Pennsylvania has a long and illustrious history. It was here that the first presidential mansion was erected, the first computer was developed, the first daily newspaper was launched, and the stars and stripes were sewn together for the first time. Punxsutawney Phil initially raised his head out of the melting winter earth to announce the coming, or delay, of spring. However, although history stands steadfast in its reality, payroll taxes are always changing, often on an annual basis.

Let's take a closer look at Pennsylvania's payroll taxes.

- Introduction

- Must-Have List of Forms Before You Run a Payroll

- Terms & Definitions Related to Pennsylvania Payroll Taxes

- Step-by-Step Guide to Pennsylvania Payroll Taxes

- Benefits to Pennsylvania’s Workers

- Final Paycheck Laws in Pennsylvania

Introduction

Payroll administration in Pennsylvania entails more than just paying your employees on time. Businesses in Pennsylvania must comply with a slew of state requirements governing minimum wage, overtime pay, perks, income tax, and a slew of other HR and accounting issues.

You're not alone if you're a small company owner attempting to find out how to calculate payroll. Thousands of other small companies in Pennsylvania are in the same situation as you. They all have flames to put out, workers to pay, futures to prepare, and little to no time to deal with the Internal Revenue Service's tax law.

The good news is that, while the tax law may appear hard at first, it is rather simple once you understand what tax files are necessary and how to perform the calculations. As a result, accurately computing payroll taxes is crucial not just for your employees, but also for your accountant and other authorities. That's why we decided to publish this step-by-step tutorial on how to compute payroll taxes.

You should have a good understanding of Pennsylvania's payroll taxes.

Must-Have List of Forms Before You Run a Payroll

Before you can start computing payroll taxes, your employees must complete the following new employee documents:

- Employee Withholding Certificate (Form W-4)

- W-4 for the state (as applicable)

- Direct Deposit Authorization Form

- Employment Eligibility Verification Form (Form I-9)

Form W-4: Employee’s Withholding Certificate

Each new employee must fill out IRS Form W-4, which provides you with valuable information of how much federal income tax (FIT) you should deduct from their pay. The employee's name, residence, and social security number will be entered.

In 2020, the W-4 was updated. For determining employee withholding, the new form contains a five-step method and a new Publication 15-T (Federal Income Tax Withholding Methods). Withholding allowances are no longer used.

You can proceed to use the information given on the previous form W-4 for workers recruited in 2019 or before. It comes with a worksheet that your workers may use to figure up withholding allowances for dependents and children. If an employee works a second job, gets married, has a kid, or gets divorced, they may wish to fill out a new W-4, but you cannot force current workers to do so.

Employees can also choose to have more tax withheld or apply to be excluded from withholding on federal income taxes. The new W-4 form includes comprehensive instructions.

Ensure that the employee signs the W-4, but only send it to the IRS if the IRS requests it. Keep it in your employee's personnel file for at least four years following the employee's most recent tax return.

State W-4 (as applicable)

Some states have their own forms for withholding. In areas where they don't, Form W-4 is frequently used to calculate state and/or local income tax withholding. The Federation of Tax Administrators maintains a comprehensive list of eligible state tax forms.

Direct Deposit Authorization Form

You can pay your workers in various methods as an employer, including paper checks, direct payments, prepaid debit cards, and cash. Direct deposit is by far the most popular method of delivering paychecks since it is frequently the simplest and most secure. In fact, direct deposit is currently used by more than 82% of US workers.

If an employee wishes to be paid via direct deposit, he or she must submit a direct deposit permission form, which includes bank routing and account information. You can use the document as a consent slip to deposit the employee's net salary into their bank account online.

Many companies will want a voided blank check as part of the verification procedure to ensure the correctness of the bank account information given by the employee.

Form I-9: Employment Eligibility Verification

A Form I-9 is completed by new workers to prove that they are legally authorised to work in the United States. They can either show you their US passport or both their driver's licence and Social Security card to establish their employment status.

