rules and regulations when completing your payroll tax return. For paying and reporting taxes, you must complete the following requirements:

Payroll Tax Online

After all the information is gathered together and all forms are filled out, now the next step is to pay the taxes. The most convenient way to pay payroll taxes is using an online system Electronic Federal Tax Payment System (EFTPS). By the U.S. Department of the Treasury, this is a free government website provided. All you need to do is to sign up and pay these taxes through this online system to the IRS.

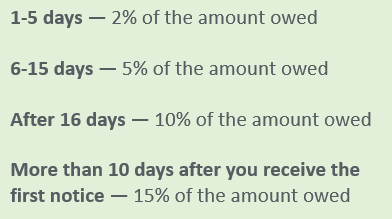

Late filing Penalty

Continuously missing the deadline to pay payroll taxes will lead to fines.Following are the fine for late payments.

What is Income Tax?

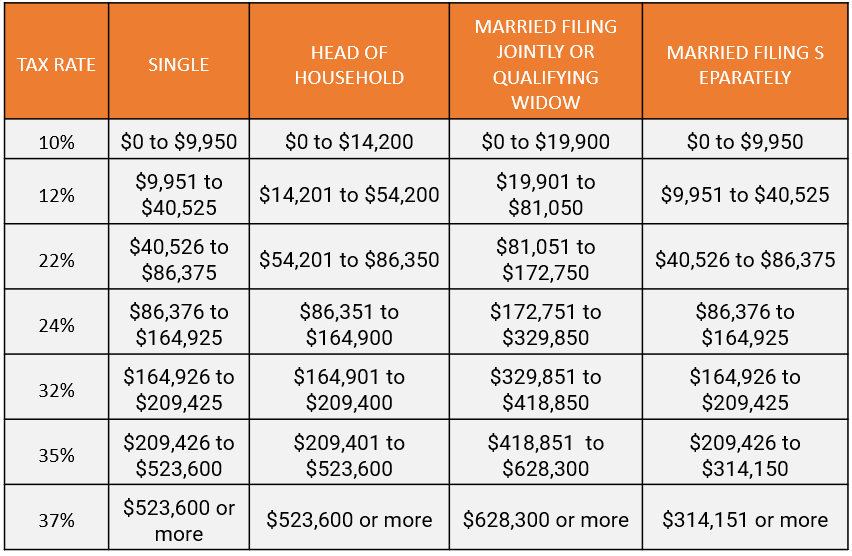

Income tax consists of federal, state, and local income taxes. Federal income tax us, not one flat rate, unlike payroll tax. It used a progressive tax rate.

The Federal tax will depend on your employee's information mentioned in the Form W-4( filing status, dependents, and additional withholding requests). During a hiring process, each employee needs to fill in form W-4 and the withholding certificate.

The employee wages and pay frequency will also affect the federal income tax amount.

Use IRS Publication 15 to determine how much to withhold for federal income tax. Available are two withholding tax table methods, percentage and wage bracket.

To figure out the employee's federal income tax deduction, you need to use the information on their Form W-4 and their weekly wages and frequency.

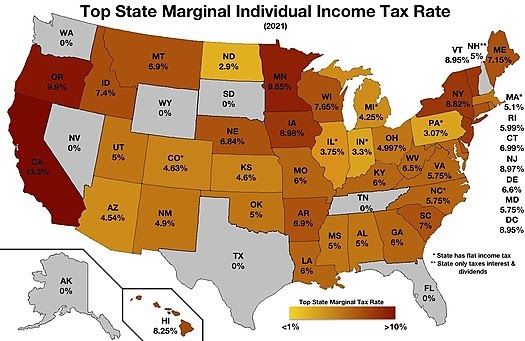

Similar to the federal income tax, State income tax works. You will give your employees a state income withholding tax form if there is a state income tax. State income tax can be either on a progressive or flat rate.

Local income tax is on a flat rate, progressive rate, or on a dollar amount. On local income taxes, make sure you contact your locality.

For more information, let us look at the Federal, State, and Local income taxes more in detail.

What is Federal Income Tax Withholding?

Form each of your employee's paycheck; you need to withhold the following few types of federal taxes,

- Social Security

- Medicare

- Income

Federal withholding income tax will vary between employees. On the total amount of taxable income, the IRS bases FITW. Federal income taxes do not go to one specific program, unlike Social Security and Medicare taxes.

The government uses federal income taxes to fund several programs such as defense and veteran benefits from the employees.

How To Calculate Federal Income Tax Withholding

There is a different FITW for every employee. Based on the factors that vary between employees, the IRS determines federal income tax which includes,

- Number of dependents

- Filing status (e.g., head of household)

- Pay frequency

Use IRS Publication 15 to calculate FITW manually and calculate the withholdings; use IRS Publication 15-T. IRS Publication 15 will give you detailed information about FITW and for you employees how to tax different types of income. In addition, in Publication 15-T, there are the IRS tax tables and FITW worksheet.

There are two different methods used to calculate federal income tax withholding: the percentage method and the wage bracket method. However, both ways will give you similar calculations.

Gather the information from your employee after you decide which federal withholding tax table you want to use. For your employee, you will need the pay frequency and their total earnings for the pay period and the information mentioned on their Form W-4. Then, to calculate their federal tax withholding, use all of this data.

Federal Income Tax Rates and Brackets 2021

Depositing Federal Income Tax

After the employee's withholding is calculated, the IRS wants you to deposit the taxes regularly. Make sure you do not keep these taxes or use them for any other purposes. Using or keeping this money is illegal which leads you subject to civil and criminal sanctions.

The IRS will determine your frequency for income tax deposit and notify you of any changes. There are two deposit schedules, monthly and semi-weekly.

The monthly deposit needs to be paid by the 15th of the following month of the end of the calendar month.

For example, January deposits are due on February 15. If the 15th of the month falls on a weekend or holiday, deposit the next business day's taxes.

Semi-weekly deposits will depend on your pay date. In case the date of payment falls on a Wednesday, Thursday or Friday; you need to deposit the taxes by the following Wednesday. And the pay dates that fall on Saturday, Sunday, Monday, or Tuesday, you need to deposit the taxes by the following Friday.

To determine your schedule deposit based on a specified lookback period, the IRS uses your Form 941

To deposit the taxes electronically, use the Electronic Federal Tax Payment System (EFTPS). You may have to pay the penalty if you do not make your deposits on time.

Reporting Federal Income Tax

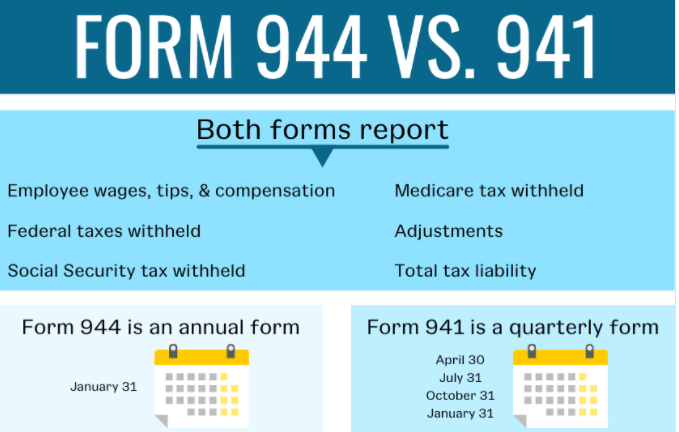

You need to use either Form 941 or Form 944 to report your federal income tax you deposit.

