Do you own a shop or an establishment in Odisha but don’t know the rules and regulations? Do you want to know everything about the statutory requirements of the law?

Don’t worry! Here is a comprehensive guide that will explain some relevant details about the Orissa Shops Commercial Establishments Act. The below-mentioned laws will help you run your Odisha shops and establishments diligently.

All Odisha shops and commercial facilities are subject to the laws and regulations relating to the Orissa shops commercial establishments act. This law was enacted to protect the rights of workers. The law covers wage payments, working conditions, working hours, breaks, overtime, opening and closing hours, leaves, vacations, maternity leave and benefits, child benefits and administration, maintenance, etc.

Table of Contents

- Some critical definitions of terms frequently used in the Odisha shops and establishments Act

- Registration of Odisha shops and establishments

- Exemptions of the Odisha Shops and Establishment Act

- About Registration and Renewal of Odisha Shops and Establishments

- More about the Registration and Renewal of Odisha Shops and Establishments:

- Application for Registration or Renewal

- Issue of the registration certificate

- Notification of change of establishment

- Other Provisions under the Odisha Shops and establishment Act

- Working Hours

- How to calculate the normal wage

- The notice of weekly holidays is given on form no. 7

- Compliances to be filled under the Odisha Shops and Establishment Act

- Conclusion

- Key Takeaways

Some critical definitions of terms frequently used in the Odisha shops and establishments Act

Commercial Establishments in Orissa mainly mean official work, hotels, restaurants, houses, coffee or other trade, banks, insurance companies, or management services where people participate in official work for entertainment and public amusement. To become a commercial organization for this law, the establishment needs to be declared as a commercial establishment by the Odisha state government.

The Establishment means shops or commercial institutions

Odisha shops mean a building or a facility where trade and companies or businesses are implemented in which the goods or services are provided to customers. Odisha shops include offices, shops, warehouses, Godowns, etc. It means that it is used in business but it does not include a commercial organization. Alternatively, there is no shop connected to a factory that can be benefited from the conditions mentioned in the Factories Act,1948 for workers.

Registration of Odisha shops and establishments

The establishment or Odisha shop which has been incorporated within 30 days from the date on which the Orissa shops commercial establishments act enters into force or within 30 days of its establishment. The details need to be submitted to the field inspector in which a new institution is registered as an Odisha shop or establishment.

The following elements are included, together with the declarations of the Odisha shop and the payment of the required fees:

- The name of the employer or the manager of the Odisha shop or establishment

- Institutional postal address

- If there is any name of an institution

- The category of foundation, that is, if it is for general entertainment, commercial institutions, hotels, restaurants, coffee, houses, meals, theatres, or entertainment

Adolescents and young children are not authorized to work more than 6 hours a day. In case of doubt or disagreement between the employer and the inspector as to the class to which the establishment belongs, the inspector will refer the matter to the chief inspector and the chief inspector will determine the class after the determined investigation. Such determination and its decision are final as per the law.

Exemptions of the Odisha Shops and Establishment Act

The following institutions or organizations have not been included in the Odisha Shops and Establishment Act:

- Office under the Central government, the State government, or the local government

- Office under the Reserve Bank of India

- A managed institute assumes the owner without employees or institutions that are employed only by the families of employers

- An institution that is into the treatment of patients or health institutions, elderly, poor, inappropriate spirit

- People who have a management position work for a secret agency or service

- People who work at intervals, as travelers and recipients of care

- People who participate directly in preparations or additional work, such as clearing and forwarding guidelines to employees who are responsible for sending or dispatching products

- Exhibitions or bazaars for the sale of works for charity or other purposes that have not been extracted for special interests

- Libraries where the lending of books is not done for monetary or profitable purposes. Instead, it is run towards charity organizations or educational interests

About Registration and Renewal of Odisha Shops and Establishments

Schedule for Registration and renewal of Odisha Shops and Establishments

|

Sl. No. |

Category of Establishment |

Fees for registration |

Fees for renewal of registration for five years |

|

1 |

2 |

3 |

4 |

|

Rs. P. |

Rs. P. |

||

|

1. |

Shops and commercial establishments other than items 3 and 5 employing five or more employees |

5.00 |

10.00 |

|

2. |

Shops and commercial establishments other than items 3, 4, and 5 employing less than five employees |

