Do you have a shop or an establishment in Goa? Is the validity of your registration certificate ending soon, and do you want to get it renewed?

If your answer to both these questions is yes, then this article is for you. This article will take you through the steps on how you will be able to renew your registration certificate through Form IV while also covering the basics of the guiding Act- Goa, Daman, and Diu Shops and Establishments Act 1973.

In India, the Shops and Establishments Act is set up to regulate the payment of wages, terms of service, hours of work, wages for holidays, work conditions, leave policy, overtime work, the interval for meals and rest, conditions for employment of young persons and women, maternity policies, and prohibition of employment of children to mention some of the core and shared regulating provisions across all the states of India.

However, while the topics covered by the provisions in all the shops and establishments Act of the individual states of India are shared, the details and requirements are bound to vary as per the geographical location and requirements, political influence, ideologies of the state government, the requirement of the labor forces including inter-state migrant workforce, and intra-state workforce, as well as the requirements of other employees, and their employers.

Thus, this means that the eligibility and procedure for issuing the registration certificate for shops and establishments in Goa, as well as the renewal of the registration certificate, will be distinct to that particular state. This article will hence cover the following topics:

- Goa, Daman, and Diu Shops and Establishments Act, 1973

- Registration of Establishments Under the Goa, Daman, and Diu Shops and Establishments Act

- Renewal of Registration Certificate Under the Goa, Daman, and Diu Shops and Establishments Act

- Steps to Apply for the Renewal of Registration Certificate

- Important Amendments to the Goa, Daman, and Diu Shops and Establishments Act, 1973

- Exemptions to this Act

- How Can Deskera Help You?

- Key Takeaways

- Related Articles

Goa, Daman, and Diu Shops and Establishments Act, 1973

The Goa, Daman, and Diu Shops and Establishments Act, 1973 was enacted by their legislative assemblies to provide for the regulation of conditions of work, and employment in shops, commercial establishments, restaurants, theaters, and other establishments and for matters connected therewith. This Act is applicable to the whole of the union territory of Goa, Daman, and Diu.

As per this Act, “commercial establishments” means any establishment which carried on any business, trade, or profession, or any work in connection with, or incidental or ancillary to, any business, trade, or profession and includes a society registered under the Societies Registration Act, 1860 (Central Act XXI of 1860), or charitable or other trusts, whether registered or not, but which carries on any business, profession, trade, or work in connection with, or incidental or ancillary to, such profession or business trade.

This Act is also applicable to an establishment that carries on the business of commission agency, advertising, forwarding, or commercial agency, or which is a clerical department of a factory or of any commercial or industrial undertaking. Additionally, this Act is also applicable to an insurance company, broker’s office or exchange, Joint Stock Company, and other establishments which the Government may notify to be included as a commercial establishment but does not include a shop, factory, eating house, residential hotel, theater or any other place of public amusement or entertainment.

As per this Act, an “establishment” means a commercial establishment, a shop, an eating house, a residential hotel, a restaurant, a theater, or other place of public amusement or entertainment and a bank. It also includes any other establishments that the Government may, by notification in the Official Gazette, have declared to be an establishment for the purposes of this Act. Also, as per this Act, “factory” means factory within the meaning of the Factories Act, 1948 (Central Act 63 of 1948).

Lastly, as per this Act, “shop” means any premises where goods are sold, either by retail or wholesale or both or where services are rendered to customers and includes an office, godown, store-room, warehouse, workplace, and sale depot, whether in the same premises or elsewhere, used mainly in connection with such business or trade, but does not include a commercial establishment, factory, residential hotel, eating house, restaurant, theater, or other place of public amusement or entertainment or a shop attached to a factory where the persons employed in the shop are allowed the benefits provided for workers under the Factories Act 1948 (Central Act 63 of 1948).

Registration of Establishments Under the Goa, Daman, and Diu Shops and Establishments Act

Under the Goa, Daman, and Diu Shops and Establishments Act, the provisions related to the registration of establishments are:

- Within the specified period, you-as, the employer of an establishment, except a bank, shall send to the Inspector concerned a statement in the prescribed form together with such fees as may be prescribed (sub-section 1), containing-

- The name of the employer and the manager, if any.

- The postal address of the establishment

- The name, if any, of the establishment.

- Category of the establishment

- Such other particulars as may be prescribed.

- Once the Inspector receives such a statement, along with the prescribed fees for the same, he or she, after being satisfied with the correctness of the statement, register the establishment in the Register of Establishments in such manner as may be prescribed. He or she will then also issue in the prescribed form a registration certificate to the employer, who shall display it at a prominent place in the establishment (sub-section 2).