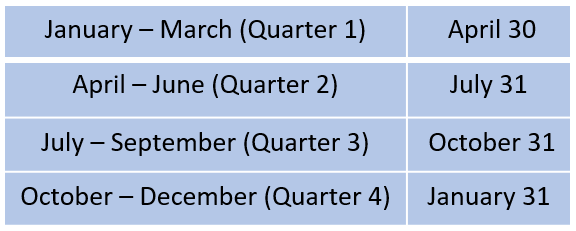

By the last day of the month following the end of the quarter file Form 941. Following are the filing schedule deadlines for Form 941,

- April 30 for the first quarter

- July 31 for the second quarter

- October 31 for the third quarter

- January 31 for the fourth quarter

- For annual form due on January 31 of the following year use Form 944 . You can only use Form 944 if in case the IRS in writing notifies you that, you must use this form and not Form 941.

File a Federal Income Tax Return

- Gather your paperwork

- From each employer collect the A W-2 form

- Other interest and earning statements (1099 and 1099-INT forms)

- If you are itemizing your return, receipts for medical, charitable donations and business expenses

2. Choose your filing status

It is based on whether you are married. Your filing statuS will affect the percentage you pay towards household expenses.

3. Decide how you want to file your taxes.

For the easiest and most accurate returns, the IRS recommends using tax preparation software to e-file.

4. Determine if you are taking the standard deduction or itemizing your return.

5. Learn how to make a tax payment, if you owe money, including applying for a payment plan.

6. File your taxes by May 17, 2021.

Find out how to check the status of your tax refund.

Calculating federal income tax should be quick and easy. Deskera People calculates all of your payroll taxes as easily as 1-2-3. With our Full Payroll Service option, we will help collect, deposit, and file your taxes for you, which saves you time you can use for your business. Start your free 30-day trial today!

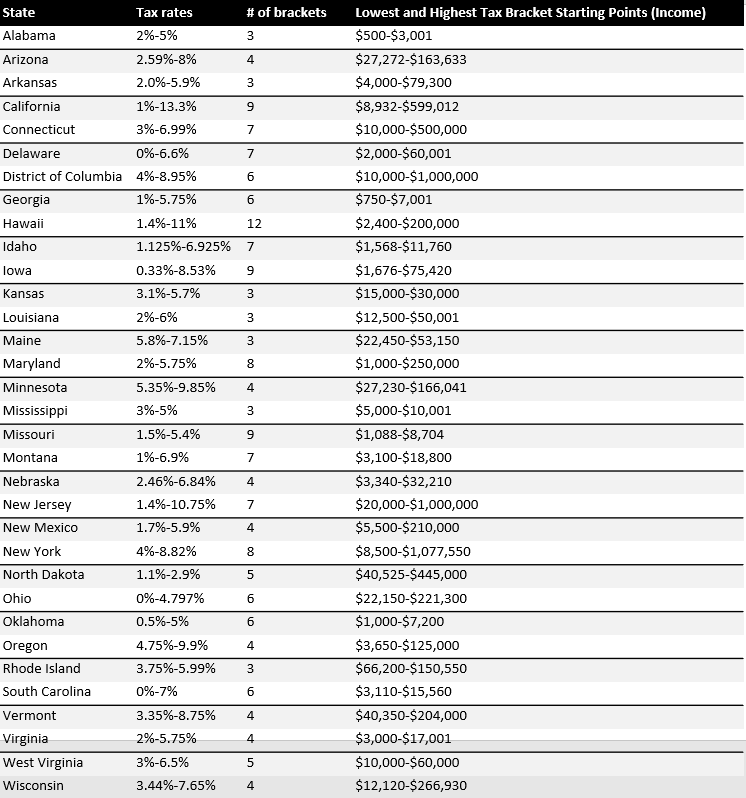

State Income Tax

State Income Tax(SIT) is a mandatory tax that is applied to a worker's wage. Form and employees gross wage, employers are responsible for deducting SIT and remitting it to the appropriate state tax agency.

SIT rate may differ and can either be progressive or flat. Each employee in the states is taxed with the flat-rate tax structure. On the other hand, the progressive tax structure uses wage brackets to tax employees at different tax rates.

Employees need to fill out their state W-4 form before they begin working at a business. Same as the federal Form W-4, State form W-4s collect the information regarding employees so that you can start withholding state income tax from their wages.

For income tax withholding at the state level, most states have their own version of the W-4 form. Four states, such as New Mexico, Colorado, Utah, North Dakota, want their employees to use the federal Form W-4 for SIT withholding.

Once you collect a completed form from the new hire, you can now start running payroll and state withholding income tax from their wages. These state income taxes are used to fund various state projects and programs such as health care, education, public assistance, and corrections.

What States Have State Income Tax?

Currently, there are 41 states and Washington DC, have state income tax on the earned wages from employment,

Listed below are the states having SIT,

What States Do Not Have State Income Tax?

There are 9 states that do not have any State income tax on the employment income.

States With Flat Income Tax Rates 2021

Local Income Tax

In several states, local governments impose a local income tax. These local taxes are in addition to federal and state income taxes. Local income tax is imposed on the people who stay or work in the locality. It is the employer's responsibility to pay attention to local taxes where your employees work.

Local income taxes are typically used to fund local programs, such as education, parks, and community improvement.

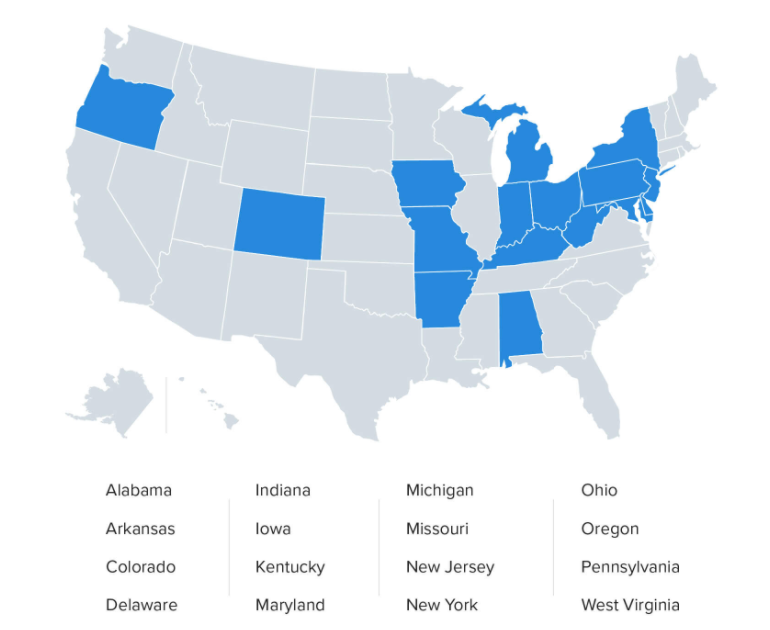

States With Local Income Tax

The following states charge local income tax:

Types of Local Income Taxes

Few of the local income taxes are permanent, which are often used to fund the operating budget. The remaining local income taxes are fund-specific and temporary and short-term purposes. As the local taxes change, you need to ensure that your withholdings and records are up to date.