Before your employee starts working for you, you must receive a signed Form I-9 from them. The completed form, as well as any supporting documentation, should be kept in your employee's personnel file.

Ideal Practice

At this stage, you might wish to have new workers affirm that they have received the business handbook, code of conduct, and any other written policies. While the acknowledgement isn't required for payroll calculations, having your new workers submit all essential business paperwork at the same time is a smart practice. There is a variety of HR software available that may help you handle all of these responsibilities.

Terms & Definitions Related to Pennsylvania Payroll Taxes

- Gross Wages. Every pay cycle starts with gross wages. It's simply their hourly rate multiplied by the number of hours they worked during the payment period for hourly employees. Divide the yearly compensation of salaried personnel by the number of pay periods in the year. Bonuses, commissions, and tips are all factored into the total salary.

2. Pre-Tax Withholdings. As pre-tax withholdings are not taxable income, subtract the sum from your workers' gross salaries if they have a 401(k), FSA, or any other account that falls into this category.

3. Federal Income Tax. The tax can range from 0% to 37% of each paycheck.

4. FICA Taxes: Social Security & Medicare

a. Social Security Tax is 6.2% of an employee's taxable salary up to $147,000. This implies the employee's maximum annual Social Security tax is $9,114. You, as an employer, are also responsible for this tax. You must dollar-for-dollar equal your employee's contribution.

b.Medicare Tax is 1.45% of their taxable salary until an employee earns $200,000 in a calendar year. The rate is increased to 2.35% after the earning amount exceeds $200,000. The Additional Medicare Levy is a 0.9%t tax on higher-wage earners (super original, we know). You're solely accountable for the first 1.45% as an employer, not the remaining 0.9%.

5. FUTA Tax. The Federal Unemployment Tax Act (often known as FUTA) levies a 6% tax on an employee's first $7,000 in taxable income. You can receive a tax credit of up to 5.4% if you pay your state unemployment tax in full and on time. The FUTA tax is not the responsibility of your employees. This one is entirely up to you.

6. Post-Tax Withholding. There are a variety of various post-tax withholdings that your employees may be accountable for, so you should factor those in as well. These are items that a judge has required them to pay, such as salary garnishments or child support.

Step-by-Step Guide to Pennsylvania Payroll Taxes

Step 1: Register your company as an employer

You must apply for a Federal Tax ID and create an account with the Electronic Federal Tax Payment System on the federal level (EFTPS).

Step 2: Enroll with the Pennsylvania Department of Revenue

The PA-100 Business Entity Registration Form may be used to register for both Income Withholding and Unemployment Insurance tax accounts online. After filling out the online registration, you should obtain your account number instantly.

Step 3: Pay your city taxes

If you pay an employee in either the city of Pittsburgh or the city of Philadelphia, you must register for tax accounts with both jurisdictions separately.

City of Pittsburgh: You must register your business with the City of Pittsburgh if you do not have a City ID and will be paying an employee in Pittsburgh. With Jordan Tax Service, you'll want to pick Payroll Expense Tax, Local Services Tax, and Earned Income Tax. After enrolling, you should receive your number within one to two days.

City of Philadelphia: You must register your business with the City of Philadelphia if you do not have a City ID and will be paying an employee in Philadelphia. You may register with the Department of Revenue of the City of Philadelphia online. After completing the online registration, you should obtain your account number instantly.

Step 4: Enroll for local taxes

You must withhold and pay the local Earned Income Tax (EIT) and Local Services Tax (LST) on behalf of workers working in Pennsylvania if one of your work sites is in Pennsylvania. Industries, offices, divisions, and warehouses are examples of workplaces. You can register by filling out and submitting an Employer Registration Form to your local tax collector.

