Mr. Abhishek Dutta became the head employer in one of the industries in Orissa and was asked to prepare the Form X Muster - Orissa – form 10 - combined muster roll-cum-register of wages for his employees. He wanted more details of the form before he could start preparing it.

The X Muster and all other compliance forms that come under The Odisha Shops and commercial establishments act 1956 are primarily aimed to safeguard the rights of the employees, track their work, and regulate their employment. The X Muster needs to be prepared by the employer which is a record of the attendance of employees and of their wages which should be noted in the prescribed format. It is a crucial compliance form and comes within the Act.

Let us understand more about the X Muster form and its relevance in The Odisha Shops and commercial establishments act 1956.

Table of Contents

- About the Odisha Shops and Commercial Establishments Act 1956

- Registration of shops and establishments under the Act

- The registration form filled by the employer should include contact details like:

- Exceptions - The X Muster will not include the following:

- Different Forms and Registers to be maintained by the employer under the Odisha Shops and Commercial Establishments Act 1956

- Preservation of forms and records that are maintained by the employer

- Displaying Records and Other Forms

- The X Muster Form and its various roles in other Acts of Orissa

- Sample of the X Muster Form

- Other Compliances Besides the X Muster Form to be maintained under the Odisha Shops and Commercial Establishments Act 1956

- Conclusion

- How Can Deskera Assist You?

- Key Takeaways

About the Odisha Shops and Commercial Establishments Act 1956

All shops and commercial facilities in Orissa are subject to the laws and regulations enacted to safeguard the rights of workers. The law covers wage payments, working conditions, working hours, breaks, overtime, opening and closing hours, holidays, vacations, holidays, maternity leave and benefits, working conditions, child benefits, administration, etc.

A commercial establishment or a shop, which is supposed to maintain all the compliance forms as specified under The Odisha Shops and commercial establishments act 1956, including the X Muster form, is a place of trade or business, which has been duly registered under the Act and stipulated by the State Government as a shop or establishment. It can include restaurants, hotels, shops where goods and services are sold, warehouses, godowns, etc.

This Act does not include any establishment or facility that is attached to a factory as, the welfare of the workers, employed in a factory is monitored by the Factories Act, 1948.

Registration of shops and establishments under the Act

The X Muster form will be prepared by establishments that have been registered under the Odisha Shops and commercial establishments act 1956, within 30 days of the Act into force, or within 30 days of its initiation.

The registration form should be duly filled out and passed on to the state government-appointed inspector. He will thoroughly check the form, and if everything seems correct, he will deem the establishment as a registered shop or commercial establishment under the Act. A registration certificate will be issued to the employer which has to be displayed on the premises.

The registration form filled by the employer should include contact details like:

- Name and postal address of the employer/manager

- Name of the shop or establishment

- Category of the establishment, whether it belongs to the entertainment or supply section, for example, if it’s a hotel, a grocery store, a restaurant, etc.

- Other details of the facility to be noted in the form

Exceptions - The X Muster will not include the following:

- Adolescents that work for more than 6 hours a day (they will not be allowed to work for more than 6 hours)

- Employees belonging to the Central or State Government office

- Employees working for the Reserve Bank of India

- People who are into a family business, wherein all workers are members of a family

- Employees working for the care and treatment of the sick or the mentally unfit

- Employees who are employed in a secret service

- Employees whose work is sporadic like travelers

- Employees who are into philanthropic tasks and non-profitable work

Different Forms and Registers to be maintained by the employer under the Odisha Shops and Commercial Establishments Act 1956

The X Muster Form will include details of employees based on the other records that the employer will be maintaining. Here are some mandatory forms and registers and their details that need to be maintained by the employer:

All employers are required to maintain an X Muster form and a payroll that specifies the following details for each employee.

(A) Minimum wage paid

(B) Days of overtime

(C) Total pay for each pay period

(D) Any deductions from salary

(E) Actual wages paid and payment date

Each employer must provide each employee with a pay slip with specific details at least one day before the payment is paid. Each employer must have each employee's signature or fingerprint on the payroll and pay slip.

Payroll and payroll entries must be formally certified by the employer or someone authorized by your employer to do so. Every employer must maintain records in a prescribed format including the X Muster form.