- (Sub-section 3) The period in respect of establishment mentioned in column 1 below for filing the statement, and depositing the fees, as required as per the provisions of this section of this Act, shall be as specified against it in column 2-

- (Sub-section 1, section 3A) If yours is a bank that needs to get a registration certificate, then you shall send to the Inspector concerned a statement in the prescribed form, along with the registration fees amounting to Rs. 25,000 containing-

- The name of the bank and its General Manager or Branch Manager or Regional Manager or Manager, as the case may be.

- The postal address of the bank.

- Such other particulars as may be prescribed.

- (Sub-section 1, section 3B) Once such a statement, along with its prescribed fees, is received by the Inspector, he or she will register the bank in the register of establishments after being satisfied with the correctness of the statement. The registration of the bank in the register of establishments will happen in such manner as may be prescribed and shall issue in the prescribed form a Registration Certificate to the bank, which shall have to be displayed at a prominent place in the bank.

Renewal of Registration Certificate Under the Goa, Daman, and Diu Shops and Establishments Act

Under the Goa, Daman, and Diu Shops and Establishments Act, the provisions related to the renewal of the registration certificate of the establishment are:

- Along with the prescribed fees, you, as the employer, will have to give an application to the Inspector for the renewal of your registration certificate. Once this is received by the Inspector, he or she will renew the registration certificate for a period of maximum of five years commencing from the date of its expiry (sub-section 4).

- What needs to be noted is that every application for the renewal of the registration certificate shall have to be made in such form and in such manner as may be prescribed so as to reach the Inspector not later than thirty days before the date of its expiry.

If the application for the renewal of a registration certificate is received by the Inspector later than thirty days after its expiry, may be entertained by the Inspector on the applicant paying such penalty, not exceeding twenty-five rupees, as may be prescribed (sub-section 5).

- An applicant for the renewal of the registration certificate as discussed above shall, until communication of orders on his or her application, be entitled to act as if his or her registration certificate is renewed.

- If there is any doubt or difference of opinion between you as the employer and the Inspector as to the category to which your establishment belongs, then the Inspector shall refer the matter to the prescribed authority, which shall, after such inquiry as it thinks proper decide the category of such establishment. Its decisions shall be final for the purposes of this Act.

- If you need to get the registration certificate of your bank renewed, then, in that case, you will have to make an application for the same with fees amounting to Rs. 5,000 if your bank is situated within the limits of a Municipal Council, and Rs. 1,000 in other cases. Once the Inspector has received your application along with the prescribed fees, he or she will renew the registration certificate for a period of one year commencing from the date of its expiry.

Note: If you as an employer fail to possess a valid certificate of registration in contravention of the provisions of section 3 or 3A, or of the rules made thereunder, on conviction, you shall be punishable, in the case of a continuing offense, with a further fine which may extend to hundred rupees for each day during which the offense continues.

Steps to Apply for the Renewal of Registration Certificate

In order to apply for the renewal of the registration certificate for your shop or establishment based in Goa, you will need to fill up Form IV as per Rule 6 of the Goa, Daman, and Diu Shops and Establishments Act. Considering this, the steps to apply for the renewal of your registration certificate are:

- Register yourself on goaonline.gov.in and login.

- Fill in the application form.

- Attach relevant documents (here, that will be the original registration certificate).

- Submit the application and note the acknowledgment number for the tracking of your application.

- For auto-renewal, the certificate/license will be issued immediately on successful payment.

Note: The processing time of the same is seven days as per the Right of Citizens to Time-Bound Delivery of Public Services Act.

The designated officials for the renewal of your registration certificate will be as follows:

- Designated Officer- Labor Inspector

- Appellate Authority- Labor Commissioner

Thus, Form IV- Renewal of Registration Certificate must be filled and submitted to the concerned labor department for renewal of the Registration Certificate of your establishment.

Form IV- Renewal of Registration Certificate

|

|

FORM IV |

|

|

|

(See Rule 6) |

|

|

|

Renewal of Registration Certificate |

|

|

|

||

|

|

Category of

Establishment : |

|

|

|

Total No. of

Employees : |

|

|

|

Name of

Establishment and Postal Address : |

|

|

|

||

|

|

To, |

|

|

|

The Inspector, |

|

|

|

||

|

|

Sir, |

|

|

|

As the period of

Registration Certificate No. ………….………………...…….. Originally

granted/subsequently renewed to us/ is to expire/has already expired on

……………………..…….. I (We) have to request for its renewal. The original

certificate is enclosed. |

|

|

|

||

|

|

||

|

|

||

|

|

Signature of Employer |

|

|

|

Date : |

|

|

|

Place: |

|

Important Amendments to the Goa, Daman, and Diu Shops and Establishments Act, 1973

Some of the important amendments that have been made to this Act are:

- This Act is now called the Goa Shops and Establishments (Amendment) Act, 2021.

