If you are going to enter the business world that too in Maharashtra, you must know about the Maharashtra Shops and Establishments Act in India since this act is a vital move toward the promising business world. Here in this article, we have attempted to cover the nuts and bolts of the Act while we focus on one of its sections- Maharashtra Form M register of leave.

This article covers the following:

About Maharashtra Shops and Establishments Act

This Act may be called the Maharashtra Shops and Establishments Act. It extends to the whole of the State of Maharashtra. In the first instance, it shall come into force in the local areas specified in Schedule I.

Provided that, on the commencement of the Bombay Shops and Establishments, extension and amendment Act, 1960, (Maharashtra XXVI of 1961), all the provisions of this Act shall also come into force in each of the areas in which the Central Provinces and Berar Shops and Establishments Act, 1947, (C.P. and Berar Act, XXII of 1947), or the Hyderabad Shops and Establishments Act, 1951, (Hyderabad X of 1951), was in force immediately before such commencement.

The State Government shall, by notification published in the Official Gazette, direct that all or any of the provisions of this Act shall come into force in other local areas with a population of twenty-five thousand and more as may be specified in the notification.

The State Government may also, by a like notification, direct that all or any of the provisions of this Act shall come into force in such local areas having a population of less than twenty-five thousand as may be specified in the notification.

Registration of establishments. Within the period specified in sub-section, the employer of every establishment shall send to the Inspector of the local area concerned a statement, in a prescribed form, together with such fees as may be prescribed, containing:

(a) the name of the employer and the manager, if any.

(b) the postal address of the establishment.

(c) the name, if any, of the establishment.

(d) the category of the establishment, i.e., whether it is a shop, commercial establishment, residential hotel, restaurant, eating house, theater, or another place of public amusement or entertainment; and

(e) such other particulars as may be prescribed.

On receipt of the statement and the fees, the Inspector shall, on being satisfied with the correctness of the statement, register the establishment in the register of establishments in such manner as may be prescribed and shall issue, in a prescribed form, a registration certificate to the employer.

The registration certificate shall be prominently displayed at the establishment. A registration certificate granted under sub-section (2) shall be valid [for a period of twelve months from the day on which it is granted or renewed.

An application for the renewal of a registration certificate shall be submitted not less than fifteen days before the date of expiry of the registration certificate or the renewed registration certificate, as the case may be, and shall be accompanied by such fees.

The renewed registration certificate shall be in such form, as may be prescribed.

If the application for the renewal of a registration certificate is submitted after the expiry of the period specified in sub-section (2A), but within thirty days after the date of expiry of the registration certificate or of the renewed registration certificate, as the case may be, such application shall be accompanied by an additional fee as a late fee equal to half the fee payable for the renewal of a registration certificate.

Notwithstanding anything contained in the preceding sub-sections of this section, any registration certificate granted under sub-section (2) or renewed under subsection (2A) may, at the option of the employer, be granted or renewed for a period of thirty-six months at a time, on payment of the fees for that period, so as to be valid up to the end of thirty-six months from the date on which it is granted or renewed, as the case may be.

In the event of any doubt or difference of opinion between an employer and the Inspector as to the category to which an establishment should belong, the Inspector shall refer the matter to the prescribed authority, which shall, after such inquiry as it thinks proper, decide the category of such establishment and its decisions shall be final for this Act.

Within thirty days from the date mentioned in column (2) below in respect of an establishment mentioned in column (1), the statement together with fees shall be sent to the Inspector under the sub-section.

It shall be the duty of an employer to notify to the Inspector, in a prescribed form, [any change in any of the particulars contained in the statement submitted under section 7 within such period, after the change has taken place, as the State Government may prescribe in respect of any establishment or class of establishments.

The Inspector shall, on receiving such notice and the prescribed fees and being satisfied with its correctness, make the change in the register of establishments by such notice and amend the registration certificate or issue a fresh registration certificate, if necessary.

Closing of the establishment to be communicated to Inspector. - The employer shall notify the Inspector within ten days of his closing of the establishment. The Inspector shall, on receiving the information and being satisfied with its correctness, remove such establishments from the register of establishments and cancel the registration certificate.