Employees usually pay Local Income Taxes; however, employers withheld and deposited them. In some locations, the tax is paid by the employer.

The flat tax rate is charged in some locations, which means a single rate will apply across all income levels.

In other locations, they have progressive local income tax rates, which means that the tax rate also increases if someone's income level increases.

Also, some locations want their workers to pay at a flat dollar amount, no matter what their income level is. For example, all employees will have to pay $2 per week.

In some locations, employers will need to pay the local income taxes. For example, in Colorado, there is an occupational privilege tax in some locations. Over some time, employers need to pay a few dollars for each employee at the business.

Local income tax is imposed, tax computation, collection, and spending vary across the different jurisdictions. To understand the specific tax requirements, consult your local laws

Withholding Local Income Tax

If the employee works in the location where the local income taxes are imposed, you will need to deduct the tax from their wages. You must register with the income tax office for local income tax withholding of the school district or location where your business is located.

You must calculate the employee's taxable wages every time you run payroll. Then by using the tax table or multiplying by the local tax rate, determine how much to withhold.

After the local taxes are withheld, you need to remit them. Usually, you need to pay the local taxes quarterly, but the due date may vary.

Once you withhold local taxes, you need to remit them. Often, local taxes are due quarterly, but due dates vary.

Everyone employed during the year will need to send Form w-4 at the end of the year. Form W-2 will record the tax amount you have withheld from each employee's wages.

Click here to read more about State and Local Taxes in the U.S.

Summary of Employee’s Payroll Taxes

Here is a brief recap below of which payroll taxes are the employee’s responsibility.

Make payroll easier on yourself. Deskera People calculate taxes on employee wages. And, our Full Service payroll services option will deposit and file taxes for you. Try either for free today!

Different Types of Employee Withholding and Federal Forms in the United States

You have many things to mark off on your to-do list when it comes to running payroll. One of the biggest responsibilities you have is to know which forms you need to fill out as an employer and employee. With so many forms available, it can be challenging to know which forms will apply to your business.

Let's get to know more about which IRS payroll forms your small business needs to file, due dates, and where to file these forms.

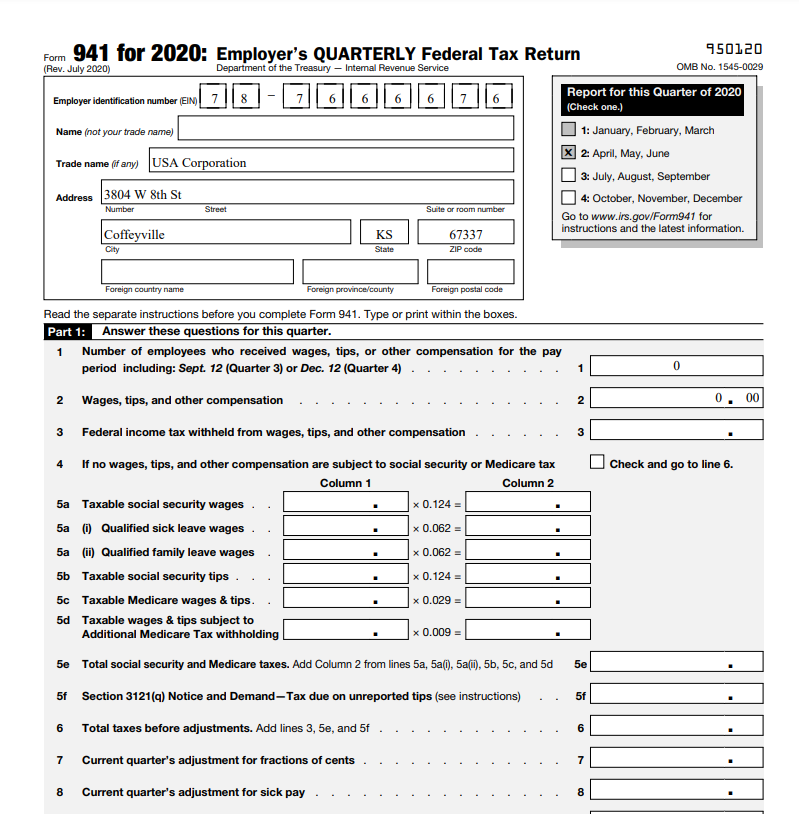

Form 941

In the U.S. Form 941 is an Internal Revenue Service (IRS) tax form for employers. This form is filed quarterly. Form 941 is used by the employers to report income taxes, social security tax, and Medicare tax which is deducted from the employee paycheck. According to the IRS, Form 941 is also used to pay an employer's part of Medicare tax or social security.

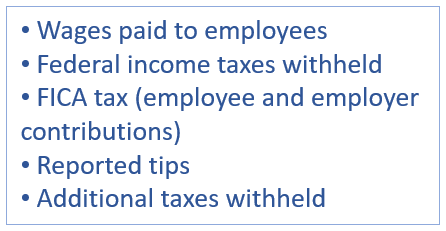

What Information is on Form 941?

Following is the information you need to report on Form 941 each quarter:

Apart from the above information, you also need to include any adjustments to medicare and social security taxes, tips, sick pay and group-term life insurance.

Who Fills Out Form 941?

In most cases, if you have employees, it will be your responsibility to fill out Form 941. Once the first Form 941 is filed, you will continue to file one every quarter.

If you do not have any 941 taxes to report, you will still need to submit Form 941. However, some employers are exempted from filing Form 941. In this case, you do not need to file the form if.

Some employers are exempt from filing Form 941. You don't have to file the form if you:

- Filed a final return

- Are a seasonal employer

- Employ household employees (e.g., Schedule H)

- Employ farm employees (e.g., Form 943)

- Are told by the IRS to file Form 944 instead

When Is Form 941 Due Date?

Each quarter you must file Form 941 with the IRS. There are different due dates for each quarter. Listed below are the Form 941 due dates:

What Are The Penalties for Late Filing of Form 941?

If Form 941 is not filed in a timely manner, it may result in a penalty of 5% of the due tax with the return for each month or the part of a month of late return. The maximum penalty is 25%.

In case there is a delay in payment for 1-5 days, the IRS will also impose a penalty of 2 % of the tax not paid.

For 6-15 days in delayed payment there is a penalty of 5%. If payment is more than 16 days late, the IRS will charge a 10% penatly. Apart from the additional penalties, the IRS will also charge an interest on unpaid balances.

Where Do You Send Form 941?

Where you Filing Form 941 depends on your state and whether you make or not a deposit with your filing. To find out where you need to mail your form,Check out the IRS’s website.

Depending on your state and business, you may also be able to file Form 941 electronically.

Consult the IRS’s Instructions for Form 941,for more details about filling out Form 941with the IRS.

How to Download Form 941 Using Deskera People?