Each employer must display the following details in a clean and easily readable place in the location chosen by the inspector, in English, or in a language understood by most employees:

(A) Minimum wage

(B) Extracts from the laws and regulations drawn up below

(C) Name and address of the inspector

Preservation of forms and records that are maintained by the employer

The records and forms that are prepared by the employer shall be stored with him for 3 years from the date of registration of the data. This rule is provided for in Rules 21(4), 26(2), and 26(1).

Displaying Records and Other Forms

All records and registers that the employer is required to keep under these rules must be submitted to the inspector upon request during the facility inspection. However, the inspector may, if necessary, request registrations and records at the office or other public places close to the employer.

Violations of the provisions of the law or this regulation reported by the inspector and reported to the employer during or otherwise inspected must be proven by the employer and a report to that effect must be submitted to the inspector.

The X Muster Form and its various roles in other Acts of Orissa

The X Muster Form is a form that is prepared by the employer to record the attendance and wages of the employees within the establishment. This record is crucial and can be checked and verified by the inspector at any point in time. Form No. X (Wages) Rule 26(1) of Orissa Minimum Wages Rules, 1954 is specifically prepared for this Act Orissa has other employee and worker welfare acts, under which the same Muster-cum-Wage records are maintained but with different names. Here is a list of them:

- Muster Form No. 29 under Rule 104 of Orissa Factories Rules, 1950

- Muster Form No. 8 (Daily record of works & orders relating to compensating Leave and Deduction from wages of Orissa Shops and Commercial Establishment Rules, 1958

- Wages Form No. X (Wages) Rule 26(1) of Orissa Minimum Wages Rules, 1954

- Muster Form No. XVII under Rule 52(2)(a) of Orissa Inter-state Migrant Workmen (RE&CS) Rules, 1980

- Muster Form No. XVI under Rule 239(1) (a) of Orissa Building & Other Construction Workers etc. Rules, 2002

- Wages Form No. XVII under Rule 239 (1) (a) of Orissa Building & Other Construction Workers etc. Rules, 2002

- Muster Form No. XIII under Rule 33(1) of Orissa Beedi & Cigar Workers (Condition of Employment) Rules, 1969

- Muster Form No. V under Rule 26(5) of Orissa Minimum Wages Rules, 1954

- Muster Form VI under Rule 9 of Orissa Industrial Employment (N&F) H. Rules, 1972

- Muster Form X under Rule 36 of Orissa Motor Transport Workers Rules, 1966

- Wages Form XIII under Rule 77(2)(a) of Orissa Contract Labour (R&A), Rules, 1975

- Wages Form No. XVIII under Rule 52(2)(a) of Orissa Inter-State Migrant Workmen (RE&CS) Rules, 1980

- Wages Form No. 10 under Orissa Shops and Commercial Establishment Rules, 1958

- Muster Form No. XV111 under Rule 239(1) (a) of Orissa Building & Other Construction Workers etc. Rules, 2002

- Muster Form XII under Rule 77(2)(a) of Orissa Contract Labour (R&A), Rules, 1975

Sample of the X Muster Form

Components of the X Muster Form

- Name and Address of the Factory or Establishment

- Name and Address of the Contractor (if any)

- Place of work

- Name of Address of the Principal employer

- The Month and the Year

- Serial Number

- Name of the employee

- Father/ Husband name

- Sex M/F

- Date of Birth

- Emp No.

- Serial Number in Register of employees

- Designation

- Department

- Date of joining

- Employees' State Insurance Scheme No.

- Provident Fund No.

- ATTENDANCE

- Units of work done (if piece rated)

- Number of payable days

- Total units of work done

- Name of N & FH for which wages have been paid

- EARNINGS

- Basic

- DA/ VDA

- HRA

- Conveyance allowance

- Medical allowance

- ATT/ allowance- bonus

- Spl. all

- OT

- Miscellaneous Earnings

- Others

- Total

- ESI

- DEDUCTIONS

- PF

- PT

- TDS

- Insurance

- Sal. Adv.