Provided that if the Inspector does not receive the information but is otherwise satisfied that the establishment has been closed, he may remove such establishment from such register and cancel such certificate.

Leave

Subject to the provisions of clause (b), every employee who has been employed for not less than three months in any year shall pay for every 60 days on which he has worked during the year be allowed leave, consecutive or otherwise, for a period of not more than five days.

Every employee who has worked for not less than two hundred and forty days during a year irrespective of the date of commencement of his service shall be allowed leave, consecutive or otherwise, for a period of not less than twenty-one days.

Provided that such leave may be accumulated up to a maximum period of forty-two days. The leave allowed to an employee under clauses (a) and (b) shall be inclusive of the day or days during the period of such leave on which a shop or commercial establishment remains closed under sub-section (1) of section 18 or on which he is entitled to a holiday under subsection (1) of section 24 or section 31.

If an employee entitled to leave under subsection (1) or (1A) is discharged by his employer before he has been allowed the leave, or if, having applied for and having been refused the leave, he quits his employment before he has been allowed the leave, the employer shall pay him the amount payable under section 36 in respect of the leave.

Suppose an employee is entitled to leave under subsection (1) or is refused the leave. In that case, he may inform the Inspector or any other officer authorized by the State Government on this behalf regarding such refusal. The Inspector shall enter such intimation in a register kept in such form as may be prescribed.

The employee shall also send a copy of such intimation to his employer, and thereupon, the employee shall be entitled to carry forward the un-availed leave without any limit.

Notwithstanding anything contained in this section, every employee, irrespective of his period of employment, shall be entitled to an additional holiday on the 26th January, 1st May, 15th August, and 2nd October every year.

For a holiday on these days, he shall be paid wages at a rate equivalent to the daily average of his wages (excluding overtime), which he earns during the month in which such compulsory holidays fall.

Provided that the employer may require any employee to work in the establishment on all or any of these days, subject to the condition that for such work, the employee shall be paid double the amount of the daily average wages and also leave on any other day instead of the compulsory holiday.

Pay during leave. Every employee shall be paid for the period of his leave at a rate equivalent to the daily average of his wages for the days he worked during the preceding three months, exclusive of any earnings in respect of overtime.

Payment when to be made, an employee who has been allowed leave under section 35 shall, before his leave begins, be paid half the total amount due to him for the period of such leave.

Application and amendment of the Payment of Wages Act- Notwithstanding anything contained in the Payment of Wages Act, 1936, (V of 1936) herein referred to as "the said Act," the State Government may, by notification published in the Official Gazette, direct that subject to the provisions of sub-section (2) of the said Act shall, in such local areas as may be specified in the notification apply to all or any class of establishments or to all or any class of employees to which or whom this Act for the time being applies.

On the application of the provisions of the said Act to any establishment or any employees under sub-section (1), the Inspector appointed under this Act shall be deemed to be the Inspector for the enforcement of the provisions of the said Act within the local limits of his jurisdiction.

Application of Act VIII of 1923 to employees of the establishment - The provisions of the Workmen's Compensation Act, 1923 (VIII of 1923), and the rules made from time to time thereunder, shall, mutatis mutandis, apply [to employees of an establishment to which this Act applies, as if they were workmen within the meaning of the Workmen's Compensation Act, 1923.

Application of Industrial Employment (Standing Orders) Act to establishments.] - The provisions of the Industrial Employment (Standing Orders) Act, 1946 (XX of 1946), in its application to the State of Maharashtra.

Hereinafter in this section referred to as "the said Act," and the rules and standing orders (including model standing orders made thereunder, from time to time, shall, mutatis mutandis shall apply to all establishments wherein fifty or more employees are employed and to which this Act applies as if they were industrial establishments within the meaning of the said Act.

38C Application of Maternity Benefit Act to women employees in the establishment. Notwithstanding anything contained in the Maternity Benefit Act, 1961 (LIII of 1961) hereinafter in this section referred to as the said Act, the State Government may, by notification in the Official Gazette, direct that all or any of the provisions of the said Act or the rules made thereunder shall apply to women employed for wages in all or any of the establishments to which this Act applies. For that purpose, such women employees shall be deemed women within the meaning of the said Act.