Using Deskera People you can Download federal form 941 for employers. Please refer the below article,

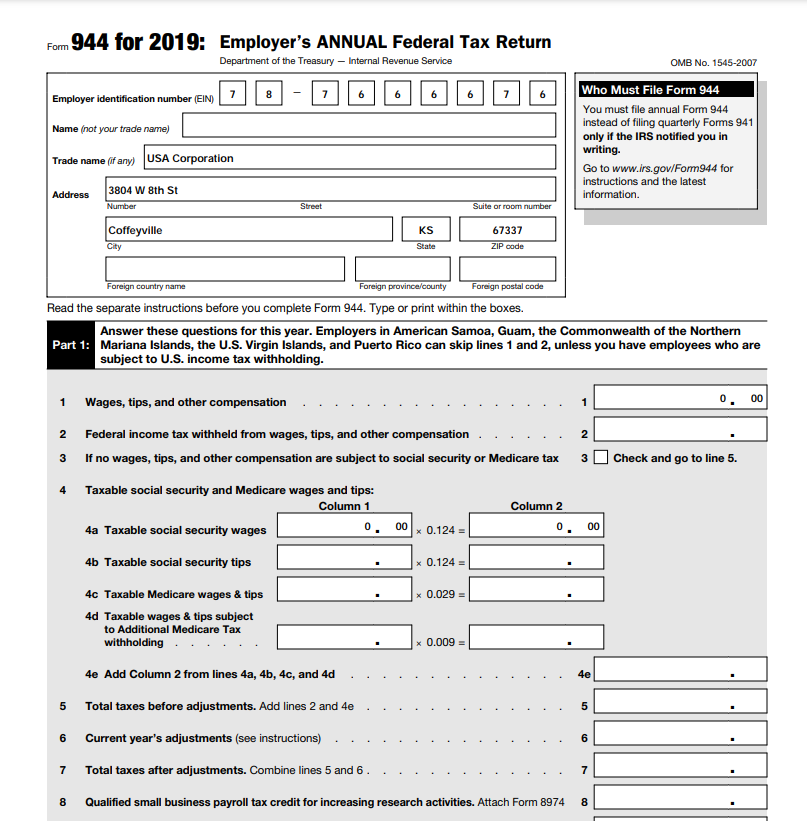

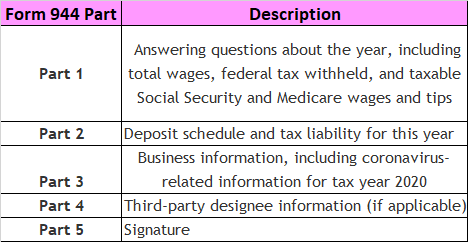

Form 944

Form 944 is an employer’s Annual Federal Tax Return, which is eligible for small business file it annually for reporting the Federal Income Tax and FICA tax(Medicare and Social Security Taxes) on employee wages

IRS Form 944 is also used by small businesses to calculate and report their employees medicare and social security tax liabilities.

This form is especially designed by the IRS for small businesses with less employees and a smaller tax liability than any other companies.

Who Needs to File Form 944?

To report wages and taxes, not all small businesses can use Form 944. However, only a specific group of small businesses can use it.

The IRS will inform you if you need to file the Form 944. In case your annual liability for medicare, social security and federal income taxes is $1,000 or less for the year, then the IRS will tell you to file Form 944. This usually comes in the form of written notice.

If you believe that your business meets the requirements and if you have not received a notice, ensure that you immediately contact the IRS to request to file a Form 944.Yu can either contact the IRS by calling on 1-800-829-4933 or sending a written request.

How to Fill Out Form 944

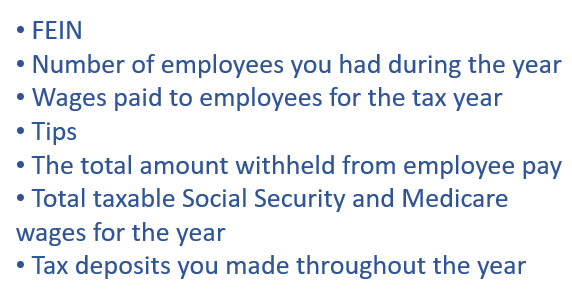

You need to gather the following information, before you can fill out Form 944,

There are five parts to Form 944, including:

Double-check your calculations to ensure they’re correct, in case you are filling out the form by hand.

Consult the IRS’s Instructions for Form 944,for more details about filling out Form 941with the IRS.

Filing Form 944

You have a couple of options When it comes to filing Form 944,you have couple of options available,

- Mail a physical copy to the IRS

- Electronically file the form

Follow the instructions carefully, if you mail your complete Form 944 to the IRS. The instructions of the IRS will specify if you need to send the form based on your state and if or not you are filing with a payment.

Use the IRS’s e-Filing system to e-file Form 944. When e-Filing, you have two options available:

- Submit the forms yourself

- Use a tax professional to file on your behalf

Form 944 Due Date

The due date for filing Form 944 is by January 31 each year. If January 31 falls on a weekend, then it’s due the following business day.

How To Download Form 944 Using Deskera People?

Using Deskera People you can Download federal form 944 for employers. Please refer the below article,

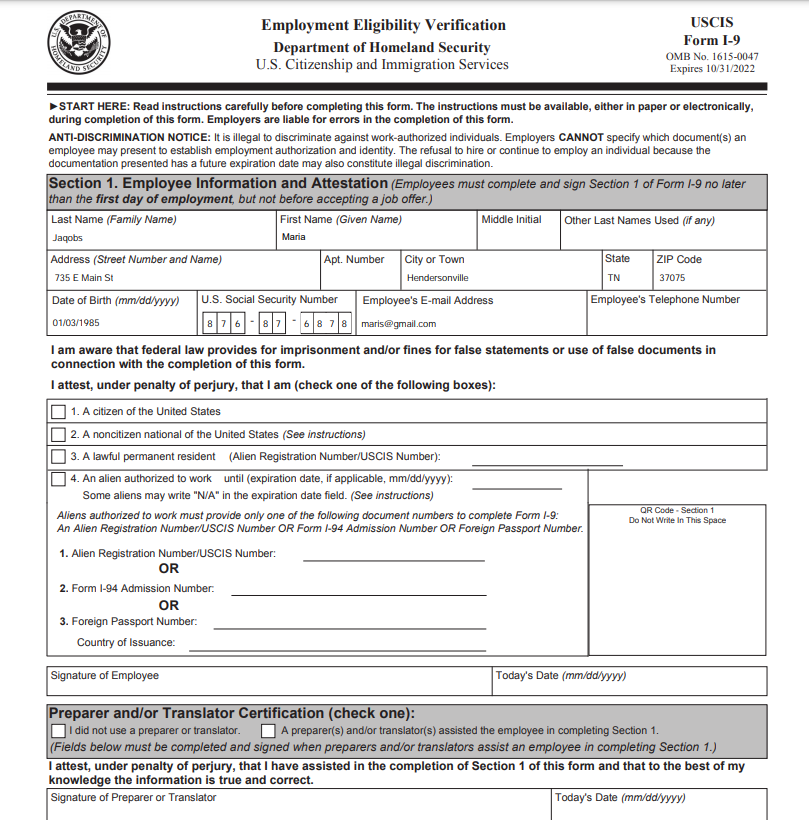

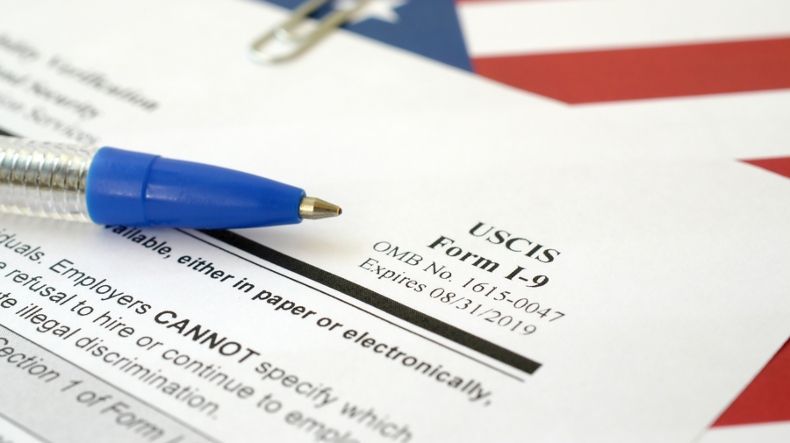

Form 1-9

Form I-9 is for the employment eligibility verification, that will confirm your employees if they are legally allowed to work in the U.S. You and your employee must fill out Form I-9, before you can authorize employment. For an employer to review and verify, in addition to filling out the form, your employee needs to carry in specific identification and documentation.