- In sub-section 1 of the section - ‘Registration of Establishments Under the Goa, Daman, and Diu Shops and Establishments Act, the following words - “in the prescribed form together with such fees as may be prescribed” got substituted with- “in such form, and such manner and along with such fees and such documents as prescribed.”

- In sub-section 2 of the section - ‘Registration of Establishments Under the Goa, Daman, and Diu Shops and Establishments Act, the following words- “on receipt of the statement and the fees, the Inspector shall, on being satisfied with the correctness of the statement,” got substituted with- “the Inspector shall, within the period of seven working days from the date of receipt of the statement and the fees.”

- After the preceding substitution is made in the sub-section 2, the following sub-section 2A was added-

“ If the Inspector fails to register the establishment within the prescribed period specified in sub-section 2, such establishment shall be deemed to have been registered under this Act immediately on the expiration of such period, and the electronic certificate of registration shall be auto-generated.”

- For sub-section 4, the following sub-section shall be substituted:

“The Inspector shall, within a period of seven working days from the date of receipt of the application for renewal made by the employer together with such fees as prescribed, renew the registration certificate for such period as requested by the applicant.”

- After the sub-section 4, the following sub-section was added as sub-section 4A-

“If the Inspector fails to renew the registration certificate within the period specified in the sub-section 4 (as amended), then such registration certificate shall be deemed to have been renewed immediately on expiry of such period, and an electronic certificate of renewal shall be auto-generated.

- For sub-section 5, the following sub-section shall be substituted:

“Every application for the renewal of the registration certificate shall be made in such form and in such manner as prescribed not later than thirty days before the date of its expiry, and an application made beyond such period shall not be entertained by the Inspector unless the applicant pays such penalty, not exceeding twenty-five percent of the registration fees, prescribed.”

- In sub-section 1, section 3A, the following words- “the prescribed form together with registration fees amounting to Rs.25,000,” got substituted with- “in such form, manner, and documents as may be prescribed together with registration fees amounting to Rs.25,000.”

- In sub-section 2, the expression- “on being satisfied about the correctness of the statement” shall be omitted.

- In sub-section 1, section 3B, the following sub-section shall be substituted:

“The Inspector shall, within a period of seven working days from the date of receipt of the application made by the bank or financial institution together, with fees amounting to Rs.5,000 per year in case of a bank situated within the limit of a municipal council and Rs.1,000 per year, in other cases, renew the registration certificate for such period as requested by the applicant.”

- After sub-section 3, the following sub-section 3A was inserted-

“If the Inspector fails to renew the registration certificate within the period specified in sub-section 3, such registration certificate shall be deemed to have been renewed immediately on expiry of such period, and an electronic certificate of renewal shall be auto-generated.”

Exemptions to this Act

Nothing in this Act shall apply to:

- Employees in any establishment whose average monthly wages exceed six thousand five hundred rupees.

- Establishments under the State and Central Governments, cantonment authorities, local authorities, the Reserve Bank of India, and a railway administration operating any railway as defined in clause 20 of article 366 of the Constitution.

- Establishments in oil fields and mines.

- Establishments in bazaar or in places where festivals or fairs are held temporarily for a period not exceeding one month at a time.

- Establishments belonging to any co-operative, scheduled or nationalized bank.

- Establishments known as ‘Gadas’ as defined under clause 10-A of section 2 of this Act.

Note: The Government may, by notification, exempt either permanently or for any specified period, any establishment or class of establishments, or persons or classes of persons, from all or any of the provisions of this Act, subject to such conditions as they may deem fit.

How Can Deskera Help You?

