The Karnataka Shops & Commercial Establishments Act, 1961, is a legislation that regulates the opening and closing times of shops, commercial establishments and factories. The registration certificate of establishment - form C helps maintain the necessary record and outlines the compliance laws implemented by the legislature.

The registration certificate of establishment - form C is covered under the Act to consolidate and amend the law relating to shops and commercial establishments in the State of Karnataka.

Table of Contents

- What is the Karnataka Shops & Commercial Establishments Act, 1961?

- Karnataka Shops & Commercial Establishment Act, 1961– Features

- Purpose and Significance of the Karnataka Shops & Commercial Establishments Act, 1961

- Why is the Karnataka Shops & Commercial Establishments Act, 1961, vital for employees?

- What is the Form C registration certificate used in the case of the Karnataka Shops & Commercial Establishments Act, 1961?

- Key Takeaways

What is the Karnataka Shops & Commercial Establishments Act, 1961?

The Karnataka Shops & Commercial Establishments Act, 1961 is an act of the legislature of the Indian state of Karnataka. The Act applies to all shops, commercial establishments, shift timings, leaves availed, work environment and all the working conditions.

The Act seeks to regulate the working hours of employees engaged in shops and commercial establishments and to provide for a weekly holiday for all such employees.

The provisions of this Act shall not apply to any shop or establishment its proprietor himself is managing, where there are no other persons employed therein except members of his own family and persons who are wholly dependent upon him for their livelihood.

Definition of a Shop and Commercial Establishment as per the Act

The definition of a shop and commercial establishment as per the Act are:

'Shop' means any premises used for carrying on any retail business, whether such premises be situated within or outside the limits of a municipal area or not; It is the premises where goods are sold or displayed for sale or hire to the general public; or where any industrial material is made available for purchase; or where any service is rendered to the general public.

Here the goods are sold by retail or wholesale to the public and include any premises used to carry on such business.

'Commercial establishment' means any premises used to carry on any manufacturing, industrial process, or business other than those specified. It is the premises where industrial activity is carried on by an industrial establishment, including factories, mines, oil fields and other places where articles are manufactured or produced.

It covers any establishment engaged in manufacturing goods or providing services for sale to the public and includes all premises used for carrying on such business.

Registration Process and Renewal of Licenses

The registration process and renewal of licenses under the Karnataka Shops and Commercial Establishments Act is essential to operate a business in Karnataka. Here are the details regarding the process:

Registration process:

- To register a shop or a commercial establishment, the owner must submit an application in Form A to the Chief Inspector.

- The application must include details such as the name and address of the establishment, the name of the owner, the number of employees, and the type of business.

- Once the application is received, the Chief Inspector will issue a registration certificate in Form B.

- The certificate will be valid for five years and must be renewed before it expires.

Renewal of licenses:

- To renew the license, the owner must submit an application in Form D to the Chief Inspector at least 30 days before the expiry date of the certificate.

- The application must include details such as the name and address of the establishment, the name of the owner, the number of employees, and the type of business.

- The Chief Inspector will then issue a renewal certificate in Form E, which will be valid for five years.

- If the renewal application is not submitted within the stipulated time, a penalty of 2% per month on the renewal fee will be charged.

Documents required for registration and renewal:

- The following documents are required for the registration and renewal process:

- Identity proof of the owner (Aadhaar card, PAN card, passport, etc.)

- Address proof of the establishment (property tax receipt, electricity bill, rent agreement, etc.)

- Certificate of incorporation (in case of a company)

- List of employees working in the establishment

- PAN card of the establishment

- Registration certificate of the establishment under GST, if applicable.

Fees for registration and renewal:

- The fees for registration and renewal are based on the number of employees working in the establishment.

- The registration fee ranges from Rs. 250 to Rs. 5000, while the renewal fee ranges from Rs. 100 to Rs. 5000.

- The fees must be paid through a demand draft or online payment.

Consequences of non-registration or non-renewal:

- Non-registration or non-renewal of the license can result in legal consequences, including the closure of the establishment and the imposition of penalties.

- The penalty for non-registration is Rs. 500 for the first offense and Rs. 1000 for subsequent offenses.

- The penalty for non-renewal is 2% per month on the renewal fee, subject to a maximum of 100% of the renewal fee.

Karnataka Shops & Commercial Establishment Act, 1961– Features

It aims to provide for the safety and health of workers employed in shops and commercial establishments, to ensure their proper working conditions, including protection against hazards arising out of or in connection with work, and to protect them against risks arising out of or in connection with employment.