On such application of the provisions of the said Act, an Inspector appointed under this Act shall be deemed to be the Inspector for the purpose of enforcing the provisions of the said Act within the limits of his jurisdiction.

Powers and duties of local authorities. Save as otherwise provided in this Act, it shall be the duty of every local authority to enforce, within the area subject to its jurisdiction, the provisions of this Act, subject to such supervision of the State Government as may be prescribed.

Provided that the local authority may order direct that the said duty of enforcing the provisions of this Act shall be discharged, in such circumstances and subject to such conditions, if any, as may be specified in the order by its Chief Executive Officer or any other subordinate to it.

Provided also that in respect of the areas not subject to the jurisdiction of any local authority, it shall be the duty of the State Government to enforce the said provisions. Power to make by laws.

A local authority empowered under section 43 to enforce the provisions of this Act may, with the previous sanction of the State Government, make by-laws not inconsistent with the provisions of the Act or the rules or orders made by the State Government thereunder to carry out the provisions of this Act.

Provision for taking over administration of the Act from local authorities. Notwithstanding anything contained in sections 43 and 44, to implement the policy of the State Government of taking over the administration of this Act gradually from all the local authorities in the State, the State Government may, from time to time, by notification in the Official Gazette without the necessity of giving any further notice or reasons, declare that any local authority or authorities or class of local authorities specified in such notification shall cease to perform the duty of enforcing the provisions of this Act from a date specified in that notification.

From that date, it shall be the duty of the State Government to enforce the said provisions in respect of the areas subject to the jurisdiction of such local authorities.

The State Government may by order published in the Official Gazette, direct that any power exercisable by it under this Act or the rules made thereunder (except the power to make rules) shall in relation to such matters and subject to such conditions, if any, as may be specified in the order, be exercised also by any local authority, or by any officer subordinate to the State Government, as may be specified in the order.

Power of State Government to provide for the performance of duties on default by the local authority. Suppose any local authority defaults in performing any duty imposed by or under this Act.

In that case, the State Government may appoint some person to perform it and may direct that the expense of serving it with reasonable remuneration to the person appointed to perform it shall be paid immediately by the local authority.

Suppose the expense and remuneration are not so paid. In that case, the State Government may, notwithstanding anything contained in any law relating to the municipal fund or local fund or any other law for the time being in force, make an order directing the bank in which any moneys of the local authority are deposited or the person in charge of the local Government Treasury or of any other place of security in which the moneys of the local authority are deposited to pay such expense and remuneration from such moneys as may be standing to the credit of the local authority in such bank or maybe in the hands of such person or as may from time to time be received from or on behalf of the local authority by way of deposit by such bank or person; and such bank or person shall be bound to obey such order.

Every payment made pursuant to such order shall be a sufficient discharge to such bank or person from all liability to the local authority in respect of any sum or sums so paid by it or him out of the money of the local authority so deposited with such bank or person.

Expenses of local authority to be paid out of its fund. Notwithstanding any enactment in any municipal or local fund, all costs incurred by a municipality or a local board under and for the purposes of this Act shall be paid out of the municipal or local fund, as the case may be.

Every local authority shall appoint a sufficient number of persons with the prescribed qualifications as Inspectors for the area subject to its jurisdiction as it may deem fit for carrying out this Act's provisions.

In areas that are not subject to the jurisdiction of any local authority, the State Government shall appoint Inspectors with the prescribed qualifications and in areas that are subject to the jurisdiction of any local authority, the State Government may appoint Inspectors with the prescribed qualifications for such supervision as the State Government may prescribe.

A local authority or, as the case may be, the State Government may direct that the powers conferred on it by this section shall in such circumstances, and subject to such conditions (if any), as may be specified in the direction, be exercised.

In the case of a local authority, by its standing committee or by any committee appointed by it in this behalf or, if such local authority is a municipal corporation, by its Municipal Commissioner or Deputy Municipal Commissioner, and in the case of the State Government, by any officer subordinate to it.

Notwithstanding anything contained in the Minimum Wages Act, 1948, (XI of 1948), Inspectors appointed, whether by a local authority, or the State Government under this Act in relation to any area, shall be deemed to be also Inspectors for the purposes of the Minimum Wages Act, 1948, in respect of establishments to which this Act applies, and the local limits within which an Inspector shall exercise his functions under that Act shall be the same as the area for which he is appointed under this Act.

