Estimating payroll for your small company on your own might be complex, especially if you're new to conducting business in Texas. But, if you're still attempting to figure out how to deduct and pay taxes when reporting payroll, you've come to the perfect place. You'll be relieved to learn that, while Texas is a vast state, the number of needed payroll taxes is low.

Keeping this in mind, it's still critical that you follow Texas payroll tax rules and regulations so that your firm may continue to operate smoothly. Read further to learn everything about documenting and reporting taxes in Texas as a small business owner.

Table Of Content:

- Texas Payroll Laws & Regulations

- Payroll Taxes In Texas

- Income Tax

- Additional Medicare Tax

- Unemployment Insurance (UI) Tax

- Property Tax

- FICA Tax

- Estate Tax

- Sales & Use Taxes

- Minimum Wage Rules in Texas

- Commission and Bonus Amounts

- Texas Overtime Regulations

- How To Do Payroll In Texas

- Different Ways to Pay Employees in Texas

Let's Start!

Texas Payroll Laws & Regulations

Texas payroll tax regulations are unique in that they only demand one state-level tax from business owners: unemployment insurance (UI). Employers, even small company owners, are not required to record state income taxes on account of their employees, nor are they required to submit employee taxable income at the municipal level.

In short, Texas has among of the country's most lax payroll tax requirements. These laws minimize the taxable income that workers must pay. As a result, it makes Texas an attractive place to work. While this image is often correct, payroll administration in Texas also involves federal taxes that apply to all persons who operate a business in the state.

To ensure a perfect account of payroll deductions and payments, use the list of taxation terms below.

Texas Payroll Taxes

In Texas, running a small business entails significant tax breaks and a short roster of payroll taxes to cope with. The following are the most important phrases to understand while filing payroll taxes in Texas:

Income Tax

Federal income taxes are the first federal taxes that Texas workers must pay. Your workers must deduct a sum for income tax based on their preferences on the IRS Form W-4. Income taxes at the national level may range from 0% to 37% as of 2021.

Additional Medicare Tax

It is the next national tax that workers must pay. In Texas, employers are obligated to withhold the 0.9 percent Additional Medicare Tax from workers who fulfill specific filing requirements and earnings exceeding $200,000 per year.

Unemployment Insurance Tax.

Employers must charge UI revenue on the initial $9,000 of their workers' annual incomes. The exact rate at which the state levies the UI taxes varies yearly. It depends on five factors: the General Tax Rate, the Replenishment Tax Rate, the Obligation Assessment Rate, the Deficit Tax Rate, and the Employment Training Investment Assessment. The taxable pay base of your employees' first $9,000 in compensation each year calculates UI rates. It ranges between 0.31 percent and 6.31 percent.

Property Tax

The comptroller's office in Texas does not collect real estate taxes or determine property tax rates at the state level. Instead, local entities in Texas set up and collect real estate taxes and can use the tax income to fund services such as schools, governments, and local police and firefighting.

Estate Tax

Texas is among 38 states in the United States that do not impose estate taxes on its people. As a result, neither the municipal governments nor the states get any revenue from willed or inherited property in Texas.

Federal Insurance Contributions Act (FICA) Tax

Both entrepreneurs and their workers are obliged to pay FICA taxes. In Texas, companies and their workers pay 6.2 percent of their wages up to $132,900 for Social Security taxes. The Medicare tax rate is 1.45 percent of both a business's and a worker's gross pay in a given year. Rates fluctuate yearly per IRS guidance and should be monitored regularly, especially as you get more familiar with filing Texas payroll taxes.

Sales and Use Taxes

No small company owner may begin processing their payroll taxes until they know their state's sales and use tax rates. Texas's state rate is now 6.25 percent. Still, municipalities, townships, districts, and other local taxing entities can impose their extra rate of 2% for a total sales usage tax rate of 8.25 percent. Businesses in Texas are obligated to charge sales and use duties at the state and city levels, and they should check the local taxation levels for their specific area.

The above words refer to several sorts of taxes that small company owners should be aware of while handling payroll in Texas, plus there are a few extra federal taxes that businesses must pay. Owners must pay 6% of their workers' first $7,000 in yearly earnings to the FUTA. FUTA urges company owners to investigate if they are eligible for a federal tax benefit to pay to FUTA.

When relevant, business owners must also include court-ordered income garnishments, support payments, and employee contributions to funds. Employers in Texas must take the necessary sums from their employee's wages and report them on time to the authorized regulators.

Minimum Wage Rules in Texas

The minimum payment is $7.25 per hour in Texas, the same as the federal minimum wage. Exemptions include those included in the federal Fair Labor Standards Act (FLSA) as well as the following:

- Employees of religious, educational, philanthropic, or nonprofit organizations.