The Karnataka Shops & Commercial Establishments Act, 1961 contains provisions relating to:

- Opening hours of shops

- Closing days and holidays

- Employment conditions of employees

They provide for the regulation of employment of children below specified age in any establishment; provide for the regulation of recruitment and conditions of service of persons employed by employers; provide for the establishment of advisory committees at the district level for advice and guidance on matters relating to safety and health at workplaces; provide for the constitution of local committees under this Act.

The registration certificate of establishment - form C establishes an inspectorate for administration and enforcement of this Act; provides penalties for contravention or non-compliance with provisions of this Act or rules made thereunder; prescribes the procedure for adjudication of disputes referred by employer or workman or by the Inspectorate under this Act; safeguard interests of women workers employed in establishments under the legislation.

- The act applies to all commercial establishments and shops in the state of Karnataka except for certain categories such as factories, restaurants, and theatres.

- The act provides for the working hours of employees, including the maximum number of hours per day and per week, rest intervals, and weekly holidays.

- The act also mandates certain amenities to be provided to employees such as drinking water, adequate ventilation, and lighting.

- The act further provides for the registration of commercial establishments and shops with the relevant authorities, and failure to register can result in penalties and fines.

- The act also includes provisions for the inspection of commercial establishments and shops by authorized personnel to ensure compliance with the provisions of the act.

- The act stipulates certain obligations of employers such as the maintenance of registers and records, the provision of notice of holidays, and the payment of wages.

- The act also includes provisions for the termination of employment, the settlement of disputes between employers and employees, and the payment of compensation in case of injury or death of employees during work.

- The act empowers the state government to make rules and regulations for the effective implementation of the act.

- The act has been amended several times to keep up with the changing needs and requirements of the modern-day workplace.

The Karnataka Shops & Commercial Establishments Act, 1961, is a legislation that regulates the opening and closing hours of shops in Karnataka. It also covers matters such as shop licenses, penalties for violations and so on.

The commission has the power to recommend penalties which may extend up to three years imprisonment or fine, or both. The Act also provides for the constitution of district committees at the district level and local committees at the taluk level.

Working Hours, Overtime, and Leave Policies

The Karnataka Shops and Commercial Establishments Act governs various aspects related to working hours, overtime, and leave policies of employees in the state. Here are some points regarding these aspects:

Working Hours: As per the Act, the maximum working hours for an employee in a week should not exceed 48 hours. Also, the total number of working hours in a day should not be more than 9 hours.

Overtime: If an employee works for more than the prescribed working hours, then it is considered as overtime. The employer has to pay the employee double the wages for every hour of overtime worked. However, an employee cannot be forced to work overtime.

Weekly Holiday: Every employee is entitled to one day of weekly holiday, and it should be given on a rotation basis.

Leave Policies: The Act provides for various types of leaves that an employee can avail, such as:

- Casual Leave: An employee is entitled to a maximum of 12 days of casual leave in a year.

- Sick Leave: An employee can avail a maximum of 12 days of sick leave in a year.

- Earned Leave: An employee is entitled to earned leave, which is calculated at the rate of one day for every 20 days of work done.

- Maternity Leave: Female employees are entitled to maternity leave for a period of 12 weeks.

National and Festival Holidays: The Act provides for a list of national and festival holidays that an employee is entitled to. The list includes 12 national holidays and 5 festival holidays.

Night Shifts: If an employee works in a night shift, then the employer has to provide adequate safeguards for the safety and health of the employee.

Child Labour: The Act prohibits the employment of children below the age of 14 years in any establishment. It also mandates that adolescents between the ages of 14 to 18 years can only work in non-hazardous occupations.

Purpose and Significance of the Karnataka Shops & Commercial Establishments Act, 1961

The Karnataka Shops and Commercial Establishments Act, 1961, is a law enacted by the state of Karnataka to protect the interests of shopkeepers and other commercial establishments. The purpose of this Act is to ensure that all retail establishments in the state are run fairly so that there is no exploitation of customers or employees by owners or managers.

This Act has been implemented to protect unfair trade practices and consumer exploitation by traders. It also protects employees from any form of harassment at the workplace.

The Act applies to all shops, markets and other commercial establishments in the state except those exempted under various sections of this Act or any other law for the time being in force. This Act was enacted to provide minimum statutory protection to workers in shops, commercial establishments and those who work from home or establishments run by their employers.

The primary purpose of this Act is to ensure fair trade practices in commercial establishments such as retail shops and restaurants so that customers are not cheated into buying substandard goods or services at exorbitant prices.