Subject to any rules made by the State Government on this behalf, an Inspector may, within the local limits for which he is appointed enters, at all reasonable times and with such assistants, if any, being persons in the service of the Government or of any local authority as he thinks fit, any place which is or which he has reason to believe is an establishment; Make such examination of the premises and of any prescribed registers, records, and notices, and take on the spot or otherwise evidence of any persons as he may deem necessary for carrying out the purposes of this Act.

He has reason to suspect that any employer of an establishment to which this Act applies has committed an offense punishable under section 52 or 55 to seize, with the previous permission of such authority as may be prescribed such registers, records or other documents of the employer, as he may consider necessary, and shall grant a receipt therefor and shall retain them only for so long as may be necessary for examination thereof, or for prosecution; and exercise such other powers as may be necessary for carrying out the purposes of this Act.

Provided that no one shall be required under this section to answer any question or give any evidence tending to discriminate himself. Inspectors to be public servants, every inspector appointed under section 48 shall be deemed to be a public servant within the meaning of section 21 of the Indian Penal Code (XLV of 1860).

Employer and manager to produce registers, records, etc., for inspection. Every employer and in his absence, the manager shall on demand produce for inspection of an Inspector all registers, records, and notices required to be kept under and for this Act.

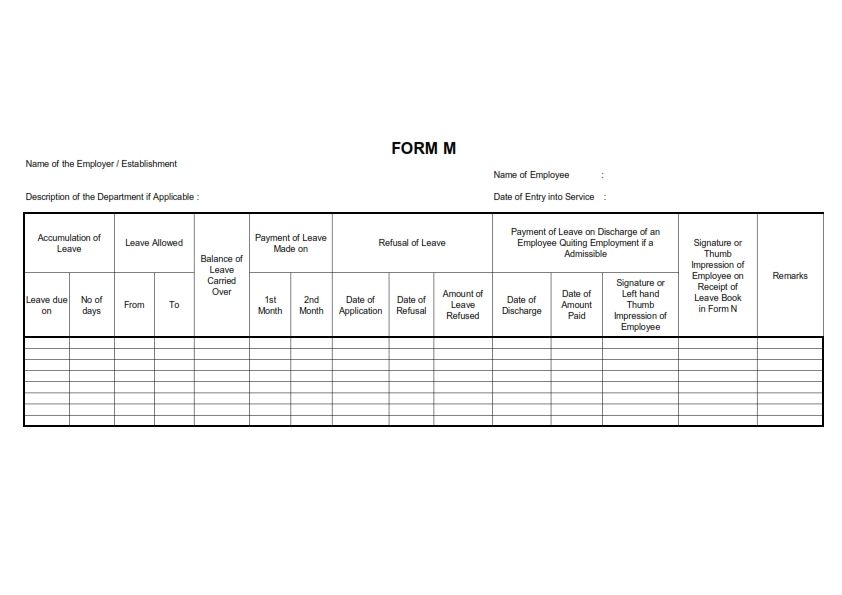

Maharashtra Form M

Penalties

Contravention of certain provisions and offenses. If an employer fails to send to the Inspector a statement within the period specified in section 7 or to notify a change within the period specified in section 8 or notify the closing of his establishment under section 9.

If in any establishment there is any contravention of any of the provisions of sections 10, 11, 13, 18, 19, 20, 26, 27, 39, 40, 41 or 42 or any orders made thereunder; or If in any establishment any person is required or allowed to work in contravention of sections 14, 15, 16, 17, 21, 22, 23, 24, 28, 29, 30, or 31; or

If in any establishment a child or young person or woman is required or allowed to work in contravention of section 32, 33, or 34; or If any employer or manager contravenes the provisions of Section 51 or any employer contravenes the provisions of section 62 or 65; or

If in any establishment there is any contravention of any section, rule, or order for which no specific punishment is provided in this Act; the employer and the manager shall, on conviction, each be punished for each offense with fine which shall not be less than one thousand rupees and which may extend to five thousand rupees.

Provided that, if the contravention of the provisions of sub-section (1) of section 7 is continued after the expiry of the tenth day after convictions, the employer shall on conviction be punished with a further fine which may extend to [one hundred rupees for each day on which the contravention is so continued.