Step 5: Set up payroll and gather employee paperwork

Whether you conduct your own payroll or utilise payroll software, you'll need to figure out a pay cycle that complies with Pennsylvania law and create a method that works for your company. During the onboarding process, it's important to gather employment forms from new recruits. W-4, I-9, and Direct Deposit information are among the forms. There are no extra forms in Pennsylvania.

Step 6: Collect, evaluate, and approve timesheets

Make sure you accomplish this a few days before payday, as the Pennsylvania Wage Payment and Collection Law mandates that employees get their paychecks by the designated payday. If you don't have a system in place yet, use one of our free timesheet templates to get started.

Step 7: Figure out your payroll and pay your staff

There are several methods for calculating payroll, and you must choose the one that is ideal for your company. Payroll software, a calculator, or even Excel can be used.

Step 8: Register with the federal and state governments to file payroll taxes

All state and local tax payments must be submitted directly to the appropriate agency, according to the schedule that has been given to your company. EFTPS is required for federal tax payments. In general, you must deposit federal income tax withheld, as well as employer and employee Social Security and Medicare taxes, according to the IRS's timetable for your firm. You may be assigned to one of the following depositing schedules by the IRS:

Monthly Depositor: This option requires you to deposit employment taxes on payments received throughout the month by the 15th of the following month.

Semi-Weekly Depositor: Requires you to deposit employment taxes by the following Wednesday for payments made on Wednesday, Thursday, and/or Friday. Taxes paid on other weekdays must be deposited by the following Friday.

It's vital to remember that the deposit and reporting of taxes follow different schedules. Employers who deposit both monthly and semi-weekly should only file Form 941 or Form 944 quarterly or yearly to report their taxes.

Step 9: Finish your payroll reports for the year

For all employees, W-2s must be finalised, and for all private contractors, 1099s must be done. By January 31 of the following year, both employees and contractors must have received these documents.

Benefits to Pennsylvania’s Workers

Pennsylvania employees are eligible for federal benefits including Social Security and the Family and Medical Leave Act (FMLA). The following benefit requirements are also crucial to note under state law:

Workers’ compensation: Workers' compensation insurance is required by Pennsylvania law for most companies.

Health insurance: Any Pennsylvania business with 50 or more full-time (or equivalent) employees must provide health insurance coverage under the Patient Protection and Affordable Care Act (ACA). While Pennsylvania law does not compel firms with less than 50 employees to provide health insurance, those who do must provide some specified benefits in addition to the ACA's minimums. Health insurance premiums can be deducted from employee paychecks in Pennsylvania.

Sick leave: While state law does not mandate employers to provide sick leave benefits, several localities, such as Pittsburgh and Philadelphia, do. Check with your local government to see if you're obligated to provide paid sick time.

Jury Duty: Employers must provide employees unpaid time off for jury service. It is unlawful to terminate employees for jury service.

Voting: Employers are not required by Pennsylvania law to provide time off to vote.

Final Paycheck Laws in Pennsylvania

When a company fires an employee, it's critical that they receive their final salary as soon as possible. Regardless of whether the employee left or was fired, Pennsylvania law mandates that last payments be provided on the following scheduled payday. The employee's normal earnings from the most recent pay period should be included in the final payment, as well as any other forms of remuneration owed to them (commissions, bonuses, and accrued sick/vacation money).

If an employee owes your company money, you have the legal right to deduct money from their last paycheck. This might be the consequence of unpaid corporate loans, money for uniforms that were never paid, or even unlawful charges on a company credit card.

Tip: While it's not legally necessary, it's a good idea to keep track of any deductions from final paychecks. Make a note of the amount withdrawn as to what it was for so you can find it readily if you need it.

How Can Deskera Assist You?