- Professionals and salespeople.

- Domestic servants

- Certain teenagers and students.

- Inmates.

- Members of the family

- Employees in entertainment and leisure businesses.

- Employees who work for non-agricultural firms are not required to pay state unemployment benefits.

- Employees involved in dairying and cattle production.

- Workers in sheltered workshops.

Commission and Bonus Amounts

If you give an employee an incentive or a bonus, you must have a precise written agreement outlining the payment structure. This does not imply that the amounts must be fixed, and there is no minimum quantity. But, you are not permitted to make any modifications retrospectively; only adjustments for future payments are permitted.

Texas Overtime Regulations

Texas uses the federal FLSA to decide who is eligible for overtime pay. According to Texas tax legislation, workers are qualified for compensation if they work for more than 40 hrs per week. They can be compensated with either extra pay at 1.5 times their usual rate or equivalent time off at 1.5 hours each hour of excess work. Employees who choose leave may not accrue more than 240 hours.

How To Do Payroll In Texas

To better understand what you'll need to set up and manage your payroll system, it's time to consider the elements that distinguish payroll administration tools and functions from the competition.

Let's take a look at some of the payroll tools and services available to company owners who want to make conducting their payroll easier:

Step 1: Establish your company as an employer. You will need your EIN and an account in the Electronic Federal Transfer System to apply at the federal level.

Step 2: Apply to Texas Workforce Commission. To obtain your TWC Account Number, sign up online within 10 days of the first check dates.

Step 3: Create your payroll. According to Texas law, employees exempt from the FLSA must be reimbursed at least once a month, while everyone else must be reimbursed at least twice a month. Semi-monthly pay periods must be as near to equal in length as practicable. The first and fifteenth are essential.

Step 4: Collect employee payroll paperwork. It is simplest to accomplish this during onboarding. W-4, I-9, and Direct Deposit information are all included on the forms. Unfortunately, there are no more forms in Texas.

Step 5: Collect, evaluate, and approve timesheets. Ensure you accomplish this a few days before payday, as Texas Deadline Law requires employees to get their earnings no later than the designated payday.

Step 6: Prepare the payroll and pay the employees. Payroll may be calculated using software, excel or a calculator.

Step 7: Submit payroll taxes to Texas's federal and state governments. For federal taxes, notably unemployment, follow the IRS guidelines.

Texas has no income tax, but you must submit State Unemployment Insurance taxes each quarter. Businesses with less than 1,000 employees can submit online using a CSV report or an Excel, manual input, entry based on the previous report, or a No Wages report if they did not pay wages that quarter. Navigate to Unemployment Tax Services and follow the on-screen instructions.

Step 8: Document and keep track of your payroll information. It is critical to retain records for all of your workers, including those terminated, for at least three to four years.

Step 9: File your payroll tax returns for the year. These are the federal W-2 (for workers) and 1099 forms (for contractors.) Employees and contractors must have these before the end of the fiscal year on January 31st of the following year. Unfortunately, there are no Texas-specific forms; federal versions will suffice.

Different Ways to Pay Employees in Texas

There are no unique laws in Texas that limit the methods you can use to pay employees. You may pay staff via cash, cheque, direct deposit, or payroll card. Suppose you're paying the employee in a form other than one previously listed, such as products. You'll need to establish a formal agreement with the payment arrangement terms for both you and the employee to sign before distributing.

How Can Deskera Assist You?