If any person contravenes the provisions of section 12, he shall, on conviction, be punished for each offense with a fine which shall not be less than one thousand rupees and which may extend to five thousand rupees.

Employee contravening sections 18(2), 24, 31, and 65. If any employee contravenes the provisions of sub-section (2) of section 18, 24, 31, or 65, he shall, on conviction, be punished for each offense with a fine which shall] not be less than five hundred rupees and which may extend to five thousand rupees.

False entries by employer and manager. If any employer or manager with intent to deceive makes, or causes or allows to be made, in any register, record or notice prescribed to be maintained under the provisions of this Act or the rules made thereunder, an entry which, to his knowledge, is false in any material particular, or willfully omits or causes or allows to be omitted, from any such register, record or notice, an entry which is required to be made therein under the provisions of this Act or the rules made thereunder, or maintains or causes or allows to be maintained, more than one set of any register, record or notice except the office copy of such notice, or sends, or causes or allows to be sent, to an Inspector, any statement, information or notice prescribed to be sent under the provisions of this Act or the rules made thereunder which, to his knowledge, is false in any material particular, he shall, on conviction, be punished with fine which shall, not be less than one thousand rupees and which may extend to five thousand rupees.

Provided that if both the employer and the manager are convicted, the aggregate of the fine in respect of the same contravention shall not exceed five thousand rupees an enhanced penalty in some instances after a previous conviction.

If an employer and manager who have been convicted of any offense under subsection (1) of sections 10, 11, 13, 14, 18, 19, 24, 31, or 34 or under sub-section (2) or (3) of section 14 or under section 55 or sections 21, 26, 28, 32, 33, 51, 57, 62 or 65, are again guilty of an offense involving a contravention of the same provision, they shall each be punished on the second conviction with fine which shall not be less than one thousand rupees and which may extend to five thousand rupees; and if they are again so guilty, they shall each be punished on the third or any subsequent conviction with fine which shall not be less than seven thousand and five hundred rupees and which may extend to ten thousand rupees.

If both the employer and the manager are convicted, the aggregate of the fine in respect of the same contravention shall not exceed ten thousand rupees on the second conviction and fifteen thousand rupees on the third or any subsequent conviction.

Provided further that, for this section, no cognizance shall be taken of any conviction made more than two years before the commission of the offense being punished.

Provided also that the Court, if satisfied that exceptional circumstances warrant such a course, may, after recording its reasons in writing, impose' a smaller fine than is required by this section.

Penalty for obstructing Inspector whoever willfully obstructs an Inspector in the exercise of any power under section 49 or conceals or prevents any employee in an establishment from appearing before or being examined by an Inspector, shall, on conviction, be punished with fine which shall not be less than one thousand rupees and which may extend to five thousand rupees.

Determination of employer for this Act. Where the owner of an establishment is a firm or other association of individuals, any one of the individual partners or members thereof may be prosecuted and punished under this Act for any offense for which an employer in an establishment is punishable.

Provided that the firm or association may give notice to the Inspector that it has nominated one of its members who are resident in the State to be the employer for the purposes of this Act and such individual shall so long as he is so resident be deemed to be the employer for the purposes of this Act until further notice canceling the nomination is received by the Inspector or until he ceases to be a partner or member of the firm or association.

Where the owner of an establishment is a company, any one of the directors thereof, or in the case of a private company, any one of the shareholders thereof, may be prosecuted and punished under this Act for any offense for which the employer in the establishment is punishable.

Provided that the company may give notice to the Inspector that it has nominated a director, or, in the case of a private company, a shareholder who is resident in the State to be the employer in the establishment of this Act, and such director or shareholder shall so long as he is so resident be deemed to be the employer in the establishment for the purposes of this Act until further notice canceling his nomination is received by the Inspector or until he ceases to be a director or shareholder.

Exemption of employer or manager from liability in certain cases. Where the employer or manager of an establishment is charged with an offense against this Act or the rules or orders made thereunder, he shall be entitled upon complaint duly made by him to have any other person whom he charges as the actual offender brought before the Court at the time appointed for hearing the charge.