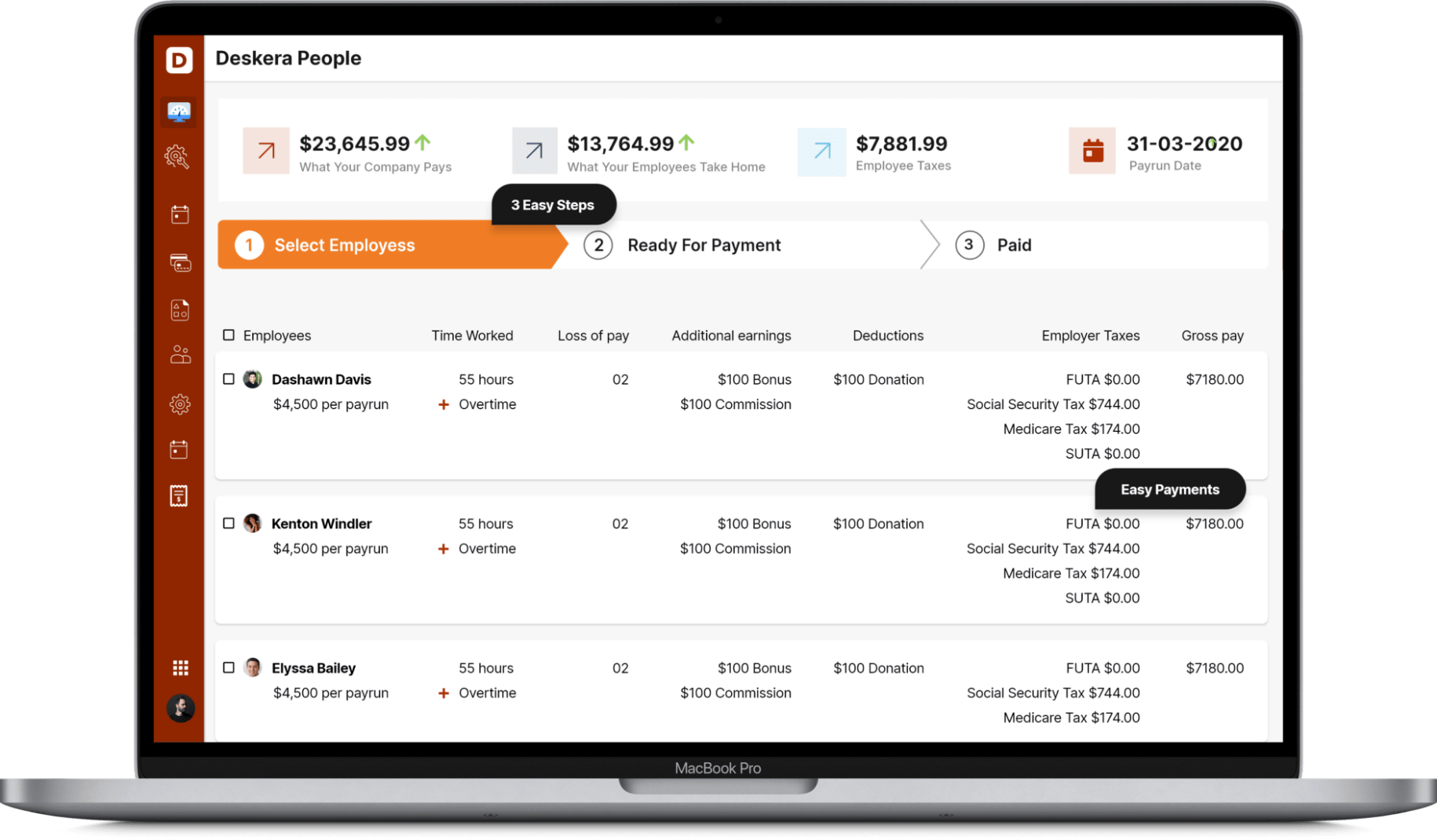

Deskera People make it simple to handle attendance, leave, payroll, and other processes so that you can focus on making the best decisions. For example, creating payslips for your employees is now simple since the platform also automates and digitizes HR tasks.

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Related Articles