Make sure you store the Form I-9 records for at least 3 years after you hire an employee or 1 year once their employment ends.

To double-check an employee’s employment authorization you can use E-Verify. Input information from Form I-9 into the system, if you use E-Verify.

Filling Out an I-9 Payroll Form

You need to learn how to fill out Form I-9 if you are an employer or plan on becoming an employer.

On an I-9 form there are three sections. The first two sections need to be filled out by you and your employee when you hire them. If you need to update an employee’s information or rehire an employee, you only need to fill out the third section

Following is the section-by-section breakdown to learn how to fill out an I-9 form.

Section 1

Your employee fills out Section 1. This section covers things like the employee’s:

Section 2

Section 2 needs to be completed and signed. Within three days of the employee’s first day of work, Employer or Authorized Representative Review and verify it.

From your new employee, to fill out this section, you need specific identification and authorization documents. As an employer you need to verify and examine these documents to ensure that they match on Form I-9.

The I-9 acceptable documents are grouped into List A, List B, and List C.

Employees can show either of below to prove their identity and citizenship,

- 1. One document from List A

- 2. A document from both List B and List C (two documents total)

- You need to fill out the certification section, under Section 2. This section includes the employee's 1st working day along with your title, name, business address and signature.

This portion includes the employee’s first day of employment as well as your title, name, business name, business address, and signature. After you verify the employee’s documentation is legitimate, fill out the certification section.

Section 3

Fill in the section 3 only for rehires and re verification if,

1. You need to update information on Form I-9

2. A temporary employment authorization expires

3. You’re rehiring a former employee

Within three years of when you first filled out Form 1-9, if you rehire an employee, fill out section 3 on the original form of employee’s. Else you must fill out a new I-9 Form.

If applicable, dont forget to reverify an employee’s employment authorization. You don’t need to reverify U.S. citizens or non-citizen nationals.

How To Download Form I-9 Using Deskera People?

Using Deskera People you can Download federal form I-9 . Please refer the below article,

W-4 Form For Employees

You will again need Form W-4 information for calculating the income tax withholding for your employees. So what exactly is Form W-4?

Form W-F for a W-4 Form is a document used by an employee for notifying their employer tax withholdings. You need to make sure that your employees must complete this form during their hiring process. In the form, the employees will list their filing status (eg, single), number of dependents, and if any additional withholdings.

If you claim dependents, it will decrease the withholding, using the worksheet deduction on Form W-4. Employees can increase their withholdings from each check for federal income tax by listing an additional amount to withhold.

For example, an employee who is single with zero dependents has the maximum amount of FITW taken from each paycheck.

An employee who is single with one dependent has less federal income tax withheld from each paycheck.

An employee who files under a married or head of household status also has less income tax withheld than an employee who files as single.

Downloading Employee Withholding W-4 Form In Deskera People

Using Deskera People you can Download form W-4 form. Please refer the below article,

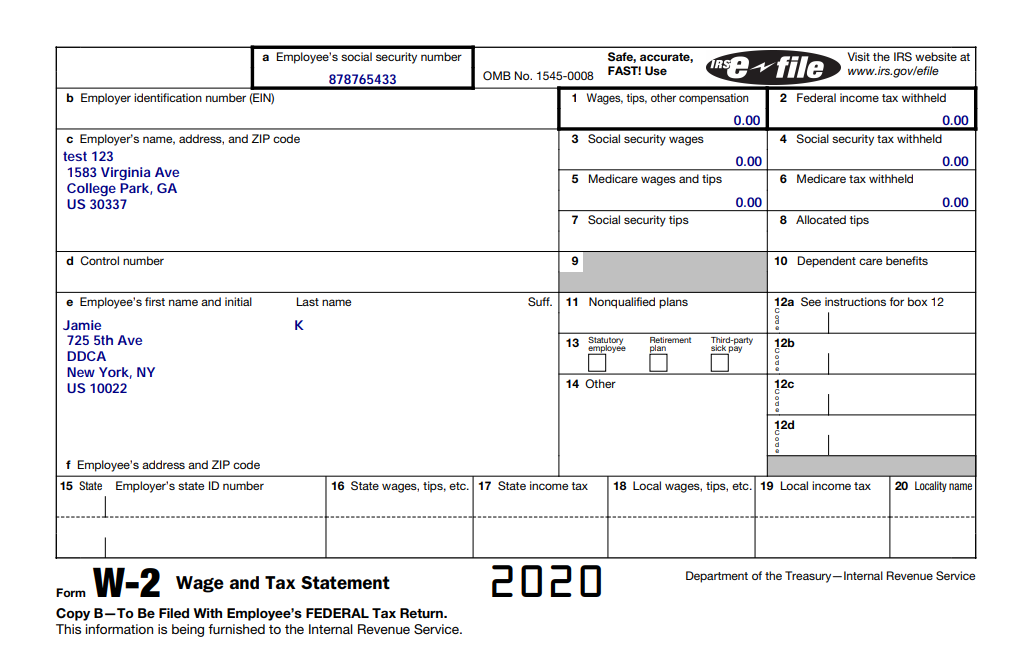

Form W-2

Form W-2, is a wage and tax statement, that will report the taxes you withheld from employee wages to the IRS.

Wage and Tax Statement, reports the taxes you withheld from employee wages to the IRS. During the calendar year, you will need to file Form W-2 for each employee.

What Is Included on Form W-2?

Form W-2 includes the below information:

Who Needs These Forms?

According to the IRS, there are clear and specific conditions that apply to W-2 forms, as follows:

Deadlines For Filing W-2 Form?

- 1 January and 31 December – the start and end of the tax year.

- 31 January – the deadline for submitting an employee's W-2 form for the previous tax year.

- 28/29 February – the deadline for paper filing of employer's Copy A of form W-2.

- 31 March – the deadline for online filing of employer's Copy A of form W-2.

Where Do You Send Forms W-2?

To the SSA you need to send the copies of Form W-2 to your employees. There are multiple copies for Form W-2, so it is important to know where you send each of these copies.