If, after the commission of the offense has been proved, the establishment's employer or manager proves to the Court's satisfaction. That he has used due diligence to enforce the execution of this Act, and that the said other person committed the offense in question without his knowledge, consent, or connivance, that other person shall be convicted of the offense and shall be liable to the like fine as if he were the employer or manager, and the employer or manager shall be discharged from any liability under this Act.

When it is made to appear to the satisfaction of the Inspector at any time before the institution of the proceedings that the employer or manager of the establishment has used all due diligence to enforce the execution of this Act, by what person the offense has been committed, and that it has been committed without the knowledge, consent or connivance of the employer or manager.

In contravention of his orders, the Inspector shall proceed against the person he believes to be the actual offender without first proceeding against the employer or manager of the establishment. Such person shall be liable to the like fine as if he were the employer or manager.

Cognizance of offenses. No prosecution under this Act or the rules or orders made thereunder shall be instituted except by an Inspector and except with the previous sanction of the District Magistrate Additional District Magistrate, sub-Divisional Magistrate, Commissioner of Labor, Additional Commissioner of Labor or Deputy Commissioner of Labor, or the local authority as the case may be or, without any such sanction, by an aggrieved person, or by a representative of the registered union of which the aggrieved person, is a member.

Provided that any local authority may direct that the powers conferred on it by this subsection shall, in such circumstances and subject to such condition, if any, as may be specified in the direction, be exercised by its standing committee or by any committee appointed by it in this behalf or, if such local authority is a municipal corporation, by its Municipal Commissioner, Deputy Municipal Commissioner or Assistant Municipal Commissioner.

No court inferior to that of a Metropolitan Magistrate or a Judicial Magistrate of the first class shall try any offense against this Act or any rule or order made thereunder. Limitation of Prosecutions.

No court shall take cognizance of any offense under this Act or any rule or order made thereunder unless a complaint thereof is made within three months from the date on which the alleged commission of the offense came to the knowledge of an Inspector.

Notwithstanding anything contained in sub-section one, the aggrieved person or a representative of the registered union of which the aggrieved person is a member, may within three months from the date on which the alleged commission of the offence took place give intimation of the offence to the Inspector and request Him to institute prosecution.

On receipt of such intimation and request, the Inspector may himself institute the prosecution within the period of limitation specified in subsection (1) or inform the applicant before the expiry of the said period or as soon as possible thereafter that he does not propose to institute prosecution.

On receipt of such intimation, the applicant shall be entitled to institute prosecution, and the Court shall take cognizance of the offense if compliant thereof is made to it within two months from the date of receipt of the intimation of the Inspector by the applicant.

Maintenance of registers and records and display of notices. - Subject to the general or special orders of the State Government, an employer shall maintain such registers and records and display on the premises of his establishment such notices as may be prescribed. All such registers and records shall be kept on the premises of the establishment to which they relate.

Wages for overtime work where an employee in any establishment to which this Act applies is required to work in excess of the limit of hours of work, he shall be entitled, in respect of the overtime work, wages at the rate of twice his ordinary rate of wages.

For the purposes of this section, the expression "limit of hours of work" shall mean. In the case of employees in shops and commercial establishments, nine hours on any day and forty-eight hours on any week;

(b) in the case of employees in residential hotels, restaurants, eating houses, theatres, or other places of public amusement or entertainment, nine hours in any day; and

(c) in the case of employees in any other establishment, such hours as may be prescribed.

Provided that the maximum limit for working overtime shall not exceed three hours, the employer may, for the purpose of the work beyond the said overtime hours, engage additional numbers of employees.

Evidence as to age. When an act or omission would, if a person were under or over a certain age, be an offense punishable under this Act, and such person is in the opinion of the Court, apparently under or over such age, the burden shall be on accused to prove that such person is not under or over such age.

A declaration in writing by a qualified medical practitioner relating to an employee that he has personally examined him and believes him to be under or over the age set forth in such declaration shall, for this Act, be admissible as evidence of the age of the employee.

For the purposes of this section, a qualified medical practitioner] shall have the same meaning as in the Factories Act, 1948 (LXIII of 1948). Restriction on double employment on holiday or during leave.

No employee shall work in any establishment, nor shall any employer knowingly permit an employee to work in any establishment on a day on which the employee is given a holiday or is on leave in accordance with the provisions of this Act.