- Fine

- Damage

- Others

- Total Net payable

- Date of payment

- Complete Signature of the Employer/Principal Employer/Authorized Signatory

Other Compliances Besides the X Muster Form to be maintained under the Odisha Shops and Commercial Establishments Act 1956

Form 1 - Request for registration or renewal of registration

Form 2 – Establishment Registration

Form 3 - Certificate of registration. This needs to be displayed within the premises of the shop or establishment and should be shown to inspectors or authorities whenever they ask for it. This is an important document that all employers my always retain

Form 5 - Notification of employees' daily working hours

Form 7 – Weekly holiday notification form. The same format needs to be notified to the authorities and the inspector, letting them know which one day of the week has been decided as a weekly off for employees or workers. It can be different for different categories of workers. This form should also be displayed on the notice board so that all employees have access to the stipulated weekly off as decided by the employer

Form 8 - Daily overview of work and orders relating to paid leave and salary deductions. This information is crucial for the X Muster form as well, as details regarding the compensatory leaves or wage calculations can be done using this form.

Form 9 – Leave register

Form 11 - Integrated summary of penalties, damages or losses, and deductions from advance payments

Form 12 - Subscriber overview of overtime and payments

Form 13 - Annual sales

Form 15 - Self-certification form presented by the employer. This form needs to be filled out and attested by the employer and should be presented to the labour department and concerned officials.

Conclusion

The X Muster and Wages form prepared by the employer of a shop or commercial establishment is an integral part of the Odisha Shops and Commercial Establishments Act 1956. The primary objective of preparing the X Muster form is to regulate the employment of contract work and regular employment in shops and establishments in Orissa. It is to encourage a better life for workers and reduce unemployment.

The form has details of attendance, wages, overtime, weekly off, and leaves taken by the employees which eventually leads to the calculation of wages of each employee. The employer must keep a strict check on the details of each employee.

How Can Deskera Assist You?

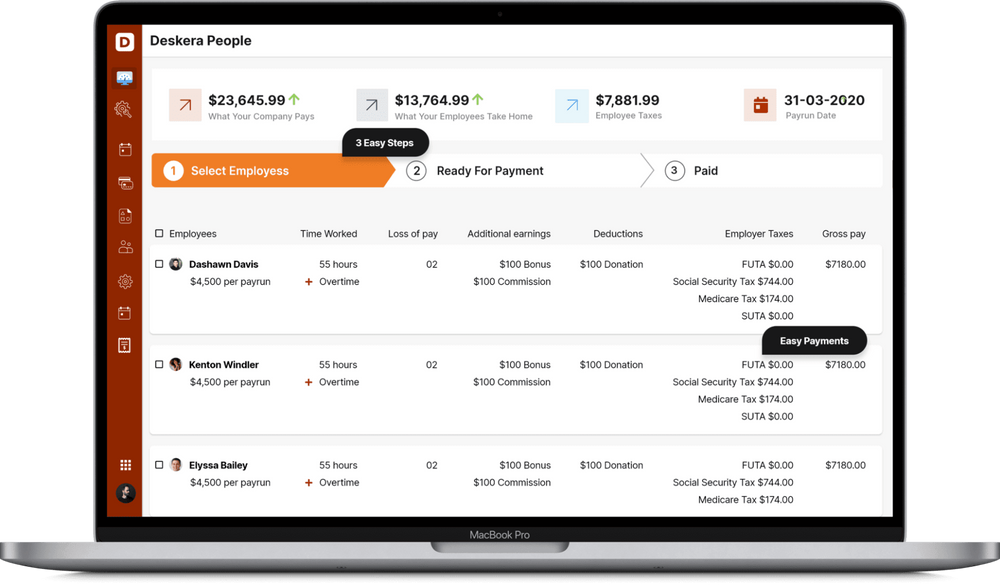

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

- The X Muster Form is a fundamental wage-cum-attendance form for employees which is prepared by the employer

- The employer is supposed to retain the records and compliance forms, including X Muster form for a minimum of 3 years from its registration

- The employer is liable to get the X Muster form and other records checked by the appointed inspector as and when asked for.

- If there is any violation in creating the X Muster form by the employer, it can call for a strict fine or penalty

- The X Muster form comes under the Odisha Shops and commercial establishments act 1956 which has its primary aim of regulating the employment conditions of all workers employed in shops or commercial establishments

- The law deals with working hours, overtime, working conditions, leaves, annual holidays, wages, etc regarding the employees and workers

- The Act and X Muster form do not apply to factories as they are already governed by the Factories Act 1948

Related Articles