Following os list of the copies you are responsible for distributing and who you must send each cop

Downloading W-2 Forms Using Deskera People

Using Deskera People you can Download form W-4 form. Please refer the below article,

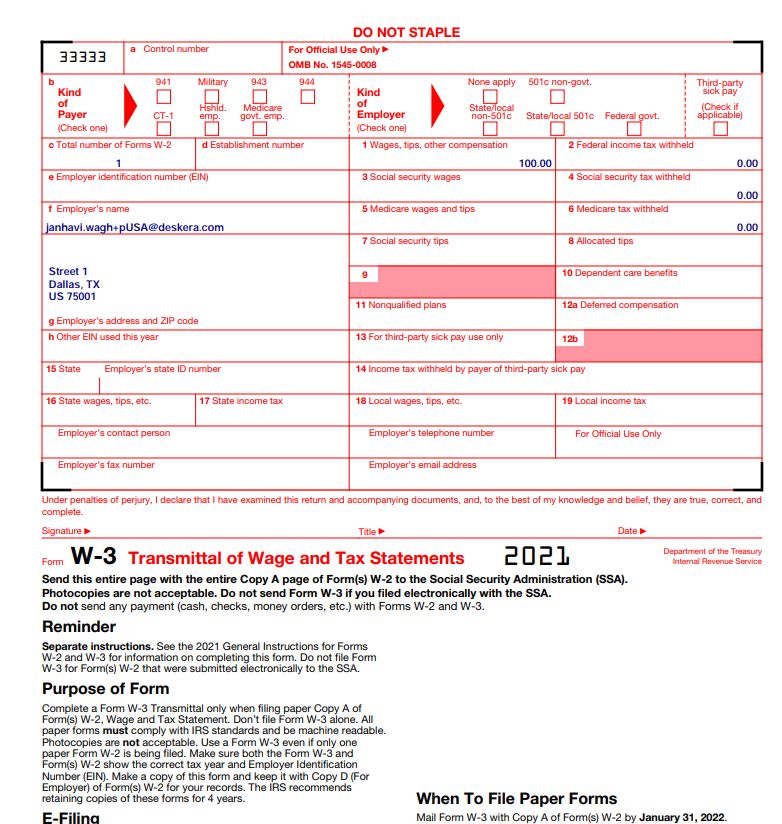

W-3 Form

Form W-3 is a Transmittal of Wage and tax statements, is an accompanying Form W-2 that summarizes information in Form W-2. Form W-3 of IRS provides a list compiled of employee information which is included on all of the Forms W-2.

Form W-3 will show the IRS total amount paid to all your employees, and also the total federal income, medicare and social security taxes you withheld from your employees. Form W-3 to IRS will also tell the number of people you hired and state the total number of Forms W-2 you are filing it with.

What Is Included in a W-3 Form?

Filling out and submitting Form W-3 is pretty straightforward.

In boxes a-h needs to fill employer information and Boxes 1-19 needs to fill the total wage and tax information for all employees.

Filling out and filing Form W-3 is a pretty straightforward process. The form has a similar set up to Form W-2.

Boxes a-h ask for employer information. Boxes 1-19 ask about the total wage and tax information for all employees. At the bottom there are four unnumbered boxes that ask for employer contact information.

- a: Control number

- b: Kind of payer / Kind of Employer / Third-party sick pay (if

- applicable)

- c: Total number of Forms W-2

- d: Establishment number

- e: Employer Identification Number

- f: Employer’s name

- g: Employer’s address and ZIP code

- h: Other EIN used this year

- 1: Wages, tips, other compensation

- 2: Federal income tax withheld

- 3: Social Security wages

- 4: Social Security tax withheld

- 5: Medicare wages and tips

- 6: Medicare tax withheld

- 7: Social Security tips

- 8: Allocated tips

- 9: Blank

- 10: Dependent care benefits

- 11: Nonqualified plans

- 12a. Deferred compensation

- 12b. Blank

- 13: Nonqualified plans

- 14: Income tax withheld by payer of third-party sick pay

- 15: State and employer’s state ID number

- 16: State wages, tips, etc.

- 17: State income tax

- 18: Local wages, tips, etc.

- 19: Local income tax

- - Employer’s contact person

- - Employer’s telephone number

- - Employer’s fax number

- - Employer’s email address

Deadline To File W-3 Form

The deadline for giving W-2 forms to employees and sending W-2 and W-3 forms to the Social Security Administration is the same date: January 31 of the year following the tax year

Downloading W-3 Forms In Deskera People

Using Deskera People you can Download the W-3 form, please refer to the below article,

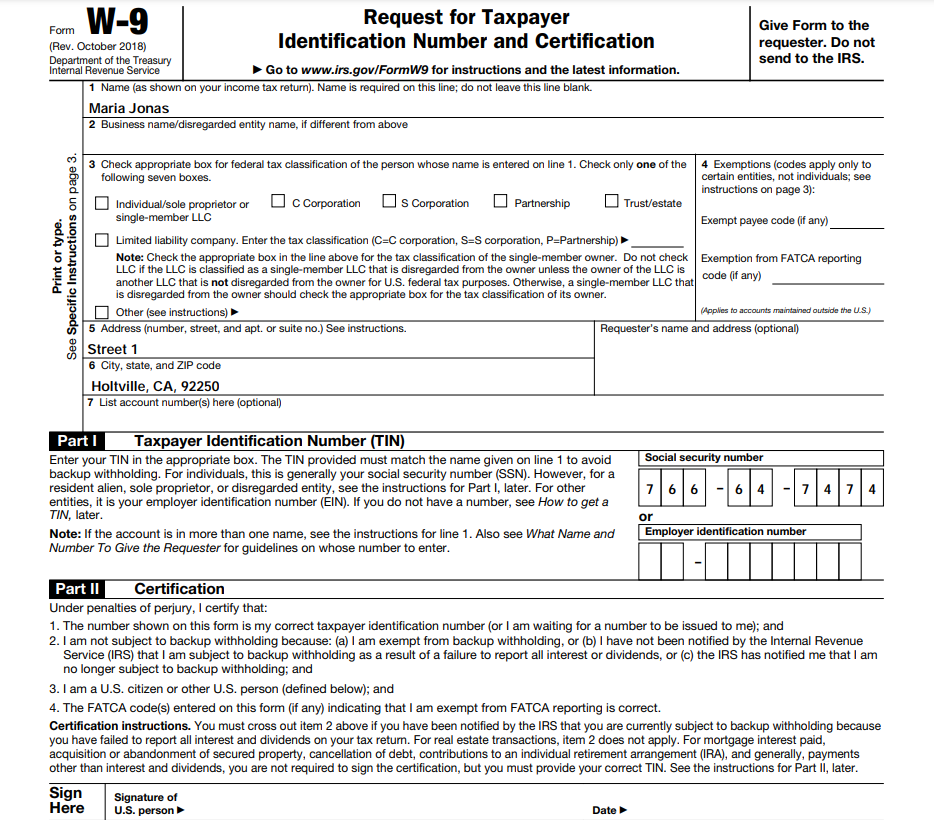

W-9 Form

Form W-9 is given one you have identified that a worker is an independent contractor and Request for Taxpayer Identification Number.

Once you’ve determined that a worker is an independent contractor, you must give them Form W-9, Request for Taxpayer Identification Number. On the Form 1099-NEC, all businesses are required to report non-employee compensation of $600 or more.