The Act was enacted to ensure that all shops, commercial establishments and other places of business have proper sanitation facilities for employees so that they do not suffer from any health problems. The Act also ensures that there are no unnecessary risks to customers' lives by providing proper hygiene in these places.

In addition, the Act provides for adequate security measures to be taken by shopkeepers so that their goods do not get stolen or damaged due to theft or vandalism. It also requires them to display signs outside their premises indicating the nature of their business so that it can be easily identified by those looking for such services in their vicinity.

Another purpose behind enacting this law was to provide for minimum wages, weekly holidays with pay and annual holidays with salary, bonus on festivals and sick leave with pay for employees employed in shops and commercial establishments.

Minimum Wages and Payment of Wages

Here are some points regarding minimum wages and payment of wages under the Act:

- Minimum Wages: The Act prescribes minimum wages for different categories of employees based on their skills and qualifications. The minimum wages are revised every year.

- Payment of Wages: Every employer is required to pay wages to his employees on or before the seventh day of the succeeding month. The wages can be paid either in cash or by cheque or through electronic transfer to the employee's bank account.

- Deductions: The employer can make deductions from the employee's wages only in the following cases: (a) statutory deductions such as provident fund, gratuity, etc., (b) deductions for absence from duty, (c) deductions for damage or loss caused to the employer's property, and (d) deductions for recovery of advances or loans granted to the employee.

- Payment of Bonus: Every employer is required to pay an annual bonus to his employees who have worked for a minimum of 30 working days in a year. The bonus is calculated as a percentage of the employee's annual wages.

- Record Keeping: Every employer is required to maintain registers and records of his employees as prescribed under the Act. The registers should contain details such as the name and address of the employee, date of birth, date of appointment, wages paid, deductions made, etc.

Why is the Karnataka Shops & Commercial Establishments Act, 1961, vital for employees?

The Karnataka Shops & Commercial Establishments Act, 1961, is vital for the employees because it provides them with certain rights and protects them from exploitation by their employers.

It is important to note that this Act does not apply to all establishments in Karnataka but only to those that are commercial or industrial. However, this Act has been amended several times over the years to include other ventures such as manufacturing and service sectors under its purview.

It is an act that deals with the working conditions of the employees. It also provides for several social security measures like maternity benefits and compensation in case of accidents or injuries.

The Karnataka Shops & Commercial Establishments Act, 1961, requires employers to set up a welfare fund for their employees. This fund helps them pay for their medical expenses, maternity benefits and pensions, among other things. The Act also provides for several social security measures like medical insurance and gratuity payments.

The registration certificate of establishment - form C is a law passed by the Karnataka legislature to regulate the employment of people in shops and commercial establishments. It was given to regulate the working conditions of employees working in retail establishments, shops and factories. The primary purpose behind enacting this law was to improve the conditions of work for all employees in any form of business establishment.

The registration certificate of establishment - form C is covered under the Act that was passed by the state of Karnataka to protect the interests of labourers, workers and employees. The Act lays down the guidelines that employers should follow while employing people and sets up a grievance redressal system for those employees who have been wronged by their employers.

Health and Safety Measures for Employees

Health and safety measures are crucial for any workplace, including shops and commercial establishments. In Karnataka, the Shops and Commercial Establishments Act has various provisions for ensuring the safety and well-being of employees. Here are some of the health and safety measures that employers must follow:

- Ventilation: Employers must ensure that the workplace has adequate ventilation to provide fresh air and maintain a healthy working environment.

- Lighting: The workplace should have sufficient lighting to ensure that employees can work comfortably and avoid eye strain or other health issues.

- Cleanliness: The premises must be kept clean and hygienic to prevent the spread of diseases.

- First aid: Employers must provide first aid facilities for employees in case of an emergency.

- Fire safety: The workplace should have fire safety equipment such as fire extinguishers, alarms, and sprinklers to ensure the safety of employees in case of a fire.

- Safety of machinery: Employers must ensure that machinery and equipment are safe for employees to use and that they receive proper training on how to use them.

- Hazardous substances: If the workplace involves the use of hazardous substances, employers must take necessary precautions to ensure the safety of employees.

- Personal protective equipment (PPE): If required, employers must provide PPE such as gloves, helmets, and safety goggles to ensure the safety of employees.

- Emergency exits: The workplace should have proper emergency exits that are clearly marked and easily accessible in case of an emergency.

- Regular inspections: Employers must conduct regular inspections of the workplace to identify any potential hazards or safety issues.

What is the Form C registration certificate used in the case of the Karnataka Shops & Commercial Establishments Act, 1961?