Notice of termination of service. No employer shall dispense with the services of an employee who has been in his continuous employment. For not less than a year, without giving such person at least thirty days notice in writing or wages in lieu of such notice; for less than a year but more than three months, without giving such person at least fourteen days' notice in writing, or wages in lieu of such notice.

Provided that such notice shall not be necessary where the services of such employees are dispensed with for misconduct. For the purposes of this section, "misconduct" shall include absence from service without notice in writing or without sufficient reasons for seven days or more; going on or abetting a strike in contravention of any law for the time being in force, and causing damage to the property of his employer.

The State Government may make rules to carry out the purposes of the Act. In particular and without prejudice to the generality of the foregoing provision, such rules may be made for all or any of the following matters, namely.

The appointment of prescribed authority under clause (21) of section 2. The period for which, the conditions subject to which, and the holidays and occasions on which, the operation of the provisions of this Act may be suspended under section 6.

The form of submitting a statement, the fees, and other particulars under sub-section (1), the manner in which the registration of establishments is to be made and the form of registration certificate under sub-section (2) of section 7; and the form and the period for notifying a change and the fees under section 8.

Fixing six days in a year for additional overtime under subsection (3) of section 14; fixing ten days in a year for overtime under subsection (3) of section 19; further particulars to be prescribed for an identity card under section 25;

Fixing times and methods for cleaning the establishments under section 39; fixing standards and methods for ventilation under section 40, and prescribing such establishments as are to be exempted from the provisions of, and precautions against fire to be taken under, section 42.

The articles which a first aid box maintained under section 42A shall contain; the supervision which the State Government shall exercise over local authorities under section 43.

The qualification of Inspectors appointed under section 48 and their powers and duties under section 49; the registers and records to be maintained and notices to be displayed under section 62; the limit of hours of work under clause (c) of the Explanation to section 63 any other matter which is or may be prescribed.

The rules made under this section shall be subject to the condition of previous publication and, when so made, shall be deemed to be part of this Act. All rules made under this Act shall be laid before each House of the State Legislature as soon as possible after they are made and shall be subject to such modifications as the State Legislature may make during the session in which they are so laid or the session immediately following and published in the Official Gazette.

Protection to a person acting under this Act, no suit, prosecution, or other legal proceedings shall lie against any person for anything which is in good faith done or intended to be done under this Act.

Rights and privileges under other laws, etc. not affected. Nothing in this Act shall affect any rights or privileges which an employee in any establishment is entitled to at the date this Act comes into force in a local area, under any other law, contract, custom or usage applicable to such establishment or any award, settlement or agreement binding on the employer and the employee in such establishment, if such rights or privileges are more favorable to him than those to which he would be entitled under this Act.

Persons employed in the factory are to be governed by Factories Act and not by this Act; people employed in the factory are to be governed. Nothing in this Act shall be deemed to apply to a factory to which the Factories Act, 1948 (LXIII of 1948) applies.

Provided that where any shop or commercial establishment situated within the precincts of a factory is not connected with the manufacturing process of the factory, the provisions of this Act shall apply to it.

Provided further that the State Government may, by notification in the Official Gazette, apply all or any of the provisions of the Factories Act, 1948 (LXIII of 1948), to any shop or commercial establishment situate within the precincts of a factory and on the application of that Act to such shop or commercial establishment, the provisions of this Act shall cease to apply to it.

Submission of annual report etc. It shall be the duty of every local authority to submit, within two months after the close of the year, to the Commissioner of Labor, Bombay, a report on the working of the Act within the local area under its jurisdiction during such year. It shall also submit to him from time to time such annual or periodical return as may be required.