All businesses are required to report nonemployee compensation of $600 or more on Form 1099-NEC. To accurately fill out Form 1099-NEC use the information on Form W-9 (i.e., tax identification number and contact information

W-9 for needs to fill it out when they hire an independent contractor at business, and the information on the form has to be secured and protected.

To understand Form W-9 instructions, it is very important. Following are the Form W-9 requirements that independent contractors must provide:

- Name

- Business name if different than name

- Business entity (sole proprietor, LLC, C corporation, S corporation, partnership)

- Exemptions

- Address

- Taxpayer Identification Number (Social Security number or Employer Identification Number)

- Certification: signature and date

W-9 Form is not send to the IRS, however it is kept for your records.

What Is Form W-9 Used for?

Form W-9 gives you detailed information about the independent contractors. On Form 1099-NEC you need to report non-employee compensation, then send a copy to:

- The independent contractor

- The IRS

- The state tax department (if applicable)

- Your records

Downloading Contractors Withholding W-9 Form In Deskera People

Using Deskera People you can Download the W-9 forms for contractors, please refer to the below article,

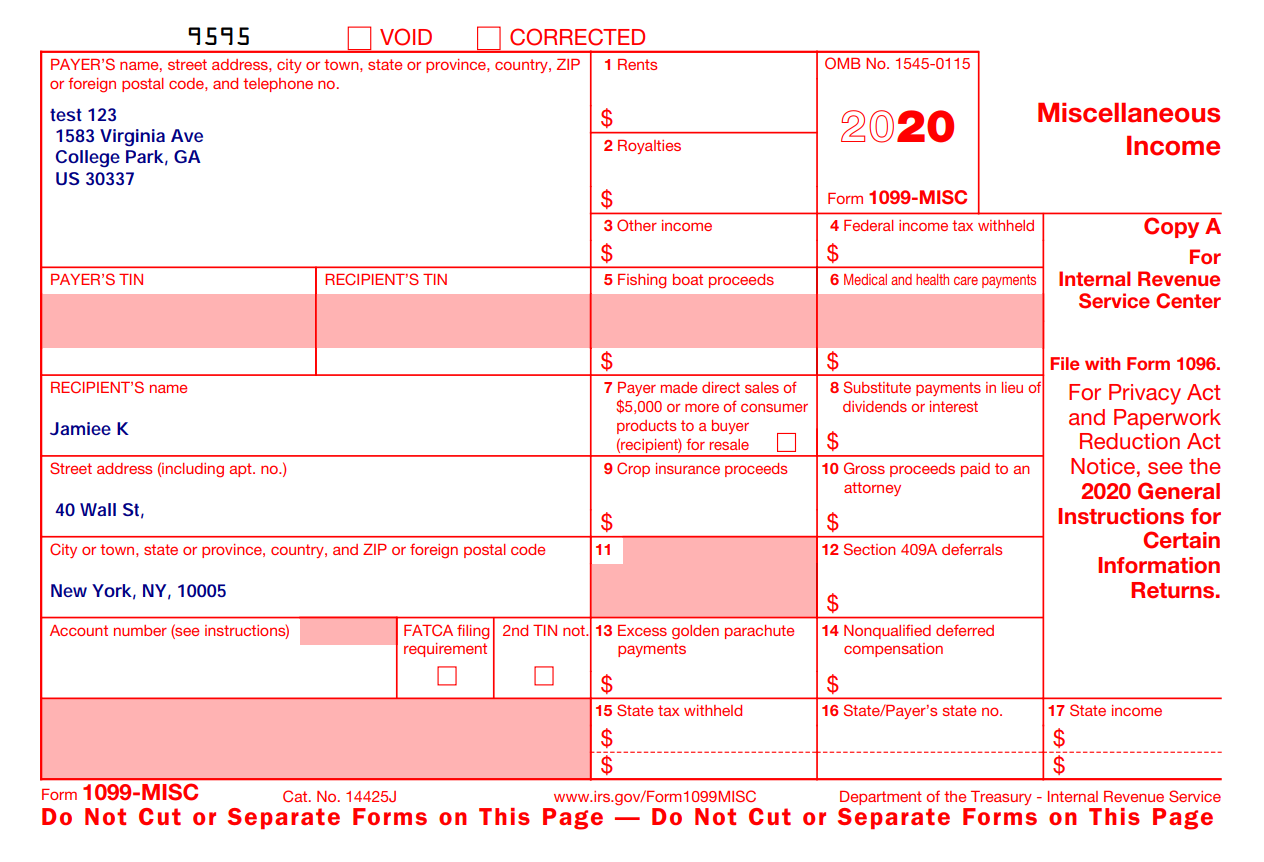

Form 1099 - MISC

Form 1099-MISC, is a miscellaneous income that contains the information of return business which is used to report payments and miscellaneous income.

On the Form 1099-MISC, before 2020, business owners also reported nonemployee compensation. But now, business owners must use Form 1099-NEC to report nonemployee compensation.

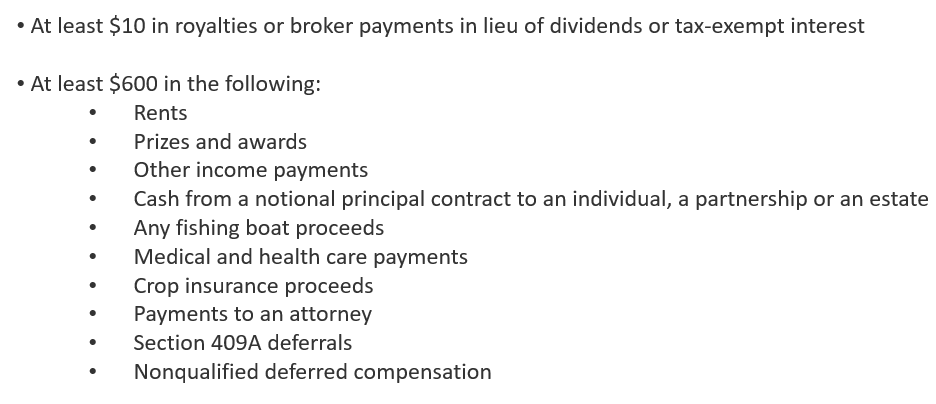

Form 1099-MISC Recipients

For each person file Form 1099-MISC, if you have given the below payment types in the course of your business during tax year :

Check out the IRS 1099 instructions for a list of payments that you should report on Form 1099-MISC.

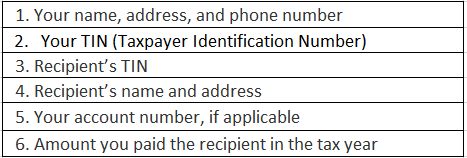

Filling Out Form 1099-MISC

When filling out Form 1099-MISC, include:

Filing Form 1099-MISC

Once you have finished filling out Form 1099-MISC, then you need to ensure that you send the correct copies to the IRS and the recipient. Form 1069 must also be sent, which is an annual summary and transmittal of the U.S. information returns to the IRS. In short, form 1096 is a summary form of IRS Form 1099-MISC.

Forms 1099-MISC can either be mailed or e-file. You must e-File If you need to file 250 or more information returns throughout the year, you must use the e-file option.

The IRS will send your e-Filed 1099 forms to your state, if your state participates in the Combined Federal/State Filing Program(CF/SF) .