The registration certificate of establishment - form C is used to maintain a complete record of the registration details of the shops and commercial establishments by the owners. It's submitted to the Office of the Inspector covered under the legislation of the Karnataka Shops & Commercial Establishments Act, 1961.

The license is issued by issuing a registration certificate of establishment - form C that contains information about the owner of the business and other details like address and name of his company etc. The form C certificate can be obtained from the sub-registrar office of your area where you want to open your shop or commercial establishment.

The registration certificate of establishment - form C is a document issued by the municipality that states that you have registered your business with them. If you don't have this document, then it's possible that your business could be forcibly shut down by the authorities.

To obtain this registration certificate of establishment - form C, you need to fill out an application form and submit it along with all of your required documents (such as proof of identity and address). Once these documents have been approved, you will receive your registration certificate within one week of submitting your application.

The registration certificate of establishment - form C must be submitted to the Local Bodies Department at regular intervals if one wants to continue operation as a shop or commercial establishment.

The registration certificate of establishment - form C is an important document, used by various traders and commercial establishments. The purpose of this form is to provide information about the retail establishment and its legal status.

The registered trader can use the registration certificate of establishment - form C for opening new shops, renewing licenses and getting loans from banks. The law defines the rights and responsibilities of employers, employees and workers in the state.

The Act requires all employers to obtain a license from the appropriate authority for starting businesses like shops and commercial establishments. The license application should be submitted along with an application for a registration certificate of establishment - form C.

It should be noted that this certificate is required only if there is no registration under any other law. If there is registration under some other direction, then an application has to be made under that Act for renewal or revision of registration.

The registration certificate of establishment - form C can be obtained from the concerned authority on payment of a fee. The form has to be filled up to get a licence for starting up a new business or for renewing an existing one. The state also provides details about the addresses of all registered firm members, including their names and addresses.

Employment of Women and Children Provisions

The employment of women and children is a significant issue, and the Karnataka Shops and Commercial Establishments Act includes provisions to protect their rights. Here are some of the provisions related to the employment of women and children:

- Hours of work for women: Women are not permitted to work in a shop or commercial establishment between 8:00 pm and 6:00 am. This rule is intended to ensure the safety and well-being of women employees.

- Prohibition of night work for children: Children below the age of 14 years are not allowed to work in a shop or commercial establishment, and those between 14 and 18 years are not permitted to work during night hours.

- Weekly holidays for children: Every child employed in a shop or commercial establishment is entitled to one day of rest per week.

- Maternity leave for women: A woman employee is entitled to 12 weeks of maternity leave, including six weeks of postnatal leave. She can also request an extension of the leave period under certain circumstances.

- Crèche facilities: Every shop or commercial establishment employing more than 30 women employees must provide crèche facilities for their children.

- Prohibition of discrimination: Women employees cannot be discriminated against in terms of recruitment, remuneration, promotion, or transfer based on their gender.

- Employment of children in non-hazardous work: Children above the age of 14 years can be employed in non-hazardous work, subject to certain conditions.

- Record-keeping: Shop and commercial establishment owners must maintain registers containing details of children and women employees, including their age, name, and address.

Challenges Faced by Employers in Compliance

Here are some of the most common challenges that employers face:

- Compliance with working hours: One of the biggest challenges for employers is ensuring that their employees work within the permitted working hours as outlined in the Act. They must also ensure that their employees take mandatory breaks and are not overworked.

- Maintaining accurate records: Employers are required to maintain detailed records of their employees, including their working hours, overtime, and wages. Maintaining these records can be a daunting task, especially for small businesses with limited resources.

- Compliance with leave policies: Employers must ensure that their employees are provided with mandatory leave and that they are compensated accordingly. This can be a challenge when it comes to managing the schedules of multiple employees.

- Compliance with minimum wage laws: The Karnataka Shops and Commercial Establishments Act specifies a minimum wage for employees, and employers must ensure that they are paying their employees at least this amount. This can be challenging, especially for businesses with limited resources or for those operating in areas with a high cost of living.

- Implementation of health and safety measures: Employers must ensure that their workplace is safe for their employees and that they are provided with adequate safety equipment. This can be a challenge, especially for businesses that operate in hazardous environments or for those with limited resources.

- Inspections and penalties: Employers must be prepared for inspections by government officials, which can be disruptive to their operations. Additionally, employers may face penalties if they are found to be in violation of the Act, which can be costly and time-consuming to resolve.

- Keeping up with changing regulations: The Act is subject to periodic updates and amendments, and it can be challenging for employers to keep up with these changes. This can be particularly difficult for small businesses, which may not have the resources to hire legal experts to navigate the complex regulations.

