Are you a business owner operating in the U.S.?

Do you have a lot of employees working for your organization?

If the answer to the above questions is 'YES.'

Then, we have got you covered with the gleaming new retirement savings to plan to position as a win-win for your business and employees.

This plan is known as Safe Harbor 401(k), a retirement benefit plan you offer to your employees. This specialized plan can help you gain tax-deferred savings and reduce any kind of risks that may occur during the tenure.

In this article, we will look forward to knowing in-depth about the safe harbor plan 401(k) and why it is suitable for the companies to go ahead with a plan.

The article covers the following:

• What is the Safe Harbor 401(k) plan?

• What is the set of requirements to set a Safe Harbor 401(k) plan?

• How to set up a 401(k)?

• Why is it right for the company to adopt Safe Harbor

• What are Safe Harbor Deadlines to meet?

• What are key dates for new 401(k) and existing 401(k) plans?

What is the Safe Harbor 401(k) plan?

A Safe harbor 401(k) is a retirement savings plan adopted by the companies running in the U.S.U.S. for their employees. The 401(k) plan makes it easier for the employees to save for retirement and embrace the joy of prosperity in the next phase of life.

The company explicitly adopts this plan to avoid regulations and expenses associated with nondiscrimination tests.

With the help of Safe Harbor 401(k), the companies are in a position to roll out the retirement plan to the employees such that they feel more satisfied with the jobs.

What is the set of requirements to set a Safe Harbor 401(k) plan?

To meet the safe harbor requirements, the employers need to provide certain information to all the eligible employees for the plan.

The set of requirements to set the safe harbor plan 401(k) plan are as follows:

- The rights, duties, and obligations of the employee considered under the plan

- The procedure to make a deferral to the employees' account

As far as the information on the above two points is concerned, it must be provided at least 30 days before the plan begins to execute. If there are delays, it should not be more than 90 days.

As of 2020, the safe harbor 401(k) annual contribution for the employer's limited to $19,500 and an additional $6,500 catch-up contribution for employees above 50 years of age.

How to set up a 401(k) plan?

The most important step to set up a 401 (k) plan is to pass a series of nondiscrimination tests by the Internal Revenue Services of the U.S.U.S. Federation.

The nondiscrimination test's purpose is to measure whether a 401(k) plan only favors highly compensated employees over the rank and files.

If in case, the company fails in any of these tests, then it will turn into an extra burden for you.

The company will be required to make expensive corrections, juggle heavy administrative work, and even refund the 401(k) contributions.

After the company passes all the tests, the following work is to set up a safe harbor 401(k).

Here, the employers need to make contributions to their employees' 401 (k) savings account and vest their contributions as soon as possible.

To set up the safe Harbor 401(k), the following are the three main contribution structures that the companies can choose for their safe harbor plan.

- Basic Matching

- Enhanced Matching

- Non-elective Contribution

1. Basic Matching

Under basic matching, the companies will be required to match the hundred percent of each employee's 401 (k) contributions, up to 3% of the employees' compensation.

In addition, they will be required to match 50% of the next 2% of the employees' compensation.

2. Enhanced Matching

Under enhanced matching, the companies will be required to match at least a hundred percent of each employee's 401(k) contributions and up to 4% of the employee's compensation.

3. Non-elective contribution

Under non-elective contributions, the company is required to contribute at least 3% of each employee's compensation to their 401(k).

This is independent of whether the employees have made their contribution themselves.

Why is it right for the company to adopt Safe Harbor 401(k)?

Safe Harbor helps the companies sail off into the retirement plan for their employees and increases the overall payroll by almost 3% or more.

Following are five of the reasons why safe Harbor 401 (k) is a good choice for the companies:

- You don't want to worry about the nondiscrimination testing

- You are looking forward to matching the employees' contributions because of your predictable and consistent business

- You have got lower participation among the ranks and file employees in the company's 401 (k) plan

- You want to take good care of your employees working under the organization

- You have failed with the compliance non-discriminating testing in the prior year.

Suppose your company falls under the category of any of the above reasons. In that case, it is recommended for you to adopt the safe harbor provision that will simplify the administration of 401(k) plans.

With the safe harbor 401(k) plan, the company can look forward to tax savings and retirement benefits and savings for making a prosperous future for your employees associated with the company.

What are Safe Harbor Deadlines to meet?

The first deadline to set up the safe harbor plan is September 1 of every year.

Here, you need to notify all your employees about the new 401(k) to ensure they get a 30 day heads up.

October 1 is the last day for your 401 (k) plan to go live.