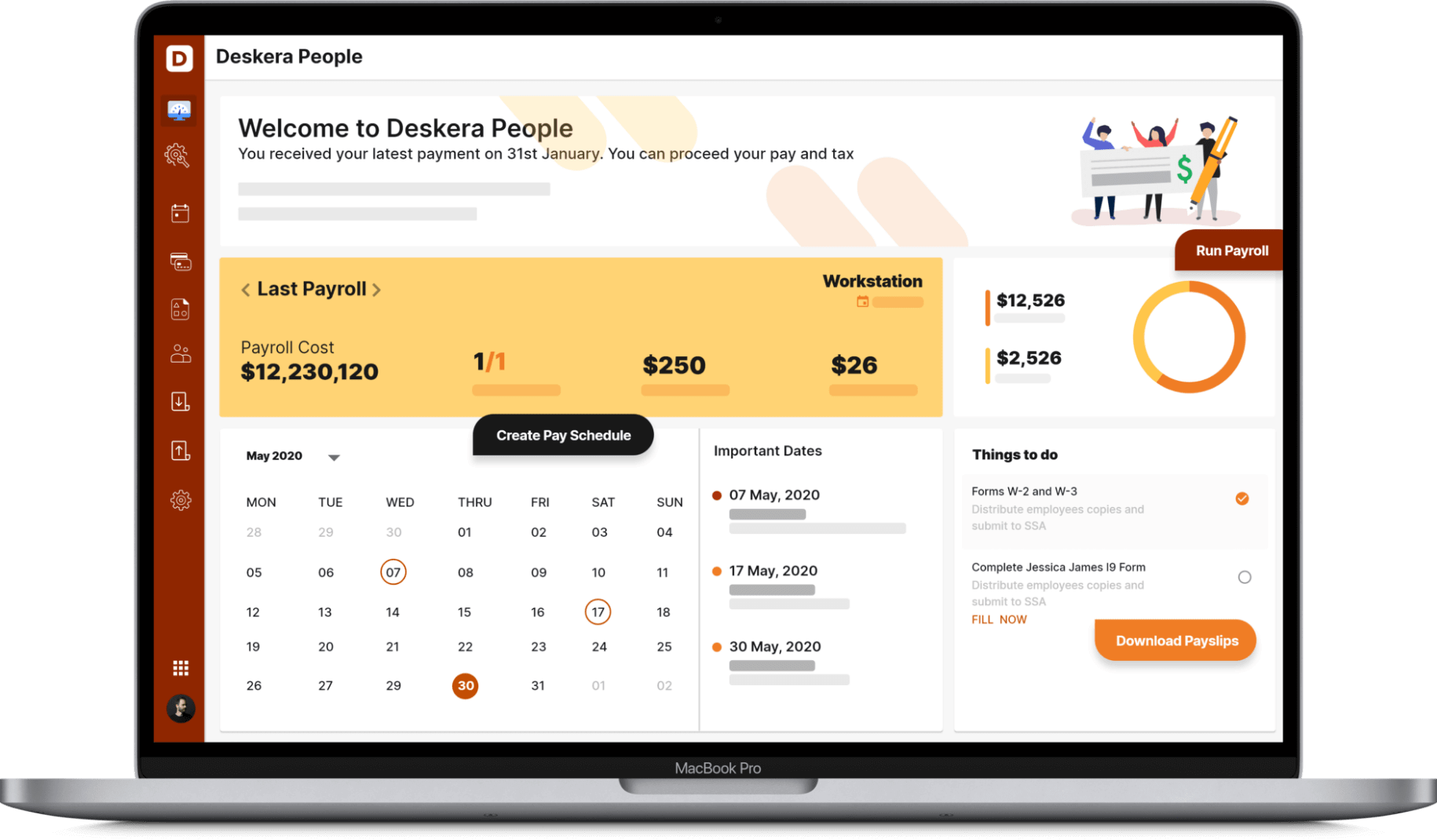

Deskera, with its bundle of software, is designed in a manner that will ease the functioning as well as regulation of your business while also ensuring that you fulfill all the statutory compliances.

With Deskera Books- its accounting software, Deskera People- its HR software, and Deskera CRM will help you drive business growth and improve your business metrics, financial statements, and financial KPIs.

By using Deskera People, you would be able to automate and run your payroll, leave, expenses, and every other employee management. Through this software that comes with its award-winning mobile app, the taxes would be calculated automatically, while your employees would be paid as per their industry-specific pay schedules after calculating their deductions.

Additionally, you would also be able to transfer all your existing data seamlessly to Deskera People. It will also help you maintain compliance with statutory requirements like EPF and ESI in the case of India. It will also let you set up your own custom calendar with reminders for important deadlines that you need to meet in order to get fined due to non-compliance.

Key Takeaways

The Goa, Daman, and Diu Shops and Establishments Act regulates the terms of service, working hours, rest intervals, overtime, opening and closing hours, conditions for employment of women and young people, prohibition of employing children, record-keeping, and need for registration to mention some of the main domains that are regulated by the provisions of this Act.

Applicable all across Goa, unless specified otherwise by the Government, this Act is known as Goa Shops And Establishments Act after its amendment in 2021. There were a series of other amendments included with this amendment, which set a deadline of seven days for the Inspector to grant you a renewed registration certificate, even if you are a bank, else, it will get renewed automatically in the electronic version.

This is subject to your filling in the application form with the prescribed fees. Also, the seven days should be seven working days. The form to be filled for the renewal of your registration certificate is Form IV, as per rule 6. This form can also be filled out online.

If you get delayed in filing your application for the renewal of the registration certificate, which is later than thirty days before the expiry of your registration certificate, then you will have to pay a penalty of a maximum of twenty-five percent of the prescribed fees, post which the Inspector will consider your application for the same.

Having a registration certificate is important to continue your business in Goa because, as per the Goa Shops And Establishments Act, you are required to have a registration certificate within ninety days from the date on which your business commences work. Deskera People, with its custom calendar and reminders, will ensure that you do not miss the deadline in filing for the renewal of the registration certificate.

Related Articles