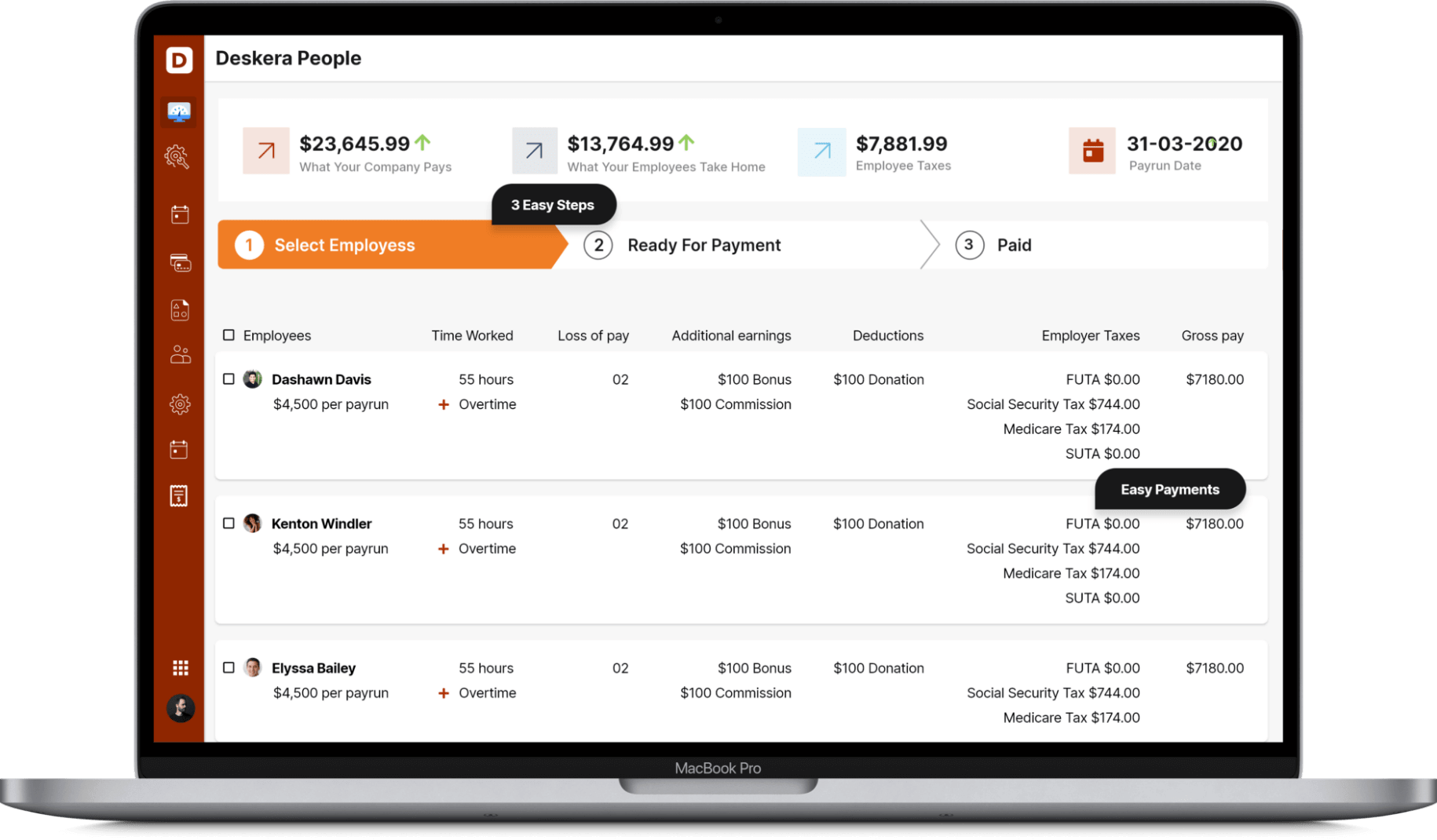

How Can Deskera Assist You?

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. Features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning and uploading expenses, and creating new leave types make your work simple.

Key Takeaways

- The act extends to the whole of the State of Maharashtra. In the first instance, it shall come into force in the local areas specified in Schedule I.

- The employer of every establishment shall send to the Inspector of the local area concerned a statement.

- Penalty for obstructing Inspector whoever willfully obstructs an Inspector in the exercise of any power under section 49 or conceals or prevents any employee in an establishment from appearing before or being examined by an Inspector.

- Persons employed in the factory are to be governed by Factories Act and not by this Act; people employed in the factory are to be governed.

- Suppose an employee is entitled to leave under subsection 1 or is refused the leave. In that case, he may inform the Inspector or any other officer authorized by the State Government.

Related Articles