Comparison with Other Labor Laws and Regulations in India

- The KSE Act applies to shops and commercial establishments, while other labor laws such as the Factories Act apply to factories and other manufacturing units. The KSE Act provides specific provisions for working hours, overtime, and leave policies for employees in shops and commercial establishments, while the Factories Act focuses on issues related to health, safety, and welfare of workers in factories.

- The KSE Act provides for minimum wages and payment of wages, and its provisions are similar to other labor laws such as the Minimum Wages Act and the Payment of Wages Act. However, the KSE Act also covers issues related to overtime pay and leaves, which are not explicitly covered in these other laws.

- The KSE Act provides for the employment of women and children in shops and commercial establishments. In contrast, other laws such as the Child Labor (Prohibition and Regulation) Act and the Maternity Benefit Act provide specific provisions for the employment of children and women in different sectors.

- The KSE Act also covers issues related to the inspection and penalties for non-compliance, which is similar to other labor laws such as the Industrial Employment (Standing Orders) Act and the Shops and Establishments Act. However, the penalties under the KSE Act are comparatively lower than those under other laws.

- One of the significant challenges faced by employers in complying with the KSE Act is the requirement to maintain various registers and records. Other labor laws such as the Employees' Provident Fund and Miscellaneous Provisions Act and the Employees' State Insurance Act also require employers to maintain specific registers and records, which can be a challenge for businesses with limited resources.

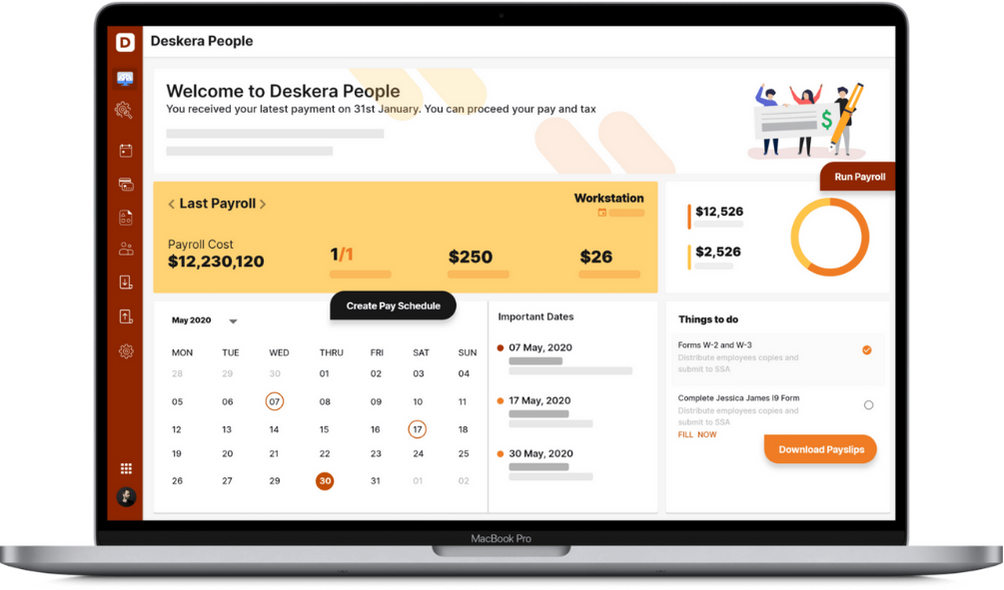

How Deskera Can help You?

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Wrapping Up

The registration certificate of establishment - form C is a piece of legislation that defines the rights and responsibilities surrounding land-based businesses. All business owners in Karnataka should know the following laws surrounding registration so they can avoid legal trouble with the authorities and protection against fraudsters.

Key Takeaways

- The Karnataka Shops & Commercial Establishments Act, 1961 is an act to provide for the regulation of shops and commercial establishments in the State of Karnataka

- The Act provides for the regulation of shops and commercial establishments and also lays down provisions regarding labour welfare and safety measures

- The main objective of this Act is to provide for the registration of all shops, commercial establishments and hawkers in the State of Karnataka, their licensing and regulation, as well as the prevention of unlicensed trade or business which might be harmful to public health or interest

- The Act also provides for the levy of fees for registration, collection of licence fees and penalties for non-compliance with provisions of the Act

- The registration certificate of establishment - form C is issued by the authority that has jurisdiction over the area where the shop or commercial establishment is situated

- Every shop or commercial establishment shall be registered with the authority of the person running it

Related Articles