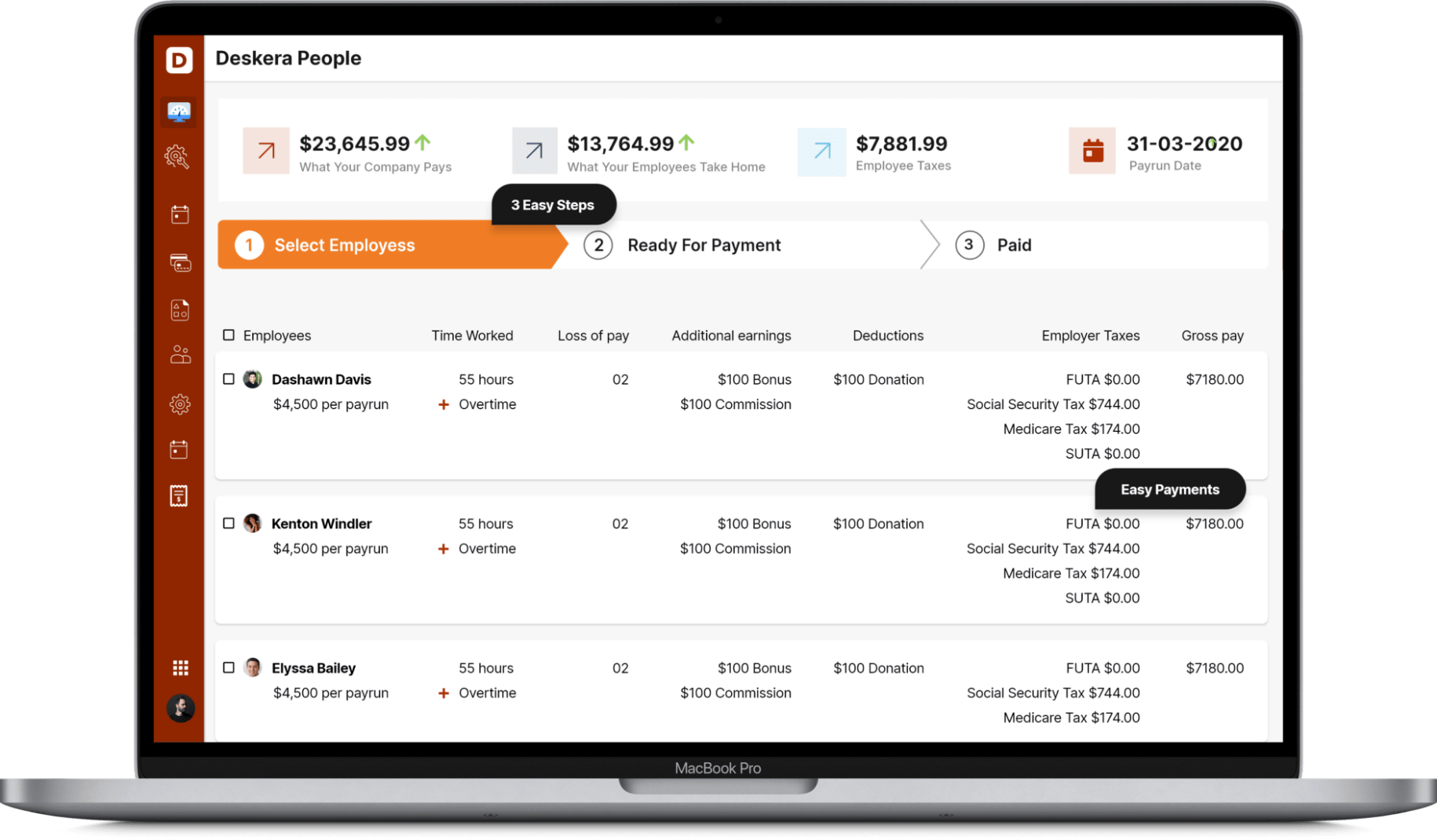

Deskera People make it simple to handle attendance, leave, payroll, and other processes so that you can focus on making the best decisions. For example, creating payslips for your employees is now simple since the platform also automates and digitizes HR tasks.

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Frequently Asked Questions

What is the Texas payroll tax rate range?

Texas's minimum payroll tax rate is 0.31 percent, and the maximum rate is 6.31 percent.

In Texas, is there a personal income tax?

The Texas constitution prohibits the use of a personal income tax. Instead, Texas collects its revenue from sales and use taxes and local taxes.

In Texas, what are payroll taxes?

Employers in Texas pay the Texas Unemployment Tax as part of their payroll taxes. FICA tax is paid by both employees and employers, although only employees pay federal income tax and the Additional Medicare tax.

Is it true that Texas has low payroll taxes?

Texas has minimal payroll tax regulations and no state withholding tax. As a result, Texas has the fifth-lowest total tax burden per capita in the US and is fair to company owners to pay payroll taxes.

Key Takeaways

- Texas payroll tax regulations are special in that they only demand one state-level tax from business owners: unemployment insurance (UI).

- Employers, even small company owners, are not required to record state income taxes on account of their employees, nor are they required to submit employee taxable income at the municipal level.

- Important phrases to understand while filing payroll taxes in Texas:

- Income Tax

- Additional Medicare Tax

- Unemployment Insurance (UI) Tax

- Property Tax

- Federal Insurance Contributions Act (FICA) Tax

- Estate Tax

- Sales & Use Taxes

- Owners must pay 6% of their workers' first $7,000 in yearly earnings to the FUTA.

- Because most companies are generally eligible for government tax breaks, the FUTA rate often becomes 0.6 percent of the first $7,000 of an employee's yearly income.

- Texas' minimum pay is $7.25 per hour, the same as the federal minimum wage.

- If you give an employee an incentive or a bonus, you must have a precise written agreement outlining the payment structure.

- According to Texas overtime legislation, workers are eligible for compensation if they work more than 40 hours in a week.

- There are no unique laws in Texas that limit the methods you can use to pay employees. You may pay staff via cash, cheque, direct deposit, or payroll card

Related Articles