Hence, it is recommended to give yourself at least a week to set up the 401(k) plan.

What are the key dates for new 401(k) and existing 401(k) plans?

Key dates for new 401(k) plans:

The key dates for the new 401 (k) plan that a company needs to comply with are as follows:

- For setting up a safe harbor 401(k) Plan, the date is by or before August 31

- A notice will be sent to all the employees covered under the plan, the date for the same is September 1

- The plan will be effective and exempted from the nondiscrimination testing for the following year; the date for the same is October 1

Key dates for existing 401(k) plans

The key dates for the existing 401 (k) plan that a company needs to comply with are as follows:

- For requesting the addition of safe harbor provisions to the 401 (k) plan for the following year, the date is by or before November 30

- A 30-day notice will be sent to the employees; the date is December 2

- For putting the harbor provision into effect and exemption from the nondiscrimination testing, the date is January 1

Bottom Line

The safe harbor 401(k) plan boosts the retirement savings program and adds up to the benefit to your employees.

It helps the company avoid unnecessary compliance challenges and keeps them informed about changes to the plan.

It is a true reflection of you contributing towards the employees' benefit by adding those contributions to their retirement accounts.

The safe harbor 401(k) plan indeed takes you along!

How can Deskera Help You?

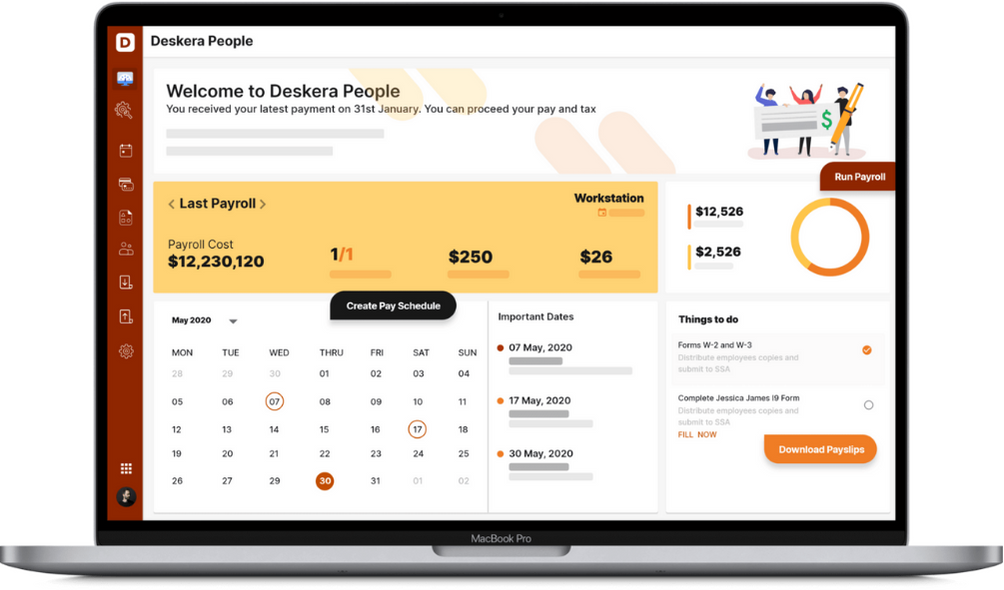

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

A safe harbor plan is undoubtedly the right decision that a company can make to reduce its risk and make things easier down the road.

Let's take a look at the key takeaways of the article:

- Safe harbor 401(k) is a retirement savings plan that companies adopt to make it easier for employees to save for retirement.

- By following specific rules, the companies are in a position to get a tax advantage.

- To meet the safe harbor requirements, the companies need to mention the rights and obligations of employees and the procedure to make the difference to the employees' accounts.

- The safe harbor 401 (k) annual contribution for the employer limits to $19,500 along with the additional $6500 to catch up with the contribution for employees above 50 years of age

- Before setting up the 401(k) plan, the company must pass a series of nondiscrimination tests by the I.R.S. of the U.S. federation.

- To set up the safe Harbor 401(k), the company can adopt three contribution structures.

- The structures are basic matching, enhanced matching, and non-elective contribution.

- It is suitable for the company to adopt a safe harbor 401(k) if they fall under the category of five primary reasons.

- With the safe harbor 401(k) plan, the company can look forward to tax savings and retirement benefits in making a prosperous future for the employees associated with the company.

- The deadline to meet the safe Harbor is September 1 of every year.

- There are respective key dates for the new 401(k) plans and existing 401(k) plans that a company and employees need to adhere with

Related Articles