2.50 |

5.00 |

|

3. |

Residential hotels |

5.00 |

10.00 |

|

4. |

Hotels other than residential, restaurants cafes, boarding and eating houses |

2.50 |

5.00 |

|

5. |

Theatres and other places of public amusement and entertainment |

5.00 |

10.00 |

Fees prescribed for registration and renewal of registration of shop/commercial establishments

|

Number of workers employed in Shop/Commercial Establishment |

Fees for registration and renewal of registration per year |

|

[(1)] |

(2) |

|

1 to 9 |

Rs. [50.00] |

|

10 to 19 |

Rs. [100.00] |

|

20 or more |

Rs. [200.00] |

More about the Registration and Renewal of Odisha Shops and Establishments:

Application for Registration or Renewal

During the period referred to in Article 4 (4) of the law, the employer of each establishment requests the inspector of each district to register or renew the registration of the establishment:

However, the application for renewal of registration must be submitted to the Inspector at least two months before the expiration date of the current registration and, if the request is submitted, the facility will be registered until the Inspector's registration date. This application should be properly stored.

If the renewal application is not submitted within the term specified in the clause, you will be liable to pay 25% more than the normal rate payable on the registration certificate for such renewal.

Issue of the registration certificate

- The fees for commercial facilities and Odisha shop registration must be paid as specified in the table given above

- The inspector will amend the registration certificate issued under Rule 5 (a) if the inspector confirms that the description on the application is correct and the changes are reflected on the registration document

- The employer wishing to change the registration certificate requests the Inspector use an application in Form I in duplicate duly filled in explaining the nature of the requested change and the reason, together with the registration certificate to make the necessary changes. The letter must be presented to the inspector

- The fee for the modification of the registration certificate is rupees 20 plus the amount (if any) that would have been paid if the registration document had originally been issued in the modified form

- Fees of 50% more than fees normally paid for enrolment and renewal as referred to in paragraph (a) of Rule (5) will be paid after five years

- Validity of the registration certificate - Any certificate issued under Rule 5 is valid for one year

- Display of the registration certificate - Employers must present their registration certificate in a prominent place within the facility

Notification of change of establishment

An employer in possession of a registration certificate may, at any time before expiration, request permission to transfer the certificate on form no. 4 to another person. This request is submitted to the inspector, who, if he agrees to the transfer, will also sign the registration certificate and the registration certificate will be transferred to the designated person.

The redemption fee for the certificate of registration is 50% of the amount specified in Rule 5.

If the employer holding the registration certificate dies or goes bankrupt, the person who manages the is not subject to legal sanctions if he exercises the power conferred on the employer by the registration deed. It is reasonably necessary to allow him to apply on Form 4 to transfer the registration certificate to his name.

Other Provisions under the Odisha Shops and establishment Act

Working Hours

The employer must submit a notification regarding his Odisha shop or institution stating the daily working hours of each employee. The notice is drawn up on Form no. 5 and will remain on display until the working hours indicated therein are valid.

How to calculate the normal wage

For Article 8 paragraphs (1) and (2), the normal hourly wage is calculated by dividing the total wage paid to the employer by the actual number of hours during the pay period the employee has worked.

However, the working hours of those who work outside the normal daily working hours during the pay period are not included in the calculation of the employee's actual working time.

Each employer must keep a joint record of overtime and payments on Form 12.

The notice of weekly holidays is given on form no. 7

Details of each employee - All employers maintain the following employee records at their place of business:

The Work and Leave account on form no. [8] can be kept for one year after the employee's employment relationship ends.

The total salary return for Form 10 should be kept for 3 years.

Leaves, as Treated for Section 14 - Leave, is treated as a business day to calculate an employee's number of business days for Section 14.

- Sick leave - It is sufficient to present a medical certificate signed by a registered professional or by a Vaidya or Hakim registered or recognized if the worker is absent due to illness or requested in writing to the employer. The employee must state the reason for their absence

- All applications by employees on sick leave under paragraph (3) of Article 14 must be made in writing. The employer must include the ordinance in the application and keep it until the end of the following calendar year

The Wage Payment Act 1936 (1936 Act IV) applies to all employees referred to in the law with any amendments. Employees are entitled to Gratuity under Article 21-

(1) If you become unable to work or medically incapacitated due to an accident

(2) 60 years old

The age of the minor worker - The inspector may request your employer to provide an original extract from a school, panchayat, or municipal document. If you do not have such an extract, you must submit a statement from your registered health care practitioner stating the age of the person employed by the employer.