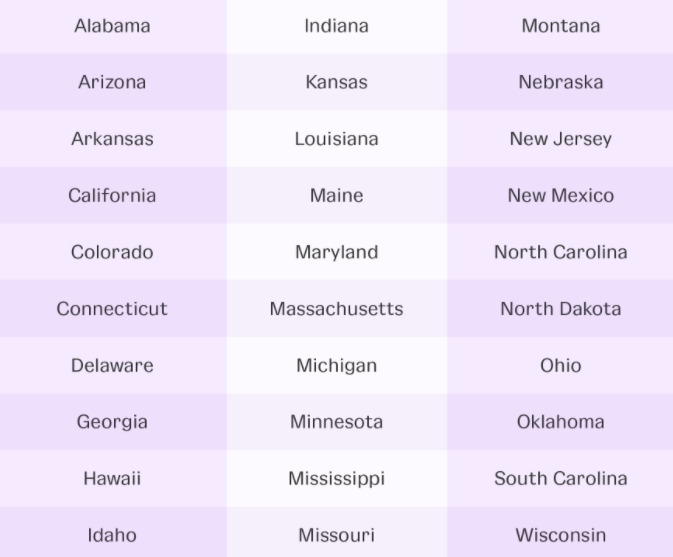

Following is the list of states that participate in CF/SF:

Form 1099 Due Date

Form 1099-MISC, needs to be distributed and filed by the correct due date.

- March 1, If you are filing a paper form, your Form 1099-MISC

- February 1, you must send the recipient their copy no later than

Downloading 1099- misc Forms Using Deskera People

Using Deskera People you can Download the 1099- misc form, please refer to below article,

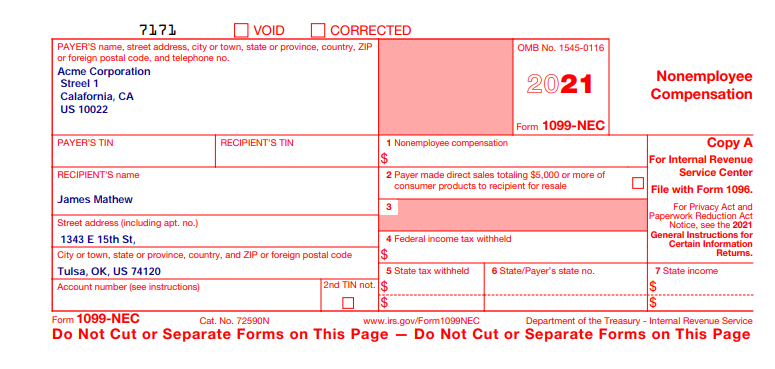

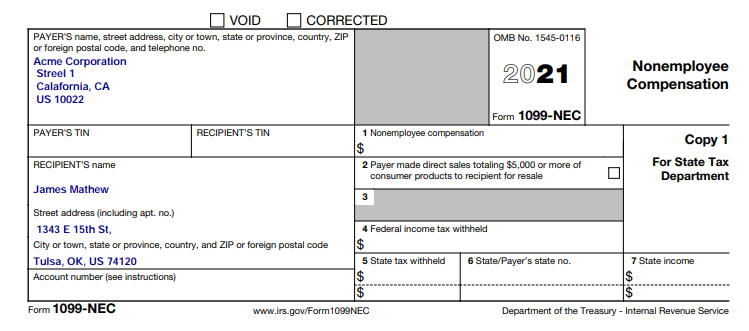

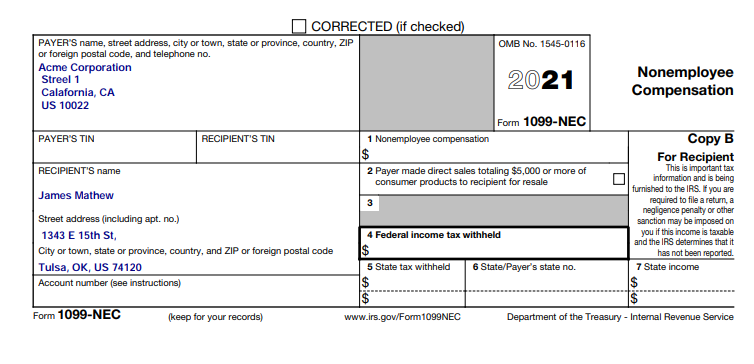

Form 1099 - NEC

Form 1099-NEC is a non-employee compensation form that solely reports only non-employee compensation. This form is not a replacement of Form 1099-MISC.Form 1099-NEC is only replaced by the Form 1099-MISC for reporting contractors payments

Who Uses Form 1099-NEC?

All businesses must file a Form 1099-NEC form for non-employee compensation if all four of these conditions are met:

Where Do You Send Form 1099-NEC?

You must know where to file Form 1099-NEC. There are multiple copies of Form 1099-NEC that you must distribute.

Following mentioned is the each copy and its recipient:

Form 1099-NEC can be filed electronically, or you can mail it to the IRS. Where you mail your completed form depends on your state. Use the IRS’s FIRE system, to e-File Form 1099-NEC.

What Do You Include on Form 1099-NEC?

When filling out Form 1099-NEC, include the following information:

- 1. Your name, address, and phone number

- 2. Your Taxpayer Identification Number (TIN)

- 3. Recipient’s name, address, and TIN

- 4. Nonemployee compensation total

- 5. If applicable, federal and state income tax withheld

When Is the Form 1099-NEC Deadline?

The employer not only has to keep the new 1099-NEC on their radars but also have to make sure to mark their calendars for a due date for a new non-employee compensation.

By January 31 or the next business day(If it falls on weekends), send the copies of Form 1099-NEC to workers you pay non-employee compensation during the year.

Also, by January 31 each year, file Copy A with the IRS.

How to Generate Form 1099-NEC Using Deskera People?

Using Deskera People you can Download the 1099- NEC Form, please refer to below article,

Key Takeaways

And that's a wrap.

By now you would have developed the understanding of how the U.S. payroll works and what the the various work-permits, payroll components, Payroll taxes, Income Taxes, and forms that you need to be aware of.

We covered the following topics in the article:

- Registering Your Business for Payroll in the United States

- The Different Types of Work Permits in the United States

- Federal, State, and Local Minimum Wage Law in the U.S.

- Setting Up Payroll for the First Time in the United States

- Components of Payroll in the United States

- Types of the Payroll Frequencies in the United States

- Payroll Taxes and Income Taxes Deductions in the United States

- What Is FICA Tax

- What Is FUTA Tax

- What Is SUTA Tax

- Paying And Reporting Quarterly Payroll Taxes

- What is Income Tax

- Federal Income Tax

- State Income Tax

- Local Income Tax

- Different Types of Employee Withholding and Federal Forms in the United States

The U.S payroll can be complicated, with the various taxes, rules, contributions and forms. It is highly recommended to opt for an out-of-the-box solution for managing your payroll and.

Deskera People is a payroll software developed especially for small and medium enterprises (SME). Deskera People also supports auto computation for various contributions, like, Federal Taxes, State and Local Taxes, Social and Medicare contributions. All these contributions submission to the respective statutory bodies are made easy with the readily available auto-generated Forms from the system.

Refer to the video tutorial for how to set up a US Payroll in Deskera People

Selling in the US? Head over to our guide on sales tax nexus guide in the USA.