Maternity allowance - The Childbirth Benefits Act 1953 of Orissa regulates the allowances and payment arrangements for childbirth benefits paid to women employees.

Compliances to be filled under the Odisha Shops and Establishment Act

Form 1 - Request for registration or renewal of registration

Form 2 - Registration of Establishments and Institutions

Form 3 - Certificate of registration

Form 5 - Notification of employees' daily working hours

Form 7 – Weekly holiday notification form

Form 8 - Daily overview of work and orders relating to paid holidays and salary deductions

Form 9 - Keep a record of Leaves

Form 10 – Muster roll and register of wages

Form 11 - An integrated record of penalties, damages or losses, and deductions, or advance payments

Form 12 – Register overtime and payments

Form 13 - Record of annual returns

Form 15 - Self-certification form presented by the employer

Conclusion

The Odisha Shops and Establishment Act is to protect the rights of workers while regulating the payment of wages, leaves and holidays, terms of service, working conditions, work hours, maternity and sickness benefits, rest intervals, etc. This applies to workers, employees, and local staff to protect their rights and make sure the employers are diligently following the law and providing the best working conditions, and basic benefits to the workers as stipulated by the law

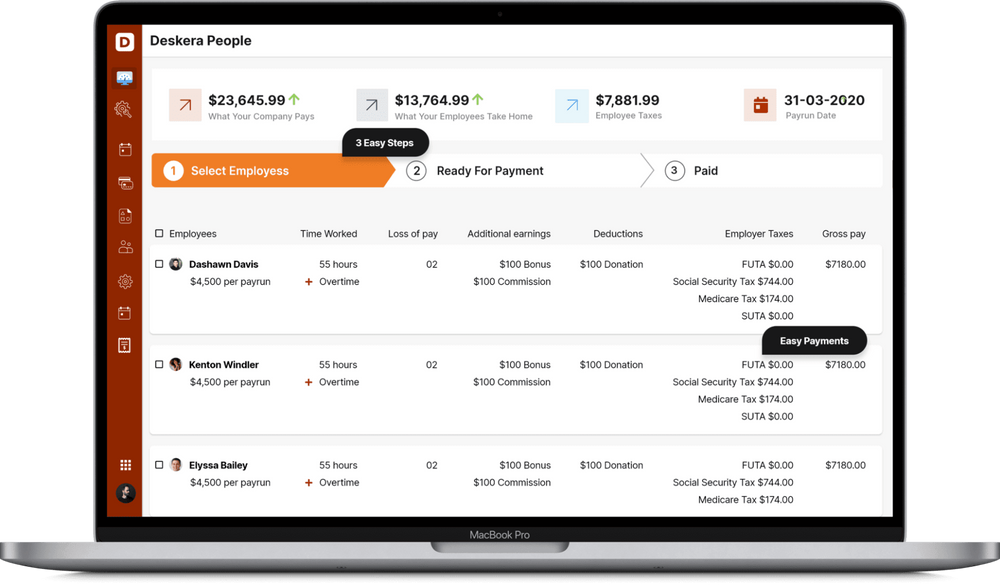

How Can Deskera Assist You?

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

- The Odisha Shops and Establishment Act is an important law that manages and regulates the shops and commercial establishments in the state

- All employers are required to submit and maintain all compliance forms after the registration of their respective Odisha shops and establishments to the Department of Labor

- The main components of the Odisha Shops and Establishment Act are working hours, paid leaves, working days, working conditions of the workers, public holidays for the whole year, maternity benefits, details of wage (salary), bonus payments, and maintenance of employee data

- All employers must keep all the compliance forms under the Odisha Shops and Establishment Act up to date as the forms can be properly inspected and verified by the designated arbitrator

- The Odisha Shops and Establishment Act determines the types of welfare activities that employers offer employees

- It is important for employers to fill out all the forms and be compliant, to fulfill all the requirements of the Odisha shops and establishments Act

Related Articles